11 minute read

Is Exness Regulated in India? Overview Trading

When choosing a broker for online trading, regulation plays a crucial role in ensuring security, transparency, and compliance with legal standards. For traders in India, understanding the regulatory status of a broker is essential to determine its legitimacy and suitability. Exness, a globally recognized forex and CFD broker, has garnered attention for its innovative features and competitive trading conditions. However, Indian traders often wonder: Is Exness regulated in India?

This article delves into Exness’s regulatory framework, both globally and in the Indian context. We’ll explore how Exness operates in India, its compliance with local trading laws, and what Indian traders need to consider when using an international broker. By the end, you’ll have a clear understanding of whether Exness is a suitable and secure choice for trading in India.

Overview of Exness

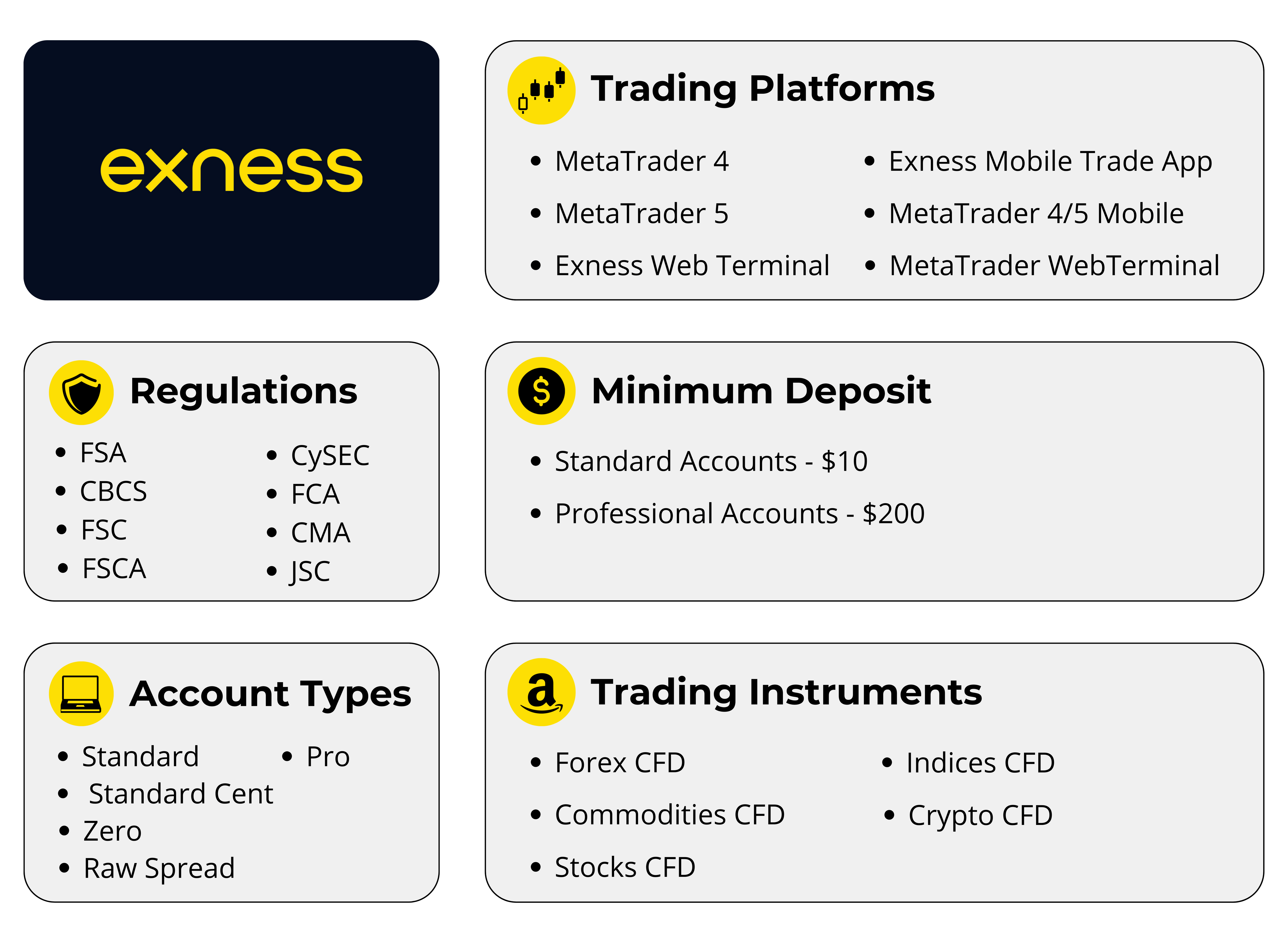

Exness is a globally recognized forex and CFD broker that has been operating since 2008. Known for its innovative approach and commitment to transparency, Exness has established itself as a reliable choice for traders across more than 100 countries. The broker is celebrated for its competitive trading conditions, including low spreads, customizable leverage, and user-friendly platforms, making it suitable for both beginners and experienced traders.

Start Trading: Open Exness Account or Visit Website

Diverse Trading Instruments

Exness offers a wide range of trading instruments to cater to varying trader preferences. These include forex currency pairs, commodities like gold and silver, cryptocurrencies such as Bitcoin and Ethereum, indices, and stocks. This diversity enables traders to build a well-rounded portfolio and explore multiple market opportunities from a single platform.

Advanced Trading Platforms

Exness supports leading trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. These platforms are compatible with desktops, web browsers, and mobile devices, ensuring that traders can access their accounts anytime, anywhere. Equipped with advanced tools for charting, technical analysis, and algorithmic trading, these platforms provide flexibility and functionality for all trading styles.

User-Focused Features

Exness is designed with the user in mind, offering features that enhance convenience and efficiency. Traders benefit from low minimum deposits, which make it accessible for those starting with limited capital. The broker also provides customizable leverage, up to 1:Unlimited for qualified accounts, allowing traders to tailor their risk exposure. Instant withdrawals ensure fast access to funds, while 24/7 multilingual support ensures assistance is always available.

Reputation Among Indian Traders

For traders in India, Exness has become a popular choice due to its localized features, including support for regional payment methods and favorable trading conditions. Its transparent policies and customer-focused approach make it particularly appealing to Indian traders looking for reliability and efficiency in their trading platforms.

Trading in India: Regulatory Landscape

India’s financial trading market operates within a well-defined regulatory framework to ensure the safety, transparency, and fairness of financial transactions. Understanding the regulatory landscape is essential for traders in India, especially when dealing with international brokers like Exness.

Role of SEBI in Regulating Financial Markets

The Securities and Exchange Board of India (SEBI) is the primary regulatory authority overseeing the financial markets in India. SEBI regulates brokers, exchanges, and other financial entities, ensuring they comply with Indian laws to protect investors. For a broker to operate legally in India, it must hold a valid SEBI license. SEBI also regulates the trading of derivatives, including forex, but with certain restrictions.

Forex Trading in India

Forex trading in India is permitted but under specific conditions:

Currency Pairs: Indian traders can trade only in currency pairs that include the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading other forex pairs is not allowed under Indian regulations.

Platforms and Entities: Forex trading is restricted to exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), which offer currency derivatives approved by SEBI.

International Brokers and Indian Traders

While SEBI regulates domestic brokers, Indian traders often engage with international brokers like Exness for broader access to trading instruments and markets. These brokers operate under their respective international regulatory licenses but do not hold SEBI registration. This means that while trading with such brokers is not explicitly illegal, it exists in a regulatory gray area, and traders must exercise caution.

Key Considerations for Indian Traders

Indian traders engaging with international brokers should keep the following in mind:

Currency Pair Restrictions: Trading non-INR currency pairs may violate Indian regulations.

Payment Channels: Using local payment methods or transferring funds for trading outside authorized exchanges might raise compliance issues under the Foreign Exchange Management Act (FEMA).

Taxation: Earnings from forex trading are subject to taxation in India, and traders must report their income as per the guidelines of the Income Tax Department.

Exness’s Status in India

Exness, a globally recognized forex and CFD broker, has a growing presence among Indian traders. While it operates under the regulatory oversight of several top-tier international authorities, its specific status within India’s regulatory framework requires clarification. For traders in India, understanding Exness’s operations and compliance with local laws is essential for informed decision-making.

Compliance and Legality

While Exness complies with international regulatory standards, Indian traders must be aware of local laws. Forex trading in India is regulated under the Foreign Exchange Management Act (FEMA), which permits trading only in INR-based currency pairs (e.g., USD/INR, EUR/INR). Engaging in forex trading outside these guidelines may be viewed as non-compliant under Indian regulations.

Exness’s Appeal to Indian Traders

Exness has gained popularity among Indian traders for its transparent policies, competitive pricing, and ease of access. However, its lack of a SEBI license places certain limitations on its operations within India’s regulatory framework. Traders should consider these factors and ensure they understand the implications of using an international broker.

Start Trading: Open Exness Account or Visit Website

Is Trading with Exness Legal in India?

The legality of trading with Exness in India is a nuanced issue, influenced by the country’s regulatory framework. While Exness operates as a globally regulated broker, it does not hold a license from the Securities and Exchange Board of India (SEBI), which oversees financial brokers within the country. Despite this, many Indian traders access Exness’s platform for its diverse offerings and advanced trading tools. Understanding the regulatory landscape is essential to assess whether trading with Exness aligns with Indian laws.

Forex Trading Regulations in India

In India, forex trading is regulated under the Foreign Exchange Management Act (FEMA), which permits trading only in currency pairs involving the Indian Rupee (INR). Approved pairs include USD/INR, EUR/INR, GBP/INR, and JPY/INR. Additionally, forex trading is restricted to exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), which offer these currency derivatives. Trading non-INR currency pairs or engaging in forex activities outside these exchanges is not authorized under Indian regulations.

Using International Brokers Like Exness in India

Indian traders can legally access Exness as an international broker, but they must ensure their activities comply with FEMA regulations. A key consideration is avoiding non-INR currency pairs, as trading these pairs may breach Indian forex rules. Additionally, payment methods used to fund trading accounts must comply with FEMA guidelines. While Exness supports local payment options such as UPI and e-wallets, traders must be cautious to ensure their transactions align with regulatory requirements.

Taxation and Compliance

Earnings from trading on Exness are taxable under Indian income tax laws. Traders must report their profits as part of their taxable income and maintain clear records of their transactions. Failure to comply with tax regulations could lead to penalties, so it is vital for Indian traders to understand their obligations and adhere to them.

Advantages and Risks for Indian Traders

Many Indian traders are drawn to Exness for its advanced trading features, including access to global markets, high leverage options, and low minimum deposits. The platform’s support for local payment methods and multilingual customer service further enhances its appeal. However, the lack of SEBI regulation means traders assume greater responsibility for ensuring their activities are compliant with Indian laws.

Key Takeaways for Traders

Trading with Exness in India is not explicitly illegal, but it operates outside the purview of SEBI regulation. Indian traders must navigate this regulatory ambiguity carefully. To stay compliant, traders should limit their forex activities to INR-based currency pairs, use authorized payment channels, and maintain accurate records for tax purposes.

Safety and Security for Indian Traders

For Indian traders considering Exness as their trading platform, understanding the safety and security measures implemented by the broker is crucial. Exness is renowned for its commitment to protecting client funds, ensuring data security, and providing a transparent trading environment. While not regulated by SEBI, Exness’s global regulatory compliance and advanced security protocols make it a trusted choice for many Indian traders.

1. Segregation of Client Funds

To safeguard client assets, Exness maintains a policy of segregated accounts. This means traders' funds are kept separate from the broker’s operational accounts, ensuring that their money is protected and accessible even in the event of financial instability at Exness. This practice aligns with global regulatory requirements and enhances trust among users.

2. Advanced Data Security

Exness employs advanced encryption protocols to protect traders’ personal and financial data. The use of Secure Socket Layer (SSL) technology ensures that all data transmitted between the trader’s device and the Exness servers is encrypted and secure. Additionally, features like two-factor authentication (2FA) provide an added layer of account protection, safeguarding against unauthorized access.

3. Secure Payment Options for Indian Traders

Exness supports a variety of secure payment methods tailored to Indian traders, including UPI, bank transfers, and e-wallets like Skrill and Neteller. These payment gateways are monitored to ensure compliance with anti-money laundering (AML) regulations, reducing the risk of fraudulent transactions. Real-time transaction monitoring also ensures that deposits and withdrawals are processed safely and efficiently.

4. Transparent Trading Practices

Exness is committed to transparency in its operations. The broker provides real-time account monitoring, detailed transaction histories, and clear terms of service. These features enable Indian traders to track their funds, trading activity, and fees with ease. Regular audits by third-party firms further validate Exness’s financial stability and operational transparency.

5. Multilingual Customer Support

Indian traders have access to 24/7 multilingual customer support, including languages commonly spoken in India. This ensures that traders can resolve their concerns promptly and effectively, contributing to a more secure and user-friendly experience.

Conclusion

Exness has established itself as a globally trusted forex and CFD broker, offering Indian traders access to diverse markets and advanced trading tools. While Exness is not directly regulated by the Securities and Exchange Board of India (SEBI), it operates under the oversight of top-tier international regulators like the FCA, CySEC, and FSCA. This robust global regulatory framework ensures transparency, security, and reliability, making Exness a viable choice for Indian traders.

Start Trading: Open Exness Account or Visit Website

Indian traders benefit from Exness’s user-friendly platforms, local payment options, low minimum deposits, and multilingual customer support. However, it is essential for traders to remain aware of the Foreign Exchange Management Act (FEMA) restrictions, particularly those limiting forex trading to INR-based currency pairs. Compliance with local laws and tax regulations is crucial for trading responsibly.

FAQs

Is Exness regulated in India?

No, Exness is not regulated by the Securities and Exchange Board of India (SEBI). However, it is licensed by top-tier international regulators like FCA, CySEC, and FSCA.

Can Indian traders legally use Exness?

Yes, Indian traders can use Exness as an international broker. However, trading must comply with the Foreign Exchange Management Act (FEMA), which restricts forex trading to INR-based currency pairs.

What currency pairs can Indian traders trade with Exness?

Indian regulations allow trading in currency pairs that include the Indian Rupee, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading other pairs may violate FEMA guidelines.

Does Exness offer secure payment options for Indian traders?

Yes, Exness supports secure payment methods for Indian traders, including UPI, bank transfers, and e-wallets like Skrill and Neteller. These methods comply with anti-fraud measures.

Are my funds safe with Exness?

Yes, Exness ensures the safety of client funds through segregated accounts, adherence to global regulatory standards, and advanced data encryption technologies.

Does Exness provide customer support for Indian traders?

Yes, Exness offers 24/7 multilingual customer support, including languages commonly spoken in India. This ensures prompt assistance for Indian traders.

What platforms are available to Indian traders on Exness?

Exness provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal, all of which are available on desktop and mobile devices.