7 minute read

What is the Minimum Deposit for Exness Social Trading?

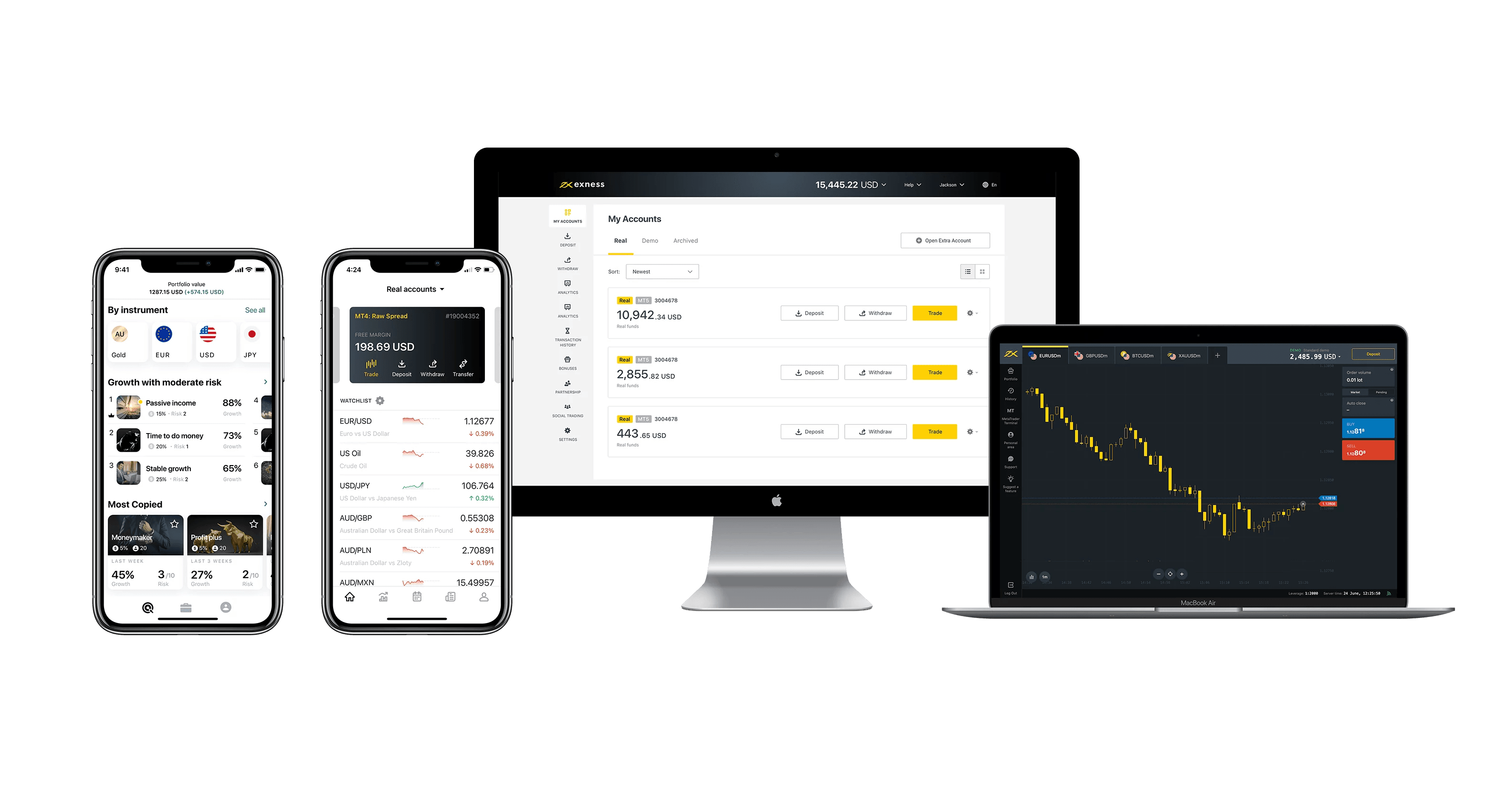

Exness Social Trading is a platform that allows traders to connect with experienced strategy providers and copy trading strategies. For many beginners, one of the first questions is what is the minimum deposit for Exness social trading? This is crucial because it helps you understand the investment amount needed to start trading and make the most of the social trading features available.

The minimum deposit to start with Exness social trading depends on several factors, including the account type and the payment method you choose. However, Exness offers low minimum deposit requirements compared to other brokers, making it accessible for new traders to begin trading in the financial markets.

How Exness Social Trading Works

Exness Social Trading allows you to copy trading strategies from seasoned traders or strategy providers. The social trading account gives you access to social trading strategy accounts that have different risk levels and performance metrics. By following these successful traders, you can replicate their trading style and gain exposure to the financial markets.

Traders can start by browsing the social trading platform, where they can view various strategy providers and their past performance. Once you select a strategy account, your investment account will automatically mirror the trades made by the strategy provider. The minimum deposit requirement for these accounts may vary, but Exness generally offers low minimum deposit options, making it accessible for traders to start.

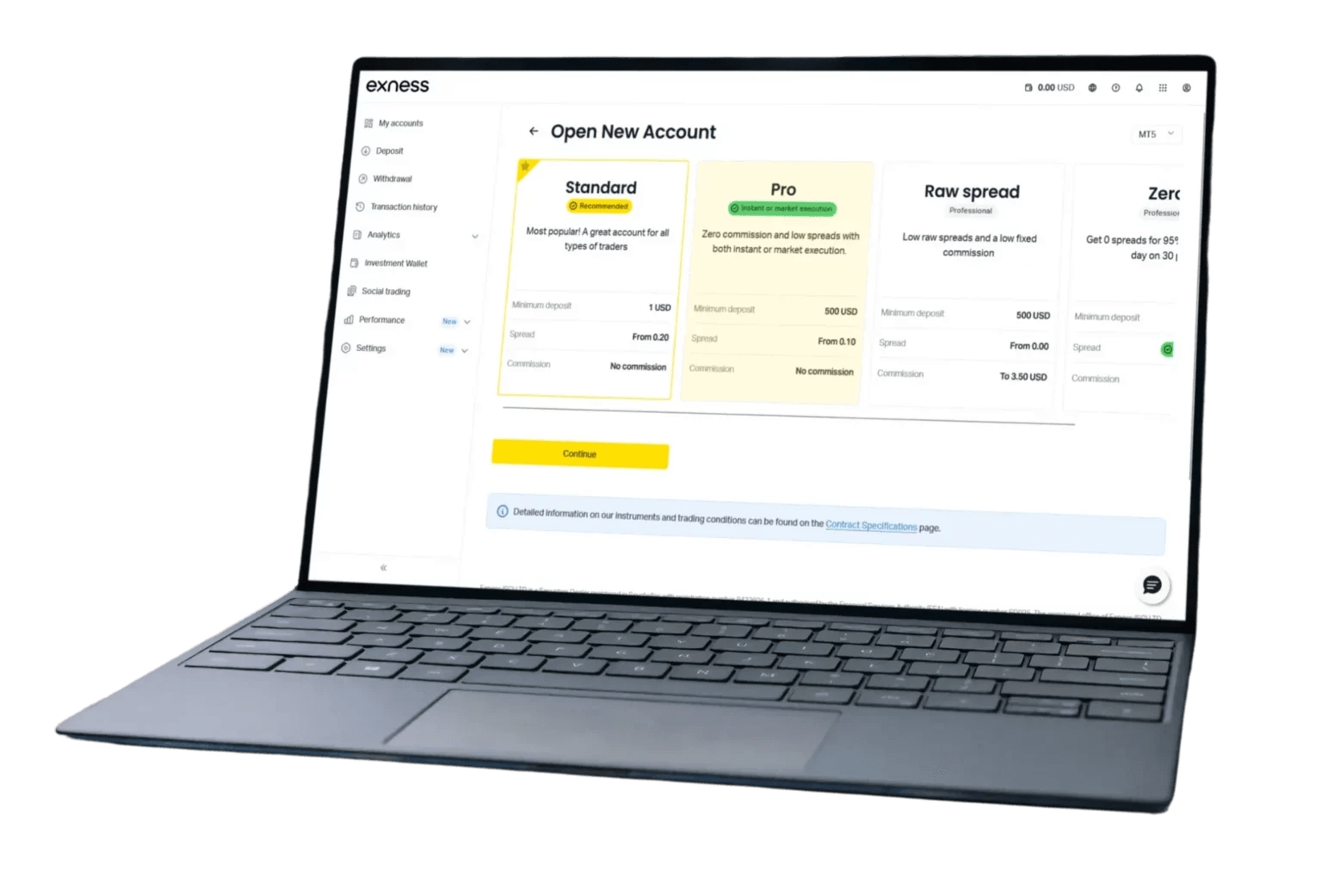

Exness Social Trading Account Types

Exness offers different account types for social trading. The minimum deposit for each account type can vary, but here’s an overview of the most common Exness account types for social trading:

1. Cent Account

The cent account is designed for new traders or those who want to trade with small amounts. The minimum deposit for this account type is usually very low, making it a popular choice for demo accounts and beginner traders. This account offers low-risk exposure, ideal for testing strategies without committing large sums of money.

2. Standard Account

For those who want to trade in forex and other trading instruments with a little more flexibility, the standard account is a great option. The minimum deposit for the standard account is still quite low, and traders can benefit from more advanced features as their experience grows.

3. Pro Account

The Pro account is typically used by experienced traders or those who need more advanced tools for copy trading. The minimum deposit for the Pro account is higher compared to the Cent or Standard accounts, but it offers higher leverage, more trading options, and the ability to handle larger trading volumes.

4. Social Pro Accounts

For those focusing on social trading, Exness social pro accounts are designed for serious traders who want to share their strategies and attract followers. These accounts have a higher minimum deposit requirement but come with advanced trading features and the ability to earn commissions from followers.

Start Trading: Open Exness Account or Visit Website

What is the Minimum Deposit for Exness Social Trading?

The minimum deposit for Exness social trading depends on the account type and the payment method chosen. Here are some general guidelines:

Cent Account: The minimum initial deposit is typically as low as $1, making it an ideal choice for beginners who want to try out social trading without risking a significant amount of capital.

Standard Account: The minimum deposit usually starts around $10, which is still relatively low and accessible for most traders.

Pro Account: The minimum deposit for this account type is generally higher, often starting from $200 or more, depending on the trading volume and desired leverage.

Social Pro Accounts: These accounts, which allow traders to become strategy providers, typically require a minimum deposit of around $500 to start.

It’s important to note that Exness minimum deposit can also be influenced by the payment method chosen, as some payment providers have their own rules regarding deposit amounts. For instance, e-wallets like Skrill or Perfect Money may offer more flexibility with minimum deposits, while bank transfers may have higher requirements.

Key Features of Exness Social Trading

1. Low Minimum Deposit Requirement

One of the main advantages of Exness social trading is its low minimum deposit requirement. Whether you’re opening a cent account or a pro account, Exness makes it affordable for traders to start social trading with as little as $1.

2. Risk Management Options

With Exness social trading, you can choose strategy providers based on their risk tolerance. Each strategy account comes with a risk score, so you can select a strategy that aligns with your risk profile. This risk management feature helps you control your investment amount and avoid excessive losses.

3. Access to Experienced Traders

Exness social trading allows you to follow successful investors who share their trading strategies. These experienced traders often provide insights into financial markets, helping you learn new strategies while potentially earning profits.

4. Copy Trading Feature

Once you’ve selected a strategy provider, you can automatically copy trades from their account, replicating their actions in real-time. This copy trading system makes it easier for new traders to engage in the trading world without the need to actively manage each trade themselves.

How to Start Social Trading with Exness

Create Your Exness Account. To begin social trading, create an Exness account by signing up on the Exness website. Make sure to verify your account for a smoother deposit and withdrawal process.

Deposit Funds. Once your account is set up, make your initial deposit using a payment method that suits you. Exness offers a variety of deposit options, including bank transfers, e-wallets, and cryptocurrencies.

Select a Strategy Provider. Browse through the strategy providers available on the Exness social trading platform. Check their performance history, risk score, and trading style before selecting the one that aligns with your goals.

Start Copying Trades. Once you’ve chosen a strategy provider, you can start copying their trades directly from your social trading account. You’ll automatically mirror the provider’s actions, allowing you to benefit from their expertise.

Start Trading: Open Exness Account or Visit Website

Conclusion

Exness offers a user-friendly platform for social trading that allows both new and experienced traders to profit from copy trading. With a low minimum deposit, you can start trading with as little as $1 and access professional traders’ strategies. By understanding the minimum deposit requirement and choosing the right account type, you can start social trading on the Exness platform and potentially earn profits without actively managing each trade. Always remember to consider the risks involved and manage your investment amount according to your risk tolerance.

FAQs About Exness Social Trading

What is the minimum deposit for Exness Social Trading?

The minimum deposit for Exness social trading depends on the account type you choose. For cent accounts, the minimum deposit is around $1, while for Pro accounts, it can be higher, starting from $200.

How do I start with Exness Social Trading?

To start with Exness social trading, create an Exness account, deposit funds, and choose a strategy provider whose trades you would like to copy. Ensure your account is verified for smoother transactions.

What payment methods can I use for Exness Social Trading?

Exness supports a variety of payment methods, including bank transfers, e-wallets (like Skrill and Neteller), and cryptocurrencies. The payment method you choose may impact the minimum deposit required.

Can I lose money with Exness Social Trading?

Yes, there is a risk of loss in social trading. It’s important to carefully choose strategy providers whose risk tolerance matches yours and to manage your investment amount according to your risk profile.

How does Exness calculate the performance of strategy providers?

Exness calculates the performance of strategy providers based on past performance, risk score, and trading volume. This data helps investors make informed decisions about which trading strategy to follow.