9 minute read

Does Exness work in Kenya? Regulated, Registered, Legal?

from Exness

by Exness_Blog

Exness is one of the most recognized names in the forex trading industry, known for its wide range of services, competitive pricing, and global reach. For traders in Kenya, it is essential to understand whether Exness is a regulated, registered, and legal entity to ensure a safe and secure trading experience. This article explores Exness' operations in Kenya, its regulatory compliance, the availability of its services, and the legal considerations for Kenyan traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview of Exness as a Brokerage

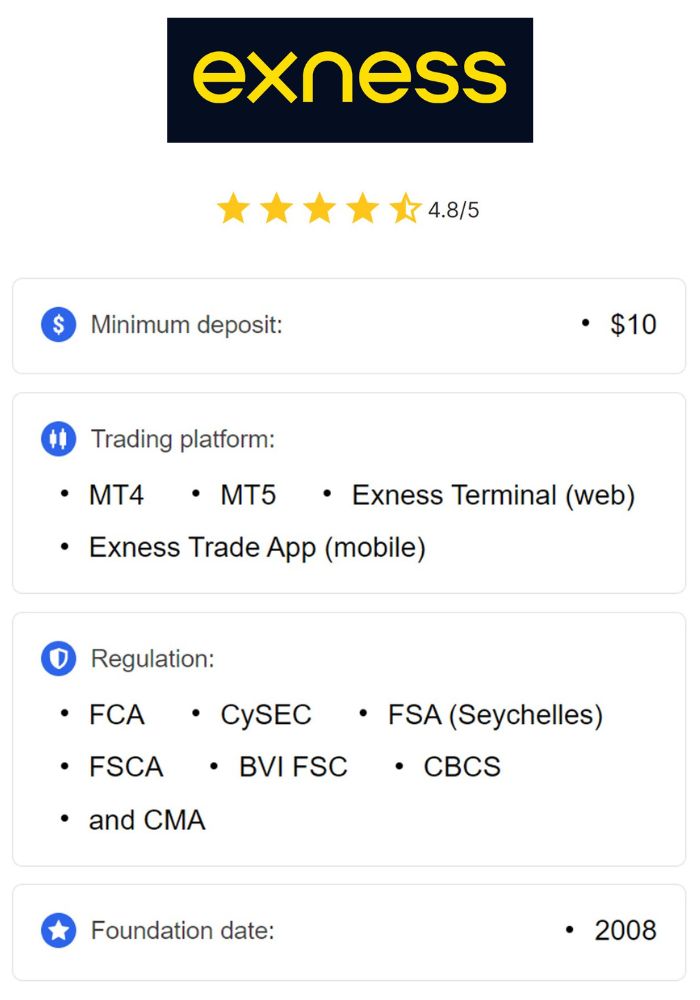

Exness is a global online forex and commodities broker that offers a comprehensive suite of trading services. Founded in 2008, Exness has grown into a reputable brokerage with a focus on providing a user-friendly platform, competitive spreads, and diverse financial instruments. Whether you are a novice or an experienced trader, Exness offers a range of tools to help you access global markets.

Brief History of Exness

Exness was established by a group of financial experts who aimed to provide high-quality, accessible, and secure trading services. Over the years, Exness has expanded its presence globally and continues to serve traders in over 150 countries. The company’s growth has been fueled by a commitment to transparency, innovation, and client-focused services. Exness has consistently improved its platform, risk management features, and educational resources to cater to traders of all levels.

Regulatory Framework for Forex Brokers in Kenya

Role of the Capital Markets Authority (CMA)

In Kenya, the Capital Markets Authority (CMA) is the primary regulatory body overseeing the country’s financial markets, including forex brokers. The CMA ensures that brokers comply with local laws, promoting fairness, transparency, and investor protection in the financial markets. The CMA’s role is crucial in safeguarding Kenyan investors and ensuring that forex brokers operate within a legally sound and ethical framework.

Importance of Regulation in Forex Trading

Regulation plays a pivotal role in ensuring the safety of traders' funds and maintaining the integrity of the financial markets. For Kenyan traders, working with a regulated broker is essential to ensure that they are protected from fraud and other unethical practices. A regulated broker is required to adhere to strict guidelines, such as maintaining minimum capital requirements, offering clear pricing, and segregating clients' funds, which gives traders a sense of security.

Exness Regulations and Licensing

Global Regulatory Bodies Overseeing Exness

Although Exness is not directly regulated by the Capital Markets Authority (CMA) in Kenya, it is regulated by several respected financial authorities worldwide. These include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC) in Seychelles. These global regulators impose strict rules that ensure Exness operates in a transparent and ethical manner.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance with International Trading Standards

Exness is compliant with several international trading standards, which is a key factor in its global operations. These standards cover various aspects such as risk management, financial reporting, and ensuring the safety of traders' funds. Being licensed by respected regulators like the FCA and CySEC gives Exness credibility and ensures that it follows industry best practices in managing client funds and operations.

Significance of Being Regulated in Kenya

Investor Protection Measures

Regulation in Kenya ensures that forex brokers protect investors by adhering to specific rules that promote fairness and transparency. Although Exness is not regulated by the CMA, it complies with international regulations that focus on similar investor protection principles. Regulatory measures, such as ensuring that traders’ funds are kept in segregated accounts, ensure that your money is protected in the event of a broker’s insolvency.

Trust and Credibility in Financial Markets

Being regulated by reputable international authorities increases the trust and credibility of Exness in the financial markets. Traders in Kenya can rest assured knowing that Exness follows industry standards for financial management and risk control. The presence of these global regulators helps mitigate concerns about the safety and reliability of the broker, which is important for Kenyan traders looking for a trustworthy trading environment.

Availability of Exness Services in Kenya

Account Types Offered by Exness

Exness provides a wide range of account types to cater to the needs of traders with different levels of experience and financial goals. Kenyan traders can choose from accounts such as the Standard Account, Cent Account, and Professional Account, each offering varying spreads, leverage options, and other benefits. These accounts ensure that traders can select the most appropriate setup based on their trading style and preferences.

Supported Trading Instruments

Exness offers a variety of trading instruments to Kenyan traders, including forex, stocks, commodities, indices, and cryptocurrencies. This broad range of financial products allows traders to diversify their portfolios and access different markets. Exness’ trading platform provides real-time access to these instruments, ensuring that Kenyan traders can execute trades quickly and efficiently.

Opening an Exness Account from Kenya

Step-by-Step Account Registration Process

Opening an account with Exness is a simple and straightforward process. Kenyan traders can visit the Exness website and follow the registration steps to create an account. The process generally involves providing personal information, verifying identity, and uploading necessary documents. Once the account is approved, traders can deposit funds and start trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Required Documentation for Kenyan Traders

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Exness requires Kenyan traders to submit certain documentation. This may include proof of identity, such as a passport or national ID card, and proof of address, such as a utility bill or bank statement. This documentation ensures that Exness meets international regulatory standards and provides a safe trading environment for all clients.

Deposit and Withdrawal Options for Kenyan Traders

Payment Methods Accepted by Exness

Exness supports several deposit and withdrawal options for Kenyan traders, including bank transfers, credit/debit cards, and e-wallet services like Skrill, Neteller, and WebMoney. These payment methods provide flexibility and convenience, allowing Kenyan traders to fund their accounts and withdraw profits easily.

Transaction Processing Times

Exness offers fast and efficient transaction processing times for both deposits and withdrawals. Deposits are usually processed instantly, especially with e-wallets and credit cards, while withdrawals typically take 1-5 business days depending on the method used. E-wallets tend to offer the quickest withdrawal times, making them a popular choice among traders.

Trading Conditions on Exness in Kenya

Spreads and Commissions

Exness offers competitive spreads and low commissions on its trading accounts. The spreads vary depending on the account type and market conditions, with professional accounts often offering tighter spreads. This pricing structure is designed to provide Kenyan traders with a cost-effective trading environment, allowing them to minimize trading costs and maximize potential profits.

Leverage Options Available

Exness offers flexible leverage options to Kenyan traders, allowing them to trade with higher positions relative to their initial capital. Leverage can go up to 1:2000, depending on the account type and financial instruments. While leverage can enhance profits, it also increases the risk, so Kenyan traders should exercise caution and use appropriate risk management techniques when trading with high leverage.

Customer Support and Resources for Kenyan Clients

Availability of Customer Support

Exness provides comprehensive customer support through multiple channels, including live chat, email, and phone. Kenyan traders can access customer support 24/7, ensuring that help is available whenever needed. The support team is trained to assist with technical issues, account inquiries, and other trading-related questions.

Educational Resources for Traders

Exness offers a variety of educational resources to help Kenyan traders improve their trading skills. These resources include webinars, tutorials, and market analysis tools. By providing these learning materials, Exness ensures that traders of all experience levels can access the information they need to make informed trading decisions.

Risks Associated with Trading Forex in Kenya

Understanding Market Volatility

Forex trading is inherently risky, especially due to the volatility of currency markets. Kenyan traders must understand market fluctuations and price swings before entering trades. Volatility can create significant opportunities, but it also increases the risk of loss, especially for traders who do not employ proper risk management strategies.

Common Trading Pitfalls

Common mistakes made by traders in Kenya include overleveraging, failing to use stop-loss orders, and chasing losses after a bad trade. It is essential for Kenyan traders to adopt disciplined strategies, remain patient, and manage risk to avoid these pitfalls and increase their chances of long-term success.

User Reviews and Feedback from Kenyan Traders

Positive Experiences Shared by Users

Many Kenyan traders report positive experiences with Exness, highlighting the broker's competitive spreads, quick withdrawals, and easy-to-use platform. Traders appreciate the range of trading tools and resources available, which help them make informed decisions and manage risk effectively.

Areas of Improvement Noted by Users

While Exness receives largely positive feedback, some Kenyan traders have noted areas of improvement. For instance, there have been mentions of occasional delays in bank transfers and a desire for more local support in Kenya. However, Exness continues to improve its services to meet the needs of its global client base.

Comparison with Other Forex Brokers in Kenya

Key Competitors of Exness

Exness faces competition from several other well-known forex brokers in Kenya, such as IG Group, eToro, and Forex.com. These brokers offer similar services, but Exness stands out with its competitive leverage options, low spreads, and excellent customer support.

Unique Selling Points of Exness

Exness differentiates itself from its competitors by offering some of the highest leverage options in the industry, an intuitive trading platform, and a range of educational resources to help traders succeed. Its strong regulatory framework and commitment to security also make Exness a trusted choice for Kenyan traders.

Legal Considerations for Forex Trading in Kenya

Tax Implications for Kenyan Traders

Kenyan traders are required to pay taxes on any profits made through forex trading. It is essential to keep accurate records of all trading activities to ensure compliance with tax regulations. The Kenya Revenue Authority (KRA) requires traders to report their forex trading income and pay capital gains tax where applicable.

Legal Restrictions and Guidelines

Forex trading is legal in Kenya, but traders must adhere to the regulations set by the Capital Markets Authority (CMA). Traders should ensure they only use licensed brokers and comply with all local guidelines to avoid legal issues.

Conclusion on Exness' Viability in Kenya

Exness is a reliable and well-regulated broker that offers a wide range of services to Kenyan traders. While it is not regulated by the Capital Markets Authority in Kenya, it is licensed by multiple respected global regulatory bodies, ensuring compliance with international standards. Kenyan traders can benefit from Exness' competitive trading conditions, educational resources, and comprehensive customer support. However, it is important for traders to be aware of the risks involved in forex trading and to choose a trading strategy that suits their individual goals and risk tolerance.

Read more: