13 minute read

Is Exness Banned in India?

Forex trading has become increasingly popular in India, with many traders seeking to profit from global currency markets. As more people look to international brokers like Exness, it’s important to understand the legal landscape surrounding their use in India. While Exness is a well-known global forex broker, Indian traders often wonder whether it is banned or legal to trade with Exness from within India.

In this article explore the legal status of Exness in India, the regulatory framework that governs forex trading, and whether Exness faces any specific restrictions or bans in the country. Discuss potential challenges Indian traders may encounter when using Exness, including issues related to payment methods and regulatory compliance, as well as how to navigate these hurdles to ensure safe and legal trading.

What is Exness?

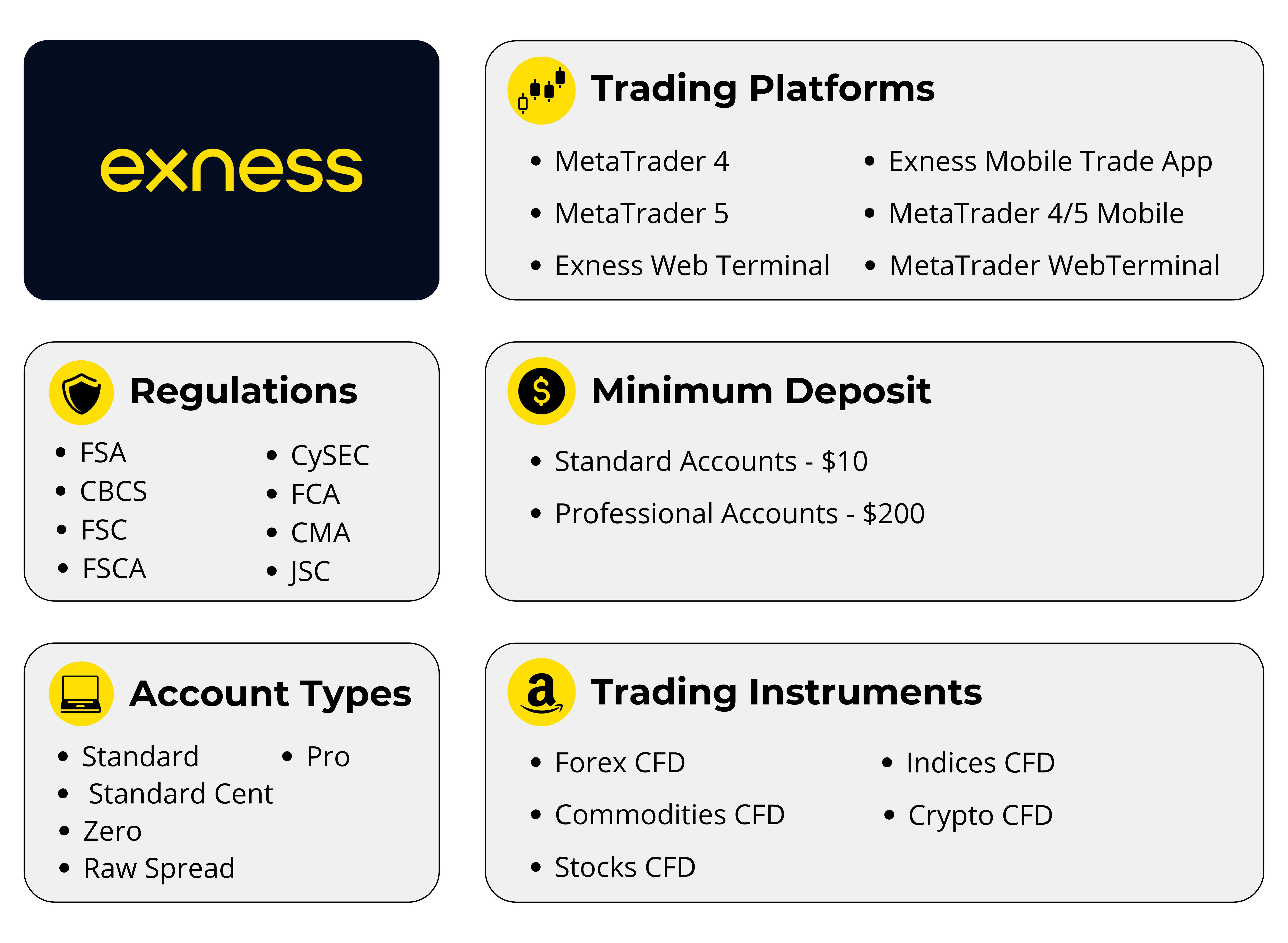

Exness is a well-established global forex and financial services broker, providing online trading solutions for retail and institutional clients worldwide. Founded in 2008, Exness has built a strong reputation within the financial industry by offering a wide range of services, including forex trading, commodities, indices, and cryptocurrencies. The company is known for its advanced trading platforms, transparent pricing, and competitive trading conditions, which attract both new and experienced traders.

Key features of Exness:

Regulatory Compliance: Exness is regulated by several respected financial authorities around the world, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). This ensures that Exness adheres to international standards of financial regulation, which promotes a safe and secure trading environment for clients.

Variety of Trading Instruments: Exness offers a diverse range of financial instruments, such as forex currency pairs, commodities, indices, cryptocurrencies, and stocks. This allows traders to explore a wide variety of trading opportunities across different asset classes.

Flexible Account Types: Exness provides multiple account types to cater to different levels of traders, from beginners to professionals. The account types include Standard, Pro, and ECN, each designed to suit different trading styles and preferences.

Competitive Trading Conditions: Exness offers competitive spreads, low commissions, and flexible leverage options, allowing traders to optimize their trading strategies. The broker is also known for offering zero spread accounts on some platforms, which can be especially beneficial for high-frequency traders.

Start Trading: Open Exness Account or Visit Website

Exness's Regulatory Status in India

Exness, while being a globally recognized forex broker, is not directly regulated by Indian financial authorities, such as the Reserve Bank of India (RBI) or the Securities and Exchange Board of India (SEBI). This absence of regulation by Indian authorities places Exness in a unique position within India’s forex trading ecosystem.

1. Exness and Indian Regulatory Bodies

In India, the regulatory environment for forex trading is primarily governed by the SEBI and the RBI. SEBI oversees financial markets and the conduct of brokers operating within India, ensuring compliance with local laws, investor protection, and market integrity. Meanwhile, the RBI regulates foreign exchange and capital flows in and out of India, ensuring that transactions comply with the Foreign Exchange Management Act (FEMA).

2. Does the Lack of Indian Regulation Affect Exness?

The lack of regulation by Indian authorities does not necessarily mean that Exness is illegal to use in India. Indian traders are still allowed to access Exness’s services, and there are no official laws or regulations that explicitly ban its use. However, the key issue is the lack of consumer protection under Indian law, meaning that any disputes or issues that arise between Indian traders and Exness would have to be resolved through the legal systems of the jurisdictions where Exness is regulated.

3. Indian Government’s Stance on Forex Trading

The Indian government, through the RBI, has placed restrictions on currency trading by Indian residents, primarily to prevent unauthorized capital outflows and maintain control over the Indian Rupee (INR). According to FEMA, Indian citizens are only allowed to trade forex through SEBI-registered brokers or banks offering forex trading services. This means that Indian traders who wish to engage in forex trading legally should ideally use platforms that comply with local regulations, which includes brokers regulated by SEBI or authorized Indian banks.

4. Exness's Compliance with Indian Law

Exness does not operate as a fully regulated broker within India, which means it does not comply with all local laws that apply to forex brokers in the country. However, Exness does adhere to global regulatory standards set by the authorities in the countries where it is licensed, such as:

FCA (UK): One of the most respected financial regulators globally, ensuring that Exness follows stringent rules regarding transparency, fund protection, and fair trading practices.

CySEC (Cyprus): Regulates Exness’s operations in Europe and ensures that it meets all necessary legal requirements for customer protection.

FSCA (South Africa): Provides additional regulation for Exness’s operations in Africa.

5. Is Exness Completely Compliant with Indian Forex Rules?

Exness's operations are not fully compliant with India’s FEMA and RBI regulations for trading forex, especially in terms of capital movement and the ability to make cross-border payments without restrictions. As mentioned, while Exness itself is not banned in India, traders may face limitations when it comes to transferring funds between their Indian bank accounts and Exness accounts. Local banks in India might impose certain restrictions on international transactions, including payments to and from foreign forex brokers like Exness.

Is Exness Banned in India?

No, Exness is not banned in India. Indian traders are legally allowed to use Exness to trade in the global forex market. There are no official regulations or government bans preventing Indian traders from accessing or using Exness's services. However, while Exness is accessible in India, there are important considerations regarding its regulatory status and the challenges that Indian traders may face.

Regulatory Status of Exness in India

Exness is a well-regulated broker globally, with licenses from financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). However, Exness is not regulated by Indian financial authorities, such as the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI). This means that Exness operates outside the purview of Indian regulatory laws, and Indian traders using the platform are not covered by local consumer protection regulations.

Legal Considerations for Indian Traders

While Exness itself is not banned in India, Indian traders must be aware of the legal framework surrounding forex trading in the country. Forex trading is legal in India under certain conditions, and traders must comply with the Foreign Exchange Management Act (FEMA), which governs cross-border capital movements. The RBI regulates the flow of currency and ensures that Indian citizens do not engage in unauthorized foreign exchange transactions.

3. Challenges Faced by Indian Traders

Payment Restrictions: The RBI controls the movement of funds across borders, and local banks may impose restrictions on transactions with international brokers like Exness. Traders might have difficulty depositing or withdrawing funds from Exness through traditional banking methods, as Indian banks often restrict payments related to forex trading that does not comply with FEMA regulations.

Consumer Protection: Because Exness is not regulated by Indian financial authorities, traders in India do not have the same legal recourse or consumer protection they would have with a SEBI-registered broker. If issues arise, such as difficulties withdrawing funds or disputes with the broker, Indian traders cannot rely on local regulatory bodies to resolve the situation.

4. Alternatives for Indian Traders

While Exness is not banned, Indian traders who are concerned about these regulatory issues may consider using brokers that are regulated by SEBI or authorized by the RBI. These brokers comply with local laws and offer more direct protection for Indian traders. Some Indian brokers provide access to global markets while ensuring compliance with Indian regulations, giving traders a safer and more secure option for trading.

Start Trading: Open Exness Account or Visit Website

Legal and Regulatory Considerations for Indian Traders

Forex trading in India is legal, but it is subject to strict regulations set by Indian financial authorities, particularly the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These regulations are designed to maintain financial stability, control capital flows, and ensure that traders engage in activities that comply with Indian laws. However, the situation becomes more complex when traders choose to use international brokers like Exness, which are not regulated by Indian authorities.

The Foreign Exchange Management Act (FEMA) governs all foreign exchange transactions in India and places limits on the kinds of currency trading that Indian residents can engage in. While residents are allowed to trade in foreign currencies, they must do so within the constraints of FEMA. Indian traders are generally required to use SEBI-registered brokers or brokers affiliated with authorized Indian banks to trade forex. These local brokers must adhere to strict guidelines designed to protect investors and ensure that the trading activity does not undermine the stability of the Indian Rupee (INR) or facilitate illegal capital flight.

Exness is regulated by financial authorities outside India, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). While Exness operates under stringent global regulations, it is not licensed or regulated by SEBI or RBI, meaning that Indian traders who choose to trade with Exness are not protected under Indian laws. This can create significant risks, particularly when it comes to consumer protection, since Indian traders have no recourse to Indian regulatory bodies in the event of disputes or problems with the broker.

Start Trading: Open Exness Account or Visit Website

Benefits of Exness in India

Despite the regulatory challenges that Indian traders face when using international brokers like Exness, the platform offers several advantages that make it appealing to Indian traders. These benefits include access to global markets, advanced trading tools, competitive trading conditions, and customer support. Here are some of the key benefits of using Exness for forex trading in India:

1. Global Market Access

Exness provides Indian traders with access to global forex markets, enabling them to trade a wide range of financial instruments, including currency pairs, commodities, indices, and cryptocurrencies. This global exposure allows traders to diversify their portfolios and capitalize on opportunities in various markets that may not be available with local brokers. Whether it's trading major currency pairs like EUR/USD or exploring emerging market currencies, Exness provides a broader scope for trading compared to Indian brokers that are typically limited to domestic markets.

2. Competitive Trading Conditions

One of the standout features of Exness is its competitive trading conditions, which include low spreads, zero commission accounts, and flexible leverage options. For traders in India, this can mean more favorable trading costs compared to local brokers, especially when looking to engage in high-volume or short-term trading. Exness offers tight spreads, which can help traders minimize their trading costs, particularly for those who trade frequently or with larger positions.

3. Advanced Trading Platforms

Exness offers two of the most popular and reliable trading platforms in the world: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their user-friendly interface, advanced charting tools, and customizability, making them ideal for both beginner and experienced traders. MT4 and MT5 allow traders to execute trades with ease, use automated trading systems (Expert Advisors), and analyze market data in real-time with a variety of technical indicators and chart patterns.

4. Regulation and Transparency

Although Exness is not regulated by SEBI or the RBI in India, it is regulated by several top-tier financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). These licenses ensure that Exness adheres to strict standards of financial transparency, fund security, and fair trading practices. Exness is required to maintain segregated accounts for client funds, ensuring that client money is protected in case of the broker’s insolvency.

5. Customer Support

Exness offers 24/7 customer support in multiple languages, including Hindi, which is highly beneficial for Indian traders who may need assistance at any time. The support team is accessible via live chat, email, and phone, providing prompt responses to queries related to trading, account management, and technical issues. This level of support is crucial, especially for traders who are new to forex trading or who face issues with account deposits, withdrawals, or technical platform usage.

Conclusion

Exness is not banned in India, and Indian traders can legally use the platform to engage in forex trading. There are no specific laws or regulations that prohibit the use of Exness in India. However, while the broker is accessible, it is important to note that Exness is not regulated by Indian financial authorities like SEBI or the RBI, meaning that Indian traders are not covered by local consumer protection laws.

Although Exness provides a secure and well-regulated trading environment globally, the lack of local regulation poses potential risks for Indian traders, such as issues with payment processing and the absence of legal recourse under Indian law in case of disputes. Indian traders may face challenges with cross-border transactions due to RBI restrictions, making it crucial to use reliable payment methods.

FAQs

Is Exness Legal in India?

Yes, Exness is legal to use in India. There are no laws that ban Exness, but it is not regulated by Indian authorities like SEBI or RBI, which means Indian traders are not covered by local regulations.

Is Exness Banned in India?

No, Exness is not banned in India. Indian traders can access Exness and trade, but they must be aware of potential issues with payment processing and the lack of local regulatory protection.

Can Indian Traders Withdraw Funds from Exness?

Yes, Indian traders can withdraw funds from Exness, but they may face challenges with RBI regulations on capital movement, which could lead to delays or difficulties in using certain payment methods for withdrawals.

What Payment Methods Can Indian Traders Use with Exness?

Indian traders can use various payment methods with Exness, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. However, local banks may impose restrictions on international payments.

Does Exness Provide Customer Support in India?

Yes, Exness offers 24/7 customer support in multiple languages, including Hindi, making it accessible to Indian traders for assistance with accounts, technical issues, or queries about trading.

Is Exness Safe for Indian Traders?

Exness is regulated by major global authorities, like FCA and CySEC, ensuring a secure trading environment. However, the lack of local regulation means Indian traders do not have consumer protection under Indian law.

Can I Trade with Exness in Indian Rupees (INR)?

Exness does not offer direct trading in Indian Rupees (INR), but traders can still trade in other global currencies. Some Indian traders use alternative payment methods like e-wallets or cryptocurrency to bypass payment restrictions.