10 minute read

Exness Kenya Review: Legit, Safe, Is a good broker?

Forex trading has surged in popularity across Kenya over the past decade, with more individuals seeking reliable brokers to navigate the dynamic world of online trading. Among the many options available, Exness stands out as a globally recognized brokerage that has gained traction among Kenyan traders. But is Exness the right choice for you? In this detailed Exness Kenya Review, we’ll explore everything you need to know about trading with Exness in Kenya—from its regulatory status and account offerings to its trading platforms, fees, and customer support. Whether you’re a beginner or an experienced trader, this guide will help you decide if Exness aligns with your trading goals.

💥 Trade with Exness now: Open An Account or Visit Brokers

What is Exness? A Global Broker with a Local Presence

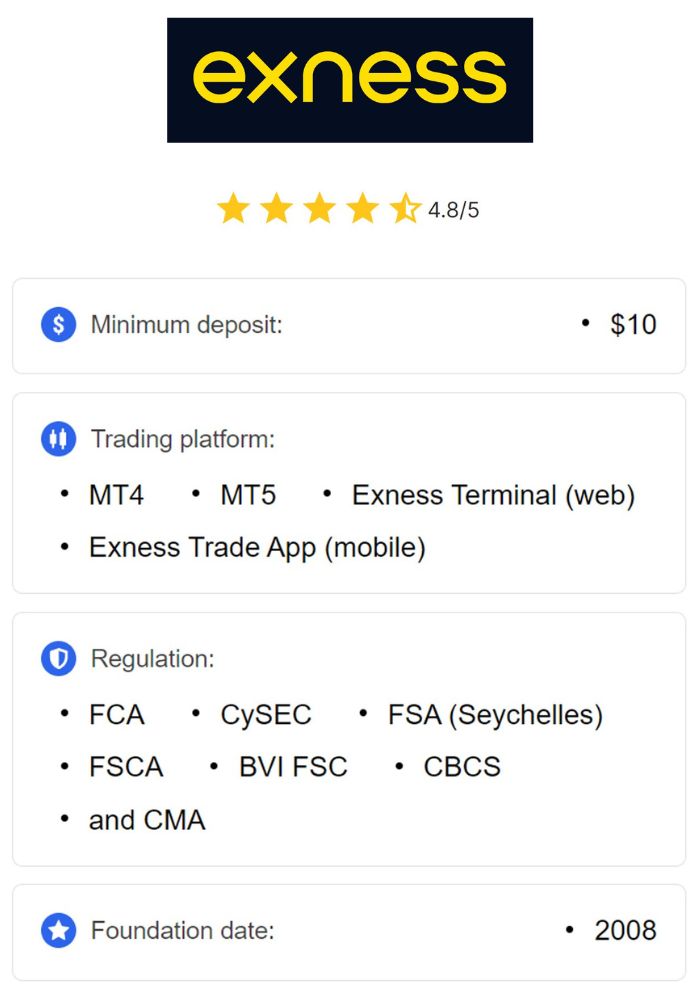

Founded in 2008, Exness has grown into one of the most reputable names in the forex and CFD trading industry. With headquarters in Cyprus and operations spanning multiple continents, the broker serves millions of clients worldwide, including a growing number in Africa. Exness is known for its competitive spreads, robust trading platforms, and a commitment to transparency—qualities that have made it a favorite among traders globally.

In Kenya, Exness has tailored its services to meet the needs of local traders. From supporting payments via M-Pesa to offering accounts in Kenyan Shillings (KES), the broker has made significant efforts to integrate into the Kenyan market. But how does it stack up against other forex brokers in the region? Let’s dive into the specifics.

Is Exness Regulated in Kenya? Safety and Legitimacy Explored

One of the first questions any trader should ask is whether a broker is safe and legitimate. For Kenyan traders, this means checking if Exness complies with local regulations and offers adequate protection for their funds.

Regulation by the Capital Markets Authority (CMA)

Exness operates in Kenya under the legal entity Tadenex Limited, which is licensed by the Capital Markets Authority (CMA) as a non-dealing online foreign exchange broker (license number 162). The CMA is Kenya’s primary regulatory body overseeing financial markets, ensuring brokers adhere to strict standards for transparency, client fund protection, and operational integrity. This local regulation is a significant advantage, as it provides Kenyan traders with a layer of security and recourse in case of disputes.

Global Regulatory Oversight

Beyond Kenya, Exness is regulated by several top-tier international authorities, including:

Financial Conduct Authority (FCA) in the United Kingdom

Cyprus Securities and Exchange Commission (CySEC) in Cyprus

Financial Sector Conduct Authority (FSCA) in South Africa

Financial Services Authority (FSA) in Seychelles

These licenses require Exness to segregate client funds, undergo regular audits, and maintain high standards of financial stability. For Kenyan traders, this global oversight adds an extra layer of confidence, knowing that Exness operates under some of the world’s most stringent regulatory frameworks.

Fund Security Measures

Exness takes client fund security seriously. All customer funds are held in segregated accounts, separate from the company’s operational funds, ensuring they’re protected even if the broker faces financial difficulties. Additionally, Exness is a member of the Financial Commission, which offers up to €20,000 in compensation per client in case of disputes—a rare feature among forex brokers.

In summary, Exness is both legitimate and safe for Kenyan traders, thanks to its CMA license and robust global regulations.

Exness Account Types: Options for Every Kenyan Trader

Exness offers a variety of account types to cater to different trading styles and experience levels. Here’s a breakdown of the options available to Kenyan traders:

1. Standard Accounts

Standard Account: Ideal for beginners, this account requires a low minimum deposit (as little as $1 or KES 100, depending on the payment method). It offers spreads starting at 0.3 pips, no commissions, and leverage up to 1:2000 (subject to restrictions).

Standard Cent Account: Perfect for testing strategies with minimal risk, this account uses cent lots. It’s not available in KES but supports USD and other currencies, with spreads from 0.3 pips.

2. Professional Accounts

Raw Spread Account: Designed for experienced traders, this account features ultra-low spreads (from 0.0 pips) with a fixed commission of up to $3.5 per lot per side. Leverage is up to 1:2000.

Zero Account: Offers zero spreads on major instruments for 95% of the trading day, with a commission starting at $0.05 per lot per side. It’s ideal for high-volume traders.

Pro Account: A commission-free option for pros, with spreads from 0.1 pips and instant execution.

Key Features for Kenyan Traders

KES as a Base Currency: Unlike many brokers, Exness allows Kenyan traders to open accounts in Kenyan Shillings (except for the Standard Cent account), avoiding currency conversion fees.

High Leverage: Leverage up to 1:2000 is available, though it’s capped at 1:400 for CMA-regulated accounts to comply with local rules.

Islamic Accounts: Swap-free options are available for Muslim traders, with no overnight fees.

With these options, Exness ensures flexibility, making it suitable for both novices and seasoned traders in Kenya.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Platforms: Powering Your Trading Experience

A broker’s trading platform can make or break your experience. Exness offers a suite of platforms to suit different preferences:

1. MetaTrader 4 (MT4)

MT4 remains a favorite among forex traders for its simplicity and powerful tools. It supports automated trading via Expert Advisors (EAs), offers extensive charting capabilities, and is available on desktop, mobile, and web.

2. MetaTrader 5 (MT5)

The upgraded version of MT4, MT5 provides more advanced features like additional timeframes, economic calendars, and a broader range of order types. It’s ideal for traders looking to diversify into stocks and cryptocurrencies.

3. Exness Terminal

A proprietary web-based platform, the Exness Terminal is lightweight, user-friendly, and requires no downloads. It’s perfect for traders who prefer a streamlined experience with real-time market data.

4. Exness Trader App

For mobile trading, the Exness Trader app (available on iOS and Android) offers full account management, real-time quotes, and charting tools. Kenyan traders appreciate its integration with M-Pesa for instant deposits and withdrawals.

All platforms are customizable and support multiple languages, including English and Swahili, enhancing accessibility for Kenyan users.

Trading Instruments: What Can You Trade with Exness?

Exness provides a diverse range of instruments, allowing Kenyan traders to explore various markets:

Forex: Over 100 currency pairs, including majors, minors, and exotics.

Metals: Gold, silver, and platinum against USD and other currencies.

Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and more, available 24/7.

Indices: Major global indices like the S&P 500 and FTSE 100.

Stocks: CFDs on shares of top companies like Apple, Tesla, and Google.

Energies: Crude oil and natural gas.

This variety ensures Kenyan traders can diversify their portfolios and capitalize on global market trends.

Deposits and Withdrawals: Seamless Transactions for Kenyans

Efficient payment methods are crucial for a smooth trading experience. Exness excels in this area, especially for Kenyan traders.

Supported Payment Methods

M-Pesa: A game-changer for Kenya, M-Pesa allows instant deposits and withdrawals with no fees from Exness (though network charges may apply).

Bank Cards: Visa and Mastercard are accepted for quick funding.

Bank Transfers: Local bank transfers in KES are supported, commission-free.

E-Wallets: Options like Skrill and Neteller are available for faster transactions.

Cryptocurrencies: Bitcoin and USDT for tech-savvy traders.

Processing Times and Fees

Deposits: Most methods, including M-Pesa, are instant.

Withdrawals: Processed within minutes to 24 hours, depending on the method. Exness charges no withdrawal fees, making it cost-effective.

The inclusion of M-Pesa and KES accounts makes Exness exceptionally convenient for Kenyan traders, eliminating the hassle of currency conversion.

Fees and Spreads: How Cost-Effective is Exness?

Trading costs can significantly impact profitability. Here’s how Exness fares:

Spreads: Start at 0.0 pips on professional accounts (Raw Spread and Zero) and 0.3 pips on standard accounts. Major pairs like EUR/USD often have tight spreads.

Commissions: Zero on Standard and Pro accounts; $0.05–$3.5 per lot on Raw Spread and Zero accounts.

Swap Fees: Competitive, with swap-free options for Islamic accounts.

Inactivity Fees: None, unlike some brokers that penalize dormant accounts.

Compared to competitors, Exness offers some of the lowest trading costs in Kenya, making it an attractive option for cost-conscious traders.

Customer Support: Help When You Need It

Reliable support is essential, especially for new traders. Exness provides:

24/7 Availability: Contact via live chat, email, or phone, any time of day.

Multilingual Support: English, Swahili, and 13 other languages are supported.

Local Presence: A representative office in Nairobi enhances accessibility.

Help Center: A comprehensive FAQ section for quick answers.

While there’s no local phone number, the international support team is responsive and knowledgeable, earning positive feedback from Kenyan users.

💥 Trade with Exness now: Open An Account or Visit Brokers

Educational Resources: Empowering Kenyan Traders

Exness offers a range of educational tools to help traders improve their skills:

Exness Academy: Articles, tutorials, and guides on forex basics, technical analysis, and risk management.

Webinars: Live sessions covering market trends and strategies.

Demo Accounts: Practice trading with virtual funds, risk-free.

While the resources are solid, they’re more suited to beginners and intermediate traders. Advanced traders may need to supplement with external materials.

Pros and Cons of Trading with Exness in Kenya

Pros

CMA-regulated and globally licensed for safety.

Low minimum deposit (KES 100) and no withdrawal fees.

M-Pesa integration and KES accounts for convenience.

Competitive spreads and high leverage (up to 1:2000).

Diverse trading instruments and platforms.

Cons

Limited advanced educational content.

No local phone support.

Social trading and portfolio management accounts unavailable in Kenya.

How to Open an Exness Account in Kenya

Getting started with Exness is straightforward:

Visit the Website: Go to Exness now: Open An Account or Visit Brokers

Fill in Details: Select Kenya as your country, enter your email, and set a password.

Verify Your Account: Upload ID (e.g., passport or national ID) and proof of address.

Deposit Funds: Use M-Pesa or another method to fund your account.

Start Trading: Choose your platform and begin trading.

The process takes minutes, and verification is typically completed within 24 hours.

Exness vs. Competitors: How Does It Compare?

Here’s how Exness stacks up against other popular brokers in Kenya:

Exness vs. XM: Exness offers lower spreads and M-Pesa support, while XM has more educational resources.

Exness vs. Pepperstone: Both have tight spreads, but Exness’s KES accounts give it an edge for Kenyans.

Exness vs. HotForex (HFM): Exness has faster withdrawals and no inactivity fees, though HFM offers more account variety.

Exness’s local focus and cost-effectiveness make it a strong contender in the Kenyan market.

Why Kenyan Traders Choose Exness

Kenyan traders are drawn to Exness for several reasons:

Accessibility: Low entry barriers and local payment options.

Trust: Strong regulation and fund protection.

Flexibility: Multiple account types and high leverage.

Technology: Reliable platforms and fast execution.

These factors have positioned Exness among the top forex brokers in Kenya.

Tips for Success with Exness in Kenya

To maximize your trading experience with Exness, consider these tips:

Start with a Demo Account: Practice strategies risk-free.

Leverage Wisely: High leverage can amplify gains but also losses.

Monitor Spreads: Trade during peak hours for the tightest spreads.

Stay Educated: Combine Exness resources with external learning.

Final Verdict: Is Exness Worth It for Kenyan Traders?

After a thorough review, Exness emerges as a top-tier broker for Kenyan traders. Its CMA regulation, low-cost trading, M-Pesa integration, and diverse offerings make it an excellent choice for both beginners and pros. While it lacks advanced educational content and local phone support, these are minor drawbacks compared to its strengths.

If you’re in Kenya and looking for a reliable, cost-effective, and user-friendly forex broker, Exness is worth considering. Ready to get started? Open an account today and explore the opportunities awaiting you in the forex market.

Have you traded with Exness in Kenya? Share your experience in the comments below!

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: