12 minute read

What Leverage Options Does Exness Offer?

Leverage is a fundamental tool in the world of online trading, enabling traders to control larger positions with a smaller initial investment. It’s an essential concept for traders looking to maximize their potential returns while minimizing their capital outlay. However, with great power comes great responsibility—leverage also amplifies the risks involved in trading.

At Exness, one of the leading online forex brokers, traders are offered a variety of leverage options designed to suit different trading styles and risk tolerances. Whether you're a novice looking for lower leverage or an experienced trader seeking more flexibility, Exness provides the tools necessary to trade efficiently and confidently.

What is Leverage

In the world of trading, leverage refers to the ability to control a large position in the market with a relatively small amount of capital. Essentially, it allows traders to borrow funds from their broker in order to increase their exposure to the market, amplifying both potential profits and losses.

To understand leverage better, let's look at an example: If you have $1,000 in your trading account and use 10:1 leverage, you can control a position worth $10,000 in the market. This means that with a relatively small investment, you can access much larger trades.

Leverage is typically expressed as a ratio, such as 10:1, 50:1, or even 500:1, where the first number represents the trader's own capital and the second number represents the amount of leverage provided by the broker. In this case, a 10:1 leverage means that for every $1 of your own funds, you can control $10 in the market.

While leverage can enhance your potential profits, it also comes with increased risk. A small market movement against your position can lead to significant losses, potentially exceeding your initial investment. This is why it’s essential for traders to use leverage wisely and ensure they fully understand the risks involved. Proper risk management tools, such as stop-loss orders, and maintaining a strong margin are key to using leverage effectively in trading.

Start Trading: Open Exness Account or Visit Website

Leverage Options at Exness

Exness offers a wide range of leverage options to cater to the diverse needs of its global trader base. Whether you're just starting your trading journey or you're a seasoned professional, the flexibility of leverage settings available at Exness ensures you can tailor your trading experience to match your risk tolerance and strategy.

Here’s an overview of the leverage options available at Exness:

1. Standard Leverage

Exness provides standard leverage for different account types, allowing traders to control larger positions with a relatively low margin requirement. For many account types, leverage can be set to as high as 1:2000, though the exact amount depends on the trader’s account type, the financial instrument being traded, and the trader’s location.

2. Variable Leverage

Exness offers variable leverage, meaning the level of leverage can fluctuate based on market conditions and account settings. This flexibility allows traders to adjust leverage according to their trading style and market outlook, making it ideal for those who prefer a more dynamic approach to risk management.

3. Leverage for Different Account Types

Exness offers different leverage levels depending on the account type you open. For example:

Standard Accounts: These accounts tend to offer higher leverage (up to 1:2000 or more), which is ideal for retail traders who need more flexibility and access to the global markets.

Raw Spread and Pro Accounts: These accounts often feature leverage settings based on the type of instruments being traded and the trader’s expertise. More experienced traders can access leverage of up to 1:2000 for forex pairs, while lower leverage may apply to more volatile instruments such as commodities or cryptocurrencies.

Professional Accounts: Exness offers tailor-made leverage for professional traders, with the ability to choose leverage settings according to their specific risk management preferences and trading objectives.

4. Leverage for Different Asset Classes

The leverage available can also vary depending on the asset you’re trading. For example:

Forex Pairs: Exness offers high leverage on forex trading, up to 1:2000, for many currency pairs, allowing traders to maximize their market exposure.

CFDs (Contracts for Difference): For CFDs, such as commodities, indices, and stocks, leverage can vary. Typically, Exness offers leverage from 1:20 up to 1:100 for commodities and indices, depending on market conditions.

Cryptocurrencies: Exness offers leverage on cryptocurrencies, with leverage options ranging from 1:5 to 1:10, reflecting the higher volatility and risk involved in trading these assets.

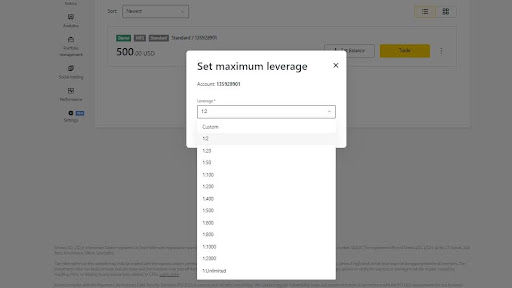

5. Adjusting Leverage

Traders at Exness can adjust their leverage levels directly from the trading platform. The ability to modify leverage based on market conditions or personal preferences helps traders manage risk more effectively. Whether you're looking to trade with more caution or increase your potential returns, Exness makes it simple to adjust leverage levels as needed.

6. Leverage and Risk Management

While Exness provides flexibility with its leverage options, it’s crucial for traders to use leverage responsibly. High leverage can magnify both profits and losses. As a result, traders should always be aware of their risk exposure, employ risk management strategies such as stop-loss orders, and ensure they don’t overexpose themselves to the markets.

Start Trading: Open Exness Account or Visit Website

Max Leverage Exness Offers

Exness is known for providing some of the highest leverage in the forex industry, offering traders the ability to control larger positions with a relatively small amount of capital. The maximum leverage available on Exness can vary depending on the account type, the financial instruments being traded, and the trader’s location, but it can be as high as 1:2000.

Here’s a breakdown of the maximum leverage options available on Exness:

Leverage for Standard Accounts

For most standard account types, Exness offers leverage of up to 1:2000, which is among the highest leverage levels available in the market. This high leverage is especially useful for forex traders who want to maximize their exposure to the currency markets without needing a significant initial investment.

Leverage for Raw Spread and Pro Accounts

Exness offers competitive leverage for more experienced traders who open accounts like Raw Spread or Pro Accounts. These accounts allow for tailored leverage depending on the instruments traded, with leverage often as high as 1:2000 for specific forex pairs. However, leverage for other asset classes, such as indices and commodities, may be lower to mitigate risk.

Leverage for Cryptocurrencies

While Exness does offer leverage on cryptocurrency trades, the maximum leverage available is significantly lower compared to traditional forex pairs due to the higher volatility and risk associated with digital currencies. For cryptocurrencies like Bitcoin, Ethereum, and others, leverage is generally capped at 1:5 or 1:10.

Variable Leverage Based on Market Conditions

Exness operates with variable leverage, meaning that leverage can change depending on market conditions. For example, during times of high market volatility, leverage may be automatically adjusted to lower levels to protect traders from significant losses. This dynamic leverage system helps ensure that traders are not overexposed during uncertain market conditions.

Regional and Account Type Restrictions

While 1:2000 is the maximum leverage Exness offers in many cases, there are some factors that might affect the leverage a trader can access:

Regulatory Requirements: Depending on your country of residence and the regulatory body governing your account (e.g., FCA for the UK), leverage limits might be lower to comply with regional rules. For instance, traders in Europe may be subject to leverage restrictions that limit them to a maximum of 1:30 due to European regulatory guidelines.

Account Type: Different account types have different leverage caps. For example, professional accounts might be able to access higher leverage compared to retail accounts.

Considerations with High Leverage

While Exness’ max leverage of 1:2000 can be highly beneficial for traders looking to increase their market exposure, it’s important to remember that leverage also amplifies risks. A small move in the market against your position can lead to significant losses, especially when using such high leverage.

To mitigate risks, Exness offers several tools, including margin calls, stop-loss orders, and negative balance protection. Traders are advised to use leverage carefully and ensure they have a solid risk management plan in place.

Risk and Reward of Exness High Leverage

Exness offers some of the highest leverage in the industry, with options up to 1:2000 on certain account types. This high leverage presents substantial opportunities for traders looking to maximize their potential profits. By allowing traders to control large positions with relatively small amounts of capital, Exness enables them to amplify their returns even from small market movements. For instance, with leverage of 1:2000, a trader can take a position much larger than their account balance, turning even minor price fluctuations into significant profits. This can be particularly advantageous in fast-moving markets like forex, where small price movements are frequent but can result in big rewards for those who leverage their positions effectively.

However, with the potential for high returns comes the significant risk of magnified losses. The same leverage that increases profits also exposes traders to greater losses. A small adverse price movement can quickly wipe out a trader’s margin, resulting in a margin call or forced liquidation of positions. In the worst-case scenario, traders can lose more than their initial investment, especially if they are not using effective risk management strategies. Exness helps mitigate this risk by offering tools like negative balance protection, which ensures traders cannot lose more than their account balance, and stop-loss orders that automatically limit potential losses. Despite these safeguards, high leverage requires careful consideration, discipline, and solid risk management practices to avoid the dangers of overexposure and emotional trading. For traders who use it wisely, Exness’ high leverage can be a powerful tool, but it's essential to balance the desire for profit with the reality of the risks involved.

Why Choose Exness for Leverage Options

Exness stands out as a top choice for leverage options due to its flexibility and competitive leverage ratios across various account types. The broker offers leverage of up to 1:2000, which allows traders to control larger positions with smaller capital, maximizing potential returns. This high leverage is especially beneficial for forex traders, as it enables them to trade larger volumes of currency pairs without needing significant initial deposits. Furthermore, Exness provides the option to adjust leverage based on market conditions, giving traders greater control over their positions and risk exposure. Whether you're a beginner looking for lower leverage or an experienced trader seeking higher leverage, Exness offers customizable solutions that can be tailored to individual trading preferences.

Another key reason to choose Exness for leverage options is the advanced risk management features that come with its platform. Despite offering high leverage, Exness provides essential tools like stop-loss orders, negative balance protection, and margin call alerts to help traders minimize their risk. These safeguards are especially important for those using high leverage, as they reduce the chance of substantial losses and help maintain control over trading capital. Additionally, Exness is a regulated broker, ensuring that its leverage offerings are compliant with international standards. With its transparency, flexibility, and robust risk management tools, Exness is a reliable choice for traders who want to take full advantage of leverage while maintaining a secure and controlled trading environment.

Conclusion

Exness provides a broad range of leverage options, designed to cater to traders of all experience levels and trading preferences. Whether you're just starting out or are an experienced professional, the ability to choose from flexible leverage settings—up to 1:2000 for many account types—gives you the freedom to trade according to your risk tolerance and strategy.

The broker’s flexibility in offering variable leverage, the option to adjust settings as needed, and high leverage on a variety of asset classes—such as forex, CFDs, commodities, and cryptocurrencies—makes Exness a top choice for traders looking to maximize their exposure to global markets.

FAQ

What is leverage in trading, and how does it work at Exness?

Leverage allows traders to control a larger position with a smaller amount of capital. At Exness, leverage can go up to 1:2000, meaning you can trade positions worth much more than your account balance. This magnifies both potential profits and losses. Leverage options vary by account type and asset class, giving traders the flexibility to tailor their risk and exposure.

What is the maximum leverage available at Exness?

Exness offers leverage up to 1:2000 on certain account types, particularly for forex trading. However, the available leverage may vary based on your account type (e.g., Standard, Pro, Raw Spread) and the asset you're trading (e.g., forex, CFDs, cryptocurrencies). It’s important to check the specific leverage limits for the asset you're trading.

Can I adjust my leverage on Exness?

Yes, Exness allows traders to adjust their leverage based on their trading needs. You can increase or decrease your leverage via the platform to suit your risk tolerance and market conditions. This flexibility helps you manage your exposure to different markets effectively.

What are the risks of trading with high leverage?

While high leverage can amplify potential profits, it also significantly increases the risk of larger losses. A small market movement against your position can lead to substantial losses, potentially wiping out your entire margin. Exness offers tools like stop-loss orders and negative balance protection to help manage these risks, but traders must remain cautious when using high leverage.

Is leverage different for forex and other asset classes at Exness?

Yes, Exness offers different leverage levels depending on the asset class. For forex trading, leverage can go up to 1:2000, but for other assets like CFDs, commodities, and cryptocurrencies, the leverage may be lower, such as 1:100 for commodities or 1:5 for cryptocurrencies, reflecting the higher volatility and risk associated with these instruments.

How can I manage the risks of using high leverage on Exness?

To manage the risks of high leverage, it’s essential to use risk management tools effectively. Exness offers stop-loss orders, take-profit orders, and negative balance protection to help mitigate risks. Additionally, traders should carefully consider their position size, avoid overleveraging, and regularly monitor their accounts to ensure they stay within their risk tolerance.