18 minute read

Does Exness Work in Zimbabwe? Review Broker

Understanding Exness

Overview of Exness as a Forex Broker

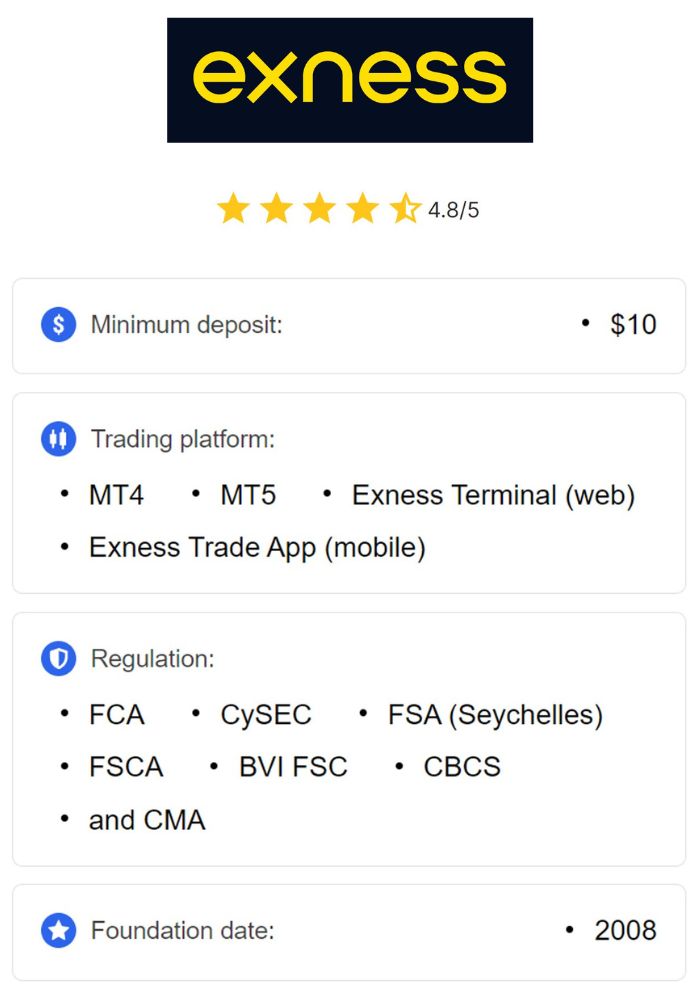

Exness is a prominent Forex and CFD broker founded in 2008, known for providing reliable and transparent trading services to clients worldwide. With its headquarters in Cyprus, Exness has rapidly expanded its global footprint, offering trading services to millions of users in various regions. The broker is regulated by several reputable financial authorities, making it a trustworthy choice for Forex and CFD trading. Exness offers a wide range of account types, competitive spreads, high leverage options, and advanced trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to diverse trader profiles.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

As a broker, Exness is recognized for its user-centric approach, emphasizing transparency, low transaction costs, and seamless trading experiences. Its features, such as flexible leverage and tight spreads, attract both beginner and professional traders. The broker also provides access to a range of financial instruments, including currency pairs, commodities, indices, and cryptocurrencies, making it versatile for traders looking to diversify. With Exness's commitment to high-quality customer support and regular updates to its trading services, it has become a reliable option in global markets.

Key Features of Exness

Exness offers a variety of features designed to enhance the trading experience. One notable feature is its ultra-tight spreads, which keep trading costs low and allow traders to maximize profits, particularly in high-volume trading strategies. Exness also provides flexible leverage, with options going as high as 1:2000, allowing traders to optimize their capital usage. This high leverage option can benefit experienced traders looking for greater exposure, though it is essential to use it cautiously. Additionally, Exness supports multiple account types, including Standard, Raw Spread, Zero, and Pro accounts, allowing traders to choose based on their preferences and trading style.

Exness also places a strong emphasis on technological support, offering advanced trading platforms like MT4 and MT5. These platforms include robust charting tools, a wide range of indicators, and compatibility with automated trading systems. Exness has also invested in mobile trading capabilities, enabling traders to stay connected and manage trades on the go. With multilingual customer support, a rich educational resource section, and multiple funding options, Exness makes trading accessible and adaptable to clients' needs across different regions, including Zimbabwe.

Regulatory Status of Exness

Global Regulation of Exness

Exness operates under a multi-regulatory framework, complying with strict standards from several leading financial authorities. It is licensed by the Cyprus Securities and Exchange Commission (CySEC) in Europe and the Financial Conduct Authority (FCA) in the UK, ensuring a high level of transparency and protection for traders’ funds. In other regions, Exness operates under the Seychelles Financial Services Authority (FSA), allowing it to reach clients in emerging markets with reliable and regulated services. This regulatory oversight reassures traders worldwide that Exness adheres to stringent policies, including maintaining segregated accounts and regular financial audits.

Having a global regulatory structure enables Exness to serve traders across different countries while adhering to their specific regulatory requirements. This multi-license model ensures that Exness complies with local laws and provides clients with a secure trading environment. For Zimbabwean traders, this regulatory approach offers peace of mind, knowing that Exness operates under global standards and follows industry best practices for fund security and client transparency.

Is Exness Regulated in Africa?

In Africa, Exness operates under its Seychelles license, which allows it to serve several African markets, including Zimbabwe. While not directly regulated by Zimbabwe's authorities, Exness’s Seychelles license provides a recognized framework for operating in emerging markets across the continent. This regulatory setup allows Exness to legally offer its services to Zimbabwean traders, enabling them to access its Forex and CFD trading platforms, with assurance that the broker adheres to international standards for security and transparency.

Although Exness does not hold a local license in Zimbabwe, it is a recognized broker in the region and adheres to African trading norms. Many traders in Zimbabwe have successfully opened accounts with Exness, taking advantage of its accessible trading options, low spreads, and flexible leverage. This accessibility, combined with Exness’s global reputation, has made it a viable option for Zimbabwean traders interested in Forex trading.

Accessibility of Exness in Zimbabwe

Availability of Exness Services in Zimbabwe

Exness’s services are accessible in Zimbabwe, allowing local traders to open accounts, deposit funds, and engage in Forex and CFD trading. With its international reach, Exness has made it possible for Zimbabwean traders to participate in global financial markets despite the local regulatory environment. Zimbabwean traders can access a wide range of instruments, including Forex pairs, commodities, and cryptocurrencies, making Exness a versatile option for those interested in diversified portfolios.

Although Zimbabwe does not regulate Exness directly, the broker’s adherence to international standards offers Zimbabwean traders a level of security and assurance. Exness also provides customer support that caters to the African market, helping Zimbabwean traders navigate the platform and its offerings smoothly. As a result, Exness has become a preferred broker for many in Zimbabwe, allowing traders to enjoy a seamless trading experience despite local regulatory limitations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Creating an Account from Zimbabwe

Creating an Exness account from Zimbabwe is straightforward, with an easy-to-follow registration process available on the Exness website. To begin, traders need to provide basic information, including their name, email address, and phone number. Once these details are submitted, Exness will prompt the user to verify their identity by uploading necessary documentation, such as a national ID, passport, or utility bill. This verification process is essential for compliance and ensures account security, allowing traders to access Exness’s full range of services after approval.

Once the account is verified, Zimbabwean traders can deposit funds using local or international payment methods and begin trading on Exness’s platforms. Exness’s user-friendly account creation process ensures that Zimbabwean traders can set up accounts quickly and securely, granting them access to a diverse range of trading instruments and advanced trading tools. This accessibility has contributed to Exness’s popularity among Zimbabwean traders, as it provides a simple and secure entry into the Forex market.

Trading Instruments Offered by Exness

Forex Pairs Available

Exness offers an extensive selection of Forex pairs, covering major, minor, and exotic currency pairs, making it an appealing choice for Zimbabwean traders. Major pairs like EUR/USD and GBP/USD provide high liquidity and narrow spreads, which are ideal for both beginners and experienced traders. Minor pairs offer moderate liquidity, while exotic pairs, such as USD/TRY, present opportunities with higher volatility and potential for larger gains. This wide range allows traders to select pairs based on their risk tolerance, trading strategy, and market interest.

The availability of numerous Forex pairs enables Zimbabwean traders to diversify their trades and engage in different market trends. Given the currency instability often experienced in Zimbabwe, trading a mix of major, minor, and exotic pairs with Exness can provide Zimbabwean traders with exposure to more stable currencies and the potential to hedge against local currency fluctuations.

CFDs and Other Financial Instruments

In addition to Forex pairs, Exness offers a variety of CFDs (Contracts for Difference) on commodities, indices, stocks, and cryptocurrencies. This includes popular commodities like gold, silver, and oil, as well as indices such as the S&P 500 and NASDAQ, which track the performance of global markets. Cryptocurrency CFDs, including Bitcoin and Ethereum, are also available, providing traders with opportunities in the digital asset space. These instruments allow Zimbabwean traders to diversify beyond Forex, expanding their portfolios across various asset classes.

The diversity of CFDs on Exness enables Zimbabwean traders to explore alternative investments, leveraging different markets to mitigate risks and capitalize on various economic trends. This versatility is particularly beneficial for traders looking to hedge or find opportunities in different financial instruments, allowing them to take advantage of Exness’s broad range of offerings.

Funding Options for Zimbabwean Traders

Deposit Methods Supported by Exness

Exness supports a variety of deposit methods suitable for Zimbabwean traders, including international payment systems like bank wire transfers, credit and debit cards, and online payment platforms such as Neteller and Skrill. These methods provide flexibility, allowing traders to fund their accounts using widely accepted payment options. Exness does not charge deposit fees, which is an advantage for Zimbabwean traders, as it reduces transaction costs. However, fees from payment providers may apply, so traders should be aware of potential additional charges.

For Zimbabwean traders, the availability of multiple deposit methods makes it convenient to transfer funds into their Exness trading accounts. Using secure, internationally recognized payment systems ensures that deposits are processed safely and efficiently, providing a smooth experience for local traders. This range of options allows traders in Zimbabwe to choose the method that best suits their preferences and minimizes transaction costs.

Withdrawal Processes for Funds

Withdrawing funds from an Exness account is straightforward, with various options to ensure fast and secure access to funds. Zimbabwean traders can use the same methods as deposits, such as bank transfers, e-wallets, and credit/debit cards, to withdraw their earnings. Exness processes withdrawals promptly, often within 24 hours, although the actual time may vary depending on the method chosen. Exness’s “same method” policy requires traders to withdraw funds using the original deposit method, a measure designed to enhance security and prevent fraud.

By offering multiple withdrawal options, Exness ensures that Zimbabwean traders can access their funds without complications. While Exness does not charge withdrawal fees, it’s advisable for traders to review any fees imposed by third-party providers. This efficient withdrawal process is particularly valuable for Zimbabwean traders, as it offers flexibility and reassurance that their funds are accessible when needed.

Currency Support for Zimbabwe

Supported Currencies for Transactions

Exness supports several major currencies for transactions, including USD, EUR, and GBP, which are widely accepted in international financial markets. Although Exness does not currently support Zimbabwean dollars (ZWL) directly, Zimbabwean traders can still open accounts and conduct transactions in widely accepted currencies like the USD. Using a stable currency such as the USD is beneficial for traders in Zimbabwe, as it helps protect their funds from local currency volatility, providing a more predictable trading experience.

Operating in international currencies also enables Zimbabwean traders to participate in global markets without the limitations imposed by fluctuating exchange rates in their home currency. For Zimbabwean traders, the use of USD offers a practical solution, as it provides stability and minimizes the risks associated with local currency depreciation. Exness’s currency support ensures that Zimbabwean traders have access to a reliable trading environment, allowing them to deposit, trade, and withdraw funds with confidence.

Exchange Rate Considerations

Given Zimbabwe's economic situation, where currency fluctuations are common, exchange rate considerations are crucial for Zimbabwean traders using Exness. Since deposits and withdrawals are made in major currencies, Zimbabwean traders may need to convert their funds to USD, EUR, or other supported currencies. Exchange rates can impact the overall cost of trading, especially when significant rate fluctuations affect the local currency’s value relative to the USD or EUR.

To manage these costs, Zimbabwean traders should monitor exchange rates and choose the most favorable times for deposits and withdrawals. Some traders also set aside a portion of their funds in foreign currencies, reducing the need for frequent conversions and helping them better manage trading expenses. By being aware of exchange rate impacts, Zimbabwean traders can effectively plan their transactions and optimize their overall trading experience with Exness.

Trading Platforms Offered by Exness

MetaTrader 4 and MetaTrader 5 Overview

Exness provides access to two of the most popular trading platforms in the Forex market: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is known for its user-friendly interface, making it ideal for beginner traders, while MT5 offers advanced features and functionalities suited to more experienced users. Both platforms come with a comprehensive suite of technical analysis tools, including charting capabilities, customizable indicators, and automated trading support through Expert Advisors (EAs). These features make it easier for traders to analyze market trends and execute strategies with precision.

For Zimbabwean traders, the availability of MT4 and MT5 means they can choose the platform that best matches their trading preferences and expertise. Both platforms are compatible with desktop and mobile devices, ensuring flexibility and accessibility regardless of location. Exness’s support of MT4 and MT5 enhances the trading experience for Zimbabwean traders, allowing them to trade XAUUSD, currency pairs, and other assets efficiently.

Mobile Trading Capabilities

Exness has invested in mobile trading solutions to meet the needs of traders who prefer managing their accounts on the go. Through the MetaTrader mobile apps available for iOS and Android, Zimbabwean traders can access real-time market data, monitor price charts, and execute trades directly from their mobile devices. The mobile platform provides much of the functionality found on the desktop versions, including one-click trading and technical analysis tools, making it suitable for active traders who require flexibility.

Mobile trading is especially advantageous for Zimbabwean traders who may not have constant access to desktop setups, enabling them to react swiftly to market changes. With Exness’s mobile trading capabilities, traders in Zimbabwe can enjoy a seamless experience, staying connected to the markets and managing their trades effectively, even with limited access to a desktop platform.

Customer Support for Zimbabwean Clients

Availability of Local Language Support

Exness offers multilingual customer support to accommodate traders from different regions, though it does not currently provide support in local Zimbabwean languages. However, English-language support is available, which is widely spoken and understood in Zimbabwe. This support ensures that Zimbabwean traders can access assistance for any issues related to account setup, deposits, withdrawals, or trading queries. Exness’s English-language support is accessible through live chat, email, and phone, offering convenience for clients who prefer different modes of communication.

While local language support might enhance the experience for some traders, Exness’s comprehensive English support is well-equipped to meet the needs of Zimbabwean clients. The broker’s support team is trained to handle queries efficiently, ensuring a smooth and responsive experience for traders from Zimbabwe. By providing reliable customer service in English, Exness remains accessible to a broad range of traders in the region.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Contact Channels and Response Times

Exness provides multiple contact channels, including live chat, email, and phone support, ensuring that Zimbabwean traders can reach assistance in a timely manner. Live chat is typically the fastest option, with immediate responses available for most inquiries, making it suitable for urgent matters. Email support is also available, with response times generally within 24 hours, making it ideal for non-urgent questions. For more personalized support, phone assistance is available, allowing traders to speak directly with support representatives.

The broker’s commitment to quick response times enhances the user experience, particularly for Zimbabwean traders who may encounter connectivity issues or specific regional challenges. Fast and efficient customer support ensures that traders can resolve issues promptly, minimizing disruptions and maintaining a seamless trading experience. Exness’s accessible support channels and prompt responses have made it a preferred broker for many traders in Zimbabwe.

Educational Resources Provided by Exness

Trading Guides and Tutorials

Exness offers a range of educational resources designed to help traders improve their knowledge and trading skills. The broker’s website includes comprehensive trading guides and tutorials, covering essential topics like technical analysis, risk management, and trading strategies. These resources cater to both beginner and advanced traders, providing insights into various aspects of Forex and CFD trading. For Zimbabwean traders, these guides can serve as valuable learning tools, helping them understand market dynamics and build effective trading plans.

Access to high-quality educational content empowers Zimbabwean traders to make informed decisions and gain confidence in their trading activities. The resources provided by Exness can be accessed at any time, allowing traders to learn at their own pace. By leveraging these educational materials, Zimbabwean traders can enhance their market knowledge, develop sound trading strategies, and navigate the XAUUSD and Forex markets more effectively.

Webinars and Seminars for Beginners

In addition to guides and tutorials, Exness conducts regular webinars and seminars, offering Zimbabwean traders an interactive way to learn from industry experts. Webinars cover a range of topics, from fundamental and technical analysis to trading psychology, providing valuable insights for beginners and experienced traders alike. Attendees have the opportunity to ask questions and engage with professional traders, gaining practical knowledge that can be applied to their own trading strategies.

These educational events are particularly beneficial for beginners, as they offer real-time learning experiences and help build a solid foundation in trading. For Zimbabwean traders, Exness’s webinars and seminars provide a convenient and accessible way to learn, with sessions available online that can be attended from anywhere. This commitment to trader education demonstrates Exness’s dedication to supporting clients at every stage of their trading journey.

Risk Factors for Trading with Exness in Zimbabwe

Market Volatility Considerations

Trading Forex and CFDs inherently involves exposure to market volatility, which can impact profitability for traders in Zimbabwe. The prices of instruments like XAUUSD and currency pairs can fluctuate widely due to economic events, geopolitical tensions, and market sentiment. For Zimbabwean traders, it’s essential to understand the risks associated with volatile markets, as price movements can lead to significant gains or losses within a short period. Being aware of these volatility factors helps traders anticipate potential risks and adapt their strategies accordingly.

To manage market volatility, traders can use risk management tools such as stop-loss and take-profit orders, which help limit losses and lock in profits. Additionally, traders can avoid trading during highly volatile periods, such as major economic announcements, to reduce exposure. For Zimbabwean traders using Exness, being mindful of market volatility is crucial for maintaining a balanced approach to trading and achieving long-term success.

Regulatory Challenges and Risks

Although Exness operates legally in Zimbabwe through its international licensing, the lack of a local regulatory framework for Forex trading presents challenges for Zimbabwean traders. Regulatory ambiguity can increase risks, as traders do not have direct local protections in case of disputes. Additionally, the absence of local regulation may complicate matters related to tax reporting and compliance, adding a layer of complexity to the trading process. Traders must also be cautious when using leverage, as regulatory limitations on maximum leverage are not enforced locally.

To mitigate these risks, Zimbabwean traders should rely on Exness’s international reputation and compliance with global regulatory standards. Choosing Exness, a broker that adheres to strict international regulations, provides some reassurance in the absence of local oversight. Nevertheless, traders should remain vigilant and conduct thorough research to ensure that their trading activities comply with personal and financial considerations within Zimbabwe.

Common Issues Faced by Zimbabwean Traders

Connectivity Issues and Solutions

One of the challenges Zimbabwean traders may encounter is connectivity issues, which can affect access to Exness’s platforms. Internet infrastructure in certain regions of Zimbabwe may lead to intermittent or slow connections, making it difficult to monitor trades in real-time. Such disruptions can be critical in Forex trading, where timely execution is essential. Exness’s mobile platform and lightweight trading apps can help mitigate connectivity challenges, as they are optimized for performance on mobile networks and lower-speed connections.

Using mobile networks as a backup option, or relying on VPN services to ensure a stable connection, can also improve connectivity for Zimbabwean traders. Exness’s responsive customer support is another resource for traders facing connectivity challenges, helping them resolve technical issues and maintain access to their accounts. By adopting these strategies, Zimbabwean traders can minimize the impact of connectivity issues on their trading experience.

Payment Processing Delays

Payment processing delays can be a common issue for Zimbabwean traders, especially when using certain international payment methods. While Exness aims to process deposits and withdrawals promptly, external factors such as bank processing times and currency exchange rates can impact the speed of transactions. Zimbabwean traders may experience delays when withdrawing funds, depending on the payment method and the bank’s processing times. To minimize disruptions, traders can opt for faster payment options like e-wallets, which typically offer quicker processing compared to traditional bank transfers.

Exness’s range of withdrawal options provides flexibility, allowing Zimbabwean traders to choose methods that best meet their needs. Staying informed about transaction times and planning withdrawals in advance can help traders manage potential delays and maintain smooth access to their funds. By understanding the available payment options and expected processing times, Zimbabwean traders can avoid inconveniences related to fund transfers.

Conclusion on Exness in Zimbabwe

Exness provides a viable and accessible trading platform for Zimbabwean traders, offering a range of financial instruments, competitive spreads, and advanced trading tools despite the absence of local regulatory oversight. With support for popular platforms like MT4 and MT5, convenient mobile trading capabilities, and a variety of deposit and withdrawal options, Exness enables traders in Zimbabwe to participate effectively in global financial markets. While certain challenges, such as connectivity issues and regulatory ambiguity, may arise, Exness’s strong international reputation and regulatory compliance help mitigate some of these concerns.

For Zimbabwean traders, Exness presents a reliable option for Forex and CFD trading, particularly for those looking to diversify their portfolios with a reputable broker. With an emphasis on education, user-friendly tools, and responsive customer support, Exness ensures that Zimbabwean traders can navigate the Forex market confidently. By leveraging Exness’s resources and being mindful of market risks, Zimbabwean traders can take advantage of the opportunities that Exness offers in the global financial arena.

Read more:

Exness standard vs pro account