12 minute read

How To Open Zero Spread Account In Exness

If you're considering trading in the financial markets, specifically forex or cryptocurrencies, you may have heard about a "zero spread" account. This type of account can offer traders significant benefits. In this article, we will cover everything you need to know about how to open zero spread account in Exness, including the advantages, the process, and tips for successful trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Zero Spread Accounts

Before diving into how to open a zero spread account in Exness, it is important to understand what exactly a zero spread account is and its implications for trading.

Definition of Zero Spread Accounts

A zero spread account is a type of trading account where the bid and ask prices of financial instruments are equal, resulting in no visible spread. This means that there is no difference between the buying and selling price at any given moment.

Traders in zero spread accounts typically pay a commission per trade instead of relying on the spread as their cost of trading. As a result, while the spread might appear non-existent, commissions can vary significantly depending on the broker's structure. This unique setup is particularly beneficial for scalpers and day traders who prefer to execute multiple trades throughout their trading sessions.

Advantages of Zero Spread Accounts

The primary advantage of opening a zero spread account lies in the potential for cost savings. With no spread, traders can enter and exit positions without incurring additional costs associated with the spread.

Additionally, zero spread accounts provide greater transparency in pricing. Instead of worrying about fluctuating spreads during economic news releases or volatile market conditions, traders can rest assured knowing their transaction costs remain consistent. This allows for more precise trading strategies, especially for short-term trading.

Moreover, these accounts often grant access to better execution speeds due to tighter price quotes, enabling traders to capitalize on quick market movements without delay.

Disadvantages of Zero Spread Accounts

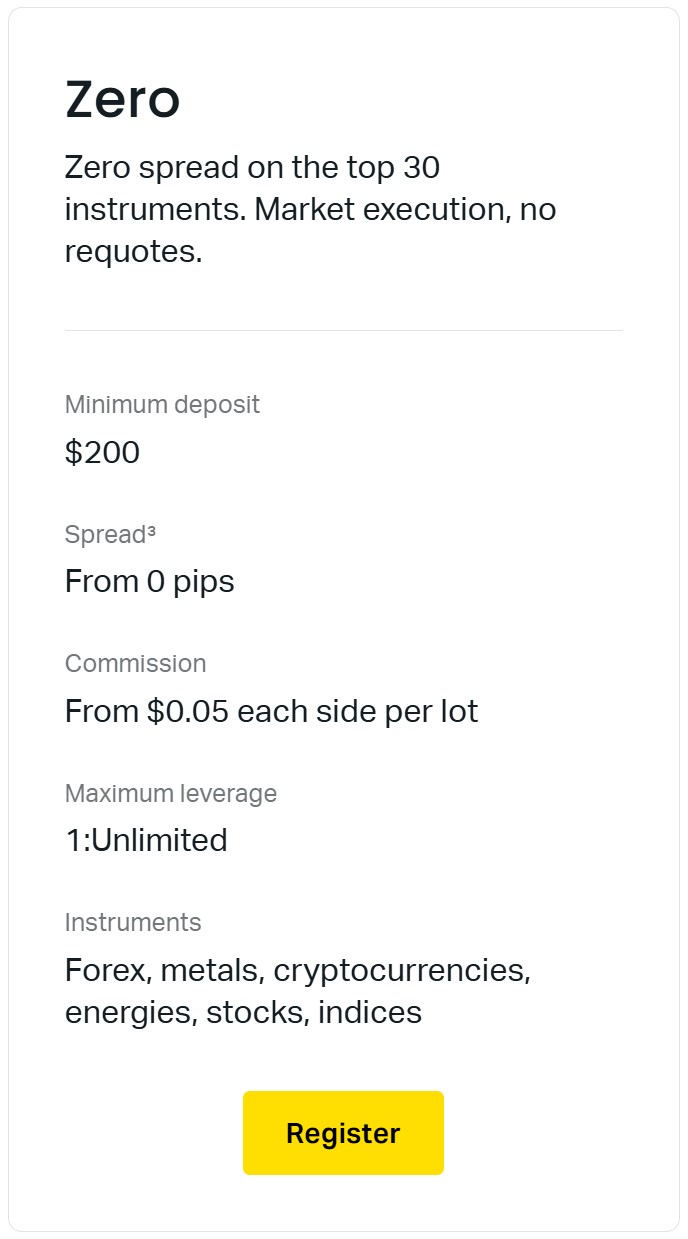

Despite the numerous benefits of opening a zero spread account, there are also some drawbacks worth considering.

One concern is that commissions can add up quickly, potentially offsetting the savings gained from having no spread. Traders must ensure they fully understand the commission structure before committing to such an account.

Additionally, zero spread accounts may require higher minimum deposits compared to standard accounts. For novice traders or those with limited capital, this requirement could be a barrier to entry.

Lastly, liquidity providers often tie their services to zero spread accounts, which can lead to increased slippage during times of high volatility. Traders should consider their risk tolerance and desired trading style before opting for a zero spread account.

Overview of Exness

Exness is one of the leading forex brokers globally, offering various account types to cater to the unique requirements of different traders. Let's delve further into the background and offerings of Exness.

Background and History of Exness

Founded in 2008, Exness has established itself as a trusted name in online trading. The broker was created to offer a professional, easy-to-use platform for retail and institutional clients alike. Since its inception, Exness has focused on providing exceptional customer service and innovative trading solutions.

Over the years, Exness has expanded its reach, now serving clients from around the globe. Their commitment to regulatory compliance has allowed them to receive licenses from reputable financial authorities, ensuring that traders can trust the safety of their funds and the integrity of their operations.

Trading Instruments Offered by Exness

Exness provides a wide array of trading instruments across several asset classes. Traders can access over 100 currency pairs, including major, minor, and exotic pairs, allowing for diverse trading strategies and approaches.

In addition to forex, Exness offers trading in commodities, indices, cryptocurrencies, and shares. This extensive range of instruments allows traders to diversify their portfolios and take advantage of various market opportunities.

Regulatory Environment and Security Measures

Regulation is a critical aspect of online trading, and Exness takes it seriously. The broker is licensed by several regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Exness employs robust security measures to protect client funds and personal information. These measures include segregating client accounts, advanced encryption technology, and compliance with international standards. In doing so, Exness ensures that traders can focus on their trading activities without worrying about the safety of their investments.

Eligibility Criteria for Opening an Account

Before proceeding with the steps to open a zero spread account in Exness, it's essential to understand the eligibility criteria that must be met.

Minimum Age Requirement

To open a trading account with Exness, clients must be at least 18 years old. This age limit is standard among forex brokers, as it ensures that traders are legally able to engage in financial trading activities.

Required Identification Documents

When opening a zero spread account in Exness, clients are required to submit identification documents to verify their identity. Typically, this includes a government-issued ID, such as a passport or driver's license, along with proof of residency, such as a utility bill or bank statement.

Verification is crucial for regulatory compliance and helps maintain a secure trading environment.

Geographical Restrictions

Exness serves clients from various countries; however, certain geographical restrictions apply. Prospective clients should check if their country of residence is eligible for account opening prior to attempting to register. Additionally, some countries may be subject to specific regulations limiting trading activities.

Steps to Open a Zero Spread Account

Now that we understand the prerequisites for opening a zero spread account in Exness, let's outline the necessary steps.

Visit the Exness Official Website

The first step in the process is to visit the official Exness website. The user-friendly interface makes navigation seamless, and prospective clients will find clear instructions on how to open an account.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

It's essential to ensure that you access the legitimate site and not a phishing version. Always verify the URL and utilize secure internet connections when entering personal information.

Selecting the Account Type

Once on the Exness website, navigate to the "Accounts" section to explore the available account types. Here, you will find details about the zero spread account, along with other account options.

Selecting the right account type is crucial as it determines your trading conditions, fees, and available leverage. Ensure you review the specifics of the zero spread account, including commission structures and funding requirements, before making your choice.

Filling Out the Registration Form

After selecting the zero spread account, you will be prompted to fill out a registration form. This form typically requires basic personal information, such as your full name, email address, phone number, and residential address.

It's essential to provide accurate information during this process, as discrepancies may lead to delays in the account verification process later on.

Verification Process and Document Submission

Following completed registration, Exness will initiate the verification process. You will need to submit the required identification documents mentioned earlier to confirm your identity.

This process may take anywhere from a few hours to several days, depending on the volume of applications being processed. It's advisable to keep an eye on your email for updates regarding your application status and take note of any additional documents that may be requested.

Funding Your Zero Spread Account

Once your account is successfully verified, you'll need to fund it before you can begin trading. Understanding the available deposit methods, minimum requirements, and associated fees is vital.

Available Deposit Methods

Exness offers a variety of deposit methods to cater to the preferences of its global clientele. Common deposit options include bank transfers, credit/debit cards, e-wallets, and cryptocurrency transactions.

Each method comes with its own set of processing times and fees. It's advisable to choose a payment method that aligns with your trading habits and speed preference.

Minimum Deposit Requirements

While the minimum deposit requirements can vary based on account type and selected funding method, Exness typically offers flexible options.

As a new trader, be sure to familiarize yourself with the minimum deposit amount for the zero spread account, and plan your funding strategy accordingly to ensure you meet the threshold.

Fees Associated with Deposits

Although many funding methods at Exness are fee-free, it's essential to be aware of potential charges that may arise. Depending on the method used, third-party fees may apply, and these can vary by provider.

Carefully reviewing the terms and conditions associated with your chosen deposit method can help mitigate any unexpected costs that may impact your trading budget.

Trading Conditions on Zero Spread Accounts

Understanding the trading conditions on zero spread accounts is essential for developing a successful trading strategy.

Leverage Options Available

Leverage is a powerful tool that allows traders to control larger positions with a smaller amount of capital. Exness offers varying leverage levels depending on the account type and trading instruments.

For zero spread accounts, traders may have access to higher leverage ratios, which can amplify both profits and losses. It’s crucial to understand the implications of using leverage and develop a sound strategy to manage risks effectively.

Margin Requirements

Margin refers to the amount of capital required to open and maintain a trading position. In zero spread accounts, margin requirements can differ based on the financial instrument being traded and the level of leverage utilized.

Being aware of margin requirements is critical, as insufficient funds in your trading account can lead to forced liquidation of positions. Therefore, maintaining proper account balance and understanding margin calls is essential for long-term success.

Commission Structures

Commission structures for zero spread accounts can vary extensively. While the absence of a spread reduces trading costs, traders should closely examine the commission rates charged per trade.

Understanding the commission structure not only aids in calculating overall trading costs but also informs decision-making regarding trade frequency and position sizing.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tips for Successful Trading on Zero Spread Accounts

Having access to a zero spread account can enhance your trading experience, but success ultimately hinges on strategic planning and execution.

Choosing the Right Trading Strategy

Selecting an appropriate trading strategy is paramount to achieving success in the forex markets. Given the unique characteristics of zero spread accounts, high-frequency trading strategies, such as scalping or day trading, may be particularly advantageous.

These strategies capitalize on small price fluctuations, allowing traders to benefit from the lack of spread. However, each trader must assess their risk tolerance and market understanding before settling on a particular approach.

Risk Management Techniques

Effective risk management is critical for preserving capital and navigating the inherent uncertainties of trading. Implementing techniques such as stop-loss orders, diversification, and position sizing can significantly reduce exposure to adverse market movements.

Since zero spread accounts may encourage more aggressive trading due to the absence of spreads, maintaining a disciplined approach to risk management becomes even more vital.

Utilizing Trading Tools and Resources

The right tools and resources can enhance your trading effectiveness. Exness offers various features, including advanced charting tools, economic calendars, and trading signals, which can aid in informed decision-making.

Leveraging these tools can assist traders in identifying potential trading opportunities and developing well-informed strategies tailored to their unique trading styles.

Common Issues When Opening a Zero Spread Account

Despite Exness's reputation for efficiency, traders may encounter challenges during the account opening process. Being aware of common issues can ease frustrations and expedite resolution.

Account Verification Delays

One of the most frequently encountered issues is delays in the account verification process. High volumes of applications or incomplete documentation may slow down approvals.

Traders experiencing delays should remain proactive and responsive to any requests for additional information, as timely cooperation can help facilitate a swift resolution.

Technical Difficulties with the Platform

Technical difficulties can arise for a myriad of reasons, including server maintenance, software glitches, or connectivity problems.

In cases where traders face challenges accessing their accounts or executing trades, it's advisable to check Exness's official communication channels for updates and follow troubleshooting steps provided in their support resources.

Troubleshooting Deposit Problems

Depositing funds into your trading account should be a straightforward process; however, technical issues or errors can occasionally occur.

If you experience challenges completing a deposit, verify that you've entered the correct payment details and that your chosen method aligns with Exness’s accepted payments. Should problems persist, reaching out to Exness's support team can provide clarity and assistance.

Customer Support Services at Exness

Quality customer support is an essential aspect of any trading platform, and Exness places a strong emphasis on assisting clients.

Contacting Customer Support

Traders can quickly contact Exness’s customer support through various methods, including live chat, email, or phone. The availability of multilingual representatives ensures that traders can communicate comfortably and efficiently.

Utilizing live chat can facilitate swift responses, making it an excellent option for urgent inquiries or troubleshooting support.

Types of Support Available

Exness offers a range of support services designed to assist traders at all levels. Clients can receive help with account-related inquiries, general trading questions, and technical issues related to the trading platform.

Additionally, Exness provides educational resources, webinars, and seminars aimed at enhancing clients' trading knowledge and skills.

Response Time and Satisfaction Ratings

Exness generally maintains a strong reputation for response times and customer satisfaction. Many users report positive experiences, citing prompt and helpful responses from support representatives.

As with any service, individual experiences may vary, but the overall sentiment reflects Exness’s commitment to meeting the needs of its clients.

Conclusion

Opening a zero spread account in Exness presents an exciting opportunity for traders seeking to minimize transaction costs and maximize their trading potential. By understanding the intricacies of zero spread accounts, the process involved in opening one, and the critical factors that contribute to successful trading, you’ll be equipped to make informed decisions in your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With thorough preparation and comprehensive knowledge, you can confidently navigate the world of forex trading while leveraging the advantages offered by a zero spread account. Whether you’re a seasoned trader or just starting, the ability to adapt and utilize effective strategies will be key to achieving your trading goals.

Read more: