5 minute read

Exness Go India: Real or Fake? Review Broker 2025

from Exness

by Exness_Blog

The rise of online forex trading in India has led to the emergence of several trading platforms, one of which is Exness Go India. Many traders are now asking:

👉 Is Exness Go India a real trading platform or a scam?

👉 Is Exness a legitimate broker for Indian traders?

The short answer is: Exness is a globally regulated forex broker, but Exness Go India is NOT officially recognized by Indian regulators (SEBI & RBI). While Exness operates legally in many countries, Indian traders must be cautious when using offshore brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In this guide, we will uncover:✔️ What Exness Go India is and whether it is a real or fake platform.✔️ Exness’ regulatory status in India.✔️ The risks and challenges of using Exness Go India.✔️ Best practices to avoid forex trading scams.

1. What is Exness Go India?

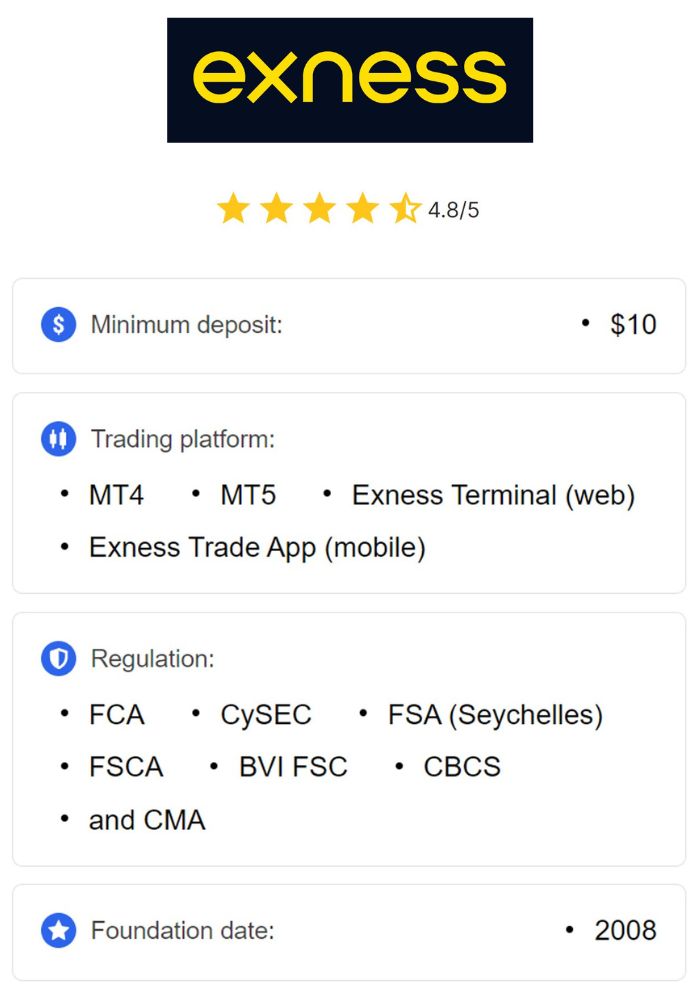

Exness is a well-established forex and CFD broker founded in 2008, offering:✅ Over 100 forex pairs, commodities, indices, and cryptocurrencies.✅ High leverage up to 1:2000.✅ Tight spreads and commission-free accounts.✅ A user-friendly mobile trading app and MetaTrader (MT4/MT5) support.✅ Instant deposits and withdrawals via various payment methods.

What About Exness Go India?

Exness does not have an official Indian website or an India-specific platform. However, some third-party sources promote “Exness Go India” as a localized version of the broker.

🚨 Warning: Many of these “Exness Go India” promotions come from unofficial sources, and some could be fraudulent.

💡 Key takeaway:

Exness is a real and globally recognized broker.

Exness Go India does not officially exist as a separate platform.

Beware of fake websites, apps, and social media promotions pretending to be Exness.

2. Is Exness Regulated in India?

✅ Yes, Exness is a globally regulated broker

Exness holds multiple licenses from top-tier financial authorities, including:✔️ FCA (UK) – Financial Conduct Authority.✔️ CySEC (Cyprus) – Cyprus Securities and Exchange Commission.✔️ FSCA (South Africa) – Financial Sector Conduct Authority.✔️ FSA (Seychelles) & FSC (Mauritius) – Offshore regulatory licenses.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

❌ No, Exness is NOT regulated by SEBI or RBI

SEBI (Securities and Exchange Board of India) has not approved Exness as a legal forex broker.

RBI (Reserve Bank of India) does not allow forex trading in non-INR currency pairs through offshore brokers.

🔹 What does this mean for Indian traders?

You can use Exness, but at your own risk.

There is no local regulatory protection if you face issues with the broker.

Deposits and withdrawals may be complicated due to Indian banking restrictions.

3. How to Identify a Fake Exness Go India Platform?

With forex trading scams increasing in India, it is crucial to identify real vs. fake platforms.

A. Signs of a Fake Exness Go India Website or App

🚩 Website URL looks suspicious (e.g., "exness-go-india.com" instead of "exness.com").🚩 No official Exness contact details or regulation information.🚩 Offers unrealistic bonuses or guaranteed profits.🚩 Asks for direct payments to personal accounts instead of secure payment gateways.

B. Fake Social Media Promotions

🚨 Beware of Telegram, WhatsApp, or Instagram groups promising:❌ "Guaranteed profits with Exness Go India!"❌ "VIP Forex Signals with 100% Win Rate!"❌ "Exness Go India Referral Scheme – Earn ₹50,000/month!"

C. Fake Exness Go India Mobile Apps

⚠️ Scam apps may steal your funds and personal data.✔️ Always download Exness from the official website (www.exness.com) or Google Play Store/App Store.

🚀 How to Stay Safe?🔹 Trade only on the official Exness website.🔹 Avoid third-party platforms claiming to be "Exness Go India".🔹 Do not share personal or banking details with unverified brokers.

4. Risks of Using Exness Go India in India

A. Legal Risks

Trading forex in non-INR pairs is restricted under FEMA (Foreign Exchange Management Act, 1999).

Indian authorities may block access to offshore trading platforms.

No legal protection if Exness or Exness Go India suspends your account.

B. Banking & Fund Withdrawal Issues

Indian banks do not allow direct forex deposits to offshore brokers.

Traders must use alternative methods like crypto, e-wallets, or peer-to-peer (P2P) transfers.

Withdrawals may be delayed or flagged by Indian banks.

C. High Leverage Risks

Exness offers leverage up to 1:2000, which can amplify both profits and losses.

Most SEBI-regulated brokers allow only 1:30 leverage for risk management.

D. Scams & Fake Brokers

Many fake "Exness Go India" platforms scam traders by stealing deposits.

Always verify if you are using the real Exness website before trading.

5. How to Trade Safely with Exness in India

If you still want to trade with Exness in India, follow these best practices:

A. Verify the Official Exness Website

✔️ Only use www.exness.com (official site).✔️ Check regulatory licenses on the Exness website.

B. Use Secure Payment Methods

✅ Crypto Payments: Bitcoin, Tether (USDT), Ethereum.✅ E-Wallets: Skrill, Neteller, Perfect Money.✅ Avoid direct bank transfers to personal accounts.

C. Manage Your Risk

✔️ Use stop-loss and take-profit orders to protect capital.✔️ Avoid using high leverage unless you are an experienced trader.

D. Avoid Forex Scams in India

🚨 Never believe in "guaranteed profits" or "VIP forex signals".🚨 Do not send money to unverified Exness Go India agents.🚨 Join forex trading communities to learn from experienced traders.

6. Conclusion: Is Exness Go India Real or Fake?

📌 Final Verdict:✅ Exness is a legitimate forex broker, regulated in multiple countries.❌ Exness Go India does NOT officially exist—beware of fake websites and scams.⚠️ Exness is NOT regulated by SEBI or RBI, so Indian traders must be cautious.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Key Takeaways:

✔️ If you use Exness, always access it through the official website.✔️ Stay away from “Exness Go India” promotions on social media.✔️ Use SEBI-regulated brokers for safe and legal forex trading in India.

Read more: