18 minute read

Exness Review South Africa: Is it a legit or scam forex broker?

from Exness

by Exness_Blog

Introduction to Exness

Overview of Forex Trading

Forex trading, or the foreign exchange market, allows traders to buy and sell currencies to profit from fluctuations in exchange rates. It’s the largest and most liquid market globally, with trades amounting to trillions of dollars daily. South African traders are increasingly interested in forex trading as a way to diversify their income streams or invest capital. One reason for this interest is the accessibility of forex trading, which requires relatively low initial investments and offers flexibility through online trading platforms that operate 24 hours a day.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In forex trading, currency pairs such as EUR/USD or USD/ZAR represent the value of one currency against another. By analyzing price trends, global economic data, and technical indicators, traders try to predict future movements and earn profits on their positions. However, forex trading comes with significant risks, especially due to leverage—borrowed capital that can magnify gains but also increase potential losses. Selecting a regulated and reputable broker, like Exness, is crucial for managing these risks and ensuring fair trading conditions.

What is Exness?

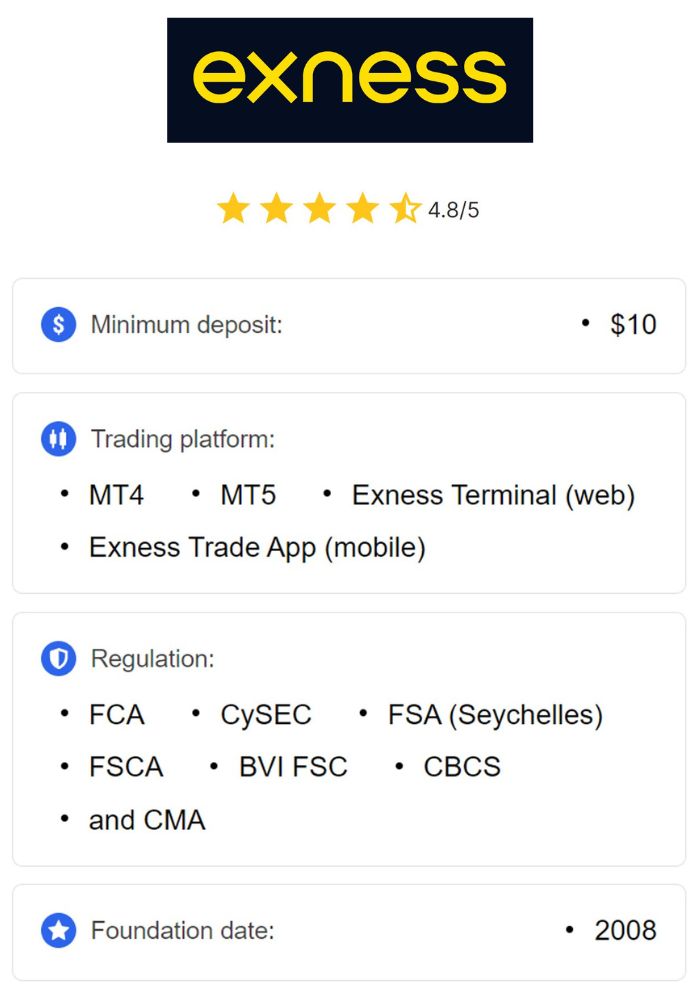

Exness is an established forex and CFD broker, founded in 2008, with a presence in over 100 countries, including South Africa. Known for its commitment to transparency and innovation, Exness has built a solid reputation in the industry by offering competitive spreads, fast trade execution, and a user-friendly trading environment. The broker provides access to various financial markets, including forex, commodities, indices, and cryptocurrencies, making it suitable for a wide range of trading preferences and strategies.

Exness stands out for its robust regulatory compliance and extensive client support, including localized options for South African traders. It offers a wide selection of account types, trading platforms, and educational resources, aiming to cater to both beginners and professional traders. With these features, Exness has become a popular choice for South African traders looking for a reliable, regulated broker with versatile trading options.

Regulatory Status of Exness

Financial Conduct Authority (FCA) Regulations

Exness is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, one of the most respected regulatory bodies globally. The FCA enforces strict rules on brokers, requiring them to operate transparently, fairly, and with strong protections for client funds. FCA-regulated brokers must segregate client funds, keeping them separate from the broker’s operational funds to protect client deposits in case of bankruptcy. Additionally, the FCA mandates compliance with anti-money laundering (AML) practices, ensuring that the broker conducts thorough identity checks to prevent fraud and financial crime.

The FCA also has specific policies to protect traders’ interests, such as enforcing leverage caps for retail clients to reduce risk exposure. For South African traders, the FCA’s oversight offers reassurance that Exness adheres to high standards and is unlikely to engage in deceptive practices.

Other Regulatory Bodies

Besides the FCA, Exness is also regulated by other major entities, including the Cyprus Securities and Exchange Commission (CySEC) and the South African Financial Sector Conduct Authority (FSCA). CySEC, which oversees brokers in the European Union, ensures that Exness complies with the Markets in Financial Instruments Directive (MiFID II) guidelines, protecting traders and maintaining transparency. The FSCA, South Africa’s primary financial regulator, is essential for Exness’s operations in the country, as it ensures Exness provides fair, transparent, and localized services to South African clients.

These regulatory bodies strengthen Exness’s reputation and commitment to security, offering South African traders added peace of mind when trading with Exness.

Account Types Offered by Exness

Standard Accounts

Exness offers Standard accounts tailored for beginner and intermediate traders. These accounts have low minimum deposit requirements, making them accessible for new traders looking to explore forex without substantial capital. Standard accounts offer competitive spreads and often have no commission on trades, making them cost-effective for traders with smaller volumes. These accounts also come with access to all available trading platforms, including MetaTrader 4, MetaTrader 5, and the Exness Web Terminal, providing traders with flexibility in executing trades.

Professional Accounts

For experienced traders, Exness offers professional accounts with advanced features. Professional accounts generally have tighter spreads and higher leverage options, providing an environment suited for high-frequency or large-volume traders. These accounts include options like Raw Spread, Zero, and Pro accounts, each offering specific trading benefits such as minimal spreads or reduced commissions. While the minimum deposit for professional accounts is higher, the enhanced trading conditions can make a substantial difference in profitability for advanced traders.

Islamic Accounts

To accommodate Muslim traders, Exness offers swap-free accounts, which comply with Islamic principles by avoiding interest charges on overnight positions. These accounts are designed for traders who wish to engage in forex trading without violating Sharia law, as they do not incur any swap fees. Islamic accounts at Exness maintain the same features as other account types, making them accessible and convenient for Muslim traders in South Africa.

Trading Platforms Available

MetaTrader 4

MetaTrader 4 (MT4) is widely regarded as one of the most reliable trading platforms globally, and Exness provides full support for it. Known for its intuitive design and powerful analytical tools, MT4 is suitable for traders of all experience levels. MT4 offers advanced charting capabilities, technical indicators, and automated trading through Expert Advisors (EAs). South African traders often appreciate MT4’s stability, speed, and compatibility with various trading strategies, including scalping, day trading, and swing trading.

The platform’s advanced charting tools allow traders to analyze price movements and trends effectively, making it easier to make informed trading decisions. Additionally, MT4’s user-friendly interface allows traders to place orders, set stop losses and take profits, and manage their trades effortlessly. With Exness’s MT4 platform, South African traders can benefit from low latency and quick execution, which are essential for trading success in fast-paced markets.

MetaTrader 5

MetaTrader 5 (MT5) is the more advanced version of MT4 and includes additional features such as extra timeframes, advanced order types, and extended analytical tools. MT5 is ideal for traders interested in trading a variety of assets, including forex, stocks, and commodities. Exness’s support for MT5 offers South African traders more flexibility and tools, making it well-suited for in-depth market analysis and complex trading strategies.

MT5 includes features like the economic calendar and news feed integration, allowing traders to stay informed of market-moving events directly from the platform. Moreover, MT5’s enhanced backtesting capability is beneficial for traders who rely on automated trading strategies and want to test their systems in different market conditions. With additional technical indicators and graphical objects, MT5 provides a more comprehensive trading experience, making it a valuable tool for professional traders.

Exness Web Terminal

The Exness Web Terminal is a proprietary trading platform that allows traders to access their accounts via any web browser, eliminating the need for software downloads. Although it lacks some advanced features found in MT4 and MT5, the Web Terminal is fast, reliable, and perfect for quick access and straightforward trading needs. It offers essential trading functions, such as chart analysis, order placement, and account management, making it a convenient option for traders who frequently switch devices or prefer browser-based platforms.

For South African traders who prioritize flexibility and mobility, the Exness Web Terminal provides an accessible solution. Its intuitive interface allows users to navigate markets and monitor positions seamlessly. Furthermore, the Web Terminal synchronizes with the desktop and mobile versions of MT4 and MT5, enabling traders to transition between platforms smoothly.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Instruments Provided by Exness

Currency Pairs

Exness offers a comprehensive selection of currency pairs, including major, minor, and exotic pairs. For South African traders, popular major pairs like EUR/USD, GBP/USD, and USD/JPY provide high liquidity and tighter spreads, making them ideal for day trading and scalping strategies. Additionally, Exness supports exotic pairs, including those involving the South African Rand (ZAR), such as USD/ZAR and EUR/ZAR. This variety of currency pairs allows South African traders to diversify their portfolios and capitalize on currency fluctuations within both global and local markets.

With competitive spreads and low latency on currency trading, Exness is well-suited for traders focused on forex markets. South African traders can benefit from a wide array of currency pairs to implement various strategies, including trend following, arbitrage, and hedging.

Commodities

In addition to forex, Exness offers commodities trading, which provides an opportunity for traders to diversify their portfolios beyond currencies. Exness offers popular commodities like gold, silver, and crude oil, which are widely traded due to their volatility and potential as safe-haven assets. Gold, in particular, is favored by many South African traders as a hedge against economic uncertainty and currency devaluation.

Commodities trading with Exness allows traders to speculate on price movements in globally significant assets. These commodities are affected by global supply and demand factors, geopolitical events, and economic indicators, which can lead to profitable trading opportunities. By including commodities in their portfolios, South African traders can mitigate risks associated with forex trading alone and gain exposure to other market dynamics.

Indices and Stocks

Exness also offers CFD trading on indices and individual stocks, allowing traders to speculate on the performance of popular indices like the S&P 500, NASDAQ, and FTSE 100. Index trading enables traders to gain exposure to a basket of stocks without needing to manage individual securities, which can be advantageous for those looking to diversify within the equity markets. For South African traders, index CFDs offer a way to trade international stock markets without directly owning the assets.

Additionally, Exness offers CFD trading on individual stocks, allowing traders to speculate on the price movements of well-known companies across various sectors. This access to global stocks provides South African traders with diversified options, enabling them to trade on trends within sectors such as technology, healthcare, and energy. Trading indices and stocks through Exness can complement forex trading strategies, helping traders balance risks and returns.

Spreads and Fees Structure

Overview of Spreads

Exness offers variable spreads on its range of accounts, with spreads that differ based on account type, trading instrument, and market conditions. For standard accounts, spreads are typically wider, while professional accounts offer tighter spreads, especially for high-volume trading. Exness’s spreads are competitive within the industry, often falling below the average for forex brokers, making it attractive for cost-conscious traders.

South African traders benefit from Exness’s low spread structure, especially during high liquidity periods. Spreads can vary during volatile market events, so it’s essential for traders to consider these fluctuations when planning their trades. Overall, Exness’s transparent approach to spreads provides traders with predictable costs, helping them manage trading expenses more effectively.

Commission Rates

Exness charges commission fees on certain accounts, primarily those offering tighter spreads, such as the Raw Spread and Zero accounts. For South African traders with high trading volumes, these commission-based accounts can be cost-effective due to their reduced spreads. Exness’s commission rates are transparent and competitive, making it easier for traders to understand the full cost of their trades.

Typically, commission fees apply to trades on forex pairs and specific indices, where low spreads are essential for scalping and day trading. For traders who prioritize lower spreads over zero commission, Exness’s commission-based accounts offer a suitable option that balances costs with trading efficiency.

Other Fees

Apart from spreads and commissions, Exness maintains a low-fee structure, which enhances its appeal to traders concerned about hidden charges. Exness does not charge account maintenance or inactivity fees, which can be advantageous for South African traders who may not trade frequently. However, overnight positions on certain accounts may incur swap fees, which is something traders should consider if they hold trades long-term.

Exness’s transparent fee structure is part of its commitment to trader satisfaction, allowing users to calculate their trading costs accurately and avoid unexpected charges.

Deposit and Withdrawal Methods

Supported Payment Options

Exness offers a range of payment methods to accommodate South African traders, making deposits and withdrawals convenient and flexible. These options include traditional bank transfers, credit and debit cards, as well as popular e-wallets like Neteller, Skrill, and Perfect Money. Exness also supports localized payment methods for South Africa, which allows for faster transactions and eliminates the need for currency conversions, reducing transaction costs for traders.

For traders, having multiple payment options is essential for convenience and speed, especially in a fast-moving market. Exness’s wide array of payment methods allows South African traders to choose the most accessible and cost-effective option, making it easier to fund their accounts or withdraw profits without unnecessary delays or high fees.

Processing Times for Deposits

Deposits at Exness are typically processed instantly for most payment methods, including credit/debit cards and e-wallets. This instant processing feature is crucial for traders who want to take advantage of market opportunities without waiting for funds to clear. Bank transfers may take longer, depending on the processing times of the financial institution involved, but Exness strives to complete deposit requests as quickly as possible.

For South African traders, the availability of instant deposits means they can add funds to their accounts and start trading immediately. This flexibility enhances the trading experience and allows traders to stay responsive to market trends and price fluctuations.

Withdrawal Process and Fees

Exness has a straightforward withdrawal process designed to make accessing funds easy for traders. Withdrawal requests are processed quickly, with many payment methods allowing for same-day withdrawals. E-wallets and cards typically offer faster processing times compared to bank transfers, which can take several days depending on the bank’s policies. Exness does not charge additional withdrawal fees for most payment methods, making it cost-effective for traders to access their funds.

However, it’s important for South African traders to check with their chosen payment providers for any external fees that might apply, such as bank charges or intermediary fees on international transfers. Overall, Exness’s commitment to fast and low-cost withdrawals aligns well with the needs of South African traders, ensuring they can access their funds efficiently.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support Services

Contact Methods

Exness provides multiple contact methods to assist traders with any questions or issues they might encounter. Traders can reach Exness’s customer support team through live chat, email, and phone, ensuring convenient access to assistance. Live chat is the most popular option for quick responses, while email support is useful for more detailed inquiries. Exness also offers a dedicated phone line for urgent matters, which is beneficial for South African traders who prefer direct verbal communication.

The company’s customer support is available in multiple languages, including English, catering to a diverse client base. With localized support for South African traders, Exness aims to provide effective and timely assistance tailored to the needs of its clients in the region.

Response Times and Availability

Exness is known for its quick response times, particularly through its 24/7 live chat support. This round-the-clock availability is valuable for traders who may encounter issues outside of standard business hours or during market sessions in different time zones. Email inquiries are usually addressed within 24 hours, while phone support offers immediate help for urgent issues.

For South African traders, having access to 24/7 support provides reassurance, especially when trading in a volatile market where immediate assistance may be required. Exness’s commitment to responsive customer service contributes to its reputation as a reliable broker for traders in South Africa and around the world.

Educational Resources and Tools

Market Analysis and Insights

Exness provides a wealth of market analysis resources to help traders stay informed about market trends, economic events, and potential trading opportunities. These resources include daily market news, technical analysis reports, and insights into major currency pairs and commodities. Exness’s market analysis is available directly on its platform and website, enabling traders to access real-time data and expert opinions.

For South African traders, these resources offer an opportunity to enhance their understanding of global market dynamics. The market analysis provided by Exness helps traders make well-informed decisions, particularly during volatile periods when access to accurate information is essential.

Trading Academy Resources

Exness offers a comprehensive trading academy that includes video tutorials, webinars, and educational articles covering various aspects of forex trading. Topics range from beginner-level introductions to advanced strategies, making it suitable for traders at all levels. The academy is designed to equip traders with the knowledge and skills needed to develop effective trading strategies, understand technical and fundamental analysis, and manage risk effectively.

For South African traders new to forex, the trading academy provides a solid foundation for getting started, while experienced traders can benefit from advanced content to refine their strategies. Exness’s focus on education reflects its commitment to supporting traders’ growth and ensuring they have the tools necessary for successful trading.

User Experience and Interface

Website Navigation

Exness has designed its website to be user-friendly and intuitive, ensuring that traders can easily access the information they need. The website provides clear navigation to important sections, such as account types, trading platforms, deposit and withdrawal options, and customer support. Additionally, Exness’s website is available in multiple languages, including English, catering to a diverse client base.

For South African traders, the seamless website experience makes it easy to navigate between different sections, manage accounts, and stay updated with market news and resources. The clean design and structured layout contribute to a positive user experience, helping traders focus on their trading activities without unnecessary distractions.

Mobile Trading Experience

Exness offers a mobile trading experience through its MT4 and MT5 mobile apps, as well as its proprietary Exness Trader app. These mobile platforms allow traders to manage their accounts, place trades, and access charts and indicators directly from their smartphones. The mobile apps are optimized for Android and iOS devices, providing fast and reliable performance for trading on the go.

For South African traders who need flexibility, the mobile trading options provided by Exness are a valuable feature. The apps enable traders to monitor the market and execute trades anytime and anywhere, which is particularly useful for those with busy schedules or who prefer trading from their mobile devices.

User Reviews and Feedback

Positive User Experiences

Exness has received positive feedback from traders globally, including South African clients, due to its reliable trading platforms, fast execution, and transparent fee structure. Many traders appreciate Exness’s quick deposit and withdrawal process, as well as its competitive spreads, which contribute to cost-effective trading. The availability of multiple account types also allows traders to choose an option that aligns with their trading style and experience level.

Customer service is another area where Exness has received praise, particularly for its responsiveness and 24/7 availability. For South African traders, Exness’s focus on providing a smooth and efficient trading experience has contributed to its popularity and reputation as a trustworthy broker.

Common Complaints

While Exness is highly regarded, some traders have reported challenges with certain features. Common complaints include occasional slippage during volatile market periods and issues with the Web Terminal’s limited advanced features compared to MT4 and MT5. Some traders have also mentioned that while Exness offers a wide variety of payment methods, international bank transfers can incur fees or take longer than expected due to intermediary banks.

It’s important for South African traders to be aware of these potential drawbacks and consider them in light of their specific trading needs. Understanding the strengths and weaknesses of Exness can help traders make informed decisions about whether the broker is the right fit for them.

Security Measures and Safety of Funds

Data Protection Practices

Exness places a strong emphasis on data security and uses advanced encryption technology to protect client information. This includes secure encryption protocols on its website and trading platforms, ensuring that sensitive data such as personal details, financial information, and transaction history is safeguarded against unauthorized access.

For South African traders, knowing that their data is secure is essential, especially in the digital age where cybersecurity threats are increasingly common. Exness’s commitment to data protection aligns with industry standards, providing traders with peace of mind when managing their accounts and trading online.

Client Fund Segregation

Exness follows strict client fund segregation practices, keeping client deposits separate from the broker’s operational funds. This ensures that, in the unlikely event of the company facing financial difficulties, client funds remain safe and accessible. Additionally, Exness works with reputable banks to hold these funds, further enhancing the security of deposits.

For South African traders, client fund segregation is a critical factor in choosing a broker. Exness’s adherence to this practice demonstrates its commitment to transparency and protecting clients’ financial interests.

Comparison with Other Forex Brokers in South Africa

Advantages of Choosing Exness

Exness stands out among forex brokers in South Africa due to its competitive spreads, diverse account types, and reliable customer support. Its strong regulatory framework, including oversight by the FCA, CySEC, and FSCA, also provides a high level of security for traders. Additionally, Exness’s transparent fee structure and extensive payment options make it a convenient choice for South African clients looking for an accessible and trustworthy broker.

Disadvantages of Choosing Exness

Despite its many advantages, Exness has some drawbacks compared to other brokers. The occasional slippage during high volatility periods and limited features on the Exness Web Terminal may be concerns for advanced traders. Additionally, while Exness offers many payment options, some South African traders may experience delays with international bank transfers due to intermediary bank processing times.

Conclusion: Legit or Scam?

Based on Exness’s regulatory status, client fund security measures, transparent trading conditions, and positive user feedback, Exness is a legitimate and reputable forex broker. It provides South African traders with a safe and flexible trading environment supported by strong regulatory oversight. While Exness has some limitations, such as slippage during volatile periods, it remains a reliable choice for traders seeking a broker with competitive fees, versatile trading platforms, and extensive market offerings. For South African traders considering Exness, the broker’s advantages far outweigh its disadvantages, making it a trustworthy option for forex and CFD trading.

Read more: