13 minute read

Is Exness Regulated in Kenya? Review Broker

from Exness

by Exness_Blog

Forex trading is rapidly gaining popularity in Kenya, as more traders explore online platforms to participate in global financial markets. One broker that has attracted significant attention is Exness, a global leader in forex and CFD trading. For Kenyan traders, one of the primary concerns is the legality and regulation of the broker. So, is Exness regulated in Kenya, and can Kenyan traders legally use the platform? The answer is yes—Exness operates legally in Kenya, adhering to international regulatory standards, making it a reliable and safe option for Kenyan traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In this article, we will review Exness, explore its regulatory status, and discuss its features and services for Kenyan traders, including how it compares to local competitors.

Introduction to Exness

Overview of the Company

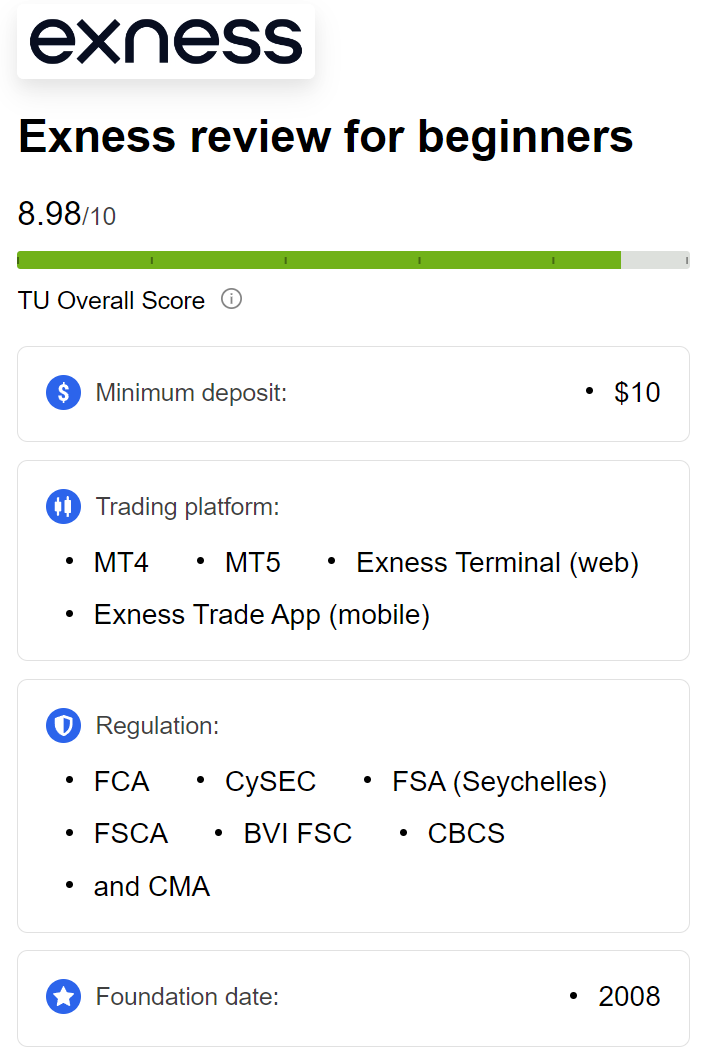

Exness was founded in 2008 and has since grown into one of the most recognized brokers in the global forex and CFD trading industry. The company has earned a reputation for providing transparent, reliable, and secure trading services to millions of traders worldwide. With its headquarters in Cyprus, Exness operates under several licenses from top-tier regulatory bodies, ensuring that it adheres to international financial standards.

Exness offers access to a wide variety of financial instruments, including forex, commodities, indices, cryptocurrencies, and stocks. The broker is known for its competitive trading conditions, including tight spreads, fast execution speeds, and robust customer support.

Services Offered by Exness

Exness provides a broad range of services designed to cater to both novice and experienced traders. Key services include:

Forex Trading: Exness offers access to a wide range of currency pairs, including major, minor, and exotic pairs.

CFD Trading: The broker allows for the trading of contracts for difference (CFDs) on commodities, indices, cryptocurrencies, and stocks.

Leverage Options: Exness provides flexible leverage options, allowing traders to increase their market exposure with a smaller capital investment.

Educational Resources: The broker offers a comprehensive selection of learning materials, including webinars, tutorials, and market analysis, to help traders improve their skills.

Trading Platforms: Exness supports popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are available on desktop and mobile, providing traders with flexible access to markets.

Understanding Regulation in Forex Trading

Importance of Regulation

Regulation in forex trading is essential for ensuring a safe and transparent trading environment. A regulated broker operates under strict guidelines set by financial authorities, which helps protect traders from fraud and malpractice. Regulatory oversight also ensures that brokers follow ethical business practices, including proper handling of client funds, adherence to anti-money laundering (AML) protocols, and providing accurate trade execution.

For Kenyan traders, choosing a regulated broker like Exness ensures that they can trade with confidence, knowing their funds are safe and that the broker operates under a strict regulatory framework.

Regulatory Bodies in Forex Trading

There are several regulatory bodies that oversee forex trading globally. Some of the most prominent include:

Cyprus Securities and Exchange Commission (CySEC): Regulates brokers based in the European Union, ensuring they adhere to the MiFID II framework.

Financial Conduct Authority (FCA): The FCA is a UK-based regulatory body known for its strict financial standards and trader protection policies.

Seychelles Financial Services Authority (FSA): The FSA oversees brokers operating in offshore jurisdictions but still enforces high levels of compliance and transparency.

These regulatory bodies are responsible for ensuring that brokers like Exness operate transparently and that traders’ funds are secure.

Exness Regulatory Status

Global Regulatory Framework

Exness is regulated by several well-known financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and the Seychelles Financial Services Authority (FSA). These regulators ensure that Exness adheres to international standards related to client protection, financial reporting, and operational transparency. Exness’s compliance with these regulations means that traders can trust the broker to provide a fair and secure trading environment.

Specific Regulations Applied to Exness

Although Exness does not have a specific license from the Capital Markets Authority (CMA) in Kenya, it operates legally in the country by adhering to international regulations. Kenyan traders can access the platform and legally trade forex, provided they comply with local tax laws and regulatory guidelines. Exness ensures that it follows the global best practices set by its regulatory bodies, offering Kenyan traders the same level of protection and security as those in other jurisdictions.

Exness and Kenyan Traders

Availability of Services in Kenya

Exness is fully available to Kenyan traders, providing them with access to all its trading instruments, platforms, and account types. Traders in Kenya can sign up for an Exness account, deposit funds using local payment methods, and start trading within minutes. The broker also supports trading in Kenyan Shillings (KES), making it convenient for local traders to manage their accounts without the need for currency conversions.

Popularity Among Kenyan Forex Traders

Exness has become a popular choice among Kenyan traders due to its user-friendly platforms, competitive spreads, and flexible deposit options. The broker’s educational resources have also been instrumental in helping many new traders in Kenya develop their skills and gain confidence in the forex market. Additionally, Exness’s robust customer support and fast withdrawal processes have contributed to its growing popularity among Kenyan traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Key Features of Exness

Trading Platforms Offered

Exness provides access to two of the most widely used trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their ease of use, advanced charting tools, and automated trading capabilities. MT4 is favored by traders for its simplicity, while MT5 offers additional features such as more timeframes, built-in economic calendars, and improved trade execution.

Both platforms are available for desktop, mobile, and web trading, ensuring that traders in Kenya can access the markets from anywhere at any time. The mobile trading app is particularly popular among Kenyan traders who prefer to trade on the go.

Account Types Available

Exness offers a variety of account types to suit different trading styles and experience levels. These include:

Standard Account: This account type is ideal for beginner traders and offers competitive spreads with no commission on trades.

Pro Account: Designed for experienced traders, the Pro account offers lower spreads and faster execution speeds, making it suitable for high-volume traders.

Raw Spread Account: This account provides the tightest spreads possible, starting from 0 pips, with a small commission per trade.

Zero Account: Ideal for traders who want to avoid spread costs, this account offers 0 spreads on major instruments with a low commission fee.

Each account type offers different leverage options, allowing traders to choose the level of risk that best suits their trading strategy.

Deposit and Withdrawal Methods

Payment Options for Kenyan Clients

Exness provides Kenyan traders with multiple payment options to make deposits and withdrawals simple and convenient. Popular payment methods include:

Bank Transfers: Traders can use local banks to deposit and withdraw funds in Kenyan Shillings.

Mobile Payments: Exness supports mobile payment platforms like M-Pesa, which is widely used in Kenya.

E-wallets: Traders can use e-wallet services like Skrill, Neteller, and WebMoney for fast and secure transactions.

Cryptocurrency: For those who prefer digital currencies, Exness allows deposits and withdrawals in popular cryptocurrencies like Bitcoin.

This variety of payment methods ensures that Kenyan traders can easily fund their accounts and access their profits quickly.

Processing Times for Transactions

Exness is known for its fast processing times for both deposits and withdrawals. Most transactions are processed instantly, ensuring that traders have immediate access to their funds. In cases where instant processing is not possible, withdrawals are usually completed within 24 hours, making Exness one of the fastest brokers in the industry when it comes to fund withdrawals.

Customer Support and Resources

Availability of Support Services

Exness offers 24/7 customer support, ensuring that Kenyan traders can get help whenever they need it. Support is available in multiple languages, including English and Swahili, making it easier for local traders to communicate with the support team. Traders can contact Exness via live chat, email, or phone, and the response times are typically fast.

Educational Resources Provided

Exness provides a wide range of educational resources to help traders improve their skills and knowledge of the forex market. These resources include:

Webinars: Live online sessions where traders can learn about different trading strategies, market analysis, and risk management.

Tutorials: Step-by-step guides that cover everything from opening an account to executing trades and using advanced trading tools.

Market Analysis: Daily and weekly market reports that provide insights into current market trends, helping traders make informed decisions.

These educational resources are valuable for both beginners and experienced traders who want to stay updated on the latest market developments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Experience and Reviews

Overview of User Feedback

User feedback on Exness from Kenyan traders has been overwhelmingly positive. Many traders praise the platform for its intuitive interface, ease of use, and fast execution times, especially for forex trading. The flexibility of the trading platforms—MetaTrader 4 and MetaTrader 5—has also been commended, as it allows both beginners and experienced traders to tailor their trading strategies according to their preferences. The availability of the mobile app has been a significant advantage for traders in Kenya, as it allows them to trade on the go, a feature that has contributed to the platform's growing popularity in the region.

Many users also highlight Exness’s transparency in terms of pricing, spreads, and commissions, which helps traders better manage their trading costs. The quick and easy withdrawal process is frequently mentioned in reviews, with traders often noting how fast they can access their profits, which sets Exness apart from many competitors.

Common Praise and Criticism

Praise:

Fast Withdrawals: Kenyan traders often commend Exness for its swift withdrawal processing, ensuring they can access their funds in a timely manner.

User-Friendly Interface: The Exness platform, both on desktop and mobile, is designed to be accessible and easy to navigate, even for beginners.

Competitive Spreads: Traders appreciate the tight spreads offered on major currency pairs, which help to minimize trading costs and improve profitability.

24/7 Customer Support: The around-the-clock support, available in multiple languages, including Swahili, is a key feature that has been well-received by Kenyan traders. Quick responses via live chat and email have made Exness a top choice for many.

Educational Resources: Many traders in Kenya are new to forex, and Exness’s extensive range of educational tools, including webinars and tutorials, has been helpful in developing trading skills.

Criticism:

Mobile App Limitations: While the Exness mobile app is highly rated, some traders feel that it lacks certain advanced features found on the desktop version, such as more complex charting tools or customization options.

Leverage Restrictions: Some users have noted that, depending on the regulatory framework, Exness may impose limits on leverage for traders in certain regions, which could affect trading strategies.

Despite these minor concerns, Exness has generally received high marks from Kenyan users for its functionality, transparency, and overall trading experience.

Security Measures Implemented by Exness

Data Protection Practices

Exness places a strong emphasis on the security and protection of its clients’ data. The platform employs advanced encryption technologies, including SSL (Secure Socket Layer) protocols, to ensure that all sensitive information—such as personal data and financial transactions—is securely transmitted. This level of encryption safeguards traders from potential cyber threats and unauthorized access to their accounts.

In addition to encryption, Exness follows strict privacy policies, ensuring that clients' personal information is not shared with third parties without consent. These data protection practices are in line with global financial regulations, providing an added layer of security for Kenyan traders using the platform.

Fund Safety Protocols

One of the primary concerns for forex traders is the safety of their funds, and Exness addresses this concern through several safety measures. The broker adheres to a policy of segregating client funds from the company’s operational accounts. This means that traders’ funds are kept in separate bank accounts, reducing the risk of them being misused or exposed in the event of financial difficulties faced by the broker.

Additionally, Exness is a member of the Investor Compensation Fund (ICF), which offers compensation to traders in the unlikely event of the broker becoming insolvent. This provides further assurance to Kenyan traders that their funds are protected when using Exness.

Comparison with Other Brokers in Kenya

Exness vs. Local Competitors

When compared to local brokers operating in Kenya, Exness stands out for its international reputation, strong regulatory compliance, and superior trading conditions. Many local brokers may not offer the same level of global regulation or access to advanced trading platforms like MetaTrader 4 and MetaTrader 5. Moreover, Exness's ability to provide 24/7 customer support and a wide range of deposit and withdrawal methods, including mobile payment options like M-Pesa, gives it an edge over many local competitors who may offer limited customer service hours and fewer payment options.

Exness also differentiates itself by offering tight spreads and fast execution speeds, which are often more competitive than those provided by local brokers. This makes Exness a preferred choice for Kenyan traders looking for a cost-effective and efficient trading experience.

Unique Selling Points of Exness

Global Regulation: Exness is regulated by top-tier financial authorities, including CySEC, FCA, and FSA, ensuring that it adheres to high standards of transparency and security. This global regulatory framework is a major advantage compared to local brokers that may only be regulated by regional authorities.

Wide Range of Trading Instruments: While many local brokers offer limited trading options, Exness provides access to a wide array of financial instruments, including forex, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios.

Fast and Transparent Withdrawals: Exness’s commitment to providing fast and hassle-free withdrawals is one of its key selling points, setting it apart from many competitors that may take longer to process fund transfers.

Educational Resources: Exness offers an extensive range of educational materials, including webinars, tutorials, and market analysis, which are particularly beneficial for Kenyan traders who are new to forex and want to learn more about the market.

Conclusion

Exness operates legally in Kenya and is a trusted broker for traders seeking a secure and transparent trading experience. While Exness is not directly regulated by the Capital Markets Authority (CMA) in Kenya, it operates under the oversight of reputable international regulatory bodies, ensuring compliance with global financial standards. This allows Kenyan traders to trade safely on the platform, knowing that their funds are protected and that Exness adheres to strict operational guidelines.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The Exness platform offers Kenyan traders access to a wide range of trading instruments, competitive spreads, and fast execution speeds, making it a leading choice among both novice and experienced traders. With its robust customer support, educational resources, and secure payment options, Exness continues to be a highly recommended broker for those looking to enter or expand their presence in the forex market.

For traders in Kenya, Exness provides a legal, reliable, and user-friendly platform that offers all the tools needed for successful trading, making it a top choice for anyone looking to trade forex in a secure and regulated environment.