19 minute read

How To Trade Forex With $50: A Comprehensive Guide

Trading Forex is an exciting and potentially lucrative endeavor, even with a modest starting capital of $50. Understanding how to navigate the complexities of the Forex market is crucial, as it can lead to both opportunities and risks. In this article, we will explore how to trade Forex with $50 by delving into essential concepts, strategies, and practices that can help you succeed in your trading journey.

Top 4 Best Forex Brokers

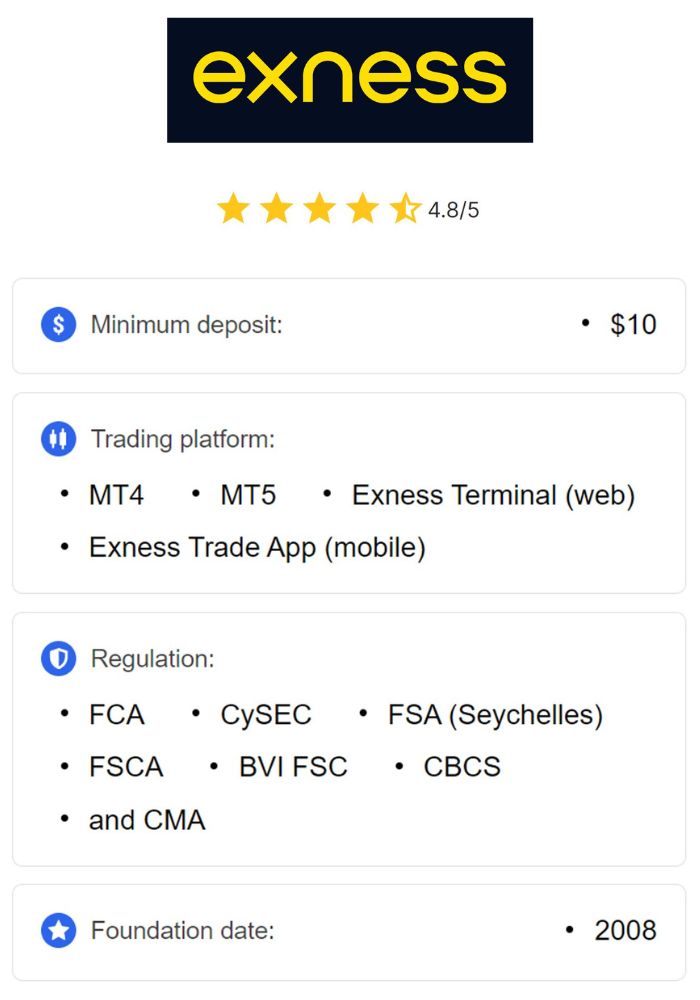

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding Forex Trading Basics

Before diving into the intricacies of trading forex with limited funds, it's essential to grasp the fundamental concepts that underpin the forex market. Understanding these basics will prepare you for the next steps.

What is Forex Trading?

Forex trading refers to the buying and selling of currency pairs in the foreign exchange market. Unlike stock markets that are confined to a specific set of assets, forex trading takes place 24 hours a day and involves a vast array of global currencies.

The primary goal of forex trading is to profit from fluctuations in currency values. Traders speculate on whether a currency will rise or fall against another, allowing them to capitalize on market movements. This dynamic nature makes forex trading appealing to many investors.

Moreover, forex trading operates on a decentralized platform, meaning there is no central exchange. Instead, transactions occur over-the-counter (OTC) through a network of banks, brokers, and financial institutions, which contributes to its high liquidity.

Major Currency Pairs and Their Importance

In forex trading, currencies are traded in pairs. The most widely traded pairs include major currencies like the Euro (EUR), United States Dollar (USD), British Pound (GBP), and Japanese Yen (JPY). These pairs are characterized by their high trading volumes and tight spreads, making them ideal for both beginner and experienced traders.

Understanding the importance of major currency pairs is crucial because they exhibit consistent behavior and volatility, providing ample opportunities for profit. Additionally, major pairs are often influenced by economic news and geopolitical events, which can create significant trading opportunities.

Traders should familiarize themselves with the characteristics of each pair, including factors that may influence price movements, such as interest rates, inflation, and employment data.

The Role of Brokers in Forex Trading

Brokers act as intermediaries between traders and the forex market. They provide access to trading platforms where orders can be executed, and they often offer various tools and resources to facilitate trading decisions.

Choosing the right broker is critical, especially for those starting with a small investment. A reliable broker offers competitive spreads, low fees, a user-friendly interface, and educational resources. Moreover, an ethical broker ensures that your trades are executed swiftly and transparently, which is particularly important for traders aiming to make small profits.

Additionally, brokers can significantly impact your trading experience through leverage options. However, leverage can be a double-edged sword; while it amplifies potential profits, it also magnifies risks. Therefore, understanding how brokers operate and choosing one that aligns with your trading goals is vital, especially when learning how to trade forex with $50.

Starting with a Small Capital

With a basic understanding of forex trading, let’s explore how to effectively start trading with a modest amount of capital. Many aspiring traders wonder if it's feasible to begin their trading journey with just $50.

Is It Possible to Start Trading Forex with $50?

While $50 might not seem like a substantial amount for trading, it is indeed possible to initiate trading within the forex market. Some brokers offer micro accounts that allow trading in smaller increments, making it achievable to start with limited funds.

However, prospective traders need to recognize that trading with a small capital comes with limitations. For instance, the number of trades may be restricted due to lower leverage, meaning you won't be able to take advantage of larger price movements as effectively as someone with more substantial capital.

Nonetheless, trading with $50 can serve as an excellent opportunity for beginners to learn and develop their skills without risking large amounts of money. It enables individuals to understand market dynamics, test strategies, and gain confidence before committing more significant funds.

Understanding Leverage and Margin

Leverage allows traders to control a more prominent position in the market than the actual cash they have in their accounts. For example, if a broker offers a leverage ratio of 1:100, this means that for every $1 in your account, you can trade up to $100 in the market.

While leveraging can enhance potential profits, it also increases the risk of loss, particularly when trading with small capital. As leveraged positions can require margins, traders must maintain sufficient funds in their accounts to cover potential losses. If the market moves unfavorably, traders could face margin calls that require additional deposits or result in forced closures of positions.

It is crucial for traders using $50 to understand how to manage leverage wisely. Effective risk management, including setting stop-loss orders and being disciplined about trade sizes, helps to mitigate the inherent risks associated with trading on margin.

Choosing the Right Broker

Selecting the right broker is a pivotal step in your forex trading journey, particularly when starting with a limited budget. A trustworthy and suitable broker will shape your experience and help you navigate the complexities of the forex market.

Factors to Consider When Selecting a Forex Broker

When looking for a forex broker, several factors should be considered:

Regulatory Compliance: Choose a broker that is regulated by recognized authorities. Regulatory bodies ensure that brokers adhere to strict guidelines, helping protect traders' interests and investments.

Trading Conditions: Analyze the trading conditions offered by the broker, including spreads, commissions, and rollover fees. Lower costs often lead to better profitability, especially for those with small accounts.

Platform Ease of Use: An intuitive trading platform enhances your experience, enabling you to execute trades quickly and efficiently. Look for features that assist in analysis, backtesting, and real-time monitoring.

Customer Support: A responsive customer support team is crucial for addressing any issues or queries you may encounter during your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Taking the time to evaluate these factors will help you identify a broker that meets your needs and supports your trading ambitions.

Importance of Regulation and Licensing

Regulation plays a vital role in ensuring the integrity of the forex market. A regulated broker is subject to strict oversight and must adhere to specific operational standards, which helps instill confidence among traders.

Working with licensed brokers minimizes the risk of fraud and unethical practices, as regulatory bodies implement measures to protect clients’ funds. Traders should research the regulatory status of their chosen broker and confirm that they’re operating under reputable jurisdictions.

Furthermore, if a broker is registered with multiple regulatory bodies, this adds an extra layer of assurance regarding their credibility and reliability.

Evaluating Broker Fees and Spreads

Understanding the fee structure is paramount when selecting a forex broker, especially for traders starting with minimal capital. Brokers typically charge spreads, which is the difference between the bid and ask price of a currency pair. The tighter the spread, the less cost incurred when entering a trade.

Additionally, some brokers may charge commissions per trade, while others operate solely on spreads. Thoroughly evaluating these costs can significantly impact long-term profitability, making it essential to choose a broker with transparent and competitive fees.

It's advisable to compare different brokers and consider how their fee structures align with your trading style, especially when learning how to trade forex with $50.

Setting Up Your Trading Account

With a suitable broker selected, the next challenge involves setting up your trading account. This process can sometimes feel overwhelming for new traders, but following a systematic approach makes it manageable.

Types of Trading Accounts for Small Investors

Most forex brokers offer several types of trading accounts tailored to different levels of experience and capital. For small investors, common account types include micro accounts and demo accounts.

Micro Accounts: These accounts are designed for traders who wish to trade small amounts, typically with minimum trade sizes as low as 1,000 units (1 micro lot). Micro accounts allow traders to engage in live trading with minimal risk, making them ideal for those with limited capital, like our $50 trader.

Demo Accounts: A demo account enables traders to practice trading without risking real money. It utilizes virtual funds and mirrors real-market conditions, offering an excellent way to gain confidence and test strategies before transitioning to live trading.

Understanding the differences between account types will help you choose one that aligns best with your trading objectives and comfort level.

How to Open a Forex Trading Account

Opening a forex trading account is typically straightforward. Most brokers offer an online registration process requiring you to complete a simple application form. You’ll need to provide personal information, such as your name, email address, and phone number.

After submitting the application, the broker will verify your identity and may request documentation such as proof of residency and identification. This process varies by broker, but it usually takes only a few hours to a couple of days.

Once verification is complete, you can fund your account. Funding methods generally include bank transfers, credit/debit cards, and e-wallets. For our $50 trader, it’s essential to choose a deposit method that incurs minimal fees.

Verifying Your Identity and Funding Your Account

Identity verification is a critical step in safeguarding your trading account and ensuring compliance with regulations. Brokers implement this process to prevent fraud and protect client funds.

Be prepared to upload necessary documents for verification, including government-issued ID and utility bills reflecting your name and address. Once your account is verified, you can proceed to fund it.

For funding, select a method that suits your preferences and allows for quick deposits. Ensure you review any deposit limits and fees associated with your chosen method.

Developing a Trading Plan

A well-defined trading plan lays the foundation for successful trading. It serves as a roadmap that guides your decisions, helping you stay focused and disciplined amid market fluctuations.

Importance of a Trading Strategy

Having a trading strategy is crucial for maintaining consistency and managing emotional responses to market movements. A strategy outlines your approach to entering and exiting trades based on predefined criteria.

Without a clear strategy, traders may find themselves reacting impulsively to short-term price changes, which can lead to losses. A solid trading plan includes specifications on your chosen currency pairs, entry and exit points, along with risk management parameters.

Setting specific goals, such as daily, weekly, or monthly profit targets, can further bolster your focus and motivation.

Determining Risk Levels and Position Sizing

Risk management is an integral aspect of any trading plan, especially for traders beginning with limited capital. Determine your acceptable risk levels based on your overall trading capital and individual comfort zones.

Position sizing refers to the amount of capital allocated to each trade. For our trader with $50, employing a conservative approach is advisable—generally risking no more than 1-2% of your account balance on a single trade.

Adhering to a disciplined risk management strategy can safeguard your capital and provide greater opportunities for success over the long term.

Setting Realistic Profit Goals

When developing your trading plan, it’s essential to set realistic profit goals that reflect your experience and initial capital. While ambitious traders may seek to multiply their investments rapidly, it’s wiser to adopt a more gradual approach, especially when starting with limited funds.

Aiming for small, consistent profits builds confidence and reinforces positive trading behavior. Incremental gains can compound over time, leading to more substantial long-term results.

Learning Technical Analysis

Technical analysis is an essential tool for forex traders. By analyzing price charts and patterns, traders can develop insights into future price movements and improve their decision-making processes.

Key Chart Patterns Every Trader Should Know

Understanding chart patterns is vital for recognizing potential market trends and reversals. Common patterns include head and shoulders, triangles, and flags. Each pattern offers insights into market psychology and potential price movements.

For example, a head and shoulders pattern suggests a reversal of an upward trend, indicating that the market may soon move downward. Conversely, bullish flags indicate continuation after a strong upward movement.

Familiarizing yourself with these patterns can aid in identifying potential entry and exit points, enhancing your trading strategy's effectiveness.

Understanding Indicators and Oscillators

Indicators and oscillators are mathematical calculations applied to price charts to help traders identify potential buy or sell signals. Popular indicators include Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence).

By combining multiple indicators, traders can create a comprehensive view of market conditions. For instance, a trader may use Moving Averages to identify trends while applying RSI to assess overbought or oversold conditions, thus confirming potential trade setups.

Using a combination of technical analysis tools enables you to make informed trading decisions, increasing your chances of success while navigating the forex market.

Using Candlestick Charts for Entry and Exit Points

Candlestick charts provide a visual representation of price movements and are widely utilized in technical analysis. Each candlestick reflects four key price points: open, close, high, and low, offering valuable insights into market sentiment.

Understanding candlestick patterns, such as doji, engulfing, and hammer patterns, can help traders identify potential reversal or continuation signals. For instance, a hammer candlestick at the bottom of a downtrend may suggest a bullish reversal.

Incorporating candlestick patterns into technical analysis empowers traders to establish effective entry and exit points, enhancing the likelihood of profitable trades.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Implementing Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis examines economic indicators and news events that influence currency values. A comprehensive understanding of both analyses can enhance your overall trading strategy.

Economic Indicators That Impact Forex Markets

Economic indicators, such as GDP growth, unemployment rates, inflation, and consumer spending, play a significant role in shaping currency values. Monitoring these indicators can provide insights into the health of an economy and potential currency movements.

For example, stronger-than-expected GDP growth may bolster a country's currency, while rising unemployment figures may have the opposite effect.

Traders should remain informed about upcoming economic releases and analyze their potential impact on currency pairs. Utilizing economic calendars helps traders stay ahead of critical events that could influence market behavior.

The Role of News in Forex Trading

News events can create sudden and significant price movements in the forex market. Economic reports, political developments, and geopolitical tensions can all impact currency values sharply.

Keeping abreast of news headlines and understanding the context behind significant announcements enables traders to react appropriately. Sudden news can cause increased volatility and trading volumes, presenting both risks and opportunities for traders.

Nevertheless, it's crucial to avoid emotional reactions to news events. Traders should rely on their trading plans and analyses to make informed decisions rather than responding impulsively to breaking news.

How to Use Economic Calendars

Economic calendars are invaluable resources for forex traders, providing schedules of upcoming economic releases and events. These calendars outline expected data releases, forecasts, and previous results, helping traders anticipate potential market impacts.

By integrating economic calendars into your trading strategy, you can plan your trades around significant events and adjust your positions accordingly. Staying ahead of economic data releases positions you to capitalize on reactive market movements while minimizing exposure to unexpected volatility.

Managing Your Trades Effectively

Effective trade management is essential for maintaining profitability and reducing risks. Implementing proper trade management techniques fosters discipline and maximizes the potential of your trading strategies.

The Importance of Stop Loss and Take Profit Orders

Stop-loss and take-profit orders are vital tools for managing risk in forex trading. A stop-loss order automatically closes a trade at a predetermined price level to limit losses, while a take-profit order locks in profits once a specified target is reached.

By implementing stop-loss and take-profit orders, traders can protect their capital and minimize emotional decision-making. These orders ensure that trades are executed according to your predefined strategy, even if you cannot monitor the market continuously.

Strategies for Monitoring Trades

Monitoring your trades effectively enables you to make timely adjustments in response to market movements. Depending on your trading style, you may opt for manual monitoring or employ automated trading tools such as expert advisors (EAs).

Manual monitoring requires vigilance and discipline, as traders must keep an eye on market conditions and respond to changing variables. On the other hand, EAs can execute trades automatically based on pre-set parameters, alleviating some of the emotional stress associated with trading.

Regardless of your monitoring approach, staying engaged with the market environment is essential to capitalize on favorable conditions and mitigate potential losses.

How to Adjust Trades Based on Market Conditions

Market conditions are constantly evolving, necessitating a flexible approach to trade management. Traders should routinely assess their open positions and adjust stop-loss and take-profit levels in response to new information or changing trends.

For instance, if a currency pair approaches a critical resistance level, it may be prudent to tighten your stop-loss order to secure potential profits. Alternatively, if favorable economic news emerges, traders may choose to widen their take-profit levels to capitalize on momentum.

Being adaptable to shifting market dynamics enhances your ability to manage trades effectively and optimize performance over time.

Emotional Discipline in Trading

Emotional discipline forms the bedrock of successful trading. Forex trading can evoke strong emotions, such as fear, greed, and anxiety. Being aware of and managing these emotions is crucial for maintaining a steady trading mindset.

Recognizing Emotional Triggers in Trading

Traders must identify personal emotional triggers that may compromise their decision-making. For instance, fear of losing may lead to premature exits, while greed may drive traders to hold onto losing positions longer than necessary.

Keeping a trading journal to document trades, thoughts, and feelings can promote self-awareness and highlight patterns in emotional responses. Recognizing these triggers allows traders to develop coping strategies tailored to their unique circumstances.

Techniques for Maintaining Discipline

Maintaining discipline is essential for adhering to your trading plan, regardless of market fluctuations. Techniques such as visualization, mindfulness, and setting routine check-ins can help reinforce discipline.

Envisioning successful trades and outcomes can create a positive mindset and motivate you to stick to your strategy. Practicing mindfulness techniques can alleviate anxiety and anchor your focus, allowing you to trade with clarity.

Establishing check-in routines, whether daily or weekly, to review your trading performance promotes accountability and encourages constructive evaluations of your decisions.

Building a Positive Trading Mindset

Developing a positive trading mindset involves cultivating patience, resilience, and a willingness to learn from mistakes. Traders should embrace setbacks as opportunities for growth rather than viewing them as failures.

Engaging with trading communities, attending workshops, and seeking mentorship can foster a supportive environment that aids in building confidence. Surrounding yourself with like-minded individuals creates opportunities for collaboration and shared learning.

Overall, a positive trading mindset reinforces discipline and resilience, enabling you to navigate the challenges of the forex market with confidence.

Common Mistakes to Avoid

While embarking on your trading journey, it's essential to remain vigilant about common pitfalls that can hinder your progress. Awareness and proactive measures can significantly enhance your trading experience.

Overtrading and Its Consequences

Overtrading occurs when traders take excessive positions in an attempt to recoup losses or chase profits. This behavior often leads to emotional decision-making and poor trade execution, ultimately resulting in larger losses.

To avoid overtrading, establish clear criteria for entering and exiting trades based on your strategy. Stick to your trading plan, and resist the temptation to deviate from your predefined rules in pursuit of immediate results.

Ignoring Risk Management Principles

Neglecting risk management principles can be disastrous for traders, particularly those with limited capital. Failing to set appropriate stop-loss orders, risking too much capital on a single trade, or not diversifying can expose traders to unnecessary risks.

Prioritizing risk management ensures that your trading journey remains sustainable. Adhere to conservative risk parameters and continuously reassess your strategies based on market conditions.

Failing to Stay Educated and Adaptable

The forex market is ever-evolving, and staying informed about new developments, trends, and strategies is crucial for success. Traders who become complacent in their knowledge may miss opportunities or fail to adapt to changing market environments.

Dedicate time to continuous learning through reading, taking courses, attending webinars, and engaging with trading communities. Remaining adaptable allows you to refine your strategies and navigate the complexities of the forex market effectively.

Resources for Continued Learning

Continuous education is vital for developing as a trader, especially when starting with limited capital. Numerous resources exist to facilitate ongoing learning and skill enhancement.

Online Courses and Webinars

Numerous online platforms offer forex trading courses and webinars tailored to traders at various experience levels. Websites like Udemy, Coursera, and BabyPips provide structured learning paths covering everything from basic principles to advanced trading techniques.

Participating in webinars hosted by experienced traders enables you to gain insights from industry experts and interact with fellow learners. Engaging in discussions can deepen your understanding and expose you to diverse perspectives.

Recommended Books for Forex Traders

Reading books authored by seasoned traders can provide invaluable guidance and inspiration. Works such as "Currency Trading for Dummies" by Kathleen Brooks and Brian Dolan and "Day Trading and Swing Trading the Currency Market" by Kathy Lien offer practical advice and strategies applicable to the forex market.

In addition to foundational texts, exploring biographies of successful traders can offer motivation and insight into their journeys. Learning from the experiences of others can help shape your approach to trading and equip you with survival tips.

Engaging with Trading Communities and Forums

Joining trading communities and forums can foster a sense of camaraderie and facilitate knowledge sharing among traders. Platforms like Reddit’s r/Forex and Trade2Win offer spaces for discussions, questions, and sharing experiences.

Engaging with trading communities allows you to connect with traders from diverse backgrounds and skill levels, fostering opportunities for learning and mentorship. Additionally, accessing real-time insights from peers can enhance your market awareness and decision-making abilities.

Conclusion

Navigating the forex market with a capital of $50 may initially seem daunting, yet it is entirely achievable. By understanding the basics of forex trading, selecting the right broker, implementing effective strategies, and committing to continuous learning, traders can cultivate a rewarding trading experience.

Ultimately, achieving success in forex trading requires discipline, patience, and a willingness to learn from both triumphs and failures. By prioritizing these qualities, beginners can establish a solid foundation and gradually build their trading expertise, unlocking a world of possibilities in the dynamic forex market.

Read more: