10 minute read

XAUUSD trading legal in India, is it right?

from Exness

by Exness_Blog

Introduction to XAUUSD Trading

Understanding XAUUSD

XAUUSD represents the trading pair of gold (XAU) against the US dollar (USD), where XAU is the international code for gold. In forex markets, XAUUSD trading allows investors to speculate on the value of gold relative to the dollar, providing an entry into one of the world’s most valuable and historically significant assets. Gold’s intrinsic value has made it a popular commodity, sought after by traders who view it as a safe-haven asset in times of market turbulence.

Top 4 Best XAUUSD Brokers in India

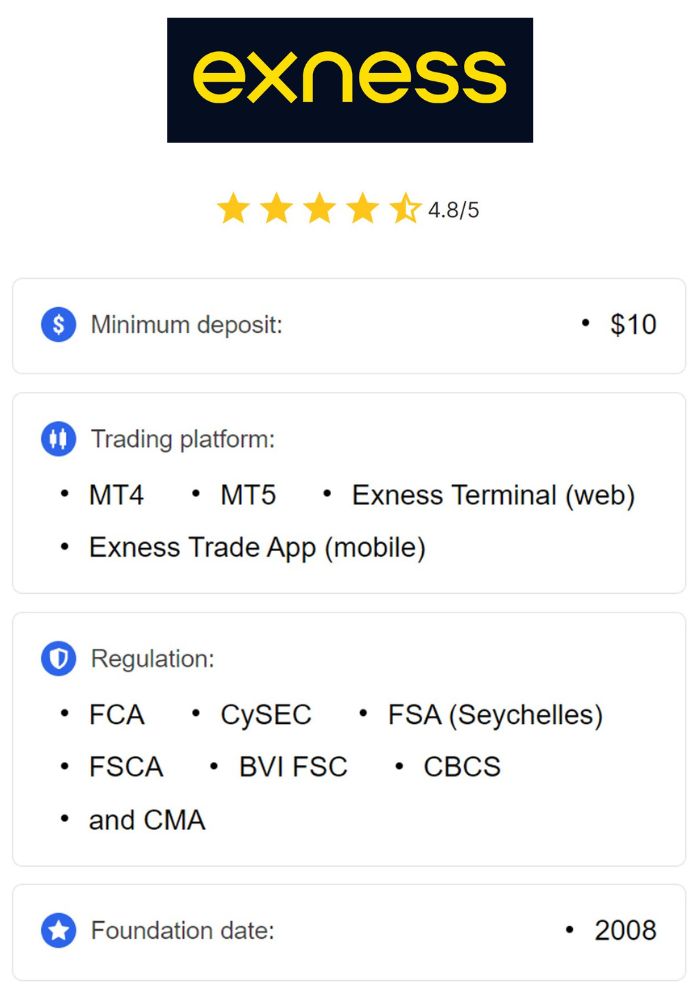

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

XAUUSD trading is widely used by investors looking to hedge against currency risk or economic instability. Traders in India often turn to XAUUSD to diversify their portfolios, gain exposure to the gold market, and utilize forex’s leverage benefits.

The Importance of Gold in Forex Trading

Gold holds a unique position in forex trading due to its status as a global reserve asset and its inverse relationship with the dollar. This means that when the dollar’s value declines, gold’s value tends to increase, making it a popular choice among traders who seek to hedge against inflation and economic downturns. The XAUUSD pair is also known for its volatility, providing opportunities for both short-term and long-term profits.

For Indian traders, gold’s economic stability and historical role as a store of value make it particularly appealing. As a result, XAUUSD trading has grown in popularity, offering a balance of safety and growth potential.

Overview of Legal Framework in India

Regulatory Authorities Governing Forex Trading

In India, forex trading is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The RBI oversees forex transactions under the Foreign Exchange Management Act (FEMA), which establishes the guidelines for foreign currency trading, particularly when it involves rupees. SEBI ensures that brokers operating within India adhere to financial regulations, protecting retail investors from potential risks.

These regulatory bodies maintain strict oversight of forex transactions to safeguard against illicit activities and speculative trading. In particular, FEMA regulates cross-border forex trading, which affects how Indian traders can engage in XAUUSD trading.

Key Legislation Impacting Trading Activities

India’s Foreign Exchange Management Act (FEMA) plays a critical role in dictating the legality of forex trading for Indian residents. Under FEMA, Indian traders can only engage in forex trading on currency pairs that involve the Indian rupee (INR). This restriction technically limits direct access to XAUUSD trading for Indian residents, as it involves a foreign currency pair without the rupee.

However, traders may legally access XAUUSD trading through regulated brokers operating outside India, provided they follow all FEMA guidelines and SEBI regulations. The landscape of forex trading in India is evolving, and traders should stay updated on any legislative changes to ensure compliance.

Is XAUUSD Trading Legal in India?

Current Rules and Regulations

Under current Indian regulations, direct forex trading in pairs not involving INR is restricted. However, Indian traders can still access XAUUSD trading via certain internationally regulated brokers that comply with SEBI and FEMA guidelines. To ensure legality, Indian traders should use platforms that operate within a legally compliant framework and provide transparent services.

Indirect access to XAUUSD through approved brokers aligns with Indian regulatory standards, allowing traders to participate in global markets while staying compliant with Indian laws.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Broker Requirements for Legal Compliance

For XAUUSD trading to remain legally compliant in India, it’s essential to choose a broker that meets SEBI regulations and operates under recognized international licensing authorities like the FCA (UK) or CySEC (Cyprus). Such brokers adhere to strict protocols for transparency, fund security, and customer protection. Indian traders should verify that the broker provides clear terms on leverage, spreads, and fund withdrawals.

Indian traders should also confirm that their brokers comply with anti-money laundering (AML) requirements, offer a secure trading environment, and avoid unsolicited promotions that can indicate non-compliance.

Risks Associated with XAUUSD Trading

Market Volatility

Gold prices can be highly volatile, driven by factors like geopolitical tensions, economic policies, and global demand for safe-haven assets. XAUUSD volatility can result in significant profit opportunities, but it also poses high risk, especially during unexpected market swings. Traders must be prepared for rapid price fluctuations, which can result in both quick gains and potential losses.

Understanding these market dynamics and using technical analysis tools can help traders manage volatility more effectively, though it remains a key risk factor in XAUUSD trading.

Leverage and Margin Risks

One of the key attractions in forex trading, including XAUUSD, is leverage, which allows traders to control larger positions with a smaller capital investment. However, high leverage also amplifies potential losses, and traders may face margin calls if the market moves against their positions. Over-leveraging can deplete a trading account rapidly, especially in volatile markets like XAUUSD.

Indian traders should be mindful of their leverage levels and use risk management techniques like stop-loss orders to minimize potential losses.

Benefits of Trading XAUUSD

Diversification of Investment Portfolio

XAUUSD trading provides a valuable opportunity for Indian traders to diversify their investment portfolios. Unlike traditional equity or fixed-income investments, gold behaves differently under various market conditions, particularly during economic downturns. Including XAUUSD in a portfolio can offer balance and potentially reduce overall risk, as gold’s value often increases when other assets decline.

Hedge Against Inflation and Economic Uncertainty

Gold has long been viewed as a hedge against inflation, as its value generally rises in response to currency devaluation. In times of economic uncertainty, such as recessions or political instability, investors often turn to gold, which can drive up the price of XAUUSD. For Indian traders, holding XAUUSD positions offers a way to protect against inflation and economic fluctuations, helping to preserve wealth.

Tax Implications for Indian Traders

Capital Gains Tax on Forex Trading

Profits from XAUUSD trading are considered capital gains in India and are subject to taxation. If held for less than three years, they fall under short-term capital gains (STCG), taxed according to the trader’s income bracket. For positions held longer than three years, profits are considered long-term capital gains (LTCG) and taxed at a flat rate of 20% after indexation.

Understanding these tax rates is essential for Indian traders to calculate net gains accurately and stay compliant with Indian tax laws.

Reporting Requirements for Income from Trading

Indian traders must report forex trading income, including profits from XAUUSD, in their annual tax filings. Proper documentation of transactions and profit calculations is necessary to ensure accurate reporting. It’s advisable for traders to consult a tax professional familiar with forex trading laws to maintain compliance and optimize tax strategies.

Choosing a Reliable Broker

Factors to Consider When Selecting a Broker

When choosing a broker for XAUUSD trading, factors such as regulatory compliance, trading conditions, account types, fees, and platform stability are crucial. Indian traders should prioritize brokers regulated by recognized authorities, as these brokers provide secure trading environments, transparent fees, and robust support.

Other considerations include customer service availability, educational resources, and withdrawal processing times, ensuring a seamless experience for Indian traders.

Importance of Regulation and Safety of Funds

Regulated brokers comply with strict security standards, ensuring the safety of client funds through measures like segregated accounts and negative balance protection. For Indian traders, selecting a regulated broker helps mitigate the risks of scams and financial fraud, offering peace of mind when trading XAUUSD.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Popular Trading Strategies for XAUUSD

Technical Analysis Techniques

Technical analysis plays a key role in XAUUSD trading, allowing traders to identify patterns and price trends. Popular techniques include moving averages, RSI (Relative Strength Index), Fibonacci retracement, and Bollinger Bands. By combining these indicators, traders can better predict potential entry and exit points, managing risk effectively.

Fundamental Analysis Factors to Watch

Fundamental analysis focuses on factors that influence the gold market, such as interest rates, currency values, inflation, and geopolitical tensions. Events like central bank announcements and economic reports can affect the XAUUSD pair. Monitoring these factors helps traders make informed decisions based on economic trends and market sentiment.

The Role of Economic Indicators in XAUUSD Trading

How Economic Data Influences Gold Prices

Key economic data, such as interest rates, inflation reports, and employment data, have a significant impact on XAUUSD prices. For example, lower interest rates make gold more attractive, leading to higher XAUUSD prices. Understanding how such indicators affect the market is essential for traders aiming to capitalize on economic news.

Key Indicators to Monitor

For XAUUSD traders, critical economic indicators include US Federal Reserve announcements, inflation rates, GDP growth figures, and non-farm payroll reports. By keeping track of these indicators, traders can anticipate potential price movements in the XAUUSD pair and adjust their positions accordingly.

Understanding the Global Gold Market

Major Players in the Gold Market

The gold market is influenced by major players like central banks, hedge funds, retail investors, and gold-producing countries such as China, Russia, and the United States. Central banks, in particular, play a significant role in gold price movements, as they hold large gold reserves and can impact the market with their buying or selling activities.

Influence of Geopolitical Events on Gold Prices

Geopolitical events, including political tensions, wars, and trade disputes, can lead to uncertainty, driving demand for gold as a safe-haven asset. This demand causes fluctuations in XAUUSD, making geopolitical factors an essential aspect to monitor for traders.

Psychological Aspects of Trading XAUUSD

Managing Emotions While Trading

Emotions like fear and greed can impact trading decisions, leading to impulsive actions and potential losses. Successful XAUUSD trading requires traders to manage these emotions, remain disciplined, and avoid overreacting to market fluctuations.

The Importance of Discipline and Patience

Patience and discipline are essential in XAUUSD trading, as traders must wait for optimal market conditions and stick to their strategies. Maintaining a structured approach prevents over-trading and helps achieve long-term profitability.

Common Misconceptions About XAUUSD Trading

Myth vs. Reality: Understanding the Market

Common myths about XAUUSD include assumptions that gold is always a “safe” investment or that it only rises during crises. While gold has protective qualities, it is not immune to market forces and can fluctuate based on demand, interest rates, and currency movements.

Debunking Common Trading Myths

It’s essential for traders to rely on data-driven insights and avoid falling into myths, such as “gold will always retain its value.” Instead, traders should recognize that XAUUSD requires careful analysis, similar to other forex pairs.

The Future of XAUUSD Trading in India

Trends to Watch in the Forex Market

The future of XAUUSD trading may see increased accessibility and regulatory changes that provide more clarity on international forex trading. As technology evolves, Indian traders could also benefit from enhanced platforms and analytical tools.

Potential Regulatory Changes

India’s forex regulations may continue to evolve, potentially allowing for more liberal access to international pairs. Changes in SEBI and RBI policies could open new avenues for Indian traders in the future.

Conclusion

XAUUSD trading offers Indian traders a valuable way to diversify and hedge against market uncertainties. While restrictions exist due to FEMA guidelines, trading through regulated international brokers remains an option, provided that traders stay compliant with local laws. With proper strategy, risk management, and awareness of the legal framework, XAUUSD trading can be a beneficial addition to an Indian investor’s portfolio.

Read more:

How to open account in Exness in India