5 minute read

Exness India Review 2025: Is it the Right Broker for You?

from Exness

by Exness_Blog

As online trading gains popularity in India, traders are constantly searching for reliable and well-regulated brokers. Exness has emerged as one of the top choices for forex and CFD trading due to its competitive spreads, high leverage, and fast execution speeds. But the question remains:

Is Exness a legitimate and safe broker in India?

What are its key features and benefits?

Are there any drawbacks traders should be aware of?

How does it compare with other brokers in 2025?

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In this comprehensive Exness India Review 2025, we will evaluate the broker based on:

✔️ Regulations & Safety✔️ Trading Instruments✔️ Account Types & Trading Conditions✔️ Fees, Spreads & Leverage✔️ Deposit & Withdrawal Methods✔️ Trading Platforms & Tools✔️ Customer Support✔️ Pros & Cons

By the end of this article, you’ll have all the necessary insights to determine whether Exness is the right broker for your trading journey in India.

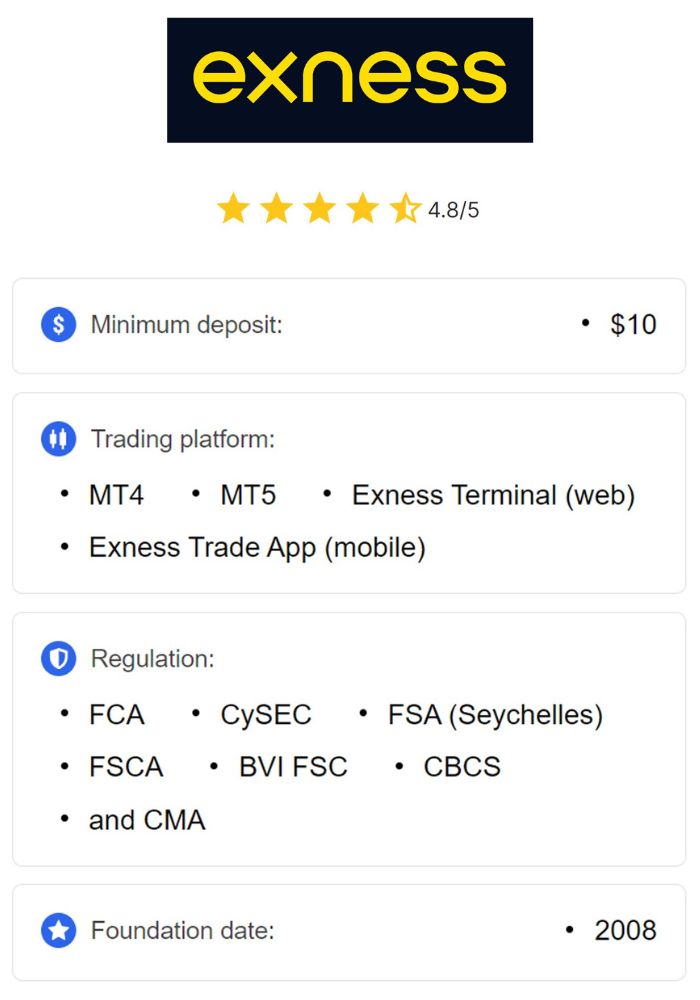

1. Exness Overview: A Global Broker

✅ About Exness

Exness was established in 2008 and has grown into a globally recognized forex and CFD broker. The company is known for its transparency, low trading costs, and instant withdrawals, attracting traders worldwide, including those in India.

🔹 Headquarters: Cyprus & Seychelles🔹 Number of Users: 500,000+ active traders🔹 Monthly Trading Volume: Over $2 trillion🔹 Regulated By: FCA, CySEC, FSA, FSCA, FSC🔹 Instruments: Forex, Metals, Cryptos, Indices, Stocks, Energies

🚀 In 2025, Exness continues to expand its services in India, making it a preferred choice among Indian traders.

2. Is Exness Legal and Safe in India?

✅ Regulations & Licenses

Exness is a regulated broker, operating under multiple financial authorities:

🔹 Financial Conduct Authority (FCA) – UK🔹 Cyprus Securities and Exchange Commission (CySEC) – Cyprus🔹 Financial Services Authority (FSA) – Seychelles🔹 Financial Sector Conduct Authority (FSCA) – South Africa🔹 Financial Services Commission (FSC) – Mauritius

📌 What does this mean for Indian traders?

✔️ Funds Protection: Client funds are kept in segregated accounts.✔️ Negative Balance Protection: Ensures traders don’t lose more than their deposits.✔️ Regular Audits: Conducted by independent firms for transparency.

🚀 Although the Reserve Bank of India (RBI) and SEBI do not regulate offshore forex brokers, Indian traders can still legally trade with Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

3. Trading Instruments Available on Exness

Exness provides access to a wide range of markets, allowing Indian traders to diversify their portfolios:

✔️ Forex: 100+ currency pairs (Major, Minor, Exotic)✔️ Metals: Gold, Silver, Platinum✔️ Cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple✔️ Indices: S&P 500, Dow Jones, NASDAQ, Nifty 50✔️ Stocks: Apple, Tesla, Amazon, Microsoft✔️ Energies: Crude Oil, Natural Gas

📌 Exness offers an extensive range of assets suitable for all trading strategies.

4. Exness Account Types & Trading Conditions

Exness provides multiple account options to cater to different trading styles:

✅ Standard Accounts

✔️ Standard: Suitable for beginners, no commission, low spreads.✔️ Standard Cent: Designed for small-scale traders, ideal for learning.

✅ Professional Accounts

✔️ Raw Spread: Low spreads starting from 0.0 pips, commission-based.✔️ Zero: No spreads on major instruments, fixed commission.✔️ Pro: Instant execution, no commission, for experienced traders.

📌 Exness offers flexibility, allowing traders to choose the right account based on their needs.

5. Fees, Spreads & Leverage

✅ Competitive Trading Costs

✔️ Spreads: As low as 0.0 pips on Raw & Zero accounts.✔️ Leverage: Up to 1:2000 (unlimited in some cases).✔️ Commission: Only applicable on Raw Spread & Zero accounts.✔️ No Hidden Charges: Free deposits and most withdrawals.

🚀 Exness provides one of the lowest-cost trading environments among brokers in 2025.

6. Deposit & Withdrawal Methods

Exness is known for instant deposits and withdrawals, making it one of the most convenient brokers in India.

✅ Popular Payment Options for Indian Traders

✔️ UPI / Paytm / PhonePe✔️ Net Banking / IMPS✔️ Credit & Debit Cards (Visa, MasterCard)✔️ Skrill, Neteller, Perfect Money✔️ Crypto Payments (Bitcoin, USDT, Ethereum)

📌 Most withdrawals are processed instantly, unlike many other brokers.

7. Trading Platforms & Tools

Exness supports industry-leading platforms:

✅ Available Trading Platforms

✔️ MetaTrader 4 (MT4) – Perfect for beginner traders.✔️ MetaTrader 5 (MT5) – Advanced features & technical tools.✔️ Exness WebTrader – No downloads required.✔️ Exness Mobile App – Trade on the go.

📌 Exness ensures smooth trading across all devices.

8. Customer Support & Educational Resources

✅ Exness Support for Indian Traders

✔️ 24/7 Live Chat (English & Hindi support)✔️ Email & Phone Support✔️ Extensive FAQs & Help Center✔️ Free Trading Education (Webinars, E-books, Tutorials)

📌 Exness provides excellent customer service and trading education.

9. Pros & Cons of Exness

✅ Pros

✔️ Globally Regulated Broker✔️ Instant Deposits & Withdrawals✔️ Low Trading Fees & Tight Spreads✔️ High Leverage (Up to 1:2000)✔️ User-Friendly Trading Platforms✔️ Excellent Customer Support

❌ Cons

❌ No Direct SEBI Regulation❌ High Leverage Can Be Risky for Beginners❌ Limited Availability of Exotic Trading Instruments

📌 Despite minor drawbacks, Exness is a strong choice for Indian traders.

10. Final Verdict: Should You Trade with Exness in India?

🚀 Is Exness the right broker for you in 2025?

✅ Yes! If you are looking for a low-cost, high-speed, and user-friendly trading experience, Exness is an excellent choice.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Who Should Use Exness?

✔️ Beginners – Easy-to-use interface & low deposit requirements.✔️ Professional Traders – Raw spreads, high leverage, and zero commission options.✔️ Scalpers & Day Traders – Fast execution & instant withdrawals.

Read more: