8 minute read

Is Exness Regulated in Nigeria? Review Broker 2025

Forex trading has surged in popularity across Nigeria, driven by economic opportunities and the growing accessibility of online platforms. Among the many brokers vying for Nigerian traders' attention, Exness stands out as a globally recognized name. But one question looms large for prospective users: Is Exness regulated in Nigeria? This article dives deep into Exness’s regulatory status, its operations in Nigeria, and what it means for traders in this dynamic market. Whether you're a beginner or an experienced trader, understanding the regulatory landscape is key to making informed decisions. Let’s explore.

💥 Trade with Exness now: Open An Account or Visit Brokers

What Is Exness? An Overview of the Broker

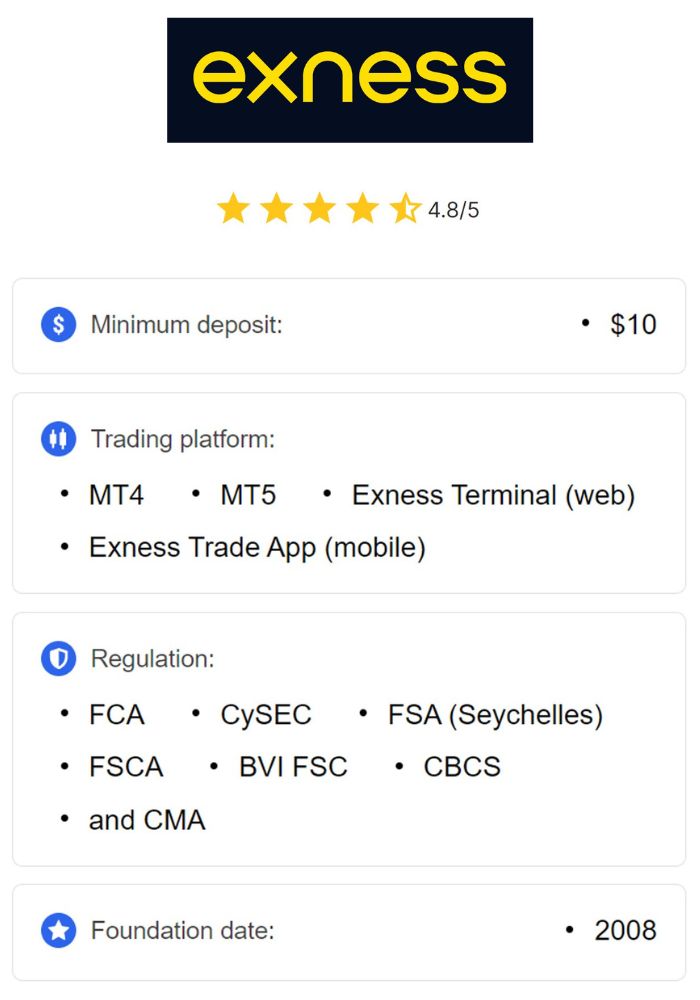

Exness is a well-established forex and CFD broker founded in 2008, with its headquarters in Limassol, Cyprus. Over the years, it has grown into one of the leading players in the global trading industry, serving millions of clients across more than 180 countries. Known for its competitive spreads, advanced trading platforms (like MetaTrader 4 and MetaTrader 5), and a wide range of financial instruments—including forex, commodities, indices, and cryptocurrencies—Exness has built a reputation for reliability and transparency.

For Nigerian traders, Exness offers appealing features such as low minimum deposits, localized payment methods (including bank transfers and e-wallets), and accounts denominated in Nigerian Naira (NGN). These factors make it an attractive option in a market where economic volatility and currency fluctuations often drive interest in forex trading. But before diving in, it’s critical to address the elephant in the room: regulation.

The Importance of Regulation in Forex Trading

Before we answer whether Exness is regulated in Nigeria, let’s establish why regulation matters. In the world of forex trading, regulation serves as a safeguard for traders. It ensures that brokers operate transparently, protect client funds, and adhere to ethical practices. A regulated broker is accountable to a governing authority, reducing the risk of fraud, fund mismanagement, or unfair trading conditions.

For Nigerian traders, regulation is especially crucial given the rise of scams and unregulated platforms targeting the country’s growing forex community. Without oversight, traders face risks like:

Loss of Funds: Unregulated brokers may not segregate client funds, leaving them vulnerable if the company faces financial trouble.

Fraudulent Practices: Price manipulation, hidden fees, or withdrawal issues are more common with unregulated entities.

No Recourse: Disputes with unregulated brokers often leave traders without legal protection or a way to recover losses.

So, where does Exness stand in this context? Let’s break it down.

Is Exness Regulated in Nigeria?

The short answer is: No, Exness is not directly regulated in Nigeria. However, this doesn’t tell the full story. To understand Exness’s status, we need to look at both the Nigerian regulatory landscape and Exness’s global credentials.

Nigeria’s Forex Regulatory Framework

In Nigeria, forex trading is legal, but the regulatory environment is complex and somewhat fragmented. Two key institutions play a role:

Central Bank of Nigeria (CBN): The CBN is the country’s primary financial regulator, overseeing monetary policy, foreign exchange transactions, and the stability of the Naira. While it has imposed restrictions on speculative forex activities (e.g., limiting access to foreign currency through unofficial channels), it does not directly regulate forex brokers operating online.

Securities and Exchange Commission (SEC): The SEC oversees investment activities and financial markets in Nigeria, including locally registered brokers. However, its jurisdiction primarily applies to Nigerian-based firms, not international brokers like Exness.

Currently, Nigeria lacks a dedicated regulatory body specifically for forex brokers, unlike countries with robust frameworks (e.g., the FCA in the UK or ASIC in Australia). This creates a “grey area” where international brokers can serve Nigerian clients without local licensing, provided they comply with their home jurisdictions’ regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers

Exness’s Global Regulation

While Exness isn’t regulated by the CBN or SEC, it operates under multiple international licenses from reputable authorities. These include:

Cyprus Securities and Exchange Commission (CySEC): License number 178/12. CySEC regulates Exness (Cy) Ltd, ensuring compliance with EU financial standards, including client fund segregation and transparency.

Financial Conduct Authority (FCA): In the UK, Exness (UK) Ltd is authorized under Financial Services Register number 730729. The FCA is one of the world’s strictest regulators, enforcing high standards for trader protection.

Financial Services Authority (FSA): In Seychelles, Exness (SC) Ltd holds license number SD025, catering to clients outside the European Economic Area (EEA).

Financial Sector Conduct Authority (FSCA): In South Africa, Vlerizo (Pty) Ltd is authorized with FSP number 51024.

Capital Markets Authority (CMA): In Kenya, Exness (KE) Limited holds license number 162 as a non-dealing forex broker.

Additionally, Exness is licensed in other jurisdictions like Curaçao, Mauritius, and the British Virgin Islands. These licenses collectively ensure that Exness adheres to global best practices, such as segregating client funds, maintaining adequate capital reserves, and implementing anti-money laundering (AML) measures.

What This Means for Nigerian Traders

For Nigerian traders, Exness operates under its international licenses rather than a Nigerian-specific one. Most Nigerian clients are registered under Exness (SC) Ltd, regulated by the FSA in Seychelles. While this isn’t a local license, it still provides a layer of oversight and security. Exness’s compliance with international standards offers reassurance, but it’s worth noting that disputes may need to be resolved through these foreign regulators, not Nigerian authorities.

Is Exness Safe for Nigerian Traders?

Regulation is just one piece of the puzzle. To determine if Exness is a safe choice, let’s examine additional factors.

Fund Security

Exness prioritizes client fund protection through:

Segregated Accounts: Client funds are kept separate from company funds, reducing the risk of loss if Exness faces financial difficulties.

Top-Tier Banking Partners: Funds are held with reputable banks, adding an extra layer of security.

Compensation Schemes: In regions like the EU (under CySEC), clients may be eligible for compensation if the broker becomes insolvent—though this may not apply to Nigerian traders under the Seychelles entity.

Trading Conditions

Exness offers competitive conditions that enhance its appeal:

Low Spreads: Starting from 0.0 pips on some accounts, ideal for cost-conscious traders.

High Leverage: Up to 1:2000 (depending on account type and experience), though high leverage carries risks.

Fast Execution: Market execution with minimal slippage, critical for volatile forex markets.

User Feedback

Nigerian traders on platforms like X and forex forums often praise Exness for its ease of use, fast withdrawals, and responsive customer support. However, some report occasional delays during high-traffic periods or verification challenges—issues not unique to Exness but worth considering.

Pros and Cons of Trading with Exness in Nigeria

Pros

Global Regulation: Licenses from CySEC, FCA, and others ensure a high standard of operation.

Localized Features: NGN accounts and local payment options cater to Nigerian needs.

Variety of Accounts: From Standard Cent (for beginners) to Pro (for experts), there’s something for everyone.

Educational Resources: Webinars, guides, and demo accounts help traders grow.

Cons

No Local Regulation: Lack of CBN or SEC oversight may limit legal recourse in disputes.

Regulatory Grey Area: Operating in Nigeria without a local license could pose risks if regulations tighten.

Dependence on International Support: Resolving issues may involve foreign entities, potentially complicating matters.

How Does Exness Compare to Other Brokers in Nigeria?

To put Exness in context, let’s compare it to other popular brokers serving Nigerian traders:

FXTM (ForexTime): Regulated by the FCA, CySEC, and FSCA, FXTM has a strong presence in Nigeria with local offices and NGN accounts. It’s a closer competitor in terms of local engagement.

HotForex (HF Markets): Licensed by multiple regulators (FCA, CySEC, FSCA), HotForex offers similar trading conditions and local payment methods.

IC Markets: Known for tight spreads and ECN trading, IC Markets is regulated by ASIC and CySEC but lacks the localized focus Exness provides.

Exness stands out for its low-cost trading and NGN support, but brokers with physical Nigerian presence (like FXTM) may appeal to those prioritizing local accountability.

The Future of Forex Regulation in Nigeria

Nigeria’s forex market is evolving rapidly, with millions of traders participating annually. The CBN has cracked down on unregulated platforms in the past (e.g., restrictions in 2021), signaling a potential shift toward stricter oversight. If Nigeria establishes a dedicated forex regulatory body, international brokers like Exness may need to obtain local licenses to continue operating legally. For now, traders must weigh the benefits of global regulation against the absence of local supervision.

Conclusion: Should You Trade with Exness in Nigeria?

So, is Exness regulated in Nigeria? Not directly, but its robust international licenses from CySEC, FCA, FSA, and others provide a solid foundation of trust and security. For Nigerian traders, Exness offers a compelling mix of affordability, accessibility, and reliability—backed by over 15 years of global experience. However, the lack of local regulation means due diligence is essential. Verify account details, understand the risks, and consider starting with a demo account to test the waters.

💥 Trade with Exness now: Open An Account or Visit Brokers

If you value global oversight and tailored features for Nigeria, Exness is a strong contender. But if local regulation is a non-negotiable priority, you might explore alternatives with a physical presence in the country. Ultimately, your choice depends on your trading goals, risk tolerance, and comfort with the regulatory landscape.