14 minute read

Is Exness Regulated in Pakistan? A Complete Guide for Traders

Introduction to Exness

Overview of Exness as a Trading Platform

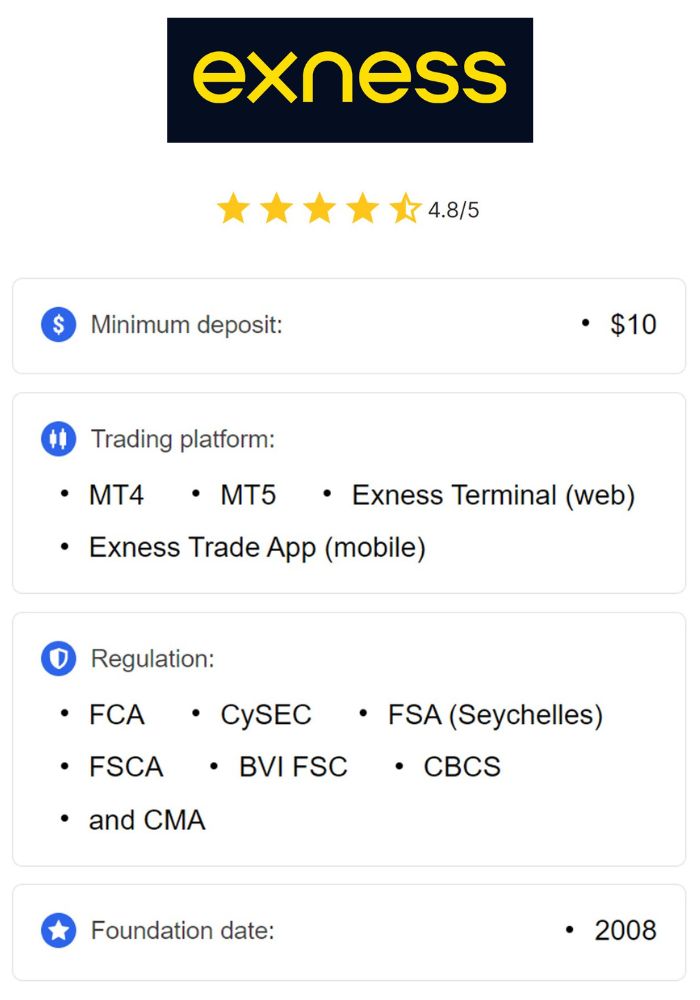

Exness is a well-established forex and CFD trading platform, founded in 2008, with a reputation for providing secure, transparent, and innovative trading solutions. Headquartered in Cyprus, Exness has grown significantly, now serving clients across Europe, Asia, Africa, and other regions. Known for its technological sophistication, Exness offers advanced tools that enable users to trade efficiently, whether they’re beginners or experienced professionals. The platform is particularly popular for its low spreads, high leverage options, and lightning-fast trade execution, catering to traders with diverse strategies and risk appetites.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness’s commitment to transparency and accountability has helped it build a strong reputation among traders worldwide. It provides regular updates on its trading volume and number of active traders, allowing clients to see the broker’s standing and growth. For traders in Pakistan, Exness has become an attractive option due to its competitive offerings and user-friendly interface, but understanding its regulatory status is key to evaluating its legitimacy in the region.

Types of Financial Instruments Offered by Exness

Exness provides access to an extensive range of financial instruments, making it suitable for traders looking to diversify their portfolios. The platform offers forex currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, which are highly liquid and popular in the trading community. Exness also supports trading in commodities like gold (XAUUSD), silver, oil, and other raw materials, allowing traders to hedge against market volatility and inflation.

Beyond forex and commodities, Exness includes indices, stocks, and cryptocurrencies in its offerings. This diverse range enables traders to tailor their investments according to market conditions, risk tolerance, and financial goals. The availability of multiple asset classes on Exness allows traders to explore both short-term and long-term opportunities, taking advantage of global market trends.

Understanding Regulation in the Forex Industry

Definition of Regulation in Trading

Regulation in trading refers to the legal framework and oversight provided by recognized authorities to ensure brokers operate within industry standards. Regulatory bodies establish strict compliance guidelines that brokers must follow, including maintaining separate accounts for client funds, submitting regular financial audits, and ensuring transparent operations. The goal of regulation is to protect traders from potential fraud and create a fair trading environment where client interests are safeguarded.

In forex trading, regulatory bodies hold brokers accountable for their business practices, ensuring they are financially stable, provide clear pricing information, and manage risk effectively. For traders, regulation signifies that a broker is held to high ethical and operational standards, reducing the likelihood of misconduct and boosting trust in the trading environment.

Importance of Regulation for Traders

Regulation plays a crucial role in protecting traders' interests by enforcing compliance standards that brokers must follow. Regulated brokers are required to adhere to guidelines on client fund segregation, risk management, and pricing transparency, which collectively foster a safe trading environment. For traders, using a regulated broker means they are less likely to fall victim to fraudulent practices, as regulatory authorities monitor brokers closely to ensure fair treatment of clients.

Moreover, regulation provides traders with a structured system for conflict resolution. If traders encounter issues with a regulated broker, they can file complaints through the appropriate regulatory authority, which can investigate and resolve disputes. This accountability helps traders feel more secure and confident in their trading activities, knowing there are avenues for recourse if needed.

Regulatory Bodies Relevant to Exness

Overview of Global Regulatory Bodies

Several respected regulatory bodies oversee forex trading and brokerage operations worldwide. Among the most prominent are the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, and the Financial Services Authority (FSA) in Seychelles. These bodies play a critical role in ensuring that brokers operate transparently, safeguard client funds, and adhere to ethical standards.

CySEC, based in Cyprus, is well-known in the European trading community and oversees many international brokers. The FCA, headquartered in the UK, is known for its stringent regulations and high standards, which make it one of the most trusted financial authorities globally. The FSA, based in Seychelles, offers regulation for international brokers, providing oversight while enabling them to serve global clients. Brokers regulated by these bodies are required to undergo regular audits, follow strict financial protocols, and operate with transparency, enhancing client protection.

Specific Regulations Applicable to Exness

Exness is regulated by multiple authorities, including CySEC, FCA, and FSA, which set stringent requirements for financial integrity and client protection. These licenses ensure that Exness complies with global standards, such as anti-money laundering (AML) protocols, client fund segregation, and fair trading practices. CySEC mandates regular financial audits to confirm brokers’ solvency, while FCA regulations require brokers to participate in compensation schemes that protect clients in the event of financial insolvency.

However, while Exness is regulated in multiple regions, the specific protections and services may vary depending on geographical location. This means that while Exness adheres to international standards, traders in Pakistan should verify whether these regulatory protections directly apply to them.

Exness Regulation Status

Regulatory Licenses Held by Exness

Exness holds licenses from various well-respected regulatory authorities. The Cyprus Securities and Exchange Commission (CySEC) license ensures that Exness adheres to European standards for transparency, financial stability, and client protection. Additionally, Exness holds a license from the Financial Conduct Authority (FCA), one of the most reputable financial regulators globally, which enforces rigorous standards for consumer protection and financial integrity.

Exness also holds a license from the Financial Services Authority (FSA) in Seychelles, allowing it to operate as an international broker and serve clients in regions outside of Europe. These licenses collectively underscore Exness’s commitment to regulatory compliance and ensure that it operates transparently and ethically.

Geographical Restrictions on Regulation

While Exness is regulated in several jurisdictions, each regulatory body’s protections typically apply only within specific regions. For instance, CySEC’s oversight primarily applies to European clients, and the FCA’s protections cover clients in the UK. Clients outside these regions, such as those in Pakistan, may not receive the same level of regulatory protection unless Exness has a specific license from local authorities, like the Securities and Exchange Commission of Pakistan (SECP).

This means that while Exness is a regulated broker, Pakistani traders should understand that the protections afforded by CySEC and FCA might not directly apply to them. It’s essential for Pakistani traders to verify the regulatory protections available to them and consider brokers with licenses recognized by local authorities.

Exness in the Context of Pakistan

Current Legal Framework for Forex Trading in Pakistan

Forex trading in Pakistan is subject to regulations overseen by the State Bank of Pakistan (SBP) and the Securities and Exchange Commission of Pakistan (SECP). Although the forex market is accessible to retail traders, certain restrictions are in place, particularly regarding offshore forex trading. The SBP has strict foreign exchange policies, and residents are advised to be cautious when engaging with foreign brokers that do not hold a local license.

SECP regulates capital markets in Pakistan, including forex trading, to ensure fair practices. However, many international brokers operate in Pakistan without SECP licensing, meaning they fall outside the jurisdiction’s consumer protection framework. Pakistani traders should carefully consider regulatory status when selecting a broker to ensure they are protected under local laws.

Role of the Securities and Exchange Commission of Pakistan (SECP)

The SECP plays a vital role in regulating Pakistan’s financial markets, ensuring that brokers comply with local laws and protecting traders from fraudulent practices. The SECP has established guidelines for brokers operating in Pakistan, promoting transparency, accountability, and ethical business practices. Brokers regulated by the SECP must meet capital requirements, follow risk management protocols, and implement measures to prevent money laundering.

While SECP does not currently license foreign brokers like Exness, it encourages Pakistani traders to select brokers with a strong regulatory foundation to minimize risk. For traders considering Exness, understanding that it is not locally regulated by SECP is essential in assessing the broker’s suitability in the Pakistani market.

Is Exness Regulated in Pakistan?

Analysis of Exness’s Operations in Pakistan

Exness is a global trading platform regulated in several major jurisdictions, including Cyprus, the UK, and Seychelles. However, Exness does not hold a local regulatory license from the Securities and Exchange Commission of Pakistan (SECP). This means that while Pakistani traders can access Exness’s services, they are technically trading with an offshore broker not under the direct oversight of Pakistani regulatory authorities. As a result, Exness operates in Pakistan without specific SECP approval or local regulatory compliance, which may impact the level of legal protection available to Pakistani clients.

The absence of SECP regulation means Pakistani traders do not benefit from the protections SECP provides, such as dispute resolution mechanisms and safeguards specific to the Pakistani market. Instead, Exness’s Pakistani clients rely on the broker’s international regulatory licenses, such as those from CySEC and FCA, which enforce high standards in terms of client fund segregation, transparency, and operational accountability. While these licenses offer a level of security, traders should be aware that local SECP protection does not apply.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Regulated Brokers in Pakistan

In Pakistan, some forex brokers operate with SECP oversight, catering directly to local clients and adhering to the specific legal requirements of the Pakistani market. Locally regulated brokers may offer enhanced legal recourse, dispute resolution services, and protections aligned with Pakistan’s financial regulations, which offshore brokers may lack. For traders prioritizing local regulatory compliance, choosing an SECP-regulated broker could provide greater assurance and easier access to regulatory support within the country.

However, Exness offers several advantages due to its reputable international licenses, global operational standards, and extensive range of trading instruments. Compared to some locally regulated brokers, Exness provides a higher level of transparency, lower spreads, and faster execution speeds, which appeal to traders looking for a more sophisticated trading experience. Ultimately, the choice between a locally regulated broker and an internationally regulated broker like Exness depends on the trader’s priorities, weighing the benefits of global standards against the desire for local regulatory support.

Risks of Trading with Unregulated Brokers

Potential Financial Losses

Trading with unregulated brokers can expose traders to significant risks, including potential financial losses due to fraudulent activities or unethical practices. Unregulated brokers are not bound by the strict compliance requirements enforced by reputable regulatory bodies, which means there is a higher likelihood of price manipulation, hidden fees, and poor trade execution. Without regulation, traders have limited avenues for recourse if the broker fails to honor withdrawal requests or engages in deceptive practices.

Exness, while not regulated by the SECP, is still a regulated broker under CySEC and FCA. This makes it a safer choice than completely unregulated brokers, as it follows international regulatory standards. However, traders in Pakistan should exercise caution when selecting any broker and ensure it has adequate regulatory protection to minimize financial risks.

Lack of Customer Support and Recourse Options

Unregulated brokers may lack the resources or motivation to provide quality customer support and may not offer recourse options in the event of disputes or account issues. Regulated brokers are generally required to have client complaint handling procedures and provide clients with access to regulatory bodies for dispute resolution. In contrast, unregulated brokers can operate with minimal accountability, which could leave traders vulnerable if they encounter difficulties with withdrawals, technical issues, or unexpected trading disruptions.

Exness, as a regulated broker under several international authorities, maintains a high standard of customer support and accountability. However, Pakistani traders should still consider the absence of SECP-specific recourse, as they may not have direct access to SECP assistance in case of disputes. This highlights the importance of selecting a broker with strong regulatory oversight and reliable customer service, particularly in markets where local regulation may not apply.

Benefits of Regulated Trading Platforms

Enhanced Trader Protection

Regulated trading platforms like Exness offer enhanced trader protection through stringent compliance requirements, including the segregation of client funds, transparency in pricing, and secure handling of client information. Regulated brokers are also regularly audited to ensure financial stability and adherence to regulatory standards, which helps protect traders from unexpected broker insolvency or unethical practices. By choosing a regulated platform, traders benefit from a secure trading environment and can trust that their funds are protected according to industry standards.

Exness’s international regulatory licenses from bodies like CySEC and FCA ensure that the platform operates transparently and protects client interests. While Pakistani traders may not have SECP-specific protections, Exness’s commitment to adhering to global standards offers a level of security that traders can rely on, even without local oversight.

Transparency and Accountability in Operations

Transparency and accountability are core values enforced by regulatory authorities. Regulated brokers are required to disclose fees, trading conditions, and potential risks to clients, ensuring that traders can make informed decisions. Additionally, regulated brokers are accountable to their licensing authorities, which means they must comply with ethical standards and provide accurate financial reporting.

Exness’s compliance with CySEC and FCA regulations underscores its commitment to transparency, as it provides clients with clear information on spreads, fees, and trading conditions. For Pakistani traders, trading with a broker that values transparency can reduce the risk of unexpected charges or hidden costs, enabling a more trustworthy trading experience. Furthermore, Exness’s regulatory adherence ensures that it remains accountable to international standards, which can provide additional peace of mind for traders in Pakistan.

How to Verify Broker Regulation

Steps to Check Broker Licensing

To verify a broker’s regulatory status, traders can follow a few key steps. First, they should visit the broker’s website, where reputable brokers typically list their regulatory licenses and corresponding license numbers. Exness, for example, prominently displays its CySEC, FCA, and FSA license information on its official website, allowing traders to verify its regulatory standing. Next, traders should cross-reference this information with the official websites of the relevant regulatory bodies, such as the CySEC and FCA websites, to confirm the validity of the licenses.

In addition to online verification, traders can also reach out to the broker’s customer support to inquire about licensing details, especially if they are unsure whether a particular regulatory authority oversees operations in their region. For Pakistani traders, understanding the regulatory protections available from each license can help them assess the level of security offered by Exness or any other broker.

Resources for Finding Regulated Brokers

Various online resources are available to help traders identify regulated brokers. Websites of regulatory authorities, such as CySEC, FCA, and SECP, often contain lists of licensed brokers and details about their licenses. Forex comparison websites and broker review platforms also provide information on broker regulatory status, enabling traders to assess different brokers based on regulation, account offerings, and client feedback.

Additionally, many forex forums and trading communities discuss broker experiences, sharing insights into which brokers provide reliable services. For traders in Pakistan, these resources can be invaluable in evaluating Exness alongside other brokers, ensuring they select a regulated platform that meets their trading needs and security preferences.

Conclusion

While Exness is a globally regulated broker under CySEC, FCA, and other international authorities, it is not regulated by the Securities and Exchange Commission of Pakistan (SECP). This means that while Exness provides robust protections for clients through its international licenses, Pakistani traders do not benefit from SECP-specific oversight. However, Exness’s global reputation, adherence to strict regulatory standards, and commitment to transparency make it a viable option for Pakistani traders seeking a reliable and secure trading platform.

Pakistani traders considering Exness should weigh the advantages of its international regulatory compliance against the absence of local SECP oversight. By understanding the benefits and limitations of trading with an internationally regulated broker, traders in Pakistan can make informed decisions that align with their trading preferences, risk tolerance, and security requirements. Ultimately, while local regulation remains an essential factor for some traders, Exness’s strong global regulatory standing and reliable trading conditions make it a competitive option for those interested in forex and CFD trading in Pakistan.

Read more: