10 minute read

Exness Raw Spread vs Zero Account Review: Pros and Cons

In the fast-paced world of online trading, selecting the right brokerage account can make or break your success. Exness, a globally recognized broker established in 2008, offers a variety of account types to cater to traders of all levels. Among its professional offerings, the Raw Spread Account and the Zero Account stand out as two of the most popular choices for traders seeking tight spreads, transparent pricing, and optimal trading conditions. But which one is right for you? In this comprehensive review, we’ll dive deep into the features, pros, and cons of the Exness Raw Spread vs Zero Accounts, helping you make an informed decision based on your trading style, goals, and budget.

Whether you’re a scalper chasing tiny price movements, a day trader looking for cost efficiency, or a long-term investor seeking predictability, understanding the nuances of these accounts is crucial. By the end of this article, you’ll have a clear picture of how these accounts differ, their unique advantages, and potential drawbacks. Let’s get started!

What is Exness? A Quick Overview

Before we delve into the specifics of the Raw Spread vs Zero Accounts, it’s worth taking a moment to understand the broker behind them. Exness is a multi-regulated brokerage firm headquartered in Cyprus, operating under licenses from top-tier authorities like the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Financial Services Authority (FSA) in Seychelles. Since its inception, Exness has grown into a trusted name in the forex and CFD trading industry, serving over 1 million traders worldwide.

Exness is known for its cutting-edge technology, competitive spreads, high leverage options (up to 1:unlimited in some regions), and a wide range of tradable instruments, including forex pairs, metals, cryptocurrencies, stocks, indices, and energies. The broker offers multiple account types, split into two categories: Standard Accounts (for beginners) and Professional Accounts (for experienced traders). The Raw Spread vs Zero Accounts fall under the Professional category, designed to meet the needs of seasoned traders who demand precision and cost efficiency.

Understanding the Exness Raw Spread Account

The Raw Spread Account is tailored for traders who want direct access to interbank market pricing with minimal broker interference. As the name suggests, this account offers "raw" spreads—meaning the spreads you see are sourced directly from liquidity providers without any markup from Exness. Instead of profiting from widened spreads, Exness charges a fixed commission per trade, ensuring transparency in pricing.

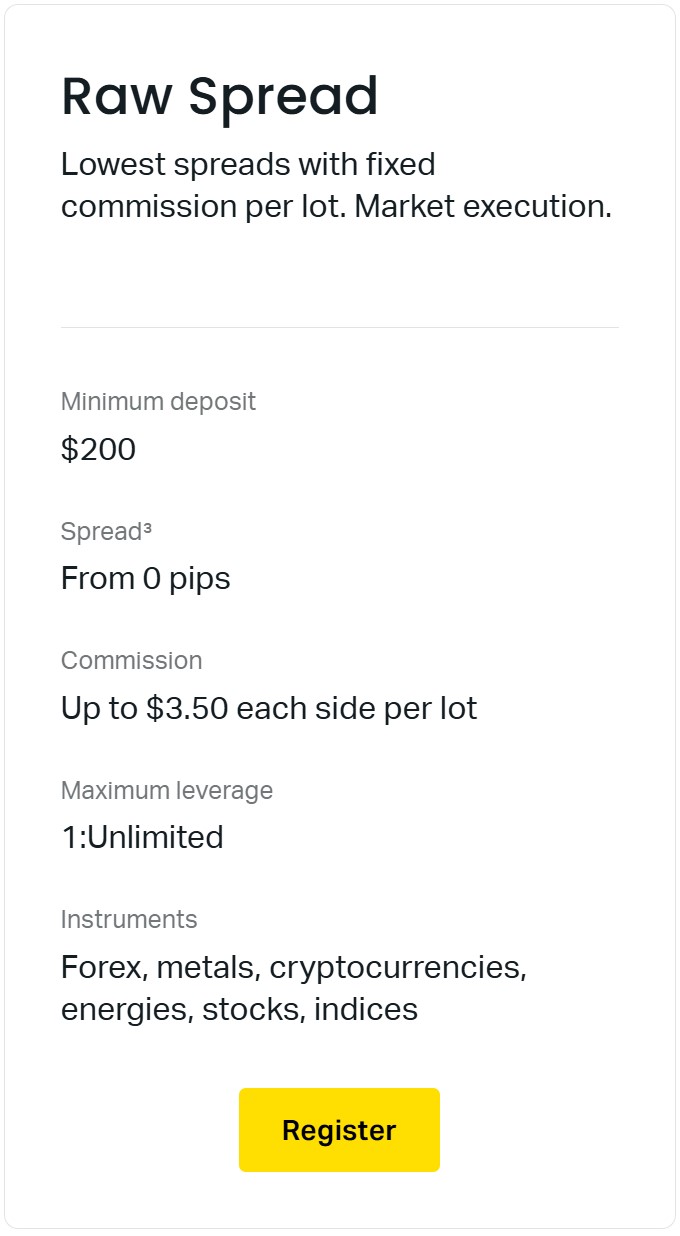

Key Features of the Raw Spread Account

Spreads: Ultra-low, starting from 0.0 pips on major forex pairs.

Commission: Up to $3.5 per lot per side (varies by instrument).

Minimum Deposit: $200 (may vary by region).

Leverage: Up to 1:unlimited (depending on your location and trading experience).

Execution Type: Market execution with no requotes.

Instruments: Forex, metals, cryptocurrencies, stocks, indices, and energies.

Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness Terminal, and Exness Trade App.

Maximum Lot Size: 200 lots (reduced to 20 lots during overnight hours for some instruments).

1️⃣ Open Exness Raw Spread MT4 Account

2️⃣ Open Exness Raw Spread MT5 Account

Who is the Raw Spread Account For?

The Raw Spread Account is ideal for high-frequency traders, scalpers, and algorithmic traders who rely on tight spreads and fast execution to maximize profits. It’s also a great fit for those who trade large volumes and prefer transparency over variable costs.

Understanding the Exness Zero Account

The Zero Account, on the other hand, takes a different approach by offering zero spreads on select instruments for a significant portion of the trading day. Instead of paying a spread, traders are charged a commission per lot traded. This account is designed to provide predictability and cost efficiency, especially for traders who prioritize stable pricing over fluctuating spreads.

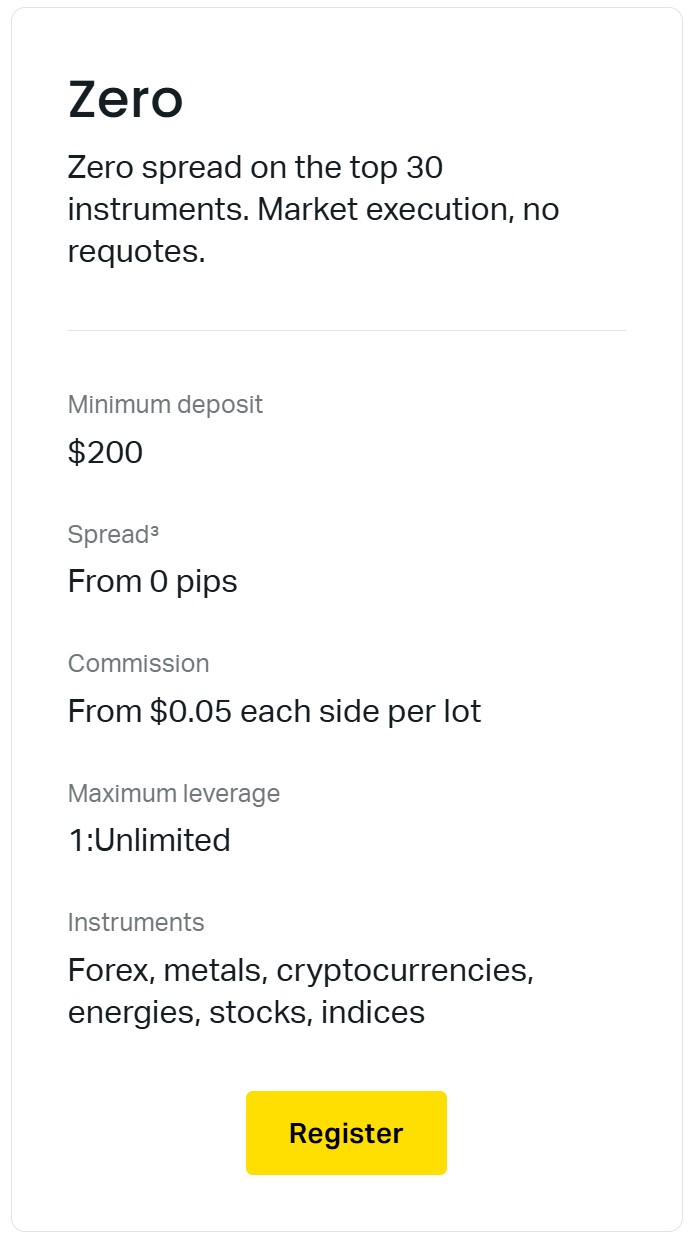

Key Features of the Zero Account

Spreads: 0.0 pips on the top 30 instruments for 95% of the trading day; ultra-low spreads on other instruments.

Commission: Starting from $0.05 per lot per side (varies by instrument and market conditions).

Minimum Deposit: $200 (varies by region).

Leverage: Up to 1:unlimited (subject to regional regulations).

Execution Type: Market execution with no requotes.

Instruments: Forex, metals, cryptocurrencies, stocks, indices, and energies.

Platforms: MT4, MT5, Exness Terminal, and Exness Trade App.

Maximum Lot Size: 200 lots (reduced to 20 lots during overnight hours for some instruments).

3️⃣ Open Exness Zero MT4 Account

4️⃣ Open Exness Zero MT5 Account

Who is the Zero Account For?

The Zero Account is perfect for scalpers, day traders, and traders who value predictability in trading costs. It’s especially beneficial for those who trade the top 30 instruments (like major forex pairs) and want to eliminate spread costs entirely during peak trading hours.

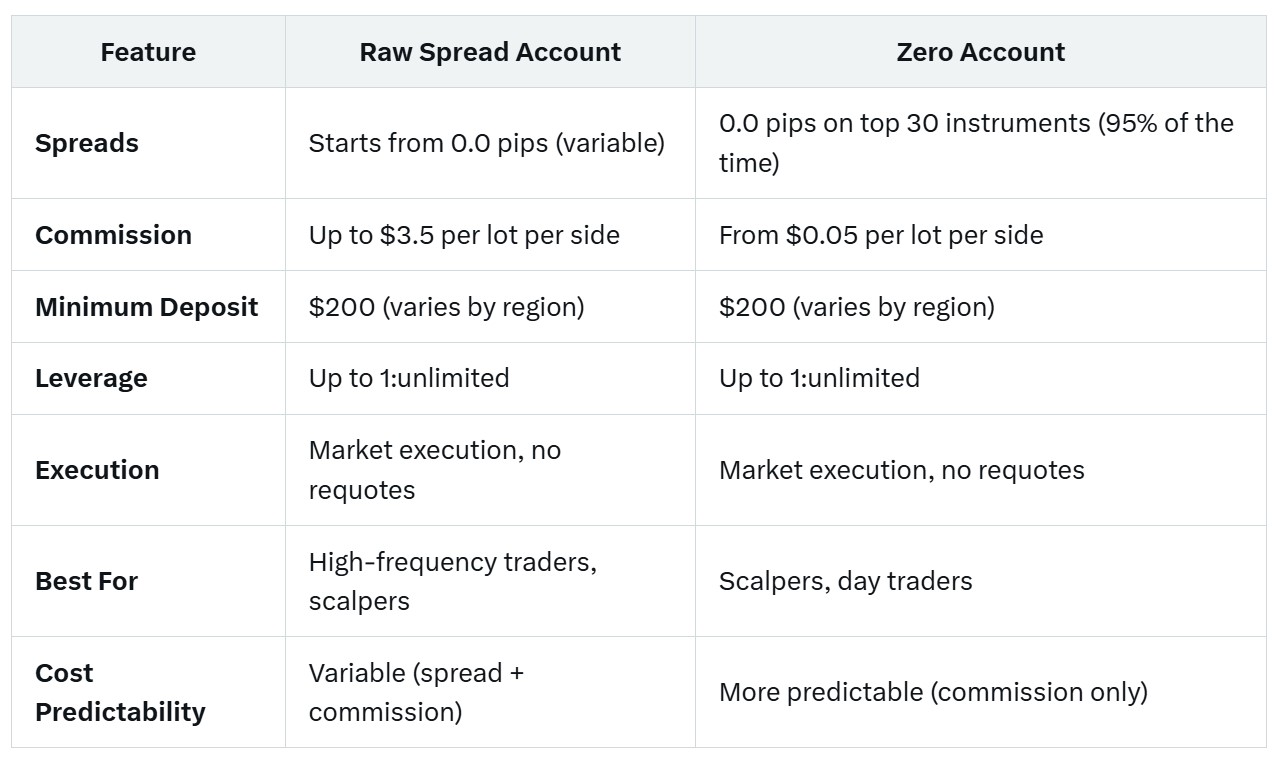

Exness Raw Spread vs Zero Account: A Side-by-Side Comparison

To help you decide between these two accounts, let’s break down their differences across key metrics.

Pros and Cons of the Exness Raw Spread Account

Pros

Ultra-Tight Spreads: With spreads starting from 0.0 pips, you get some of the lowest trading costs in the industry, especially during volatile market conditions.

Transparency: The raw pricing model ensures no hidden markups, giving you direct access to interbank spreads.

Ideal for Scalping: The combination of tight spreads and fast market execution makes this account a favorite among scalpers and high-frequency traders.

Wide Range of Instruments: Trade forex, metals, crypto, stocks, and more—all with competitive pricing.

Unlimited Leverage: Amplify your trading potential with leverage up to 1:unlimited (where available), though this comes with increased risk.

No Requotes: Market execution ensures your trades are filled at the best available price without delays.

Cons

Commission Costs: The fixed commission of up to $3.5 per lot per side can add up, especially for high-volume traders.

Variable Spreads: While spreads are tight, they can widen during periods of low liquidity or high volatility, increasing trading costs.

Higher Minimum Deposit: At $200, the entry barrier is higher than Exness’s Standard Account ($10), which may deter beginners.

Complexity: The combination of variable spreads and commissions might confuse novice traders unfamiliar with cost calculations.

Pros and Cons of the Exness Zero Account

Pros

Zero Spreads on Top Instruments: Enjoy 0.0 pips on the top 30 instruments for 95% of the trading day, eliminating spread costs entirely.

Low Commissions: Starting at just $0.05 per lot per side, the commission is significantly lower than the Raw Spread Account, making it cost-effective for frequent traders.

Predictable Costs: With no spreads to worry about on key instruments, your trading expenses are easier to calculate and manage.

Fast Execution: Market execution with no requotes ensures quick and reliable trade fills—crucial for scalping and day trading.

Versatile Leverage: Access up to 1:unlimited leverage, giving you flexibility to scale your positions (subject to risk management).

Broad Instrument Access: Trade across forex, metals, cryptocurrencies, and more with competitive conditions.

Cons

Limited Zero Spread Availability: While the top 30 instruments enjoy zero spreads, other assets have ultra-low but non-zero spreads, which may vary.

Commission Variability: Commissions can increase depending on the instrument and market conditions, reducing cost predictability for some trades.

Not Ideal for Low-Volume Traders: The $200 minimum deposit and commission structure may not suit traders with smaller budgets or less frequent trades.

Learning Curve: Beginners may find it challenging to adapt to a commission-based model without prior experience.

Trading Costs: Raw Spread vs Zero Account

One of the most critical factors in choosing a trading account is the cost. Let’s break down how the Raw Spread vs Zero Accounts stack up in terms of spreads and commissions.

Raw Spread Account Costs

Spreads: Variable, starting from 0.0 pips. During high liquidity, spreads can be razor-thin, but they may widen during news events or overnight hours.

Commission: Fixed at up to $3.5 per lot per side. For a 1-lot trade (round trip), you’d pay $7 in commissions.

Example: Trading 1 lot of EUR/USD with a 0.1-pip spread and $7 commission costs approximately $7.10 total.

Zero Account Costs

Spreads: 0.0 pips on the top 30 instruments for 95% of the day; ultra-low spreads on other instruments.

Commission: Starts at $0.05 per lot per side but can rise based on the instrument. For a 1-lot trade (round trip), you might pay as little as $0.10 or up to $7, depending on the asset.

Example: Trading 1 lot of EUR/USD with zero spread and a $0.2 commission costs just $0.40 total.

Verdict on Costs

Raw Spread: Better for traders who want the tightest possible spreads across all instruments and don’t mind a higher fixed commission.

Zero Account: More cost-effective for those focusing on the top 30 instruments, thanks to lower commissions and zero spreads.

Which Account is Best for Your Trading Style?

Your trading style plays a huge role in determining which account suits you best. Here’s a breakdown:

For Scalpers

Winner: Zero Account

Why: Zero spreads on major instruments and ultra-low commissions make it ideal for capturing small price movements with minimal costs.

For Day Traders

Winner: Tie (depends on volume)

Why: The Raw Spread Account offers tight spreads across all instruments, while the Zero Account provides cost predictability on key pairs. High-volume day traders may prefer the Zero Account for its lower commissions.

For High-Frequency Traders

Winner: Raw Spread Account

Why: Direct access to interbank spreads and fast execution cater to the needs of traders executing numerous trades daily.

For Long-Term Traders

Winner: Zero Account

Why: Predictable commission costs and zero spreads on popular instruments reduce the impact of holding positions overnight.

For Beginners

Winner: Neither (consider Standard Account)

Why: Both accounts require a $200 minimum deposit and involve commissions, which may overwhelm novices. The Exness Standard Account, with no commissions and a $10 minimum, is a better starting point.

Real-World Performance: User Feedback

To get a fuller picture, let’s consider what actual traders say about these accounts based on online reviews and community insights:

Raw Spread Account Feedback

Positive: Traders love the tight spreads and transparency, especially during volatile market hours. Scalpers frequently praise the fast execution.

Negative: Some users note that commissions can eat into profits for small accounts, and spread widening during low liquidity can be a drawback.

Zero Account Feedback

Positive: Users appreciate the zero spreads on major pairs and the low starting commission, calling it a “game-changer” for scalping.

Negative: Complaints include variable commissions on less popular instruments and the limited scope of zero-spread assets.

How to Choose Between Raw Spread vs Zero Accounts

Still unsure? Here are some questions to guide your decision:

What’s your trading frequency? High-frequency traders benefit more from the Raw Spread Account, while occasional traders may prefer the Zero Account’s predictability.

Which instruments do you trade? If you focus on the top 30 instruments, the Zero Account saves you money. For broader trading, the Raw Spread Account shines.

How much can you deposit? Both require $200, but smaller budgets might struggle with commission costs.

Do you prioritize cost or execution? Raw Spread offers top-tier execution, while Zero provides cost stability.

Tips for Maximizing Your Experience with Exness

Regardless of which account you choose, here are some tips to get the most out of your trading:

Use a Demo Account First: Exness offers demo versions of both accounts—practice your strategy risk-free before going live.

Monitor Market Conditions: Spreads and commissions can fluctuate, so time your trades during high-liquidity periods for the best results.

Leverage Wisely: Unlimited leverage is powerful but risky—use it cautiously to avoid margin calls.

Diversify Your Portfolio: Take advantage of the wide range of instruments to spread your risk.

Conclusion: Raw Spread vs Zero—Which Wins?

There’s no one-size-fits-all answer when it comes to the Exness Raw Spread vs Zero Account debate. The Raw Spread Account excels for traders who want the tightest possible spreads across all instruments and don’t mind paying a fixed commission. It’s a powerhouse for high-frequency trading and scalping in volatile markets. Meanwhile, the Zero Account shines for those who trade major instruments, offering zero spreads and lower commissions for predictable, cost-effective trading.

Ultimately, your choice depends on your trading goals, budget, and preferred style. Both accounts reflect Exness’s commitment to providing professional-grade tools for serious traders. So, weigh the pros and cons, test them out with a demo, and pick the one that aligns with your path to profitability.

1️⃣ Open Exness Raw Spread MT4 Account

2️⃣ Open Exness Raw Spread MT5 Account

3️⃣ Open Exness Zero MT4 Account

4️⃣ Open Exness Zero MT5 Account

Read more: Is Exness Regulated in Kenya?