11 minute read

Is Exness Banned in India? Is it Legal?

Introduction to Exness

Overview of Exness as a Forex Broker

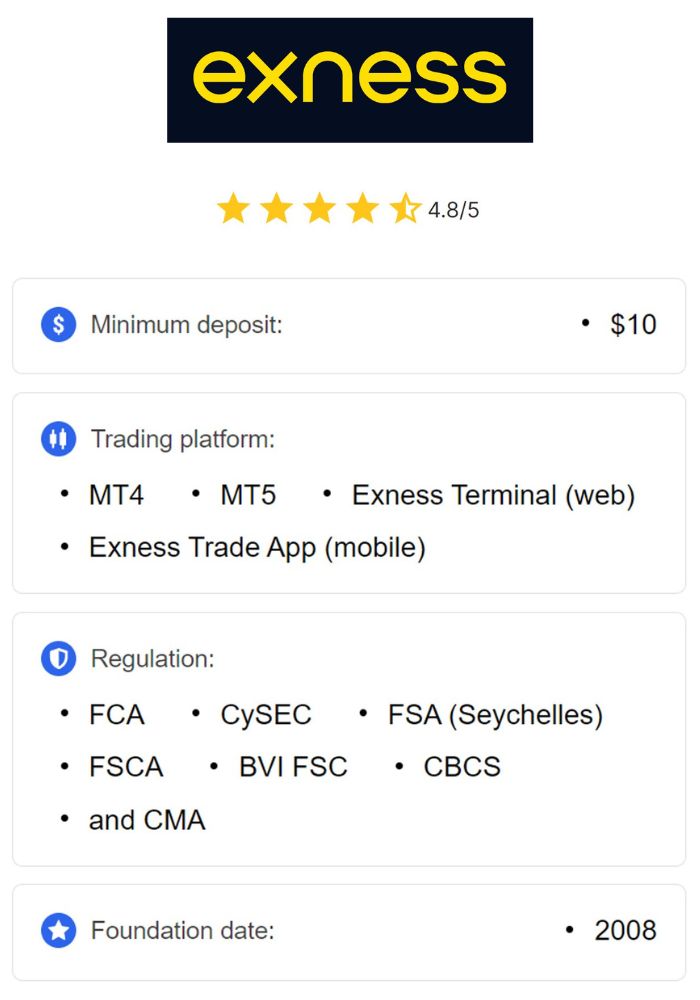

Exness is a global Forex and CFD broker that was founded in 2008, offering a variety of services for traders worldwide. Over the years, Exness has built a strong reputation due to its reliable trading conditions, competitive spreads, and cutting-edge technology. With a focus on providing top-tier trading conditions, Exness offers access to a wide range of financial instruments, including Forex, commodities, metals, and indices.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness operates in many countries and offers different account types to suit the needs of both beginner and professional traders. It is known for providing services such as low spreads, leverage options, and a user-friendly platform, making it a popular choice among retail traders. While the broker is internationally recognized, its regulatory status and legal standing in certain countries, such as India, are a topic of discussion.

Services Offered by Exness

Exness offers a wide range of services to traders, including access to Forex trading, commodities, indices, cryptocurrencies, and CFDs. The broker supports multiple trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), providing a comprehensive set of tools for technical analysis, automated trading, and real-time market data.

Exness provides different types of accounts to suit the needs of different traders, such as Standard Accounts, Professional Accounts, and ECN Accounts. These accounts come with different trading conditions, including varying spreads, leverage levels, and commission structures. Additionally, Exness is known for offering 24/7 customer support, educational resources, and a variety of deposit and withdrawal methods, making it accessible to traders worldwide, including those from India.

Understanding the Regulatory Framework in India

Role of SEBI in Financial Markets

In India, the Securities and Exchange Board of India (SEBI) plays a crucial role in regulating the securities and commodities markets, including Forex trading. SEBI’s primary objective is to protect investors' interests and ensure the development of financial markets in a fair and transparent manner. Forex trading in India, especially involving the Indian Rupee (INR), is strictly regulated by SEBI, with the aim to prevent speculation and excessive volatility in the foreign exchange market.

While SEBI regulates and oversees securities and commodity trading, it does not regulate offshore forex brokers like Exness. This lack of direct regulation of such brokers can lead to confusion among Indian traders, as they may assume that trading with unregulated or offshore brokers like Exness is either illegal or risky. However, the role of SEBI is critical in protecting traders from fraudulent activities within India.

Regulations Governing Forex Trading

Forex trading in India is primarily governed by the Foreign Exchange Management Act (FEMA), which sets out rules for currency trading in the country. Under FEMA, Indian citizens are not allowed to trade directly on offshore Forex platforms unless they are trading through an approved method, such as participating in currency futures contracts on recognized exchanges like the National Stock Exchange (NSE).

FEMA restricts Indian residents from engaging in Forex trading through foreign brokers unless the broker is licensed or regulated by an Indian authority. This means that Forex trading platforms like Exness, which are not directly regulated by SEBI or any other Indian regulatory body, fall into a grey area when it comes to Indian traders.

Exness and Its Global Operations

Licensing and Regulation in Different Countries

Exness holds licenses from several financial regulatory bodies across the globe, which helps ensure its operations comply with international standards. It is regulated by organizations such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA), among others. These regulations provide transparency and safeguard traders’ interests by ensuring that Exness adheres to rigorous financial practices and investor protection policies.

While Exness is licensed in several jurisdictions, it is important to note that it is not regulated by SEBI in India. This lack of SEBI regulation means that Indian traders do not benefit from the legal protections provided by SEBI, such as dispute resolution, compensation schemes, and oversight of the broker's financial practices. Consequently, Indian traders who choose Exness must do so with an understanding of the risks involved.

Comparison with Other Brokers in the Market

Exness is just one of many global Forex brokers that operate internationally. While many Forex brokers are regulated in multiple jurisdictions, not all of them are licensed or allowed to operate within India due to the country’s strict regulations regarding offshore Forex trading. Some other brokers that operate in India, such as IC Markets or FXTM, may offer similar services but are also unregulated by SEBI.

The key difference between Exness and brokers that are regulated by SEBI is the level of legal protection and compliance with local regulations. Brokers regulated by SEBI are required to comply with the guidelines set forth by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India, which ensures a higher level of investor protection for Indian traders. Traders should carefully consider the pros and cons of trading with offshore brokers like Exness versus those regulated locally.

The Legality of Forex Trading in India

Permissible Trading Instruments

In India, trading in Forex instruments is restricted to certain products, such as currency futures and options, which can be traded on recognized exchanges. Indian residents can legally trade in currency futures on exchanges like the NSE, but they are not permitted to trade directly in the Forex market through unregulated foreign brokers. As such, Indian traders are restricted from engaging in online Forex trading with brokers like Exness unless the broker has specific permissions to operate within the country.

For Indian residents, the legal route for Forex trading involves engaging with authorized and regulated exchanges that provide access to currency futures. Trading on unregulated or offshore platforms, such as Exness, is considered risky due to the lack of consumer protection and the potential legal implications of violating FEMA regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Legal Consequences of Unregulated Trading

Trading on unregulated Forex platforms, such as Exness, can expose Indian traders to various legal and financial risks. If Indian residents are caught violating FEMA regulations by engaging in illegal Forex trading, they could face penalties, including fines or even imprisonment, depending on the severity of the offense. While enforcement of these laws may not always be strict, traders must understand that trading on offshore platforms carries potential legal consequences.

Moreover, Indian traders who use unregulated brokers may not have access to dispute resolution mechanisms or investor protection schemes, leaving them vulnerable in case of fraud or malpractice by the broker. As a result, Indian traders need to weigh the risks and benefits of trading on offshore platforms like Exness and consider the legal implications of doing so.

Exness' Position on Indian Clients

Availability of Services for Indian Traders

Exness does offer its services to traders in India, but it is important to note that Indian residents cannot open trading accounts on the platform if they wish to engage in direct Forex trading. This is due to the restrictions imposed by the Reserve Bank of India (RBI) and SEBI regarding the legality of Forex trading with offshore brokers. However, Indian traders can access Exness' platform to trade other financial instruments, such as CFDs, commodities, or indices, if the platform offers access to such products.

Exness provides full customer support, educational resources, and trading tools to Indian traders, even if they are limited in the scope of their trading activities due to the legal framework in India. While Exness remains accessible to Indian users, traders should understand the legal framework under which they are operating and ensure that they comply with local regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Restrictions Imposed on Indian Accounts

Due to India’s strict regulations on Forex trading, Exness may impose certain restrictions on Indian clients, particularly regarding the trading instruments and services available. Indian traders may only have access to certain types of accounts or products, with Forex trading being largely restricted. This means that while traders can still use Exness for trading other assets, they cannot engage in Forex trading involving the Indian Rupee (INR) directly.

Exness also advises Indian traders to be aware of the potential risks involved when trading with an unregulated offshore broker and to consider using alternative, locally regulated platforms that comply with SEBI regulations.

Common Misconceptions Regarding Exness in India

Myths About Forex Trading Legality

One of the most common misconceptions about Forex trading in India is that it is entirely illegal to trade with offshore brokers like Exness. While India does have restrictions on trading Forex directly with foreign brokers, it does not make Forex trading outright illegal. The legal restrictions primarily concern trading in Indian Rupees or engaging in illegal speculative activities. Traders can still participate in Forex trading under certain conditions, such as through regulated exchanges or by trading certain products allowed under FEMA guidelines.

The myths surrounding Forex trading in India often arise due to confusion about the regulations and the role of SEBI and RBI. Indian traders should be aware of the legal framework and make informed decisions based on current regulations.

Clarifying the Status of Exness

Exness is not banned in India, but its operations are restricted in terms of offering direct Forex trading services involving the Indian Rupee. Exness complies with global regulations and operates legally in many countries. However, its lack of SEBI regulation and limited access for Indian traders may lead to confusion about its legal status in the country.

It is essential for Indian traders to understand the rules and regulations governing offshore Forex brokers and seek legal advice or consult with a financial expert if they are unsure about the legality of trading with Exness.

Impact of Regulation on Traders

Benefits of Regulated Brokers

Traders benefit from the transparency and investor protection provided by regulated brokers. Regulated brokers must comply with strict financial standards, including the safekeeping of client funds and fair trading practices. In the case of Indian traders, choosing a SEBI-regulated broker ensures that their investments are protected by the country's legal framework and consumer protection laws.

For traders in India, using a regulated broker offers peace of mind, knowing that the broker is under the supervision of a recognized financial authority. Furthermore, regulated brokers are required to provide clear and transparent information about fees, spreads, and commissions, ensuring that traders can make well-informed decisions.

Risks of Trading with Unregulated Platforms

The primary risk of trading with unregulated platforms like Exness is the lack of legal protections for Indian traders. If a trader faces any disputes or issues with the platform, they have limited recourse in terms of legal action or compensation. Additionally, unregulated brokers may not always adhere to industry best practices, which could result in unfavorable trading conditions or even fraud.

Indian traders should carefully consider the risks of trading with unregulated brokers and weigh them against the potential rewards before opening accounts with offshore platforms like Exness.

Reviews and User Experiences

Trader Testimonials from India

Traders in India who have used Exness often report positive experiences regarding the platform's functionality, low spreads, and user-friendly interface. Many users appreciate the broker’s educational resources and the variety of financial instruments available for trading. However, some traders have expressed concerns about the legal status of Exness in India and its lack of SEBI regulation.

Issues Faced by Users in India

Indian traders who have used Exness have noted some challenges, including the inability to trade INR directly, slow processing times for withdrawals, and occasional issues with local payment methods. Additionally, some users have raised concerns about the risks of trading with an unregulated broker in India. Despite these issues, many traders have reported a generally positive trading experience with Exness, particularly when trading other financial instruments beyond Forex.

Alternatives to Exness for Indian Traders

Recommended Forex Brokers in India

For Indian traders who seek regulated brokers, several SEBI-approved brokers provide secure and reliable trading platforms. These include well-known brokers like ICICI Direct, Zerodha, and Upstox, which offer access to Forex trading and other financial instruments while complying with Indian regulations.

Pros and Cons of Alternative Options

While SEBI-regulated brokers provide a higher level of protection, they may offer less flexibility and fewer trading options than offshore brokers like Exness. Additionally, SEBI-regulated brokers often have stricter rules regarding leverage and margin trading. However, for traders looking for legal certainty and enhanced consumer protection, SEBI-regulated brokers offer a safer option.

Conclusion

Exness is not banned in India, but it operates in a grey area when it comes to compliance with Indian regulations. Indian traders can access the platform for certain financial instruments, but direct Forex trading involving INR is restricted by Indian law.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Traders should carefully consider the legal implications of trading with an offshore broker and be aware of the risks involved. While Exness offers competitive services globally, Indian traders may benefit more from using locally regulated brokers to ensure compliance with Indian laws and regulations.

Read more: