15 minute read

Is Exness a market maker broker? Review Broker

Introduction to Exness

Overview of Exness as a Forex Broker

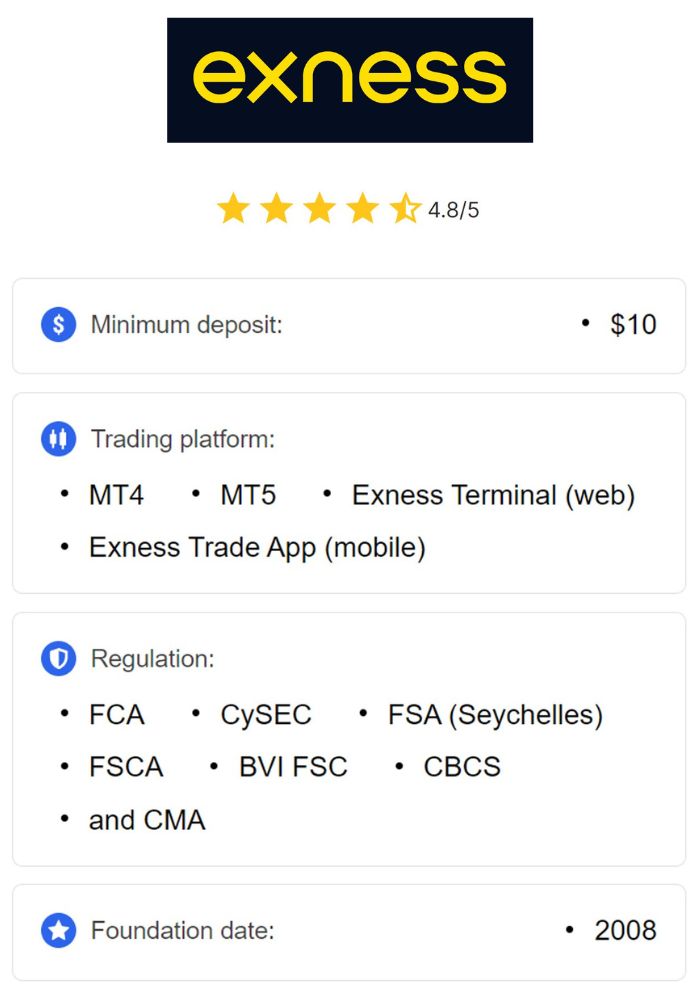

Exness is a prominent name in the online trading industry, providing access to global financial markets with a particular focus on forex and CFD trading. Founded in 2008, Exness has established itself as a reliable broker, recognized for its competitive spreads, high leverage options, and advanced trading tools. Exness offers a range of trading accounts and platforms, making it suitable for both retail and professional traders worldwide.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

What sets Exness apart is its commitment to transparency and regulatory compliance, operating under reputable bodies like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). The broker’s focus on user-friendly technology and client safety has contributed to its widespread popularity, attracting millions of clients globally.

History and Background of Exness

Since its establishment in 2008, Exness has grown rapidly, initially gaining traction in Europe and Asia before expanding its reach globally. Headquartered in Cyprus, Exness has made significant strides in becoming a leading broker through its commitment to technological innovation and customer service. The broker’s early success stemmed from its low-cost trading environment and easy account accessibility, which appealed to a broad range of traders.

Over the years, Exness has built a reputation for being a reliable, well-regulated broker, undergoing regular audits and complying with international financial standards. Exness has consistently invested in research, technology, and user experience, leading to the development of a sophisticated platform with diverse trading instruments, including forex, indices, stocks, commodities, and cryptocurrencies.

Understanding Market Maker Brokers

Definition of Market Maker Brokers

A market maker broker is a type of brokerage that provides liquidity to financial markets by creating an internal market for clients to trade within. Market makers set their own bid and ask prices and often take the opposite side of a client’s trade to ensure continuous buy and sell orders. This allows market makers to provide instant execution to traders, even when there is insufficient liquidity from other market participants.

Market makers play a critical role in the financial ecosystem by offering stability and facilitating trade executions, especially in volatile markets. Unlike ECN brokers, who act as intermediaries and pass client orders to external liquidity providers, market makers operate through a “dealing desk” model, where trades are executed in-house.

How Market Makers Operate in Financial Markets

Market makers create an internal market by setting buy and sell quotes for their clients. This means that instead of matching a client’s trade with another trader, the market maker broker takes on the counter-position to provide immediate liquidity. They earn profits primarily through the spread (the difference between the buy and sell price), allowing them to offer commission-free trading to clients.

By always standing ready to buy or sell, market makers help reduce price volatility and ensure there is always a counterparty available for each trade. However, since they are the direct counterparty to client trades, market makers have the potential to profit from client losses, which can lead to perceived conflicts of interest.

Key Differences Between Market Makers and ECN Brokers

The primary difference between market makers and ECN brokers lies in how trades are executed. Market makers execute trades internally through a dealing desk and may take the opposite side of a client’s position, while ECN brokers pass trades directly to other participants in the network, like banks or other traders.

Market Maker Brokers: Operate a dealing desk and set their own bid/ask prices, potentially leading to conflicts of interest. They typically profit from the spread and are known for providing consistent liquidity, even in thinly traded markets.

ECN Brokers: Use an Electronic Communication Network to match client orders with external liquidity providers. They usually charge a commission on trades and offer raw spreads, providing a more transparent pricing structure that avoids conflicts of interest.

The Business Model of Exness

Overview of Exness' Trading Models

Exness operates on a hybrid business model that includes both market making and Straight-Through Processing (STP) execution, which allows the broker to cater to different types of clients and trading strategies. By adopting a hybrid approach, Exness can leverage the advantages of both market making and direct market access. For some accounts, Exness acts as a market maker, while for others, it provides STP execution, where trades are routed to external liquidity providers without a dealing desk.

This hybrid model enables Exness to offer stable spreads, fast execution, and low trading costs, accommodating both beginner and professional traders. By diversifying its business model, Exness can minimize conflicts of interest while providing flexibility and competitive pricing.

Market Making vs. STP Execution in Exness

In Exness’s market-making accounts, the broker may take the opposite side of the client’s trade, acting as the counterparty. This model allows Exness to provide consistent spreads and liquidity for retail traders, particularly in forex trading, where stability and immediate execution are essential. Market-making accounts are usually suitable for smaller trades and new traders who benefit from steady spreads and minimal trading fees.

On the other hand, Exness’s STP accounts, typically offered to professional or high-volume traders, allow client orders to flow directly to liquidity providers. In these accounts, Exness does not act as a counterparty, which reduces the potential for conflicts of interest and offers clients more transparent pricing. The STP execution model is ideal for traders seeking raw spreads and lower latency.

Hybrid Model: Combining Market Making and STP Operations

Exness’s hybrid model is designed to balance liquidity, stability, and fairness. By combining market-making and STP execution, Exness can cater to a broad range of trading preferences and requirements. This model offers the flexibility of stable spreads for beginner traders while providing direct market access for professional traders who demand transparency and lower costs.

With its hybrid model, Exness can switch between market-making and STP execution based on market conditions and the specific needs of each account type. This approach enables Exness to minimize risk, enhance execution speed, and provide competitive trading conditions across the board, demonstrating its commitment to a fair and adaptable trading environment.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness Trading Conditions

Types of Accounts Offered by Exness

Exness provides several account types tailored to meet the diverse needs of its clientele:

Standard Account: This account type is designed for beginners, offering low minimum deposits, variable spreads, and no commission fees. It’s ideal for traders who prefer simplicity and low-cost trading.

Pro Account: The Pro Account is intended for experienced traders, providing tighter spreads, fast execution, and higher leverage options. This account type is well-suited for high-frequency or high-volume traders.

Raw Spread and Zero Accounts: These professional accounts feature ultra-low spreads, with the Raw Spread Account offering raw spreads from 0 pips and a commission per trade, while the Zero Account provides fixed spreads on certain assets. These accounts cater to traders seeking more cost-effective trading with direct market access.

Islamic Account: All account types are available as swap-free accounts, known as Islamic accounts, which are compliant with Sharia law by eliminating overnight interest charges.

Spreads, Commissions, and Fees

Exness is known for its competitive spreads and low trading costs. Spreads vary across account types, with Standard Accounts having variable spreads, while Raw Spread and Zero Accounts offer ultra-low or even zero spreads on certain instruments. Exness’s fee structure is transparent, and commission fees are only applied to professional accounts with raw spreads, making it easy for traders to calculate their costs.

Commissions are generally low, and Exness’s minimal or zero fees on deposits and withdrawals make it a cost-effective choice. By providing low spreads and commissions, Exness ensures that traders can retain more profits and control trading expenses.

Leverage and Margin Requirements

Exness offers high leverage options, with maximum leverage reaching up to 1:2000 for some accounts. High leverage allows traders to control larger positions with a smaller investment, maximizing potential profits. However, leverage availability is subject to regulatory restrictions and can vary based on the asset class, account type, and trader’s experience level.

Exness emphasizes responsible leverage use, as high leverage amplifies both gains and losses. The broker provides resources to help traders understand the risks of leverage and manage their margin requirements effectively, ensuring that clients make informed decisions.

Regulatory Framework of Exness

Licenses and Regulatory Bodies Governing Exness

Exness operates under multiple licenses from respected financial regulatory bodies, including the FCA (UK), CySEC (Cyprus), and the FSCA (South Africa). These authorities enforce strict regulatory standards, requiring Exness to adhere to rigorous compliance, reporting, and client fund protection measures. The broker’s regulatory framework is a cornerstone of its reputation, demonstrating its commitment to transparency and security.

Importance of Regulation in Forex Trading

Regulation plays a critical role in ensuring a safe and fair trading environment, particularly in the forex industry. Regulatory oversight requires brokers to implement client fund protection measures, such as fund segregation, and comply with strict operational standards. For traders, choosing a regulated broker like Exness means greater security, as the broker is regularly audited and held accountable to international standards.

Impact of Regulation on Market Making Practices

Regulation limits potential conflicts of interest in market-making activities, as regulated brokers are required to prioritize client interests and uphold fair trading practices. Exness’s regulatory obligations mean it must maintain transparent pricing, prevent unfair trading practices, and offer protections that align with industry standards, which helps build client trust even when using a market-making model.

Advantages of Trading with Exness

User-Friendly Trading Platforms

Exness offers a range of trading platforms that cater to both beginners and experienced traders. The broker supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most widely used trading platforms globally, known for their comprehensive features and ease of use. MT4 and MT5 provide traders with advanced charting tools, technical indicators, and customizable trading strategies, allowing for detailed market analysis and seamless trade execution.

In addition to MT4 and MT5, Exness also offers a proprietary mobile trading app, Exness Go, designed for traders who prefer to manage their accounts on the go. Exness Go provides real-time market data, one-click trading, and easy account management, ensuring a smooth and efficient trading experience across devices. The user-friendly design of these platforms makes Exness accessible for new traders while still meeting the demands of professional traders.

Customer Support and Educational Resources

Exness places a strong emphasis on customer service, providing 24/7 multilingual support to assist traders with any issues they may encounter. The support team can be reached through live chat, phone, and email, ensuring prompt assistance for account-related queries, technical issues, and general guidance. Exness’s dedication to quality customer service has contributed to its positive reputation among traders globally.

In addition to customer support, Exness provides a wealth of educational resources to help traders improve their skills and knowledge. These resources include webinars, video tutorials, articles, and guides covering a range of topics, from trading fundamentals to advanced strategies. By offering these educational materials, Exness empowers traders to make informed decisions and develop effective trading strategies, making it an excellent platform for learning and growth.

Range of Financial Instruments Available

Exness offers a diverse range of financial instruments, providing clients with the opportunity to trade across multiple markets. The broker’s asset offerings include:

Forex: With access to over 100 currency pairs, including major, minor, and exotic pairs, Exness provides a comprehensive selection for forex traders. Competitive spreads and high leverage options make Exness attractive for those looking to capitalize on currency market volatility.

Commodities: Exness allows traders to trade CFDs on popular commodities like gold, silver, oil, and natural gas, offering opportunities to diversify portfolios and hedge against inflation.

Indices: With access to leading global indices, such as the S&P 500, FTSE 100, and Nikkei 225, Exness enables traders to speculate on the performance of stock markets from around the world.

Stocks: Exness offers CFDs on stocks from top companies, allowing traders to speculate on price movements without owning the underlying assets. This flexibility lets traders benefit from both rising and falling markets.

Cryptocurrencies: Exness provides CFD trading on popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, catering to the growing demand for digital asset trading.

This extensive range of financial instruments gives Exness clients the flexibility to build diversified portfolios, trade different asset classes, and implement various trading strategies, making it a versatile platform suitable for all types of traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Disadvantages and Risks Associated with Exness

Potential Conflicts of Interest in Market Making

While Exness operates a hybrid model that includes both market making and STP execution, the market-making aspect can lead to potential conflicts of interest. In a market-making setup, the broker may act as the counterparty to client trades, which means the broker could potentially profit from client losses. Although Exness adheres to regulatory guidelines and transparency, some traders may be concerned about the possibility of a conflict of interest inherent in the market-making model.

To mitigate this, Exness offers transparency in its trading conditions and operates STP accounts for those who prefer direct market access. However, traders should be aware of this potential conflict and choose the account type that best aligns with their preferences and trading style.

Limitations in Trading Conditions

While Exness offers a wide range of financial instruments and account types, some traders may find certain limitations in trading conditions, especially those on Standard accounts. Standard accounts typically have variable spreads, which may widen during high market volatility, impacting trading costs. Additionally, the leverage offered may vary depending on regulatory restrictions, which can limit high-leverage trading in certain regions.

Traders using specific strategies, such as scalping or high-frequency trading, may find these limitations restrictive on standard accounts. For more advanced features, tighter spreads, and greater flexibility, traders may need to upgrade to a professional account type, which usually has a higher minimum deposit requirement.

Risk of Slippage and Requotes

As with any trading platform, Exness clients may occasionally experience slippage and requotes, especially during times of high market volatility. Slippage occurs when there is a difference between the expected price of a trade and the price at which it is executed, typically due to rapid market movements. Requotes, on the other hand, happen when the broker is unable to execute a trade at the requested price and offers a new price instead.

While Exness has robust infrastructure to minimize slippage and requotes, these risks cannot be entirely eliminated, particularly during significant economic events or periods of high trading activity. Traders should be mindful of these risks and consider using risk management tools, such as stop-loss and limit orders, to mitigate potential losses during volatile market conditions.

Customer Reviews and Reputation

Analysis of Client Feedback on Exness

Exness has generally positive reviews from its clients, with many praising its competitive spreads, fast execution speeds, and efficient customer service. Traders appreciate the transparency of Exness’s trading conditions, particularly the low-cost trading environment and the variety of account options available. Additionally, the broker’s educational resources and responsive support team are frequently highlighted as valuable assets for clients at all experience levels.

However, some clients have expressed concerns about occasional slippage, especially during major market events, and potential conflicts of interest due to Exness’s market-making model. Overall, Exness maintains a strong reputation in the industry, with client feedback reflecting satisfaction with the broker’s reliability, regulatory compliance, and commitment to continuous improvement.

Comparison with Other Brokers in the Market

When compared to other brokers, Exness stands out for its competitive pricing, high leverage options, and flexible trading platforms. Exness’s hybrid model offers a unique combination of market-making and STP execution, which is relatively rare among brokers. This allows Exness to offer diverse account options that cater to a wide range of trading styles and preferences.

In terms of regulatory compliance, Exness is on par with top brokers, operating under reputable authorities like the FCA and CySEC. However, in comparison to pure ECN brokers, Exness may not offer the same level of transparency in pricing for its market-making accounts. Despite this, Exness’s flexible trading conditions, extensive asset range, and commitment to client satisfaction make it a strong competitor in the market.

Addressing Common Concerns from Traders

Common concerns raised by Exness clients include issues related to slippage, requotes, and the potential conflict of interest associated with the market-making model. Exness addresses these concerns by providing transparency in its trading practices, offering multiple account types to suit different trading needs, and educating clients about market risks. The broker’s hybrid model ensures that clients who prioritize transparency can opt for STP accounts, while those seeking low-cost trading can choose market-making accounts.

Exness’s proactive approach in addressing client feedback, coupled with its dedication to continuous improvement, has helped the broker build trust and maintain a strong reputation within the trading community.

Conclusion

Exness is a versatile broker that combines the features of both market maker and STP models to offer clients a flexible trading environment. With a range of account options, competitive trading conditions, and access to multiple financial instruments, Exness is well-suited to traders of varying experience levels and preferences. The broker’s hybrid model enables it to provide stable spreads and reliable liquidity through market-making, while also offering transparent pricing with STP accounts for those seeking direct market access.

While the market-making aspect may raise concerns about conflicts of interest, Exness’s regulatory oversight and commitment to transparency help mitigate these risks. The broker’s focus on customer support, educational resources, and user-friendly platforms makes it a reliable choice for both beginners and experienced traders. Overall, Exness’s balanced approach to trading services positions it as a competitive and adaptable broker in the forex and CFD market.

Read more:

Can i withdraw from Exness without verification?