MID-YEAR 2023

Florida Luxury Real Estate Market Report

Executive Note

Welcome to the Engel & Völkers Florida 2023 Mid-Year Luxury Real Estate Market Report, your comprehensive guide to the latest real estate market trends across the beautiful state of Florida, with a special focus on metro areas boasting properties valued at over $1 million. Our report meticulously compiles data, including prior-year comparisons of total sales, average sales price, median days to sale, and active listings for both single-family homes and condominiums in each of the analyzed markets.

Over the past few years, Florida has proven to be a lucrative destination for homeowners, with substantial wealth creation since 2020. Despite the increased cost of borrowing money for mortgages, the real estate market in Florida has demonstrated remarkable stability throughout 2023. A key factor contributing to this success has been the accelerated infl ux of families and affl uent individuals, either making Florida their new home or acquiring second residences within the state. This enduring trend is fueled by the strong emotional desire among wealthy consumers to own more property, and Florida remains the top choice for such prestigious purchases.

The luxury market’s robustness is particularly evident when comparing the fi rst half of 2023 to the same period in 2019. Astonishingly, the number of single-family homes over $1 million sold in the state during the fi rst half of 2023 reached an impressive 11,113, signifying a staggering 153% increase compared to 2019. While the total active inventory of luxury homes has remained steady in 2023, with 12,162 listings compared to 11,181 in 2019, the number of new luxury homes listed soared by 109% in 2023, reaching a total of 19,781. Such a surge in demand is evident by the median time on the market in 2023, which stood at a mere 46 days, down significantly from 130 days in 2019.

For discerning buyers seeking the best opportunities in Florida, the options are expanding, with numerous emerging high-end property markets. The Florida Chamber of Commerce 2023 mid-year economic report reveals that the state has led the nation, attracting an impressive $39.2 billion in income migration over the past year. To cater to this ever-growing demand, Engel & Völkers has made significant strides, more than doubling our presence in Florida since 2020. Currently, we boast an extensive network of 42 shop locations, covering the largest metropolitan areas, enchanting beach and college towns, as well as burgeoning equestrian and emerging markets, with fi ve additional shops set to be launched imminently.

At Engel & Völkers, luxury is not just a price point, but a different level of service for all our clients. On behalf of all our franchise owners and real estate advisors, we look forward to the opportunity to serve all of your real estate needs.

- PETER GIESE, CEO ENGEL & VÖLKERS MLP FLORIDAFlorida State

Get ready to embark on an exhilarating journey through Florida’s luxury real estate landscape in the first half of 2023—a journey filled with excitement, promise, and boundless opportunities! While there were a few twists and turns that kept us intrigued, it’s been an overall remarkable experience.

Sure, the numbers may not have shattered previous records, but they still showcase the allure of Florida’s luxury real estate market. Despite a 15.40% dip in closed sales, an impressive 11,113 homes were sold for over a million dollars—clearly, demand for luxury properties remains strong.

Interestingly, the median time to contract saw an unprecedented 132.40% leap. However, it’s heartening to know that even with this increase, homes were still selling in just 43 days on average, compared to 19 days in 2022. The most sought-after properties are commanding multiple offers above the asking price, indicating the high desirability and value they hold.

While the market experienced a slight dip in new listings, down by 21.80% from the previous year, fear not, as there are still 9,703 tantalizing options available for those seeking luxury abodes. Moreover, we witnessed a modest 21.00% increase in inventory, with an impressive 12,112 fabulous homes up for grabs. This surge in options promises an exciting array of choices for potential buyers, ensuring their dream homes are within reach. Amidst the challenges, we find the silver lining—a steady supply of exquisite properties. Patience and perseverance will undoubtedly reward those on the hunt for their dream luxury homes.

As we journey through 2023, some regions in Florida showcased their resilience, navigating the market’s ups and downs with finesse. We remain optimistic that the luxury real estate market will continue to thrive and dazzle us in the second half of the year.

So, fasten your seatbelts and get ready for more excitement and surprises! The allure of Florida’s luxury real estate market is unwavering, and the second half of 2023 promises to be an even more extraordinary ride. Stay tuned for the many positive developments that lie ahead!

FLORIDA SNAPSHOT

$768K AVERAGE LISTING AVERAGE SALE

$1.43M

47 SHOPS 875 ADVISORS

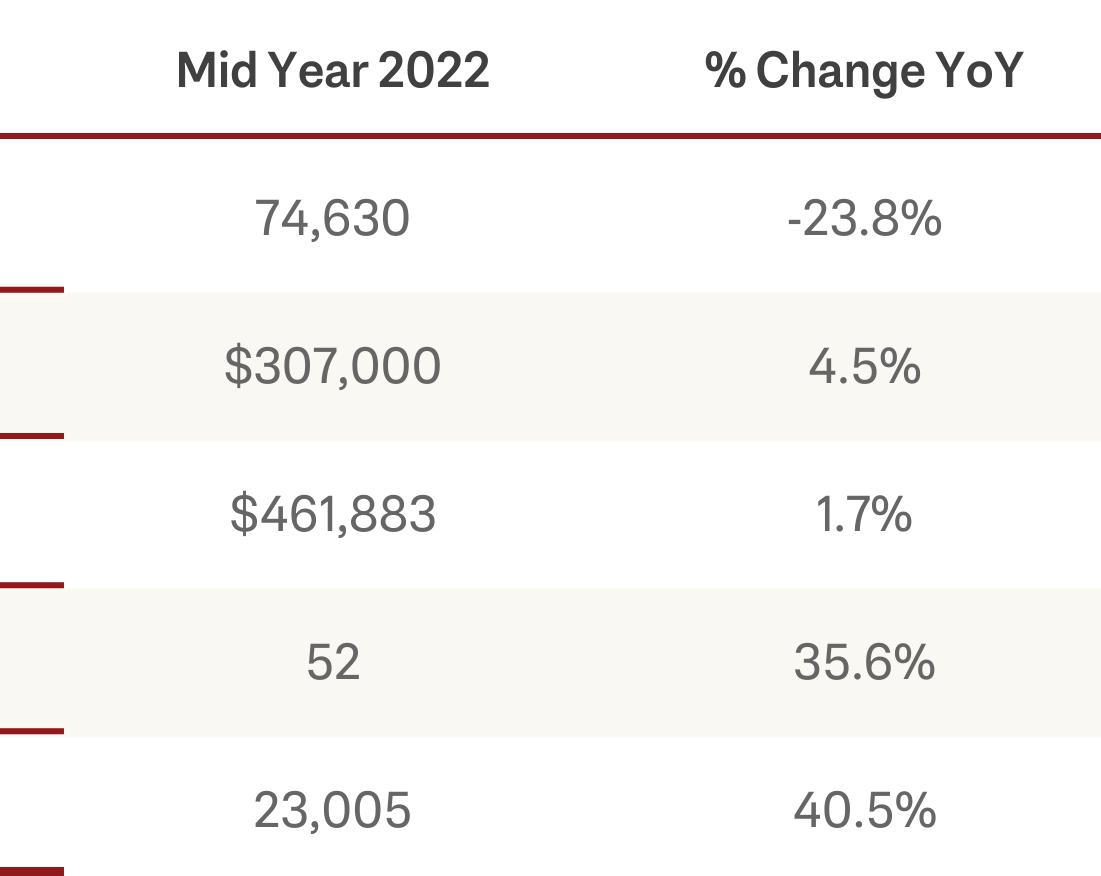

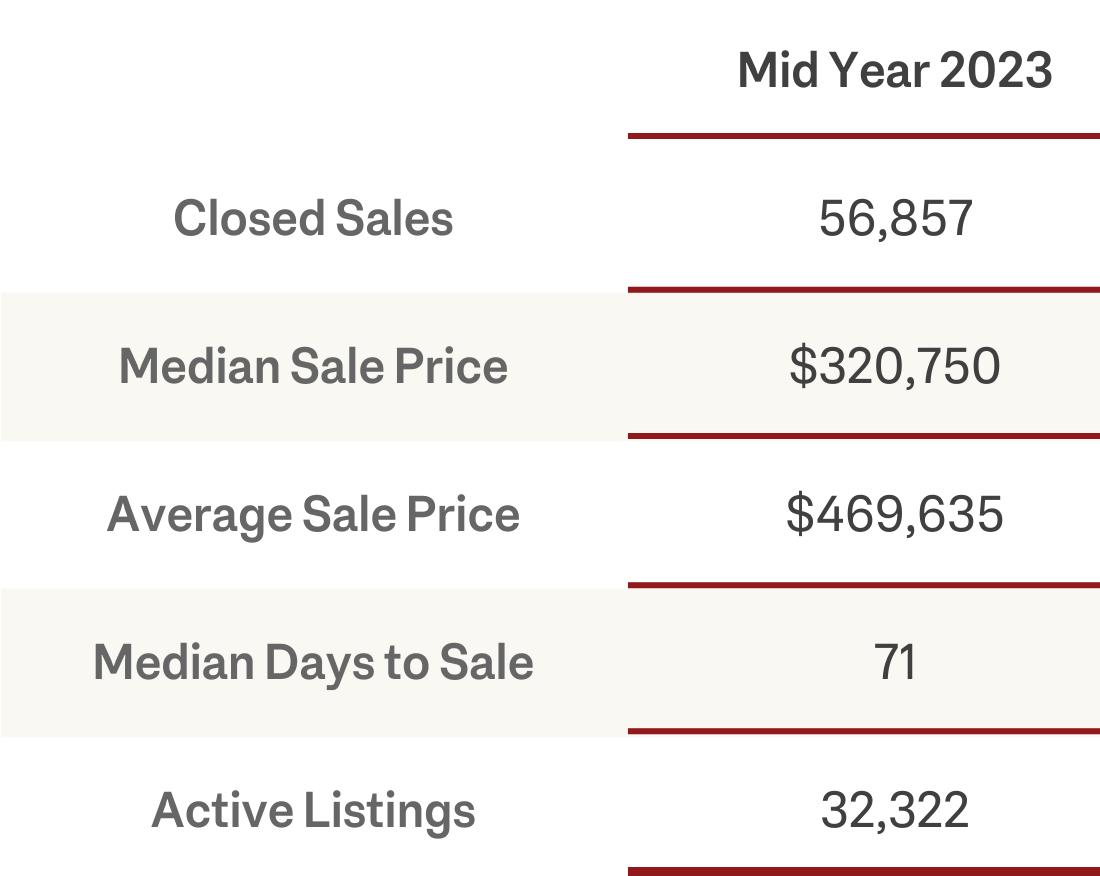

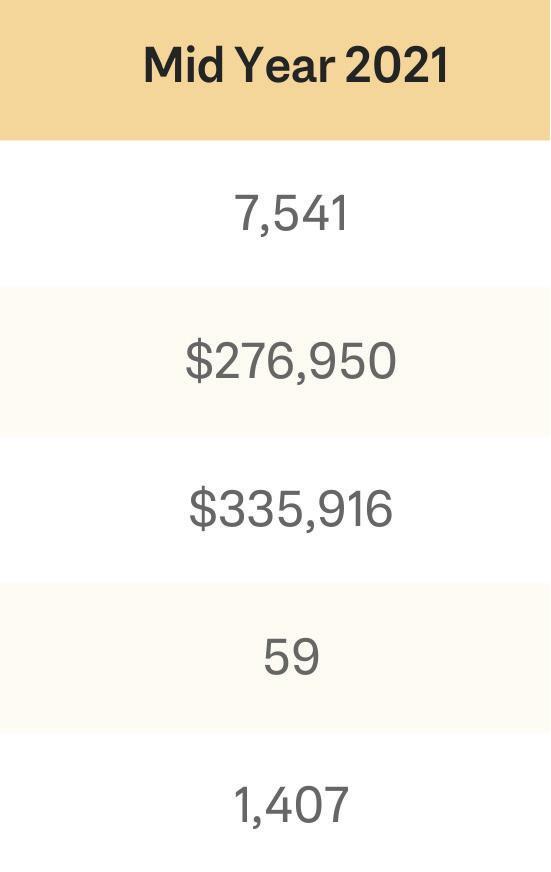

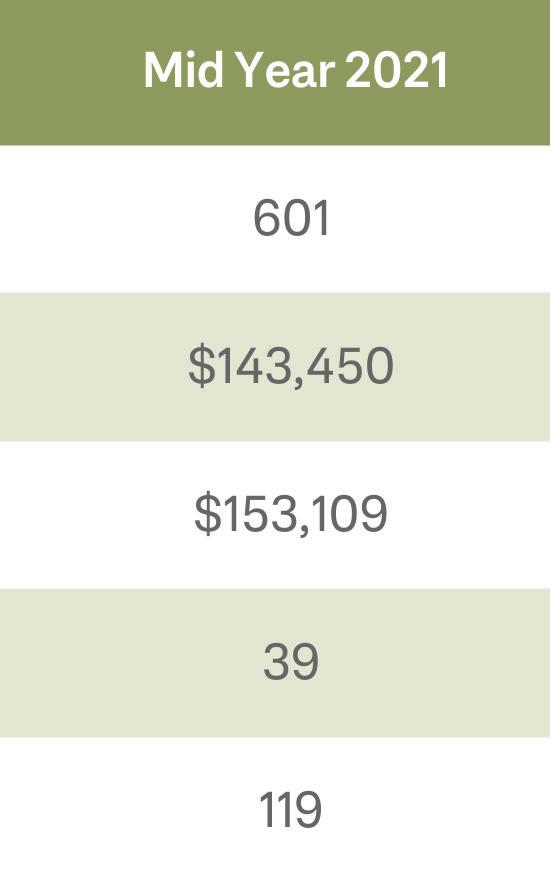

Florida Statewide Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

Broward County

In the illustrious realm of Broward County’s luxury real estate, the fi rst half of 2023 presented its share of intriguing developments and challenges. Broward County’s high-end housing scene witnessed a bit of turbulence, as closed sales took a dip by a notable 26.80%. Only 947 magnificent homes over $1 million found new owners, a decline from the previous year’s 1,294 properties sold during the same period in 2022.

Luxury homes are still selling faster than normal, but it’s essential to exercise patience as the median time to contract did increase. In 2023, it took an average of 49 days to seal the deal on a premium residence, compared to a speedy 21 days the year before.

While new listings decided to take a step back, declining by 18.70% from the previous year, the inventory of active listings decided to show off with a 24.70% increase. With 1,094 stunning houses up for grabs, you won’t be short on choices!

In Broward County’s luxury real estate market, challenges have emerged, including a slowdown in closed sales and an increase in the median time to contract. However, these hurdles present unique opportunities for buyers. The longer selling process allows for a more thoughtful selection of dream luxury homes, while decreased new listings create an exclusive market. With a boost in inventory, buyers have a plethora of luxurious gems to explore. Staying informed about market trends and seeking guidance from professionals is key to navigating this ever-changing landscape. Despite the challenges, Broward County’s allure remains strong, making it an exciting and rewarding destination for luxury real estate seekers. Embrace the hunt and prepare to discover your own luxury paradise!

$1.20 AVERAGE SALE

FORT LAUDERDALE POMPANO BEACH

Broward County Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

Step into the vibrant world of Lee County’s premium real estate market, where the first half of 2023 unfolded with captivating twists and intriguing developments. Amidst the sun-kissed shores, 692 luxury homes were sold for over $1 million, marking a 20.10% decline from the same period in 2022. The impact of Hurricane Ian may have played a role in shaping these changes, but the market’s resilience and adaptability shone through, creating unique opportunities in the region’s luxury real estate landscape. Despite the slight decline in closed sales, the luxury market in Lee County remains dynamic and promising.

The typical contracting time for luxury houses grew from 19 days in 2022 to 33 days in 2023. While this may cause alarm, it’s essential to remember that real estate markets differ greatly, and a lengthy selling process may be usual in another area. However, even with this increase, it’s worth noting that the current median days to contract is still lower than the normal average.

In terms of supply, new listings experienced a modest decline of 15.90% year over year, with 581 listings in 2023 compared to 691 in 2022. However, the inventory of active listings saw an encouraging rise of 33.40%, unveiling 715 alluring homes available for sale in the first half of 2023, as opposed to 536 in 2022. This increase in available properties provides buyers with a diverse array of options to choose from, ensuring that they find the perfect luxury residence that suits their preferences and needs.

Despite the challenges presented by Hurricane Ian, Lee County’s luxury real estate market demonstrates remarkable resilience. As the market navigates through evolving dynamics, industry professionals and buyers alike can find exciting prospects in this captivating real estate realm. The region’s enduring allure, combined with its adaptability, showcases a promising future for the luxury real estate sector in Lee County.

FLORIDA SNAPSHOT

$1.43M $768K AVERAGE LISTING AVERAGE SALE

47 SHOPS 875 ADVISORS

Cape Coral • Fort Myers

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

WALTON COUNTIES)

In the fi rst half of 2023, the luxury real estate market in Crestview - Fort Walton Beach - Destin, encompassing Okaloosa and Walton Counties, encountered challenges, yet opportunities shone through. Despite the region’s sunlit beauty, real estate sales struggled with a 33.80% decrease, selling 632 properties over $1 million compared to 955 in 2022.

The median time to contract increased in 2023, rising to 52 days from 15 days in 2022, representing a huge 243.30% rise. While this increase may appear extraordinary, it is crucial to remember that real estate markets are different, and swings can be impacted by changing situations. However, it’s important to note that even with this notable rise, the current median days to contract is still lower than normal.

New listings also declined by 27.50% year over year, with 645 listings in 2023 versus 890 in 2022. However, the inventory of active listings increased by 31.20%, offering 925 properties for sale compared to 705 in 2022.

Amidst the challenges, there is optimism in the market’s resilience. The longer selling process allows buyers more time to explore and fi nd their dream luxury properties, while sellers can still attract discerning buyers. Moreover, the increased inventory provides buyers with a broader selection of luxurious options to choose from, enhancing their chances of fi nding the perfect fi t for their lifestyle. Despite the evolving dynamics, this period indicates a promising shift towards a more balanced landscape. Buyers can revel in the increased opportunities, and sellers have the chance to showcase their properties to a wider audience. The allure of this breathtaking region remains captivating, promising a bright future for luxury real estate.

LOCAL SNAPSHOT

$2.16M $1.14M AVERAGE LISTING AVERAGE SALE

30A BEACHES • DESTIN

Crestview • Fort Walton Beach • Destin

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

Deltona • Daytona Beach • Ormond Beach

(FLAGLER AND VOLUSIA COUNTIES)

The luxury real estate market in Deltona - Daytona Beach - Ormond Beach showcased impressive resilience in the first half of 2023, despite potential challenges like the impact of Hurricane Nicole. A total of 153 properties priced above $1 million were successfully sold, representing a slight decrease of 7.30% compared to the same period in 2022 when 165 properties were sold.

While the median time to contract saw a moderate increase, taking 32 days in 2023 compared to 23 days in 2022, marking a 39.10% change year over year, it’s important to highlight that the current median days to contract is still lower than the normal medium days to contract.

On the supply side, new listings experienced a marginal decrease of 2.90% year over year, with 165 listings in 2023 compared to 170 in 2022. However, the inventory of active listings increased by 25.70%, with 191 properties available for sale in the first half of 2023, as opposed to 152 properties in 2022.

These figures point to a relatively stable luxury real estate market in Deltona - Daytona Beach - Ormond Beach during the first half of 2023. The slight decrease in sales activity and the increase in available properties hint at the potential influence of Hurricane Nicole’s impact on local market conditions. Nevertheless, this scenario also suggests a balanced market with moderate demand and supply conditions, providing potential opportunities for both buyers and sellers in the region. Overall, the luxury real estate market in Deltona - Daytona Beach - Ormond Beach remains resilient and promising. The region’s charm and allure continue to attract buyers and investors, offering a bright future for luxury real estate ventures in this captivating area.

$1.43M $768K AVERAGE LISTING AVERAGE SALE

(ALACHUA AND GILCHRIST COUNTIES)

In the fi rst half of 2023, the luxury real estate market in Gainesville, spanning Alachua and Gilchrist counties, encountered some challenges, resulting in a notable decline in closed sales. 35 properties were sold over $1 million, representing a significant decrease of 25.50% compared to the same period in 2022 when 47 properties were sold.

Despite these challenges, there are positive signs in the market. The median time to contract saw a modest decrease, taking just 14 days in 2023 compared to 16 days in 2022, marking a 15.60% change year over year. This indicates a faster selling process for luxury properties in the region, showcasing the demand for these exclusive homes.

On the supply side, new listings also decreased by 18.40% year over year, with 40 listings in 2023 compared to 49 in 2022. However, the inventory of active listings increased by 37.80%, with 51 properties available for sale in the fi rst half of 2023, as opposed to 37 properties in 2022. This increase in available properties presents potential opportunities for buyers to explore a broader range of luxury homes.

In summary, the luxury real estate market in Gainesville faced challenges in the fi rst half of 2023, with a decline in closed sales and new listings. However, the market’s resilience is evident in the relatively short time it takes for luxury properties to fi nd buyers, and the increase in available properties offers optimism for potential buyers seeking exclusive homes in this captivating region.

$1.43M $768K AVERAGE LISTING AVERAGE SALE

Gainesville Market Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

In the fi rst half of 2023, the luxury real estate market in Jacksonville, encompassing Baker, Clay, Duval, Nassau, and St. Johns counties, demonstrated remarkable adaptability and resilience amid changing dynamics. Despite facing challenges, the region experienced a slight decline of 3.70% in closed sales compared to the same period in 2022, with 602 properties sold over $1 million.

While the median time to contract saw a moderate increase, taking 36 days in 2023 compared to 28 days in 2022 (a 26.80% change), this suggests a slightly longer selling process for luxury properties in the region. However, it’s important to note that this is a positive sign of the market reverting back to its normal pace. The demand for luxury properties remains steady, and the slight lengthening of the selling process does not indicate any concerning trend.

On the supply side, new listings decreased by 6.10% year over year, totaling 567 in 2023, compared to 604 in 2022. However, the inventory of active listings increased by 21.20%, providing 560 properties for sale in the fi rst half of 2023, up from 462 in 2022. This upswing in available luxury homes widens opportunities for potential buyers to fi nd their ideal residences.

Despite the minor decline in sales activity and the slightly longer time to contract, the luxury real estate market in Jacksonville remains relatively stable and resilient. The region’s ability to adapt to market changes and maintain a steady demand for premium properties reinforces its allure for both buyers and sellers. With a positive outlook and a variety of luxury homes to explore, Jacksonville’s real estate market continues to offer captivating opportunities for investors and homeowners alike.

(BAKER, CLAY, DUVAL, NASSAU, AND ST. JOHNS COUNTIES)

LOCAL SNAPSHOT

$604 AVERAGE SALE

FIRST COAST ST AUGUSTINE ST AUGUSTINE BEACH

Jacksonville Market Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

In the fi rst half of 2023, the luxury real estate market in Lakeland - Winter Haven, Polk County, showcased its resilience and adaptability, despite encountering some challenges. While there was a notable decline in closed sales, with 25 properties sold over $1 million, representing a decrease of 44.40% compared to the previous year, there is room for optimism.

Amidst these changes, the market demonstrated its potential for growth. The median time to contract saw an extraordinary increase, taking 96 days in 2023 compared to 24 days in 2022, marking a significant shift. However, it’s important to note that this is not a concerning trend, but rather a return to normalcy for the market. In the past year, we experienced unique conditions that led to faster contracting times.

On the supply side, new listings increased slightly by 8.70% year over year, with 50 listings in 2023 compared to 46 in 2022. Additionally, the inventory of active listings grew by 32.70%, with 65 properties available for sale in the fi rst half of 2023, as opposed to 49 properties in 2022. This surge in available properties presents a bright outlook for potential buyers, offering them a diverse range of luxurious options to explore and choose from.

Despite the challenges faced by the luxury real estate market in Lakeland - Winter Haven, the region’s adaptability and positive market dynamics cannot be overlooked. The longer selling process allows for more in-depth consideration, creating a win-win situation for buyers seeking their dream luxury homes and sellers looking to showcase the unique features of their properties. With potential for growth and opportunities, the region’s allure and adaptability continue to attract buyers and investors, promising a bright future for luxury real estate ventures in this captivating area of Polk County.

FLORIDA SNAPSHOT

AVERAGE SALE

$1.43M $768K AVERAGE LISTING

OPEN MARKET - EXPLORE FRANCHISE OPPORTUNITIES INQUIRE WITHIN

Lakeland • Winter Haven

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

Miami • Dade County

In the fi rst half of 2023, the luxury real estate market in Miami-Dade County experienced fl uctuations, yet it showcased its resilience and adaptability, offering a promising outlook for the future. While there was a decline in closed sales, with 1,098 properties sold over $1 million, marking a decrease of 22.20% compared to the previous year, there are reasons to remain positive.

Despite the shift in sales figures, the market displayed its ability to adjust. The median time to contract saw a sharp increase, taking 65 days in 2023 compared to 29 days in 2022, a significant 122.40% change. This longer selling process indicates a thoughtful approach to luxury property transactions, providing ample time for both buyers and sellers to make well-informed decisions. Rather than causing concern, this adaptation refl ects the market’s capacity to fi nd equilibrium, allowing buyers and sellers to navigate the landscape with confidence and patience.

Although new listings decreased by 31.00% year over year, with 1,032 listings in 2023 compared to 1,495 in 2022, the slight increase of 2.10% in active listings suggests sellers are pricing their properties strategically. This balanced inventory refl ects the market’s adaptability and the confidence of sellers in the region’s continued allure.

The Miami-Dade real estate market maintained its vibrancy and appeal throughout the fi rst half of 2023. The consistent median sales price indicates the stability of luxury units. While the average days to close a deal increased, this also highlights a thorough approach to ensure successful transactions. The market’s resilience and enduring allure provide an optimistic outlook for potential buyers and sellers. The luxury real estate market in Miami-Dade County navigated fl uctuations with poise and adaptability, instilling optimism for the future. The region’s enduring appeal continues to attract discerning buyers seeking exclusive properties, setting the stage for exciting opportunities and a bright future in the ever-evolving luxury real estate landscape.

$3.10 AVERAGE SALE

MIAMI • MIAMI COCONUT GROVE

Miami • Dade County Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

During the fi rst half of 2023, the luxury real estate market in Naples - Immokalee - Marco Island, Collier County, displayed impressive resilience, overcoming challenges stemming from the aftermath of Hurricane Ian in 2022. Despite a slight decline of 12.30% in closed sales, with 1,047 properties sold over $1 million compared to 1,194 properties in the same period of 2022, the market adeptly adapted to significant shifts in the selling process.

The median time to contract experienced a substantial 139.00% increase, taking 49 days in 2023 compared to 21 days in 2022. This notable change indicates a longer duration for luxury property transactions in the region, which is a normal fl uctuation in the real estate market. Such variations can be infl uenced by various factors, and it’s common for the market to adapt and adjust over time.

On the supply side, the market encountered a considerable decrease of 25.70% in new listings, with 677 listings in 2023 compared to 911 in 2022. Despite the challenges, the inventory of active listings demonstrated notable growth of 33.80%, offering 1,050 properties for sale in the fi rst half of 2023, as opposed to 785 properties in 2022. This surge in available properties showcases the market’s ability to recover and provide a healthy selection of luxury homes for potential buyers.

Despite the adversities faced from Hurricane Ian in 2022, the luxury real estate market in NaplesImmokalee - Marco Island showcased unwavering resilience and adaptability. Its allure as a destination for luxury property seekers remains strong, refl ecting the market’s ability to navigate complexities and changes brought about by natural disasters. The region’s enduring appeal promises exciting opportunities for buyers seeking a slice of luxury amidst the captivating landscapes of Collier County

FLORIDA SNAPSHOT

AVERAGE SALE

AVERAGE LISTING

$2.09M $1.28M

NAPLES-BONITA-ESTERO • MARCO ISLAND

Naples • Immokalee • Marco Island

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

(MANATEE AND SARASOTA COUNTIES)

The luxury real estate market in North Port - Sarasota - Bradenton, comprising Manatee and Sarasota counties, demonstrated remarkable resilience amidst changes, resulting in a modest decline in closed sales. A total of 955 properties were sold over $1 million, marking a decrease of 4.30% compared to the same period in 2022 when 998 properties were sold.

Despite the increase in the median time to contract, taking 28 days in 2023 compared to 8 days in 2022, it’s essential to recognize that the market is simply reverting back to its normal state. Fluctuations in selling times are a natural occurrence, and the current shift is a refl ection of the market returning to its usual pace.

On the supply side, new listings also experienced a decline of 22.10% year over year, with 716 listings in 2023 compared to 919 in 2022. However, the inventory of active listings experienced a notable upswing of 35.60%, offering 869 properties for sale in the fi rst half of 2023, compared to 641 properties in 2022. This increase in available properties demonstrates the market’s adaptability to evolving demands, providing prospective buyers with ample luxury options to explore.

Overall, the luxury real estate market in North Port - Sarasota - Bradenton exhibited commendable resilience and adaptability. Despite the challenges, it maintained a healthy selection of luxury properties for prospective buyers, showcasing the region’s allure as an attractive destination for luxury real estate enthusiasts. The market’s ability to navigate through changing conditions is a testament to its enduring appeal and promises exciting opportunities for those seeking a slice of luxury amidst the scenic landscapes of Manatee and Sarasota counties.

LOCAL SNAPSHOT

AVERAGE SALE

$1.16M $1.03M AVERAGE LISTING

MIAMI MIAMI COCONUT GROVE

North Port • Sarasota • Bradenton

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

During the first half of 2023, the luxury real estate market in Ocala, encompassing Marion County, showcased resilience and stability amidst challenges, resulting in a marginal decline in closed sales. A total of 76 properties were sold over $1 million, representing a decrease of 3.80% compared to the same period in 2022 when 79 properties were sold.

The market’s adaptability is evident as the median time to contract experienced a significant increase, taking 83 days in 2023 compared to 46 days in 2022, marking a substantial 79.30% change year over year. This adjustment is a normal aspect of the real estate market, allowing buyers and sellers to make well-informed decisions and contribute to successful transactions in this resilient market.

On the supply side, new listings also decreased by 22.00% year over year, with 71 listings in 2023 compared to 91 in 2022. However, the inventory of active listings saw a moderate increase of 9.10%, with 144 properties available for sale in the first half of 2023, as opposed to 132 properties in 2022. This relatively steady inventory of available properties offers discerning buyers a variety of luxury options to explore.

Overall, the Ocala luxury real estate market demonstrated stability and adaptability in the face of challenges. The longer selling process indicates a market that carefully considers transactions, allowing for informed decisions by both buyers and sellers. With a steady inventory, the region continues to attract luxury real estate enthusiasts, promising exciting opportunities for those seeking to be part of this enduring and vibrant market in Marion County.

Ocala Market Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

(LAKE, ORANGE, OSCEOLA, AND SEMINOLE COUNTIES)

In the fi rst half of 2023, the luxury real estate market in Orlando - Kissimmee - Sanford, spanning Lake, Orange, Osceola, and Seminole counties, encountered substantial shifts, yet it remains poised for a brighter future. While there was a remarkable decline of 58.80% in closed sales, with 340 properties sold over $1 million compared to 826 properties in the same period of 2022.

The median time to contract saw a notable 83.30% increase, taking 28 days in 2023 compared to 15 days in 2022. Despite the increase in days, this market variation is entirely expected, as the market shifts back to normal, allowing buyers and sellers to make well-considered decisions and ensuring successful transactions in the thriving real estate market.

On the supply side, new listings witnessed an extraordinary decrease of 95.10% year over year, with only 40 listings in 2023 compared to 812 in 2022. Additionally, the inventory of active listings plunged by a staggering 91.30%, with only 51 properties available for sale in the fi rst half of 2023, as opposed to 587 properties in 2022. This situation presents a unique opportunity for sellers to showcase their exclusive properties in a market with limited inventory, potentially leading to better deals.

Despite the challenges, the reduced inventory presents a unique opportunity for sellers to showcase exclusive properties, potentially leading to better deals. The market’s resilience and adaptability suggest opportunities for growth and revitalization. The region’s allure continues to attract luxury property enthusiasts, promising exciting prospects for both buyers and sellers in the future. As the market navigates through complexities, it does so with optimism and strength, making way for a brighter journey ahead.

FLORIDA SNAPSHOT

$1.43M $768K AVERAGE LISTING AVERAGE SALE

47 SHOPS 875 ADVISORS

Orlando • Kissimmee • Sanford

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

During the fi rst half of 2023, the luxury real estate market in Palm Bay - Melbourne - Titusville, Brevard County, demonstrated remarkable resilience despite encountering some challenges. While there was a slight decline of 10.50% in closed sales, with 153 properties sold over $1 million compared to 171 in 2022, the market remained steadfast.

Despite the notable 94.10% increase in the median time to contract, which suggests a longer selling process for luxury properties in the region, the current 33-day median time is still lower than normal. Real estate markets often experience fl uctuations, and various external factors can infl uence the length of time it takes to secure a contract. It’s essential to recognize that these changes are part of the dynamic nature of the real estate industry.

On the supply side, new listings also decreased by 7.60% year over year, with 145 listings in 2023 compared to 157 in 2022. However, the inventory of active listings saw a moderate increase of 9.80%, providing 134 properties for sale in the fi rst half of 2023, as opposed to 122 properties in 2022.

Palm Bay - Melbourne - Titusville’s luxury real estate market faced some challenges in the fi rst half of 2023. The decline in sales and new listings created a more competitive market for buyers, while the increased inventory offered a wider selection of luxury properties. Despite these minor hiccups, the market remained resilient and steady. The outlook for the luxury real estate market in Brevard County remains positive, with its ability to navigate through challenges indicating promising opportunities for both buyers and sellers in the region.

FLORIDA

SNAPSHOT

Palm Bay • Melbourne • Titusville

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

Palm Beach County

The fi rst half of 2023 presented a tumultuous time for the Palm Beach County luxury real estate market. Though there was an observable dip of 7.30%, with 1,590 million-dollar properties being sold out compared to 1,715 in 2022, the ability of the market to swiftly adjust and remain resilient was on full display.

The median time to contract saw a significant increase, taking 45 days in 2023 compared to 18 days in 2022, marking a notable 157.10% change year over year. While this indicates a longer selling process for luxury properties in the region, it also refl ects the normalcy of the market during this period of adjustment. However, it’s important to highlight that despite this notable increase, the current median time to contract is still lower than the normal average.

On the supply side, new listings also decreased by 26.80% year over year, with 1,263 listings in 2023 compared to 1,726 in 2022. However, the inventory of active listings saw a moderate increase of 19.20%, with 1,574 properties available for sale in the fi rst half of 2023, providing a balanced selection for potential buyers.

The Palm Beach County real estate market was a tale of two halves in 2023. Despite the challenges faced, the luxurious market remained steady and proved its resilience. With fewer listings and longer closing processes, high-end buyers battled complexity before fi nding a property. However, with an ever-adapting market, there were chances for prosperity on both sides of the sale. As Palm Beach County looks forward to what lies ahead, one thing remains certain - this alluring region of Florida is still a mecca for luxury seekers.

$1.34 AVERAGE SALE

BOCA RATON • DELRAY BEACH • JUPITER • WELLINGTON

Palm Beach County Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

Panama City

During the fi rst half of 2023, the luxury real estate market in Panama City, spanning Bay and Gulf counties, faced changes with optimism and demonstrated resilience. While there was a modest decline of 5.90% in closed sales, with 128 properties sold over $1 million compared to 136 in 2022, the market remained stable.

In 2023, the median time to contract witnessed a significant increase, extending to 60 days compared to the swift 25 days seen in 2022, marking a notable 140.00% change year over year. While this indicates a longer selling process for luxury properties in the region, it’s important to highlight that the current median days to contract is still lower than the normal medium days to contract, showcasing the market’s adaptability as it shifts back to normal conditions.

On the supply side, new listings decreased by 31.80% year over year, with 131 listings in 2023 compared to 192 in 2022. However, the inventory of active listings saw only a slight decrease of 4.40%, with 195 properties available for sale in the fi rst half of 2023. This suggests a balanced supply, allowing both buyers and sellers to fi nd opportunities in the market.

The Panama City luxury real estate market faced challenges with a positive outlook. While there was a dip in sales activity and the selling process took longer, the market’s stability and adaptability shine through. The decrease in new listings may have created a competitive buyer’s market, but the balanced inventory offers potential prospects for those seeking luxury properties in this beautiful coastal region. As the market continues to navigate through changing dynamics, it remains optimistic, presenting opportunities for growth and success in the future.

ENGEL & VÖLKERS FLORIDA LUXURY REAL ESTATE MARKET REPORT | MID-YEAR 2023

FLORIDA SNAPSHOT

AVERAGE SALE

$1.43M $768K AVERAGE LISTING

OPEN MARKET - EXPLORE FRANCHISE OPPORTUNITIES INQUIRE WITHIN

Panama City Market Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

Pensacola • Ferry Pass • Brent

(ESCAMBIA AND SANTA ROSA COUNTIES)

The luxury real estate market in Pensacola - Ferry Pass - Brent, encompassing Escambia and Santa Rosa counties, faced challenges during the first half of 2023 while there was a significant decline of 33.00% in closed sales, with 75 properties sold over $1 million compared to 112 in 2022. Despite the drop in closed sales, the market showcased resilience and potential for growth.

Despite the remarkable increase, the median time to contract remains lower than the normal medium days to contract, taking 47 days in 2023 compared to the previous 19 days in 2022, marking a notable 154.10% change year over year.

On the supply side, new listings also decreased significantly by 27.60% year over year, with 89 listings in 2023 compared to 123 in 2022. However, the inventory of active listings saw a moderate increase of 18.60%, with 121 properties available for sale in the first half of 2023, offering a variety of options for potential buyers.

The numbers may reflect challenges in the luxury real estate market of Pensacola - Ferry PassBrent, but the market remains optimistic. It has shown resilience during this period and potential for growth as it navigates through complexities. Despite the decline in closed sales and longer selling process, there are opportunities for buyers and sellers to find their ideal luxury properties in this picturesque coastal region. As the market adjusts and evolves, it holds promise for a brighter future ahead.

FLORIDA SNAPSHOT

AVERAGE SALE

AVERAGE LISTING

$1.43M $768K

OPEN MARKET - EXPLORE FRANCHISE OPPORTUNITIES INQUIRE WITHIN

Pensacola • Ferry Pass • Brent

SINGLE-FAMILY HOMES

Market Snapshot

CONDOMINIUMS

Port St. Lucie

(MARTIN AND ST. LUCIE COUNTIES)

In the fi rst half of 2023, the luxury real estate market in Port St. Lucie, spanning Martin and St. Lucie counties, navigated through changes with determination. Despite a moderate decline of 16.70% in closed sales, the market remained resilient.

In 2023, the median time to contract underwent a significant increase, extending to 54 days compared to the swift 17 days seen in 2022. This notable change indicates an adjustment in the selling process for luxury properties in the region. However, it is important to highlight that even with this increase, the current median time to contract remains lower than the normal medium days to contract.

On the supply side, new listings decreased significantly by 37.50% year over year, while the inventory of active listings saw a slight increase of 1.10%. This suggests the market adapted to balance supply and demand, providing potential buyers with a steady selection of premium properties.

The luxury real estate market of Port St. Lucie faced challenges in early 2023, but its determination to overcome them is evident. The longer selling process and decrease in new listings could have created a more competitive landscape, but the market’s resilience has allowed it to endure and maintain its stability. As it continues to navigate through changing dynamics, there are opportunities for growth and success in the future.

FLORIDA SNAPSHOT

$1.43M $768K AVERAGE LISTING AVERAGE SALE

47 SHOPS 875 ADVISORS

Port St. Lucie Market Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

Punta Gorda

(CHARLOTTE COUNTY)

During the fi rst half of 2023, the luxury real estate market in Punta Gorda, Charlotte County, faced significant challenges, resulting in a substantial decline of 50.00% in closed sales compared to the previous year. However, amidst the difficulties, the market showcased resilience and adaptability.

The median time to contract saw a notable decrease, taking 27 days in 2023 compared to 40 days in 2022, indicating a relatively shorter selling process for luxury properties in the region. This suggests that despite the challenges, the market found ways to streamline transactions.

On the supply side, new listings also decreased by 22.50% year over year, with 107 listings in 2023 compared to 138 in 2022. However, the inventory of active listings saw a moderate increase of 14.20%, offering 129 properties for sale in the fi rst half of 2023, providing potential options for buyers.

The figures reveal the impact of Hurricane Ian in 2022 on the luxury real estate market in Punta Gorda, leading to a decline in sales and new listings. However, the moderate increase in inventory and shorter selling process indicate a market that has adapted and maintained stability amidst the challenges. Despite the difficulties, the market’s resilience shines through as it navigates through the aftermath of the hurricane, showing potential for growth and recovery in the coming months.

$1.43M $768K AVERAGE LISTING AVERAGE SALE

Punta Gorda Market Snapshot

SINGLE-FAMILY HOMES

CONDOMINIUMS

In the fi rst half of 2023, the luxury real estate market in Sebastian - Vero Beach, Indian River County, showcased its resilience and adaptability. Despite some changes, the market experienced a modest increase of 3.20% in sales of properties over $1 million, compared to the previous year. This growth indicates the market’s ability to weather challenges and maintain buyer interest.

Despite a significant increase, the median time to contract remains lower than the normal medium days to contract, taking 58 days in 2023 compared to the previous 26 days in 2022. This indicates a longer but still relatively shorter selling process for luxury properties in the region. While the increase may raise some concerns, the market’s ability to fi nd a balance refl ects its resilience and responsiveness to changing conditions.

On the supply side, although there was a decrease of 15.00% in new listings, the inventory of active listings showed an impressive increase of 62.20%. This higher inventory presents an exciting opportunity for buyers, providing them with a broader range of luxury properties to choose from in Indian River County.

Despite the changes, the luxury real estate market in Sebastian - Vero Beach remains relatively stable and optimistic. The growth in sales and increased inventory demonstrate the market’s potential for continued success and attractiveness to luxury property enthusiasts. The market’s resilience, combined with a diverse selection of properties, sets the stage for a thriving and dynamic luxury real estate landscape in the region.

Sebastian • Vero Beach

SINGLE-FAMILY HOMES

FLORIDA

SNAPSHOT

CONDOMINIUMS

Market Snapshot

(GADSDEN, JEFFERSON, LEON, AND WAKULLA COUNTIES)

Embracing its dynamic nature, the luxury real estate market in Tallahassee fl ourished during the fi rst half of 2023, witnessing a remarkable 40.70% rise in closed sales compared to the same period in 2022. With 38 properties sold over $1 million, the region experienced notable growth, indicating a robust market for luxury properties in Gadsden, Jefferson, Leon, and Wakulla counties.

The median time to contract increased by 35.80% in 2023, taking an average of 36 days, up from 27 days in 2022. However, it’s important to note that even with this increase, the current median days to contract is still lower than the normal medium days to contract. Fluctuations are an inherent part of any real estate market.

Challenges were evident on the supply side as well, with new listings declining by 27.30% year over year, totaling 24 listings in 2023 compared to 33 in 2022. Furthermore, the inventory of active listings saw a substantial drop of 38.90%, leaving 22 properties available for sale in the fi rst half of 2023, down from 36 properties in 2022.

Nonetheless, the market’s resilience and adaptability are clear, refl ecting heightened buyer interest and market competitiveness. The growth in closed sales demonstrates the allure of the market, and despite hurdles in new listings and inventory, opportunities and valuable insights abound for industry professionals in this thriving luxury real estate sector.

(HERNANDO, HILLSBOROUGH, PASCO, AND PINELLAS COUNTIES)

In the dynamic landscape of the fi rst half of 2023, the luxury real estate market in Tampa - St. Petersburg - Clearwater, covering Hernando, Hillsborough, Pasco, and Pinellas counties, embarked on a captivating journey. Notably, the region experienced a slight decline of 7.00% in closed sales, with 1,134 properties selling over $1 million compared to 1,219 in the same period of 2022.

A striking transformation was the significant increase in the median time to contract. In 2023, luxury properties took an average of 36 days to secure a contract, soaring by 278.90% from the mere 10 days witnessed in 2022. While this change might seem substantial, it’s essential to acknowledge that the current median days to contract is still lower than the normal medium days to contract.

On the supply side, new listings experienced a decline of 20.00% year over year. In 2023, 935 properties were listed, compared to 1,169 in 2022. This scarcity of new listings may have contributed to heightened competitiveness among buyers, vying for their dream luxury homes in a constrained market.

However, amidst the challenges, there was a silver lining. The inventory of active listings witnessed a moderate increase of 14.10%, with 909 luxury properties available for sale in the fi rst half of 2023, as opposed to 797 in 2022. This relative stability in supply offered discerning buyers more options to explore.

In the fi rst half of 2023, the luxury real estate market in Tampa - St. Petersburg - Clearwater displayed adaptability and resilience amidst a slight decline in closed sales. The significant increase in the median time to contract and a decline in new listings created a competitive environment for buyers, but the moderate increase in active listings offered more options, underscoring the region’s allure as a dynamic and intriguing luxury property market.

This is Us.

ENGEL & VÖLKERS: CHANGING REAL ESTATE EXPERIENCES SINCE 1977.

Our story began in Hamburg, Germany, in 1977 when Christian Völkers founded the privately owned Engel & Völkers franchise. Our mission was clear from the start: to revolutionize the real estate industry by providing unparalleled competency and client service.

With unwavering brand consistency, sophisticated systems, and innovation, Engel & Völkers successfully expanded throughout the U.S., Canada, and the Caribbean in 2014. Today, we are a global leader with a strong presence in the Americas.

At Engel & Völkers Florida, we focus on local specialization and global scale to help savvy consumers, advisors, and brokers follow their dream. Our brand identity revolves around four cornerstones: enjoying the best in life, paying attention to detail, embracing leadership, and maintaining a global presence.

Discover the Engel & Völkers Difference, whether you’re a real estate professional, a buyer, a seller, or an aspiring shop owner – we’ve got you covered. Experience personalized service and excellence in every step of your real estate journey.

Buying and Selling with Us

BESPOKE EXPERIENCE EVERY STEP OF THE WAY.

Engel & Völkers offers a personalized buying and selling experience, understanding that luxury is a personal and priceless connection to our homes. With trusted advisors, we guide you to find the perfect home, whether around the corner or across the globe. From search to sale, we provide transparency, insider insights, skillful negotiation, and distinguished care. Choose Engel & Völkers for an unforgettable real estate experience.

Become a Luxury Real Estate Advisor

Imagine being more than just another real estate agent. At Engel & Völkers, we are on a continued quest to inspire a new generation of talent in the industry, and you can be part of it. As a trusted advisor, you will go beyond traditional roles, guiding clients through their home journey with precise knowledge and distinguished care. Our unmatched standard of service and high standards set us apart, making us the brand of choice for those who seek excellence. Join us as an Engel & Völkers advisor, and elevate your real estate career to new heights. Experience a future where you are not just an agent, but a valued partner in creating unforgettable real estate experiences for your clients.

Franchise Opportunities in Florida

Engel & Völkers offers a compelling home for brokers looking to distinguish themselves in the luxury real estate market and take their services to new heights. By joining Engel & Völkers, you gain access to a prestigious global referral network, unparalleled brand cachet, and exclusive affiliation within your geographic market. This means collaboration instead of competition, the potential for top-tier listings, and unlimited growth opportunities. Whether you are an established broker seeking to multiply your reach with best-in-class marketing tools, an independent agent aiming to tap into the power of the Engel & Völkers brand, or a newcomer starting up in the industry, Engel & Völkers provides hands-on coaching, renowned leadership support, and cutting-edge technology to help you succeed. Elevate your real estate services, distinguish yourself from the competition, and embrace a fresh approach to luxury real estate with Engel & Völkers, the leading network in global luxury.

Engel & Völkers Florida

MID-YEAR OVERVIEW