10 minute read

Exness Withdrawal Common Issues and How to Resolve Them

Exness is renowned for its instant withdrawal feature, allowing traders to access their funds quickly and efficiently. However, like any financial system, occasional withdrawal issues can arise due to technical errors, incomplete account verification, or user mistakes. These challenges can cause unnecessary delays or complications, especially for traders who need immediate access to their funds.

Understanding common withdrawal issues and knowing how to resolve them can help ensure a smoother experience. This guide highlights the most frequent withdrawal problems faced by Exness traders and provides practical solutions to address them effectively. By following these steps, you can navigate withdrawal challenges with confidence and maintain uninterrupted access to your trading profits.

Introduction of Exness Withdrawal

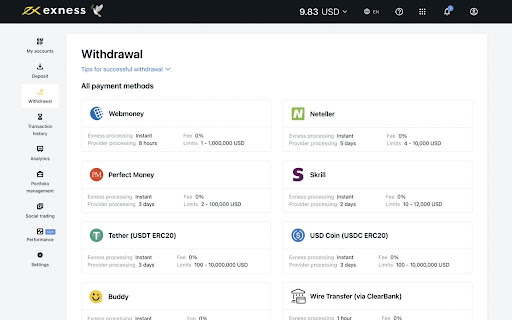

Exness is widely recognized for its efficient and user-friendly withdrawal process, enabling traders to access their funds quickly and seamlessly. With a variety of supported payment methods, including bank transfers, e-wallets, and cryptocurrencies, Exness caters to the diverse needs of traders worldwide. One of its standout features is instant withdrawals, which ensure that funds are processed within seconds for most payment methods, offering unparalleled convenience.

To make the most of Exness’ withdrawal system, it’s essential to understand the process, rules, and potential challenges. Whether you’re a beginner navigating your first withdrawal or an experienced trader looking for optimized fund management, Exness provides the tools and support to ensure a smooth transaction experience. This guide explores the key aspects of Exness withdrawals and tips for hassle-free access to your earnings.

Start Trading: Open Exness Account or Visit Website

Common Withdrawal Issues on Exness

While Exness offers a seamless and efficient withdrawal process, traders may occasionally encounter issues that can delay or complicate their transactions. Understanding these common problems and their causes can help you address them effectively and ensure a smooth withdrawal experience.

1. Incorrect Payment Details

One of the most frequent issues arises from entering incorrect payment details. Mistakes such as mismatched account names, wrong account numbers, or choosing an unsupported payment method can result in delayed or failed withdrawals. Ensuring that your payment details are accurate and consistent with your registered account information is crucial.

2. Unverified Account

Exness requires all accounts to be fully verified before processing withdrawals. If your Proof of Identity (POI) or Proof of Residence (POR) documents are incomplete, invalid, or not submitted, your withdrawal request may be rejected or delayed. Verification ensures compliance with international regulations and secures your account from unauthorized access.

3. Pending Withdrawal Status

A withdrawal marked as "pending" can occur for several reasons, such as high transaction volumes, payment system delays, or additional security checks. While Exness typically processes withdrawals instantly, external factors related to the payment provider may cause temporary delays.

4. Exceeding Withdrawal Limits

When using multiple payment methods, Exness applies a proportional withdrawal rule, meaning you can only withdraw amounts proportional to your deposits made with each method. Exceeding these limits or misunderstanding the proportionality rules can lead to withdrawal errors.

5. Currency Conversion Challenges

Withdrawing funds in a currency different from your account balance may result in delays or unexpected charges due to currency conversion. Issues can also arise if your selected payment method does not support the chosen currency.

6. Payment Method Restrictions

Some payment methods are restricted in certain regions, or their availability may vary. Choosing an unsupported payment option for your region can result in withdrawal failures. It’s essential to check the availability of methods specific to your country in the Exness Personal Area.

7. Technical Glitches

Although rare, technical issues such as platform errors, connectivity interruptions, or outdated app versions can interfere with the withdrawal process. These problems are often temporary and can usually be resolved by troubleshooting or contacting Exness support.

How to Resolve Common Withdrawal Issues on Exness

Withdrawal issues can be frustrating, but most problems encountered on Exness are easy to resolve with the right steps. Here’s a guide to addressing the most common withdrawal challenges effectively:

Double-Check Payment Details

Ensure that your payment information, such as account numbers, names, and payment methods, is accurate and matches your Exness account details.

Solution: Update any incorrect payment details in your Personal Area before submitting a withdrawal request. Avoid entering mismatched names or account numbers to prevent processing delays.

Complete Account Verification

Exness requires account verification to comply with international regulations and ensure security. Without full verification, withdrawal requests may be declined.

Solution: Upload valid Proof of Identity (POI) and Proof of Residence (POR) documents in your Personal Area. Ensure the documents are clear and legible. Common mistakes include expired documents, unclear images, or mismatched details. Correct these issues and resubmit for verification.

Address Pending Withdrawal Status

If your withdrawal is marked as "pending," it could be due to external payment system delays or additional security checks.

Solution: Wait a few hours, as most pending requests are resolved automatically. If the issue persists, contact Exness’ 24/7 customer support and provide the withdrawal reference number for faster assistance.

Understand and Manage Withdrawal Limits

Exness applies proportional withdrawal rules when multiple payment methods are used, which can lead to errors if limits are exceeded.

Solution: Ensure withdrawals are proportional to deposits made with each payment method. For example, if you deposited 60% via bank transfer and 40% via e-wallet, your withdrawals must follow the same ratio. Check the deposit and withdrawal history in your Personal Area to track your limits.

Resolve Currency Conversion Challenges

Currency conversion issues can occur when withdrawing funds in a currency different from your account balance.

Solution: Use a payment method that supports your preferred withdrawal currency. Alternatively, maintain a wallet or bank account in the same currency as your trading account to avoid delays and conversion fees.

Choose a Supported Payment Method

Certain payment methods may be unavailable in specific regions, leading to withdrawal failures.

Solution: Verify the list of supported payment methods for your country in the Exness Personal Area. If your preferred method is unavailable, choose an alternative method supported in your region.

Troubleshoot Technical Issues

Occasional platform errors or app glitches can interrupt the withdrawal process.

Solution: Refresh your trading platform, clear the browser cache, or update your app to the latest version. Restart your device if necessary. For persistent issues, report the problem to Exness support with screenshots or error messages for resolution.

Start Trading: Open Exness Account or Visit Website

Tips for Smooth Exness Withdrawals

To ensure a hassle-free withdrawal experience on Exness, traders can follow these practical tips. By being proactive and adhering to platform guidelines, you can avoid common issues and access your funds quickly and efficiently.

1. Complete Account Verification Early

Account verification is a mandatory step to unlock full withdrawal features. Ensure that your Proof of Identity (POI) and Proof of Residence (POR) documents are submitted and approved before initiating a withdrawal.

Tip: Use clear, high-quality scans of valid documents and double-check that the details match your registered information.

2. Double-Check Payment Details

Accurate payment information is critical for smooth withdrawals. Any discrepancies in account numbers, names, or payment methods can result in delays.

Tip: Review and confirm your payment details in your Personal Area before submitting a withdrawal request.

3. Use the Same Payment Method for Deposits and Withdrawals

Exness requires that withdrawals be made using the same method as deposits, in line with proportional withdrawal rules. This ensures transparency and compliance with anti-money laundering regulations.

Tip: Maintain consistency in your deposit and withdrawal methods to avoid errors or processing issues.

4. Be Mindful of Proportional Withdrawal Rules

When using multiple payment methods, withdrawals must follow the same proportion as your deposits. Exceeding these limits can lead to errors.

Tip: Check your deposit history to calculate withdrawal limits for each payment method and plan accordingly.

5. Monitor Currency Preferences

Currency mismatches between your trading account and withdrawal method can result in delays or additional conversion fees.

Tip: Use payment methods that support the same currency as your trading account to minimize conversion costs and processing times.

6. Keep Payment Methods Updated

Outdated or unsupported payment methods may lead to failed transactions or delays.

Tip: Regularly update your payment details in the Exness Personal Area and ensure the method is supported in your region.

7. Stay Within Regional and Method Limits

Certain payment methods may have regional restrictions or specific withdrawal limits.

Tip: Verify the withdrawal limits and availability of payment methods in your region to avoid complications.

8. Avoid Peak Transaction Times

High transaction volumes during peak periods may cause temporary delays in processing withdrawals.

Tip: Schedule withdrawals during off-peak hours to increase the likelihood of faster processing.

9. Keep Your Platform Updated

Using outdated versions of the Exness trading platform or mobile app can result in technical issues.

Tip: Regularly update your platform or app to the latest version for smooth operation and access to new features.

10. Maintain Records of Transactions

Keeping track of your deposit and withdrawal transactions can help you identify and resolve issues more effectively.

Tip: Save confirmation emails and monitor your withdrawal status in the Personal Area for better transaction management.

Conclusion

Exness offers a seamless and efficient withdrawal process, enabling traders to access their funds quickly and securely. While occasional issues may arise, most can be easily resolved with a proactive approach and adherence to the platform’s guidelines. Completing account verification, double-checking payment details, and understanding proportional withdrawal rules are key steps to ensure smooth transactions.

Start Trading: Open Exness Account or Visit Website

By leveraging Exness’ robust system, including instant withdrawals and 24/7 multilingual support, traders can enjoy a hassle-free experience. With proper planning and attention to detail, you can confidently manage your funds and focus on achieving your trading goals. Should any challenges persist, Exness’ dedicated customer support is always available to provide assistance and ensure your concerns are addressed promptly.

FAQs

Why is my withdrawal request pending on Exness?

A pending withdrawal status may occur due to external payment provider delays, high transaction volumes, or additional security checks. It usually resolves automatically within a few hours.

What documents are required for account verification?

Exness requires Proof of Identity (POI) and Proof of Residence (POR) documents for verification. Ensure these documents are valid, clear, and match your registered details.

Can I withdraw funds using a different payment method from my deposit?

No, Exness requires withdrawals to be made using the same payment method as the deposit, following the proportional withdrawal rule.

What is the minimum withdrawal amount on Exness?

The minimum withdrawal amount depends on the payment method. For example, e-wallets typically have lower minimums compared to bank transfers.

Why was my withdrawal request rejected?

Common reasons include incorrect payment details, unverified accounts, exceeding withdrawal limits, or using unsupported payment methods. Double-check your details and account status.

Are there fees for withdrawals on Exness?

Exness generally does not charge withdrawal fees. However, third-party payment providers may apply their own fees, especially for currency conversions.

How long does it take to process a withdrawal?

Most Exness withdrawals are processed instantly. However, external factors, such as payment provider processing times, may occasionally cause delays.