11 minute read

Is Exness Legal in Saudi Arabia? Review Broker

from Exness

by Exness_Blog

Understanding Forex Trading Regulations in Saudi Arabia

Overview of Financial Markets Authority

The Capital Market Authority (CMA) is the principal regulatory body overseeing financial markets in Saudi Arabia. Established to maintain transparency, integrity, and fairness in financial transactions, the CMA plays a crucial role in regulating all trading activities, including forex trading. Its primary objective is to safeguard the interests of investors while promoting a stable and thriving financial market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Forex trading in Saudi Arabia is governed under strict guidelines to ensure that brokers comply with the country's laws. These include requirements for brokers to obtain appropriate licensing and adhere to local financial regulations. The CMA closely monitors market participants to ensure compliance and mitigate risks associated with unregulated trading platforms.

Legal Framework for Forex Trading

The legal framework for forex trading in Saudi Arabia requires brokers to adhere to local laws and international standards. While forex trading is legal, it must align with the country's financial regulations, which are heavily influenced by Islamic principles. Brokers operating in the Kingdom must demonstrate transparency in their operations and obtain approval from relevant authorities.

Saudi traders are encouraged to work with brokers who hold certifications from global regulatory bodies and have a proven track record of compliance. These measures are in place to protect traders from fraud and ensure a secure trading environment.

Compliance with Islamic Finance Principles

A significant aspect of forex trading in Saudi Arabia is compliance with Islamic finance principles. Under Sharia law, earning interest or engaging in speculative transactions is prohibited. To cater to this, brokers like Exness offer Islamic trading accounts, which are free from swap fees (interest charges on overnight positions).

Such accounts are tailored to meet the needs of Muslim traders by ensuring that trading activities remain halal. Exness’s provision of Sharia-compliant accounts underscores its commitment to serving traders in Saudi Arabia while respecting cultural and religious values.

The Role of Exness in the Global Forex Market

Company Background and History

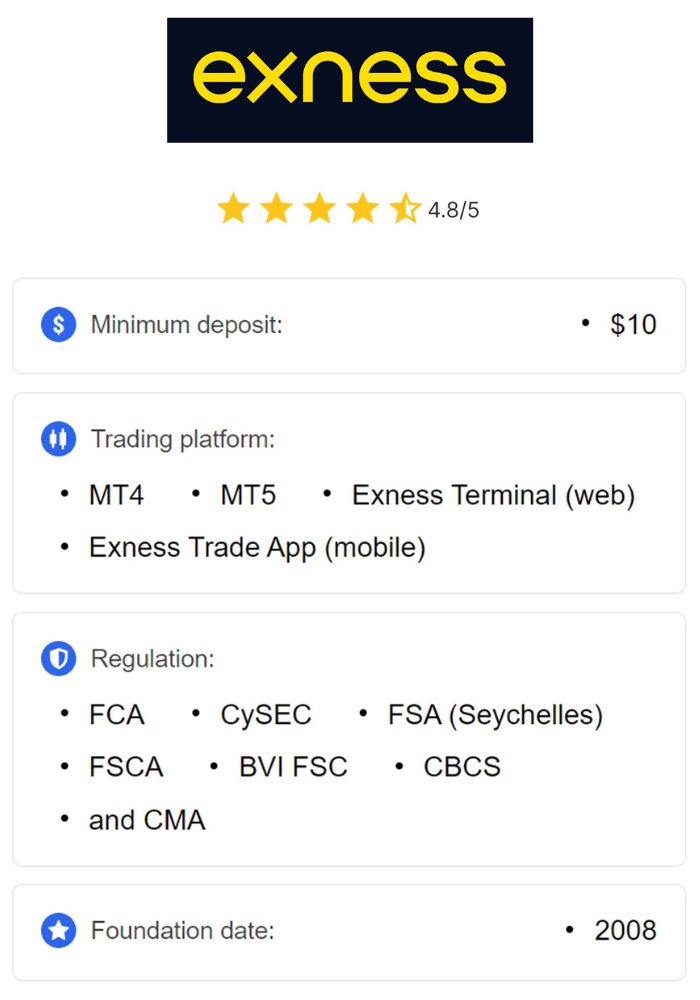

Founded in 2008, Exness has emerged as a leading name in the global forex market. With a reputation for transparency, reliability, and innovation, Exness serves millions of traders worldwide. The company’s commitment to offering high-quality services has established it as a trusted broker in numerous markets, including the Middle East.

Exness’s success is rooted in its advanced trading technology, diverse account types, and commitment to customer satisfaction. Its continuous efforts to meet global standards and adapt to regional requirements have solidified its presence in competitive markets.

Regulatory Bodies Exness is Registered With

Exness operates under the licenses of several reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These licenses ensure that the broker adheres to stringent regulatory standards, providing traders with a safe and transparent trading environment.

The company's compliance with international regulatory frameworks enhances its credibility and reliability, making it a preferred choice for traders in Saudi Arabia. Exness’s registration with recognized authorities guarantees that it operates legally and meets the highest industry standards.

Services Offered by Exness

Exness offers a wide range of services designed to cater to traders of all experience levels. These include access to major forex pairs, commodities, indices, and cryptocurrencies. The platform provides advanced trading tools, including real-time market analysis, customizable charts, and risk management features.

Additionally, Exness supports Islamic accounts, competitive spreads, high leverage, and seamless deposit and withdrawal processes. These features make it an attractive choice for traders in Saudi Arabia, who benefit from a user-friendly platform and professional support.

Is Exness Legal in Saudi Arabia?

Exness operates legally in Saudi Arabia, offering its services in compliance with both international regulations and local trading requirements. While it does not hold a specific license from the Capital Market Authority (CMA), its registration with global regulators like the FCA and CySEC ensures its operations align with international standards. Furthermore, Exness’s Islamic accounts address the needs of traders adhering to Sharia law, reinforcing its suitability for the Saudi market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Saudi traders are advised to verify a broker's compliance with local and international laws before engaging in trading activities. In Exness’s case, its reputation for transparency, regulatory adherence, and provision of Islamic trading accounts underscores its legality and reliability.

Tax Implications for Forex Traders in Saudi Arabia

Income Tax Policies

Saudi Arabia does not impose income tax on individual residents, making it an attractive environment for forex traders. Earnings from forex trading are considered personal income and are not subject to taxation. This policy provides traders with the advantage of retaining their profits in full, enhancing the appeal of forex trading in the Kingdom.

However, traders must ensure that their trading activities comply with local laws and regulations to avoid potential legal complications.

Capital Gains Tax on Forex Earnings

Similarly, there is no capital gains tax on forex earnings in Saudi Arabia. This tax-free environment is particularly beneficial for traders engaging in high-frequency trading or earning significant profits. The lack of taxation allows traders to reinvest their earnings and maximize their financial growth.

While this policy is advantageous, traders should maintain detailed records of their trading activities to address any inquiries from financial authorities, should they arise.

Reporting Requirements for Traders

Although forex trading profits are not taxed, traders should maintain accurate records of their transactions for financial transparency. Proper documentation is essential for ensuring compliance with local and international regulations. Traders should also be aware of any changes in the regulatory environment that may impact reporting requirements.

Benefits of Trading with Exness

User-Friendly Trading Platform

Exness’s trading platform is designed to provide an intuitive and seamless experience for users. The platform features advanced charting tools, real-time price updates, and customizable trading options, making it suitable for both beginners and experienced traders.

The mobile and desktop versions of the platform ensure accessibility, allowing traders to monitor and manage their accounts from anywhere. This convenience has contributed to Exness’s popularity among Saudi traders.

Competitive Spreads and Leverage Options

Exness offers competitive spreads across all account types, ensuring cost-effective trading. The availability of high leverage allows traders to maximize their positions with minimal capital, which is particularly advantageous for those with limited funds.

These features, combined with the broker’s commitment to transparency and fair pricing, make Exness an ideal choice for traders seeking value and reliability.

Customer Support Services

Exness provides exceptional customer support, available 24/7 to address queries and resolve issues. The support team includes representatives fluent in Arabic, ensuring effective communication with Saudi traders. Additionally, the platform offers a comprehensive knowledge base, webinars, and educational resources to empower traders with the skills needed for success.

Risks of Trading Forex in Saudi Arabia

Market Volatility and Financial Risks

Forex trading inherently involves significant risks due to market volatility. Currency prices can fluctuate rapidly based on geopolitical events, economic data, or market sentiment. Saudi traders should be aware that while these fluctuations present opportunities for profit, they also pose the risk of substantial losses.

To mitigate these risks, it’s crucial to employ risk management tools provided by brokers like Exness. Features such as stop-loss orders, margin protection, and leverage control can help traders minimize financial exposure and preserve capital.

Legal Risks Associated with Unregulated Brokers

Engaging with unregulated brokers can expose traders to legal and financial risks. These brokers may operate outside the purview of regulatory authorities, making it difficult for traders to seek recourse in the event of disputes or malpractice. In Saudi Arabia, the Capital Market Authority emphasizes the importance of using brokers with credible international or regional regulation.

Exness, with its licensing from reputable bodies like CySEC and FCA, ensures a level of legal protection that mitigates such risks. Saudi traders should verify a broker’s credentials and avoid platforms that lack transparency or regulatory oversight.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Potential Scams in the Forex Market

The forex market’s popularity has unfortunately attracted scams and fraudulent schemes. Traders in Saudi Arabia must remain vigilant against brokers offering unrealistic promises of guaranteed returns or leveraging aggressive marketing tactics. Such red flags often indicate potential fraud.

Exness’s strong reputation, adherence to international regulations, and transparent business practices provide reassurance to traders. To further safeguard themselves, traders should research brokers thoroughly and consider feedback from trusted sources.

Cultural and Religious Considerations

Sharia Compliance in Trading Practices

In Saudi Arabia, adherence to Islamic principles is a critical consideration for traders. Forex brokers must ensure their offerings align with Sharia law, which prohibits earning interest (riba) or engaging in excessively speculative transactions. Exness addresses this need by offering Islamic accounts that are free of swap fees.

These accounts enable Saudi traders to participate in forex trading without compromising their religious beliefs. Exness’s commitment to providing Sharia-compliant services underscores its suitability for the Saudi market.

Perception of Forex Trading in Saudi Society

Forex trading has grown in popularity in Saudi Arabia, with many viewing it as a viable investment opportunity. However, there are societal perceptions that link trading to gambling due to its speculative nature. Educating traders about the differences between calculated investments and gambling is essential to improving its perception.

Brokers like Exness play a role in promoting ethical trading practices and offering educational resources. These efforts help traders approach the forex market with informed strategies rather than speculative behaviors.

Ethical Trading Guidelines

Ethical trading is a priority for many Saudi traders who wish to align their financial activities with their moral and religious values. Exness supports ethical trading by promoting transparency, providing clear terms of service, and avoiding misleading claims about profitability.

Traders can enhance their experience by adhering to ethical guidelines, such as avoiding excessive leverage, practicing disciplined risk management, and ensuring compliance with local laws.

Steps to Start Trading with Exness in Saudi Arabia

Account Registration Process

Registering for an Exness account is straightforward and user-friendly. Saudi traders can sign up by providing basic personal information and verifying their identity with official documents. The platform ensures a secure registration process, protecting user data with robust encryption protocols.

Once registered, traders can choose between various account types, including Standard, Professional, and Islamic accounts. Each account is tailored to meet the diverse needs of traders, whether they are beginners or experienced professionals.

Deposits and Withdrawals

Exness offers multiple payment methods suitable for Saudi residents, including local bank transfers, e-wallets, and international payment gateways. The platform ensures swift and secure transactions, with most deposits being processed instantly. Withdrawals are equally efficient, often completed within a few business hours.

The broker’s transparency regarding fees and transaction times enhances user confidence. Traders are advised to use payment methods that align with their financial preferences and ensure compliance with local banking regulations.

Choosing the Right Account Type

Selecting the appropriate account type is crucial for a successful trading experience. Exness provides various options, including Standard accounts for general traders, Professional accounts for high-volume traders, and Islamic accounts for those adhering to Sharia principles.

Saudi traders should evaluate their trading goals, risk tolerance, and financial capabilities before choosing an account type. Consulting with Exness’s customer support team or exploring educational resources on the platform can help make an informed decision.

Customer Reviews and Reputation of Exness

User Feedback from the Middle East

Exness has garnered positive feedback from traders in the Middle East, including Saudi Arabia. Users appreciate the platform’s intuitive interface, competitive spreads, and commitment to Sharia compliance. Many traders have highlighted the broker’s reliability and the availability of Arabic-speaking support staff as key strengths.

These reviews underscore Exness’s efforts to cater to the unique needs of its Middle Eastern clientele. However, potential users should consider diverse feedback to gain a balanced perspective on the platform’s services.

Trustworthiness and Reliability Analysis

Exness’s strong regulatory framework and transparent operations contribute to its reputation as a trustworthy broker. The platform’s adherence to global standards and its ability to provide a secure trading environment make it a preferred choice for traders in Saudi Arabia.

Regular audits by regulatory bodies and the publication of financial reports further reinforce Exness’s commitment to accountability and reliability. These factors ensure traders can trust the platform with their investments.

Complaints and Resolutions

While Exness has a largely positive reputation, occasional complaints regarding technical issues or delays in withdrawals have been reported. The broker’s dedicated customer support team addresses such concerns promptly, demonstrating its commitment to user satisfaction.

Traders are encouraged to report issues directly to Exness and utilize its dispute resolution processes. This proactive approach ensures a smooth and transparent trading experience.

Conclusion

Exness is a legitimate and trusted forex broker in Saudi Arabia, operating in compliance with international regulatory standards and local trading requirements. Its provision of Sharia-compliant Islamic accounts, transparent services, and robust security measures make it an ideal choice for traders in the Kingdom.

By understanding the regulatory landscape, adhering to ethical trading practices, and leveraging Exness’s features, Saudi traders can confidently participate in the forex market. Whether you are a beginner or an experienced investor, Exness offers the tools and support needed to succeed while aligning with cultural and religious values.

Read more: