12 minute read

Exness vs FXTM - Which One Is Better?

Choosing the right forex broker is a critical decision for traders, as it directly impacts trading efficiency, costs, and overall experience. Two of the most well-known brokers in the industry, Exness and FXTM, offer competitive services but cater to slightly different trader needs. This comparison will delve into their features, strengths, and weaknesses to help you decide which one suits your trading style.

Overview of Exness

Exness is a leading global broker known for its innovative approach to online trading, offering access to forex, commodities, cryptocurrencies, stocks, and indices. Established in 2008, Exness has earned a reputation for transparency, reliability, and superior trading conditions. The broker provides a range of account types suitable for beginners and professionals alike, with features like tight spreads, customizable leverage, and instant withdrawals. Exness supports popular platforms like MetaTrader 4 and 5, as well as proprietary tools, ensuring traders have access to cutting-edge technology. Regulated by multiple international authorities, including CySEC and the FCA, Exness prioritizes security, compliance, and a seamless trading experience, making it a trusted choice for traders worldwide.

Why Choose Exness?

Exness stands out as a trusted broker due to its exceptional trading conditions, advanced platforms, and commitment to transparency. Traders benefit from ultra-tight spreads, customizable leverage, and fast trade execution, ensuring efficient and cost-effective trading. The platform supports instant deposits and withdrawals, with no hidden fees, giving you full control over your funds. Exness is regulated by top-tier authorities like CySEC and FCA, providing a secure trading environment. With access to over 200 financial instruments, including forex, cryptocurrencies, stocks, and indices, Exness caters to traders of all levels.

Introduction of FXTM

FXTM (ForexTime) is a globally recognized forex and CFD broker that has established itself as a trusted name in the trading industry. Launched in 2011, FXTM offers a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies, catering to traders of all levels. The broker provides access to popular platforms like MetaTrader 4 and 5, alongside proprietary tools for enhanced trading experiences. Known for its tight spreads, flexible leverage options, and fast execution speeds, FXTM emphasizes customer satisfaction and education, offering extensive resources for both novice and professional traders. With strong regulatory oversight from authorities such as CySEC and FCA, FXTM delivers a secure and transparent trading environment that meets the needs of a global clientele.

Key Comparisons of Exness and FXTM

Exness and FXTM are both leading brokers in the forex and CFD trading industry, offering unique advantages to traders. Exness is renowned for its ultra-tight spreads, unlimited leverage options, and instant withdrawals, catering to high-volume and professional traders. In contrast, FXTM emphasizes education and accessibility, with extensive resources for beginners and more traditional leverage offerings.

Here are table of Key Comparisons of Exness and FXTM:

Start Trading: Open Exness Account or Visit Website

Pros and Cons

Here’s a side-by-side look at the advantages and disadvantages of both brokers to help traders decide which one fits their needs best.

Exness Pros:

Tight Spreads: Competitive spreads starting as low as 0.0 pips on certain accounts.

High Leverage: Offers leverage up to 1:Unlimited, ideal for experienced traders.

Instant Withdrawals: Funds are processed instantly without withdrawal fees, ensuring quick access to profits.

Robust Trading Platforms: Supports MT4, MT5, and Exness Terminal for advanced trading.

Wide Range of Instruments: Trade forex, indices, stocks, cryptocurrencies, and commodities.

24/7 Multilingual Support: Always available to assist traders in multiple languages.

Strong Regulation: Regulated by leading authorities, ensuring safety and compliance.

Exness Cons:

Limited Educational Content: Fewer resources for beginners compared to other brokers like FXTM.

Restricted Services in Some Regions: Certain jurisdictions may have limited access to Exness features.

FXTM Pros:

Educational Resources: Comprehensive tutorials, webinars, and market analysis to support beginner traders.

Diverse Account Options: Offers Cent, Standard, and ECN accounts tailored to various trading needs.

Regulation and Safety: Overseen by multiple reputable financial authorities (FCA, CySEC, FSCA).

Fixed Spread Options: Provides fixed spreads on certain accounts, offering predictability in trading costs.

Global Reach: Serves traders in over 150 countries with localized payment options.

Platform Versatility: Supports MT4, MT5, and a proprietary mobile app for convenience.

FXTM Cons:

Withdrawal Fees: Some payment methods may incur withdrawal charges.

Slower Withdrawals: Compared to Exness’ instant withdrawals, processing times can be longer.

Limited Leverage: Offers conservative leverage options compared to Exness, which may not appeal to high-risk traders.

Both Exness and FXTM have distinct strengths and drawbacks, catering to different trading needs. Exness excels with its ultra-tight spreads, customizable leverage (including unlimited options), and instant withdrawals, making it highly appealing for experienced and high-volume traders. Its integration with TradingView and 24/7 multilingual support further enhance its advanced trading capabilities. However, its focus on experienced traders may feel less accommodating to beginners. On the other hand, FXTM shines with its extensive educational resources, multiple account types tailored for various experience levels, and attractive promotions like bonuses. Its user-friendly environment makes it ideal for beginners.

Start Trading: Open Exness Account or Visit Website

Right Choice from Exness and FXTM

Selecting the right broker depends on your trading goals, experience level, and preferences. Both Exness and FXTM are reputable brokers with unique strengths tailored to different types of traders. Here’s how to determine the right choice based on key factors:

Choose Exness If:

You Prioritize Low Costs: Exness offers tighter spreads and commission-free options on many accounts, making it ideal for cost-conscious traders.

Instant Withdrawals Are Important: With Exness, withdrawals are processed instantly, giving you quick access to your funds without additional fees.

High Leverage Appeals to You: Exness provides leverage up to 1:Unlimited, which is perfect for experienced traders seeking greater market exposure.

You Need Advanced Trading Tools: Exness supports MT4, MT5, and its proprietary Exness Terminal, offering robust tools for technical analysis and execution.

You’re an Experienced Trader: While Exness caters to all levels, it excels in offering features like tight spreads and high leverage that seasoned traders value.

Choose FXTM If:

You’re a Beginner: FXTM stands out for its educational resources, including webinars, tutorials, and trading guides, making it ideal for new traders.

You Prefer Flexible Account Options: With diverse account types like Cent, Standard, and ECN, FXTM accommodates various trading styles and skill levels.

Fixed Spreads Suit Your Strategy: FXTM offers fixed spread accounts, ensuring predictable costs regardless of market volatility.

You Value Regulatory Oversight: FXTM has a strong global regulatory presence, providing additional trust and security for traders.

You Want Tiered Services: FXTM provides tiered pricing and accounts, giving traders options to grow as they progress in their trading journey.

Choosing between Exness and FXTM depends on your trading goals, experience level, and priorities. If you’re an experienced trader looking for tight spreads, high leverage, instant withdrawals, and advanced tools like TradingView integration, Exness is a clear choice. It caters to professionals who prioritize speed, efficiency, and customizable trading environments. On the other hand, if you’re new to trading or value extensive educational resources, tailored account options, and promotional bonuses, FXTM might be the better fit. Both brokers are secure and regulated by top-tier authorities, making them reliable options.

Exness Tools vs FXTM’s Learning Hub

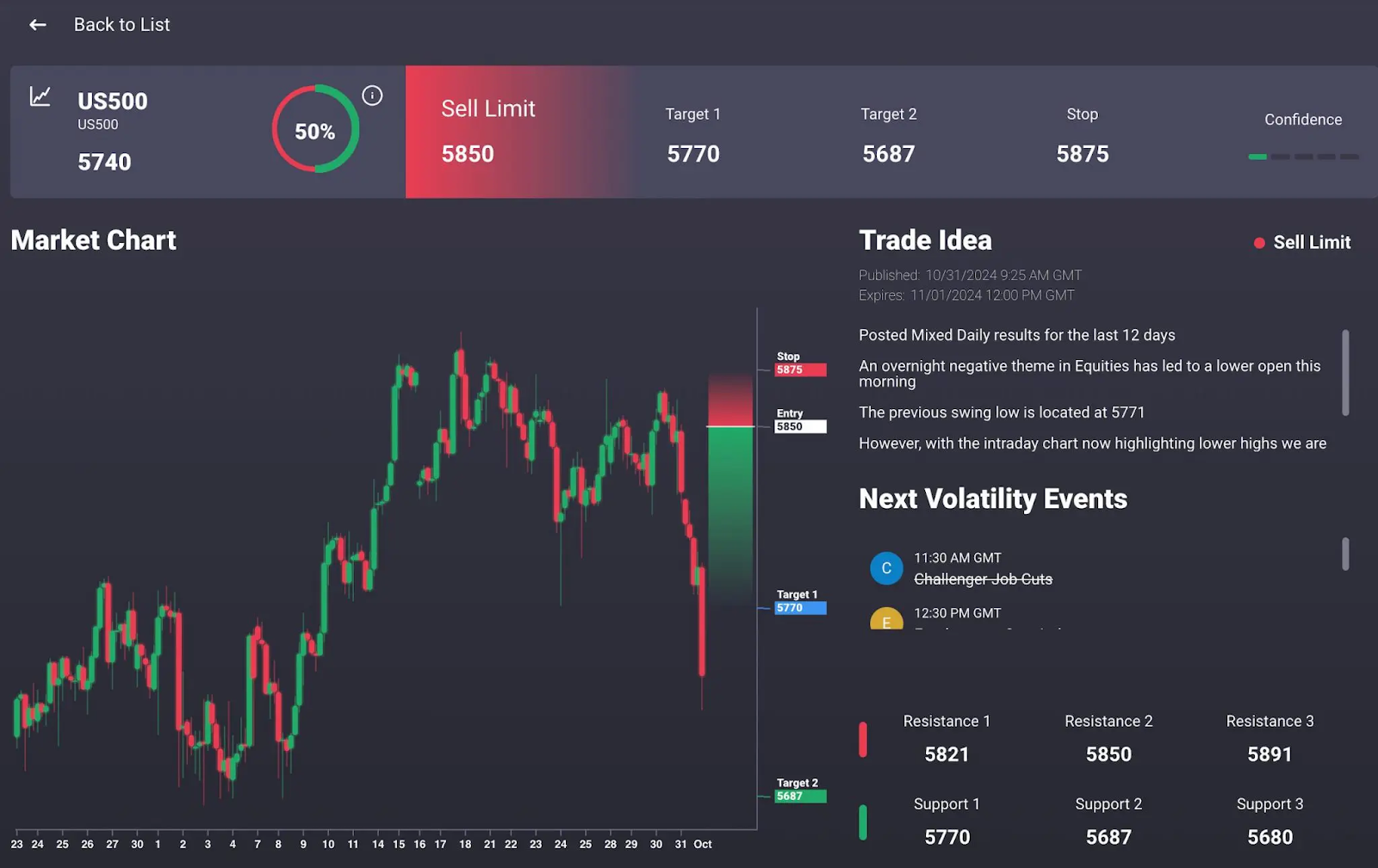

Exness focuses on equipping traders with cutting-edge tools and technology to optimize their trading experience. The platform’s integration with TradingView offers advanced charting capabilities, allowing traders to analyze market trends and execute trades seamlessly. Additionally, Exness provides real-time market data, customizable leverage, instant withdrawals, and robust risk management features such as negative balance protection. These tools cater primarily to experienced traders looking for high performance and efficiency.

In contrast, FXTM emphasizes education and trader development through its Learning Hub, making it an excellent choice for beginners and intermediate traders. The platform offers a wealth of educational resources, including webinars, tutorials, trading guides, and market analysis, to help users build foundational trading knowledge. FXTM’s focus on trader education empowers users to gain confidence and improve their strategies over time. While Exness appeals to tech-savvy professionals, FXTM’s Learning Hub ensures accessibility for those seeking a more knowledge-based approach to trading. Both brokers bring valuable offerings, tailored to different levels of expertise and trading needs.

TradingView on Exness vs FXTM’s Proprietary Features

Exness stands out with its integration of TradingView, a leading charting platform known for its advanced technical analysis tools and robust alert systems. This partnership allows traders to seamlessly analyze markets, create custom indicators, and execute trades directly from TradingView’s interface. The availability of multi-timeframe analysis, over 100 built-in indicators, and a vibrant social trading community enhances the decision-making process for Exness users. TradingView’s precision and compatibility make it ideal for experienced traders seeking sophisticated tools.

On the other hand, FXTM offers proprietary features tailored to its user base, including tools like the FXTM Invest program, which allows users to copy trades from experienced professionals. This is particularly beneficial for beginners or passive investors looking for simplified trading strategies. FXTM also provides proprietary calculators and analytics designed to optimize trade planning and risk management. While Exness focuses on delivering technical excellence for advanced analysis, FXTM’s proprietary features prioritize accessibility and strategic convenience, making them more appealing to a broader range of traders. Both platforms provide unique advantages, depending on a trader’s goals and experience level.

Exness vs FXTM: For Beginners or Professionals?

When deciding between Exness and FXTM, your trading experience level plays a crucial role. Exness is better suited for professionals and experienced traders who value advanced tools, tight spreads, and fast execution. With its integration of TradingView, customizable leverage options, and instant withdrawals, Exness provides the precision and efficiency that seasoned traders demand. It also offers comprehensive analytical tools, making it ideal for those with established strategies looking for optimal performance.

FXTM, on the other hand, caters more effectively to beginners and intermediate traders. Its Learning Hub is packed with educational resources such as webinars, tutorials, and market insights, making it a perfect choice for those new to trading. FXTM also offers a range of account types, including cent accounts, which allow novices to practice trading with smaller investments. Additionally, features like copy trading via FXTM Invest simplify the learning curve, enabling less experienced traders to benefit from the expertise of professionals.

Ultimately, professionals may gravitate toward Exness for its advanced features and market efficiency, while beginners and learners may find FXTM’s supportive environment and educational resources more beneficial. Both brokers are excellent choices but cater to distinct trading needs.

Promotions and Bonuses

When it comes to promotions and bonuses, FXTM is a clear leader, offering a variety of incentives designed to attract and support traders. FXTM frequently provides deposit bonuses, cashback programs, and trading competitions, which are particularly appealing to beginners looking to boost their initial capital or seasoned traders seeking additional rewards for their activity. These promotions are often tailored to specific account types and regions, providing flexibility and value to different types of traders.

In contrast, Exness takes a more streamlined approach, focusing on delivering superior trading conditions rather than promotional offers. Exness does not rely heavily on bonuses, choosing instead to enhance the trading experience through features like ultra-tight spreads, customizable leverage, and instant withdrawals. This approach is more aligned with experienced traders who prioritize performance and efficiency over short-term incentives.

While FXTM’s bonuses and promotions are attractive for those starting out or looking for additional perks, Exness appeals to traders who value transparency and consistent trading advantages without relying on incentives. Your choice depends on whether you prioritize ongoing promotions or a focus on trading performance.

Exness or FXTM Wins for Your Trading Style?

he choice between Exness and FXTM ultimately depends on your trading style, experience, and priorities. If you are an experienced trader seeking tight spreads, high leverage, and advanced tools like TradingView integration, Exness is the superior option. Its focus on seamless execution, instant withdrawals, and robust analytics makes it ideal for professionals who prioritize efficiency and performance in their trading journey.

On the other hand, FXTM is a better fit for beginners or traders who value educational resources and support. With features like its Learning Hub, flexible account types, and promotional bonuses, FXTM caters to those looking to build their skills and gain confidence. Its copy trading options also provide an excellent opportunity for passive investors or less experienced traders to benefit from expert strategies.

For professionals and tech-savvy traders, Exness delivers the advanced infrastructure and features needed for high-level trading. For those starting out or seeking guidance, FXTM’s supportive environment and incentives make it the preferred choice. Evaluate your goals and experience to determine which broker aligns best with your trading style.

Conclusion

Both Exness and FXTM are reliable brokers, but their strengths cater to different trader profiles. Exness is ideal for experienced traders who value low costs, instant withdrawals, and high leverage. On the other hand, FXTM is a better choice for beginners and intermediate traders looking for robust educational resources, account flexibility, and a more guided trading experience. Ultimately, the best broker depends on your trading goals and experience level. Exploring demo accounts with both brokers is a practical way to make the right decision.

FAQ

Which broker offers better spreads?

Exness generally provides tighter spreads, while FXTM offers fixed spreads on certain accounts.

Are both brokers regulated?

Yes, both Exness and FXTM are regulated by multiple top-tier financial authorities, ensuring trader safety and compliance.

Which broker is better for beginners?

FXTM is better for beginners due to its extensive educational resources, including webinars and tutorials, and flexible account options.

Do both brokers support MT4 and MT5?

Yes, both brokers offer access to MT4 and MT5 platforms for trading.

Which broker processes withdrawals faster?

Exness is known for its instant withdrawal feature, making it faster than FXTM for most payment methods.

Can I use high leverage with these brokers?

Exness offers leverage up to 1:Unlimited, while FXTM provides more conservative leverage options depending on the account type.

Are there any fees for deposits and withdrawals?

Exness does not charge fees for deposits or withdrawals. FXTM may charge fees depending on the payment method used.