12 minute read

Is Exness regulated in India? Review Broker

Introduction to Exness

Overview of Exness as a Forex Broker

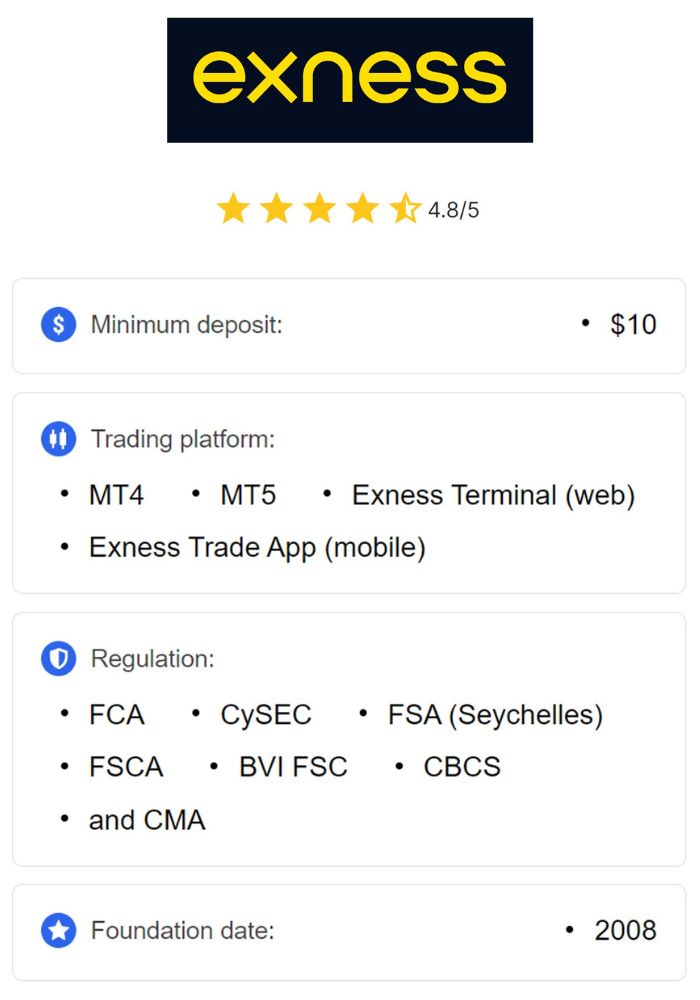

Exness is a globally recognized forex and CFD broker that has been serving traders since 2008. Known for its commitment to transparency, Exness has gained a reputation for offering competitive trading conditions, including tight spreads, fast execution, and flexible leverage options. It provides access to a wide range of financial instruments, such as forex, commodities, cryptocurrencies, indices, and stocks, making it a versatile choice for traders of all levels.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

What sets Exness apart is its dedication to innovation and customer satisfaction. The broker offers advanced trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside proprietary tools and real-time market data. Its localized services, multilingual support, and user-friendly interface cater to traders worldwide, including those in emerging markets like India.

Services Offered by Exness

Exness provides a range of services tailored to meet the needs of diverse traders. For retail traders, the broker offers multiple account types, including Standard, Raw Spread, Zero, and Pro accounts, each designed to suit varying trading strategies and experience levels. Exness also stands out for its unlimited leverage feature, which enables traders to maximize their capital, particularly useful for those starting with smaller balances.

The broker ensures seamless transactions through instant deposit and withdrawal options via various payment methods, including local banking solutions for Indian traders. Additionally, Exness prioritizes risk management by offering tools like stop-loss, take-profit orders, and comprehensive market analysis resources. These features make Exness a reliable and flexible trading partner for traders globally.

Understanding Regulation in Forex Trading

Importance of Regulation

Regulation in forex trading is crucial for ensuring a safe and transparent trading environment. Regulated brokers are required to comply with strict financial and operational standards, which include maintaining segregated client accounts, providing fair pricing, and adhering to anti-money laundering (AML) practices. These measures protect traders from fraud, safeguard their funds, and promote ethical business conduct.

For traders, choosing a regulated broker offers peace of mind and reduces the risk of scams or malpractice. It also ensures access to dispute resolution mechanisms and guarantees that brokers operate under strict scrutiny, fostering trust and reliability in the trading ecosystem.

Key Regulatory Bodies Globally

Several financial authorities oversee forex trading globally, setting the standards for brokers. Among the most respected regulatory bodies are:

Financial Conduct Authority (FCA): Based in the UK, the FCA enforces stringent rules to ensure financial stability and consumer protection.

Cyprus Securities and Exchange Commission (CySEC): Oversees brokers operating within the European Union, ensuring compliance with EU directives.

Australian Securities and Investments Commission (ASIC): Regulates brokers in Australia, focusing on transparency and market integrity.

These organizations require brokers to submit regular audits, maintain minimum capital requirements, and follow ethical practices. A broker regulated by these authorities is generally considered trustworthy, providing traders with a secure trading environment.

The Regulatory Landscape in India

Overview of Financial Regulation in India

In India, financial regulation is primarily governed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These bodies ensure the stability of the financial system and protect retail investors from fraudulent activities. RBI oversees currency-related transactions, while SEBI regulates securities markets and trading platforms.

Forex trading in India is subject to specific restrictions. For example, Indian traders are only allowed to trade currency pairs that include the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. These restrictions aim to prevent capital outflows and maintain the stability of the Indian economy.

Role of the Securities and Exchange Board of India (SEBI)

SEBI plays a vital role in regulating forex trading in India by monitoring brokers, ensuring compliance with market laws, and protecting investors. Brokers operating in India must obtain SEBI approval to provide services to Indian traders, ensuring they meet local regulatory standards.

SEBI’s regulations prioritize transparency, requiring brokers to disclose fees, maintain segregated accounts, and implement robust risk management systems. Traders working with SEBI-regulated brokers benefit from enhanced security and compliance, reducing the risk of financial misconduct or fraud.

Exness Regulation Status

Current Regulatory Framework for Exness

Exness operates under the regulation of several international financial authorities, including CySEC, FCA, and the Financial Services Commission (FSC) of Mauritius. These licenses ensure that Exness adheres to global standards for fund security, transparency, and ethical practices.

However, in India, Exness is not directly regulated by SEBI or RBI. While this does not make Exness illegal for Indian traders, it places the broker in a regulatory gray area. Indian traders can still access Exness's services, but they must understand the associated risks, including limited legal recourse under Indian jurisdiction.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Brokers Operating in India

Compared to SEBI-regulated brokers, Exness offers distinct advantages, such as broader trading options, higher leverage, and tighter spreads. SEBI-regulated brokers, on the other hand, typically focus on INR-based currency pairs and provide limited leverage, aligning with India’s regulatory framework.

While Exness appeals to traders seeking diverse instruments and advanced tools, its lack of SEBI regulation may deter cautious traders. To mitigate risks, traders must verify the broker’s compliance with international standards and consider their risk tolerance.

Exness Licensing Information

Licenses Held by Exness

Exness holds licenses from multiple top-tier regulators, including:

CySEC (Cyprus): Ensures compliance with EU directives like MiFID II, which mandate transparency and fund protection.

FCA (UK): Focuses on safeguarding client funds and promoting fair trading practices.

FSCA (South Africa): Regulates Exness’s operations in African markets, ensuring adherence to local laws.

These licenses validate Exness’s credibility and demonstrate its commitment to maintaining high regulatory standards across different regions. Indian traders can rely on these credentials when evaluating the broker’s trustworthiness.

Impact of Licensing on Indian Traders

For Indian traders, Exness’s international licenses provide reassurance about the broker’s reliability, even in the absence of direct SEBI regulation. The broker’s adherence to global standards ensures fund security and ethical trading practices, making it a viable option for traders seeking advanced features and diverse instruments.

However, traders should remain aware of Indian forex laws and trade responsibly. Using internationally regulated brokers like Exness requires thorough research and an understanding of the legal landscape.

Safety and Security of Funds with Exness

Client Fund Protection Mechanisms

Exness employs several measures to ensure the safety of its clients' funds, a critical factor for traders, especially those in countries like India where regulatory frameworks may differ. One key protection mechanism is the use of segregated accounts. This means traders’ funds are kept separate from the company’s operational accounts, ensuring that the funds are not used for the broker’s internal expenses or liabilities.

Additionally, Exness is a member of various compensation schemes, depending on its regulatory jurisdiction. These schemes offer financial protection to clients in the unlikely event of broker insolvency. Indian traders can rest assured that their funds are secure, even though the broker is not regulated locally by SEBI.

Transparency in Financial Reporting

Transparency is at the core of Exness’s operations. The broker regularly publishes financial reports audited by independent third-party firms. These reports detail the company’s financial health, ensuring traders are aware of the broker’s stability and compliance with regulatory standards.

This level of transparency helps traders build trust with Exness, knowing that the company adheres to global best practices. Indian traders should prioritize brokers like Exness that openly disclose their financial standings to avoid risks associated with less transparent brokers.

Trading Conditions with Exness

Leverage Options Available

Exness is renowned for its flexible leverage options, which cater to both novice and experienced traders. The broker offers unlimited leverage in certain jurisdictions, allowing traders to open larger positions with minimal capital. For Indian traders, this feature is particularly appealing as it enables them to maximize their $50 or $100 deposits.

However, while leverage can amplify profits, it also increases the potential for significant losses. Exness provides educational resources and tools, such as margin calculators, to help traders understand and manage leverage effectively. Using leverage responsibly is crucial for long-term success, especially for traders operating in volatile markets.

Spreads and Commissions Structure

Exness offers competitive spreads and a transparent fee structure, making it a cost-effective choice for traders. For Standard accounts, the broker provides zero-commission trading with spreads starting as low as 0.3 pips. For advanced traders, Raw Spread and Zero accounts feature even tighter spreads, with fixed commission fees that are clearly outlined.

Indian traders can benefit from these cost-efficient conditions, as lower trading fees mean higher profitability. Before trading, it’s essential to understand the cost implications of different account types and choose one that aligns with your trading strategy.

Customer Support and Resources

Availability of Customer Service

Exness takes customer service seriously, offering 24/7 multilingual support to address traders' queries promptly. Indian traders can benefit from localized support channels, including email, live chat, and phone assistance. The availability of support in multiple languages ensures that communication barriers are minimized, making the trading experience smoother for diverse users.

In addition to real-time support, Exness provides an extensive FAQ section and knowledge base on its website. These resources cover common issues, such as account setup, platform navigation, and payment processing, enabling traders to resolve minor concerns independently.

Educational Resources for Traders

For traders in India, Exness offers a wealth of educational materials designed to enhance trading knowledge and skills. Resources include detailed guides, video tutorials, webinars, and market analysis reports. These materials cater to traders of all levels, from beginners seeking to learn the basics to advanced traders refining their strategies.

The broker also provides a demo account, allowing traders to practice in a risk-free environment before transitioning to live trading. Leveraging these educational resources helps traders make informed decisions and reduces the risk of costly mistakes.

Exness User Experience in India

Platform Usability and Accessibility

Exness provides access to leading trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their intuitive interfaces and advanced features. These platforms support a variety of devices, including desktop, mobile, and web, ensuring that traders can access their accounts anytime, anywhere.

For Indian traders, Exness’s platform usability stands out due to its fast execution speeds, customizable charting tools, and a wide range of indicators. The user-friendly design makes it easy for beginners to navigate, while advanced tools cater to the needs of experienced traders.

Payment Methods Supported

Exness supports multiple payment methods tailored to the needs of Indian traders. These include:

Local bank transfers: Facilitates seamless deposits and withdrawals in Indian Rupees.

E-wallets: Options like Skrill, Neteller, and PayPal provide fast and secure transactions.

Credit/Debit cards: A convenient choice for traders who prefer traditional payment methods.

With instant deposit and withdrawal options available, Exness ensures a hassle-free experience for Indian traders managing their accounts. The absence of processing fees on most transactions adds to the broker’s appeal.

Risks of Trading with Unregulated Brokers

Potential Scams and Fraudulent Activities

Trading with unregulated brokers poses significant risks, including exposure to scams and fraudulent activities. Unregulated brokers may engage in unethical practices, such as manipulating spreads or refusing withdrawals, leading to financial losses for traders.

While Exness is regulated by reputable authorities internationally, its lack of direct SEBI regulation means Indian traders need to exercise caution. Verifying the broker’s credentials and understanding its terms and conditions can mitigate potential risks.

Legal Implications of Trading without Regulation

Forex trading in India is subject to strict regulations, with only INR-based currency pairs legally permitted. Trading with unregulated brokers or those not approved by SEBI can lead to legal repercussions, including penalties.

Indian traders using Exness should ensure compliance with local laws while taking advantage of the broker’s features. Staying informed about regulatory changes and trading responsibly minimizes legal and financial risks.

Alternatives to Exness for Indian Traders

Recommended Regulated Brokers

For traders seeking SEBI-regulated alternatives, brokers like Zerodha and Angel Broking offer forex trading services within the legal framework. These brokers primarily focus on INR-based currency pairs and provide limited leverage, ensuring compliance with Indian regulations.

While these options lack the advanced tools and diverse instruments offered by Exness, they provide a safer choice for risk-averse traders prioritizing local regulatory compliance.

Comparison of Features and Services

Exness stands out for its global reach, advanced platforms, and flexible trading conditions, making it a preferred choice for traders seeking diversity. However, SEBI-regulated brokers excel in ensuring local compliance and protecting traders from potential legal issues.

Indian traders must weigh the benefits and drawbacks of each option, considering factors like trading goals, risk tolerance, and regulatory preferences.

Future of Forex Regulation in India

Trends in Regulatory Developments

India’s regulatory landscape for forex trading is evolving, with increasing discussions about liberalizing the market to accommodate global brokers. These changes could pave the way for brokers like Exness to secure local licenses and operate under SEBI guidelines, enhancing their credibility and accessibility for Indian traders.

Such developments would benefit traders by offering a wider range of instruments, higher leverage, and advanced tools within a compliant framework. Staying updated on these trends is crucial for navigating the changing regulatory environment.

Potential Changes Affecting Exness and Other Brokers

As the forex market grows in popularity, SEBI may introduce stricter guidelines to protect retail investors. These changes could include mandatory licensing for international brokers, increased transparency requirements, and enhanced fund protection mechanisms.

For Exness, aligning with these potential changes would strengthen its position in the Indian market, making it a more viable option for traders seeking both global features and local compliance.

Conclusion

Exness is a globally regulated broker offering advanced tools, competitive trading conditions, and excellent customer support. While it is not directly regulated by SEBI, its international credentials and commitment to transparency make it a trusted choice for Indian traders seeking flexibility and diversity.

Indian traders must remain aware of local forex laws and exercise caution when using international brokers. By staying informed, practicing risk management, and leveraging Exness’s features responsibly, traders can achieve success in the dynamic forex market. For those prioritizing compliance, monitoring future regulatory changes will be key to navigating the evolving landscape of forex trading in India.

Read more: