15 minute read

Is Exness Legal in Bahrain? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Forex Broker

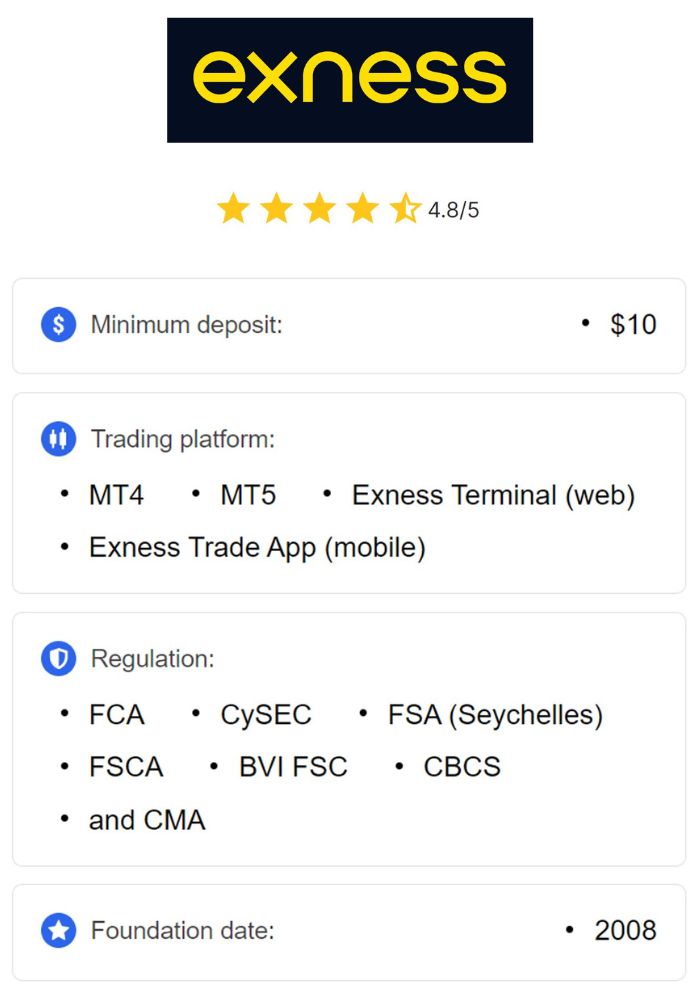

Exness is a well-established global online forex broker that has been providing trading services since 2008. The broker has rapidly gained popularity due to its commitment to offering a broad range of trading services, transparency, and a strong reputation for customer service. Exness operates in several regions worldwide, including Europe, Asia, and the Middle East, providing traders with access to various financial markets such as forex, commodities, stocks, indices, and cryptocurrencies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness is known for offering competitive spreads, low commissions, and advanced trading platforms, making it an attractive option for both beginners and experienced traders. The broker provides access to multiple financial instruments with flexible leverage and multiple account types. As part of its commitment to transparency, Exness ensures that all its trading conditions, such as spreads, commissions, and leverage, are clearly outlined for clients. It also has robust security measures in place, ensuring a safe and reliable trading environment for its clients.

Key Features and Services Offered by Exness

Exness offers several key features and services that make it an appealing choice for traders. Among these are its trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness WebTrader, which are accessible on desktops, tablets, and mobile devices. These platforms are widely regarded for their ease of use, reliability, and a wide range of trading tools such as advanced charting and real-time market analysis.

Exness provides multiple account types to suit various trading strategies and risk preferences, including Standard Accounts, Professional Accounts, and ECN Accounts. The broker is also known for offering negative balance protection, which ensures traders cannot lose more than their deposited funds, even in highly volatile market conditions. Additionally, Exness supports a wide range of payment methods for depositing and withdrawing funds, ensuring convenience for traders globally.

Regulatory Framework in Bahrain

Understanding the Central Bank of Bahrain (CBB)

The Central Bank of Bahrain (CBB) is the primary regulatory body responsible for overseeing the financial system in Bahrain. The CBB regulates and supervises banks, investment firms, insurance companies, and other financial institutions, ensuring they operate within the legal framework and comply with international standards. The CBB plays a key role in maintaining financial stability and safeguarding consumer interests in the country.

Bahrain has earned a reputation as a regional financial hub, largely due to its sound regulatory environment. The CBB aims to maintain the integrity of the financial system by setting clear regulations that financial institutions must follow. These regulations cover aspects such as licensing, reporting requirements, financial disclosure, anti-money laundering (AML) measures, and customer protection. Forex brokers looking to operate in Bahrain must adhere to these regulatory standards to ensure that they can legally offer their services to Bahraini clients.

Licensing Requirements for Forex Brokers in Bahrain

In order for a forex broker to operate legally in Bahrain, they must be licensed by the Central Bank of Bahrain (CBB). The licensing process is rigorous and ensures that only brokers with proper financial standing and operational integrity are permitted to offer their services. Forex brokers must meet specific criteria set out by the CBB, including providing detailed financial reports, maintaining minimum capital requirements, and ensuring compliance with anti-money laundering (AML) regulations.

Additionally, brokers wishing to operate in Bahrain must submit an application and undergo a thorough evaluation by the CBB. This evaluation ensures that the broker meets the necessary requirements for handling client funds and trading operations in a secure and transparent manner. Brokers licensed by the CBB are required to abide by strict regulatory standards that ensure consumer protection and financial stability in the country.

Exness and Its Regulatory Compliance

Exness’s Regulatory Status Globally

Exness is regulated by multiple authorities around the world, ensuring that it complies with various international standards. Exness holds licenses from regulatory bodies in Europe, Asia, Africa, and the Middle East, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the South African Financial Sector Conduct Authority (FSCA). These regulatory bodies ensure that Exness adheres to strict rules regarding client fund protection, reporting standards, and financial transparency.

Exness is also regulated in other jurisdictions, and its global presence ensures that it follows local laws and regulations wherever it operates. The broker’s commitment to regulatory compliance helps reassure traders that they are dealing with a legitimate and trustworthy financial institution. However, Exness does not currently hold a license from the Central Bank of Bahrain (CBB), meaning it is not officially authorized to operate in Bahrain under the local regulatory framework.

Analysis of Exness’s Compliance with Bahrain Regulations

While Exness is not licensed by the Central Bank of Bahrain (CBB), the broker operates in several countries in the region under licenses from other regulatory bodies. Exness follows global regulatory standards that are widely recognized and respected in the financial industry. The broker is committed to maintaining high standards of customer service, financial transparency, and security, which are essential components of regulatory compliance.

However, Bahraini traders should be cautious when trading with Exness, as the broker is not licensed locally. This means that Bahraini traders may not benefit from the same level of legal protection that clients of CBB-regulated brokers would receive. In case of any disputes or issues, traders may face challenges in seeking recourse through local regulatory bodies. It is important for traders in Bahrain to consider this factor when deciding to trade with Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Advantages of Trading with Exness

Competitive Spreads and Leverage Options

Exness is well-regarded for offering competitive spreads, especially on its ECN accounts, where traders can access spreads as low as 0.0 pips. The broker also offers a wide range of leverage options, with leverage ratios that can go up to 1:2000 on certain accounts. This high leverage allows traders to maximize their trading potential with lower capital requirements, although it also introduces higher risk. For many traders, the ability to trade with such high leverage is a significant advantage, as it allows them to enter larger positions with smaller amounts of capital.

The availability of tight spreads and high leverage options makes Exness an attractive choice for both short-term and long-term traders. The broker offers several account types, such as the Standard Account, Raw Spread Account, and Pro Account, each of which is tailored to different trading styles. This flexibility allows traders to choose the best trading conditions for their strategies and risk tolerance.

User-Friendly Trading Platforms and Tools

Exness offers several user-friendly trading platforms to cater to different types of traders. The most widely used platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are known for their intuitive design, powerful charting tools, and automation features. These platforms allow traders to execute trades efficiently, conduct in-depth market analysis, and automate their trading strategies through expert advisors (EAs).

In addition to MT4 and MT5, Exness provides its WebTrader platform, which can be accessed directly through a browser without the need for any downloads. This is particularly useful for traders who want to access their accounts from different devices without installing additional software. The platform comes with a simple, clean interface and provides easy access to all the essential trading features, including real-time market data, news, and analysis tools.

Risks Associated with Forex Trading in Bahrain

Market Volatility and Its Implications

Forex trading involves a high level of risk due to market volatility. Currency pairs can experience rapid price fluctuations due to various factors such as geopolitical events, economic data releases, and market sentiment. Traders in Bahrain, like those in other markets, are exposed to the risk of significant losses if the market moves against their positions. This volatility is amplified when using high leverage, which can lead to large profits or losses in a short amount of time.

It is crucial for traders to manage their risk carefully and use appropriate risk management tools, such as stop-loss orders and position sizing, to mitigate potential losses. Exness offers negative balance protection, which ensures that traders cannot lose more than their initial deposit, even in highly volatile market conditions. However, traders should still be cautious when trading in such a volatile environment.

Regulatory Risks for Traders

As mentioned earlier, Exness is not currently licensed by the Central Bank of Bahrain (CBB). This means that Bahraini traders are not protected under the local regulatory framework and may face difficulties in resolving disputes or claiming compensation in case of issues with the broker. Traders who choose to trade with an unregulated or lightly regulated broker may expose themselves to higher risks, as the legal protections available to them may be limited.

To mitigate regulatory risks, Bahraini traders should carefully consider whether they are comfortable trading with a broker that is not regulated by the CBB. It may be advisable to explore other brokers that are licensed in Bahrain or those that operate under stronger regulatory oversight to ensure a higher level of protection.

User Experience and Customer Support

Client Feedback and Reviews on Exness

Exness has generally received positive feedback from traders around the world for its user-friendly platforms, competitive spreads, and excellent customer support. Many traders appreciate the range of account types and the ability to trade with high leverage. The broker is also known for providing robust educational resources, which help both new and experienced traders improve their trading skills.

However, some traders have raised concerns about Exness’s lack of regulatory licensing in certain regions, including Bahrain. While the broker is well-regulated in other jurisdictions, some users may be hesitant to trade with Exness due to its lack of local regulation. Overall, Exness is highly regarded for its professionalism and commitment to customer service, but traders should always ensure they understand the risks associated with trading with an unregulated broker.

Availability of Customer Support in Bahrain

Exness offers customer support services in multiple languages, and its team is available 24/7 to assist traders with any issues or queries. Bahraini traders can reach out to the support team via live chat, email, or phone. The customer support team is knowledgeable and can assist with a wide range of issues, from account inquiries to technical problems.

For Bahraini traders, Exness also provides localized support to ensure that any region-specific issues are addressed promptly. However, since Exness is not regulated by the Central Bank of Bahrain, traders may not have access to local dispute resolution channels in case of conflicts.

How to Open an Account with Exness

Step-by-Step Guide to Account Registration

Opening an account with Exness is a straightforward process. To get started, traders need to visit the Exness website and click on the “Open an Account” button. They will be asked to provide their personal details, including name, email address, phone number, and country of residence. Once the basic information is submitted, traders will need to verify their identity and address by uploading supporting documents, such as a passport, national ID, or utility bill.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

After completing the verification process, traders can choose the account type that best suits their needs. Exness offers several account types, including Standard, Pro, and ECN accounts, each with different trading conditions. Once the account is activated, traders can deposit funds and begin trading on their preferred platform.

Required Documentation for Bahrain Residents

Bahraini residents are required to provide certain documents when opening an account with Exness. This typically includes a valid proof of identity, such as a passport or national ID card, and proof of address, such as a utility bill or bank statement. These documents are necessary to comply with anti-money laundering (AML) regulations and to verify the identity of the trader.

Once the documents are submitted, Exness will review them and, if everything is in order, approve the account within a few hours to a couple of days. Traders should ensure that the documents they submit are clear and up to date to avoid any delays in the verification process.

Payment Methods Available for Bahraini Traders

Deposit and Withdrawal Options

Exness offers a variety of payment methods for Bahraini traders to deposit and withdraw funds. These include bank transfers, credit and debit cards, and e-wallets such as Skrill and Neteller. These payment options are secure and convenient, allowing traders to deposit and withdraw funds quickly.

Exness also offers multiple currency options, including Bahraini Dinar (BHD), making it easier for local traders to manage their funds without worrying about currency conversion fees. Withdrawals are typically processed within a few hours, depending on the payment method used.

Currency Conversion Considerations

Bahraini traders should be aware that when depositing or withdrawing funds in currencies other than BHD, currency conversion fees may apply. Exness offers competitive exchange rates, but traders should still consider the impact of currency conversion on their overall trading costs. It’s advisable to use a payment method that supports BHD directly to minimize conversion fees and ensure smoother transactions.

Comparison with Other Forex Brokers in Bahrain

Overview of Competitors in the Market

In Bahrain, traders have access to a wide range of forex brokers, including local and international players. Brokers that are regulated by the Central Bank of Bahrain (CBB) offer a higher level of consumer protection, making them an attractive option for Bahraini traders who prioritize security and regulatory compliance. Some of the popular competitors to Exness include FXTM, IG Group, and Saxo Bank, which are licensed and regulated in Bahrain.

Exness faces competition from these brokers, but its competitive pricing, high leverage options, and a wide range of financial instruments give it a strong edge in the market. However, the lack of a CBB license may be a disadvantage for traders who prioritize local regulatory oversight.

Unique Selling Points of Exness

Exness stands out in the market due to its competitive spreads, high leverage options, and negative balance protection. The broker also offers a wide range of account types tailored to different trading strategies. Additionally, Exness's strong customer support and educational resources make it an attractive choice for traders, particularly those new to forex trading.

Despite its advantages, traders in Bahrain should be aware of the regulatory implications of trading with a broker that is not licensed by the CBB. This factor may influence some traders to consider other brokers that are regulated locally.

Tax Implications for Traders in Bahrain

Understanding Tax Obligations for Forex Trading

In Bahrain, forex trading is not taxed directly. The country does not have a specific tax on capital gains or income from trading, which makes it an attractive destination for forex traders. However, traders should still be aware of potential tax obligations in their home country or country of residence if they are earning income from forex trading.

Bahraini traders can benefit from the absence of capital gains tax and other taxes related to trading profits. However, if they hold trading accounts with brokers regulated in other jurisdictions, they may be subject to taxes based on their residency status.

Impact of Taxation on Profitability

The lack of taxes on forex trading in Bahrain can have a positive impact on traders' profitability. Without capital gains or income taxes, traders can retain a larger portion of their earnings, allowing them to reinvest or withdraw funds without the impact of taxation. This makes Bahrain an attractive location for traders who wish to maximize their trading returns.

Traders should still be mindful of any tax obligations they may have in other jurisdictions where they are residents or citizens. While Bahrain offers tax advantages, traders must remain compliant with the tax laws of their respective countries.

Educational Resources Provided by Exness

Training Programs and Webinars

Exness provides a range of educational resources to help traders improve their trading skills. These include webinars, tutorials, and training programs designed for traders of all experience levels. Exness regularly hosts live webinars where market experts provide insights on trading strategies, market analysis, and trading psychology.

These educational materials are available on the Exness website and can be accessed by registered traders. By offering these resources, Exness helps ensure that its clients are well-prepared to navigate the complexities of the forex market.

Access to Trading Research and Analysis

Exness provides traders with access to market research and technical analysis to help them make informed trading decisions. The broker's research team regularly publishes detailed reports and analysis on various financial instruments, including currency pairs, commodities, and indices.

These resources are available on the Exness platform and can be used by traders to enhance their trading strategies. By providing high-quality research, Exness ensures that traders have the necessary tools to stay ahead in the competitive forex market.

Conclusion

Exness is a popular and reliable forex broker that offers a wide range of features and services for traders worldwide. However, Bahraini traders should be aware that Exness is not regulated by the Central Bank of Bahrain (CBB), which may pose risks for those who prioritize local regulatory oversight. Despite this, Exness remains a strong contender in the global forex market, offering competitive spreads, high leverage options, and a variety of account types to cater to different trading preferences.

Traders in Bahrain can benefit from the broker's user-friendly platforms, educational resources, and competitive trading conditions, but they should consider the lack of local regulation and assess their own risk tolerance. By doing so, traders can make an informed decision about whether Exness is the right choice for their trading needs.

Read more: