MID-YEAR 2025

MID-YEAR 2025

Welcome to the Engel & Volkers Florida 2025 mid-year end Luxury Real Estate Market Report! The year has started with transactions and prices being stagnate in many of Florida’s real estate submarkets and price declines in other property types and geographical areas as the number of homes for sale has increased substantially.

Uncertainty has dominated most of the economic narrative in 2025, and this along with higher interest rates has led to normalization of the once hot Florida luxury market. Florida is the outright leader in the number of second homes owned in the United States, along with being a leader in population growth. These long-term macro trends will continue as the population continues to grow, however, not at the rate that was witnessed in 2020 and 2021. The number of new construction starts is beginning to align with the number of individuals moving to the state, and as the inventory is sold off prices will resume their growth trajectory.

With tax policy and economic policy being established by a new federal administration, the uncertainty that remains is with interest rates. However, unlike last year, it is not a matter of whether the Federal Reserve will cut rates but when. The stock market has continued to reach all-time highs in 2025, and with lower interest rates on the horizon and reaching a low point in housing prices will have combined effect to spur investors, second home, and primary residence purchasers to accelerate their return into the market and propel the number of sales and prices forward.

What is the immediate future hold before interest rates decline? Concessions are being made on most homes for sale. Buyers have negotiating power in a lot of situations with more listings to choose from and sellers need to have home priced strategically and align with a real estate company that has enhanced marketing tools to gain the best result. While the statewide average sales price remained the same year over year, variance between markets is at all-time high. With that in mind, please look at our market-bymarket analysis closely as there is not a statewide general real estate market, nor is it the same for the different property types.

At Engel & Volkers luxury is not just a price point but a different level of service for all our clients. On behalf of all our franchise owners and real estate advisors we look forward to helping you with local expertise to make informed decisions.

Sincerely,

Peter Giese — CEO of Engel & Völkers Florida

Florida's market is cooling down, and that's good news for buyers. You have more homes to choose from and prices are holding steady, but not soaring like they used to.

Florida, known as the Sunshine State, offers a diverse blend of vibrant cities, picturesque beaches, and rich cultural heritage. From the bustling metropolis of Miami and the historic charm of St. Augustine to the serene beauty of the Gulf Coast and the thrilling attractions of Orlando, Florida presents a lifestyle for every preference. The state boasts a robust economy, no state income tax, and a year-round warm climate, making it a desirable destination for both residents and investors. Whether it's waterfront living, golf course communities, or urban luxury, Florida's real estate market continues to thrive, attracting those seeking both primary residences and vacation getaways.

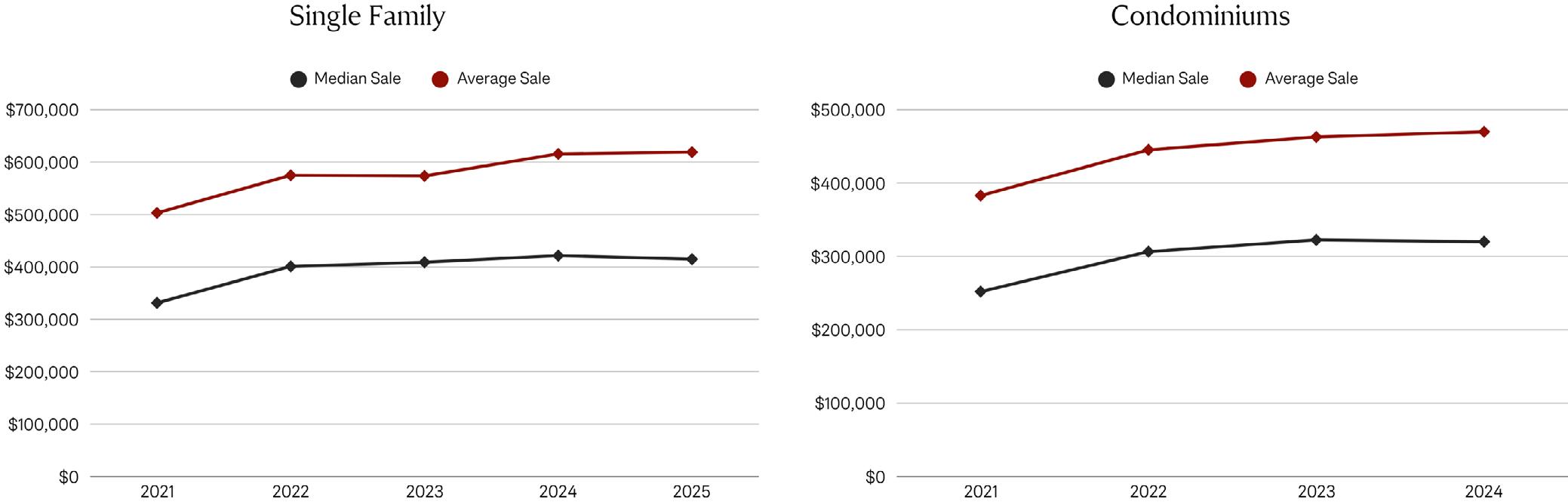

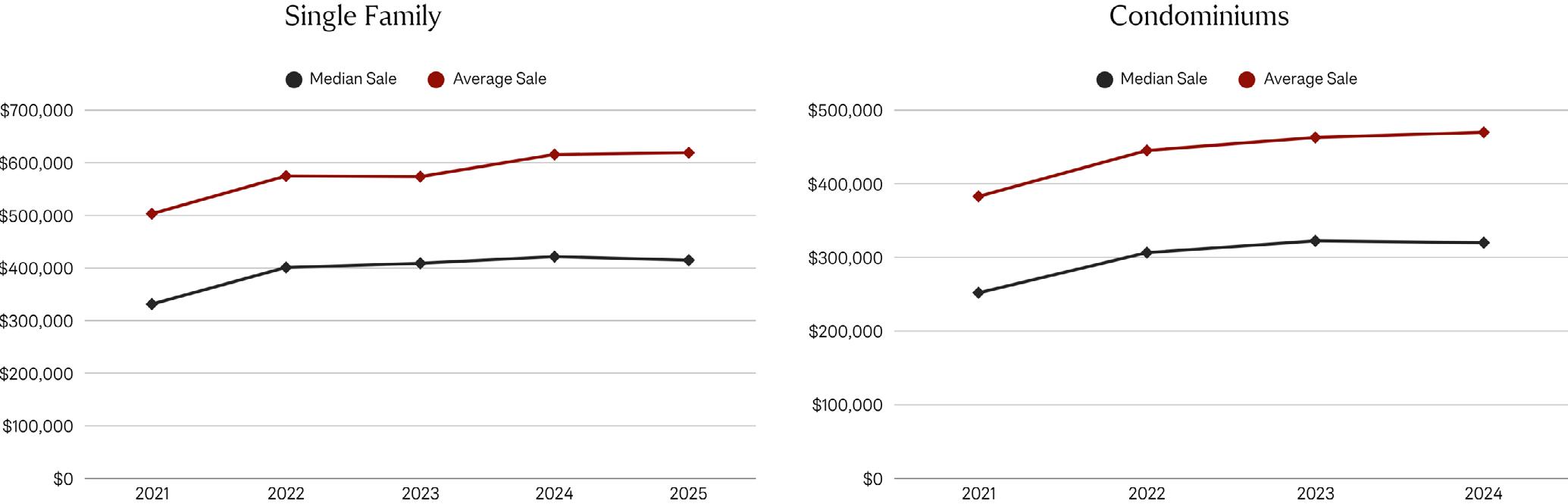

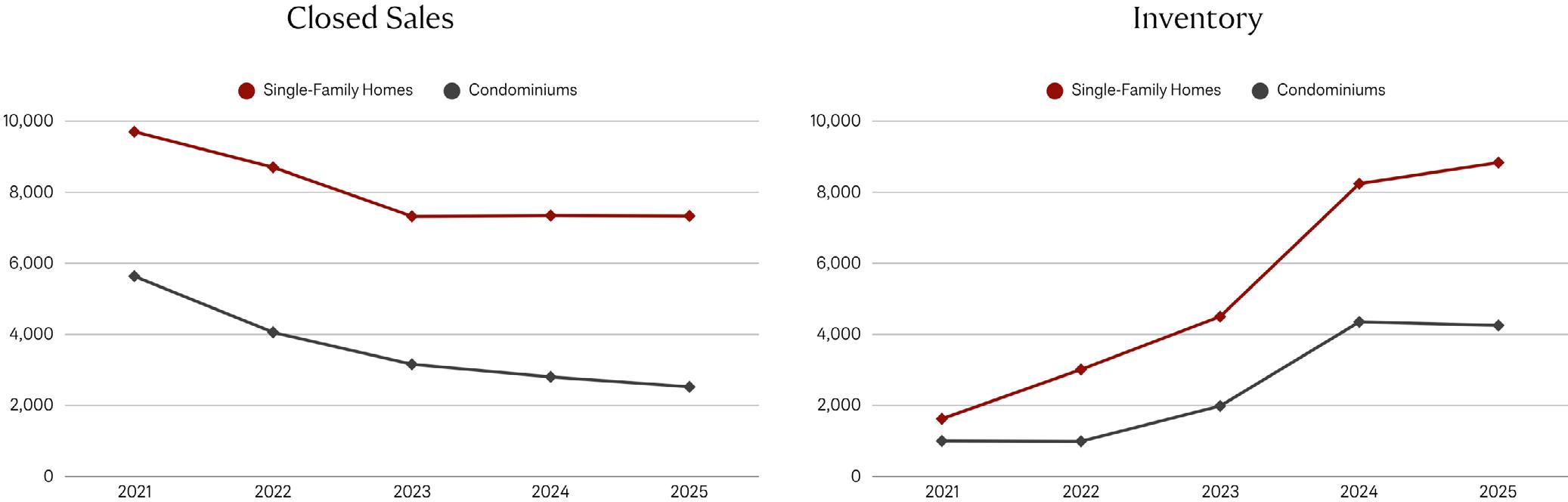

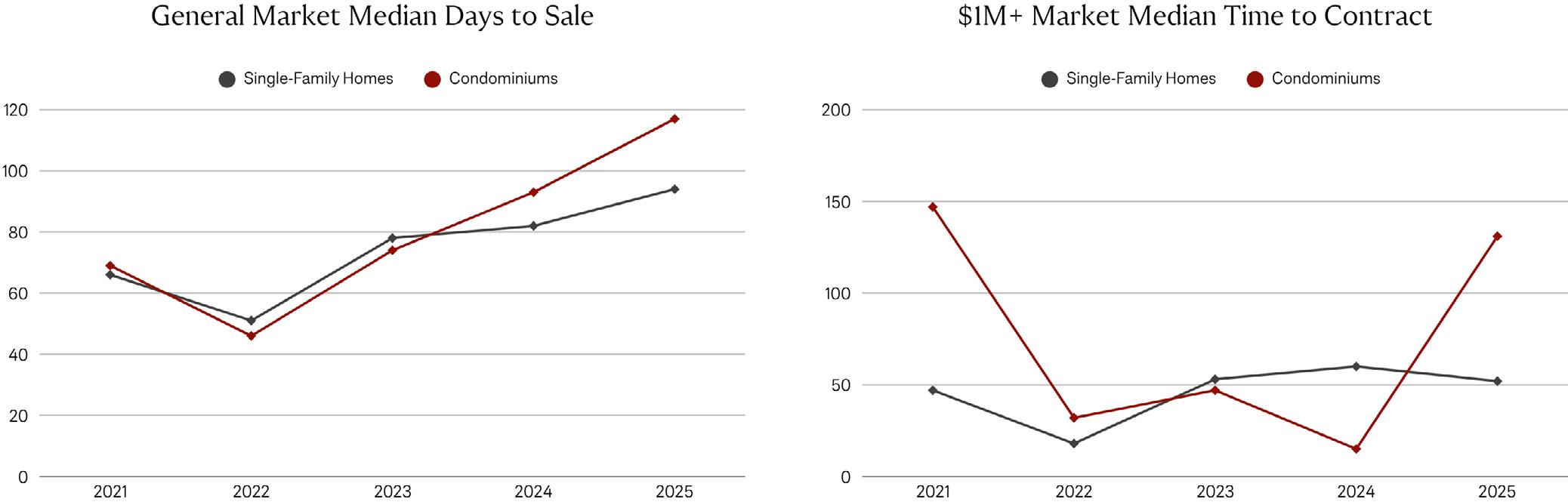

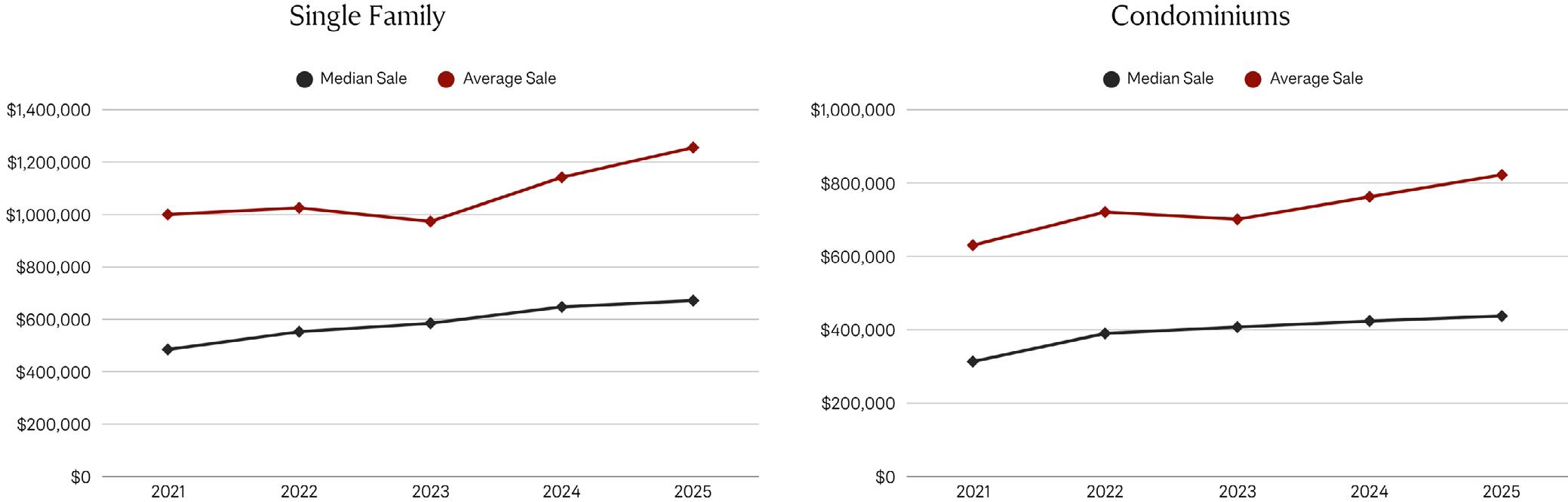

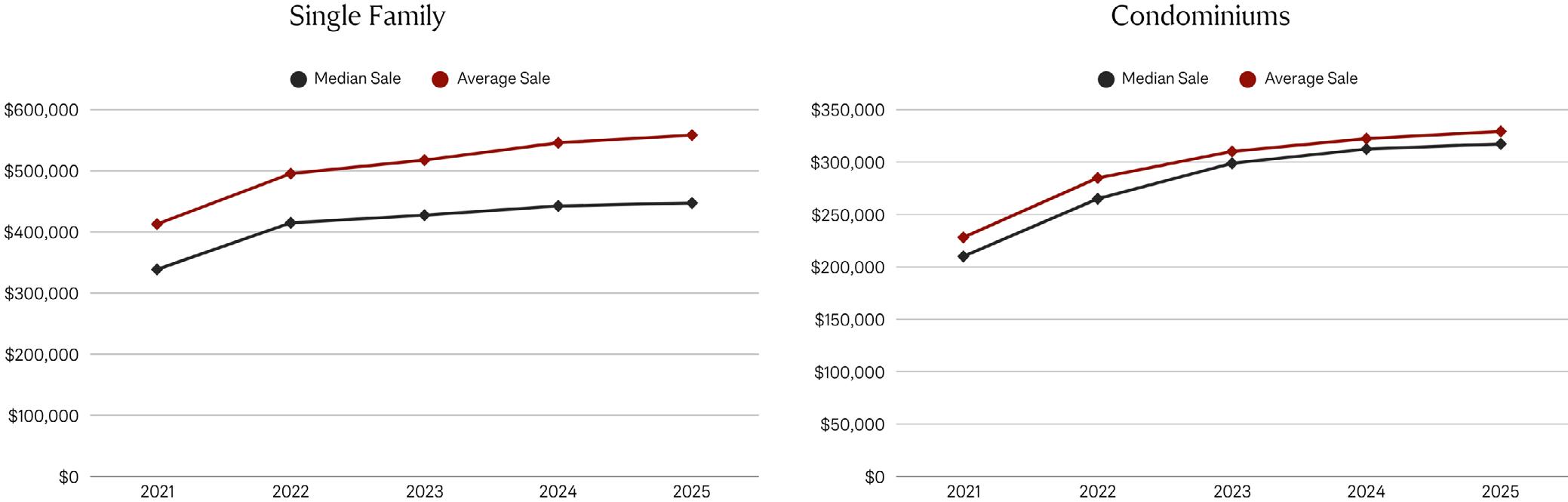

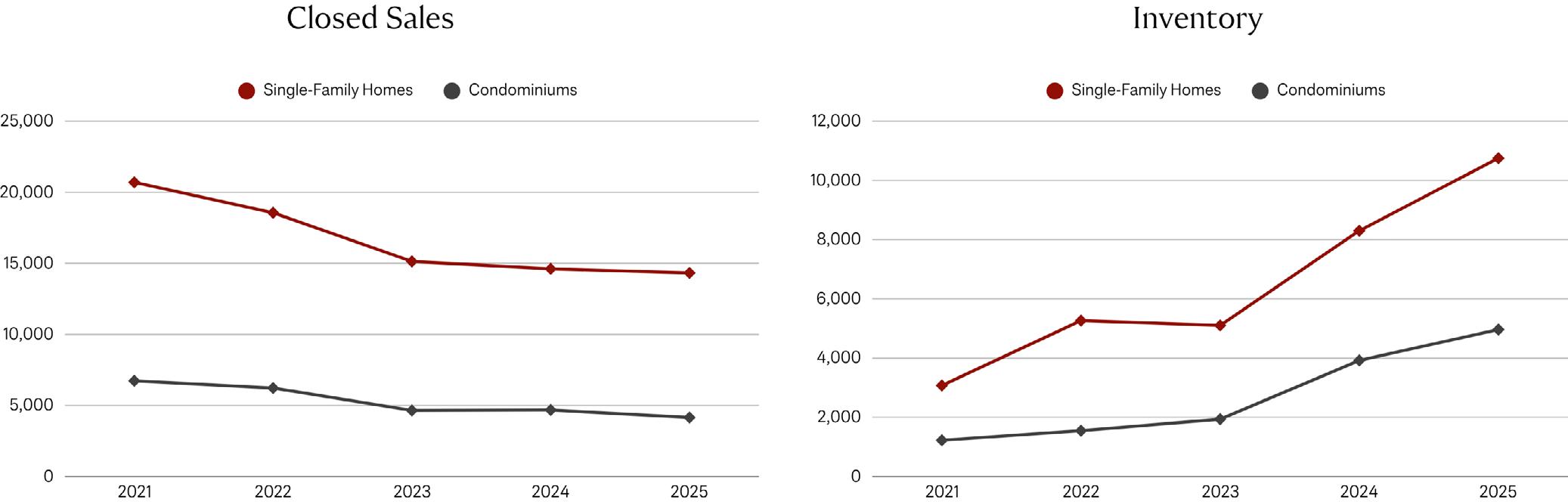

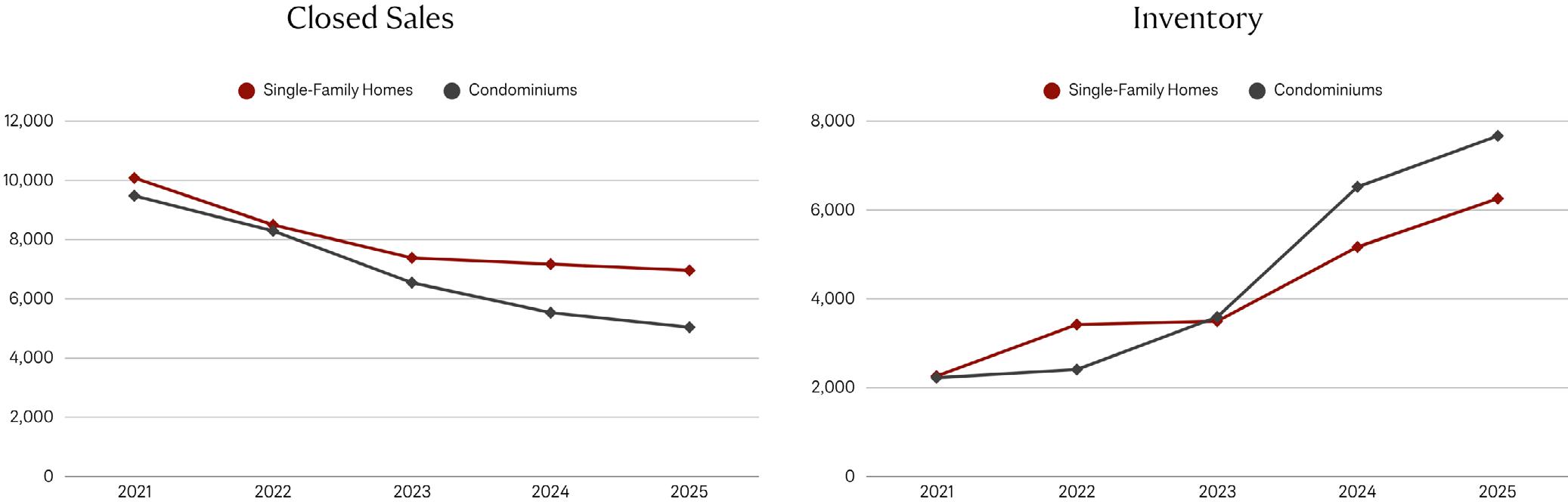

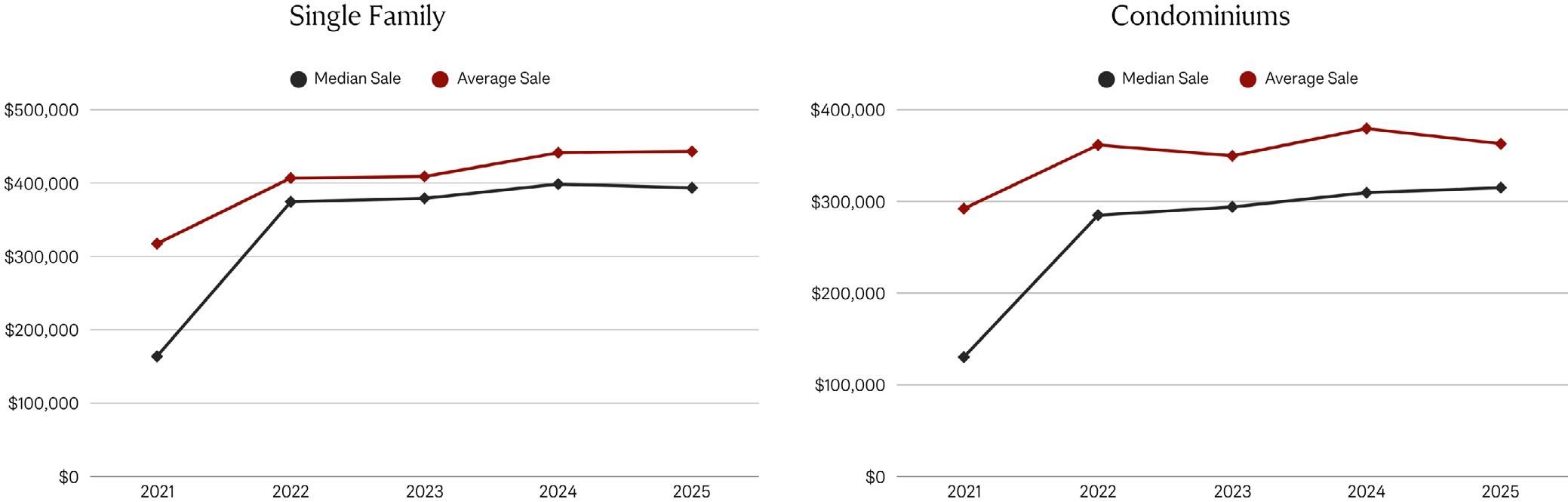

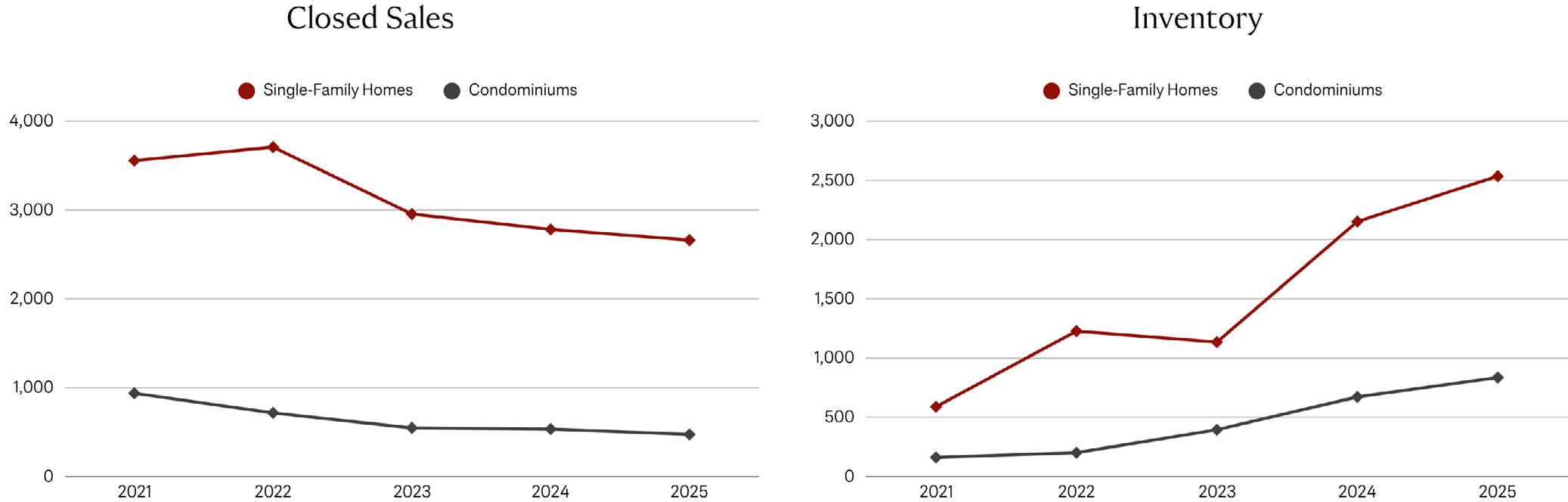

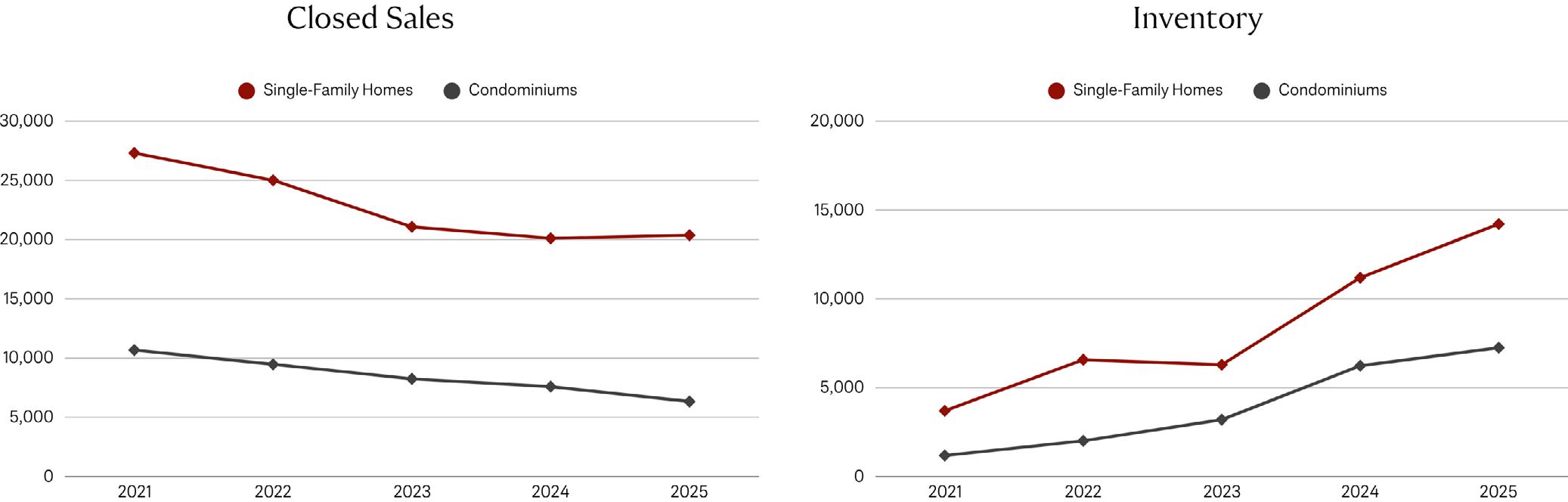

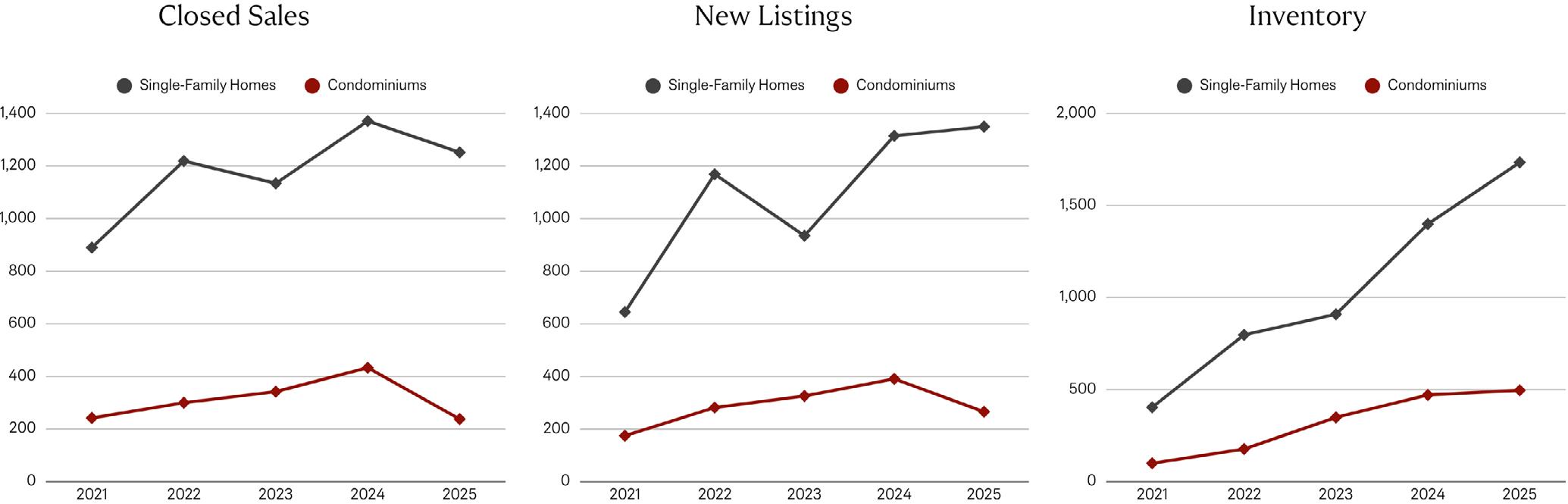

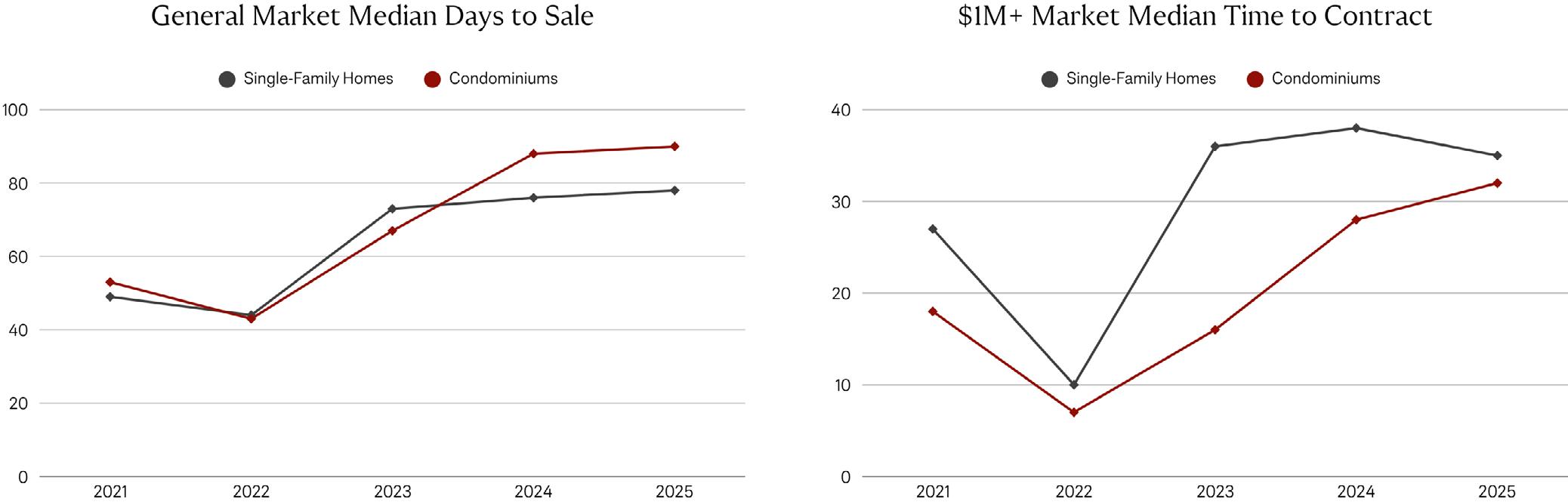

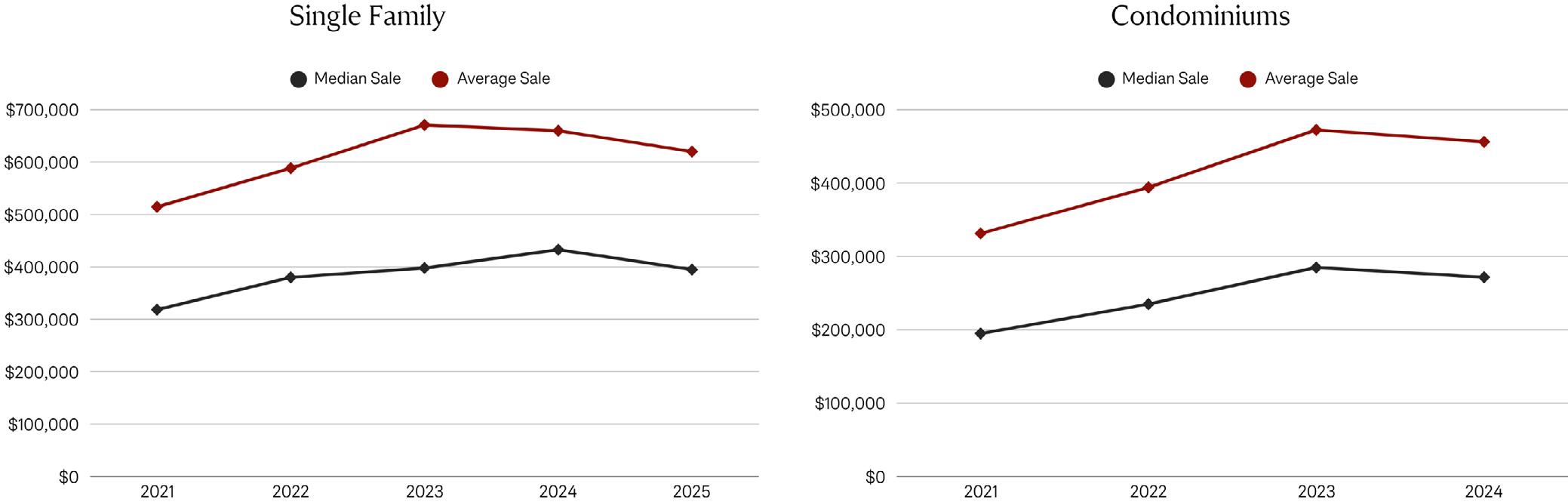

The single-family market across Florida is navigating a new era of thoughtful recalibration, with resilient values holding firm despite a moderation in sales volume. Closed sales have steadily decreased from 176,767 in 2021 to a more measured 128,364 by mid-2025, reflecting a significant shift from the high-demand pace of previous years. Despite this trend, median sale prices have shown remarkable strength, climbing to $414,728 by mid-2025, a testament to the state’s enduring desirability.

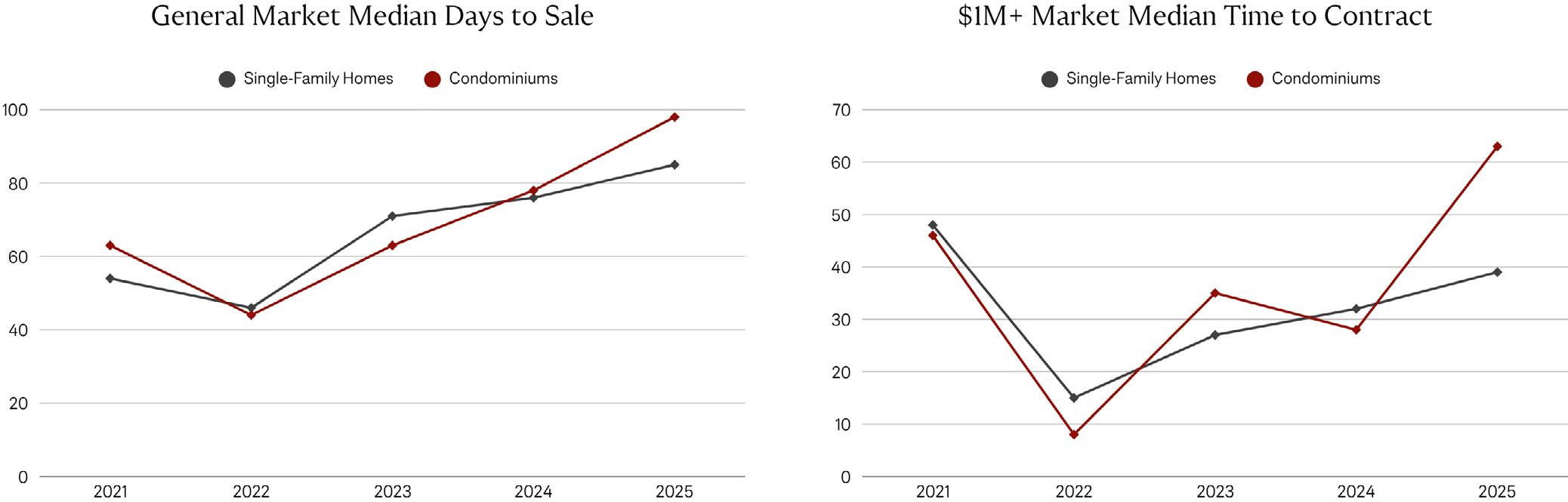

This new market rhythm is defined by a significant lengthening of the sales cycle, with the median days to sale extending to 90.5 days, providing discerning buyers with ample opportunity for due diligence. This shift is empowered by a dramatic expansion of inventory, which has surged from 32,835 units in 2021 to a substantial 115,678 by mid-2025. This confluence of factors indicates a transition to a more balanced market, where clients can now exercise greater negotiation leverage.

The Florida condominium market is navigating a significant shift, with a consistent and sharp reduction in sales volume signaling a new era of buyer power. Closed sales have decreased dramatically from 86,481 in 2021 to a more subdued 45,568 by mid-2025, highlighting a cooling of demand that has reshaped the landscape for sellers. This shift is reflected in a recent price recalibration, as the median price adjusted from its 2024 peak of $327,750 to $312,500, marking a transition to a more deliberate market.

This new reality for sellers is defined by a prolonged period of deliberation, with the median days to sale extending to 103.5 days. This change in pace is a direct consequence of a continuous expansion of available inventory, which has swelled from 22,461 units in 2021 to a substantial 73,225 by mid-2025. This confluence of factors firmly establishes a strong buyer’s market, where ample supply creates intense competition among sellers and empowers discerning clients with greater leverage.

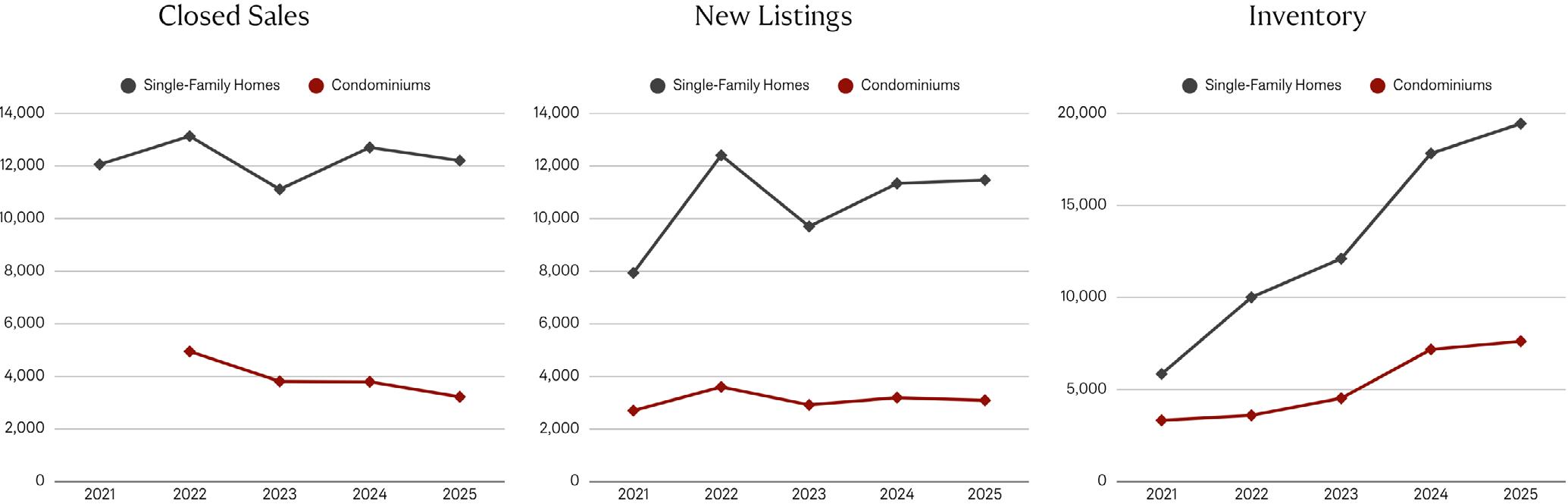

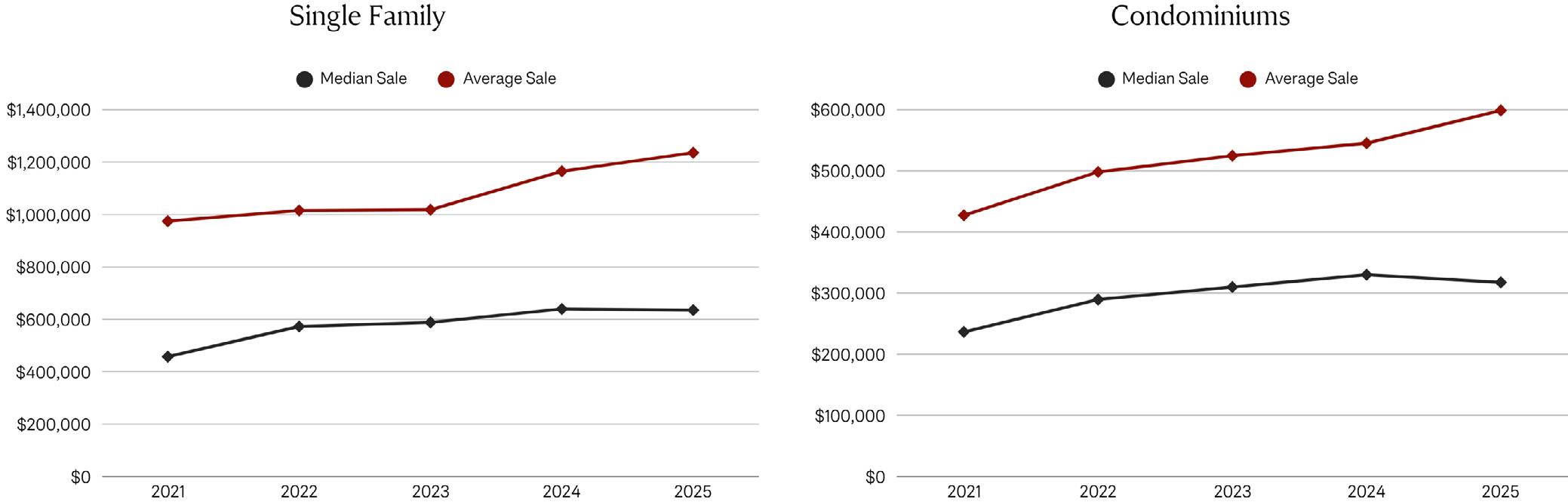

The Florida luxury single-family market is navigating a dynamic new phase, where a robust volume of high-end transactions is paired with a more considered sales cycle. Closed sales have shown strong performance, fluctuating around a high level and settling at 12,204 by mid-2025, which indicates a resilient and consistent appetite for prime residences. This enduring demand is, however, paired with a significant lengthening of the sales cycle, with the median

The Florida luxury condominium market is navigating a significant shift, with a consistent decline in sales volume paving the way for increased buyer advantage. Closed sales have decreased from 4,594 in 2021 to 3,222 by mid-2025, indicating a considerable cooling of demand in this elite segment. This slower pace is reflected in the lengthening of the sales cycle, with the median time to contract extending to a more deliberate 73 days in 2025.

time to contract extending to 53 days.

This new market rhythm is directly supported by a continuous expansion of inventory, which has grown from 5,849 units in 2021 to a significant 19,447 by mid-2025. This influx of highend homes provides discerning buyers with an unprecedented selection and a valuable window for due diligence and negotiation. This confluence of factors indicates a luxury market that is becoming more balanced, offering expanded choice while maintaining a healthy pace of transactions.

This new market rhythm is further defined by a steady upward trend in new listings and a dramatic expansion of available inventory, which has grown from 3,330 units in 2021 to 7,628 by mid-2025. This expanding selection, combined with reduced sales and extended market times, indicates a definitive transition to a buyer’s market. This dynamic provides luxury clients with ample choices and increased negotiation power compared to the competitive environment of previous years.

GROW YOUR BUSINESS WITH US

Beyond mere transactions, our exclusive ownership opportunities offer a pathway to true transformation. We provide the global advantage, tools, and unwavering support to drive exponential growth, allowing you to focus on your vision and goals. Join us, and discover the freedom to grow, sell, and own your future, together.

1,000+

FLORIDA ADVISORS

50 FLORIDA SHOPS

40+ FLORIDA FRANCHISEES

ENGEL & VÖLKERS FLORIDA MID- YEAR MARKET DETAILS

$1.285B+ SALES VOLUME

1,696 TRANSACTIONS

$757,906 AVERAGE SALE

The market has cooled down a lot, with prices dropping and homes taking much longer to sell. There's a ton more inventory, making it a strong buyer's market now.

The 30A Beaches, stretching through Bay and Gulf counties, are a collection of charming coastal communities along Florida’s scenic Highway 30A. Known for their sugar-white sands, emerald waters, and laid-back luxury, towns like Rosemary Beach, Seaside, and Grayton Beach offer a blend of upscale beach homes, boutique shops, and local dining. This area is a haven for those seeking a relaxed coastal lifestyle with an emphasis on outdoor activities, from paddleboarding and kayaking to biking along scenic trails. With its unique charm and natural beauty, the 30A Beaches continue to attract buyers looking for vacation homes, investment properties, and a slice of paradise on Florida’s Gulf Coast.

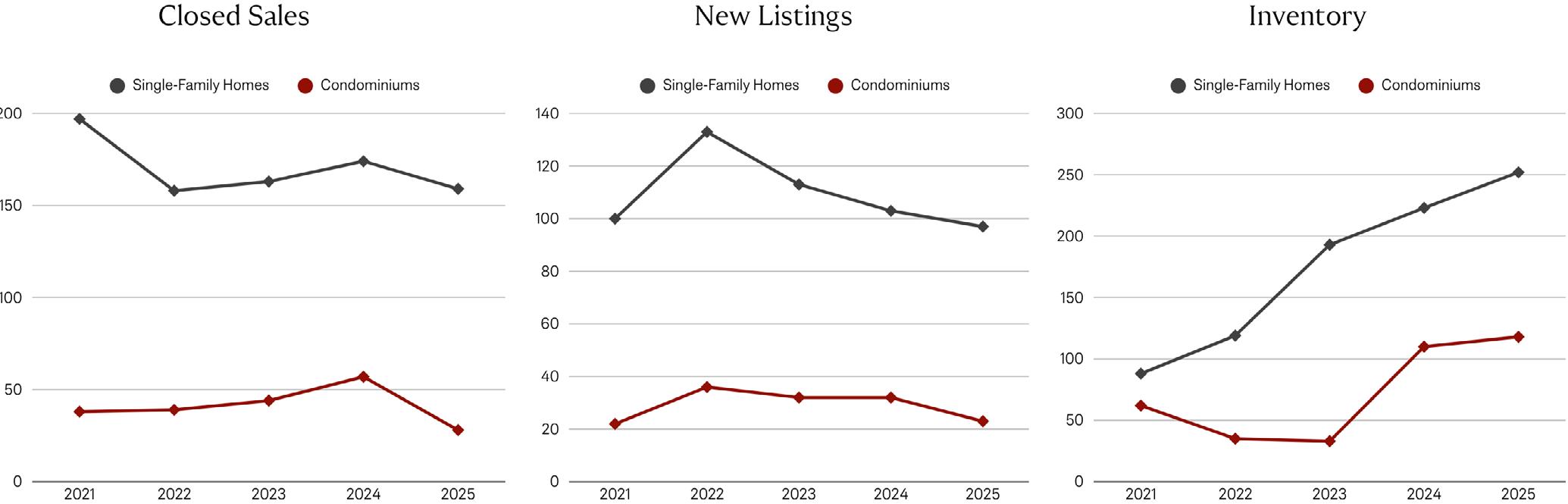

The single-family market in Panama City has entered a new phase, with a moderation in sales volume and a recalibration of prices that is creating new opportunities. After a peak in 2021, closed sales have moderated to 1,904 by mid-2025, a shift that is accompanied by a stabilization of the median sale price. The market's adjustment from its 2023 peak now offers more accessible price points for discerning clients.

This new dynamic is further defined by a significant lengthening of the sales cycle, with properties now taking 96 days to go under contract. This allows for a more deliberate purchasing process, which is empowered by a dramatic expansion of inventory to 2,420 units by mid-2025. This confluence of factors indicates a clear transition to a strong buyer-favored environment, providing clients with unparalleled choice and greater leverage.

The condominium market in this coastal region is undergoing a substantial recalibration, marked by a significant decline in sales volume and a noticeable correction in prices. Closed sales have sharply decreased from 1,558 in 2021 to a more subdued 537 by mid-2025, highlighting a notable cooling of demand in the sector. This slowdown is paired with a noticeable price correction, with the median sale price declining from its peak of $437,475 to $376,550 in 2025.

This new market rhythm is further defined by a significant lengthening of the sales cycle, with properties now taking a considerable 135 days to go under contract. This shift is empowered by a continuous expansion of inventory, which has grown to 1,386 units by mid-2025. This confluence of robust supply and a more cautious buyer sentiment firmly establishes a strong buyer’s market, where discerning clients possess greater choice and negotiation power.

The luxury single-family market in Panama City is navigating evolving dynamics, with a moderation in sales volume and a consistent lengthening of the sales cycle. Closed sales have tempered from their 2022 peak of 136 to 90 by mid-2025, signaling a more considered pace of high-end transactions. This new market rhythm is defined by a significant lengthening of the sales cycle, with the median time to contract expanding to a prolonged 129.5 days.

The luxury condominium market in Panama City remains an extremely niche segment, defined by very low transaction volumes and highly variable, extended market times. Closed sales in this elite category have remained minimal, with only four transactions by mid-2025, highlighting a very specific and limited demand. This limited activity is paired with a sales cycle that has shown extreme volatility, extending to a prolonged 98 days in 2025.

This shift is set against a backdrop of a growing supply, with luxury inventory expanding from 84 units in 2021 to 352 by mid-2025. This increasing availability, coupled with a slower sales cycle, clearly indicates a luxury market shifting toward a buyer-favored environment. The current conditions offer high-end buyers a broader selection and more favorable terms, marking a definitive departure from the urgency of previous years.

This new dynamic is further defined by a growing supply of luxury condominiums, with inventory expanding from seven units in 2021 to 57 by mid-2025. This limited but growing supply, coupled with extremely low sales volumes and extended market times, underscores the substantial leverage now available to luxury buyers. This provides a unique window for strategic acquisitions and negotiation within this niche market.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

pensacola.evrealestate.com

• Sales volume has consistently declined, while median and average sale prices have shown persistent appreciation.

• Inventory has more than doubled and median days to sale has extended considerably, indicating a transition to a more balanced market.

• Luxury single-family sales volume has fluctuated but remains robust, while median time to contract has expanded.

• Luxury condominium sales have declined significantly from their 2022 peak, with a substantial growth in inventory that favors buyers.

$1,600,000

1025 Highway A1a 902

Engel & Völkers Melbourne Beachside

Prices are still strong, but sales are slower and homes are taking longer to sell. With a lot more inventory available, the market is much more balanced for buyers.

Brevard County, known as Florida’s Space Coast, offers a unique blend of innovation and coastal living. Home to the Kennedy Space Center, the area is rich in aerospace history and continues to inspire with rocket launches visible from miles away. Beyond its space heritage, Brevard features picturesque beaches along the Atlantic, vibrant communities like Melbourne and Cocoa Beach, and abundant outdoor activities along the Indian River Lagoon.

The single-family market in Brevard County is navigating a period of moderation, where its resilient values stand firm despite a cooling of sales activity. Closed sales have consistently declined from 5,941 in 2021 to 4,768 by mid2025, a shift that has not diminished the area’s underlying property values. Median sale prices have shown consistent appreciation, climbing from $285,309 to $370,245, a testament to the enduring desirability of single-family residences in the region.

The condominium market in Brevard County has entered a period of strategic recalibration, marked by a consistent reduction in sales volume and a recent price correction. Closed sales have steadily decreased from 1,780 in 2021 to 1,011 by mid-2025, indicating a notable cooling of demand in the sector. This slowdown is paired with a noticeable correction in median prices, which declined from a peak of $299,620 to $290,000, as values soften amidst an increasing supply.

This new market rhythm is defined by a significant lengthening of the sales cycle, with median days to sale extending to a deliberate 87.5 days. This shift is empowered by a dramatic expansion of inventory, which has surged from 931 units in 2021 to 3,461 by mid-2025. This confluence of factors indicates a definitive transition to a more balanced, buyerfavored environment, providing discerning clients with greater choice and leverage.

This new dynamic is further defined by a significant lengthening of the sales cycle, with median days to sale extending to a deliberate 98.5 days. This change is directly empowered by a continuous expansion of inventory, which has grown from 337 units in 2021 to 1,393 by mid-2025. This combination of robust supply and a slower pace of sales firmly establishes a strong buyer's market, creating intense competition among sellers.

The luxury single-family market in Brevard County is navigating new dynamics, where consistent demand has been met with a longer sales cycle and an expanding supply. Closed sales have remained robust, settling at 180 by mid2025 after a peak of 186 in 2024, indicating a healthy and sustained appetite for prime residences. This enduring demand is paired with a significant lengthening of the sales

cycle, with the median time to contract extending to a more deliberate 55 days.

This shift in pace is directly correlated with a significant expansion of inventory, which has grown from 87 units in 2021 to 251 by mid-2025. This increasing supply, coupled with a longer sales cycle, indicates a luxury market that is becoming more balanced. This environment offers affluent buyers a broader selection and a new window for negotiation.

The luxury condominium market in Brevard County is in a new era, defined by a surge in buyer advantage following a period of volatility. After a remarkable increase in sales peaking at 50 in 2024, transactions have since declined to 32 by mid2025, indicating a notable market adjustment. Concurrently, the sales cycle has dramatically lengthened, with the median time to contract surging to a striking 97 days.

This new dynamic is further defined by an elevated inventory, which has grown from 24 units in 2021 to 53 by mid-2025. This abundance of choice, coupled with dramatically extended market times, creates a strong buyer's market. This unique confluence of factors provides luxury buyers with ample opportunities and increased negotiation power.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

melbourne.evrealestate.com

• Sales volume has consistently declined, while median and average sale prices have shown persistent appreciation.

• Inventory has more than doubled and median days to sale has extended considerably, indicating a transition to a more balanced market.

• Luxury single-family sales volume has fluctuated but remains robust, while median time to contract has expanded.

• Luxury condominium sales have declined significantly from their 2022 peak, with a substantial growth in inventory that favors buyers.

$7,195,000

441 Royal Plaza Dr Engel & Völkers Fort Lauderdale

Sales are a bit slower in Broward County, but prices are still going up. There are way more homes available now, so buyers have a lot more power in the market.

Broward County, encompassing vibrant cities like Fort Lauderdale, Hollywood, and Pompano Beach, is celebrated for its dynamic lifestyle, waterfront living, and robust cultural scene. Known as the "Venice of America" for its extensive canal system, the area offers everything from luxurious oceanfront estates and high-rise condominiums to charming suburban neighborhoods. Broward’s thriving economy, top-rated schools, and proximity to Miami make it a prime choice for both families and professionals. With its mix of urban excitement, beachside relaxation, and strong real estate market, Broward County stands out as a hub for luxury living in South Florida.

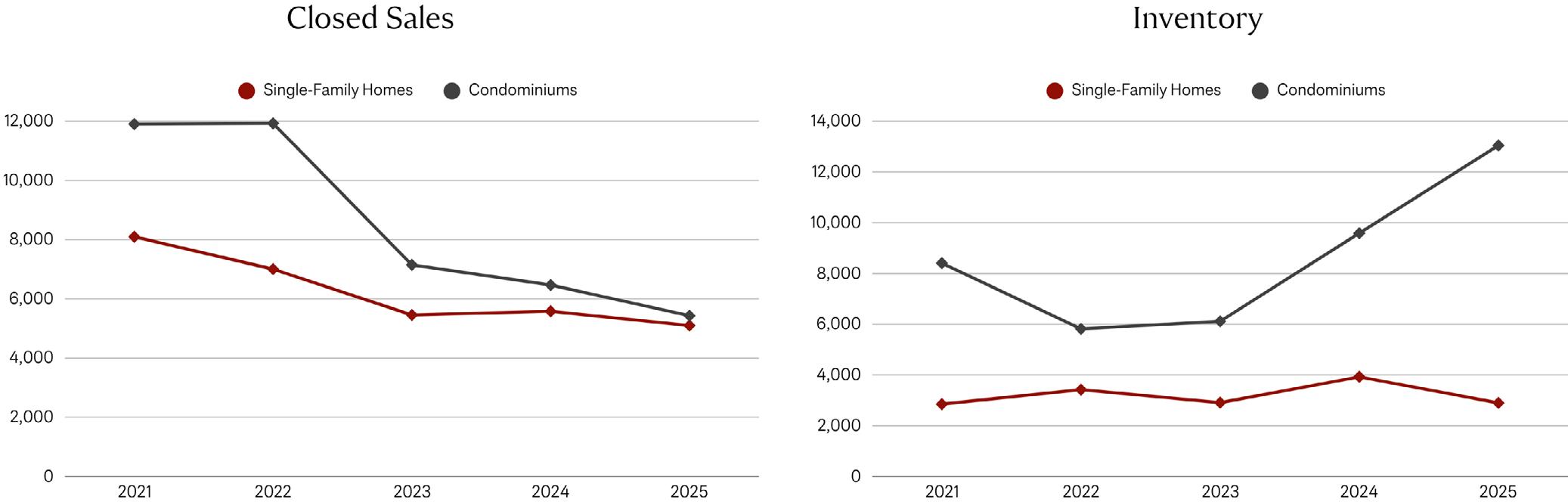

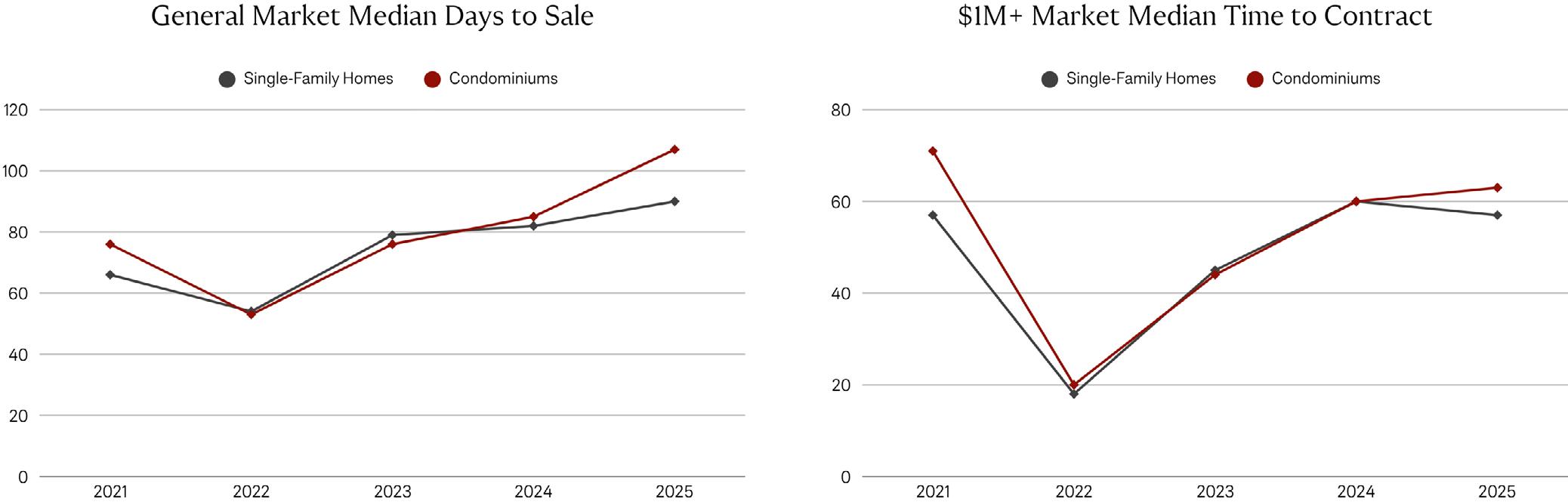

The Broward County single-family market is navigating a new, more deliberate phase, with resilient prices standing firm amidst moderating transaction volume. Closed sales have seen a significant reduction of nearly 39%, moving from 9,486 sales in 2021 to a more measured 5,823 by mid-2025. Despite this decline in activity, median sale prices have shown remarkable and consistent appreciation, climbing from $455,000 to a substantial $628,750 over the same period. This sustained price growth underscores persistent demand for single-family residences, a testament to the area's

enduring desirability, even as fewer properties change hands.

The pace of acquisition has become more thoughtful, with the median days to sale extending to 86 days by mid-2025, providing a valuable window of consideration for prospective buyers. This change in rhythm is directly correlated with a dramatic expansion of available inventory, which has more than doubled from 2,284 units in 2021 to 5,897 in 2025. This combination of a growing supply and extended market times signals a significant market rebalancing. The landscape is shifting away from a robust seller's market, now offering discerning buyers an unparalleled opportunity for strategic engagement and negotiation.

This condominium market is navigating a significant shift, with a cooling of demand that has led to a dramatic reduction in sales volume. Closed sales have seen a decline of over 51%, dropping from 11,477 transactions in 2021 to a more subdued 5,622 by mid-2025. While median prices showed growth initially, a recent minor adjustment to $275,000 hints at a market recalibration, even as the average sale price remains elevated. This nuanced price movement, influenced by a blend of external factors, is reshaping the landscape for both sellers and buyers.

This transition to a buyer's market is most evident in the prolonged period properties now spend on the market, with the median days to sale extending to a significant 109 days. This lengthening is a direct consequence of a substantial surge in inventory, which has nearly tripled from 3,972 units in 2021 to 11,686 by mid-2025. Compounding the challenge for sellers are rising property insurance costs and escalating association fees, creating a more competitive environment. This confluence of factors provides clients with a large selection of properties and negotiation power.

The luxury single-family market in Broward County is navigating a dynamic new phase, where robust activity has settled into a more considered pace. After sales experienced a notable peak of 1,294 in 2022, transactions have since tempered, settling at 1,087 by mid-2025. This fluctuation in sales volume is paralleled by an evolution in the market’s velocity, with the median time to contract expanding from a remarkably swift 21 days to a more deliberate 62 days. This lengthening of the sales cycle signals a market that is not slowing, but rather offering discerning buyers a more thoughtful and strategic purchasing environment.

This new reality is underpinned by a consistent influx of new luxury listings, which has contributed to a notable increase in available inventory. From 1,460 units in 2021, the supply of luxury single-family homes has steadily risen to 1,663 units by mid-2025. This significant expansion provides buyers with an abundance of choice, empowering them with a heightened sense of control and unparalleled opportunities for negotiation. This market is shifting away from the intense competition of previous years, creating a uniquely advantageous landscape for those with a strategic approach to their next acquisition.

The luxury condominium market in Broward County is navigating a significant shift in momentum, moving away from a period of heightened interest to a more deliberate and subdued pace. Closed sales have seen a sharp decline from a peak of 467 in 2022 to just 244 by mid-2025, highlighting a cooling of demand that has reshaped the landscape for sellers. This considerable slowdown in transactions points to a more discerning buying process, a departure from the urgency of earlier years. The balance of power has definitively shifted, now offering savvy clients a more advantageous position than in previous, highly competitive periods.

This new reality is underpinned by a prolonged period of deliberation, with the median time to contract extending to a significant 81 days by mid-2025. This change in rhythm is a direct consequence of a substantial rise in available inventory, which has swelled to 673 units. This considerable growth in supply, coupled with declining sales, creates a market where buyers have a broader selection than ever before. This unique confluence of factors provides discerning clients with immense leverage and negotiation power, a dramatic departure from the competitive environment of previous years.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

fortlauderdale.evrealestate.com | pompanobeach.evrealestate.com

KEY TRENDS AND CHALLENGES

• Sales volume has consistently declined, while median and average sale prices have shown persistent appreciation.

• Inventory has more than doubled and median days to sale has extended considerably, indicating a transition to a more balanced market.

• Luxury single-family sales volume has fluctuated but remains robust, while median time to contract has expanded.

• Luxury condominium sales have declined significantly from their 2022 peak, with a substantial growth in inventory that favors buyers.

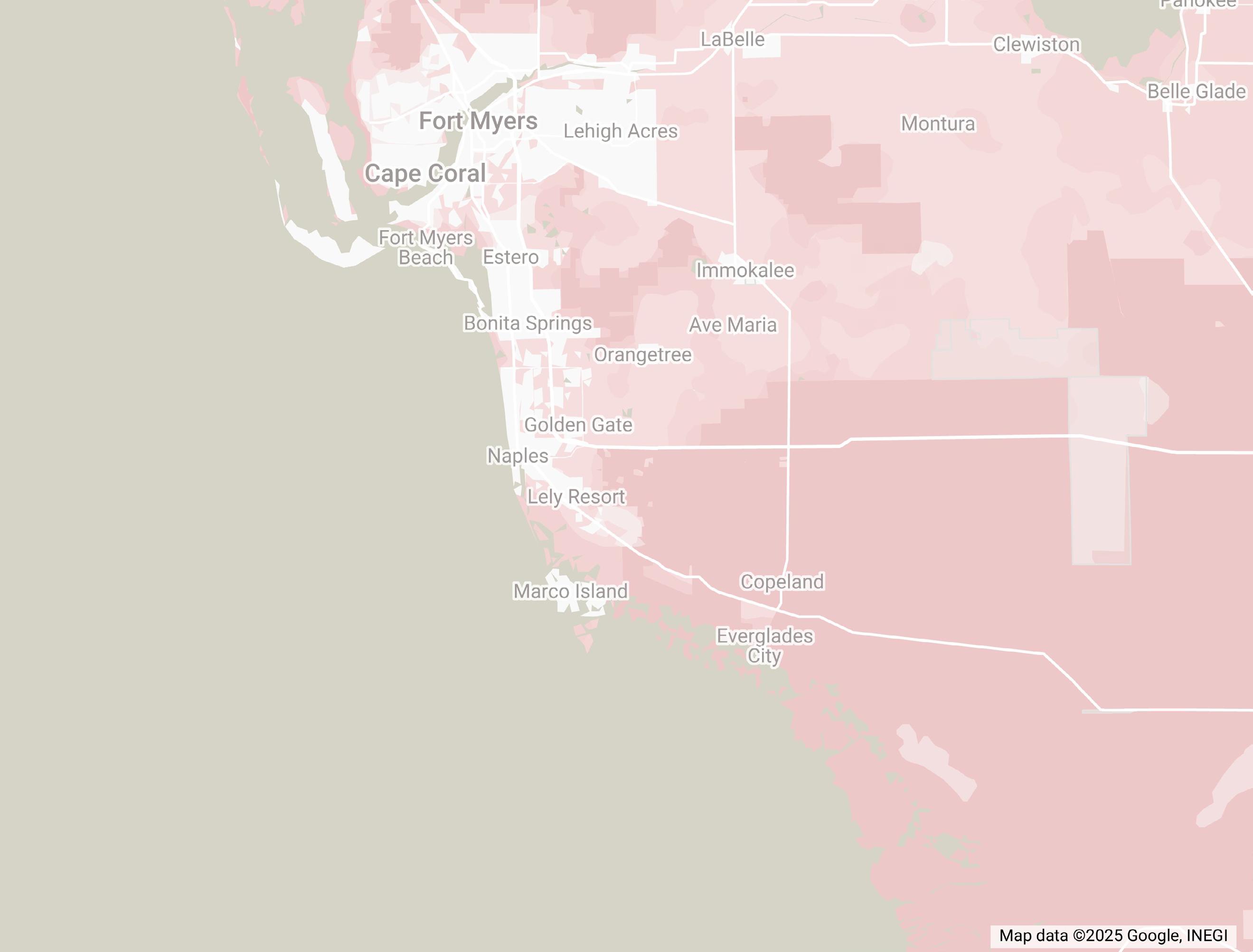

NAPLES | MARCO ISLAND

This market is shifting in a big way. Sales are slower, homes are taking much longer to sell, and prices are starting to adjust. It's a clear move to a buyer's market now.

Collier County, home to the upscale city of Naples and the tranquil Everglades City, is synonymous with luxury living along Florida’s Paradise Coast. Renowned for its pristine beaches, world-class golf courses, and vibrant arts and dining scene, Naples offers a sophisticated yet relaxed coastal lifestyle. Beyond the opulence, Collier County boasts natural beauty with access to the Everglades, providing endless opportunities for outdoor adventures. Whether exploring the chic shops of Fifth Avenue South or enjoying the serene Gulf waters, Collier County delivers a blend of elegance and natural splendor.

$2,100,000

13029 Bald Cypress Ln Engel & Völkers Naples

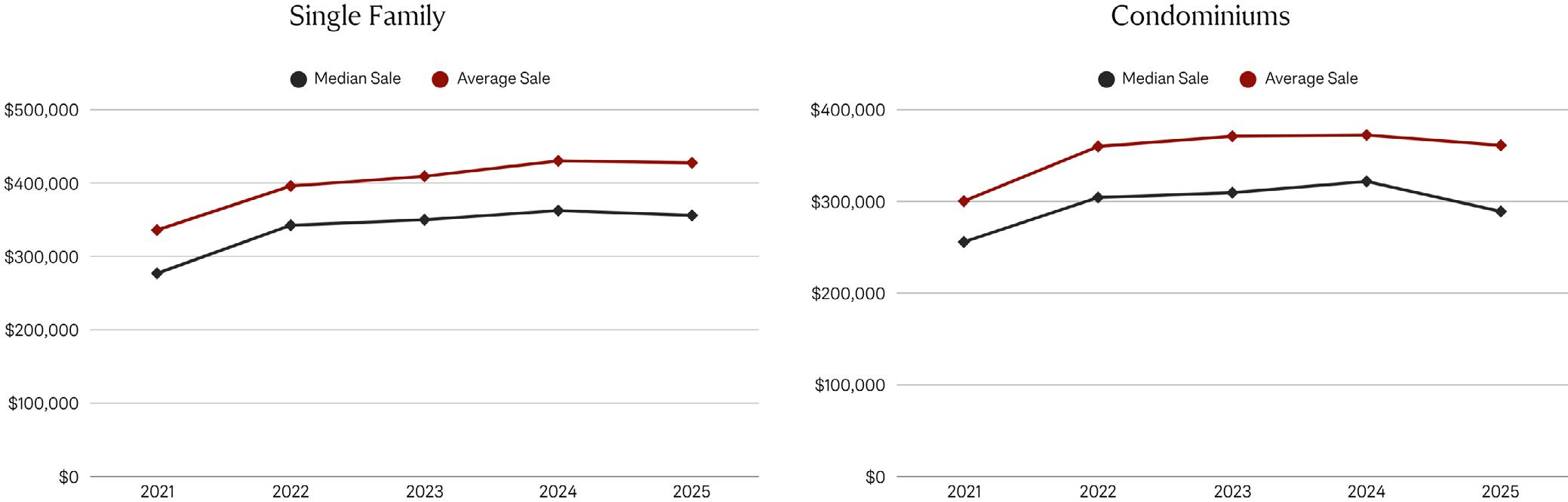

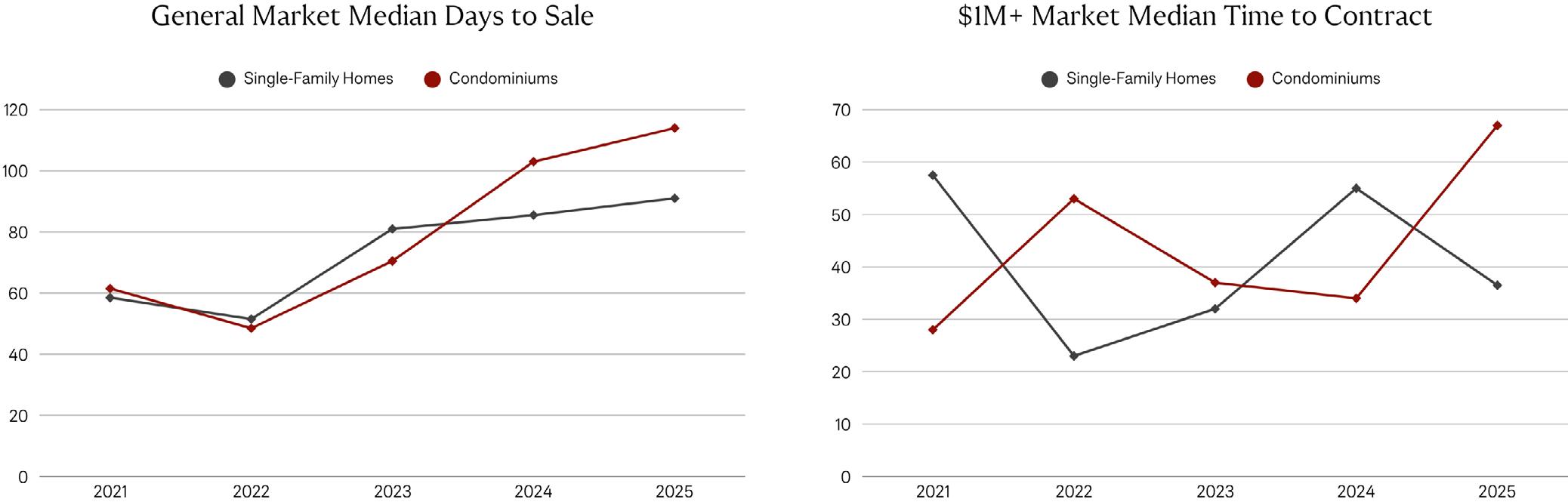

The single-family market in Collier County is navigating a significant shift, with moderating sales activity juxtaposed against the continued appreciation of values. Closed sales have seen a consistent decline, moving from 4,564 in 2021 to a more measured 2,458 by mid-2025. Despite this trend, average sale prices have shown robust and continuous growth, climbing from $1.2 million to a significant $1.73 million, suggesting that high-end properties continue to

drive strong appreciation.

This dynamic is further defined by a significant lengthening of the sales cycle, with properties now taking a considerably longer 112 days to go under contract. This shift is empowered by a substantial increase in available inventory, which has grown to 3,251 units, providing discerning clients with more time and choice. This confluence of factors indicates a clear transition to a more balanced market, where buyers can exercise greater negotiation leverage.

The condominium market in this region is experiencing a substantial recalibration, marked by a pronounced deceleration and a consistent decline in sales volume. Closed sales have steadily decreased from 5,636 in 2021 to 3,304 by mid-2025, a significant drop that has reshaped the market. This slowdown is paired with a noticeable price correction, with the median price pulling back from its peak of $386,373 to $328,188, suggesting values are softening amidst increased supply and rising ownership costs.

This new market rhythm is further defined by a significant lengthening of the sales cycle, now at a median of 101 days, giving buyers more time for meticulous evaluation. This shift is empowered by a continuous expansion of inventory to 3,852 units by mid-2025. This abundance of supply, combined with a more cautious buyer sentiment, firmly establishes a strong buyer's market, creating intense competition among sellers and providing discerning clients with ample choice.

The luxury single-family home market in this region presents a compelling narrative of stability and expansion, with strong and robust demand. After a slight dip, closed sales have stabilized around 1,035 by mid-2025, following a peak of 1,115 in 2024, which indicates a consistent and healthy appetite for prime residences. This enduring demand is supported by a remarkably efficient sales cycle, with the median time to contract holding at a moderate 33 days, suggesting properties continue to move efficiently.

This dynamic is further defined by a healthy influx of new listings and a significant expansion of inventory, which has grown from 271 units in 2021 to 1,488 by mid-2025. This robust supply is being absorbed by a thriving market, which offers affluent buyers a broader selection without compromising on pace. This confluence of factors solidifies the luxury singlefamily market as a healthy and expanding landscape of opportunity.

The luxury condominium market in this region is navigating a notable deceleration, with a consistent decline in sales volume paving the way for a more buyer-friendly environment. Closed sales have steadily decreased from 402 in 2021 to 231 by mid-2025, indicating a significant cooling of demand in this elite segment. This slower pace is paired with a substantial lengthening of the sales cycle, with the median time to

contract extending to a more prolonged 43 days.

This new market rhythm is directly tied to a growing supply, as inventory has expanded from 94 units in 2021 to 393 by mid2025, providing buyers with a wider array of choices. This significant increase in available inventory, coupled with reduced sales and extended market times, creates a strong buyer's market. This dynamic empowers luxury clients with more ample choices and increased leverage for negotiation.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

marcoisland.evrealestate.com | naples.evrealestate.com

KEY TRENDS AND CHALLENGES

• Sales volume has seen a substantial decrease, while average prices have climbed continuously.

• Market time has lengthened significantly, and inventory has seen a dramatic increase, indicating a shift to a more balanced, buyer-favored market.

• Luxury single-family sales have moderated from their peak, while market time has consistently lengthened.

• Luxury condominium sales have steadily declined from their peak, and market time has seen a dramatic increase, firmly establishing a strong buyer's market for luxury condos.

$5,500,000

1215 Commodore Dr

Sales have dipped a little, but prices are still on the rise. This market is looking good for both buyers and sellers, with a good balance of activity and value.

Flagler and Volusia counties, located along Florida’s Atlantic coast, offer a unique blend of natural beauty, historic charm, and vibrant coastal living. The area is home to picturesque beaches, including the famous sands of Daytona Beach, and scenic coastal towns like Palm Coast and Ormond Beach. With a mix of historic sites, outdoor recreation, and a laidback lifestyle, Flagler and Volusia counties attract both tourists and residents seeking a relaxed yet dynamic environment. The region's real estate market is diverse, featuring everything from waterfront estates to charming bungalows, appealing to a wide range of buyers.

The single-family home market in this region has entered a phase of thoughtful recalibration, with its enduring value standing firm despite moderating sales activity. While closed sales have declined from 7,541 in 2021 to 5,518 by mid-2025, median sale prices have shown a remarkable resilience. After surging from $276,950 in 2021, values have stabilized at a high plateau, with the recent minor adjustment serving as a strategic fine-tuning rather than a significant retraction.

This new dynamic is defined by a significant lengthening of market time, now at 91 days, affording buyers more time for meticulous consideration. This shift is empowered by a continuous expansion of inventory, which has surged from 1,407 units in 2021 to a substantial 5,259 by mid-2025. This confluence of factors indicates a clear transition to a more balanced and buyer-friendly environment, providing discerning clients with expanded choices and greater leverage for negotiation.

The condominium market in this region has faced a significant cooling of demand, with closed sales dropping from 2,418 in 2021 to just 1,328 by mid-2025. This sharp reduction in transactions has been accompanied by a noticeable price correction, as the median sale price declined from its 2024 peak of $321,800 to $289,000 in 2025. These adjustments reflect a market undergoing a substantial recalibration as buyer interest softens amid increasing supply.

This new market rhythm is further defined by a prolonged sales cycle, with the median days to sale extending to 114.5 days, a stark departure from the urgency of previous years. This longer market time, paired with a surge in inventory from 411 units in 2021 to 2,500 in 2025, firmly establishes a strong buyer's market. This dynamic provides discerning clients with an abundance of choice and an opportune window for strategic negotiation.

The luxury single-family market in this region presents a compelling, counter-trending narrative of sustained demand and robust performance. Closed sales have consistently risen, reaching a peak of 179 by mid-2025 and indicating a strong and continuing appetite for prime residences. While the market pace has seen some fluctuation, the median time to contract notably tightened to 36.5 days, showcasing that well-priced luxury properties

continue to move with efficiency.

This strong performance is supported by a healthy expansion of inventory, which has grown to 389 units by mid-2025, a significant increase from 104 in 2021. This influx of new supply is being effectively absorbed by the sustained sales volume, maintaining a balanced environment for luxury properties. The confluence of these factors offers discerning clients an expanding canvas of choices without compromising on transaction speed.

The luxury condominium market in this area is navigating a volatile period, with a distinct shift in dynamics that now favors the buyer. After a peak of 47 closed sales in 2022, transactions have settled to 42 by mid-2025, a reflection of fluctuating demand. This deceleration is paired with a dramatic expansion of market time, as the median days to contract has surged to 67 days, creating a prolonged window for deliberation.

This new market reality is underpinned by a significant increase in available inventory, which has expanded from a mere 16 units in 2021 to 164 by mid-2025. This considerable growth in supply, coupled with a slower sales pace, firmly establishes a buyer's market in this elite segment. This dynamic provides luxury clients with an abundance of choice and increased leverage for negotiation, making it an opportune time for strategic acquisitions.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

newsmyrnabeach.evrealestate.com | palmcoast.evrealestate.com

KEY TRENDS AND CHALLENGES

• Transition from a robust seller’s market (2021–2022) to a more balanced market (2023–2024) across all segments.

• Rising interest rates impacting buyer affordability and demand.

• Sales volume has seen a substantial decrease, while average prices have climbed continuously.

• Increased inventory in both single-family and condominium markets, providing buyers with more choices.

• Slower price appreciation, indicating a market stabilization.

• The luxury market followed similar trends, with increased median days to sale and reduced buyer urgency.

• Market time has lengthened significantly, and inventory has seen a dramatic increase, indicating a shift to a more balanced, buyer-favored market.

• Luxury single-family sales have moderated from their peak, while market time has consistently lengthened.

• Managing increased inventory while maintaining property values, particularly in the luxury condominium segment.

• Luxury condominium sales have steadily declined from their peak, and market time has seen a dramatic increase, firmly establishing a strong buyer's market for luxury condos.

• Adapting to broader economic conditions influencing buyer sentiment and market dynamics.

The market is slowing down, but home prices are still climbing. You've got more homes to pick from now, which is making it a more balanced market overall.

$1,271,510

11616 SW 6th Ln

Engel & Völkers Gainesville

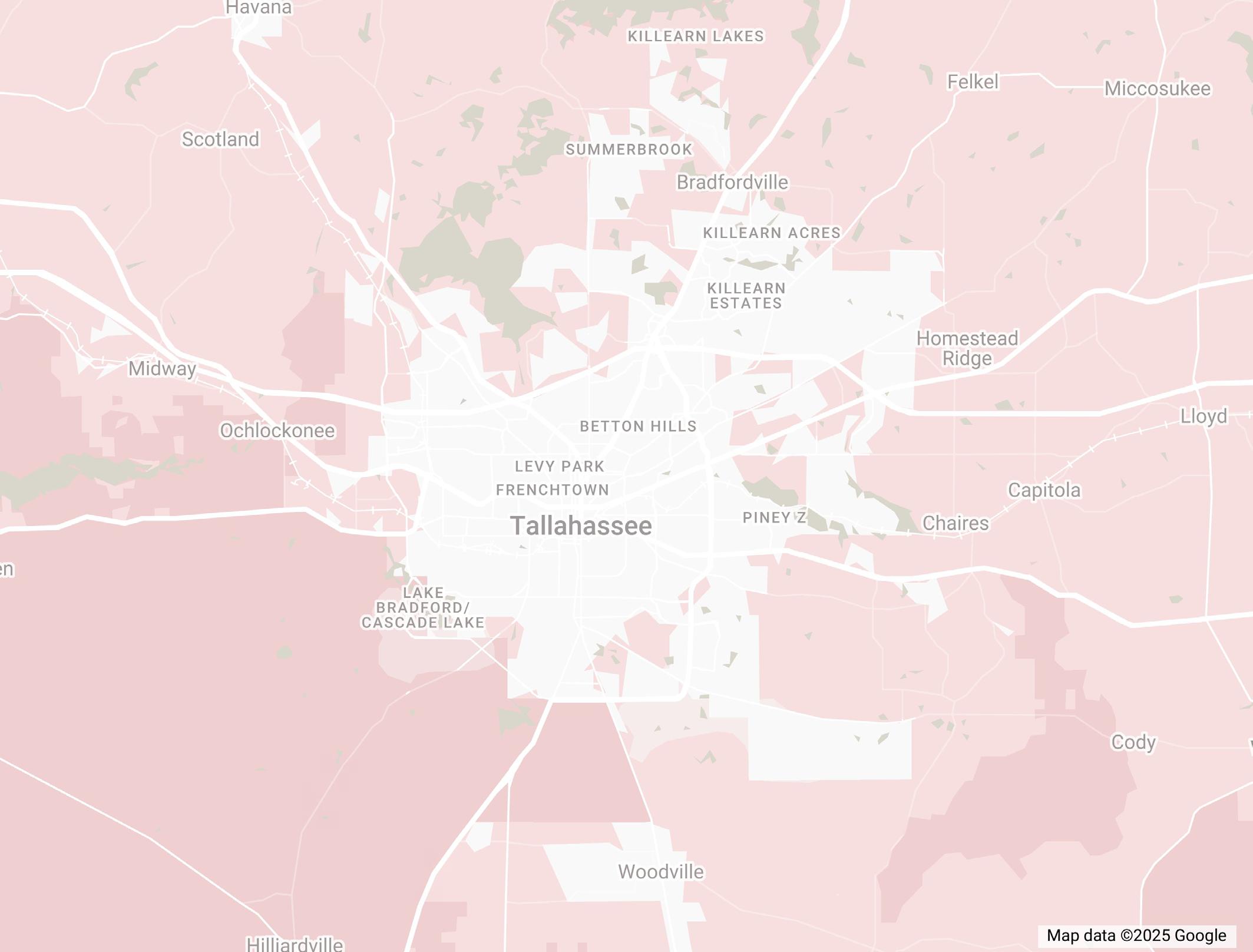

Gainesville, nestled in Alachua and Gilchrist counties, is best known as the home of the University of Florida, bringing a vibrant college-town atmosphere and a steady influx of students, faculty, and sports enthusiasts. The area blends academic prestige with natural beauty, offering access to scenic springs, trails, and parks. Gainesville’s thriving healthcare and education sectors drive its economy, while its historic downtown, lively arts scene, and community events create a welcoming environment. With a mix of youthful energy and Southern charm, Gainesville offers a balanced lifestyle that appeals to both residents and visitors.

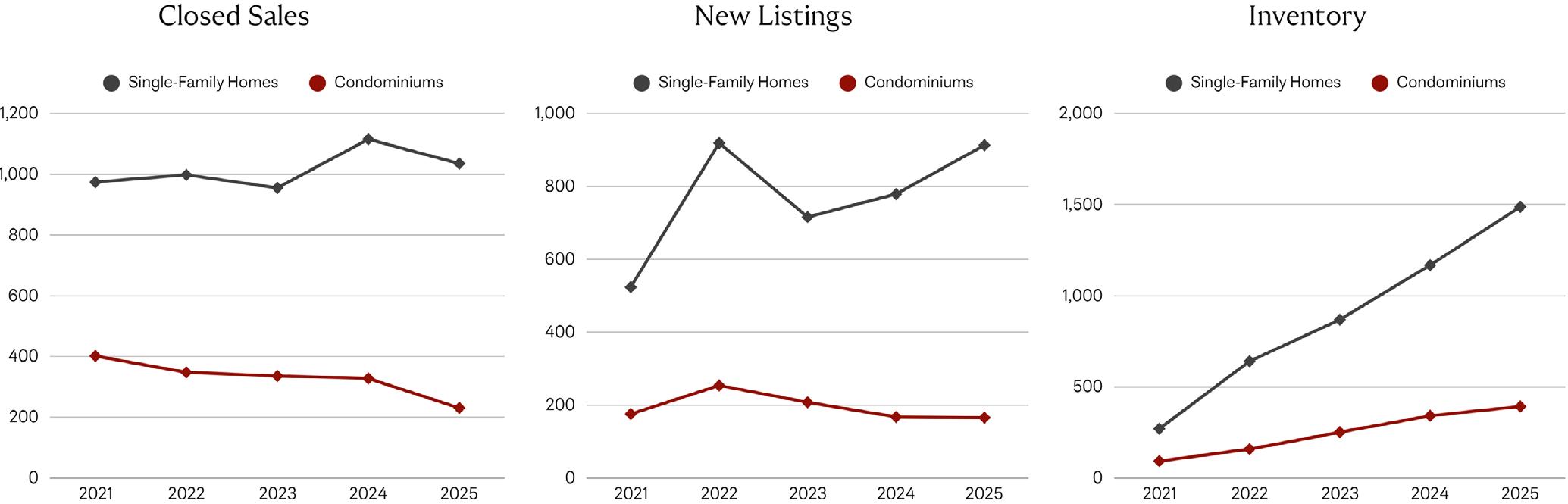

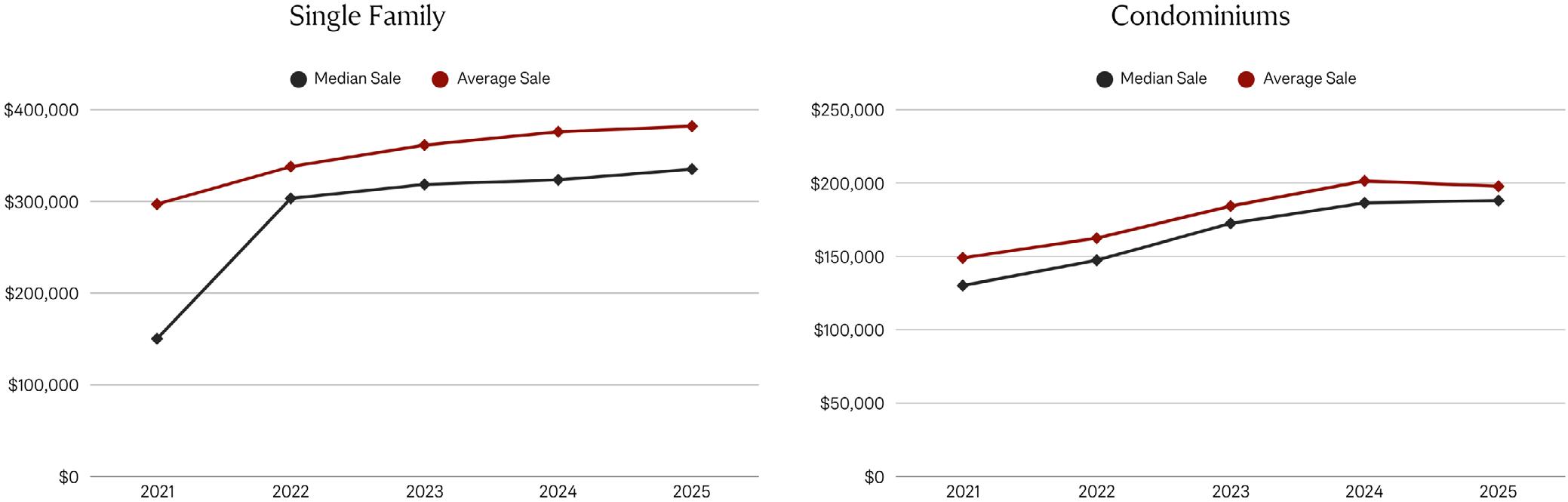

The Gainesville single-family market is navigating a period of moderation, where sales volumes have cooled but property values continue their upward trajectory. Closed sales have consistently declined from 1,870 in 2021 to 1,434 by mid-2025, signaling a shift away from the more frenzied activity of earlier years. Despite this trend, median sale prices have shown remarkable resilience, appreciating from $290,000 in 2021 to $355,967 by mid-2025, a testament to the fundamental

strength of the area’s property values.

This market is also defined by a lengthening sales cycle, with the median days to sale extending to 88.5 days, a change that provides a new window for buyer deliberation. This shift is accompanied by a notable increase in available inventory, which has grown from 668 units in 2021 to 1,020 by mid-2025. This combination of factors indicates a transition to a more balanced market, offering discerning buyers a greater selection and more time to make strategic decisions.

The condominium market in this region has faced significant challenges, marked by a substantial decline in sales volume and a pronounced shift in market dynamics. Closed sales have consistently dropped from 601 in 2021 to just 309 by mid-2025, a sharp reduction that highlights a notable cooling of demand. Despite this, median sale prices have shown appreciation, rising from $143,450 to $200,000 by mid-2025, suggesting that value is still holding in key segments.

The sales cycle has significantly lengthened, with properties now taking 91 days to go under contract, a clear departure from the urgency of previous years. This new reality is further defined by a substantial increase in available inventory, which has grown from a mere 119 units in 2021 to 338 by mid-2025. This combination of a slower sales pace and a robust supply firmly establishes a strong buyer's market, empowering clients with ample choice and greater leverage.

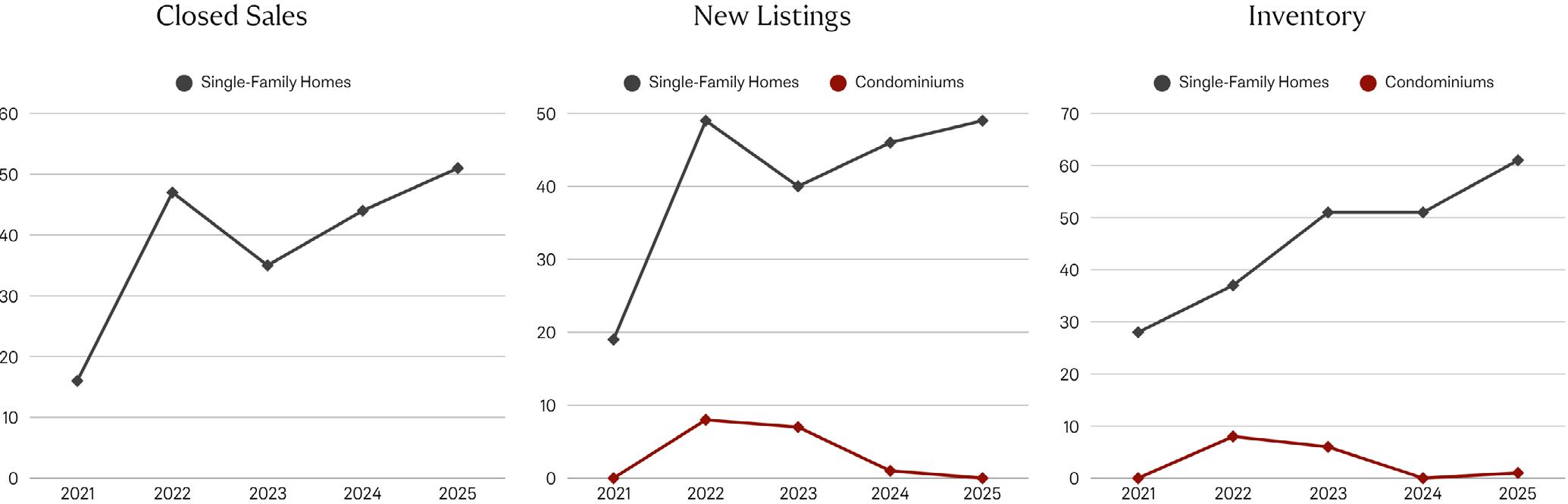

The luxury single-family home market in Gainesville presents a compelling and counter-trending narrative of sustained growth. Closed sales in this high-end segment have consistently risen, increasing from just 16 in 2021 to a remarkable 51 by mid-2025. This sustained growth in transactions, despite some fluctuations in market time, points to a healthy and active luxury market where properties still move at a reasonable pace.

This market's momentum is supported by a steady influx of new listings and a sustained increase in available inventory, which has grown to 61 units by mid-2025. The combination of strong, increasing sales and a manageable time on market demonstrates the area’s ability to absorb new high-end supply. This evolving luxury landscape offers discerning clients a growing selection of prime residences and a strategic opportunity for acquisition.

• Sales have consistently declined, while prices have shown persistent appreciation.

• Market time has lengthened and inventory has grown, indicating a transition towards a more balanced market.

• Luxury single-family sales volume has shown strong and

consistent growth, reaching a new peak in 2025, with market time also improving.

• The luxury condominium market is extremely niche with minimal to no activity and consistently negligible closed sales and inventory from 2021-2025.

$4,950,000

255 Deer Haven Dr Engel & Völkers First Coast

Jacksonville's market is getting more balanced. Prices are still strong, but homes are taking longer to sell and there are a lot more of them, which is great for buyers.

Jacksonville, spanning Baker, Clay, Duval, Nassau, and St. Johns counties, is Florida’s largest city by land area and a dynamic gateway to the Southeast. With a bustling urban core, historic neighborhoods, and miles of pristine beaches, Jacksonville offers a diverse lifestyle for its residents. The city is known for its thriving business environment, vibrant arts and culture scene, and outdoor adventures along the St. Johns River and Atlantic coastline. Nearby St. Augustine, the nation’s oldest city, adds a historic charm, while the region's strong job market and affordability continue to attract new residents.

The single-family market in the Jacksonville area is navigating a new equilibrium, where resilient property values stand firm amidst moderating sales activity. Closed sales have seen a significant reduction from 14,327 in 2021 to a more measured 10,782 by mid-2025. Despite this cooling, median sale prices have shown remarkable strength, appreciating from $305,000 to approximately $393,000, signaling a sustained foundation of value.

The condominium market in the Jacksonville area is experiencing a definitive shift, marked by a cooling of demand and a consistent reduction in sales volume. Closed sales have decreased from 3,577 in 2021 to 2,428 by mid-2025, a significant drop that has reshaped the market. While median prices have seen a slight recalibration, a unique trend in the average sale price suggests that higher-value condominiums are still being transacted, adding a layer of complexity to the market's performance.

This new dynamic is further defined by a longer sales cycle, with the median days to sale extending to 87 days, which is a direct consequence of a continuous expansion of inventory. This robust supply, which has surged to 8,332 units by mid2025, provides buyers with a wealth of options. This combination of factors indicates a clear transition to a more balanced and increasingly buyer-favored environment, where clients can exercise more leverage and engage in a more deliberate purchasing process.

This shift is underscored by a lengthening of the sales cycle, with properties now taking 90.5 days to go under contract, providing buyers with more time for consideration. The market is also defined by a substantial expansion of inventory, which has surged from 872 units in 2021 to 2,705 by mid-2025. This confluence of factors firmly establishes a strong buyer's market, where abundant supply creates immense choice and leverage for discerning clients.

The luxury single-family market in the Jacksonville area presents a compelling counter-narrative of robust demand and consistent performance, defying the broader market's moderation. Closed sales in this high-end segment have shown remarkable strength, surging from 467 in 2021 to a peak of 786 in 2024, with a strong finish of 732 by mid-2025. This consistent transaction volume is a powerful testament to the enduring and growing appetite for prime residences in the region.

The pace of acquisition in this market remains remarkably efficient, with the median time to contract holding at a relatively swift 35 days, signaling continued buyer urgency. This is supported by a continuous upward trend in new luxury listings and an expanding inventory, which has grown to 856 units by mid-2025. This combination of strong sales, quick market times, and a healthy supply solidifies the Jacksonville luxury single-family market as a healthy and thriving one, capable of absorbing new high-end offerings.

The luxury condominium market in the Jacksonville area maintains a consistent level of activity, but with a palpable shift in dynamics that now favors the buyer. Closed sales in this niche segment have remained relatively stable, fluctuating around 79 transactions by mid-2025, suggesting a persistent demand for high-value units. This stability, however, is paired with a lengthening of the sales cycle, with the median time to contract expanding from a swift 17.5 days in 2022 to a more deliberate 39 days in 2025.

This new market rhythm is further defined by a continuous upward trend in new luxury listings and a growing inventory, which has risen from 40 units in 2021 to 113 by mid-2025. This expanding selection, coupled with a slower pace of sales, indicates a gradually shifting balance within the market. This creates a new advantage for luxury buyers, providing them with a wider array of choices and potentially more negotiation room than in previous years.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

firstcoast.evrealestate.com | staugustine.evrealestate.com

• Sales volume has steadily decreased, while prices have shown sustained appreciation with a slight recent dip.

• Market time has lengthened significantly, and inventory has nearly tripled, indicating a transition to a more balanced, buyer-favored market.

• Luxury condominium sales volume remains stable and niche, while median time to contract has expanded, suggesting a shifting balance and more negotiation room for buyers.

• Luxury single-family sales volume remains robust and has fluctuated around a high level, with market time remaining relatively low and efficient.

$4,999,900

75761 Overseas Highway

Engel & Völkers Florida Keys

The market here has cooled down a lot. Sales are slower, homes are taking longer to sell, and there are way more options for buyers. Prices are still high, but not at their absolute peak.

Key West, located in Monroe County, is the southernmost point of the continental United States, known for its vibrant island culture, historic charm, and breathtaking sunsets. With its colorful architecture, lively Duval Street, and storied history— including the former home of Ernest Hemingway—Key West offers a unique blend of art, culture, and tropical living. The island’s crystal-clear waters invite snorkeling, diving, and boating adventures, while its laid-back vibe and welcoming community make it a true paradise at the end of the Florida Keys.

" Across the Florida Keys, the market is finding a new rhythm, with a definite shift in leverage as buyers now have the upper hand. While luxury oceanfront estates remain strong, sellers of other properties must now be realistic on pricing as the days of bidding wars are clearly behind us. "

Stephany Duvall ENGEL & VÖLKERS FLORIDA KEYS License Partner | Broker

The single-family market in Monroe County is navigating a period of moderation, with sales volumes cooling while values maintain elevated levels, a testament to the area’s enduring desirability. Closed sales have decreased from 1,317 in 2021 to 630 by mid-2025, reflecting a significant shift in buyer demand from earlier years. Despite this moderation, median sale prices have sustained their appreciation, climbing from $832,500 to a significant $1,124,250, showcasing the fundamental strength of this unique market.

This new market rhythm is defined by a significant lengthening of the sales cycle, with median days to sale extending to a considerable 118 days. This allows for a more deliberate purchasing process, which is empowered by a notable increase in available inventory, rising from 389 units in 2021 to 1,057 by mid-2025. This confluence of factors indicates a transition to a more balanced market, providing discerning clients with a greater selection and opportunities for strategic negotiation.

The condominium market in Monroe County is experiencing a notable cooling trend, with sales volumes moderating while prices continue their robust appreciation. Closed sales have decreased from 499 in 2021 to 221 by mid-2025, indicating a significant reduction in transactions from previous peaks. Despite this, median sale prices have shown remarkable strength, rising from $481,000 to a compelling $696,250, underscoring the continued desirability of these

units in this market.

This new dynamic is further defined by a significant lengthening of the sales cycle to 109 days, a shift that provides buyers with more time for consideration. This is a direct consequence of a continuous expansion of inventory, which has grown from 109 units in 2021 to 369 by mid-2025. This combination of a slower pace and robust supply suggests a clear shift toward a buyer’s market, offering clients a wider selection and increased leverage.

The luxury single-family home market in Monroe County is navigating a period of fluctuating activity and prolonged deliberation, moving away from its previous peak. Closed sales, after surging to 611 in 2022, have since moderated to a consistent level of 355 by mid-2025, a testament to a stable, yet more measured, demand. This new rhythm is defined by a highly variable and often lengthy sales cycle, with the median time to contract extending to 77.5 days.

The luxury condominium market in Monroe County remains a highly specialized segment, defined by limited transaction volumes and extreme volatility in market times. Closed sales, after peaking at 65 in 2022, have settled at a modest 44 by mid-2025, highlighting the niche nature of this market. This limited activity is paired with a sales cycle that has shown extreme variability, surging from a quick 12 days to a prolonged 130.5 days.

This more deliberate pace is directly influenced by a continuous growth in inventory, which has more than tripled from 211 units in 2021 to 722 by mid-2025. This expanding selection provides luxury buyers with a greater abundance of choice, empowering them with new opportunities for negotiation. The luxury market is becoming more balanced, and for those with patience and a strategic approach, it presents an ideal environment for meticulous, high-value acquisitions.

This dynamic is further underscored by a growing supply, with inventory expanding from 28 units in 2021 to 102 by mid-2025, offering a wider selection for the discerning client. This confluence of factors, from low sales volume to extended market times, solidifies a significant shift in leverage towards the buyer. For luxury clients, this market presents a unique opportunity for strategic negotiation to secure an ideal property.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

floridakeys.evrealestate.com

• Sales have consistently declined, while prices have maintained elevated levels with some recent recalibration.

• Market time has lengthened significantly, and inventory has nearly tripled, indicating a transition to a more balanced market.

• Luxury single-family sales have moderated from their 2022

peak, and market time is highly variable and often lengthy.

• The luxury condominium market is a specialized segment with limited, though stable, sales volume, with a recent significant lengthening of market time, giving buyers more leverage.

$1,950,000

5321 SW 20th Pl

Engel & Völkers Cape Coral

This market has definitely hit the brakes, with prices dropping and a ton more homes for sale. If you're a buyer, this is your time to shine.

Lee County, home to Fort Myers, Cape Coral, and Sanibel Island, offers a blend of coastal charm, vibrant communities, and rich history. Known for its pristine beaches, boating lifestyle, and abundant wildlife, Lee County attracts residents and visitors seeking both relaxation and adventure. The area’s real estate market features diverse options, from waterfront estates and island retreats to family-friendly neighborhoods and golf communities. With its strong sense of community, excellent amenities, and access to the Gulf of Mexico, Lee County continues to be a desirable destination for luxury living and investment opportunities.

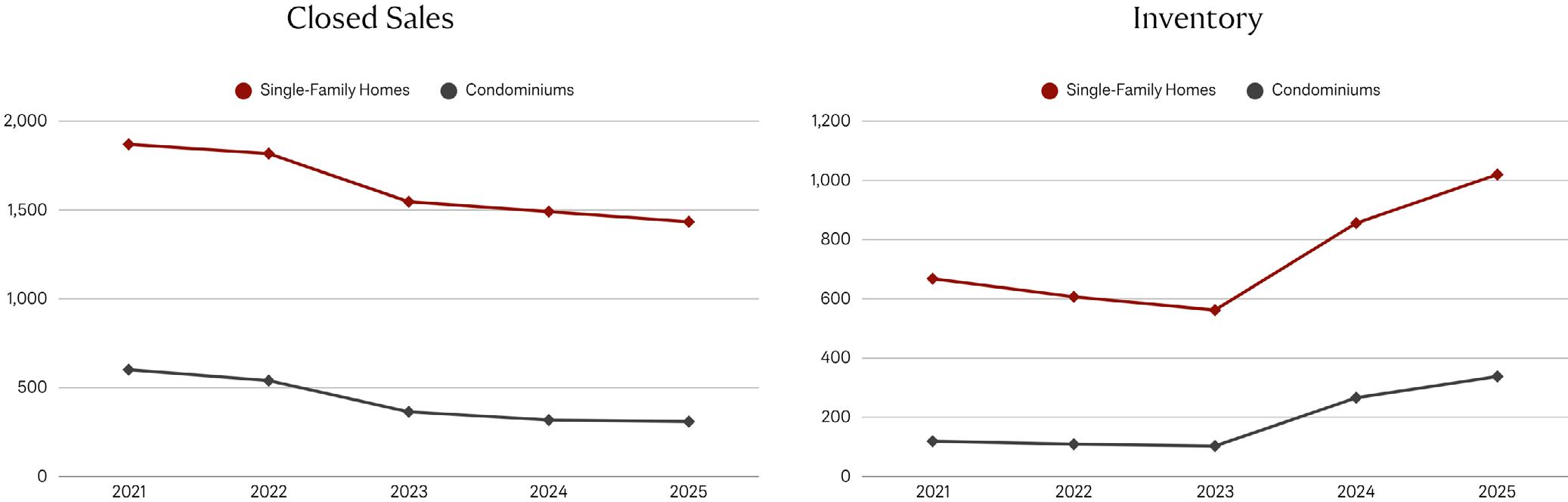

The single-family market in Cape Coral and Fort Myers has shifted into a more buyer-friendly environment, marked by a recalibration of values and a more measured pace of transactions. After an initial surge in demand, the median sale price has adjusted from its 2022 high of $440,050 to $392,318 by mid-2025. This correction, combined with a moderation in closed sales, signals a market that is finding its new equilibrium.

This new dynamic is defined by a significant lengthening of market time, with median days to sale extending to nearly 100 days by mid-2025. This allows for a more considered purchasing process, which is empowered by a dramatic expansion of inventory that has grown to a substantial 8,837 units. This confluence of factors firmly establishes a buyer's market, providing discerning clients with unparalleled choice and greater leverage for negotiation.

The Cape Coral and Fort Myers condominium market has entered a period of significant correction, with closed sales dropping from 5,637 in 2021 to just 2,523 by mid-2025. This dramatic reduction in transactions is paralleled by a softening in values, as the median sale price has declined from its peak of $340,000 in 2024 to $300,000 in 2025. The current environment presents a distinct opportunity for strategic buyers to enter the market with a strong advantage.

Market dynamics are further defined by a substantial increase in available inventory, which has grown from 1,000 units in 2021 to 4,251 by mid-2025. As a result, the median days on market for a condominium has significantly lengthened, rising to 114.5 days by mid-2025. This combination of robust supply and extended market times solidifies a strong buyer's market, providing ample leverage for negotiation and selection.

The luxury single-family home market in Cape Coral and Fort Myers is navigating a dynamic period, where a consistent level of demand persists despite a notable recalibration of market conditions. After a peak of 866 closed sales in 2022, the market has settled at a more deliberate pace, with 655 transactions by mid-2025. This enduring demand for prime residences is paired with a significant lengthening of the sales cycle, as the median time to contract has expanded from a rapid 18.5 days to a more considered 65 days.

This shift in pace is directly influenced by a substantial expansion of inventory, which has grown from 262 units in 2021 to a remarkable 1,190 units by mid-2025. This considerable growth provides affluent buyers with an unprecedented selection of homes, empowering them with greater leverage and more time for meticulous evaluation. The current market dynamic thus presents a unique opportunity for strategic acquisition, offering clients a departure from the intense competition of previous years and a window for more deliberate negotiation.

The luxury condominium market in Cape Coral and Fort Myers is navigating a significant recalibration, moving away from a period of heightened interest to a more subdued and deliberate pace. After a peak of 210 closed sales in 2022, transactions have since declined to 121 by mid-2025, highlighting a notable cooling of demand that has redefined the market. This considerable slowdown in activity, paired with a substantial lengthening of the sales cycle to 73 days, offers a unique window of opportunity for sophisticated

buyers.

This shift is underscored by a dramatic increase in available inventory, which has swelled from a mere 37 units in 2021 to a significant 288 by mid-2025. The confluence of these factors, from declining sales to a robust supply, firmly establishes a buyer’s market. This new dynamic empowers clients with unprecedented leverage for negotiation and a broader selection of properties than in previous, highly competitive years.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

capecoral.evrealestate.com | fortmyersdowntown.evrealestate.com

• Sales have moderated since the 2021 peak, while prices have seen a notable downward correction.

• Inventory has expanded dramatically, and market time has nearly doubled, indicating a clear shift to a strong buyerfavored market.

• Luxury single-family sales have declined from their 2022 peak, and median time to contract has expanded significantly.

• Luxury condominium sales have fallen sharply from their 2022 peak, and market time has expanded to a prolonged 73 days, solidifying a strong buyer's market.

$5,300,000

5205 SW Honey Terr Engel & Völkers Stuart

Prices are still appreciating nicely, even though sales are slower. With more homes on the market and a longer selling time, it's a much more balanced playing field for buyers now.

Martin County, nestled along Florida’s Treasure Coast, is celebrated for its charming coastal communities, unspoiled natural beauty, and laid-back lifestyle. With Stuart, the “Sailfish Capital of the World,” at its heart, the county offers a mix of historic downtown charm, waterfront dining, and abundant recreational opportunities on the St. Lucie River and Atlantic Ocean.

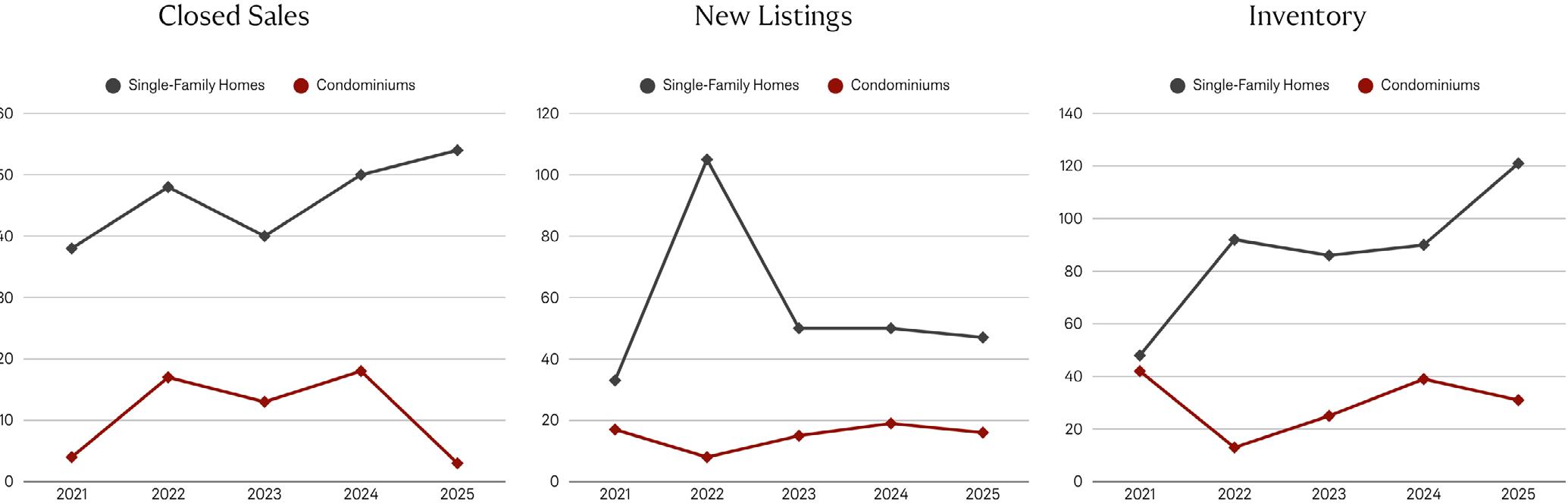

The single-family market in Martin County is navigating a more deliberate phase, with resilient values holding firm despite a moderation in sales volume. Closed sales have steadily decreased from 1,512 in 2021 to 974 by mid-2025, signaling a shift away from the heightened pace of earlier years. Despite this trend, median sale prices have shown consistent appreciation, climbing from $468,750 to a substantial $605,250, a testament to the area’s enduring desirability.

The condominium market in Martin County has entered a cooling trend, marked by declining sales volume and a recalibration of values. Closed sales have steadily decreased from 749 in 2021 to 484 by mid-2025, a significant drop that has reshaped the market. While the median price recently adjusted from its peak, the average sale price has remained resilient, suggesting a diverse market composition with a sustained interest in higher-priced units.

This new market rhythm is further defined by a lengthening of the sales cycle, with the median days to sale extending to 93.5 days, providing discerning buyers with ample opportunity for due diligence. This change is directly correlated with a significant expansion of inventory, which has more than tripled from 304 units in 2021 to 939 by mid-2025. This confluence of factors indicates a transition to a more balanced market, offering buyers a greater selection and more time to make strategic decisions.

This new dynamic is further defined by a substantial lengthening of the sales cycle to 116.5 days, a stark departure from the urgency of past years. This shift is empowered by a continuous expansion of inventory, which has swelled from 128 units in 2021 to 699 by mid-2025. This combination of a slower pace and robust supply firmly establishes a strong buyer's market, providing clients with a new degree of leverage and choice.

The luxury single-family market in Martin County is characterized by remarkably consistent activity, with stable sales volumes despite broader market shifts. Transactions have remained fairly steady, fluctuating between 184 and 230 sales annually and finishing with 214 by mid-2025, which indicates a persistent and robust demand for prime residences. This stability is, however, paired with a lengthening of the sales cycle, with the median time to

contract extending to 51.5 days, providing buyers with more time for a considered approach.

This new market rhythm is directly supported by a healthy influx of new listings and a significant growth in inventory, which has grown from 79 units in 2021 to 285 by mid-2025. This combination of stable sales and expanding choice suggests a luxury market that is becoming more balanced. This environment offers high-end buyers a greater selection while maintaining a steady pace of transactions.

The luxury condominium market in Martin County remains a niche segment, defined by limited transaction volumes and highly variable market times. Closed sales have fluctuated between 18 and 32 annually, a reflection of very specific demand, while the median time to contract has shown extreme volatility, surging from a swift 15 days in 2024 to a prolonged 130.5 days by mid-2025. This dynamic suggests that buyers for these high-value properties are very

deliberate, requiring a longer sales cycle.

The supply in this niche market, while low, has grown, with inventory increasing from 24 units in 2021 to 46 by mid-2025. This increasing supply, coupled with low sales volumes and highly variable market times, underscores the new leverage available to luxury buyers. In this environment, discerning clients have a unique window for strategic negotiation and to secure an ideal acquisition.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

stuart.evrealestate.com

• Sales volume has consistently declined, while prices have shown persistent and robust appreciation.

• Market time has lengthened and inventory has more than tripled, indicating a transition to a more balanced market.

• Luxury single-family sales volume has remained stable, while market time has lengthened.

• The luxury condominium market is a niche segment with limited sales and highly variable market times, with inventory growth providing buyers with more leverage.

$3,850,000

638 Escobar Ave Engel & Völkers Miami

Prices are still incredibly strong, which is a big win for sellers. But with more inventory and slower sales, buyers are getting a bit more room to breathe and negotiate.

Miami-Dade County is a dynamic and culturally rich region known as the gateway to Latin America, offering a vibrant blend of international influences, world-class dining, and iconic art scenes. Home to Miami’s bustling neighborhoods, from the glamorous shores of Miami Beach to the artistic streets of Wynwood and the historic charm of Coral Gables, the county offers diverse lifestyles and experiences. With its thriving real estate market, luxury waterfront properties, and ongoing development projects, Miami-Dade continues to attract global attention as a premier destination for living, investment, and business.

" We're entering a more balanced market. Buyers finally have breathing room, but sellers who market strategically are still achieving strong results. "

Vanessa Gomez ENGEL & VÖLKERS MIAMI License Partner | Broker Associate

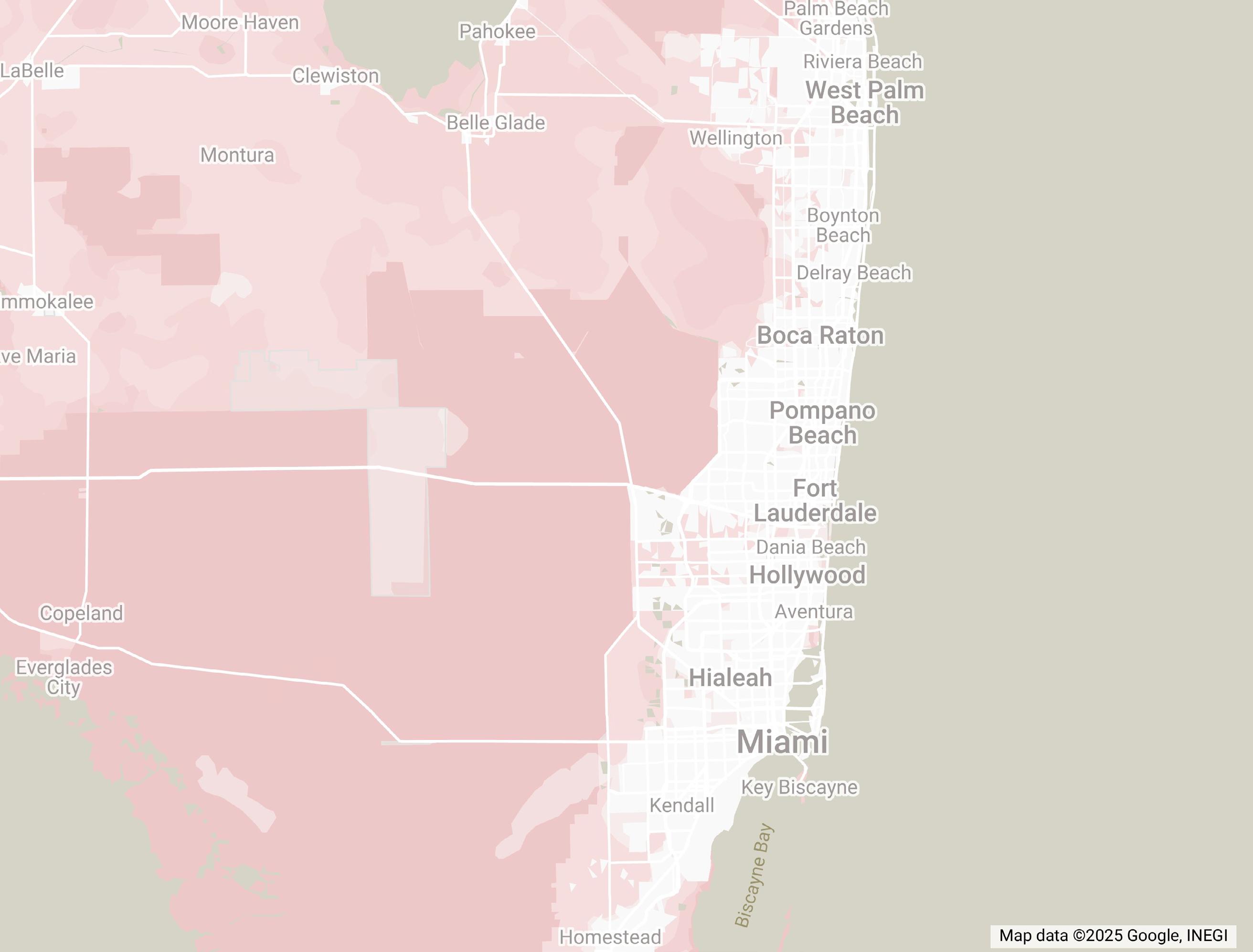

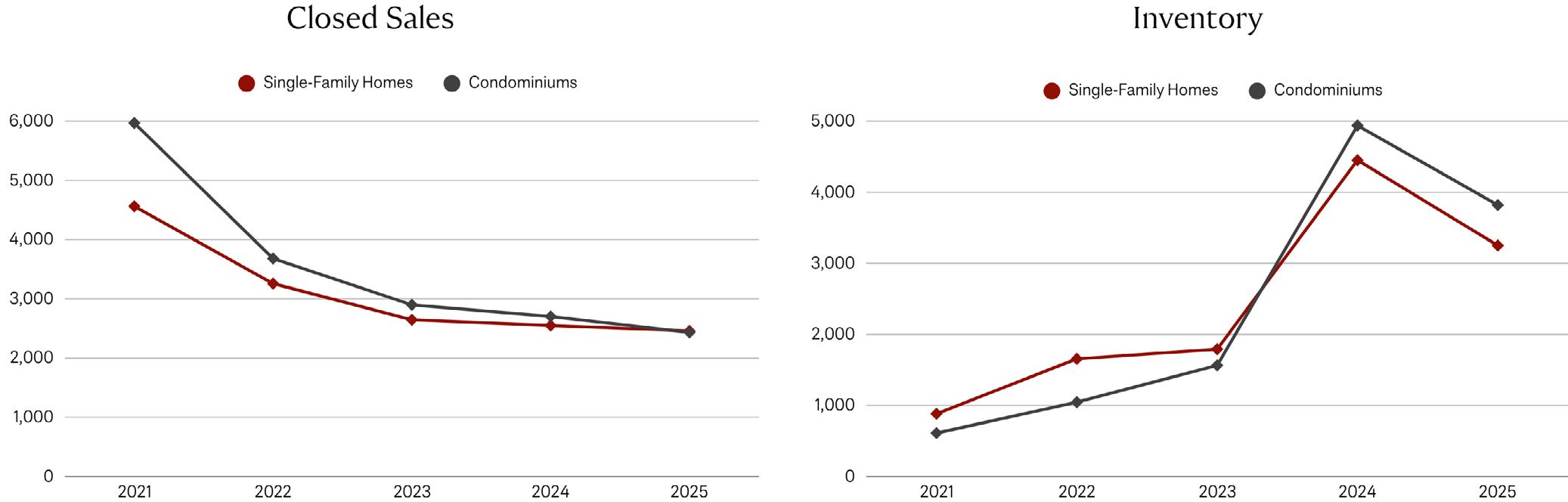

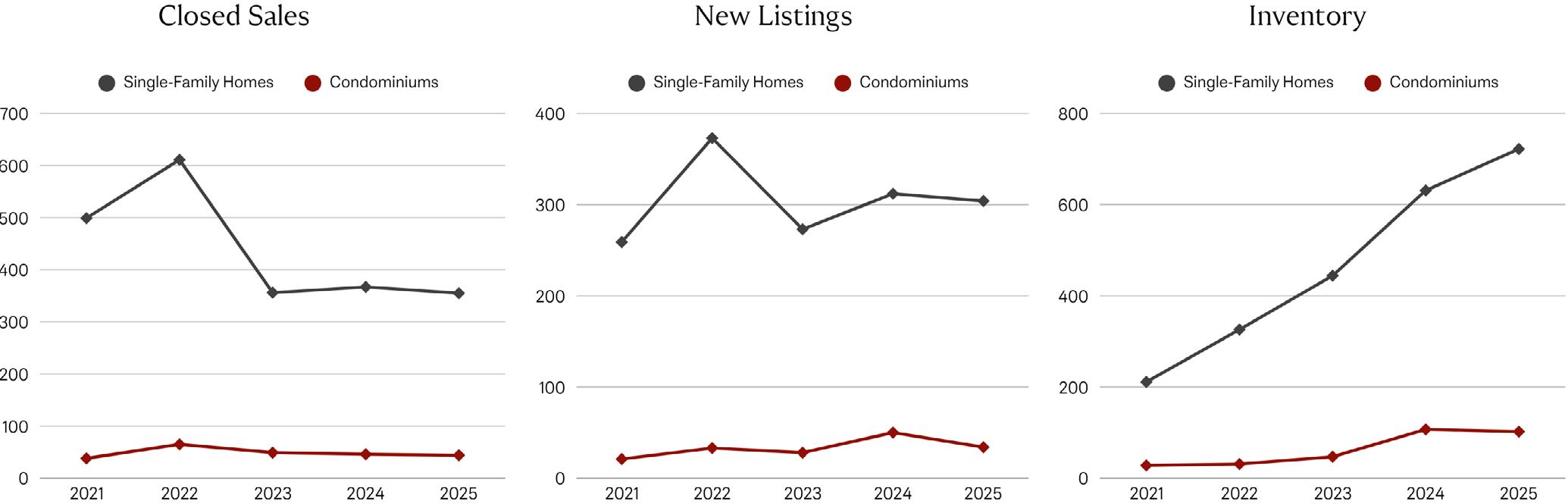

The single-family market in Miami-Dade County is navigating a more measured pace, with moderating sales volume giving way to impressive and continuous price appreciation. Closed sales have steadily decreased from 8,097 in 2021 to 5,098 by mid-2025, reflecting a shift from the high-demand environment of earlier years. Despite this trend, median sale prices have shown remarkable strength, climbing from $485,000 to a significant $671,500, a testament to the area’s enduring desirability and the increasing value of its

housing stock.

This market is defined by a dynamic in the sales cycle, with properties not moving as quickly as at the peak, yet maintaining consistent buyer engagement. Inventory levels have fluctuated, but the market appears to be absorbing new supply, contributing to the continued price appreciation. This confluence of factors points to a stable and mature market, offering a more deliberate pace for buyers without compromising on value.

The Miami-Dade condominium market is navigating a significant shift, with a cooling of sales volume despite a continuous upward trend in prices. Closed sales have seen a dramatic reduction from a peak of 11,928 in 2022 to a more measured 5,431 by mid-2025, highlighting a notable cooling of demand in the sector. This divergence suggests that while fewer units are transacting, the value of condominium units continues to appreciate, possibly driven by demand for newer or higher-end properties.

This market is further defined by a substantial lengthening of the sales cycle, with the median days to sale extending to 112.5 days by mid-2025. This change, coupled with a significant increase in inventory to 13,046 units, firmly establishes a strong buyer’s market. This confluence of factors provides discerning clients with an ample supply of condominiums and the leverage to engage in more strategic negotiations.

The luxury single-family market in Miami-Dade County presents a compelling narrative of resilience and sustained demand, defying the moderation of the broader market. Closed sales in this elite segment have shown strong performance, rebounding to 1,256 by mid-2025, demonstrating the market’s capacity to absorb a significant volume of high-value transactions. This resilient activity, despite some fluctuations, indicates a persistent appetite for

The luxury condominium market in Miami-Dade County is navigating a notable shift, with a cooling of sales volume since its peak, and a parallel increase in buyer leverage. Closed sales have seen a significant decline from a peak of 1,696 in 2022 to 895 by mid-2025, highlighting a tempering of demand in this elite segment. This slower pace is reflected in the lengthening of the sales cycle, with the median time to contract expanding to a more deliberate 98 days in 2025

prime residences among high-net-worth individuals.

The pace of acquisition in this market remains remarkably consistent, with the median time to contract holding at a relatively swift 55.5 days, a clear sign of continued buyer urgency. This is supported by a growing influx of new luxury listings and an expanding inventory, which has risen to 2,282 units by mid-2025. This combination of strong sales, stable market times, and increasing supply solidifies Miami-Dade as a robust and expanding luxury market.

This change in market dynamics is further defined by a steady upward trend in new luxury listings and a continuous growth in available inventory, which has risen to 2,734 units by mid2025. This expanding selection, combined with a longer sales cycle, indicates a definitive transition to a buyer’s market. The current environment empowers high-end clients with a wider array of choices and increased negotiation power compared to the competitive years of the past.

UNMATCHED SUPPORT AND SUCCESS

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

miami.evrealestate.com

• Sales volume has consistently moderated, while prices have shown impressive and continuous appreciation.

• Market time has fluctuated, and inventory has seen some growth, but the market is absorbing new supply, contributing to sustained price growth.

• Luxury single-family sales volume remains strong, albeit fluctuating, with stable market times.

• Luxury condominium sales have declined from their 2022 peak, and market time has steadily increased, indicating a shift towards a buyer's market.

$2,950,000

12859 sw 138th Loop Engel & Völkers Ocala

Prices are still going up, which is great for sellers. But with a ton more homes on the market and a much longer selling time, it's a definite buyer's market.

Ocala, located in Marion County, is known as the "Horse Capital of the World," boasting a rich equestrian culture with world-class horse farms and training facilities. Beyond its rolling pastures, Ocala offers natural beauty through the Ocala National Forest, Silver Springs State Park, and countless outdoor activities. The city's historic downtown features charming shops, dining, and cultural events, while its affordable housing and relaxed lifestyle attract families, retirees, and nature enthusiasts.

" Despite significant market challenges, including a sharp drop in average condo values and the complexities of hurricane damage, our team has had notable successes, completing high-value transactions that demonstrate our strategic expertise and resilience."

TaMara York ENGEL & VÖLKERS OCALA

License

Partner

| Broker

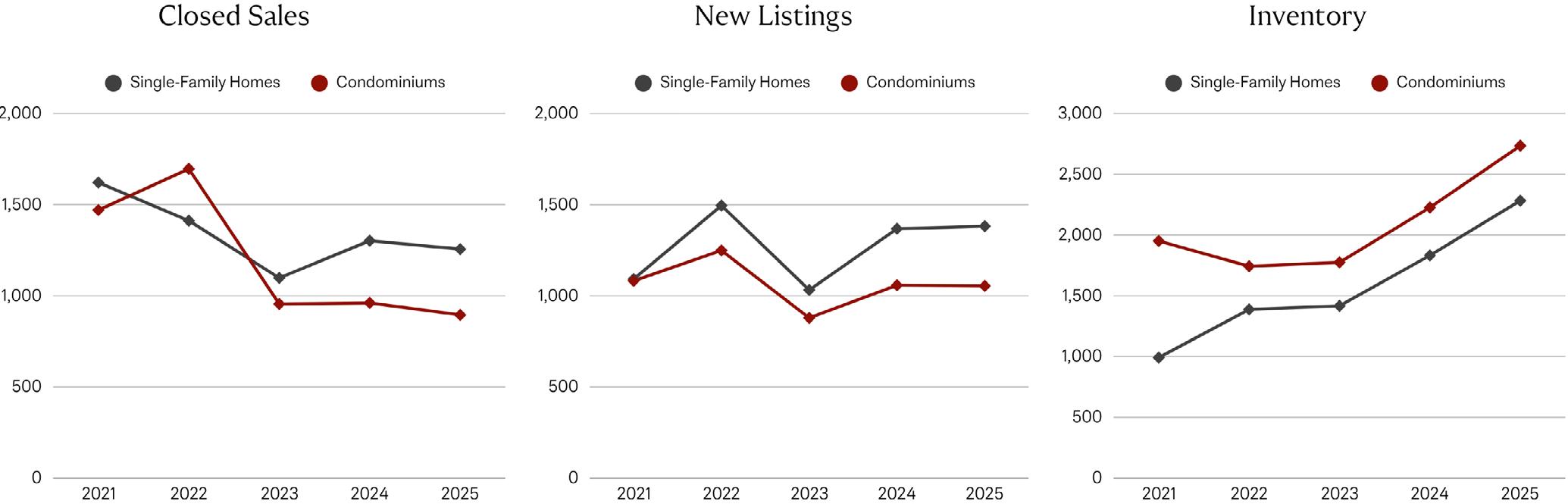

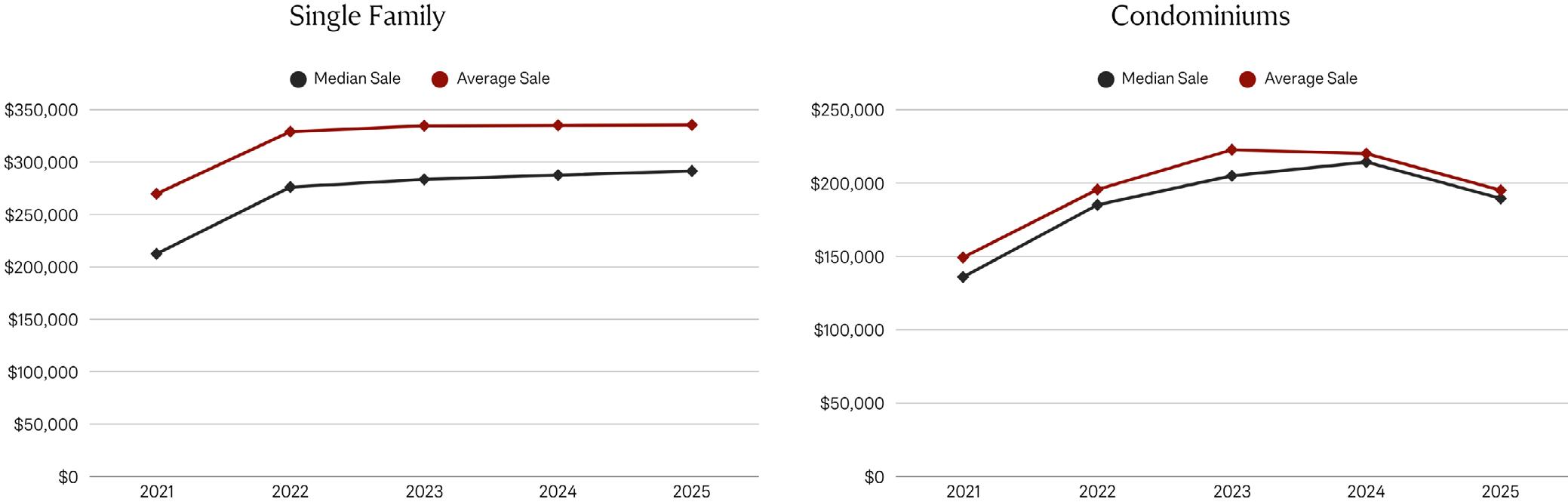

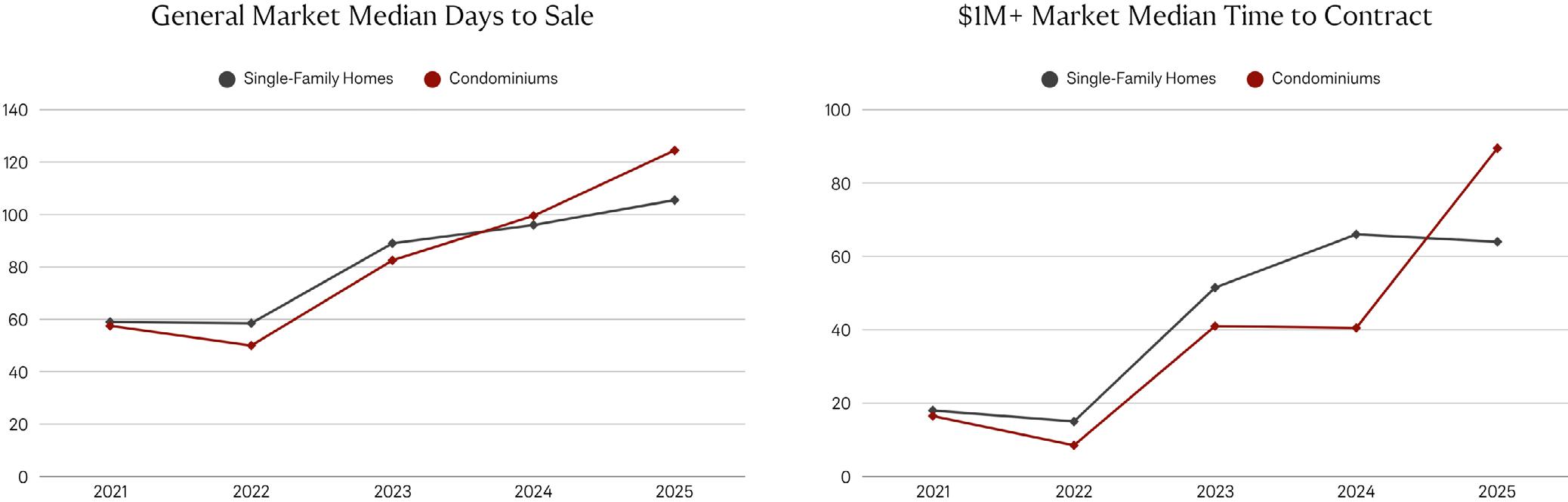

The Ocala single-family market is navigating a period of moderation, with resilient values holding firm despite a slight decrease in sales activity. Closed sales have moderated from 4,601 in 2021 to 4,243 by mid-2025, a shift that has not diminished the area’s underlying property values. Median sale prices have shown consistent appreciation, climbing from $212,450 to a significant $291,493, a testament to the enduring desirability of single-family residences in the region.

The condominium market in Marion County is undergoing a period of significant recalibration, marked by a consistent reduction in sales volume and a recent price correction. Closed sales have steadily decreased from 383 in 2021 to 280 by mid-2025, indicating a notable cooling of demand in the sector. This slowdown is paired with a noticeable price correction, with the median sale price declining from its peak of $214,325 to $189,500, as values soften amidst an increasing supply.

This new market rhythm is defined by a significant lengthening of the sales cycle, with median days to sale extending to a deliberate 102 days. This shift is empowered by a dramatic expansion of inventory, which has surged from 755 units in 2021 to 4,088 by mid-2025. This confluence of factors indicates a definitive transition to a strong buyer-favored environment, providing discerning clients with greater choice and leverage.

This new dynamic is further defined by a significant lengthening of the sales cycle, now at a median of 107 days, affording buyers more time for deliberation. This shift is empowered by a continuous expansion of inventory, which has grown from a mere 39 units in 2021 to 289 by mid-2025. This combination of robust supply and a more cautious buyer sentiment firmly establishes a strong buyer's market, creating intense competition among sellers.

The luxury single-family market in Ocala remains a niche segment with relatively stable sales volume but highly variable and often lengthy market times. Closed sales have fluctuated between 64 and 79 annually, settling at 66 by mid-2025, indicating a consistent but limited demand for prime residences. This market's dynamic is defined by an erratic sales cycle, with the median time to contract extending to a prolonged 152.5 days by mid-2025.

This shift is set against a backdrop of a growing supply, with inventory for luxury single-family homes expanding from 97 units in 2021 to 227 by mid-2025. This increasing availability, coupled with highly variable market times, provides a significant advantage to discerning buyers. The current environment offers strategic opportunities for clients willing to navigate a prolonged sales cycle to secure an optimal acquisition.

• Sales volume has moderated, while prices have shown persistent appreciation.

• Market time has lengthened, and inventory has surged dramatically, indicating a transition to a strong buyerfavored market.

• This is a niche luxury single-family segment with stable sales volume but highly variable and often lengthy market times.

• The luxury condominium market is virtually non-existent, with no closed sales and negligible inventory from 20212025.

Sales have slowed down a lot, but prices are staying strong. With more inventory and homes taking longer to sell, the market is much more balanced for buyers.

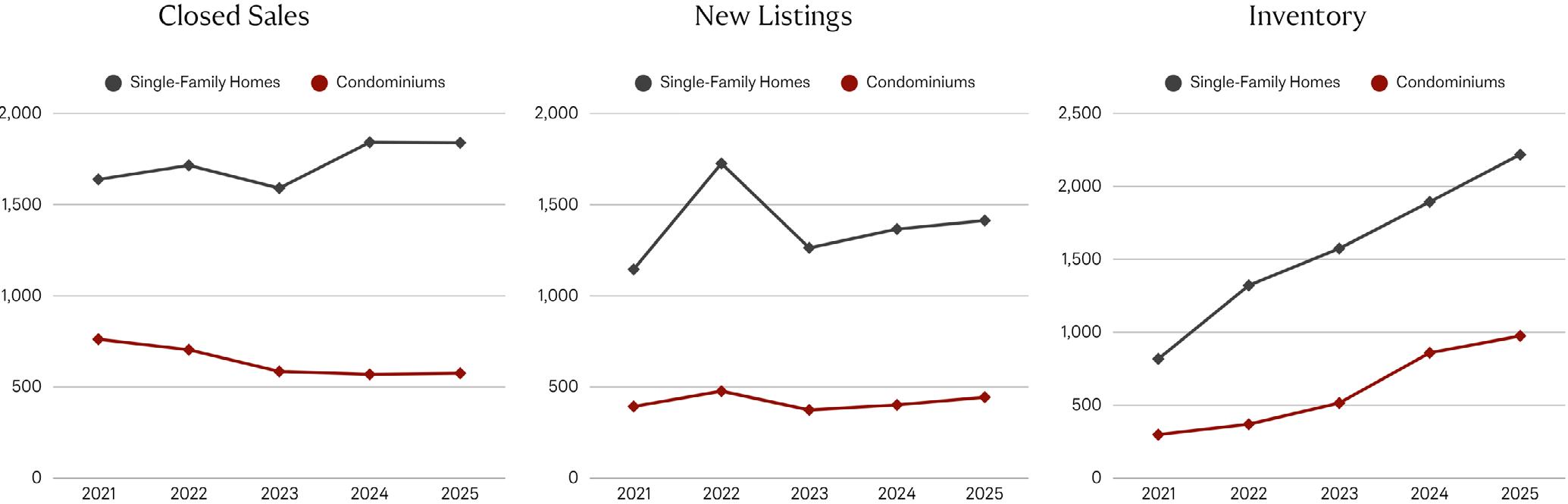

Okaloosa and Walton counties, nestled along Florida’s Emerald Coast, are renowned for their sugar-white sands, emerald-green waters, and laid-back coastal lifestyle. The area includes vibrant communities like Crestview, Fort Walton Beach, and Destin—each offering a unique blend of small-town charm and upscale amenities. Known for worldclass fishing, luxury resorts, and the scenic beauty of 30A, these counties attract both tourists and residents seeking a slice of paradise. The real estate market features a mix of beachfront condos, luxury homes, and family-friendly neighborhoods, making it a sought-after destination for both primary and vacation homes.

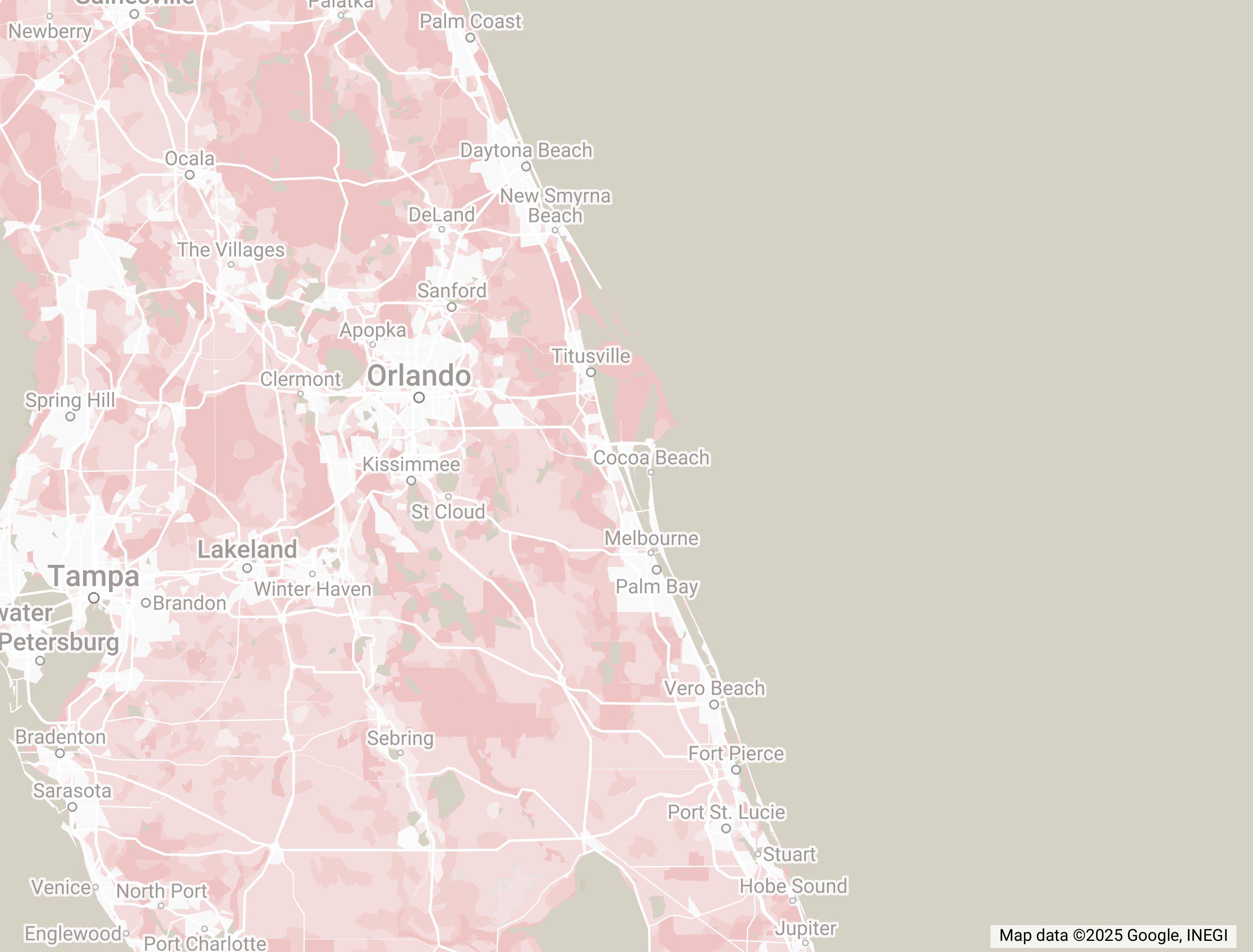

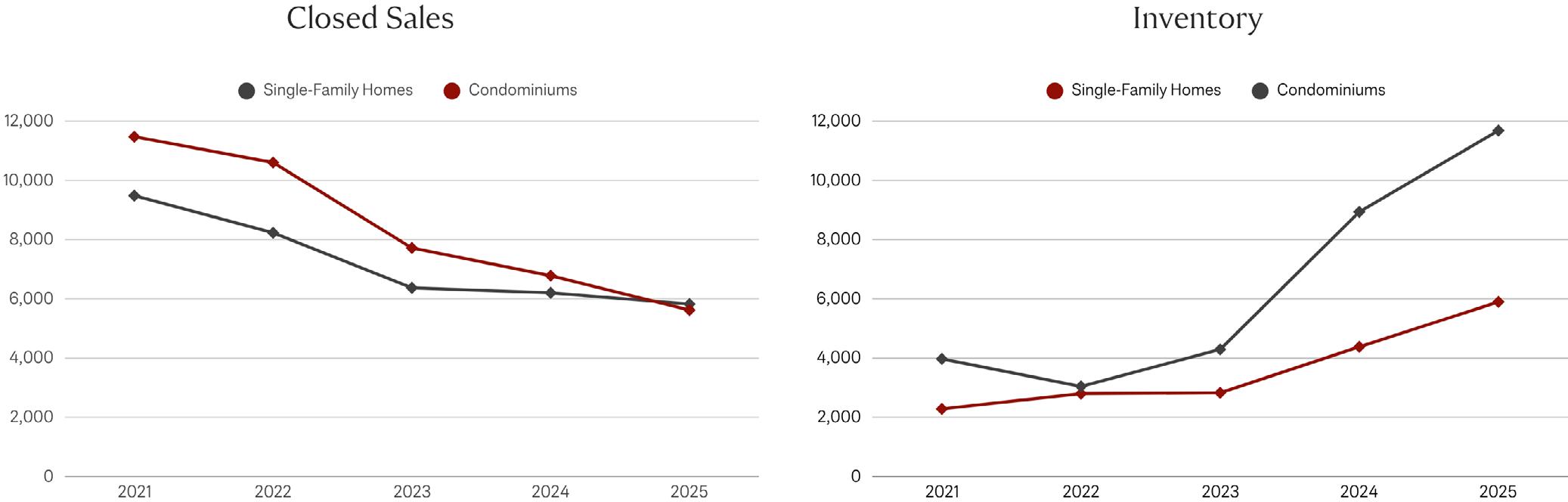

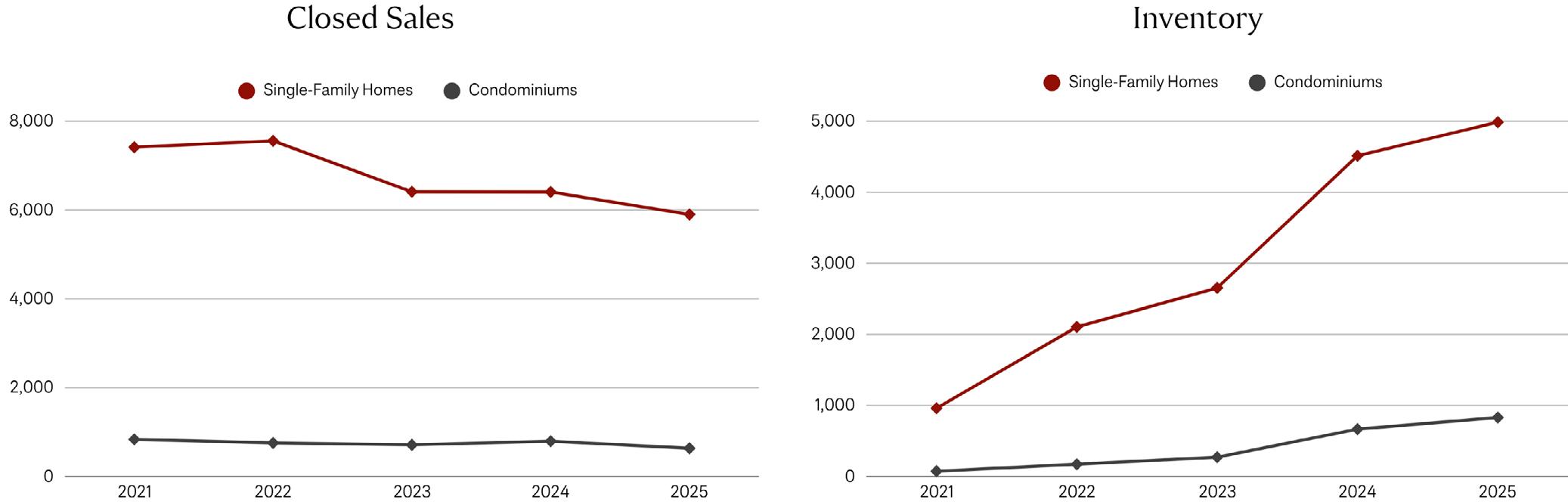

The single-family market in the Orlando metropolitan area is navigating a new equilibrium, where sales volume has moderated but property values continue their impressive upward trajectory. Closed sales have steadily declined from 20,700 in 2021 to a more measured 14,328 by mid-2025, reflecting a shift from the high-demand environment of earlier years. Despite this trend, median sale prices have shown consistent appreciation, climbing from $338,834 to a significant $447,418, a testament to the region’s enduring desirability.

This new market rhythm is defined by a significant lengthening of the sales cycle, with median days to sale extending to 84.5 days, providing discerning buyers with ample time for consideration. This shift is empowered by a dramatic expansion of inventory, which has surged from 3,075 units in 2021 to a substantial 10,752 by mid-2025. This combination of factors indicates a clear transition to a more balanced, and increasingly buyer-favored, market, offering clients greater choice and negotiation leverage.

The condominium market in the Orlando area has faced a moderation in sales volume, yet it continues to see a steady appreciation of values, signaling a unique opportunity for buyers. Closed sales have consistently decreased from 6,736 in 2021 to 4,150 by mid-2025, highlighting a notable cooling of demand in the sector. Despite this, median sale prices have shown robust growth, climbing from $210,000 to $317,375, which suggests that sustained demand for specific unit types is maintaining value.

This market is defined by a significant lengthening of the sales cycle to 98 days, giving buyers more time for meticulous evaluation, which is a direct consequence of a substantial increase in inventory. Supply has grown from 1,222 units in 2021 to 4,963 by mid-2025. This confluence of a slower pace and a robust supply firmly establishes a strong buyer's market, empowering clients with greater leverage and an abundance of choices.

The luxury single-family market in the Orlando area presents a compelling counter-narrative of consistent growth, defying the broader market's moderation. Closed sales in this elite segment have shown strong performance, increasing from 691 in 2021 to a significant 996 by mid-2025. This sustained growth in high-value transactions highlights a robust and expanding appetite for prime residences in the region.

The pace of acquisition in this market remains remarkably efficient, with the median time to contract holding at a relatively swift 38.5 days. This is a direct consequence of a continuous upward trend in new luxury listings and a growing inventory, which has risen to 1,145 units by mid-2025. This combination of strong sales, efficient market times, and increasing supply solidifies the Orlando luxury market as a healthy and expanding landscape of opportunity.

The luxury condominium market in the Orlando area remains a specialized segment, defined by limited yet growing transaction volumes and highly variable market times. Closed sales in this elite category have increased from 27 in 2021 to 38 by mid2025, a gradual but positive growth in demand. This growth, however, is paired with a sales cycle that has shown extreme volatility, extending to a prolonged 62.5 days by mid-2025.

This dynamic is further defined by a modest but growing inventory, which has risen from 18 units in 2021 to 25 by mid2025. This combination of a slower pace and a gradual increase in supply indicates a luxury condominium market that is slowly maturing. This evolving landscape offers discerning clients a somewhat wider selection and increased leverage for negotiation, marking a new chapter for this niche segment.

Engel & Völkers combines international influence with deep local market knowledge to empower real estate professionals. Work with our established shop to access premier marketing, world-class resources, and a collaborative team committed to helping you thrive.

• Sales have consistently declined, while prices have remained remarkably stable after an initial surge.

• Market time has significantly lengthened, and inventory has nearly quadrupled, indicating a transition to a more balanced, buyer-favored market.

• Luxury single-family sales have moderated from their 2022 peak, and market time has considerably lengthened.

• Luxury condominium sales have sharply declined from their 2022 peak, with a dramatic increase in market time, indicating a definitive shift to a strong buyer's market.

$2,795,000

10411

Prices are still going up, which is great for sellers. But with a lot more homes available and a longer selling time, it's a more balanced market for buyers.

Orlando, spanning Lake, Orange, Osceola, and Seminole counties, is a dynamic hub blending world-renowned entertainment with vibrant local culture. Famous as the theme park capital of the world, Orlando attracts visitors to Walt Disney World, Universal Studios, and beyond. Beyond the magic, the region boasts thriving neighborhoods, a robust economy driven by tourism, tech, and healthcare, and a flourishing arts scene.

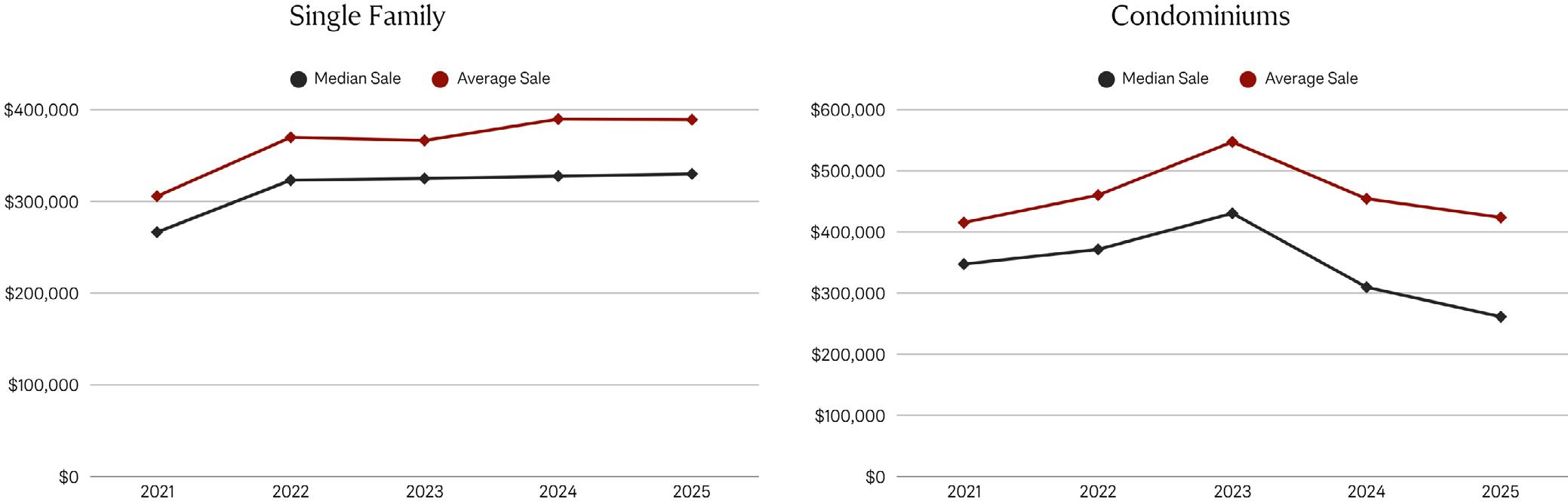

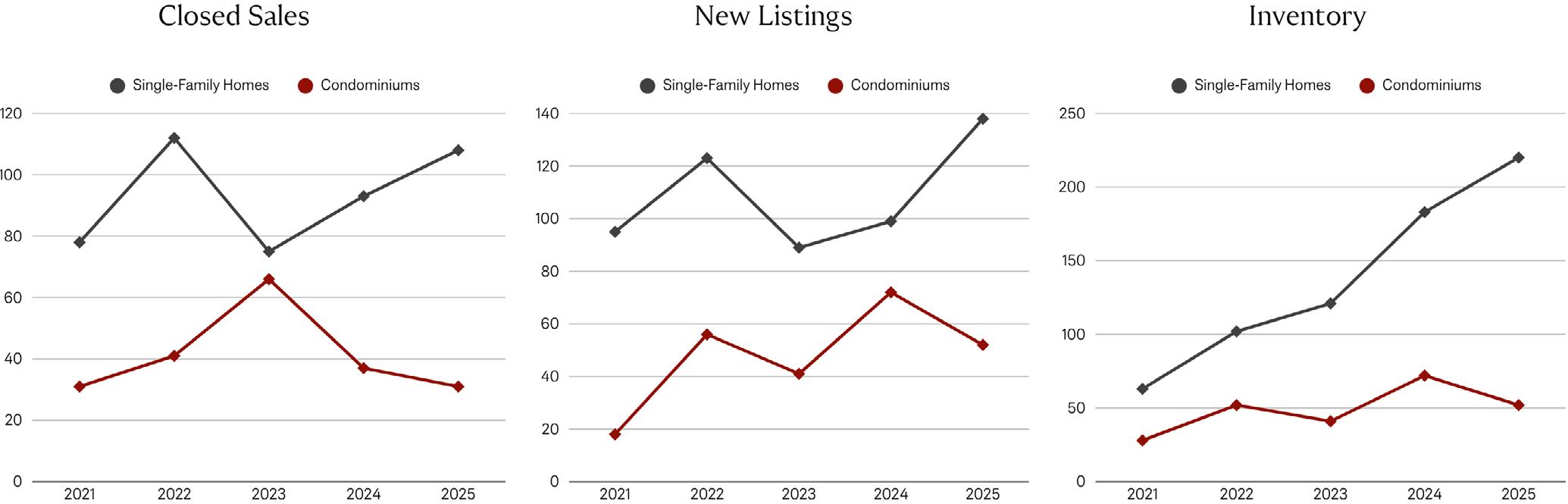

The Central Florida housing market experienced a notable transition from a strong seller’s market to a more balanced environment between 2021 and 2024. The single-family home sector in 2021 and 2022 was characterized by tight inventory, steep price increases, and quick sales, all indicative of robust seller advantages.