11 minute read

How To Fund My Exness Account in India?

Funding your Exness account is a crucial step to begin trading in the financial markets. For Indian traders, Exness offers a variety of secure and convenient payment methods tailored to local needs, making the deposit process seamless and efficient. Whether you’re a beginner or an experienced trader, understanding how to deposit funds into your Exness account ensures a smooth trading experience.

In this guide, we’ll provide a step-by-step overview of the deposit process for Indian traders, including available payment methods, minimum deposit requirements, and tips for ensuring secure transactions. By the end, you’ll be fully equipped to fund your account and take advantage of Exness’s powerful trading tools and diverse market offerings.

What is Exness Account?

An Exness Account is a trading account provided by Exness, a globally recognized forex and CFD broker. It serves as your gateway to access the financial markets, enabling you to trade a wide range of instruments such as forex, commodities, indices, cryptocurrencies, and stocks. With user-friendly features, advanced tools, and customizable options, an Exness Account caters to both beginners and experienced traders.

Start Trading: Open Exness Account or Visit Website

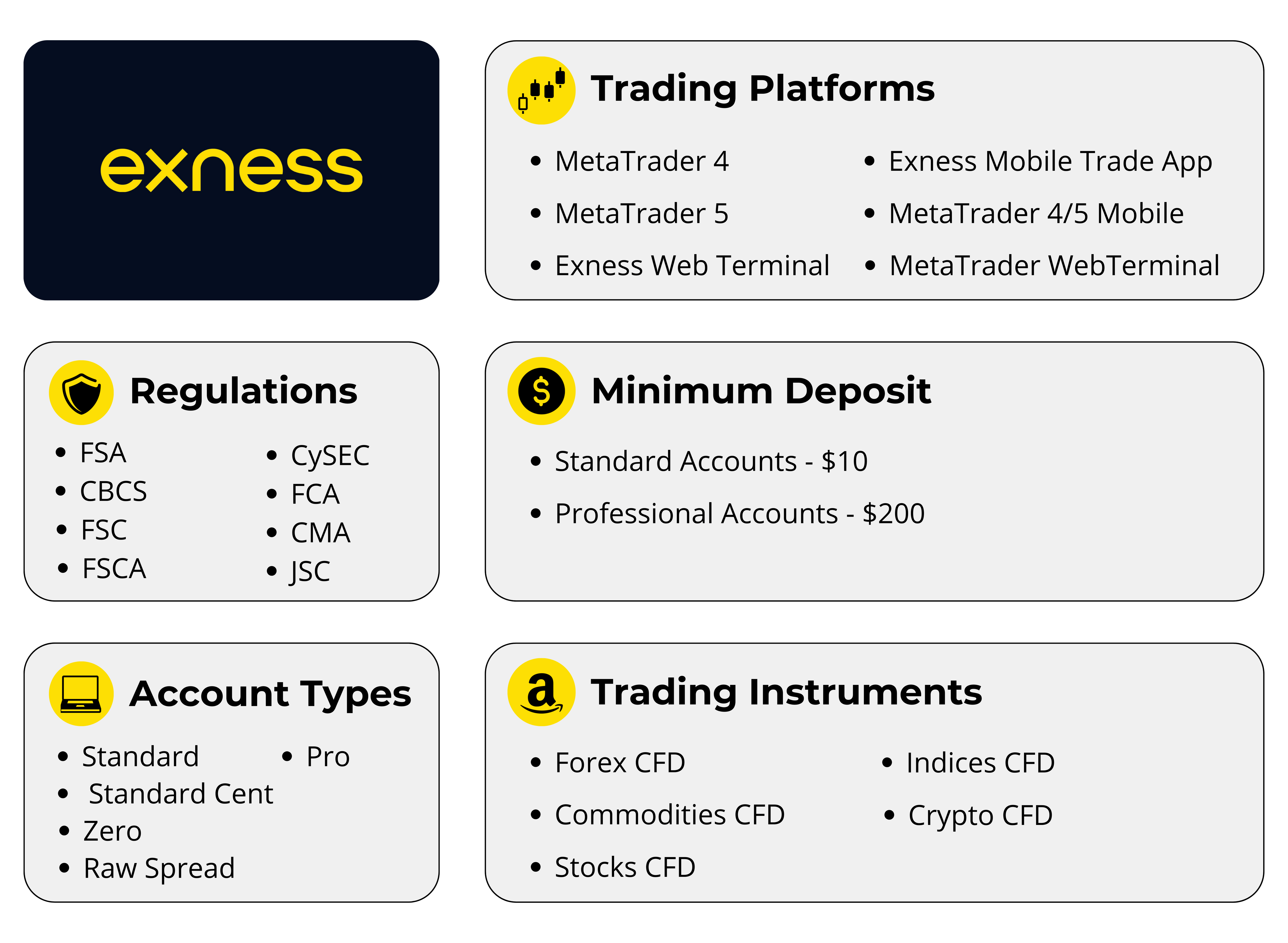

Key Features of an Exness Account:

Market Access:An Exness Account allows you to trade various financial instruments, including over 100 currency pairs, commodities like gold and oil, global indices, cryptocurrencies like Bitcoin and Ethereum, and leading stocks. This diversity enables traders to create a well-rounded portfolio.

Advanced Trading Platforms:Exness provides access to industry-leading trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. These platforms offer advanced charting tools, technical indicators, and real-time market analysis, accessible on desktop, web, and mobile devices.

Customizable Leverage:With leverage options up to 1:Unlimited, traders can adjust their exposure to suit their risk tolerance and trading strategy. While high leverage can amplify profits, it’s essential to use it responsibly to manage risks effectively.

Instant Transactions:Exness supports instant deposits and withdrawals using a variety of secure payment methods, including bank transfers, UPI, e-wallets, and cryptocurrencies. This ensures smooth and fast transactions for traders worldwide.

Low Minimum Deposits:Exness offers low minimum deposit requirements, starting from as little as $10 for Standard Accounts, making it accessible for traders with smaller capital.

Demo Account Availability:For beginners or those testing new strategies, Exness provides a demo account with virtual funds. This feature helps traders practice in a risk-free environment before moving to live markets.

Types of Exness Accounts

Exness offers multiple account types to suit different trading needs:

Standard Account: Ideal for beginners, with no commissions and competitive spreads.

Standard Cent Account: Designed for small-scale trades, with balances displayed in cents.

Pro Account: For experienced traders seeking tighter spreads and no commissions.

Raw Spread Account: Offers ultra-low spreads starting at 0.0 pips, with fixed commissions.

Zero Account: Zero-pip spreads on selected instruments, suitable for scalpers and high-frequency traders.

Payment Methods for Exness in India

Exness offers a variety of secure and convenient payment methods tailored specifically for Indian traders, ensuring a seamless experience for deposits and withdrawals. With options ranging from traditional bank transfers to modern digital wallets, Indian traders can easily fund their accounts and manage their trading finances without hassle.

UPI (Unified Payments Interface)

Unified Payments Interface (UPI) is one of the most widely used payment methods in India, offering instant and secure transfers directly from a bank account. Traders can use popular UPI apps like Google Pay, PhonePe, or Paytm to deposit and withdraw funds effortlessly. UPI transactions are processed almost instantly, making it a preferred choice for traders who want quick access to their funds.

Netbanking/Bank Transfers

Netbanking is another reliable method that allows traders to deposit funds through their online banking portals. This method is particularly suitable for traders handling larger transaction amounts, as it offers high security and direct bank-to-bank transfers. Deposits are typically processed within a few hours, while withdrawals may take up to 72 hours, depending on the bank.

E-Wallets (Skrill, Neteller, etc.)

For traders seeking speed and flexibility, e-wallets like Skrill and Neteller provide an excellent alternative. These digital wallets are known for their quick processing times, with both deposits and withdrawals being completed almost instantly in most cases. Additionally, e-wallets are ideal for traders looking to avoid the potential delays associated with traditional banking systems.

Cryptocurrency

Exness also supports cryptocurrency payments, allowing traders to deposit and withdraw funds using Bitcoin, Ethereum, and other popular cryptocurrencies. This method is particularly advantageous for traders who already hold digital assets, offering global flexibility and privacy. While the processing time depends on blockchain confirmations, most transactions are completed within minutes to an hour.

Indian Payment Gateways

Exness integrates with local Indian payment gateways to facilitate INR transactions. These gateways are optimized for Indian traders, ensuring fast and reliable processing without the need for currency conversion. This option is particularly beneficial for those who prefer to deposit and withdraw in INR, eliminating additional costs and complexities.

Instructions for Depositing Funds into an Exness Account in India

Funding your Exness Account in India is a simple and secure process, with multiple payment methods tailored for local users. Follow these step-by-step instructions to deposit funds and start trading:

Step 1: Log in to Your Exness Account

Visit the official Exness website or open the Exness mobile app.

Enter your registered email and password to log in.

Ensure your account is verified for smooth transactions and higher deposit limits.

Step 2: Navigate to the Deposit Section

On the dashboard, locate and click on the “Deposit” button.

This will take you to the deposit interface, where you can view available payment methods.

Step 3: Choose a Payment Method

Exness supports various deposit methods for Indian traders, including:

UPI (Unified Payments Interface): Instant and widely used for local transactions.

Netbanking/Bank Transfers: Secure deposits directly from your bank account.

E-Wallets: Options like Skrill and Neteller for fast and convenient transactions.

Cryptocurrencies: Deposit using Bitcoin, Ethereum, and other cryptocurrencies for global flexibility.

Step 4: Enter Deposit Details

Enter the amount you wish to deposit. Ensure it meets the minimum deposit requirement for your account type: Standard Accounts: $10 or equivalent in INR. Pro, Raw Spread, and Zero Accounts: Higher minimums may apply.

If using UPI or Netbanking, provide the necessary payment details, such as your UPI ID or bank account information.

Double-check the details to avoid errors.

Step 5: Confirm and Complete the Transaction

Follow the on-screen instructions to complete the payment.

For UPI and bank transfers, you may need to approve the transaction via your banking app or a one-time password (OTP).

For e-wallets and cryptocurrencies, confirm the transaction through your respective wallet or platform.

Step 6: Verify the Deposit

Once the payment is processed, the funds should reflect in your Exness account balance almost instantly, depending on the method used.

Navigate to the dashboard to confirm the updated balance.

Start Trading: Open Exness Account or Visit Website

Tips for Successful Deposits

Depositing funds into your Exness Account is generally quick and straightforward, but following these tips can ensure a smooth and hassle-free experience. By being prepared and taking precautions, you can avoid common issues and focus on trading.

1. Verify Your Exness Account

Before making a deposit, ensure that your Exness account is fully verified. Completing the identity and address verification process not only enhances account security but also increases your deposit and withdrawal limits. Submitting accurate documents (e.g., government-issued ID and proof of address) will help avoid delays.

2. Use Trusted Payment Methods

Choose payment methods that are secure and widely accepted. For Indian traders, UPI, Netbanking, and e-wallets like Skrill and Neteller are convenient options. Using verified payment channels reduces the risk of errors or unauthorized transactions.

3. Check Minimum Deposit Requirements

Ensure your deposit meets the minimum requirement for your selected account type: Standard Account: As low as $10. Pro, Raw Spread, or Zero Accounts: May have higher minimums. Double-check the required amount to avoid failed transactions.

4. Maintain Sufficient Funds

Ensure your bank account, UPI wallet, or e-wallet has enough balance to cover the deposit. Remember to account for potential transaction fees or currency conversion charges if applicable.

5. Double-Check Payment Details

Carefully enter your payment details, such as UPI ID, bank account number, or e-wallet credentials. Small errors can result in failed or delayed deposits. Always review the information before confirming the transaction.

6. Ensure Internet Connectivity

A stable internet connection is essential for completing your deposit without interruptions. Avoid public Wi-Fi networks to protect your payment and personal information from security risks.

7. Keep a Record of Transactions

Save the transaction confirmation or receipt for reference. This can help resolve any deposit-related issues quickly by providing proof of payment to Exness customer support.

8. Check Deposit Processing Times

Most deposits on Exness are processed instantly, but some methods, such as bank transfers, may take longer. Be patient and check the expected processing time for your chosen payment method.

9. Contact Support for Issues

If your deposit doesn’t reflect in your account within the expected timeframe, contact Exness’s 24/7 customer support. Provide your transaction ID and payment details for prompt assistance.

10. Monitor Your Account Activity

Regularly review your Exness account balance and transaction history to ensure all deposits are accurate and successful. Immediate checks can help identify and address any discrepancies.

Minimum Deposit Requirements for Indian Traders

Exness offers flexible deposit requirements to accommodate traders of all levels, making it accessible for beginners while providing advanced options for experienced professionals. Indian traders can choose from a variety of account types, each with different minimum deposit thresholds to suit their trading goals and strategies. This flexibility ensures that traders with varying capital levels can access global markets through Exness’s platform.

Standard and Standard Cent Accounts

For traders starting their journey, the Standard Account and Standard Cent Account are excellent options, requiring a minimum deposit of just $10 or the equivalent in INR. These accounts are designed for beginners and casual traders who want to explore Exness’s features with minimal financial commitment. The Standard Cent Account, in particular, allows traders to practice in a low-risk environment, with balances displayed in cents to reduce exposure while learning trading techniques.

Pro Account

The Pro Account is tailored for more experienced traders seeking tighter spreads and advanced trading conditions. With a minimum deposit requirement of $200, this account offers competitive features such as spreads starting at 0.1 pips and faster execution speeds. It is an ideal choice for traders who require more sophisticated tools and better trading conditions without committing to high capital levels.

Raw Spread and Zero Accounts

For professional traders and those with a focus on precision and cost-efficiency, the Raw Spread and Zero Accounts provide exceptional conditions. Both accounts require a higher minimum deposit of $500 or the equivalent in INR. These accounts cater to scalpers and high-frequency traders, offering ultra-tight spreads starting from 0.0 pips and fixed commissions. The Zero Account is particularly beneficial for traders targeting zero spreads on specific instruments, such as major forex pairs.

Conclusion

Exness provides Indian traders with a variety of secure and convenient payment methods, ensuring a seamless experience for deposits and withdrawals. Whether you prefer the speed of UPI and e-wallets, the reliability of Netbanking, or the global flexibility of cryptocurrency, Exness offers solutions tailored to meet the needs of Indian users. The availability of INR-based payment gateways further simplifies the process, allowing traders to focus on their strategies without worrying about complex transactions.

By verifying your account, using trusted payment methods, and double-checking transaction details, you can ensure smooth and efficient funding of your Exness account. The platform’s commitment to providing multiple payment options and instant processing times highlights its focus on user convenience and satisfaction.

Start Trading: Open Exness Account or Visit Website

FAQsLearn

What payment methods are available for Indian traders on Exness?

Exness supports a variety of payment methods for Indian traders, including UPI, Netbanking, e-wallets like Skrill and Neteller, cryptocurrency, and INR-based local payment gateways.

Is UPI supported for deposits and withdrawals?

Yes, UPI is a supported payment method for Indian traders. It allows instant deposits and withdrawals through apps like Google Pay, PhonePe, and Paytm.

Are deposits on Exness processed instantly?

Most payment methods, such as UPI, e-wallets, and cryptocurrency, process deposits instantly. Netbanking deposits may take a few hours depending on the bank.

What is the minimum deposit amount for Indian traders?

The minimum deposit starts at $10 or the equivalent in INR for Standard Accounts. Pro, Raw Spread, and Zero Accounts may have higher minimum requirements.

Can I deposit and withdraw in INR?

Yes, Exness supports INR transactions through local payment gateways, UPI, and bank transfers, eliminating the need for currency conversion.

Are there fees for deposits or withdrawals?

Exness does not charge fees for most deposits and withdrawals. However, some payment providers may impose their own fees, so it’s advisable to check with them.

What should I do if my deposit or withdrawal is delayed?

If your transaction is delayed, ensure you have entered accurate details and sufficient funds. For further assistance, contact Exness’s 24/7 customer support with your transaction ID.