13 minute read

Is the Exness Forex Broker Banned or Legal in Pakistan?

Forex trading has gained significant popularity in Pakistan in recent years, with many traders looking to capitalize on the global currency markets. However, the legal landscape for forex trading in Pakistan remains a subject of interest and concern. The rise of online trading platforms has made it easier for Pakistani traders to access international brokers, but it also raises questions about the legality and regulations surrounding such platforms.

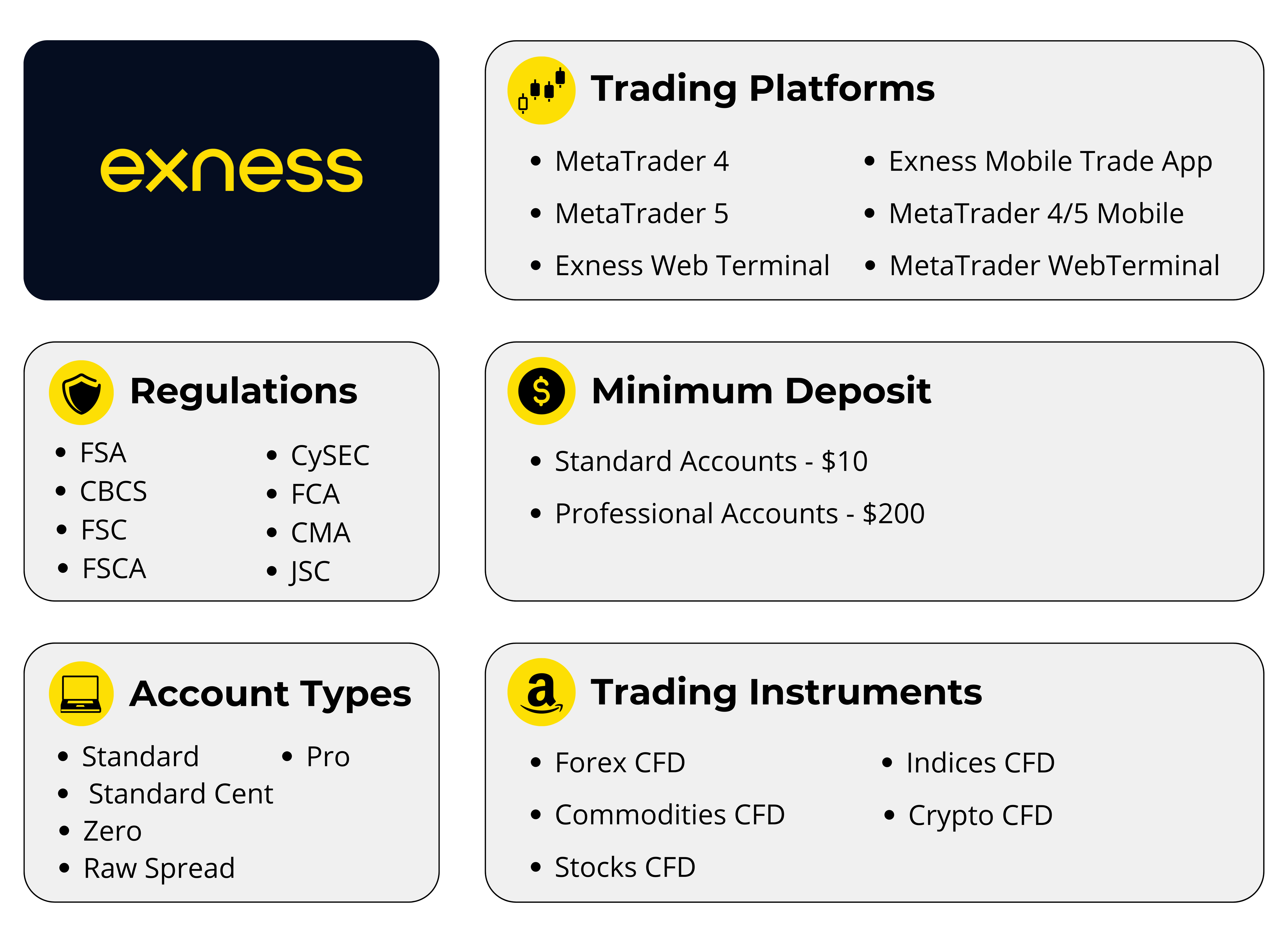

One of the popular brokers in the forex industry is Exness, known for offering competitive trading conditions, various account types, and advanced platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). But for traders in Pakistan, a pressing question is whether Exness is banned or legal to use.

What is Exness?

Exness is a global online forex and financial services broker that provides trading solutions to retail and institutional clients worldwide. Founded in 2008, Exness has quickly established itself as one of the leading players in the forex trading industry. The broker is known for offering a user-friendly experience, competitive spreads, and a wide range of financial instruments to trade, including currency pairs, commodities, indices, and cryptocurrencies.

Some key features of Exness include:

Regulation and Licensing: Exness is regulated by several top-tier financial authorities across the globe, ensuring that it operates under stringent standards and offers secure trading conditions.

Global Presence: The broker serves clients from over 150 countries and supports multiple languages, making it a truly international forex broker.

Variety of Account Types: Exness offers several account types, including Standard, Pro, and ECN accounts, catering to both beginners and experienced traders.

Competitive Spreads and Leverage: Traders benefit from low spreads and flexible leverage options, depending on their account type and trading preferences.

Start Trading: Open Exness Account or Visit Website

Exness in Pakistan

Exness has become a popular choice among traders worldwide, including those in Pakistan, due to its competitive trading conditions and user-friendly platforms. However, the question of whether Exness can be used legally and safely in Pakistan is an important consideration for traders in the country.

1. Exness's Operations in Pakistan

While Exness is a global broker with clients in over 150 countries, it does not have a physical office or regulatory presence in Pakistan. The broker operates primarily under the regulatory oversight of several international authorities, including the UK’s Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and others.

2. Challenges and Restrictions

Despite the absence of an official license from the SECP, Exness is not specifically banned in Pakistan. However, the Pakistani government has imposed some restrictions on forex trading in the past, primarily concerning the use of local financial institutions for international transactions.

3. How Exness Provides Services to Pakistani Traders

Despite these challenges, Exness remains accessible to Pakistani traders who are interested in trading forex. The broker provides the following options to Pakistani clients: Account Types: Pakistani traders can choose from various account types, such as Standard, Pro, and ECN, depending on their trading preferences and experience.

4. Legal Status of Exness in Pakistan

Currently, Exness is not banned in Pakistan, and there are no official regulations that prevent traders from using the platform. However, as mentioned, Pakistan's regulatory framework does not officially recognize Exness or other international brokers in the same way it recognizes local brokers. This creates some level of uncertainty for traders, as they are not fully protected under Pakistani law.

Overview of Forex Trading in Pakistan

Forex trading, or foreign exchange trading, has experienced significant growth in Pakistan in recent years. With a large number of individuals seeking opportunities in global financial markets, forex has become an attractive option for many. The appeal of trading currencies stems from the potential for profit from fluctuations in exchange rates. Given that currency markets are open 24 hours a day, five days a week, traders in Pakistan can access the market at any time to make trades based on market conditions, political events, and economic reports. Moreover, platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have made it easier for Pakistani traders to participate in the forex market, offering advanced charting tools, automated trading capabilities, and a user-friendly experience.

However, despite its popularity, forex trading in Pakistan is subject to a complex regulatory environment. While the Securities and Exchange Commission of Pakistan (SECP) governs investment activities and financial markets, it does not directly regulate online forex brokers. Instead, the State Bank of Pakistan (SBP) oversees the country's foreign exchange policies and governs capital flows. Although there are no clear regulations governing online forex brokers in Pakistan, trading is legal as long as it adheres to general guidelines set by the SBP and the SECP.

The absence of direct oversight from local regulatory bodies like the SECP means that traders in Pakistan may face certain challenges when using international brokers. The SBP has imposed restrictions on capital movement in and out of the country, which could impact how traders deposit and withdraw funds from their trading accounts. For instance, local banks may limit transactions to international forex brokers or block certain payment methods due to regulatory concerns.

Start Trading: Open Exness Account or Visit Website

Regulation of Forex Brokers in Pakistan

The regulation of forex brokers in Pakistan is a key concern for traders looking to participate in the global forex markets. In Pakistan, forex trading is legal, but the regulatory framework governing the activities of forex brokers is somewhat limited, especially for those operating internationally. While the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP) oversee aspects of financial markets and the foreign exchange sector, the lack of specific regulations for online forex brokers creates a regulatory gap that traders must navigate.

Securities and Exchange Commission of Pakistan (SECP)

The SECP is the principal regulatory authority overseeing financial markets and investment activities within Pakistan. It primarily regulates capital markets, securities, and other financial instruments within the country. However, when it comes to online forex brokers, the SECP does not have direct jurisdiction.

State Bank of Pakistan (SBP)

The State Bank of Pakistan (SBP) plays a critical role in regulating the country’s foreign exchange policies. The SBP’s main responsibility is to maintain the stability of the Pakistani Rupee (PKR) and manage capital flows in and out of the country. The central bank regulates foreign currency transactions, including the exchange of currencies between domestic and international markets.

Challenges with International Forex Brokers

While forex trading is legal in Pakistan, most international forex brokers, such as Exness, are not licensed by the SECP or SBP to operate within the country. This means that traders who choose to use international brokers do so without the protection and oversight of local authorities. In case of fraud, technical issues, or disputes, Pakistani traders may have limited recourse under Pakistani law.

Payment Restrictions and Capital Movement

A significant challenge for traders in Pakistan is the regulation of capital movement, which is controlled by the SBP. This affects how funds are deposited into and withdrawn from foreign trading accounts. While local payment methods such as bank transfers or credit card payments are sometimes available, they are often subject to restrictions. Many Pakistani traders turn to global e-wallets like Skrill, Neteller, and Perfect Money, but even these methods are not always universally accepted by all banks or payment processors in Pakistan.

Start Trading: Open Exness Account or Visit Website

Is Exness Banned in Pakistan?

Exness, a leading global forex broker, is not officially banned in Pakistan. Pakistani traders can access Exness’s services and use its platforms to trade in the forex market. However, while the broker is not prohibited, it operates in a regulatory gray area since it is not licensed by Pakistan's financial authorities, such as the Securities and Exchange Commission of Pakistan (SECP) or the State Bank of Pakistan (SBP).

1. Regulatory Oversight in Pakistan

Exness, like many international forex brokers, does not have an official license from the SECP to operate within Pakistan. However, the absence of a specific license does not necessarily mean that Exness is banned or illegal to use in the country. Pakistan’s regulatory framework does not currently regulate or oversee online forex brokers that operate outside its jurisdiction.

2. Payment Restrictions and Challenges

Although Exness is not banned in Pakistan, traders may face difficulties in making deposits and withdrawals due to local financial restrictions. The State Bank of Pakistan (SBP) has control over foreign currency exchanges and capital flows, and some local banks may block or restrict payments to and from international forex brokers, including Exness. Pakistani traders may need to rely on third-party payment solutions like Skrill, Neteller, or Perfect Money to fund their Exness accounts, as these methods are often more accessible for international transactions.

3. Exness’s Global Regulatory Compliance

Exness is regulated by several respected financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). This means that Exness adheres to strict regulatory standards in countries where it holds licenses. These regulations are designed to ensure transparency, client protection, and secure trading conditions.

4. Is Exness Safe for Pakistani Traders?

While Exness is not banned, and it is generally considered a reliable and well-regulated broker globally, Pakistani traders must exercise caution when trading with brokers that are not directly regulated by local authorities. The lack of local oversight means that if there are disputes or issues with fund withdrawals, traders will not have the same legal recourse they would have when dealing with local, regulated brokers.

Legal Status of Exness in Pakistan

The legal status of Exness in Pakistan is a subject of interest for many traders who wish to engage in forex trading using this popular international broker. While Exness is not banned in Pakistan, its legal standing is somewhat ambiguous due to the lack of specific regulation by Pakistani financial authorities, such as the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP). Here’s an overview of Exness’s legal status and what traders need to know:

Exness is Not Banned in Pakistan

Exness is not banned in Pakistan, and Pakistani traders are not prohibited from using Exness to trade on the forex markets. The broker offers its services to clients in Pakistan, allowing them to open trading accounts, deposit funds, and trade in various financial instruments such as forex, commodities, and cryptocurrencies. There are no official government decrees or regulations that have explicitly banned the use of Exness in the country.

Regulatory Gaps and Risks

Exness operates globally and is regulated by several top-tier financial authorities in other jurisdictions, such as the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and South African Financial Sector Conduct Authority (FSCA). These licenses provide traders with a certain level of protection and security, as Exness is required to adhere to international standards for transparency, client safety, and financial reporting.

Forex Trading is Legal in Pakistan

Forex trading, in general, is legal in Pakistan, as long as traders comply with the SBP’s regulations governing the foreign exchange market. The SBP controls currency exchanges, capital movement, and cross-border transactions, which can sometimes impact how funds are transferred for forex trading. While Pakistani traders are free to trade with international brokers, local banks may sometimes restrict payments or withdrawals related to forex transactions, particularly when they involve unregulated foreign brokers like Exness.

Challenges with Payments and Withdrawals

One of the main issues faced by Pakistani traders using Exness is the challenge of making payments and withdrawals due to the financial restrictions imposed by the SBP and local banks. While Exness offers a variety of payment methods such as bank transfers, e-wallets (Skrill, Neteller), and credit cards, Pakistani traders often encounter difficulties with these payment methods because some local financial institutions restrict or block transactions related to forex trading.

Conclusion

Exness is not banned in Pakistan. Pakistani traders are legally allowed to use Exness to engage in forex trading. However, while the broker is accessible, it operates outside the regulatory framework of Pakistani financial authorities such as the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP). This means that Exness is not directly regulated by Pakistan’s laws, and traders are not covered by local legal protections.

Although trading with Exness is legal in Pakistan, traders should be aware of the regulatory gaps and potential risks, including challenges with payment processing due to local financial restrictions. Since the SBP controls capital movement and foreign currency transactions, Pakistani traders may face difficulties with deposits and withdrawals when using international forex brokers like Exness.

FAQs

Is Exness Legal in Pakistan?

Yes, Exness is legal to use in Pakistan. There are no laws that specifically ban Exness or restrict Pakistani traders from using the platform. However, Exness is not regulated by Pakistani authorities like the SECP or SBP, which means local legal protections do not apply.

Is Exness Banned in Pakistan?

No, Exness is not banned in Pakistan. While it is not officially licensed by Pakistani regulators, there are no restrictions or bans preventing Pakistani traders from using Exness to trade on the forex market.

Can Pakistani Traders Withdraw Funds from Exness?

Yes, Pakistani traders can withdraw funds from Exness. However, due to restrictions by the State Bank of Pakistan (SBP) and local banks on foreign transactions, some traders may experience difficulties with certain payment methods. Using alternative methods like Skrill, Neteller, or Perfect Money is often recommended.

Is It Safe to Use Exness in Pakistan?

While Exness is a well-regulated and trusted broker globally, traders in Pakistan face risks related to the lack of local regulation and potential payment issues. It is essential to ensure secure payment methods and be cautious about the risks of trading with an unregulated broker in Pakistan.

What Payment Methods Can Pakistani Traders Use with Exness?

Pakistani traders can use various payment methods with Exness, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. However, traders may face some restrictions from local banks and payment processors when making international transactions.

Does Exness Offer Customer Support in Pakistan?

Yes, Exness offers customer support to Pakistani traders in multiple languages, including Urdu. Traders can contact customer support for assistance with account management, payment issues, and general trading inquiries.

Can I Open an Exness Account from Pakistan?

Yes, Pakistani traders can open an account with Exness. The account registration process is straightforward and can be completed online. Once the account is open, traders can deposit funds and begin trading in various financial instruments like forex, commodities, and cryptocurrencies.