15 minute read

How to get unlimited leverage on Exness

Understanding Leverage in Forex Trading

Definition of Leverage

Leverage in forex trading is a tool that allows traders to increase their buying power by using borrowed funds. Essentially, leverage enables traders to control a large position in the market with a relatively small amount of capital. For instance, with a leverage ratio of 1:100, a trader can open a position worth $100,000 with just $1,000 in their account. This amplification of buying power makes leverage an attractive feature for many traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Leverage is expressed as a ratio, such as 1:100 or 1:2000, indicating how much the broker is lending relative to the trader’s capital. The greater the leverage, the more market exposure a trader has with their available funds.

Importance of Leverage in Forex Markets

Leverage is crucial in forex trading because the forex market typically moves in very small increments. Without leverage, it would be challenging for traders to make meaningful gains. By using leverage, traders can capitalize on small price movements in currency pairs, allowing them to potentially increase their profits significantly.

For example, a minor movement of 10 pips can translate to substantial gains when high leverage is applied. Thus, leverage allows traders to amplify returns on relatively small initial investments, making it a popular tool in the forex market.

Risks Associated with High Leverage

While leverage can enhance profits, it also comes with considerable risk. High leverage can magnify losses, and traders can quickly deplete their account if a trade moves against them. For example, using 1:2000 leverage can lead to significant gains on successful trades, but if the market moves in the opposite direction, losses can exceed the initial investment.

To mitigate these risks, traders must use leverage carefully and implement strong risk management strategies. High leverage should be reserved for those with a thorough understanding of market conditions and a solid risk management plan.

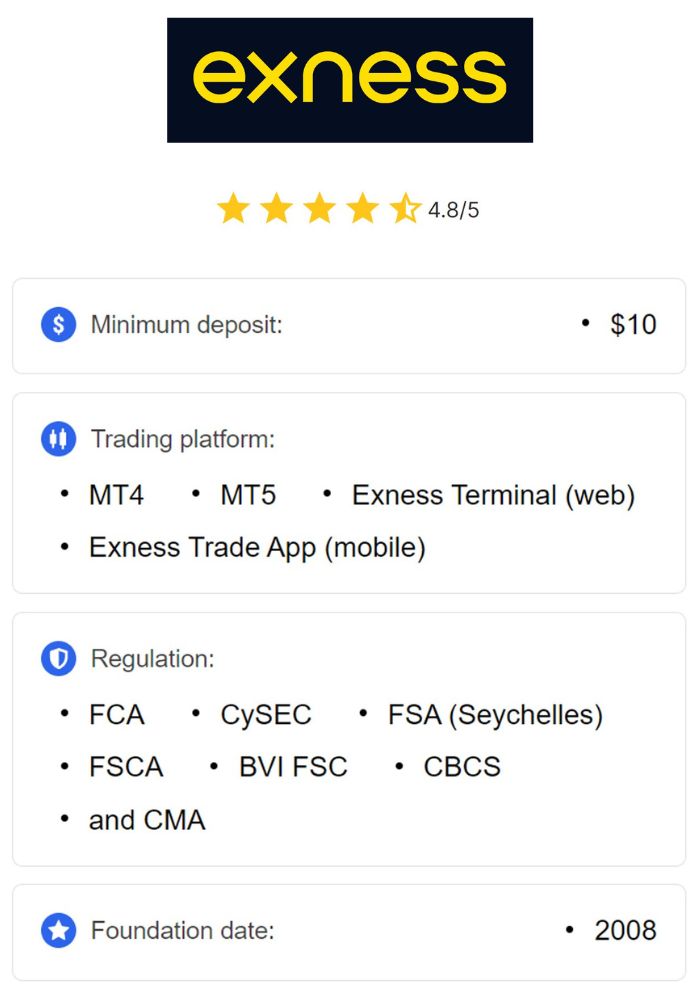

Introduction to Exness

Overview of Exness as a Trading Platform

Exness is a well-established forex broker known for its competitive trading conditions, including tight spreads, flexible leverage, and multiple account types. Founded in 2008, Exness has grown into a global trading platform with millions of active users. The platform offers access to forex, commodities, indices, and cryptocurrencies, catering to both beginner and professional traders.

Exness provides robust trading tools and features that enhance the trading experience, such as fast execution speeds and a user-friendly interface. With Exness, traders can access the markets via popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Unique Features of Exness

One of Exness’s most attractive features is its flexibility in leverage. While many brokers impose strict limits, Exness offers high leverage options, even extending up to unlimited leverage for specific accounts under certain conditions. This flexibility enables traders to choose a leverage level that matches their risk tolerance and trading style.

Other unique features include instant withdrawals, a comprehensive affiliate program, negative balance protection, and 24/7 customer support. Exness also has advanced analytical tools that help traders make informed decisions.

Regulatory Compliance and Safety Measures

Exness is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight ensures that Exness adheres to industry standards, offering a secure and transparent trading environment.

In addition to regulation, Exness employs rigorous safety measures to protect client funds. These include segregated accounts, where client funds are kept separate from the broker’s operational funds, and SSL encryption to safeguard personal information.

Types of Accounts Offered by Exness

Standard Account

The Standard Account is suitable for beginner traders and offers basic features like low spreads and high leverage options. With no commission on trades, this account is designed for those who want a straightforward trading experience. It’s ideal for traders who are just getting started in forex trading and want to understand leverage without high financial commitment.

Pro Account

The Pro Account is aimed at experienced traders who require more advanced features. It offers tighter spreads, faster execution speeds, and higher leverage options than the Standard Account. The Pro Account is ideal for traders who trade frequently and need more flexibility in their trading strategies.

Zero Account

The Zero Account offers zero spreads on specific pairs, making it an excellent choice for scalpers and high-frequency traders. With zero spreads, traders can enter and exit trades with minimal cost, making it a popular choice for those who focus on short-term price movements.

ECN Account

The ECN (Electronic Communication Network) Account connects traders directly to the interbank market, providing access to the best bid and ask prices available. This account type is preferred by professional traders looking for the tightest spreads and the most competitive trading environment.

The Role of Leverage in Different Account Types

Leverage Options for Standard Accounts

Standard Accounts typically offer high leverage, which can go up to 1:2000 or more, depending on the region and regulatory restrictions. This leverage level allows traders to open significant positions with minimal capital, ideal for those who want to explore forex trading with a modest investment.

Leverage Options for Pro Accounts

Pro Accounts offer higher leverage options, enabling traders to maximize their market exposure while maintaining competitive spreads. These accounts are suitable for traders who understand leverage and have a solid risk management strategy.

Leverage Options for ECN Accounts

ECN Accounts usually have lower leverage options than Standard and Pro Accounts due to their connection to the interbank market. However, they provide the tightest spreads, making them ideal for professional traders who focus on market execution and want access to real market prices.

How to Set Up Your Exness Account for Maximum Leverage

Step-by-Step Account Registration Process

Visit the Exness Website: Go to the official Exness website and click on “Open Account.”

Fill in Your Details: Enter your email address, phone number, and preferred password.

Select Account Type: Choose the account type that best fits your trading goals, such as Standard, Pro, or ECN.

Agree to Terms: Accept the terms and conditions and click on “Register” to complete the initial registration process.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Verifying Your Identity and Address

Verification is essential to fully unlock all trading features on Exness, including leverage options. To verify your account:

Upload a Government-Issued ID: Provide a copy of your passport or driver’s license.

Proof of Address: Submit a recent utility bill or bank statement showing your address.

Verification Confirmation: Wait for confirmation from Exness, usually within a few hours to a day.

Choosing the Right Account Type for Leverage

The choice of account type will influence your available leverage options. For instance, Standard Accounts offer higher leverage, while ECN Accounts may have stricter leverage limits. Selecting the right account type can enhance your trading strategy, depending on your risk tolerance and trading objectives.

Strategies to Maximize Leverage Effectively

Risk Management Techniques

Utilizing leverage can significantly amplify both gains and losses, so effective risk management is essential. One of the fundamental strategies is setting a stop-loss order for every trade. A stop-loss order limits potential losses by closing a position if it reaches a predetermined price level. This ensures that a single unfavorable move in the market doesn’t lead to catastrophic losses, especially when high leverage is involved.

Another key technique is using only a small percentage of your account balance for each trade. This approach, often called the “2% rule,” limits the amount of capital at risk in any one trade to a small fraction of the total account. This strategy ensures that even in volatile markets, your account can withstand a series of unfavorable trades without exhausting the balance. By carefully managing the percentage of capital at risk, you can control losses and make better use of high leverage safely.

Position Sizing and Margin Requirements

Position sizing refers to the number of units or lot sizes you choose to trade, and it’s an essential factor when trading with high leverage. Calculating position sizes based on your account balance and risk tolerance can help you manage leverage effectively. By keeping position sizes in line with account equity, you’ll avoid overextending your margin and reduce the likelihood of facing a margin call.

Exness provides various margin requirements based on the leverage ratio and account type. Understanding these requirements and keeping a buffer can prevent sudden liquidations, which often occur when your balance falls below the margin level needed to keep trades open. To maximize leverage safely, it’s wise to use margin calculators and carefully monitor your account’s free margin.

Diversification of Trading Assets

Trading with leverage amplifies the risks involved in individual trades, which makes diversification a valuable strategy. Diversifying across multiple asset classes, such as forex pairs, commodities, indices, or cryptocurrencies, can reduce the overall risk of your trading portfolio. For example, if a specific currency pair experiences unexpected volatility, holding diversified positions in less correlated assets can help balance out losses.

Another effective method is spreading trades across various timeframes and strategies. For instance, combining short-term day trades with long-term positions on different assets can improve your ability to respond to market fluctuations and safeguard against adverse moves in any single market. This diversified approach provides more stability, especially when using high leverage, as it reduces reliance on the performance of a single trade or asset.

Tools and Resources Available on Exness

Trading Platforms Supported by Exness

Exness supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms worldwide. Both platforms offer robust tools and functionalities for effective leverage trading. MT4 is known for its user-friendly interface, making it an ideal choice for beginners. It includes basic charting tools, indicators, and Expert Advisors (EAs) for automated trading. MT5 is an upgraded version, providing advanced charting, an economic calendar, additional timeframes, and the option for hedging.

Exness also offers a proprietary WebTerminal, allowing traders to access their accounts without installing software. The WebTerminal supports all major browsers, providing convenience and accessibility for those who need flexibility in their trading approach.

Analytical Tools for Traders

Exness provides an array of analytical tools that help traders make informed decisions. Technical indicators such as moving averages, RSI, and MACD are available on MT4 and MT5, allowing traders to identify trends, entry points, and potential reversals. Additionally, Exness offers real-time market data and customizable charting tools, enabling traders to adapt their strategies quickly in response to market shifts.

Exness also has an economic calendar integrated into MT5, which provides information on upcoming events, such as interest rate decisions, GDP releases, and employment reports. These events can have a significant impact on forex markets, so tracking them can help traders capitalize on volatile price movements. For those using leverage, these tools are crucial for evaluating market conditions and making timely decisions.

Educational Resources for Improving Trading Skills

Exness offers a variety of educational resources that are especially beneficial for traders using leverage. The broker provides webinars, video tutorials, and articles on risk management, trading psychology, technical analysis, and advanced trading strategies. These resources are designed to help traders improve their skills, understand leverage dynamics, and learn effective risk management techniques.

Additionally, Exness has a demo account feature, which allows traders to practice trading with virtual funds. This is particularly valuable for those who want to experiment with leverage without risking real money. Practicing on a demo account helps traders understand the impact of leverage on both gains and losses, enabling them to refine their strategies before going live.

Understanding Margin Calls and Their Implications

What Is a Margin Call?

A margin call occurs when the equity in a trader’s account falls below the required margin level. This typically happens when leveraged trades move against the trader, depleting the available balance. In such cases, Exness or any broker may issue a margin call, which requires the trader to deposit additional funds or close some positions to bring the account back to the required margin level.

Receiving a margin call is a critical alert for traders, as it indicates that their account’s equity is dangerously low. If the trader fails to act, the broker may close positions to protect against further losses, which could potentially wipe out the remaining balance. Margin calls highlight the importance of monitoring account equity, especially when using high leverage.

How to Avoid Margin Calls

To avoid margin calls, it’s essential to maintain sufficient free margin in your account. One way to achieve this is by keeping trades within manageable sizes, especially when using high leverage. Setting stop-loss orders can also help limit losses and protect your margin by automatically closing trades when they reach a certain level.

Additionally, monitoring your margin level and regularly adjusting positions based on market conditions can help prevent sudden margin calls. Many experienced traders keep a buffer in their account to absorb market fluctuations without risking a margin call. Ensuring that you have a well-thought-out risk management plan and not overleveraging will also reduce the chances of facing a margin call.

Responding to a Margin Call

If you receive a margin call, the quickest response is to add funds to your account to restore the required margin level. Alternatively, you can close some positions to free up margin and reduce the risk of further losses. In such situations, evaluating the risk of each open position is essential, as keeping volatile trades open could lead to additional losses.

Another option is to scale down on leverage, if possible, which reduces the pressure on your account’s margin. Remember, margin calls are a warning, and responding swiftly can help prevent forced liquidations, which could drastically impact your trading capital.

Client Support and Assistance from Exness

Contacting Customer Support

Exness provides 24/7 customer support to assist traders with account management, leverage settings, and other inquiries. You can reach customer support through live chat, email, and phone, depending on your preference. The live chat feature is especially helpful for urgent issues, as it connects you to a representative within minutes.

Exness also has a multilingual support team, making it accessible to traders worldwide. Whether you need assistance with leverage, margin requirements, or navigating the platform, Exness’s support team is available to help.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Utilizing Live Chat and Help Center

The Exness Help Center is a comprehensive resource for traders seeking information on various topics, from account setup to advanced trading techniques. It contains articles, FAQs, and guides that address common queries about leverage, risk management, and platform features. If you encounter issues, browsing the Help Center can provide quick answers without needing direct support.

The live chat feature allows traders to ask specific questions and receive immediate assistance. Whether you’re troubleshooting a connection issue or need clarification on leverage limits, live chat support is an invaluable resource for Exness users.

Community Forums and User Experiences

Exness’s community forums and social media channels offer an opportunity to engage with other traders, share experiences, and learn about effective leverage strategies. Many experienced traders provide tips on risk management, while new traders can ask questions and receive feedback.

These forums are valuable for understanding real-life applications of leverage and learning from both successful and challenging experiences of other traders. Participating in such communities can enhance your knowledge and help you implement more effective trading strategies.

Real-Life Examples of Using Leverage on Exness

Case Study: Successful Trades with High Leverage

One example of effective leverage use is when a trader accurately predicts a significant market movement, such as an interest rate cut that drives currency depreciation. By using leverage, the trader amplifies their position and captures substantial profits from the price swing. In this scenario, the trader set a stop-loss to protect against unexpected reversals, showcasing a prudent approach to using high leverage with risk control.

Lessons Learned from Failed Trades

A common mistake among traders is overleveraging without a risk management plan. For instance, during a volatile market event, a trader might open a large position, expecting a favorable outcome. However, an unexpected reversal could lead to a margin call, wiping out their account. This highlights the risks of high leverage and emphasizes the importance of controlling position size and setting stop-loss orders.

Analyzing Market Conditions for Optimal Leverage Usage

Traders who analyze market conditions carefully can identify periods of high volatility, which may justify using higher leverage. For example, during major economic announcements, currency pairs tend to experience sharp movements, creating opportunities for leveraged trades. However, seasoned traders avoid high leverage during uncertain periods, as unexpected price swings could lead to significant losses.

Regulations Surrounding Leverage in Forex Trading

Legal Limits on Leverage

Leverage limits vary across regions due to regulatory restrictions. For instance, in Europe, regulators impose strict leverage caps of 1:30 for retail traders. Exness, however, offers flexible leverage outside of regulated regions, giving traders more control over their trading strategy. Understanding these limits is essential for traders who wish to use high leverage responsibly.

Impact of Regulatory Changes on Traders

Changes in leverage regulations can affect trading strategies, especially for traders who rely on high leverage. When regulations limit leverage, traders may need to adapt their approach or switch to different trading styles. Exness regularly updates its clients on regulatory changes, helping them adjust accordingly.

Comparing Global Leverage Standards

Exness offers competitive leverage options compared to other brokers, making it an attractive choice for traders in regions with flexible leverage regulations. While some brokers impose lower leverage limits, Exness’s options provide traders with greater flexibility, especially in regions where unlimited leverage is permitted.

Conclusion

Using high leverage on Exness offers an opportunity to amplify profits, but it requires careful management and understanding of the associated risks. By following these strategies, utilizing Exness’s tools, and staying informed on market conditions, traders can optimize their leverage use effectively. Remember, while leverage can enhance returns, it also increases exposure to risk. Always trade responsibly and ensure your leverage level aligns with your financial goals and risk tolerance.

Read more: