15 minute read

Exness USD/JPY Trading - Spreads and Trading Conditions

The USD/JPY currency pair, representing the exchange rate between the U.S. Dollar and the Japanese Yen, is one of the most actively traded pairs in the forex market. Known for its liquidity, volatility, and strong price movement, USD/JPY offers ample trading opportunities. Understanding the spreads and trading conditions for USD/JPY on Exness is essential for optimizing trading strategies and ensuring cost-effective trades. Exness provides attractive spreads and favorable trading conditions, making it a top choice for traders looking to trade USD/JPY.

What is USD/JPY?

The USD/JPY currency pair represents the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY). It is one of the most widely traded and popular currency pairs in the forex market, known for its high liquidity, stable price movements, and relatively low trading costs. In essence, the USD/JPY pair shows how many Japanese Yen are needed to purchase one U.S. Dollar. For example, if the exchange rate is 110.50, it means that 1 USD is worth 110.50 JPY.

USD/JPY is classified as a major currency pair because it involves two of the most widely used and traded currencies globally. The pair's high liquidity makes it attractive to both professional traders and retail investors, as it provides the ability to enter and exit positions quickly and efficiently. This liquidity helps keep spreads tight and makes the pair an excellent option for traders looking for low-cost trading opportunities.

The value of USD/JPY is primarily influenced by economic conditions in both the United States and Japan, as well as global market sentiment. Key economic factors include U.S. data like Gross Domestic Product (GDP) growth, employment figures, and inflation reports, as well as Japan’s interest rate policies set by the Bank of Japan (BOJ). The exchange rate between USD and JPY is also sensitive to geopolitical events, global risk sentiment, and changes in the global economy, as both countries play key roles in the world financial system.

Spreads for USD/JPY Trading on Exness

Exness offers competitive spreads for USD/JPY trading, catering to various trading strategies and preferences. Whether you’re a scalper looking for tight spreads or a long-term trader seeking low-cost positions, Exness provides flexible options for trading the USD/JPY currency pair. The spreads for USD/JPY can vary depending on the type of account you choose, but Exness consistently delivers some of the tightest spreads in the industry.

Zero Spread Account

The Zero Spread Account on Exness offers a significant advantage for short-term traders like scalpers and high-frequency traders. In this account type, USD/JPY is available with a fixed spread of 0.0 pips. This ensures that you can enter and exit trades without the concern of spread widening, which is particularly beneficial during periods of market volatility. The fixed spread eliminates the uncertainty that traders often face when spreads fluctuate due to market conditions.

However, while the spread is zero, Exness applies a fixed commission per trade. This transparent commission fee means that you can accurately calculate your trading costs before placing your trades. The Zero Spread Account is ideal for traders who need predictable costs and want to ensure that spread movements do not impact their profitability.

Raw Spread Account

For those who prefer dynamic spreads, Exness also offers the Raw Spread Account. In this account type, USD/JPY spreads start from 0.0 pips, but they may fluctuate depending on market conditions. The advantage of the Raw Spread Account is that you benefit from market-level pricing, meaning the spreads reflect the real-time supply and demand in the market.

In addition to the raw spread, traders are charged a commission based on trading volume. This means that while the spread may widen in less liquid conditions, the overall cost of trading remains competitive due to the lower spread, especially in periods of high liquidity. This account type is more suitable for experienced traders who are comfortable with market volatility and prefer cost-effective trading during active market hours.

Standard Account

For traders who are just getting started or prefer a simpler cost structure, Exness offers the Standard Account. The spreads on USD/JPY in this account are generally wider than those in the Zero Spread or Raw Spread Accounts. While the Standard Account does not have a fixed commission, the spreads can vary and tend to be higher. This account type is best for long-term traders who don’t mind a slightly wider spread for the simplicity of commission-free trading.

Start Trading: Open Exness Account or Visit Website

Trading Conditions for USD/JPY on Exness

Exness offers competitive and flexible trading conditions for those looking to trade USD/JPY, one of the most liquid and widely traded currency pairs. Whether you are a scalper, day trader, or long-term investor, Exness ensures that you have access to tight spreads, high leverage, and efficient execution to optimize your trading strategy. Below are the key features that make trading USD/JPY on Exness both accessible and advantageous.

Leverage for USD/JPY Trading

Exness offers flexible leverage options for trading USD/JPY, with maximum leverage up to 1:2000 available on certain accounts. This high level of leverage gives traders the ability to control larger positions with a smaller initial margin, amplifying potential profits. However, while high leverage can increase your returns, it’s essential to use it cautiously, as it also magnifies potential losses. Traders can choose leverage levels based on their risk tolerance and trading strategies, whether they prefer aggressive short-term trading or a more conservative long-term approach.

Spread for USD/JPY Trading

The spread is one of the most important factors in trading costs, and Exness offers competitive spreads for USD/JPY. For traders using the Zero Spread Account, USD/JPY is available with 0.0 pip fixed spreads, making it highly attractive for scalpers and high-frequency traders who require precise trade execution without the fluctuation of spreads. On the Raw Spread Account, traders can benefit from dynamic spreads starting at 0.0 pips, with spreads widening or narrowing based on market conditions, along with a variable commission per trade. For those trading with the Standard Account, the spreads are typically wider but remain competitive for longer-term traders who prefer not to deal with commissions.

Commission Fees for USD/JPY

Exness applies commission fees for USD/JPY trading based on the account type. In the Zero Spread Account, traders will encounter fixed commissions for each trade, which compensates for the zero spread. These fixed commissions offer transparency in cost management, as traders know the exact fee for every trade. The Raw Spread Account also carries a variable commission based on trading volume, which can be more cost-effective for those executing larger trades. For traders using the Standard Account, there are no commissions, but the spread is typically wider.

Minimum Deposit Requirements

Exness has relatively low minimum deposit requirements, making it accessible to traders at various levels. For the Zero Spread Account and Raw Spread Account, the minimum deposit is usually around $200, providing an entry point for traders who wish to take advantage of tight spreads and flexible leverage. The Standard Account has an even lower minimum deposit, often as low as $1, making it ideal for beginner traders or those looking to trade with smaller amounts.

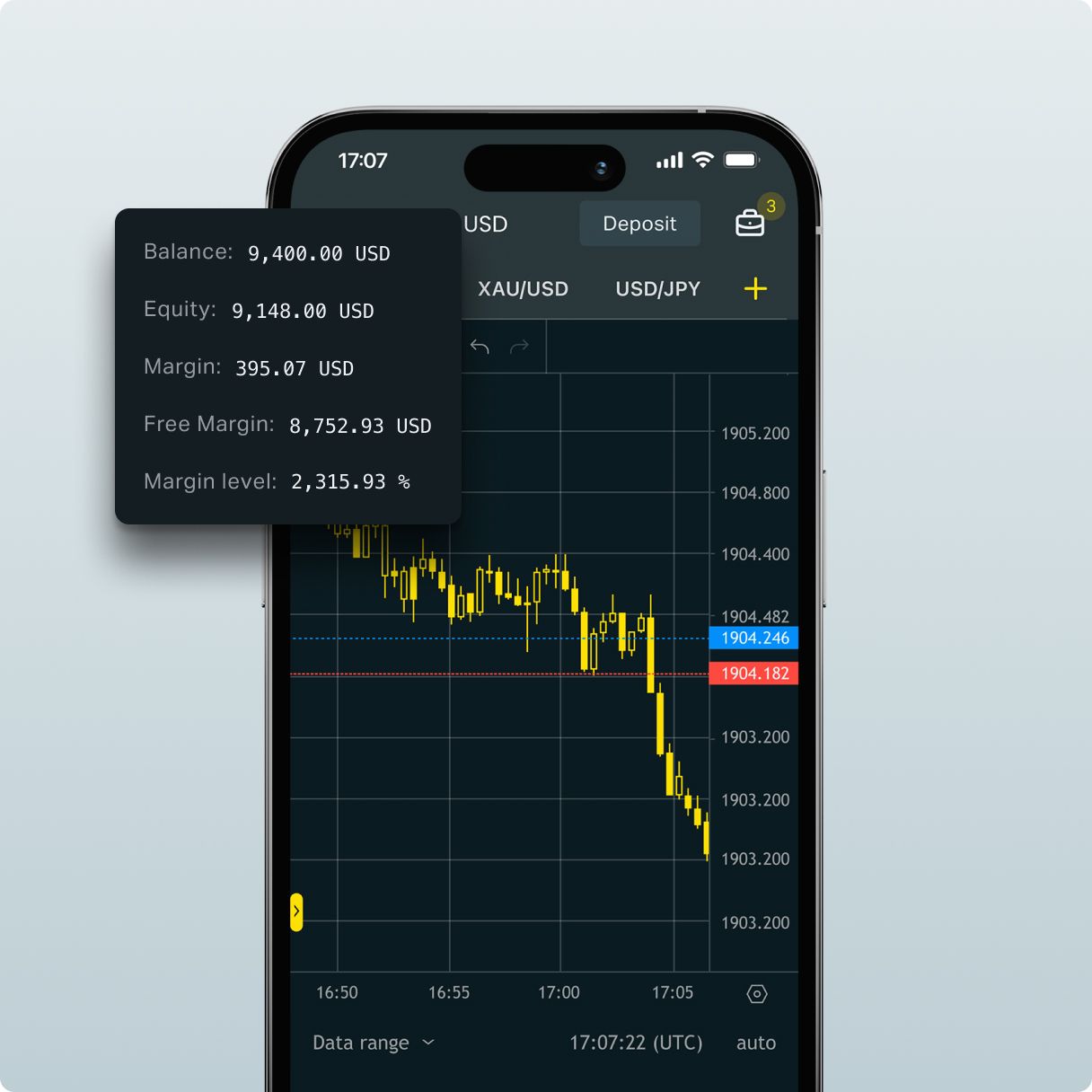

Platforms for USD/JPY Trading

Exness supports USD/JPY trading on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are equipped with a wide range of technical analysis tools, charting features, and automated trading capabilities, making them highly suitable for both beginner and advanced traders. MT4 remains popular for its user-friendly interface, while MT5 offers more advanced features such as additional timeframes and enhanced order types, making it an excellent choice for those seeking a more comprehensive trading experience.

Execution Speed and Order Types

Exness ensures fast execution with no requotes on USD/JPY trades, enabling traders to enter and exit the market with minimal delay. This is crucial for scalpers who rely on quick price movements and need to execute trades at precise levels. Traders can use a range of order types, including market orders, limit orders, stop orders, and trailing stops, to manage their positions efficiently and automatically adjust their trades based on market movements.

Why Trade USD/JPY on Exness?

Trading USD/JPY on Exness offers a range of advantages, making it an appealing choice for both novice and experienced traders. This currency pair is one of the most popular and liquid pairs in the forex market, and Exness provides a trading environment designed to enhance profitability while keeping costs low. Below are some of the key reasons why traders choose Exness for USD/JPY trading:

1. Tight Spreads for Low-Cost Trading

Exness offers tight spreads on USD/JPY, especially through its Zero Spread Account and Raw Spread Account. With Zero Spread, traders can benefit from 0.0 pip spreads on USD/JPY, which is ideal for scalpers and high-frequency traders who need precise entry and exit points with minimal trading costs. For traders in the Raw Spread Account, spreads start from 0.0 pips, and while they can fluctuate, they tend to remain competitive and low, with transparent commissions based on trading volume. This ensures cost-effective trading, which is essential for maximizing profits.

2. High Liquidity and Fast Execution

USD/JPY is one of the most liquid currency pairs, meaning that it is actively traded at all times, with high trading volumes, especially during the U.S. and Asian market hours. This liquidity allows for quick order execution and minimal slippage, meaning that your trades are filled at the expected prices. For scalpers and traders who rely on precise market entries, the high liquidity and fast execution are essential for maximizing their success in fast-moving markets.

3. Flexible Leverage Options

Exness provides flexible leverage on USD/JPY, with leverage up to 1:2000 available on certain accounts. This high leverage gives traders the ability to control larger positions with a smaller initial margin. However, while leverage can amplify profits, it also increases risk, so it’s important to use leverage responsibly and in line with your trading strategy and risk tolerance. Exness offers the flexibility to adjust leverage according to your needs, whether you're looking to take on more risk with aggressive scalping or manage risk carefully with a long-term strategy.

4. Transparent Commission Structure

Exness maintains a transparent commission structure for USD/JPY trading, particularly with its Zero Spread Account. While traders benefit from 0.0 pip spreads, a fixed commission is charged per trade. This ensures that there are no hidden costs, allowing you to accurately calculate trading expenses in advance. Similarly, the Raw Spread Account offers market-driven spreads but charges a variable commission based on trading volume. This transparency is especially valuable for traders who want to manage their trading costs effectively.

5. Low Minimum Deposit

Exness has a low minimum deposit requirement, allowing traders of all levels to access USD/JPY trading with ease. For the Zero Spread and Raw Spread Accounts, the minimum deposit is typically around $200, making it affordable for traders to start trading with USD/JPY without committing large amounts of capital. The Standard Account, which has lower spreads but no commissions, has an even lower minimum deposit requirement, often as low as $1, making it accessible for beginners who are just starting in the forex market.

6. Advanced Trading Platforms

Exness supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for trading USD/JPY. These platforms are widely regarded for their advanced charting tools, technical analysis features, and customizable trading options. Both platforms offer real-time market data, advanced order types, and automated trading options, making them ideal for traders who want to use technical indicators or algorithmic trading strategies to trade USD/JPY effectively.

7. Reliable Customer Support

Exness provides 24/7 customer support in multiple languages, ensuring that any issues you encounter while trading USD/JPY are addressed quickly and efficiently. Whether you need assistance with account setup, platform issues, or understanding trading conditions, Exness's support team is readily available through live chat, email, or phone support.

Start Trading: Open Exness Account or Visit Website

Best Strategies for Trading USD/JPY

Trading USD/JPY can be highly profitable, especially for traders who understand the dynamics of this highly liquid and volatile currency pair. Whether you're a scalper, swing trader, or long-term investor, selecting the right strategy is key to maximizing profits and managing risks. Below, we explore some of the best strategies for trading USD/JPY effectively.

Scalping Strategy

Scalping is a popular short-term strategy, ideal for traders looking to capitalize on small price movements in the USD/JPY pair. Scalpers typically make many trades throughout the day, aiming to profit from price changes that occur within seconds or minutes. USD/JPY is perfect for scalping due to its high liquidity and tight spreads, especially when using a Zero Spread Account on Exness, which provides 0.0 pip spreads. Scalpers rely on quick market entries and exits, and can use tools like moving averages and RSI (Relative Strength Index) to identify short-term overbought or oversold conditions. This strategy works best during times of high market activity, such as during the Asian and U.S. trading sessions, when USD/JPY experiences the most price action.

Swing Trading Strategy

For those who prefer to hold positions for a few days or weeks, swing trading offers the potential to capture larger price movements in USD/JPY. Swing traders focus on price fluctuations over a longer period and aim to identify trends that last for several hours or days. USD/JPY is a great pair for swing trading due to its volatility and response to economic data like U.S. employment reports or interest rate decisions from the Bank of Japan. Key tools for swing traders include Fibonacci retracement levels to identify potential support and resistance zones, along with the MACD (Moving Average Convergence Divergence) indicator to confirm trend strength. This strategy works well in both trending and consolidating markets.

Trend Following Strategy

Trend following is one of the most effective strategies for trading USD/JPY over the medium to long term. In this strategy, traders aim to capture significant price movements by identifying a prevailing trend and then entering positions in the direction of that trend. USD/JPY is known for its sustained trends, particularly during periods of economic expansion in the U.S. or significant shifts in Japanese monetary policy. Traders using this strategy can benefit from tools like the 200-period moving average (MA) to identify the long-term trend direction. Once a trend is identified, position traders can enter and hold positions for several days or weeks, using stop-loss orders to manage risk and secure profits.

News-Based Trading Strategy

News-based trading is a strategy where traders focus on economic announcements and geopolitical events that affect the USD/JPY pair. Since USD/JPY is highly responsive to news releases such as U.S. Non-Farm Payrolls (NFP), Bank of Japan policy meetings, and U.S. Federal Reserve statements, traders can capitalize on the price volatility that follows these events. This strategy requires a good understanding of economic data and the ability to react quickly to market-moving news. USD/JPY typically experiences large price swings after major news releases, and traders can profit by buying or selling based on the outcome of the data.

Conclusion

Trading USD/JPY on Exness provides a wealth of opportunities for traders across various strategies, from scalping to swing trading and news-based strategies. The pair’s high liquidity, tight spreads, and market volatility make it a popular choice for forex traders worldwide. Whether you are looking to capture quick profits with short-term trades or capitalize on long-term trends, Exness offers flexible leverage, low minimum deposit requirements, and advanced trading platforms to suit your trading style.

With Exness’s Zero Spread Account offering 0.0 pip spreads and competitive commissions, traders can optimize their trading costs while executing USD/JPY trades with precision. Trend following, range trading, and news-based trading strategies allow traders to adapt to market conditions and make informed decisions based on real-time data. By using the right combination of tools, such as technical indicators, economic calendars, and risk management techniques, traders can maximize their chances of success.

FAQs

What is the spread for USD/JPY on Exness?

Exness offers 0.0 pips spread on USD/JPY for the Zero Spread Account and dynamic spreads starting from 0.0 pips for the Raw Spread Account.

Can I use leverage when trading USD/JPY on Exness?

Yes, Exness provides leverage up to 1:2000 on USD/JPY, depending on the account type and your risk preferences.

What is the minimum deposit for trading USD/JPY?

The minimum deposit varies by account type but is generally low, making it accessible to most traders.

Is there a commission on USD/JPY trades?

Yes, commissions are charged on the Zero Spread Account and Raw Spread Account. The commission is fixed and transparent.

What platforms can I use to trade USD/JPY on Exness?

USD/JPY can be traded on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

What is the best time to trade USD/JPY?

USD/JPY is most active during the U.S. and Asian market sessions, making it ideal to trade during these hours for high liquidity and volatility.

How can I manage risk when trading USD/JPY?

Use stop-loss, take-profit, and position sizing to manage your risk and limit potential losses. Always trade within your risk tolerance.