City of FloridaTamarac,

Our Vision:

The City of Tamarac, Our Community of ChoiceLeading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

Fiscal Year 2025

Our Vision:

The City of Tamarac, Our Community of ChoiceLeading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

Fiscal Year 2025

Tamarac has been inducted into the International Palladium Balanced Scorecard Hall of Fame. The award is recognized as the worldwide gold standard of strategic performance management.

The City of Tamarac was named the 2024 Mayors Municipal Innovation Award Winner.

Tamarac received the Florida Fire Chiefs’ Association Award of Excellence in Community Education for our Smoke Alarm Program and became a Bronze Level Water Smart Community by the Florida Department of HealthBroward County.

The City of Tamarac also received an Internationally Accredited Certificate demonstrating a commitment to service, safety, and continuous improvement. The Center for Digital Government has recognized the City of Tamarac for leveraging data to improve city services, programs, transparency, and cybersecurity with Digital Cities.

Tamarac received the Tree City USA designation for its urban forestry management efforts.

GOVERNMENT FINANCE OFFICERS ASSOCIATION

PRESENTED TO

For the Fiscal Year Beginning October 01, 2023

Executive Director

The Government Finance Officers Association of the United States and Canada (GFOA) has presented a Distinguished Budget Presentation Award to City of Tamarac, Florida for its annual budget for the fiscal year beginning October 1, 2023.

In order to receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as a financial plan, as an operations guide, and as a communications device.

Levent Sucuoglu City Manager

Maxine Calloway Deputy City Manager and Director of Community Development

Hans Ottinot City Attorney

Tony Palacios Building Director/ Chief Building Official

Kimberly Dillon City Clerk

Christine Cajuste Director of Financial Services

Mike Annese Fire Chief

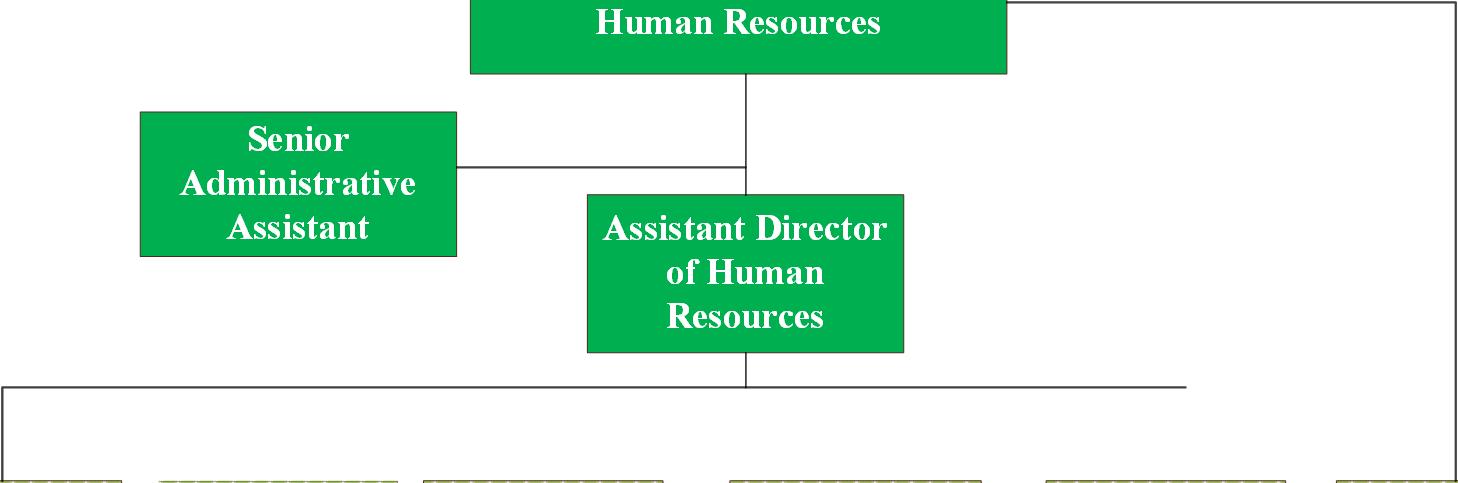

Danielle Durgan Director of Human Resources

James Twigger Chief Information Officer

Rudolph Galindo Director of Parks & Recreation

Captain Jemeriah Cooper Broward Sheriff’s Office

John Doherty Director of Public Services

Leading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

It is our job to foster and create an environment that : ■ Responds to the Customer ■ Creates and Innovates ■ Works as a Team ■ Achieves Results ■ Makes a Difference

Goal #1: Tamarac is Home

■ Inclusive and Equitable ■ Well Maintained

■ Parks and Infrastructure ■ Quality of Life ■ Convenient Transportation ■ ADA Accessibility ■ Great Education

Goal #2 : Tamarac is Safe and People Know It

■ Quick Emergency Response ■ Low Crime Rate ■ Engaged First Responders

■ Police, Fire and Medical Services ■ Visibility and Crime Prevention ■ Security Technology ■ Preparedness

Goal #3: Tamarac is Economically Resilient

■ Business-Friendly ■ A Place to Thrive

■ Development and Permitting ■ Economic Growth ■ Market Opportunities

Goal #4: Tamarac is Vibrant

■ Attractive ■ Active and Fun ■ Green and Sustainable

■ Appearance and Image ■ Resilient ■ Healthy Lifestyle

Goal #5: Tamarac is Smart and Connected

■ Tech Savvy ■ Neighborly

■ Effective Communication ■ Smart City ■ Engaged ■ Celebrating Community

Goal #6: Tamarac is a Dynamic Workplace

■ Attract and Retain Skilled Workforce ■ Promote a Culture of Excellence

■ 5-Star Customer Service ■ Professional Development ■ Supportive Environment ■ Optimal Organization

1. Improve quality education opportunities for all Tamarac residents

1. Continue to review and update regulations to ensure excellent quality of life for all residents

1. Continue to plan for, accurately estimate cost and required resources, maintain and upgrade our water, sewer, roadway and other infrastructure

1. Beautification – Plaza Revitalization (Certificate of Use Ordinance)

1. Rewrite, update and implement Alarm Ordinance

1. Explore regulatory measures for fishing in canals

1. Street Repaving, Restriping, Reflectors

1. Update the CIP Plan annually, which includes Utilities 20-year Master Plan

1. Evaluate Seawalls repair program options

1. East side water distribution system expansion; feasibility study to extend Tamarac water service

1. Construction of a new Water Treatment Plant Control Building

1. Establish and foster transportation plans and partnerships to provide convenient and accessible means of transportation

1. Advocate for the additional Turnpike On/Off Ramp (Oakland Blvd/or Cypress)

1. Traffic Congestion

1. Ensure equitable distribution of parks and recreation programs, services and facilities

1. Continue to monitor and enhance ADA compliance and accessibility

Item projected to go to Planning Board in November and City Commission in December 2024.

This item will be workshopped with the City Commission.

Currently in the research stage.

The Engineering Division is currently working on the design and permitting of the Mainland 8, 9, 10, & 15 Resurfacing Project, which is tentatively scheduled to begin in Fall 2024. Mainland 11, 12 & 13 Resurfacing Project is identified in the proposed FY25 budget.

CIP Plan is updated annually. Ongoing.

Seawall repair assistance is now included in the Curb Appeal program for eligible residents.

The South Florida Water Management District (SFWMD) has approved the Water Use Permit needed to move this project into the design stage. Ninety-percent (90%) Design Plan submittal is due in October 2024 for review and comments.

The design is complete. This project is being re-bid, with a twostep process. Step 1 includes a Request for Qualifications (RFQ). Submitted RFQ’s will be evaluated by a Selection Committee to determine the most qualified firms (short-list). With Step 2, the short-listed firms will be invited to submit formal bids for further review and processing.

Ongoing. Tracking the project's advancement closely, staff remains proactive in seeking ways for the city to lend its support to this initiative.

All the arterial roads where traffic congestion occurs are county or state-controlled roads. FDOT/Broward County Traffic Engineering (BCTE) is installing smart infrastructure to provide adaptive traffic lights within City limits. FDOT has adaptive traffic light control CIP for Commercial Boulevard from Pine Island Road to A1A in FY 2024.

1. Bus hub on property on Commercial Blvd. West of 75 Future Consideration.

1. East side Dog Park

1. Build Mainlands Park enhancements

1. Develop a park at Central Parc - Sabal Palm

1. Continue to monitor the law and upgrade existing resources

1. Update building forms to ADA compliance

Included in conceptual plan for Sabal Palm Park.

Scheduled in CIP for FY27.

Community meeting held.

The Site Assessment Report is complete, and it has been distributed to the short-listed firms, as an addendum to the RFP. Procurement of contractor is tentatively scheduled for FY25.

Allyant's audit of the City's website ADA compliance is completed. The goal to convert all non-ADA compliant documents to ADAcompliant documents is ongoing. The Information Technology department is developing training for employees on how to create documents that are ADA compliant.

IT will implement training to enable the in-house creation of documents in ADA format, eliminating the need for conversion.

2. Increase visibility and address emerging crime trends through operational plans and proactive policing

2. Enhance safety and security throughout City Parks and Facilities by deploying technology

2. Increase Police Presence - Adding 9 BSO Deputies

2. Select a vendor and implement the first phase of improvements recommended by the Security Master Plan (SMP)

2. Implement the future phases of security improvements

2. Identify partnerships, resources & other solutions to ensure response to fire and medical emergencies within 8 min. or less 90% of the time

2. Be prepared to respond to all hazards

2. Continue inclusive and positive interactions with various community groups and individuals

2. Monitor response time data and continue to identify partnerships, resources and other solutions to address the areas in need

2. Attend community meetings and events engaging with various community groups

2. Community policing/police-community relations

2. Increased Police Visibility

2. BSO Substation - Explore options for renting space on Eastside

Adopted in the budget for Fisal Year 2025. Contract amended to include officers coming to Commission meetings.

All tasks for Security Master Plan (SMP) Phase 1 have been completed. The City is awaiting the final payment application, closeout documents, and warranty information to be provided by Johnson Controls.

Sent Johnson Controls a letter advising of their inaction and to begin fines. Have not received any further response from Johnson Controls.

City Attorney's Office addressing this issue.

The Security Master Plan Phase 2, funded in FY2023 and FY2024, had a two-step bidding process. Step 1, closed on May 2, 2024, with six responses, and two vendors advanced. In Step 2, one vendor dropped out, leaving only Miller Electric. After site visits on August 1, 2024, Miller Electric’s bid is under evaluation. The decision is expected to move to the Commission in November 2024.

Response time data report analysis is done on a monthly basis and results published in our Dept Monthly Report.

8/2/24 HCA Woodmont Hospital Event. City of Tamarac Family Fun Day at Waters Edge. City of Tamarac Building/Code Hearing. City of Tamarac Commission Meeting.

8/1/24 Tamarac Elementary Walk Through. 8/9/24 Legacy Driveway Initiative.

8/23/24 Citizen Observer Patrol Mainland's Unit Training.

Burglary Operations.

High Visibility Plaza Operations. Traffic Operations.

Currently in the research stage.

3. Continue to evaluate and improve developing, permitting and procurement processes to enable businesses to open up quickly, grow and succeed

3. Identify and pursue high-quality marketdriven redevelopment opportunities

3. Update permitting Systems/TRAKiT-OneSolution

The TRAKiT version 24.1 update has been completed, along with the Common Cash Receipts (CCR) version 24.1 update, which includes functionality for Trust/Escrow payments and Miscellaneous Receivables integration. However, additional configuration is needed to correctly set up credit card payments. A new data conversion/migration was completed, addressing open issues. If no further issues arise, training will be scheduled for all TRAKiT users to enable participation in the testing process.

3. Developer Incentive Program to Revitalize Commercial Plazas/Corridors (REDA Grant and Facade & Exterior Improvement Grant)

3. Conduct a feasibility study for Redevelopment of Public Safety/Municipal Complex; Evaluate P3 opportunities

3. "Uptown Tamarac"/redevelopment of SR7/Commercial Blvd. corridor

3. Shaker Village revitalization and community partnerships

3. Proactively seeking grants for capital projects

The program is being updated and will be brought back to the commission for reconsideration.

In progress. Feasibility is scheduled for presentation to the City Commission in fall 2024.

The City already owns the SR 7 property, and with the acquisition of the Commercial Boulevard properties, an RFP will be prepared for the demolition of both the SR 7 and Commercial Boulevard locations.

Acquisition under contract.

Two of the three City ‘s appropriations projects were approved by Governor DeSantis and included in FY 2024-25 State budget; they are: 1) Tamarac Park Safety and Health Enhancements project, which is awarded $271,577 in appropriations funds and 2) Tamarac Canal Culvert Gate and Aluminum Headwall Improvements Project, which is awarded $451,081 in State appropriations funds.

East Side Water Distribution System Expansion project selected for inclusion in the FY 25 Federal Appropriations Bills and will be included in the FY 25 budget; requested amount was $2 million, with final appropriated budget amount for this project expected to be determined in early Fall.

Florida Communities Trust (FCT) grant in the amount of up to $1.875 million awarded to the City, for reimbursement acquisition of the Shaker Village Clubhouse proper ty.

U.S. Forest Service Urban and Community Forestry program grant awarded in the amount of $516,485 to the City, for Tamarac Roadway Urban Forestry rescoped project, along NW 57th Street.

3. Greater High & Density on Major Thoroughfares (Commercial, University, 441 & McNab)

3. Promote economic development

3. Implement Pilot Placemaking Projects

3. Evaluate the establishment of Sister Cities program in Tamarac, starting with a “friendship” city relationship

3. Continue efforts to enhance spend for Small, Minority, Local and Veteran Businesses

Include Nob Hill Overlay for Government Campus in Comprehensive Plan

3. Business Attraction (Building Retail and Large Businesses)

Being investigated as part of the City’s 2040 Comprehensive Plan.

Placemaking projects are currently in the planning stage for Cityowned properties at 441, Commercial Boulevard and the corner of Pine Island, and properties along Commercial Boulevard that the City is in the process of acquiring.

The committee meets monthly. The next meeting is scheduled for October 17, 2024.

The City recently awarded a contract to 6 vendors for City-wide Pressure Cleaning Services. Four (4) of the Six (6) firms are minority owned. Since this is a Requirements Contract, we do not have an exact estimate of the dollar amount to be spent with each firm.

Under consideration in the upcoming 2040 Comprehensive Plan and Land Development Code Update.

This is part of the City's 2040 Comprehensive Plan and is also linked to the Developer Incentive Grant Program.

4. Continue to provide and enhance opportunities for active, healthy and fun lifestyle

4. Park improvements/additional dog parks

4. Improvements and enhancements to City parks including projects at Sunset Point Park, and Veteran's Park.

4. Environment friendly illumination at parks

4. Dog friendly park along 108th Terrace

4. Diverse Entertainment/Events (Add a Latin and Hispanic Event)

Area along 108th Terrace to be enhanced with benches, mutt mitt stations and trash receptacles for FY25.

Completed.

Scope of work meeting scheduled with Public Services and P&R.

Included in the FY24-25 CIP Budget.

Project Scope of work will be coordinated with Public Services.

Hispanic Heritage Celebration to be included in the upcoming 2025 line up of events and a variety of bands and music for concerts through the year.

4. Programming in Partnership with HOAs Department staff are communicating with HOA's and Tamarac Lakes South has already expressed interest.

4. ASL Programing Promote Local Programs

4. Occupy Caporella – Annex Park (Aerobic Classes)

4. Tamarac Sports Complex - Add crosswalk to get to park.

4. Tamarac Sports Complex - Add Benches & Tress

4. Continue and enhance the City beautification programs

4. Beautification Plan along Bailey Rd & Sabal Palm Blvd (Landscaping)

4. Implement neighborhood signage program

4. Buffer wall program implementation & update

ASL programs in the City will be include as resource fliers at each center.

A schedule of activities and workouts is being planned for upcoming months.

This project has been added to the FY25 CIP Budget.

This project has been added to the FY25 CIP Budget.

The new Landscaping Maintenance Contractor has been instructed to give Bailey Road and Sabal Palm Boulevard additional care and attention.

Ongoing.

The Citywide Buffer Wall Program Phase 6 Project, Prospect Road, is complete. The Commercial Boulevard/Rock Island Road and Pine Island Road North Buffer Wall Projects are currently on-hold as the City is currently exploring alternate considerations to manage the growing cost associated with the Citywide Precast Buffer Wall System with a more costeffective solution. These considerations include opportunities for innovative design approaches and streamlining processes to achieve a more efficient delivery of sustainable, value-added solutions for the Citywide Precast Buffer Wall System.

4. Install directional/wayfinding and community facilities signage Citywide

4. Implement landscaping in medians and ROW’s

4. 78th St./University Dr. landscaping; signage on both South & North side of NW 78th Street

4. Public art: Social Justice Wall

4. HOA beautification grants

4. Public art significant sculpture installs:

Ongoing. IT is reviewing options for the inclusion of digital signage as part of the directional/wayfinding signage.

Landscaping Master Plan is complete. Community Development has several proposed median beautification projects in the FY25 CIP Budget.

Under construction.

Project completed.

In progress: Within the framework of the Neighborhood Partnership program, four awards are presently granted to HOAs (Homeowners Associations).

The sculpture for Fire Station 15 is anticipated to be tentatively completed by December.

Project/Initiative

4. Continue to refine and promote the City’s identity

4. Secure funding for development of corridor plans Ongoing.

4. Replace bus benches with shelters, add locations Broward County to resume next phase of installations in 2025.

4. Buffer Wall: 81st from Pine Island to McNab

4. Buffer Wall: Bailey Rd at Lakes of Carriage Hill

4. Buffer Wall: Bailey Rd at Banyan Lakes

4. Buffer Wall: 81st St from Pine Island to Nob Hill (Nor thside)

4. Continuation of robust marketing strategy and increased events marketing; telling Tamarac Story

This project has been added to the CIP Budget –design in FY25 and construction in FY26.

This project has been added to the CIP Budget –design in FY25 and construction in FY26.

This project has been added to the CIP Budget –design in FY25 and construction in FY26.

This project has been added to the CIP Budget –design in FY25 and construction in FY26.

We continue to use Tam-A-Gram, social media, digital marquees, and other forms of communication to tell the Tamarac story. In May we promoted Pirate Plunge, Groove On The Grass, Household Hazardous Waste, Movie In The Park, Memorial Day Ceremony, Island Groove In The Park, Food Truck Fridays, Hurricane Season, Happy Mother's Day, Broward County City Management Association Scholarship Program, CodeRED, BSO PSA's, National EMS Week, Proclamations, Stroke Awareness & Prevention Health Fair, Honor The Stripe, Neighborhood Meetings and Commission Meeting Recaps.

4. Placemaking Events to Revitalize City Properties

4. More Code Enforcement - Additional Code Officer

4. Park Safety - Additional Full-Time Park Ranger

4. Evaluate and promote green policies

4. Review citywide resiliency plans and update as needed

4. Tamarac Comprehensive Vulnerability Assessment

Parks and Recreation in collaboration with Community Development will identify locations to plan for activation.

Adopted in the budget for Fisal Year 2025 on September 25, 2024.

Adopted in the budget for Fiscal Year 2025 on September 25, 2024.

An appropriation of $414,367 has been awarded to develop a Comprehensive Stormwater Vulnerability Assessment, aimed at identifying and mitigating flood risks to critical assets. The assessment is tentatively scheduled to be completed early next year.

Assessing the Broward County Regional Resiliency Plan to evaluate its impacts on Tamarac as a guide for future actions.

5. Develop a SMART City Master plan to meet community needs and provide a technology road map

5. Consultant to complete a SmartCity Strategic Plan SMART City Master Plan on hold.

5. Fiber Network Expansion Phase II

5. OneSolution – Work Management Systems Module (Work Orders / Facility Maintenance / Fleet Maintenance / Asset Management)

Fiber Network Expansion (Phase 2) work has been completed.

A GIS map was to be provided as part of Automated Meter Reading project, which is required in order to integrate Lucity with NaviLine Work Order/Utility Billing.

Due to the AMI/AMR project being placed on hold, IT has requested funding to create/develop the required GIS map separately in FY2025.

CST now has an integration of Lucity with NaviLine Utility Billing. Held meeting with Robert Holt, Product Manager at CST and his team, with City IT Staff. CST is working on a Scope of Work and proposal for said integration.

5. OneSolution – HR / Financials Module

5. Solicitation RFP 22-09RP for Smart Meters for Water Service

5. Further enhance community engagement and communications

5. Transition from MyCivic to SeeClickFix

5. Determine potential to expand Digital Signage to display live bus schedules, promote local community and events

5. Increase community outreach/awareness of programs

Finance Enterprise (Finance / HR / Payroll) Migration project to be restarted once all TRAKiT-related items are complete.

CST Business Process Analysis (BPA) Questionnaires provided to Finance and HR staff in November, and still awaiting completion by relevant departments.

Proposals opened and have been reviewed by consultant however the cost of the proposals is significantly higher than originally anticipated. As a result, it has been determined that the City will not move forward with this project in the foreseeable future, the solicitation cancelled, and Agreement with the Consultant, Johnson Controls, has been cancelled for Convenience. Due to these circumstances, there will be no further updates for this initiative until it may become feasible in the future.

Completed SeeClickFix Go Live in September 2022; Past historical data migration/import from MyCivic to SeeClickFix is now complete.

Funding not provided in FY2023 nor FY2024 budget.

Funding to be re-requested in future budget years.

Social Media Posts: Pirate Plunge, Groove On The Grass, Household Hazardous Waste, Movie In The Park, Memorial Day Ceremony, Island Groove In The Park, Food Truck Fridays

Recaps: Pirate Plunge, Memorial Day, Honor The Stripe Electronic Signs For: Pirate Plunge, Groove On The Grass, Household Hazardous Waste, Movie In The Park, Memorial Day Ceremony, Island Groove In The Park, Food Truck Fridays

Paid ads: Groove On The Grass, Movie in the Park and Juneteenth Celebration, All-American Celebration, Island Groove In The Park Press Releases: Stroke Awareness & Prevention Health Fair, Tamarac Celebrates 100th Anniversary Of The National League Of Cities, Memorial Day Ceremony, Commissioner Bolton Honored With 2024 Home Rule Hero Award, Sunset Hammock RibbonCutting (Canceled).

5. Build community by bringing community together to celebrate Tamarac’s multi-cultural and unique character

5. Expansion of Building Department customer-focused practices (e.g. expired open permit program, staff training & support)

5. Re-establish District Office [Lease East of 64th] Establish pro forma for employee and rent costs

5. Add community events including Art in the Park at Tamarac Village

Current procedures for handling open/expired permits and staff cross-training are under review for potential changes.

Currently in the research stage.

Events for Tamarac Village will be included in the 2025 lineup of events.

5. Define the historic Tamarac district/create a distinctive identity; invite district residents to a Commission meeting to receive a proclamation

PIO has received information from the Historical Society, regrading the application process for historical markers, including different options and their associated costs. PIO is currently reviewing these options and will determine whether to pursue the well-known historic marker commonly seen across South Florida to be displayed at one of Tamarac's five original communities. PIO will also evaluate the qualifications required for the application process.

6. Continue supporting positive work environment

6. Travel Policy Review - Rental of electric vehicles Review in progress.

6. Continue to pursue the award for Excellence in Financial Reporting

6. Expand and support employee professional development opportunities 6. College to job internship pipeline

The City received the Distinguished Budget Award for the Fiscal Year 2024 Budget.

The City just received the Award for Excellence in Financial Reporting for the Annual Comprehensive Report for Fiscal Year 2023.

Internship positions budgeted in Public Services, Community Development and Financial Services departments. The City will be partnering with universities to fill these internship positions.

6. Celebrate successes and enhance employee recognition

6. 5-star customer service 6. Refresh customer service standards and goals

This initiative is being actively promoted by the Empowerment Committee. The committee has met with all departments, motivating them to collaborate with their staff to integrate the core values into the city's daily culture, consistently striving for excellence.

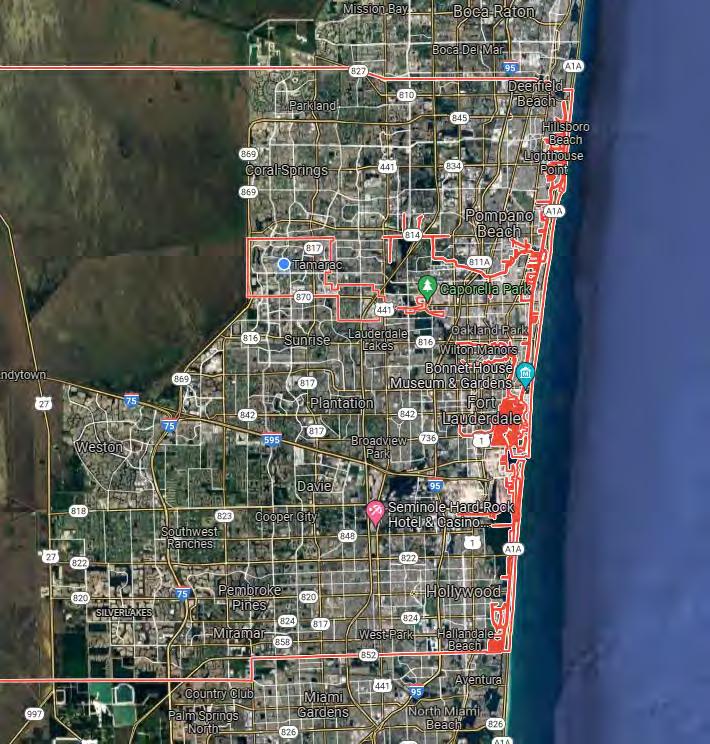

A thriving, multicultural and multigenerational community, the City of Tamarac is a great place to build a family, build a business and build a life.

Young families, retirees and businesses are all drawn to Tamarac, which boasts a top‐rated fire department and is rated the 49th out of the top 50 safest cities in the entire state of Florida by Safewise.com.

In the middle of everything, yet a world away, Tamarac offers an exceptional quality of life at an affordable price.

Tamarac’s residential neighborhoods abound with waterways – the City contains over 500 acres of freshwater canals and lakes – and plenty of open spaces.

Residents enjoy amenities such as the City‐owned Colony West Golf Club, which offers 36 holes of golf, and 11 parks that cover 153.6 acres, including a dog park and a skate park.

Originally a bedroom community favored by retirees, Tamarac is growing younger as the City grows older. Our current median age is 47.8.

Tamarac’s residential population has grown by 19% since 2013 to more than 73,000 today. The City welcomes more and more neighbors who have chosen Tamarac for our community’s quality of life and proximity to South Florida’s beaches, the Everglades, shopping, nightlife, regional sports, cultural events and the arts.

Tamarac offers programs for people of all ages and stages of life at parks and facilities throughout the City, including our 32,000 square foot community center, our recreation center and the Caporella Aquatic Complex.

There is always something to celebrate with more than 30 annual community events –including the Tamarac Turkey Trot and the One Tamarac Multicultural Festival.

The 13th largest city in Broward County and the 42nd largest in Florida, Tamarac is home to a growing business community. We offer an excellent location at the epicenter of South Florida, the 7th largest metropolitan statistical area in the U.S. by population, and easy access to five major highways and three world‐ranked airports and seaports. The 500‐acre Tamarac Commerce Park is home to approximately 80 companies including Amazon, City Furniture, New Vision Pharmaceuticals, KSM Electronics, and Gurkha Cigar Group.

We’re primed for smart growth, with a new form‐based code that ensures the right development at the right place. The construction of a mixed‐use

downtown named Tamarac Village is underway. It and the renovation of Colony West serve as economic drivers for the City.

As we look toward the Tamarac of tomorrow, maintaining infrastructure and preparing for the demands of the future remain top priorities to ensure the quality of essential services like potable water and stormwater management. We will also continue focusing on the revitalization of our commercial corridors and aging and underutilized shopping centers to better serve our vibrant community.

The first critical reading of the Fiscal Year 2025 Adopted Budget is the City Manager’s Transmittal Letter. The reader will gain an understanding of the City Manager’s vision, critical issues, recommended policy and operational changes, and financial plan.

This section provides the reader with the basic components that comprise the development of the Fiscal Year 2025 Adopted Budget. This section includes explanations of the type of government and budget, a description of the budget process, the Budget Calendar, budgetary highlights, and the Fiscal Year 2025 Personnel Complement.

This section answers the question: “What’s new in the Budget?” In this section, you will find a list of new or reclassed staff, new or enhanced programs, and capital outlay not previously forecasted.

This section provides schedules of detailed revenue sources and expenditures for the General Fund and for all funds combined for a total Fiscal Year 2025 Adopted Budget. Like a person with multiple checking accounts, a municipality categorizes revenue and expenditures into separate funds according to purpose. This section also includes a comparison of major revenue sources, the full cost allocation study, an overview of financial management policies, and a brief description of each fund.

This section explains the diverse services offered by the City of Tamarac. Each department's division has identified a mission statement, a program description, and strategic goals for the upcoming year. In addition, the Fiscal Year 2025 Adopted Budget includes performance measures for each division. Performance Measurement is an ongoing process to evaluate and report how well the City delivers its services.

Each Department and Division is responsible for goal setting and performance benchmarking to ensure alignment with the City’s Strategic Plan. The measures reflect the City’s effort to improve service, check performance quality, and make changes when necessary.

Reporting of performance measures differs from standard goals and objectives because it goes beyond simply reporting “achieved” or “not achieved”; it provides an ongoing method for measurement and allows for gauging performance against internal, external, local, and national standards.

This section includes the City’s Asset Management plan, which provides a comprehensive listing and explanation of the capital requirements and associated funding for the City for the current and next five years.

Appendix

This section contains debt management information and a glossary of commonly used terms.

results

iminary Stormwater Assessment increasing contingency balance generat preliminary Stormwater Assessment

Commissioners foresight well support Financial Policies initiatives begins, foundation rely

June 13, 2024

The Honorable Mayor and Members of the City Commission City of Tamarac

7525 NW 88 Avenue

Tamarac, FL 33321

Mayor and Members of the City Commission:

Pursuant to the City’s Charter, it is my privilege to submit to you the City of Tamarac Proposed Budget for Fiscal Year 2025 and the FY 2025 - FY 2030 Asset Management Program Budgets. In Florida, although a city can prepare budgets on a multi-year cycle, the City can only adopt a single year budget. The current process involves the preparation of a single year budget for adoption and two forecast year budgets.

During budget preparation, staff evaluates costs, the updated Strategic Plan and all programs in crafting a budget and forecast that meet the City Commission’s goals. Fiscal policies adopted by the City Commission continue to ensure a sustainable future for the City. Rating agency, Fitch, in a recent ratings update, commented that “The affirmation of Tamarac’s Issuer Default Rating (IDR) and rating of 'AA-' on capital improvement revenue bonds reflects the City's strong financial resilience and superior inherent budget flexibility supported by its solid revenue and expenditure controls. The City has exceptionally strong gapclosing capacity, positioning it well to withstand future economic downturns.”

This year’s budget process was undertaken in the post pandemic era but still with economic disruption challenges across the globe, including stubbornly high rates of inflation, elevated prices for gas and diesel coupled with lingering supply chain issues.

The FY 2025 Proposed Budget keeps the millage rate flat at 7.0000 mills. The proposed budget includes an updated Asset Management Plan that takes into account long-term financial planning for the City’s assets, and one-time expenditures. I have also provided examples of how the proposed millage rate will impact property owners under Save Our Homes various value levels.

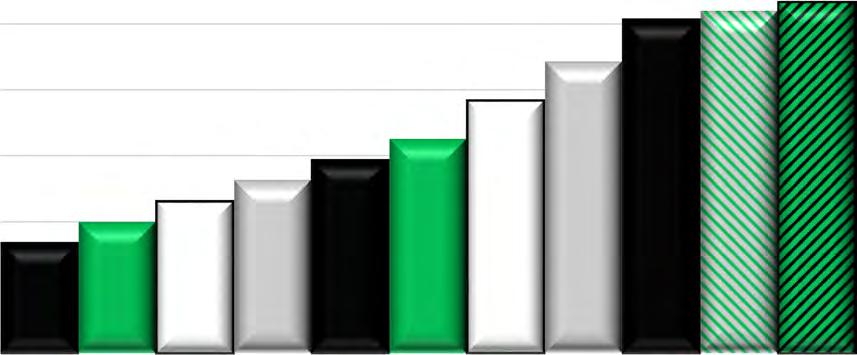

Legislative changes governing how millage rates are established were enacted during the 2007 legislative session and additional changes were made via a referendum in 2008 affecting FY 2010 and beyond. The referendum increased the homestead exemptions from $25,000 to $50,000 and rules for portability of the “Save Our Homes” values were approved. In addition, there is an annual 10% cap on assessed value increases for non-homesteaded property (both residential and commercial) The 10% cap on nonhomesteaded property referenced above, which was originally set to expire is now permanently adopted via referendum as a constitutional amendment The table below illustrates the total taxable assessed value history.

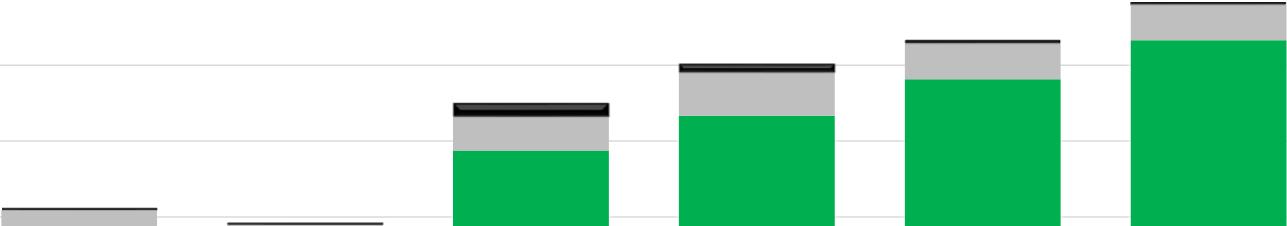

City Total Taxable Value projected to increase by 3.0% for FY 2026 and 2.0% for FY 2027 due to future economic environment uncertainties

The FY 2025 proposed budget maintains the general operating millage rate of 7.000 mills resulting in higher overall tax revenue due to an increase in taxable value of 10 60% (preliminary valuation distributed by the Broward County Property Appraiser as of June 1, 2024) The FY 2025 proposed budget for all funds totals $226,216,572 which is $33,207,377 less than the FY 2024 amended budget of $259,423,949, a decrease of 12.80%.

The decrease from the amended budget is due primarily to budgeting $5,325,000, for major capital projects in the Utilities Renewal and Replacement Fund in FY 2025 (as compared to $22,950,000 in FY 2024) together with the required transfer out from the related operating fund. This alone accounts for an approximate $35 million downward change from FY 2024 (see Enterprise Funds in above table).

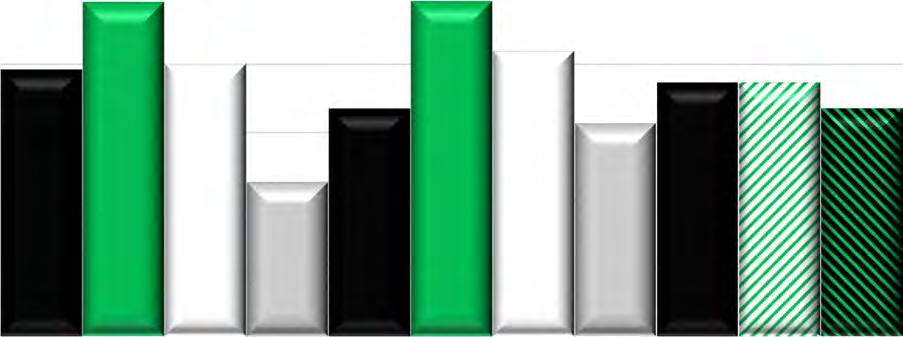

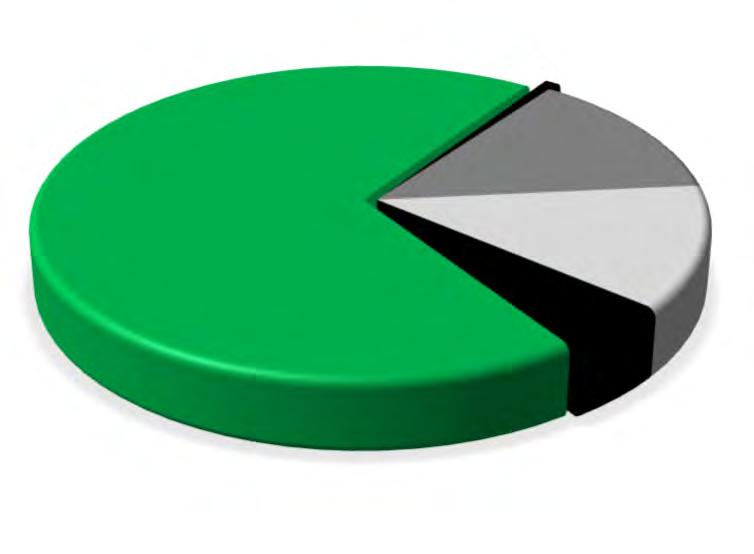

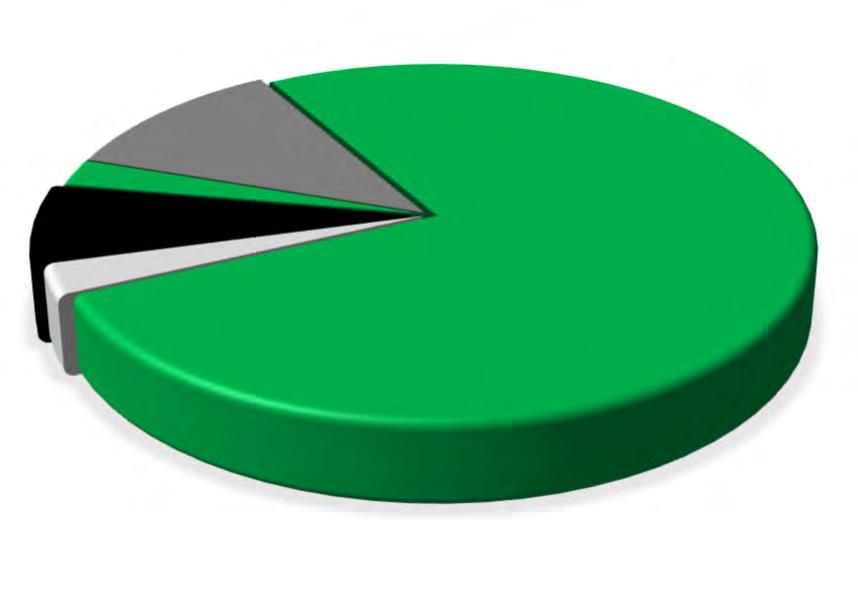

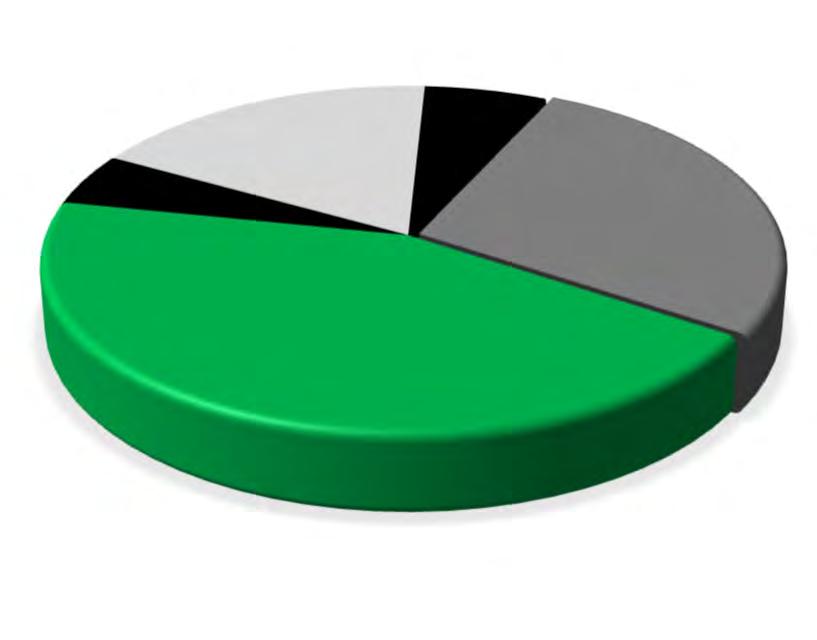

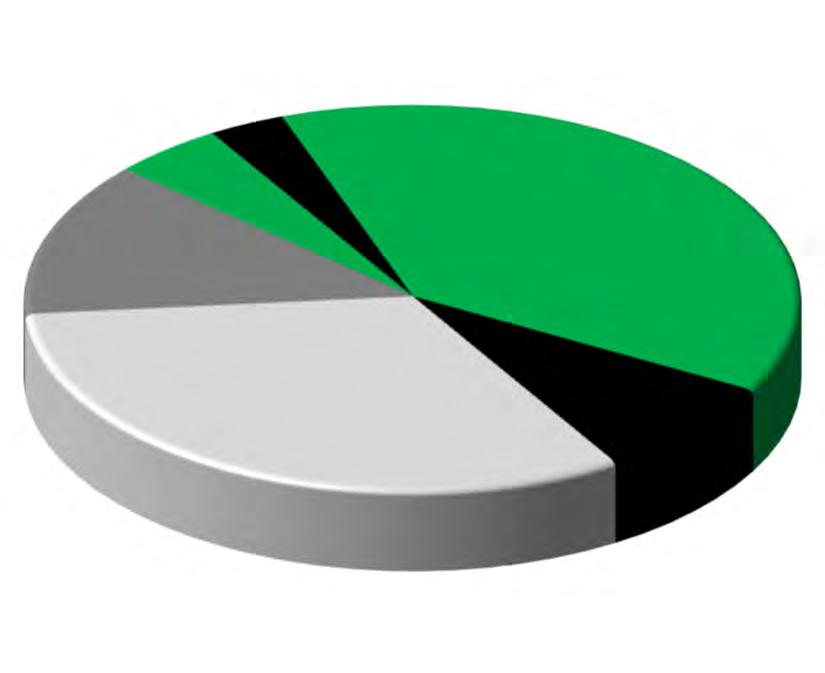

The summary chart for expenditures by category provided below identifies changes in costs for personal services, operating expenditures, capital/infrastructure expenditures, and other categories for all funds. Per the City’s Financial Policies, capital projects are budgeted on a “life- of-the-project” basis until completed or de-obligated by the City Commission, and therefore not re-appropriated annually.

Personal Services costs represent 29.34% of the total proposed budget and 27.32% of the General Fund proposed budget. The FY 2025 Proposed Budget reflects adjustments based on the current FPE Union Contract and Fire Union Contract Staff has provided an estimate of wages pursuant to the performancebased pay system in the personnel policy for non-represented employees. Elected and Appointed officials have also been provided for in the proposed budget.

The FY 2025 Proposed Budget includes additional staffing as listed in the table below necessary to maintain the City’s current level and quality of service delivery. The positions being added in the General Fund listed below resulted from the Strategic Planning Sessions held with City Commission. No other new positions are being recommended in the General Fund.

The FY 2025 proposed General Fund budget is $94.749,938, which is $4,023,672 or 4.43% more than the FY 2024 amended budget of $90,726,066. Below is a

The demand letter submitted to the City by the Broward County Sherriff’s Office (“BSO”) pursuant to our contract requests $20,419,497 for Police Protection Services as compared to the $19,397,689 contained in the Adopted FY 2024 Budget, representing an increase of 5.27%. The Police Services budget also includes a placeholder of $1,800,000 for the addition of nine deputies resulting from the Strategic Planning Sessions held with the City Commission.

The FY 2025 proposed General Fund budget includes an appropriation from fund balance of $14,716,321 for purposes of funding transfers to capital funds such as, $5,289,925 to the General Capital Improvement Fund; $480,000 to the Capital Maintenance Fund; $6,302,236 to the Roadway & Median Improvement Fund: and $4,368,989 to the Corridor Improvement Fund. In addition, $1,000,000 is included to fund a contingency and $250,000 is included for potential encumbrances (purchase orders that have not been completed by year end that are carried into the next fiscal year).

The FY 2025 proposed budget for the Fire Rescue Fund is $34,565,531 which is $2,345,039 more than the FY 2024 amended budget of $32,220,492 or a 7.28% increase. The Fire Rescue Proposed Budget was developed using a proposed Fire Rescue Assessment Fee at $420 per residential unit. The $420 represents approximately 93.5% of the maximum amount that can be charged based upon the study that was completed last year. At the current rate, an appropriation from fund balance of $8,002,922 is needed to balance the budget.

The Fire Rescue Assessment Fee revenue can only be used for fire related expenses, thus the other major source of revenue for the Fire Rescue Fund is a transfer from the General Fund in the amount of $6,990,953 for FY 2025.

The FY 2025 proposed Fire Rescue budget includes the addition of twelve (12) Firefighter / Paramedics to achieve full staffing of the new Fire Station 36 and planned capital outlay requests for equipment replacements through FY 2030 Each year the Fire Department sets aside funding for proposed replacements that will take place in future years such as fire apparatus and equipment For FY 2025, the Fire Rescue Fund also has equipment replacement requests that include an equipment bundle for FS 36 fire suppression unit, major appliances and fitness and cardio equipment for stations, power load systems (4) for stretchers, hydraulic stretchers (5) and an extrication unit.

The FY 2025 Building Fund proposed budget is $4,270,610 or $244,730 more than the FY 2024 amended budget of $4,025,880 or a 6.08% increase The proposed budget has been prepared in support of continuing operations Staffing and contractual arrangements have been made in support of new residential development that began coming online in FY 2015 and is anticipated to continue, at least into the very near future Additional revenue has been provided in support of this anticipated new construction. Building permit fee revenue budgeted for FY 2025 and the two forecast years is based on expected activity and supported by the recently increased Building Department approved fee schedule

The Public Art Fund has been budgeted in the amount of $725,500 which includes available funds received in prior years but not yet expended. The FY 2025 Public Art Fund proposed budget includes a $50,000 appropriation for work to be done by Public Art consultants, Gadson & Ravitz, a $50,000 appropriation for annual repair and maintenance of public artwork, funding for two (2) artistic fences at Sabal Palm Park for the splashpad and playground and $300,000 has been set aside as a reserve for future public art projects and/or unplanned expenditures related to existing art projects.

The Asset Management Program Capital Improvement Plan (“CIP”) is included in a six-year format beginning with FY 2025 and the five years following for planning purposes Other components of the Asset Management Program include: (1) a Capital Maintenance Plan; (2) a Capital Vehicle Replacement Plan; and (3) a Capital Equipment Plan.

The proposed Capital Improvement Plan budget in the amount of $17,921,650 is as follows:

The FY 2025 Stormwater Fund proposed budget is $8,688,605 or $312,720 less than the FY 2024 amended budget of $9,001,325 or a decrease of 3.47%. The primary revenue source for this fund is the Stormwater Utility Management Fee Assessment that is charged on a per equivalent residential unit (ERU) basis for improved and undeveloped property.

The FY 2025 stormwater fee assessment is expected to provide $7,717,056 in revenue to support operations and stormwater related capital improvements An increase to the stormwater assessment from the current $160.61 to $165.91 would be proposed for FY 2025 based on the May 2024 CPI. The increase of $5.30 is 3.3% more than the prior year, which is consistent with Section 22-254, Code of Ordinances The FY 2025 Stormwater Fund budget includes $2,479,041 for CIP and $33,000 in funding for the purchase of two (2) Gator Utility Vehicles and $16,000 for the replacement of two (2) trailers. The following table lists the Stormwater Capital Projects

The FY 2025 proposed budget is $33,153,385 or $17,924,891 less than the FY 2024 amended budget of $51,078,276 or a decrease of 54.07%. This year the Water and Wastewater Utility conducted a long-range financial planning study that looked at rates over the next several years required to support operations and planned capital projects The FY 2025 proposed budget was prepared based on a rate structure and recommendations that were recently provided to the City by the rate consultant engaged to conduct the study. The rate structure for water and wastewater services and related recommendations will be presented to the City Commission at the June 20, 2024 Budget Workshop.

The proposed budget for the Utilities Fund follows the long-range financial plan and provides support for continuing operations of the existing facilities, an active renewal and replacement program to maintain aging infrastructure, and funding for capital improvements identified in the ten-year capital improvement plan, six years of which are included in this budget proposal City staff will evaluate future funding options for capital improvement projects, where funding approaches for projects with estimated costs equal to or greater than $5 million would include the issuance of debt and pay as you go funding. The FY 2025 proposed budget includes capital outlay totaling $6,311,970, consisting of $5,325,000 for CIP renewal and replacement and $986,970 for capital equipment. The following table lists all the Utilities Capital Projects which are those that can be funded in FY 2025 from existing uncommitted fund balance in the Utilities Renewal and Replacement Fund only as the Utilities Operating Fund has essentially reached a point where no cash is available for transfer to fund capital projects.

Sewer Main Rehabilitation (I & I)

Water Main Force Main Emergency Repair and Replacement

Replacement of Galvanized Service Lines

Wastewater Lift Station Rehabilitation

Risk and Resilience Study

Replace Wastewater Force Mains

RRA Security Upgrades for WTP

Rehab Lime Silo / Slaker Systems

WTP Water Well Electrical Upgrades (Well Nos. 14-17)

Replace Transfer and Backwash Pumps

Total Utilities Capital Projects

Health Insurance Fund

$

The FY 2025 Health Insurance Fund proposed budget is $7,846,286 or $300,000 more than the FY 2024 amended budget of $7,546,286 or a 3.98% increase. Based on current information pertaining to claim activity and amounts for the prior year, staff is presently recommending that the premium for stop loss in the Health Insurance Fund remains at the FY 2024 level of $820,000. Human Resources staff is budgeting for Health Care claims to be $6.1M for fiscal year 2025 and be adjusted upward to $6.4M in both 2026 in 2027. These expenses are being closely monitored in FY 2024 and will be re-evaluated prior to the adoption of the FY 2025 Budget.

The FY 2025 Risk Management Fund proposed budget is $4,419,482 or $282,907 more than the FY 2024 amended budget of $4,136,575, a 6.84% increase. Based on the most current information available regarding property liability, staff is recommending that premiums for property liability be increased from $1,694,865 to $1,939,760 for fiscal year 2025 and then be further adjusted upward to $2,190,700 for fiscal year 2026 and to $2,399,990 for fiscal year 2027

Based on the most current information available regarding activity and the insurance market for City Property, staff is recommending that claims for damage to City Property be increased from $180,000 to $205,000 for fiscal year 2025 and then further increased to $210,000 for both fiscal years 2026 and 2027.

Based on the most current information available regarding automobile accident activity and the automobile insurance market, staff is recommending that claims for automobiles be decreased from $135,525 to $97,940 for fiscal year 2025 and be adjusted from that point upward to $104,000 for fiscal year 2026 and to $111,400 for fiscal year 2027. Lastly, staff is recommending a contingency for unplanned expenses remain at the FY 2024 level of $250,000 for fiscal years 2025, 2026 and 2027.

This proposed budget has been prepared to provide funding for the City of Tamarac’s Strategic Plan and the associated departmental work plans to achieve the outlined goals A dedicated section of the proposed budget book and this Executive Summary provide comparative benchmarks associated with the progress made with respect to the strategies

The millage rate recommendation of 7.0000 is the same as FY 2024 given an overall increase in taxable value of approximately 10.60%, new construction of $122,896,540 and $4,177,988 in additional budgeted revenue based upon the June 1 preliminary taxable value estimate and shown in the table below The additional revenue essentially only funds current ongoing operational expenses, while capital projects are again being funded using fund balance or savings

This budget proposes a millage rate of 7.0000 mills, the same as the current millage rate subject to minor modifications following receipt of the certified values from the Property Appraiser on July 1, 2024. This millage rate will generate budgeted property tax revenue of $43,580,803 for FY 2025 which is 95% of the total tax levy of $45,874,530, as required by Florida Statutes.

The rolled-back rate calculation based upon the June 1 preliminary taxable value estimate is 6.4044 mills. The rolled-back rate represents a millage rate that when applied to an amount that is equal to the total taxable value less the taxable value contributed by new construction results in the same tax revenue as the previous year The tax revenue from the rolled-back rate that would be generated is $39,872,700 at 95% of the tax levy or a slight increase of $469,884 from the FY 2024 tax revenue of $39,402,816 that was budgeted.

The following table compares the estimated distribution by property type of the ad valorem levy at the current millage rate and the proposed rate of 7.0000.

FY 2025 based on June 1, 2024 Estimated Values FY 2024 based on July 1, 2023 Certified Values

At the proposed millage rate of 7.0000 mills based upon June 1, 2024 preliminary taxable values, although the individual burden on single-family residential has decreased the combined burden, (relative reliance on for generating property tax revenue) on single-family residential, multi-family residential and condominiums has increased stemming from new units and related valuations being added to the tax rolls, while the burden on improved commercial has decreased and the burden on improved industrial has increased As residential is the largest class of property in the City, now making up approximately 79.15% of the entire City tax base and provided with the majority of services, it is expected that as values increase the burden will increase as well This is also a function of the cap on taxable value growth of nonresidential and commercial values at ten percent per year Based upon preliminary values by class, the taxable assessed value (i.e resulting value after applying Save Our Homes protection and any qualified exemptions) of all the classes of property increased from the prior year as follows: single family residential by 9.49%, multifamily residential by 22.51%, condominiums by 12.91%, improved commercial by 6.04%, improved industrial by 13.64%, while all others (includes all vacant land) increased by 7.70%.

As illustrated in the table below, the median taxable value of a single-family residential unit has increased 10.09% from $160,320 to $176,500 and the median taxable value for condominiums has increased 14.80% from $71,960 to $82,610. These taxable values include the “Save Our Homes” (SOH) limitations and all exemptions. Turnover in properties within the City seems to be the driver of these changes since SOH was limited to 3.0%.

Based on June 1, 2024 Estimated Values and FY 2024 Adopted Millage Rates

As a result of the recapture rule, as well as the normal changes in values for certain areas in the City, those properties that have “Save Our Homes” protection will experience a 3.0% increase in taxable assessed value even though there may have been a greater increase in the just (market) value of the property. Commercial and non-residential properties are limited to a 10% increase in taxable value.

The following table provides the comparison of the FY 2024 and FY 2025 ad valorem levy for homesteaded residential properties at various values ranging from $75,000 to $500,000 SOH assessed value before exemptions. The chart assumes changes in SOH assessed value before exemptions at 3.0% year over year The median single family home taxable value after exemptions in Tamarac, based the June 1 preliminary taxable value estimate was $176,500.

As stated previously, the FY 2025 proposed General Fund budget is $94,749,738, including ad valorem revenue using a staff recommended millage rate of 7.0000 mills. The millage rate recommendation of 7.0000 mills, and thus the increase over the rolled-back rate allows for the funding necessary to support a host of items for which the Commission reached a consensus on during the Strategic Planning Sessions as outlined in the table below.

The City of Tamarac Proposed Budget for FY 2025 is to maintain the overall current level of services while enhancing service levels in areas such as technology, economic development, infrastructure and the physical appearance of the City. The FY 2025 proposed millage rate of 7.0000 mills in addition to other revenue sources preserve core services within the General Fund and other operating funds to execute strategic objectives outlined by the community, City Commission, and City Management.

The City of Tamarac has experienced a resurgence in taxable property values, approximately 12.29% in FY 2023, 11.11% in FY 2024 and now 10.60% in FY 2025; however, the City will continue to face challenges due to slow and/or moderate increases in other revenues. There are limited alternatives for new revenue sources and at the same time historic increases in the cost of goods, services, and construction materials. What we have learned over the past couple of years is that it is very difficult to fully assess the economic impacts of the COVID-19 pandemic. Some of the resulting residual economic conditions including further COVID related shutdowns, job losses and supply chain issues may permeate the real estate market at any time.

Legislative and constitutional measures havelimited growth in taxable valuesthrough the years. Therefore, new construction is critical to provide additional revenue as new housing and commercial development is added to the tax rolls. New construction provided a tremendous boost to taxable values for FY 2025, amounting to $122.9 million, as compared to the $97.3 million contribution from new construction the City experienced for FY 2024. However, in the not so distant future, major new construction projects are expected to begin tapering off.

As a result, due to the pandemic and its lingering impacts on various operational costs, it is anticipated that property tax revenue, with the millage rate held at 7.0000 mills, will increase enough as a percentage of total General Fund Revenue only for FY 2025. Over time, in order to keep pace with the increased cost of operations while providing the needed funding for planned capital improvement projects, further costcuttingor austerity measures maybecome necessaryunlesssome of the burden currently borne by property taxrevenuecanbeshiftedtootherGeneralFundrevenuesources. Bearinmindthatfuturelargescalegeneral capital improvement projects are shown in the Six Year Capital Improvement Plan (“CIP”) but not actually funded beyond FY 2025.

The FY 2025 Proposed Budget with two forecast years builds upon the success of the FY 2024 and prior budget publications that have received the Government Finance Officers Association (GFOA) “Distinguished Budget Presentation Award.” The award is noteworthy as it is bestowed on only a small percentage of public organizations.

The support and dedicationof the City of Tamarac’smunicipal workforce is secondto none as often echoed by City residents speaking during the Public Participation portion of Regular City Commission meetings They tirelessly provide an extensive array of core services for residents with enthusiasm and pride. Many of these employees have contributed extensively to the analysis and preparation of this document, and I appreciatetheircontinuedcommitmenttotheevolutionandimprovementofthebudgetpreparationprocess.

Thank you for your consideration of this budget proposal. It is my continued hope that all stakeholders will find the City’s Budget to be user-friendly and that it will be a valuable financial tool and operations guide. As you know, this proposed budget is the funding vehicle through which the city will be able to respond to the needs of our residents while accounting for the challenges associated with the availability of resources and furthering the City’s newly implemented Mission of “Excellence Always”.

I look forward to working collectively with the Mayor, members of the City Commission, and the Tamarac community in crafting the final adopted budget.

Sincerely,

Levent Sucuoglu City Manager

The City of Tamarac is governed by a Commission/Manager form of government, which combines the political leadership of elected officials with the managerial experience of an appointed administrator. The City Commission consists of five members: The Mayor, chief elected official‐at‐large, and four commission members elected from each of the four districts in the City. The legislative powers of the City are vested in and exercised by the City Commission, consistent with the United States Constitution, the Florida Constitution, laws of the State of Florida, the City Charter, and City ordinances. The City Commission is vested with policy‐setting authority, adopting the annual budget, formulating goals and objectives, and making decisions that affect the quality of life in the community.

The City Manager is appointed by and directly responsible to the City Commission. As the administrative head of the City, the City Manager carries out policies made by the Commission and directs and coordinates the work of all City departments.

The Program/Performance Budget is an effective budget model which focuses on policy planning and resource allocation. It assumes that in an environment of scarce resources, elected officials must choose between different and competing items. This method expands on the basic line item budget concept giving residents, commissioners, management and employees a better understanding of government's role in the community. The Program/Performance Budget improves the quality of decision‐making and provides a mechanism to increase the efficiency and effectiveness of City operations. Our Budget has four objectives.

1. Policy Document

The City’s budget process is conducted within the framework of the Strategic Plan, providing financial management policies, financial trends and fiscal forecasts. The information contained in these documents gives policy makers an opportunity to review policies and goals that address long‐term concerns and issues of the City and evaluate City services.

2. Operations Guide

The budget describes activities, services and functions carried out through departmental goals and objectives and a continuation/enhancement of performance indicators. The document includes an organizational layout for the City and a three‐year analysis of staffing.

3. Financial Plan

The budget presents the City’s fiscal resources through a process of needs analysis, service delivery priorities, and contingency planning. The document includes the current and long‐term debt obligations along with a comprehensive list of capital improvements (included in an asset management program) and the basis of budgeting for all funds.

4. Communications Device

The budget communicates summary information, including an overview of significant budgetary issues, trends and resource choices, to a diverse audience. It describes the process for preparing, reviewing and adopting the budget for the ensuing fiscal year.

Per Florida Statute 166‐241(2), all municipalities must adopt a balanced budget, defined as “the amount available from taxation and other sources, including amounts carried over from prior fiscal years, must equal the total appropriations for expenditures and reserves.”

Adopting the budget is the culmination of a process that integrates financial planning, trend analysis, accounting enhancements, goals and objectives, and strategic planning, into service delivery. Pursuant to Florida Statutes, total estimated expenditures shall not exceed total estimated revenue and appropriated fund balance. The City also adopts and maintains a capital improvement plan.

The City Charter requires the City Manager to submit a proposed budget to the City Commission by July 30th of each year. The City Commission holds budget workshops with City staff and the public. Pursuant to Florida Statutes, two public hearings are held in September. The first public hearing is for the adoption of a tentative millage and tentative budget. The second public hearing adopts the final operating and debt service millage rates along with the annual budget and capital improvement plan.

Florida law provides general guidelines regarding budget amendment policies. Appropriation of additional unanticipated revenue is allowed by law in all fund categories for many types of revenue at public City Commission meetings. The law allows appropriation increases of any nature to occur through a supplemental budget process requiring advertised public hearings.

Formal appropriation by the City Commission is at the department level for the General Fund and at the fund level for all other funds. Amendments to these appropriations are adopted twice each fiscal year, reflecting actions approved by the City Commission, allocation of encumbrances, transfer of funds from a non‐departmental account to other departments in the General Fund, and additional capital improvements. Budget transfers not requiring an increase in a fund total or department total are granted within guidelines to various levels of management.

All government funds are accounted for using the modified accrual basis of accounting. Revenues are recognized in the period when they become measurable and available to pay liabilities of the current period. Property taxes, utility taxes, franchise fees, intergovernmental revenues, and charges for services may be accrued when collected depending on the billings to which they pertain. Property taxes are recognized as revenue in the fiscal year for which they are levied. Investment earnings are recorded as earned. Permits, fines, forfeitures and contributions are not subject to accrual because, generally, they are not measurable until received in cash. Revenues collected in advance of the year to which they apply are recorded as deferred revenues.

Expenditures under the modified accrual basis of accounting are generally recognized when the related fund liability is incurred and expected to be liquidated with available resources. Exceptions to this rule include principal and interest on general long‐term debt, which are recognized when due.

All proprietary fund types and the Pension and Nonexpendable Trust Funds are accounted for using the accrual basis of accounting. Revenue is recognized when earned, expenses recognized when incurred. Agency funds are custodial in nature and are not a direct result of operations. They are accounted for under the modified accrual basis of accounting. Assets and liabilities are recognized on the modified accrual basis.

The budget follows the basis of accounting, meaning general government type funds are prepared on a modified accrual basis Obligations of the City of Tamarac are budgeted as expenses, but revenues are recognized when they are actually received.

The budget is a balanced budget which means that estimated revenues are equal to estimated expenditures. All appropriations lapse at year end, except capital improvement projects that are budgeted on a life of the project basis. Some encumbrances are carried forward to the next fiscal year which include the capital improvement program encumbrances.

The Annual Comprehensive Financial Report (ACFR) shows the status of the City of Tamarac’s finances on the basis of “generally accepted accounting principles” (GAAP) and fund expenditures and revenues on both a GAAP and budget basis for comparison purposes.

January

•Depts begin conducting internal/cross dept budget prep meetings Jan 2nd

February

March

April

May

June

July

August

Sept

October

Nov

•HTE Budget Data Entry Access OPENED (Immediately after Bugdet Training) Feb 2nd

•New Position requests due to HR Feb 16th

•Utilities 20-Year Plan Capital Projects List due Feb 23rd

•Program Modifications/Capital Outlay/Capital Maintenance/Equipment/Vehicles due Feb 26th

•HTE Budget Data Entry Access CLOSED Mar 14th

•New Capital Requests for FY 2025/2026/2027 (CIP Ranking Forms) due Mar 14th

•Clearpoint mission, description, and goals updates are due Mar 25th

•Departmental Budget Review meetings March 27th-April 4th

•Budget enters adjustments based on meeting outcomes

•City Manager Budget Review meetings May 13th & 15th

•Budget enters adjustments based on meeting outcomes

•Estimated Taxable Values distributed by Property Appraiser

June 1st

•Proposed Budget delivered to City Commission June 14th

•Commission Budget Workshop June 20th

•Certified Taxable Values distributed by Property Appraiser (Day 1 TRIM compliance)

•Commission sets Proposed Property Tax Millage/Assessment rates

July 1st

•City certifies DR420 Form to Property Appraiser (Day 35 TRIM compliance) by Aug 4th

•Truth-in-Millage (TRIM) notices sent to property owners (Day 55 TRIM compliance) by Aug 23rd

•1st Public Hearing Tentative Budget Adoption Special Commission Meeting (Day 65-80 TRIM compliance) Sept 12th

•Published Advertisement for 2nd Public Hearing Sept 22nd

•2nd Public Hearing Final Budget Special Commission Meeting (Day 95 TRIM compliance) Sept 25th

•Adopted Resolution & Ordinance to Prop Appr & Tax Collector (Day 97-100 TRIM compliance) within 3 days of hearing

•New Fiscal year begins Oct 1st

•Certification of Compliance/DR487(within 30 days of Final Public Hearing) Oct 23rd

•1st Reading of FY 2024 2nd Budget Amendment (amending last year's budget) Oct 23rd

•2nd Reading (Hearing) of FY 2024 2nd Budget Amendment Nov 13th

•FY 2025 Adopted Budget Finalized for Print/Submitted to GFOA (within 90 days of adoption) TBD

The tentative, adopted, and/or final budgets are on file in the office of the above mentioned taxing authority as a public record.

The State of Florida does not have a state income tax. The primary source of funds for cities, counties, and school boards are property taxes, which are regulated by the state via the TRIM (Truth in Millage) process. Property taxes are an ad valorem tax, meaning they are allocated to each property according to its value. The City of Tamarac sets a property tax rate, called a millage rate, to help fund the operations of the City. This millage rate is multiplied by the taxable value of each property to arrive at the property taxes due to the City.

As part of the TRIM process, the City is required to announce a Rolled Back Rate. This is a millage rate which will provide the same ad valorem tax revenue to the city that was received last year. Florida statutes require the City to use the Rolled Back Rate as a benchmark against which to measure the millage rate being adopted for the upcoming budget year. If the Adopted Rate is greater than the Rolled Back Rate, the City must declare a property tax increase.

The Broward County Property Appraiser (BCPA) establishes the taxable value of every parcel of property in our city. BCPA determines the just, or market, value of each property as of January 1. Then they apply all eligible exemptions to determine the property’s taxable value and provide this information to the City each year, initially at June 1 to set the proposed budget and again at July 1. The July 1 values are what the City must use to calculate the primary City revenue, ad valorem taxes, for the adopted budget.

*Based on July 1,2024 Certified Taxable Values

Florida offers a Homestead Exemption to ease the burden on taxpayers by exempting property taxes on up to $50,000 of a homeowner’s residence. The first $25,000 applies to all taxing authorities. The second $25,000 does not apply to all taxing authorities and only applies to the portion of the home’s value between $50,000 and $75,000. A further protection for taxpayers is “Save Our Homes" (SOH). “Save Our Homes” caps the annual increase in assessed value on homesteaded properties to the lesser of 3% or the increase in the Consumer Price Index (CPI). For 2024, the SOH maximum increase is 3.0%.

City Property Taxes at 7.0000 Millage Rate Taxable Value of Dwelling No Homestead Exemption With Homestead Exemptions

$175,000 $1,225 $875

$150,000 $1,050 $700

$125,000 $875 $525

$100,000 $700 $350

$75,000 $525 $175

$50,000 $350 $175

$25,000 $175 $0

In addition to the Homestead Exemption, low‐income senior citizens in the City of Tamarac can claim an additional $25,000 exemption, which only applies to the County and City taxes. Beginning with Tax Year 2019 the City also offers the Senior Long‐Term Residency Exemption. This exemption grants full homesteaded property tax relief to low‐income seniors who have lived in their home for at least 25 years. This exemption eliminates the entire City and County portion of the tax bill for qualifying seniors.

NOTES to Explain Personnel Changes:

1 City Manager ‐1 Elimination of 1 Economic Development Coordinator

2 Community Development +0.83 Added 1 Code Compliance

4

5 Fire & Rescue +12 Added 12 Firefighters

6

8 Utilities +3 Modifications/miscalculations to the personnel structure within the Stormwater and Utility Fund reorganization

1 Water Plant Operator: total of eight (8), one (1 ) Senior Chemist: total of two (2). FY25, one new addition is a Water System Operator I in Distribution.

The City adopted Financial Management Policy #11 to minimize the financial burden on the taxpayers through systematic program reviews and evaluation to improve the efficiency and effectiveness of City programs. Adds to staff are made judiciously.

Every year as part of the budget process, each department considers its staffing, operations, and capital needs for the upcoming fiscal year. Any need that would cause an increase to the budget is thoroughly vetted and discussed. The following tables summarize the requested additions to the City’s budget, indicate those funded, and provide a snapshot of what’s new. This same exercise is also done for the next two fiscal years to provide a longer‐term perspective on the impact on the budget.

The Fiscal Year 2025 Proposed Budget austerity measures will continue due to the global economic disruption challenges, inflation, and post‐pandemic potential impacts on FY25 revenues, limiting new positions and only critically needed reclassifications/changes.

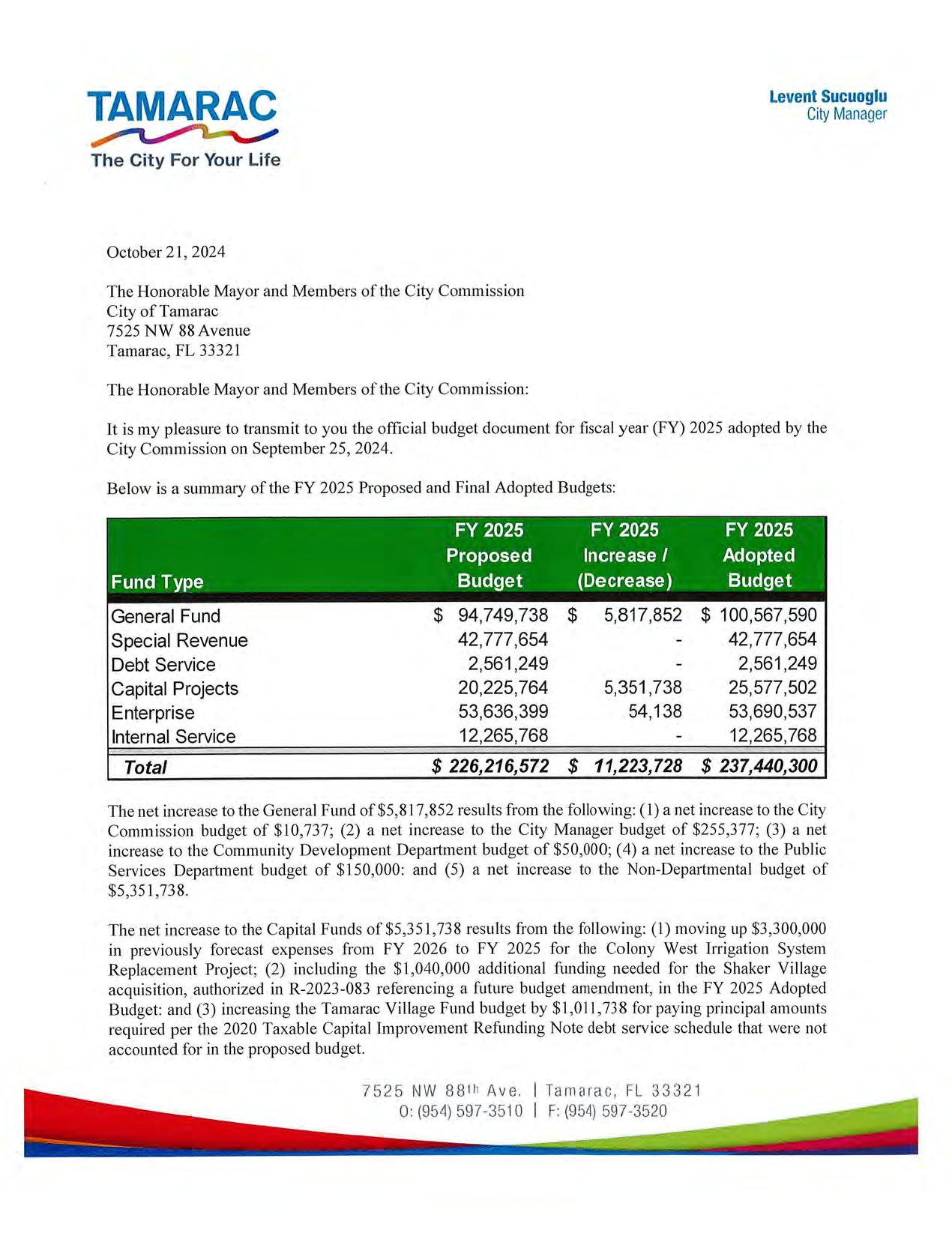

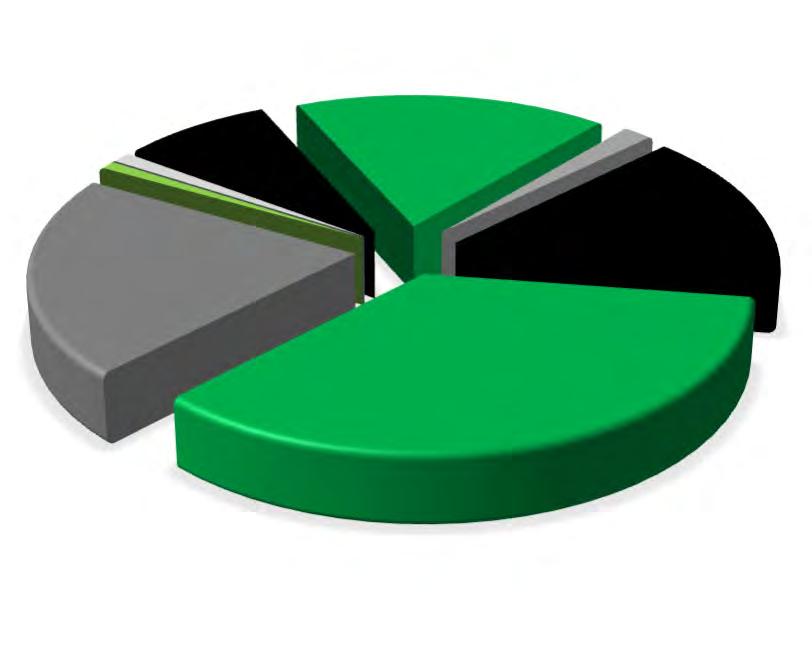

The FY 2025 Total Adopted Budget is $237,440,300 which includes $100,567,590 for General Fund expenditures. Summarized below are the changes broken out by fund type. The largest change is a decrease of $34.6 million in the Enterprise Funds, primarily due to a decrease in total cost for planned Utilities capital improvement projects together with the required transfer.

ALL FUNDS

FY 2025 ADOPTED BUDGET BY FUND TYPE $237,440,300

The General Fund is the City's primary operating fund and is the largest fund. It accounts for all the financial resources needed to operate the City except for those required to be accounted for in a separate fund. The General Fund budget for FY 2025 totals $100,567,590 which is an increase of 10.85% from last year's budget, as amended.

The General Fund (Fund 001) serves as the primary reporting vehicle for current operations. The major sources of revenue include ad valorem (property) taxes, utility taxes, communications services tax, franchise fees, user fees and charges for services, and intergovernmental revenues. The major departments funded within the General Fund are City Commission, City Manager, City Attorney, City Clerk, Financial Services, Human Resources, Community Development, Parks and Recreation, Information Technology, and Public Services. Police services are provided by contract with Broward County Sheriff's Office and are also funded in the General Fund.

These are the City's Operating Funds. The City of Tamarac has adopted a Fund Balance Policy. The purpose of the Fund Balance Policy is to provide enhanced financial stability by ensuring that the City maintains a prudent level of financial resources to protect against reducing service levels or raising taxes and fees because of temporary revenue shortfalls or unexpected one-time expenditures. The policy sets acceptable ranges of fund balance for each fund that contains operating revenues. The amounts set for each fund are based on the predictability of revenues, volatility of expenditures, and liquidity requirements of each fund. In some cases, the range of fund balance is determined by bond covenants. The policy also provides guidelines for actions that should be implemented should the fund balance either grow or diminish to amounts outside of the recommended ranges

The City's Budget seeks to preserve and build fund balances in each of the operating funds to continue implementation of the Fund Balance Policy. Budgeting was performed conservatively so that, for the most part, available revenues funded anticipated expenses and preserved fund balance levels.

Insurance Services Fund is Fund 502 & 504 combined All projected amounts are unaudited and based on preliminary FY 2024 year-end results. Future estimates are based on historic actual collection rates for revenues and expended budget percentages for expenditures.

Revenues

Expenditures-All Departments

Revenue Type Definitions:

(1) Variable-Discretionary/Restrictive - Relies solely on a tax increase to generate additional funds beyond growth.

(2) Variable-Discretionary means that it is adjustable by Home Rule to a certain extent.

(3) Variable-Non-Discretionary means it is received but not adjustable by the City due to certain factors such as, the rate is at the maximum percentage, it will take more than one year to adjust, and/or receipts are out of the City's control.

Underlying Assumptions:

(1) Revenues are forecasted in the General Fund using a conservative approach in accordance with the City's Financial Policies.

(2) Expenditures are forecasted conservatively with annual increases to Personal Services and Operating Expenditures aligned with inflation.

(3) At times when actual revenue exceeds estimates and actual expenditures are less than forecasted in the same year, the excess revenues are used to shore up the City’s Fund Balances and fund capital improvements.

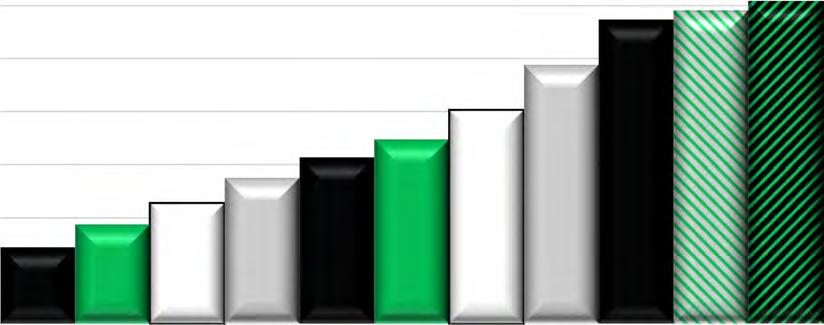

Major General Fund revenue sources for the City of Tamarac are property taxes, utility taxes, franchise fees, sales and use taxes, telecommunication service taxes, and intergovernmental revenues.

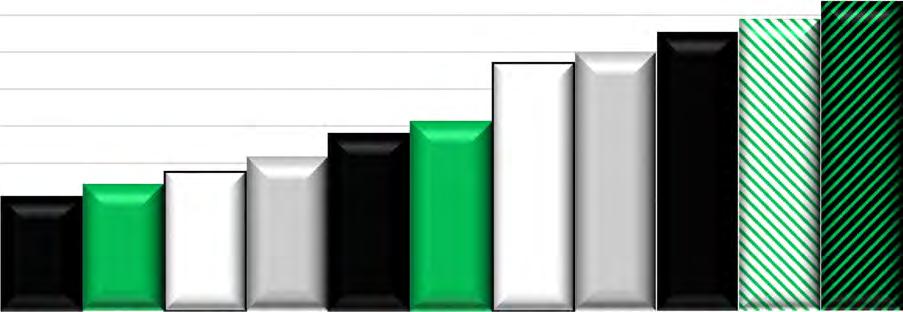

The City’s primary revenue source is property taxes. Property taxes are an ad valorem tax, meaning they are allocated to each property proportionately according to its value. The Broward County Property Appraiser (BCPA) establishes the value of property and exemptions within the City, and the City Commission sets the millage rate, which is applied against these values to calculate the expected amount of revenue. Although actual increases have ranged between 6% and 10% for the past five years, the City used a conservative projection of a 3 percent annual increase to forecast this revenue; projections remain modest for FY 2026 and FY 2027.

$50,000,000

$45,000,000

$40,000,000

$35,000,000

$30,000,000

$25,000,000

$20,000,000

$15,000,000

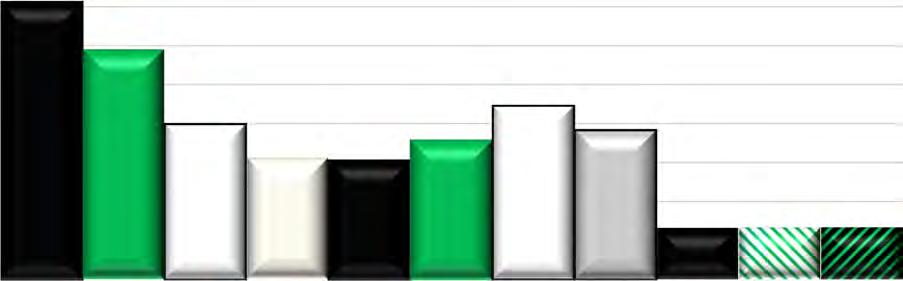

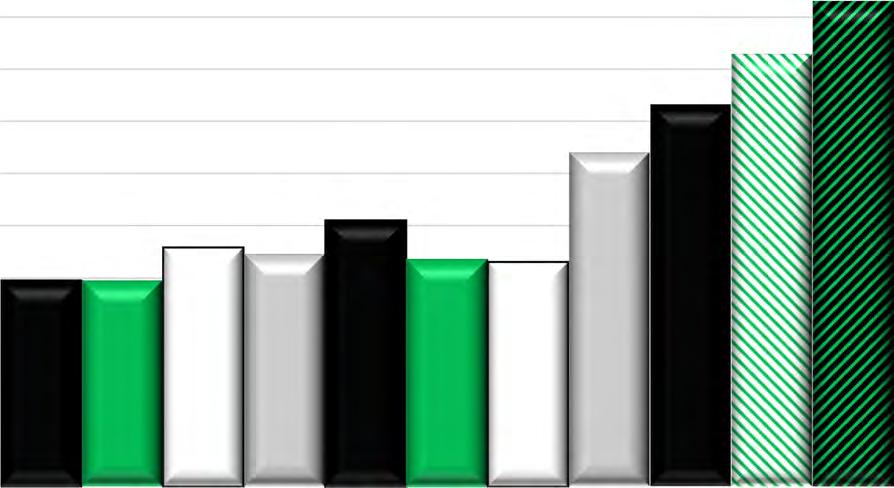

Franchise fees are negotiated fees the City charges a company or utility for the use of the City’s rights‐of‐way (poles, lines, pipes, etc.) and could include the value of the right for the utility to be the exclusive provider of its services within the City. The City has franchise agreements for electricity and solid waste, with the largest revenue source being electric franchise fees. Electric franchise fees are based on the utility’s revenues, which aren’t expected to change significantly. A small growth rate of 0.5% is forecasted.

$4,200,000

$4,100,000

$4,000,000

$3,900,000

$3,800,000

$3,700,000

$3,600,000

$3,500,000

$3,400,000

$3,300,000

$3,200,000

$3,100,000

$3,000,000

$2,900,000

$2,800,000

$2,700,000

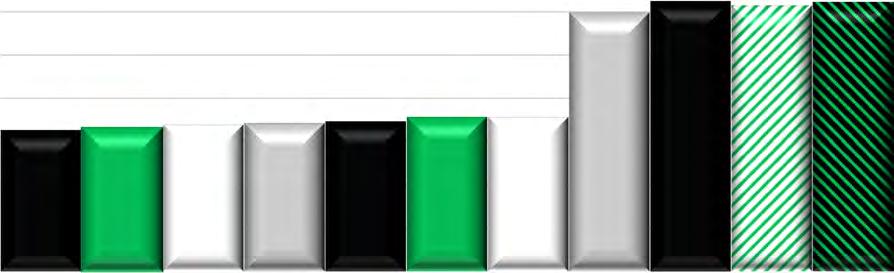

Communications Services Tax (CST) applies to telecommunications, cable, direct‐to‐home satellite, cellular telephone, and related services. The CST revenue is collected and distributed by the State of Florida and is a combination of two individual taxes: (1) the State of Florida communications services tax and (2) the local communications services tax. The economy, legislation, and technological changes have eroded the tax base for this revenue; a continued 0.5% annual growth rate is forecasted.

$2,300,000

$2,200,000

$2,100,000

$2,000,000

$1,900,000

$1,800,000

$1,700,000

$1,600,000

$1,500,000

A Public Service Tax is levied on the purchase of electricity, metered natural gas, liquefied petroleum gas, metered or bottled, manufactured gas, metered or bottled, and water service. This revenue was implemented by the City in Fiscal Year 2010 as a much‐needed effort to bridge the gap in other declining revenues, such as property taxes and other fees; forecasts are for minimal growth.

$6,500,000

$6,000,000

$5,500,000

$5,000,000

$4,500,000

$4,000,000

$3,500,000

Actual Revenues Forecast : at a 0.5% growth

This category includes revenues received from federal, state, and other governmental sources in the form of shared revenues, the largest of which for the City of Tamarac are the Half‐Cent Sales Tax and Municipal Revenue Sharing. Half‐cent sales tax revenue is allocated to local governments based on a population‐derived formula for each county. The Municipal Revenue Share is allocated based on population, sales tax collections, and ability to raise revenue based on per capita taxable values. As of January 2019, an additional tax from natural gas was included in this Share. The forecast is skewed to the downside due to the risk associated with the national economic forecasts. As far as the overall uptick for FY’23 revenue goes, the numbers are based on collections that far exceeded expectations, and a key issue is that the increased prices related to inflation have helped boost sales‐tax collections.

$6,500,000

$6,000,000

$5,500,000

$5,000,000

$4,500,000

$4,000,000

$3,500,000

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

Fire suppression, prevention, and other fire services benefit all properties in the City by protecting the value and integrity of improvements to real property and protecting the use and enjoyment of such property. The City provides these services which reduce the cost of property insurance and enhances property values. The primary revenue used to fund these services is a non‐ad valorem special assessment levied on residential and commercial property owners. The amount of the assessment is calculated by a consultant using a calculation of recoverable costs, property types, and classifications.

$17,000,000

$16,000,000

$15,000,000

$14,000,000

$13,000,000

$12,000,000

$11,000,000

$10,000,000

The second significant revenue source in the Fire Rescue fund is transport fees collected from users of ambulance and rescue services, also known as Emergency Service Fees. Emergency service fee revenue is estimated by trend analysis, utilization of historical data, and input from the department on projected activity levels. In FY 2016, at the recommendation of the auditors, the City started deferring receivables taking a fairly large amount out of revenue and placing it in a balance sheet account, which going forward is to be adjusted each year based on a 60 day availability rule.

$3,000,000

$2,500,000

$2,000,000

$1,500,000