14 minute read

Exness Zero Account Commission Calculator

Understanding trading costs is a crucial aspect of successful forex trading, and Exness makes it easier with its Zero Account Commission Calculator. Designed specifically for traders using the Exness Zero Spread Account, this tool helps you calculate your commission costs with precision, allowing you to plan your trades more effectively. Whether you’re a scalper making high-frequency trades or a long-term investor, knowing your exact costs ensures that you can optimize your strategies and manage your trading budget efficiently. With the Exness Zero Account Commission Calculator, estimating your trading expenses has never been simpler or more accessible.

What is the Exness Zero Account Commission Calculator?

The Exness Zero Account Commission Calculator is a helpful tool that allows traders to estimate the commission costs associated with trading on the Zero Spread account. Since the Zero Spread account offers zero spread but charges a fixed commission on each trade, this calculator helps traders gain a clearer understanding of the fees they will incur based on their trading activity. By entering the relevant details into the calculator, such as the trade volume, the instrument being traded, and the size of the position, traders can accurately calculate the commission they will pay for a particular trade, allowing for more effective planning and budgeting.

The calculator is an essential tool for traders who rely on short-term trading strategies like scalping or day trading, where the cost of each trade can significantly impact overall profitability. Since the Zero Spread account eliminates the spread but applies a commission, the Exness Zero Account Commission Calculator helps traders assess whether this cost structure aligns with their trading style and frequency. By inputting the relevant data, traders can quickly see the impact of commission fees on their trades, enabling them to decide if the Zero Spread account is the right choice for their needs.

In addition to trade volume and position size, the calculator allows traders to select specific currency pairs or assets, as the commission can vary based on the instrument being traded. For example, the commission might differ for forex pairs, commodities, or indices, so traders can tailor their calculations based on the specific asset they plan to trade. This flexibility ensures that traders can get an accurate, customized commission estimate for any asset class, which helps avoid surprises when executing trades.

The simplicity and transparency of the Exness Zero Account Commission Calculator also allow traders to quickly compare the commission costs between different account types, such as the Zero Spread account and other Exness accounts. This comparison helps traders evaluate which account type offers the best overall value based on their trading volume and frequency. Whether you are a high-frequency trader or a long-term investor, having access to this tool provides greater confidence in understanding your trading costs and making informed decisions.

Exness Zero Account Commission Calculator is a practical tool for traders using the Zero Spread account. It allows for precise calculations of commission fees, enabling traders to assess their trading costs based on the size of their trades and the specific assets they trade. By using this tool, traders can make better decisions, optimize their strategies, and ensure they are operating within their desired cost structures.

How Does the Commission Calculator Work?

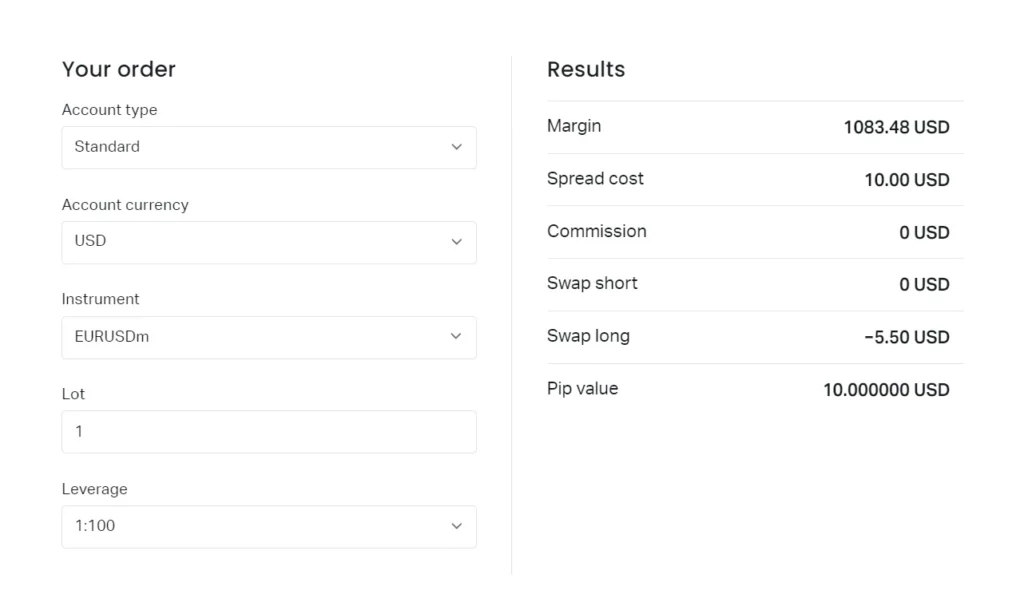

The Exness Commission Calculator is a straightforward tool designed to help traders calculate the commission costs associated with trading on accounts that charge a commission per trade, such as the Zero Spread account. Understanding how this tool works can help traders plan their trades more effectively and avoid unexpected costs. The calculator works by taking into account key details such as the trade volume, instrument type, and position size to determine the exact commission fee a trader will incur when executing a trade.

To use the calculator, traders simply need to enter a few essential pieces of information. The first input is the trade volume, typically measured in lots or contracts. The commission on a trade is often proportional to the trade volume, so the more significant the trade, the higher the commission fee will be. For example, if a trader opens a position with a larger volume (say, 1 standard lot versus 0.1 lot), the commission will be higher as it is charged per lot traded.

Next, the instrument being traded must be selected. Different financial instruments, such as forex pairs, commodities, stocks, or indices, may have different commission structures. The calculator allows traders to choose the specific instrument they are interested in, as commission rates often vary between asset classes. For instance, the commission for trading major forex pairs may differ from that of trading less liquid assets or commodities. By selecting the right instrument, the calculator can provide a more accurate commission estimate.

Additionally, traders may need to specify the currency of their trading account, as this can impact how commissions are calculated and displayed. The tool then computes the commission based on the current rates for that specific instrument and trade volume, providing an immediate estimate of the fees involved. The result will show the total commission cost for the entire trade, which can be invaluable for evaluating the overall profitability of a trade before executing it.

The Exness Commission Calculator not only helps traders understand their commission costs upfront but also allows them to compare these costs with the potential returns. This is particularly useful for traders employing scalping or short-term strategies, where small costs can accumulate quickly. With the ability to input different trade sizes and instruments, traders can experiment with different scenarios to identify the most cost-effective way to execute their trades.

Start Trading: Open Exness Account or Visit Website

Benefits of Using the Commission Calculator

The Exness Zero Account Commission Calculator offers numerous benefits, making it an indispensable tool for traders aiming to optimize their trading strategies and manage costs effectively. Here are some of the key advantages:

Accurate Cost Estimation

The calculator provides precise commission costs for trades executed in the Zero Spread Account. By eliminating guesswork, it ensures that traders can accurately predict their expenses, enabling better financial planning and risk management.

Saves Time and Reduces Errors

Calculating commission costs manually can be time-consuming and prone to mistakes, especially when dealing with multiple trades or large volumes. The Commission Calculator automates this process, delivering results instantly and minimizing the risk of errors.

Improved Trade Planning

Knowing the exact cost of each trade in advance helps traders plan their positions more effectively. The calculator allows them to assess whether a trade aligns with their profit targets and overall strategy, ensuring more informed decision-making.

Supports Strategy Optimization

By allowing traders to input different trade volumes and instruments, the calculator enables them to test and compare various scenarios. This helps in identifying the most cost-effective approaches, whether for high-frequency trading, swing trading, or long-term strategies.

Enhances Budget Management

With precise commission data, traders can allocate their capital more efficiently. They can prioritize trades with lower costs or adjust their lot sizes to stay within their trading budget while maximizing potential returns.

User-Friendly and Accessible

The calculator is designed for ease of use, making it accessible to traders of all experience levels. It’s available across Exness platforms, including desktop and mobile, ensuring convenience and flexibility.

Start Trading: Open Exness Account or Visit Website

How to Access the Exness Zero Account Commission Calculator

Accessing the Exness Zero Account Commission Calculator is a simple process that allows traders to quickly estimate their commission costs before executing trades. The tool is available on the Exness website and can be accessed through a few straightforward steps. Here’s how to use the calculator effectively:

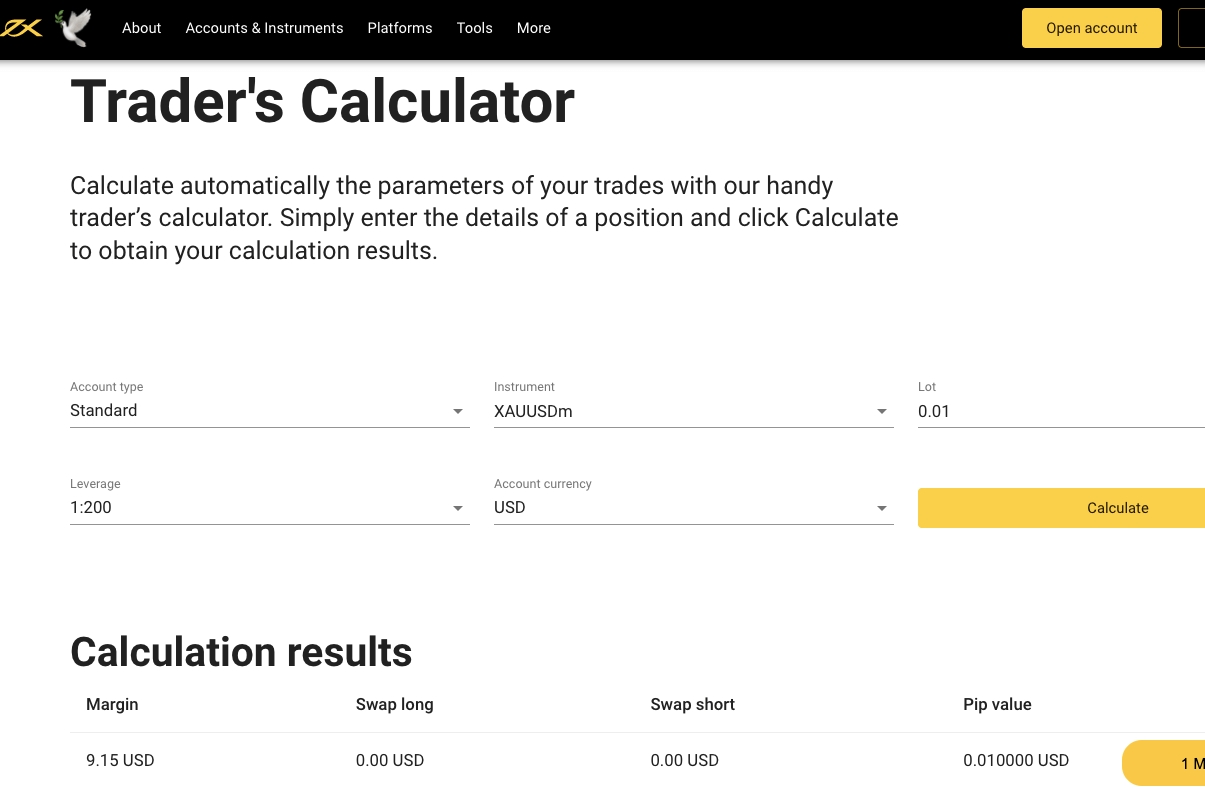

To begin, visit the Exness website and log in to your account. If you don’t have an account yet, you can create one by registering on the platform. Once logged in, navigate to the ‘Tools’ or ‘Trading Tools’ section of the website. You’ll typically find the Commission Calculator listed as one of the available tools under this category. If you're not sure where to find it, you can use the search function on the website by typing in “Commission Calculator” or “Zero Account Calculator.”

For users who prefer a more direct route, the Exness app also provides access to the Commission Calculator for those trading on mobile devices. If you're using the Exness mobile app, simply open the app, log in to your account, and look for the calculator under the relevant section for trading tools. The mobile version of the calculator offers the same functionality as the desktop version, making it convenient for traders who are on the go.

Once you have located the calculator, simply click or tap on it to open the tool. You will be prompted to input key details about your trade, such as the instrument (e.g., forex pairs, commodities, etc.), trade volume (in lots or contracts), and the currency of your account. After entering these details, the calculator will instantly calculate the commission cost for your selected trade. The results will show the exact commission fee you would incur based on the parameters you have set.

For those looking for a more tailored experience, the calculator may also allow you to adjust settings such as leverage, as commission costs may vary depending on the leverage applied to your account. You can experiment with different trade volumes and instruments to see how various scenarios affect your commission costs.

Accessing the Exness Zero Account Commission Calculator is easy and can be done via the Exness website or mobile app. Once accessed, the tool provides a quick and accurate estimate of commission costs based on your trade details. Whether you are planning your trades on a desktop or on a mobile device, this tool is a valuable resource for managing trading expenses and ensuring transparency in your overall cost structure.

Practical Examples of Using the Calculator

The Exness Zero Account Commission Calculator is a versatile tool that simplifies the process of estimating trading costs. Below are a few practical examples to illustrate how this calculator can be used effectively in different trading scenarios:

Example 1: Calculating Commission for a Single Trade

Imagine you plan to trade 1 lot of EUR/USD in your Zero Spread Account. After opening the calculator, you select EUR/USD as the trading instrument and input the trade volume as 1 lot. The calculator instantly shows the fixed commission for this trade, which could be, for instance, $3.50 per lot. This clarity allows you to factor in the exact commission cost into your profit and loss calculations before executing the trade.

Example 2: Estimating Costs for High-Frequency Trading

Suppose you are a scalper executing 10 trades of 0.5 lots each on Gold (XAU/USD) in a single trading session. Enter the trade volume (0.5 lots per trade) and the instrument (Gold) into the calculator. Multiply the calculated commission by the number of trades to estimate your total trading costs for the session. For instance, if the commission is $4 per lot, your cost for each 0.5-lot trade would be $2, resulting in a total session cost of $20. This helps you evaluate if your trading strategy aligns with your profit targets.

Using these examples, the Exness Zero Account Commission Calculator proves to be a valuable tool for optimizing your trading strategies. It not only provides accurate cost estimates but also empowers you to plan trades, evaluate strategies, and align costs with your profit objectives across various trading scenarios.

Tips for Effective Use of the Commission Calculator

The Exness Zero Account Commission Calculator is a powerful tool for managing your trading costs effectively. To make the most of it, here are some practical tips for integrating it into your trading routine and optimizing its benefits:

Use It for Trade Planning

Incorporate the calculator into your pre-trade analysis to estimate the exact commission costs for your planned trades. By knowing your costs upfront, you can determine whether a trade aligns with your risk-reward strategy, ensuring better decision-making.

Experiment with Different Scenarios

The calculator allows you to test various trade volumes and instruments. Use it to explore how commission costs change based on lot size or instrument selection. This can help you identify the most cost-effective trading opportunities that align with your budget and strategy.

Optimize Position Sizes

For high-frequency traders or those with limited capital, understanding commission costs relative to trade volume is crucial. The calculator helps you adjust your lot sizes to stay within your desired cost thresholds while maintaining your profitability goals.

Compare Costs Across Instruments

Different trading instruments may have varying commission rates. Use the calculator to compare costs for multiple instruments, enabling you to prioritize trades with lower expenses or greater profit potential.

Plan High-Frequency Trading Sessions

For scalpers and day traders, small costs can accumulate quickly. Use the calculator to estimate the total cost of executing multiple trades within a session. This helps you plan your trading strategy while keeping cumulative expenses under control.

Revisit Costs During Market Changes

Market conditions and your trading style may evolve over time. Periodically revisit the calculator to ensure your commission estimates remain accurate and align with your current strategy, especially if you’re trading new instruments or increasing trade volumes.

Combine with Other Exness Tools

Pair the Commission Calculator with other Exness tools, such as profit calculators or margin calculators, to get a comprehensive understanding of your trading costs and potential earnings. This holistic approach enhances your ability to optimize trades.

Conclusion

The Exness Zero Account Commission Calculator is an essential tool for traders looking to optimize their trading strategies and manage costs effectively. By providing precise and instant commission estimates, it eliminates guesswork and empowers traders to make informed decisions. Whether you’re planning a single trade, executing high-frequency trades, or analyzing costs across multiple instruments, the calculator ensures complete transparency and control over your expenses.

Using the calculator not only saves time but also helps in refining trading strategies, enabling you to adjust trade volumes, prioritize cost-effective instruments, and achieve your financial goals. Its accessibility across Exness platforms and compatibility with various trading scenarios makes it an invaluable resource for traders of all experience levels.

Incorporate the Exness Zero Account Commission Calculator into your trading routine to streamline your cost management and enhance your profitability. With tools like this, Exness reaffirms its commitment to supporting traders with innovative solutions for a seamless and efficient trading experience.

FAQs

What is the Exness Zero Account Commission Calculator?

The Exness Zero Account Commission Calculator is a tool that helps traders accurately estimate the commission costs for trades made in a Zero Spread Account.

Is the calculator free to use?

Yes, the calculator is completely free and available to all Exness users through their personal area on the platform.

Can I use the calculator for other account types?

The calculator is specifically designed for the Zero Spread Account, but Exness provides other tools for calculating costs associated with different account types.

How is commission calculated for Zero Spread accounts?

The calculator uses the fixed commission rates for Zero Spread accounts, multiplying the rate by the trade volume in lots to determine the total cost.

Is the calculator accessible on mobile devices?

Yes, the calculator is accessible on both the Exness mobile app and website, ensuring you can use it on the go or from your desktop.

Does the calculator support multiple trading instruments?

Yes, the calculator supports a wide range of instruments, including forex pairs, commodities, and indices, allowing you to calculate commissions across various trades.

What should I do if I encounter issues using the calculator?

If you face any difficulties, you can contact Exness customer support for assistance. They are available 24/7 to help resolve technical or usage issues.