12 minute read

Is Exness legal in Qatar? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Brokerage Firm

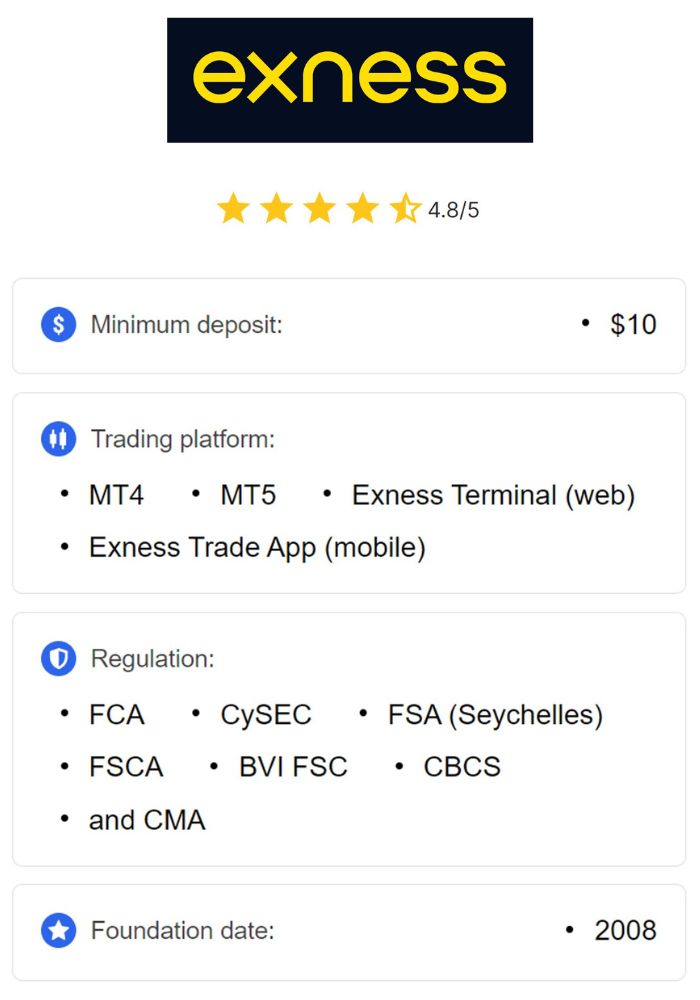

Exness is a globally recognized online brokerage firm founded in 2008, providing a platform for Forex and CFD trading. The firm has gained a reputation for its commitment to transparency, excellent customer service, and advanced trading technologies. Exness offers a wide range of trading accounts tailored to different trader profiles, from beginners to seasoned professionals. The company emphasizes a user-friendly trading experience, providing access to various financial instruments, including currency pairs, commodities, indices, and cryptocurrencies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness is dedicated to empowering traders with the necessary tools and resources to succeed in the financial markets. With a strong focus on education and customer support, the brokerage aims to create a supportive environment for traders in various regions, including the Middle East.

Global Presence and Regulation

Exness operates in multiple countries and regions, making it a prominent player in the global Forex market. The company is regulated by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. These regulatory licenses enhance the credibility of Exness and provide clients with a level of protection.

The global presence of Exness allows it to cater to a diverse clientele while adhering to local regulations in the markets it serves. This commitment to compliance ensures that Exness maintains high standards of service and security for its clients worldwide.

Legal Framework for Trading in Qatar

Overview of Financial Regulations in Qatar

Qatar has a well-established financial regulatory framework aimed at ensuring the stability and integrity of its financial markets. The primary regulatory authority is the Qatar Central Bank (QCB), which oversees banking operations and financial institutions in the country. The financial regulations in Qatar are designed to protect investors, maintain market transparency, and promote fair trading practices.

In recent years, Qatar has taken steps to diversify its economy and enhance its financial sector, leading to an increased interest in Forex trading and investment activities. However, the regulatory landscape remains stringent, and brokers operating in Qatar must adhere to local laws and guidelines.

Role of the Qatar Financial Centre (QFC)

The Qatar Financial Centre (QFC) is a key player in the country's financial landscape, providing a platform for financial services and businesses to operate within a regulated environment. The QFC aims to attract international firms and investment by offering a business-friendly regulatory framework.

Forex brokers seeking to establish operations in Qatar often look to the QFC for licensing and regulatory support. The QFC's regulations ensure that firms comply with international standards while providing a transparent environment for financial transactions. For traders in Qatar, the QFC's presence signifies a commitment to fostering a secure and stable trading environment.

Implications for Forex Brokers Operating in Qatar

Forex brokers wishing to operate in Qatar must comply with the regulations set forth by the QCB and the QFC. This includes obtaining the necessary licenses, maintaining sufficient capital requirements, and adhering to reporting and compliance standards. Brokers must also ensure that their operations align with local laws regarding financial transactions and consumer protection.

For traders, the presence of regulated brokers offers a level of assurance that their investments are protected, and they are trading within a legal framework. Understanding the implications of these regulations is crucial for Qatari traders considering Forex trading, as it helps them choose reliable brokers like Exness that comply with local requirements.

Licensing and Regulation of Exness

Regulatory Bodies Governing Exness

Exness operates under the oversight of several regulatory bodies, enhancing its credibility and commitment to compliance. The key regulators include the FCA in the UK, the CySEC in Cyprus, and the Financial Services Authority (FSA) in Seychelles. Each regulatory authority imposes specific requirements on Exness, including capital adequacy, transparency, and customer protection measures.

For Qatari traders, the presence of these regulatory licenses is crucial, as it indicates that Exness adheres to strict operational standards and provides a safe trading environment. Licensed brokers are subject to regular audits and must maintain high levels of transparency, ensuring that clients’ funds are protected.

Compliance with International Standards

Exness is committed to complying with international standards for financial services, which includes implementing measures for anti-money laundering (AML) and combating the financing of terrorism (CFT). The broker conducts thorough due diligence on its clients and monitors transactions to prevent illicit activities.

By adhering to these international standards, Exness not only protects its clients but also enhances its reputation as a trustworthy broker in the global Forex market. For traders in Qatar, choosing a broker that prioritizes compliance with international regulations ensures a safer trading experience and builds trust in the broker’s operations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness Services Offered

Types of Accounts Available

Exness offers a variety of trading accounts to cater to different trader profiles and preferences. The primary account types include:

Standard Accounts: Ideal for beginners, these accounts have a lower minimum deposit requirement and offer a user-friendly trading experience.

Pro Accounts: Designed for more experienced traders, Pro accounts feature tighter spreads and more advanced trading conditions.

Raw Spread Accounts: These accounts provide direct market access with minimal spreads, making them suitable for high-frequency traders.

Each account type is tailored to meet specific trading needs, enabling traders in Qatar to select the one that best fits their style and investment goals.

Trading Instruments Provided

Exness offers a diverse range of trading instruments, including:

Currency Pairs: Over 100 currency pairs, including major, minor, and exotic pairs.

Commodities: Trading options on commodities such as gold, silver, and oil.

Indices: Access to global stock indices, allowing traders to diversify their portfolios.

Cryptocurrencies: Exness provides trading options for popular cryptocurrencies like Bitcoin, Ethereum, and more.

The extensive selection of trading instruments allows Qatari traders to explore various markets and implement diverse trading strategies.

Platforms and Tools for Traders

Exness provides access to advanced trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their user-friendly interfaces, advanced charting tools, and support for automated trading through Expert Advisors (EAs).

In addition to these platforms, Exness offers proprietary trading tools and resources to enhance the trading experience. Traders can access educational materials, market analysis, and trading signals to improve their decision-making process and overall performance.

Exness Trading Conditions

Spreads and Commissions

Exness is known for its competitive spreads, which vary based on the account type and market conditions. Standard accounts typically feature wider spreads, while Pro and Raw Spread accounts offer tighter spreads, catering to different trading strategies.

While commissions may apply to specific account types, particularly Raw Spread accounts, the overall trading costs at Exness remain competitive. Understanding the fee structure associated with each account type is essential for Qatari traders to evaluate their potential trading costs.

Execution Speed and Slippage

Execution speed is critical in Forex trading, especially for scalpers and high-frequency traders. Exness prides itself on offering fast execution speeds, enabling traders to enter and exit positions quickly. However, during periods of high volatility, slippage may occur, where trades are executed at a different price than expected.

Qatari traders should be aware of potential slippage and incorporate this consideration into their trading strategies, especially when trading during major market events or news releases.

Leverage Options Available

Exness offers a range of leverage options to accommodate different trading styles and risk appetites. Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and losses.

Exness may offer leverage ratios of up to 1:2000, providing significant flexibility for traders. However, it is crucial for Qatari traders to use leverage responsibly, ensuring that they do not overextend themselves and risk substantial losses.

Is Exness Truly an ECN Broker?

Examining the ECN Model

To determine whether Exness operates as an ECN broker, it is important to understand the ECN model. ECN brokers connect traders directly to the interbank market, allowing them to trade against other market participants without taking the opposite side of the trade. This promotes transparency and provides traders with the best available market prices.

Exness offers accounts that provide ECN-like conditions, particularly in its Raw Spread accounts, which feature low spreads and direct market access. However, it is important to evaluate the specific characteristics of Exness's trading model to fully understand whether it meets the criteria of a true ECN broker.

Comparing Exness to Other ECN Brokers

When comparing Exness to other established ECN brokers, it is evident that Exness offers competitive trading conditions, including tight spreads, fast execution, and a diverse range of financial instruments. However, some ECN brokers may have a more pronounced focus on providing direct market access and tighter spreads without any markups.

For traders who prioritize transparency and direct access to liquidity, exploring multiple brokers can help them identify the best fit for their trading needs. Understanding how Exness's trading conditions compare to other ECN brokers is vital for making an informed decision.

Client Testimonials and Reviews

Client testimonials and reviews play a crucial role in assessing the quality of service provided by Exness. Many traders have shared their experiences with Exness, highlighting its strengths in execution speed, customer support, and overall trading experience.

However, it is essential to consider both positive and negative feedback to gain a comprehensive understanding of Exness's performance as a broker. By researching client reviews, traders can make more informed decisions regarding whether Exness aligns with their trading goals and preferences.

Benefits of Trading with Exness

Access to Global Markets

Exness provides traders with access to a wide array of global markets, including Forex, commodities, indices, and cryptocurrencies. This broad selection enables traders to diversify their portfolios and capitalize on various trading opportunities. By offering multiple financial instruments, Exness allows traders to implement different strategies and manage risks effectively.

Robust Customer Support

Exness is known for its excellent customer support, providing assistance in multiple languages and through various channels, including live chat, email, and phone. Responsive customer service is crucial for traders, especially during critical trading hours or when technical issues arise. The support team at Exness aims to resolve queries promptly, ensuring a positive trading experience for clients.

Educational Resources for Traders

Exness offers a wealth of educational resources for traders, including webinars, tutorials, and articles that cover various aspects of Forex trading. These resources are particularly beneficial for novice traders looking to enhance their knowledge and develop effective trading strategies. By providing access to educational materials, Exness fosters a culture of learning and continuous improvement among its clients.

Potential Drawbacks of Exness

Limitations in Certain Regions

While Exness is a global broker, there may be limitations in specific regions due to regulatory restrictions. For instance, traders from certain countries may not be able to open accounts or access specific trading features. It is essential for potential clients to check the availability of Exness services in their region and ensure compliance with local regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Withdrawal Processes and Fees

Some users have reported delays in withdrawal processes or concerns regarding fees associated with withdrawals. While Exness aims to provide efficient withdrawal methods, it is crucial for traders to understand the withdrawal policies and any fees that may apply. Thoroughly reviewing the broker's terms and conditions can help prevent surprises when it comes time to withdraw funds.

Market Volatility Concerns

Like all Forex brokers, Exness is subject to market volatility, which can impact trading conditions, including spreads and execution speed. During times of heightened volatility, traders may experience wider spreads or slippage, which can affect trading results. Understanding these market dynamics and how they relate to Exness's offerings is essential for effective risk management.

Comparison with Other Brokers

How Exness Stacks Up Against Competitors

When evaluating whether Exness is the right broker for Qatari traders, it is essential to compare its features and offerings with those of other brokers in the market. Exness stands out for its competitive spreads, extensive range of financial instruments, and strong regulatory compliance.

While other brokers may offer similar services, Exness's commitment to customer support and education can provide a distinct advantage for traders looking for a comprehensive trading experience.

Unique Selling Points of Exness

Exness boasts several unique selling points that set it apart from competitors, including:

High Leverage: With leverage options reaching up to 1:2000, Exness provides traders with significant flexibility.

Diverse Account Types: The variety of account types offered by Exness caters to different trading styles and experience levels.

User-Friendly Platforms: The availability of popular trading platforms like MT4 and MT5 enhances the trading experience for users.

Strong Regulatory Backing: Exness operates under multiple regulatory authorities, ensuring compliance and security for traders.

By highlighting these unique features, Exness demonstrates its commitment to providing an exceptional trading experience for clients in Qatar and beyond.

Case Studies and User Testimonials

Success Stories from Qatari Traders

Many Qatari traders have shared their success stories and positive experiences with Exness. Traders highlight the broker's user-friendly platforms, excellent customer support, and competitive trading conditions as key factors in their success. These testimonials provide valuable insights into how Exness has facilitated positive trading experiences for clients in Qatar.

Common Issues Faced by Traders

While many traders have had positive experiences, it is important to acknowledge common issues that some users have encountered. These may include concerns about withdrawal processing times, occasional platform glitches, or difficulties in accessing specific features. By understanding both success stories and challenges, potential traders can make informed decisions about whether to choose Exness as their Forex broker.

Conclusion

In conclusion, Exness operates as a legitimate Forex broker that offers a range of services tailored to traders in Qatar. With a solid regulatory framework, competitive trading conditions, and a commitment to customer support and education, Exness provides an appealing option for those looking to engage in Forex trading.

While there may be some limitations and challenges, the advantages of trading with Exness, such as access to global markets and diverse financial instruments, make it a compelling choice for both novice and experienced traders. By understanding the regulatory landscape and assessing personal trading needs, Qatari traders can confidently decide whether Exness is the right broker for them.

Read more:

Gold forex trading time in India