19 minute read

Which is better Exness or XM?

from Exness

by Exness_Blog

When it comes to choosing a brokerage for Forex trading, two names frequently come into play: Exness and XM. Each platform presents its own strengths and weaknesses, making the question of "Which is better Exness or XM?" a topic worthy of exploration. This article will provide an in-depth analysis of both platforms across various dimensions that are critical to traders, from regulatory compliance to trading instruments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Forex Trading Platforms

Forex trading has grown exponentially over the years, becoming a favorite among individual investors and institutional traders alike. With the market's liquidity and the potential for high returns, many individuals are eager to dive into Forex trading. However, selecting the right broker can greatly influence their trading success and experience.

Overview of Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in pairs. Traders speculate on price movements, aiming to profit from fluctuations in exchange rates. The Forex market operates around the clock, providing ample opportunities for traders to engage in transactions.

It’s crucial to understand that while Forex trading offers immense potential, it is also fraught with risks. Thus, choosing a reliable forex trading platform is imperative as it not only determines the trading conditions but also impacts the overall trading experience.

Importance of Choosing the Right Platform

Selecting the appropriate trading platform can be the difference between loss and gain in Forex trading. Factors like regulation, available instruments, trading costs, and customer support play significant roles in the overall trading environment.

Exness and XM, as two major players in the retail Forex space, offer various features that cater to traders' needs. As we explore their attributes, we will delve into aspects such as account types, trading instruments, spreads, and more.

Company Backgrounds

Understanding the history and background of a brokerage provides invaluable context for evaluating its credibility and stability in the trading landscape.

History of Exness

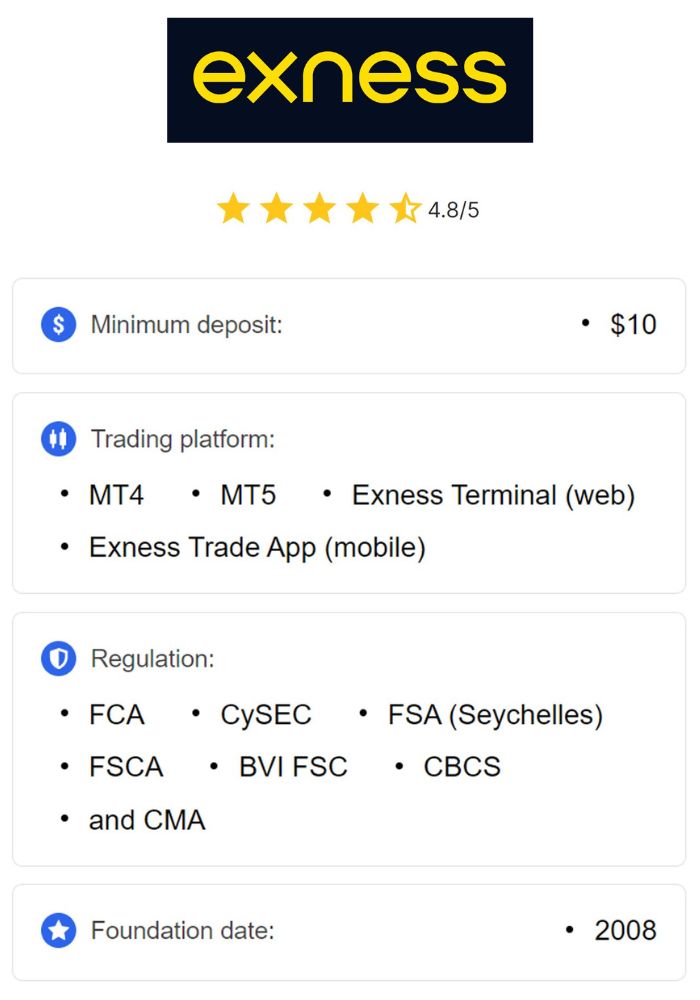

Founded in 2008, Exness has established itself as a global leader in Forex trading. The company began its journey with a goal to trade primarily through cutting-edge technology. Over the years, it has expanded significantly, attracting millions of clients worldwide.

Exness prides itself on transparency and customer-centric services. Its commitment to providing real-time market execution and a wide range of trading options has made it a preferred choice for many traders. Additionally, Exness has garnered recognition for its innovative approach, launching user-friendly platforms that simplify the trading process.

History of XM

XM was founded in 2009 and quickly became known for its extensive range of educational resources and superior customer service. The brokerage targets both novice and experienced traders by offering a variety of tools and platforms that suit different trading styles.

XM has made a name for itself by focusing on client satisfaction and market transparency. It emphasizes its commitment to providing valuable insights and education, helping traders make informed decisions. With offices around the globe, XM has positioned itself as a trustworthy broker dedicated to enhancing the trading experience.

Regulatory Compliance

Regulation is a key factor to consider when comparing brokers. It affects everything from the safety of your funds to the overall trading environment.

Exness Regulatory Framework

Exness holds multiple licenses from reputable financial authorities, including the Financial Services Authority (FSA) of Seychelles and the Cyprus Securities and Exchange Commission (CySEC). These licenses signify that Exness adheres to strict regulatory standards designed to protect traders’ funds and ensure fair trading practices.

Moreover, Exness has implemented measures like segregated accounts, which keep client funds separate from company operational funds. This helps safeguard trader investments, giving clients peace of mind knowing their money is protected.

XM Regulatory Framework

XM is regulated by multiple authoritative bodies, including CySEC and the Australian Securities and Investments Commission (ASIC). Such regulatory oversight ensures that the brokerage meets rigorous standards for financial practices and transparency.

Similar to Exness, XM prioritizes the protection of client accounts. It uses segregated accounts to protect client funds and is committed to providing a secure trading environment. The multi-regulatory framework enhances its credibility and makes it a safe choice for traders around the world.

Comparison of Regulatory Standards

While both Exness and XM are under the watchful eye of reputable regulatory authorities, there are subtle differences in their frameworks. Exness has a broader reach with licenses in several jurisdictions, which allows for greater operational flexibility and a diverse client base.

On the other hand, XM's focus on client education and support services reflects its dedication to building a trustworthy relationship with its clientele. Both platforms offer robust regulatory protections, yet the slight variations may appeal to different types of traders based on their specific needs and preferences.

Account Types Offered

The types of accounts available to traders can significantly influence their trading experience. Different accounts cater to varying levels of expertise, capital, and trading strategies.

Exness Account Types and Features

Exness offers numerous account types tailored to different trading styles and experience levels, including Standard, Pro, and ECN accounts. Each of these accounts comes with distinct features, allowing traders to select one that best aligns with their goals.

Standard accounts are ideal for beginners, providing easy access to the Forex market without high minimum deposit requirements. Pro accounts, on the other hand, are geared toward more experienced traders seeking tighter spreads and advanced trading features. ECN accounts allow for direct market access, catering to professional traders who require fast execution and liquidity.

XM Account Types and Features

XM provides a wide range of account types, including Micro, Standard, and Shares accounts, each designed for different trading needs. The Micro and Standard accounts are particularly appealing to new traders due to their low entry barriers.

For those focused on investing in equities, XM's Shares account provides an opportunity to trade stocks with varying leverage depending on the underlying asset. XM also stands out with its zero commission policy on selected accounts, which can be highly beneficial for cost-conscious traders.

Key Differences in Account Offerings

While both Exness and XM offer a variety of accounts, some key differences exist. Exness tends to have a more diverse range of account types catering specifically to various trading approaches, whereas XM focuses on simplicity and lower barriers to entry, particularly for new traders.

The choice between the two boils down to personal preference. Whether a trader values a deeper array of account types like Exness or the straightforward offerings of XM will depend on their unique trading strategy and experience level.

Trading Instruments

A diverse range of trading instruments allows traders the flexibility to diversify their portfolios, manage risk, and capitalize on various market trends.

Range of Trading Instruments at Exness

Exness offers a comprehensive selection of trading instruments that includes Forex currency pairs, commodities, indices, cryptocurrencies, and ETFs. This wide range enables traders to explore different markets and find opportunities that align with their investment strategies.

The inclusion of cryptocurrencies, in particular, has gained traction among traders seeking exposure to this burgeoning asset class. Exness continually updates its offerings to provide a modern trading experience, which is vital in today's fast-changing markets.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Range of Trading Instruments at XM

XM also boasts an impressive variety of instruments, covering Forex pairs, commodities, indices, and stocks. With more than a thousand assets available to trade, XM caters to diverse trading preferences and strategies.

One notable aspect of XM is its emphasis on CFDs (Contracts for Difference), allowing traders to speculate on price changes without owning the underlying asset. This flexibility is appealing to many traders who prefer trading on margin without the complexities of holding physical assets.

Comparison of Instruments Available

In terms of instrument variety, both Exness and XM excel, but Exness takes a slight lead with its additional offerings in the cryptocurrency sector. However, XM's extensive CFD offerings and focus on equities create a competitive edge for traders interested in stock trading.

Ultimately, the choice between Exness and XM regarding trading instruments depends on individual preferences and whether a trader is looking for exposure to newer assets like cryptocurrencies or more traditional instruments like stocks and CFDs.

Spreads and Commissions

Trading costs, including spreads and commissions, directly affect a trader's profitability. Understanding these factors is essential for making informed decisions.

Spreads Offered by Exness

Exness is known for its competitive spreads, especially on its Pro and ECN accounts. Traders often find tight spreads, which can enhance their overall trading performance. The broker utilizes variable spreads, meaning they can fluctuate depending on market conditions, but generally stays at low levels to attract a diverse clientele.

Furthermore, Exness offers a unique pricing model that ensures traders have access to some of the most favorable market rates available. This commitment to offering competitive spreads is a significant factor in its popularity among traders.

Spreads Offered by XM

XM also provides competitive spreads, especially on its Micro and Standard accounts, where spreads can start from zero pips. The zero-commission model further strengthens its appeal, enabling traders to engage in cost-efficient trading without worrying about hidden fees.

However, it’s important to note that spreads may widen during periods of high volatility or economic events. XM's transparent fee structure and commitment to fair pricing reflect its focus on providing excellent value to its clients.

Commission Structures Compared

When comparing the commission structures of both platforms, Exness generally charges commissions on its ECN accounts, while its standard accounts have no commissions. XM adopts a zero-commission policy on selected accounts, making it appealing for traders wary of incurring additional costs.

The decision here largely depends on trading style. Active traders who prioritize low spreads might gravitate towards Exness, while others may favor XM’s straightforward approach to trading costs.

Leverage Options

Leverage is a powerful tool in Forex trading, allowing traders to control larger positions with a smaller amount of capital. However, understanding its implications is crucial.

Leverage Policies of Exness

Exness offers flexible leverage options, allowing traders to choose leverage up to 1:2000 on certain account types. Such high leverage can amplify both profits and losses, making it essential for traders to exercise caution and utilize effective risk management strategies.

By offering customizable leverage settings, Exness accommodates various trading styles, from conservative long-term investors to aggressive short-term traders. This flexibility can contribute significantly to a trader's overall performance.

Leverage Policies of XM

XM also provides competitive leverage options, typically capping at 1:888. While not as high as Exness, this level still allows traders sufficient room to execute various strategies comfortably. XM emphasizes responsible trading, aligning its policies with its commitment to client protection.

The leverage offered by XM is aligned with their regulatory obligations, ensuring that traders remain within safe trading limits. This approach reduces the risk of over-leveraging, which can lead to substantial losses.

Implications of Different Leverage Levels

The differences in leverage levels between Exness and XM may influence a trader's decision based on their risk appetite and trading strategy. While higher leverage can lead to increased potential rewards, it also elevates the risk of significant losses.

Traders need to carefully assess their financial situation and consider their trading style when deciding which platform best serves their needs. In this regard, both Exness and XM offer unique advantages tailored to different types of traders.

Trading Platforms

The trading platform serves as the primary interface between traders and the market. A robust platform enhances the trading experience by providing necessary tools and resources.

Exness Trading Platforms Overview

Exness offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary platform. MT4 remains popular for its user-friendly interface and extensive functionalities, while MT5 introduces added features like advanced charting tools and improved order types.

The proprietary platform seeks to combine user-friendly navigation with advanced capabilities, catering to both novice and experienced traders. Exness continuously strives to enhance its platform offerings, ensuring that they meet the ever-evolving needs of traders.

XM Trading Platforms Overview

XM also provides users with access to the widely-used MetaTrader platforms, specifically MT4 and MT5. Both platforms are renowned for their reliability, offering advanced charting tools, technical analysis, and automated trading capabilities.

Additionally, XM offers a web-based trading platform that allows for seamless access from any device without requiring downloads. This accessibility is particularly appealing for traders who prefer flexibility in how they manage their trades.

User Experience and Interface Comparison

When comparing user experience and interface, both Exness and XM excel in providing intuitive and feature-rich platforms. MT4 and MT5 are familiar to many traders, making them easy to navigate.

However, Exness's proprietary platform introduces unique features that some users may find advantageous. This provides an opportunity for traders to explore different interfaces and select one that resonates with their trading habits and preferences.

Mobile Trading Capability

In today’s fast-paced trading environment, mobile trading capability is a significant consideration. Traders must have the flexibility to manage their accounts anytime and anywhere.

Exness Mobile App Features

Exness offers a well-designed mobile app compatible with both Android and iOS devices. The app provides a user-friendly interface, ensuring that traders can access their accounts easily. Features include real-time price alerts, comprehensive charting tools, and the ability to execute trades on-the-go.

With the app, traders can monitor their positions, analyze market trends, and manage their accounts efficiently. The platform also supports multiple languages, catering to a global audience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

XM Mobile App Features

Similarly, XM has developed a robust mobile app that allows traders to manage their accounts seamlessly. The app incorporates essential features such as live quotes, complete trading history, and advanced charting tools.

XM's mobile application is noted for its performance and reliability, enabling traders to place orders quickly and access vital information at their fingertips.

Performance of Mobile Platforms

Both Exness and XM provide excellent mobile trading experiences; however, the choice ultimately depends on individual preferences. While Exness focuses on user-friendliness, XM’s app emphasizes performance and reliability. Traders should explore both options to determine which platform meets their requirements for mobile trading.

Customer Support Services

Quality customer support can enhance a trader's experience and help resolve issues that may arise.

Exness Customer Support Channels

Exness offers multiple channels for customer support, including live chat, email, and phone support. The multilingual team ensures that clients from different countries receive assistance in their preferred language.

The support team's responsiveness and ability to address inquiries promptly have contributed to Exness's positive reputation. Furthermore, the availability of support round the clock is crucial for traders across various time zones.

XM Customer Support Channels

XM also prioritizes customer service, providing support via live chat, email, and telephone. Their professional team is ready to assist clients in multiple languages, addressing queries and concerns effectively.

XM is recognized for its proactive customer service approach, striving to resolve issues swiftly and efficiently. This commitment to quality service enhances the overall trading experience for its clients.

Quality of Customer Service

While both Exness and XM are praised for their customer service, individual experiences may differ. Traders often commend Exness for quick responses, while XM's support team is noted for their detailed assistance. Ultimately, traders should consider their own experiences when assessing the quality of customer support.

Educational Resources

Education plays a vital role in developing successful trading skills. Both Exness and XM offer a variety of educational resources to help clients enhance their knowledge and strategies.

Educational Tools Provided by Exness

Exness provides a range of educational materials, including webinars, articles, video tutorials, and eBooks. These resources cover various topics related to trading, market analysis, and risk management.

The broker's commitment to helping traders improve their skills is evident in its comprehensive educational offerings. Regular webinars featuring expert analysts allow participants to learn from industry professionals and gain valuable insights into market developments.

Educational Tools Provided by XM

XM is particularly known for its extensive educational resources aimed at traders of all skill levels. The broker provides free seminars, webinars, and online courses that cover basic to advanced trading concepts.

These educational initiatives empower traders to deepen their understanding of the markets and develop effective trading strategies. XM's focus on education distinguishes it from many competitors, as they genuinely invest in their clients' growth.

Effectiveness of the Educational Content

Both Exness and XM deliver quality educational content, but XM tends to stand out for its structured programs and interactive approach. Traders looking for a brokerage that emphasizes education may find XM's offerings more appealing.

Nonetheless, Exness also provides valuable resources, making both platforms viable choices for individuals seeking to enhance their trading skills.

Bonuses and Promotions

Promotional offers and bonuses can add value for traders seeking to maximize their trading capital.

Exness Promotions and Bonuses

Exness runs promotional campaigns occasionally, rewarding both new and existing clients with bonus offers. These promotions can range from deposit bonuses to referral programs, incentivizing traders to engage further with the platform.

However, it's essential to read the terms and conditions associated with these promotions, as they may carry stipulations that impact withdrawal processes or trading activities.

XM Promotions and Bonuses

XM is renowned for its generous promotions and bonuses, particularly the welcome bonus for new clients. Their loyalty program encourages ongoing engagement, allowing traders to benefit from rewards as they continue trading.

XM's clear and transparent promotional policies make it easy for traders to understand the benefits and requirements associated with each offer.

Comparison of Promotional Offers

While both Exness and XM offer attractive promotional incentives, XM tends to have a broader range of bonuses and a more structured loyalty program. This could provide added value for traders looking to capitalize on their investments. However, Exness's occasional promotions are still worthwhile, especially for traders who appreciate seasonal offers.

Payment Methods

Having multiple deposit and withdrawal methods enhances the trading experience, allowing traders to fund their accounts conveniently.

Deposit Options with Exness

Exness provides various deposit options, including credit/debit cards, bank transfers, and electronic wallets. The platform supports a multitude of payment providers, making it easy for clients to fund their accounts.

Deposits are relatively swift, with many options processed instantly. This facility significantly improves convenience for traders who prefer immediate access to their funds.

Deposit Options with XM

XM also offers a wide range of deposit options, including credit/debit cards, wire transfers, and e-wallets. The diversity of payment methods simplifies the funding process, accommodating traders from various regions.

XM is known for its swift processing times, providing instant deposits for most methods. This efficiency contributes to a smooth trading experience, as clients can capitalize on market opportunities without delays.

Withdrawal Processes and Fees

When considering withdrawals, both Exness and XM maintain a user-friendly process. However, traders should be aware of any potential fees associated with transactions. Typically, withdrawals through similar methods used for deposits are processed efficiently, ensuring that traders can access their funds with minimal hassle.

User Reviews and Feedback

Exploring user reviews and feedback can provide insightful perspectives on the overall trading experience with both brokers.

Common Feedback for Exness

Traders frequently praise Exness for its user-friendly platforms, competitive spreads, and excellent customer service. Many users have shared positive experiences regarding the support they received, particularly in resolving technical issues.

However, some critiques involve the limitations of certain account types and the complexity of withdrawing funds for new users. Nevertheless, overall sentiment leans positively toward Exness, with many satisfied customers endorsing its services.

Common Feedback for XM

XM enjoys a strong reputation in the trading community, with numerous reviews highlighting its educational resources and customer support. Users appreciate the thoroughness of their educational materials and the proactive nature of the support team.

On the downside, some traders have expressed concerns regarding the variability of spreads during volatile market conditions. Yet, many find the overall experience satisfactory, resulting in a solid reputation in the industry.

Overall Reputation in the Market

Both Exness and XM maintain favorable reputations in the Forex trading market. Exness is often lauded for its technological advancements, while XM's commitment to education and customer service sets it apart.

Traders should weigh the collective feedback, focusing on what aspects matter most to them—whether it be the platform’s technology, customer service, or educational resources.

Pros and Cons of Exness

To provide clarity, it's essential to evaluate the advantages and disadvantages of using Exness.

Advantages of Using Exness

Exness shines with its competitive spreads, flexible leverage options, and a variety of account types. The broker's commitment to client security, together with its robust technological infrastructure, enhances the overall trading experience.

Furthermore, Exness's user-friendly platform ensures that both novice and experienced traders can navigate the system with ease. The availability of educational resources also contributes to its appeal.

Disadvantages of Using Exness

On the flip side, some users find the withdrawal process cumbersome, particularly for newcomers. Additionally, while Exness has expanded its offerings over the years, some traders may feel limited in accessing unique trading instruments compared to other brokers.

Pros and Cons of XM

Like Exness, XM has its strengths and weaknesses that deserve consideration.

Advantages of Using XM

XM’s standout features include its extensive educational resources, a wide variety of trading instruments, and strong customer support. The zero-commission policy on selected accounts appeals to cost-conscious traders, and the ease of use of the platforms adds to its attractiveness.

The broker also scores highly for its promotional offers, providing various bonuses that enhance the trading experience.

Disadvantages of Using XM

On the downside, some traders express concern over spread variability during volatile periods. While XM provides a robust trading environment, a few users report lagging execution speeds during high-impact news events.

Conclusion

When determining "Which is better Exness or XM?", the answer ultimately depends on individual preferences and trading goals. Both platforms have established themselves as credible and reliable brokers in the Forex trading landscape, each excelling in various areas.

Exness stands out for its competitive spreads, multiple account options, and flexible leverage. Meanwhile, XM impresses with its educational resources, customer support, and zero-commission offers on certain accounts. As traders evaluate their own needs and priorities, they should consider factors like ease of use, available instruments, and trading costs to make an informed decision.

In conclusion, both Exness and XM offer compelling reasons for traders to utilize their platforms. Whether you prioritize advanced features, educational resources, or promotional offers, a careful review of each broker's attributes will guide you to the right choice tailored to your trading journey.

Read more: