DONOR ADVISED FUND HANDBOOK

WELCOME

On behalf of The Erie Community Foundation Board of Trustees, we are grateful you have decided to support your community through our Foundation. Whether you’re inspired by a cause that has touched your heart, or you want to build a tradition of giving for future generations, your philanthropy reflects your values and passions.

Whatever motivates your generosity, we are here to be your trusted partner, who understands you and your goals. Our goal is to make your giving experience seamless, meaningful, and even a little magical.

We connect you to the causes that matter most to you by offering expert guidance, intimate knowledge of the Erie community, and the tools you need to make a lasting impact. From start to finish, we ensure that giving feels effortless and fulfilling.

This handbook will serve as a guide and answer questions about your Donor Advised Fund with the Foundation. Donor Advised Funds provide a convenient and flexible way for individuals, families, and businesses to actively engage in philanthropy by recommending grants to nonprofits of your choice.

Whatever your philanthropic goals, we are your partner in making a difference. Together, we can help your generosity create lasting change and strengthen the fabric of our community.

President & CEO

The Erie Community Foundation

INSPIRING PROGRESS

With a legacy spanning nearly 100 years, The Erie Community Foundation has been deeply embedded in Erie's philanthropic landscape for generations. We support your philanthropy effectively, assisting in crafting tax-wise giving strategies that reflect your passions.

From administrative support to grantmaking assistance, we handle all the details. At the Foundation, we go beyond traditional services, providing comprehensive support and Erie-centric expertise to ensure impactful giving on your timetable.

INSPIRE

Whatever your philanthropic goals, we invite you to consider us as your partner in making a difference. Together, we can help your generosity create lasting change and strengthen the fabric of our community.

ENGAGE

We connect you to the causes that matter most to you by offering expert guidance, intimate knowledge of the nonprofit sector, and the tools you need to make a lasting impact. From start to finish, we ensure that giving feels effortless and fulfilling.

EMPOWER

The Erie Community Foundation is home to more than 900 charitable funds, united to fuel our brand promise to be a trustworthy and permanent steward of greater Erie’s generosity. Our philanthropic services team will provide direct guidance and tailored support to help you as you utilize your Donor Advised Fund. Our team is also committed to helping you establish powerful succession plans for your funds, allowing your generosity to live on in perpetuity.

BUILDING YOUR FUND FOR LASTING IMPACT

You can make contributions to your Donor Advised Fund as often as you would like. The Erie Communication Foundation accepts a variety of assets that can fuel a lasting impact.

GIVE NOW:

• Check, wire transfer, or credit card

• Appreciated securities

▪ Publicly traded stock and mutual funds

• Real Estate

• Residential or commercial properties, farmland, or timberland

• Business Interest

▪ Privately held stock, limited partnerships, and other business interests

• Transfers from charitable entities

▪ Transfer assets from a private foundation or donor-advised fund to create a Foundation fund, ensuring seamless management and continued philanthropy

GIVE LATER:

• IRA

▪ While you’re not able to utilize your QCD to support your Donor Advised Fund, you are able to contribute to your fund directly from your IRA.

• Bequests, Retirement Plan Assets, and Life Insurance

▪ You have a multitude of ways to ensure the giving from your Donor Advised Fund will continue in perpetuity. Contact Foundation staff to discuss your options whenever you are ready.

GRANTMAKING GUIDE

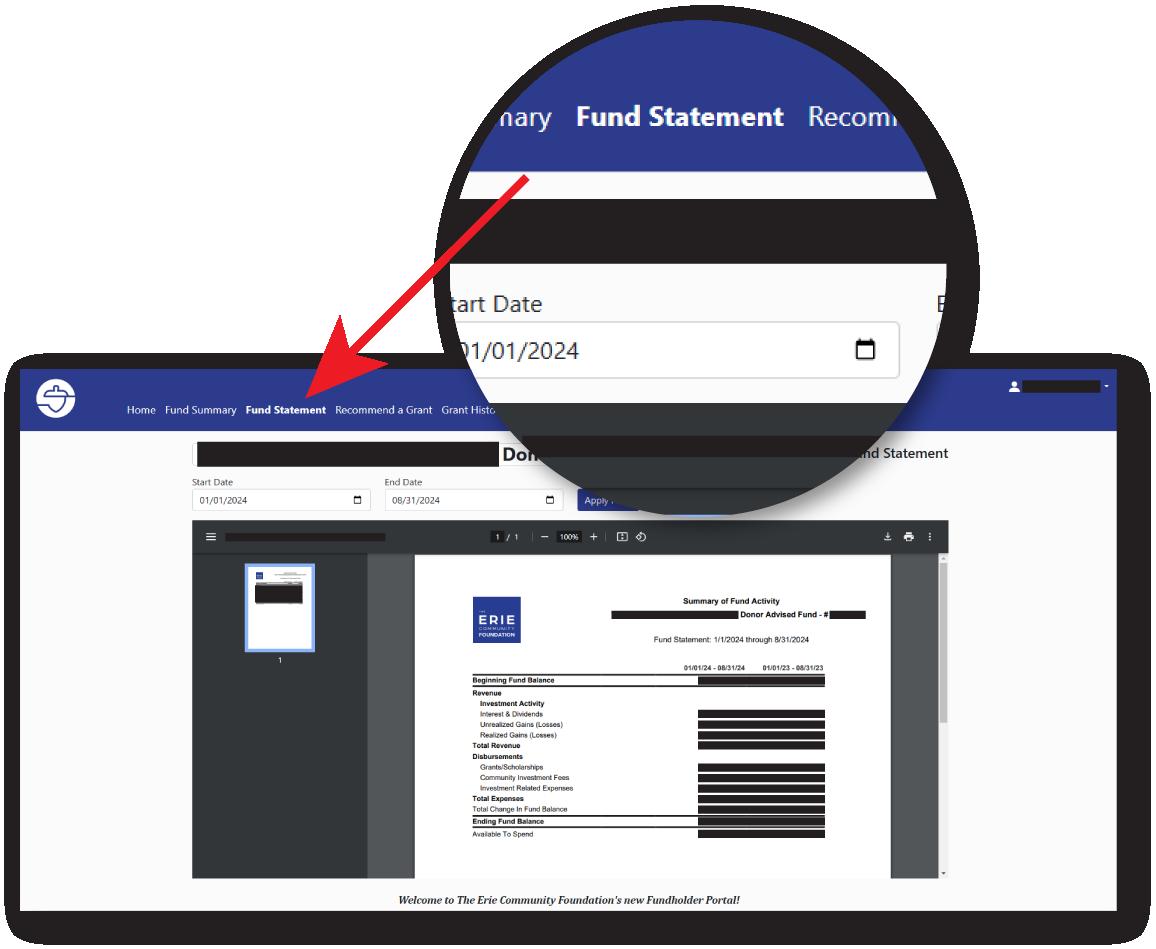

As a fund advisor, you can recommend distributions from your fund at any time. Through our comprehensive online portal, GoFund, you can view detailed reports, giving history, and more whenever you like. If your fund is endowed, we will provide information in the first part of each year about the amount available for distribution.

MAKING THE MOST OF YOUR DONOR ADVISED FUND

Through our competitive grantmaking process, we regularly communicate with nonprofits in the community and conduct impactful research on local issues and nonprofits. Our Philanthropic Services team will listen to your philanthropic vision and help you develop a customized giving plan. We will provide valuable insights and information about nonprofits aligned with your philanthropic interests to ensure your giving makes a meaningful impact.

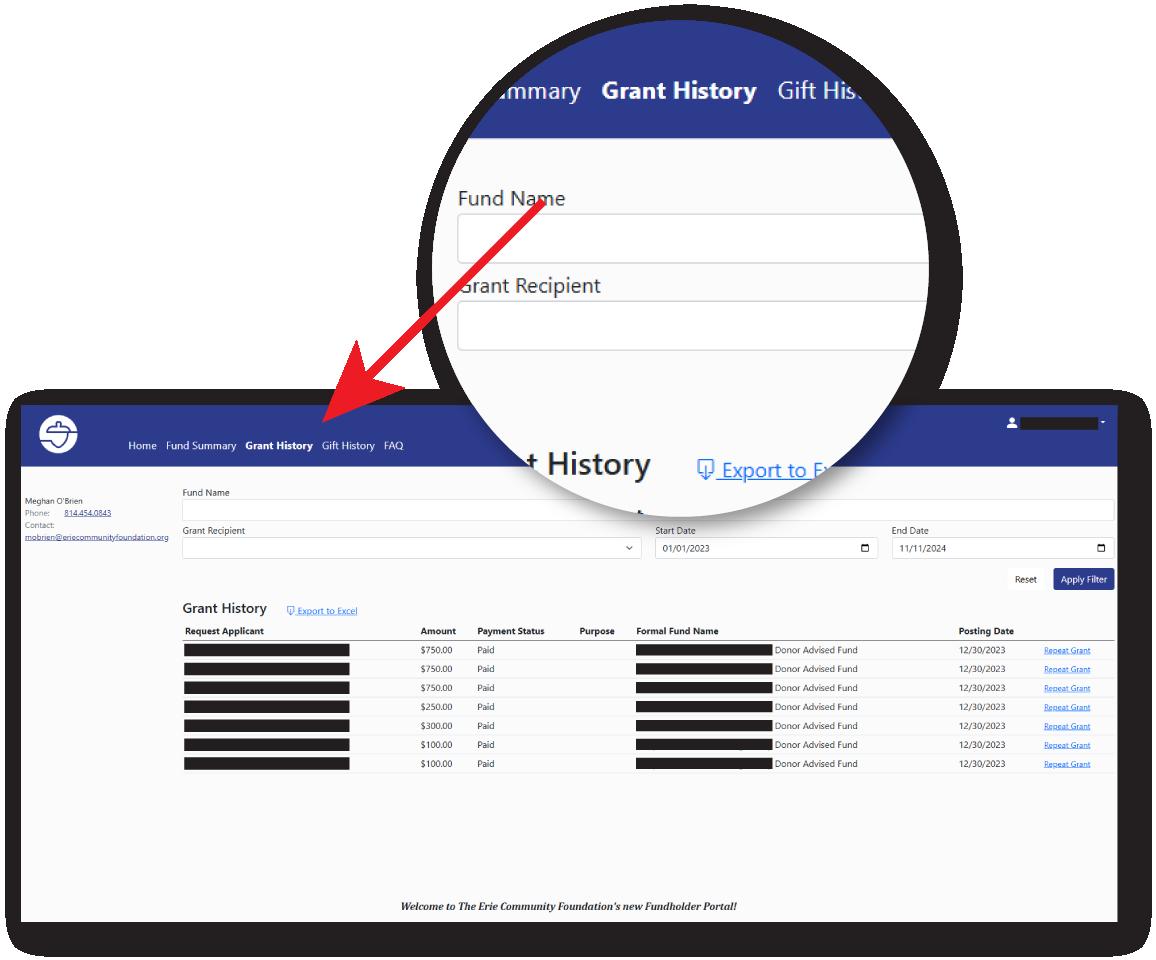

GETTING TO KNOW THE DONOR PORTAL

Once your fund is created, the assigned fund advisors will receive emailed invitations to the donor portal. Through the portal, you can monitor your fund’s activity, see the amount available to distribute, watch how investments are performing, and make grant recommendations.

RECORDKEEPING AND REPORTING

RECOMMENDING A GRANT FROM YOUR DONOR ADVISED FUND

Making grant recommendations from your Donor Advised Fund is a simple process. After the Foundation receives your recommendation(s), our staff will conduct an independent review to ensure the grantee is a qualified recipient and the recommendation is consistent with our charitable purposes.

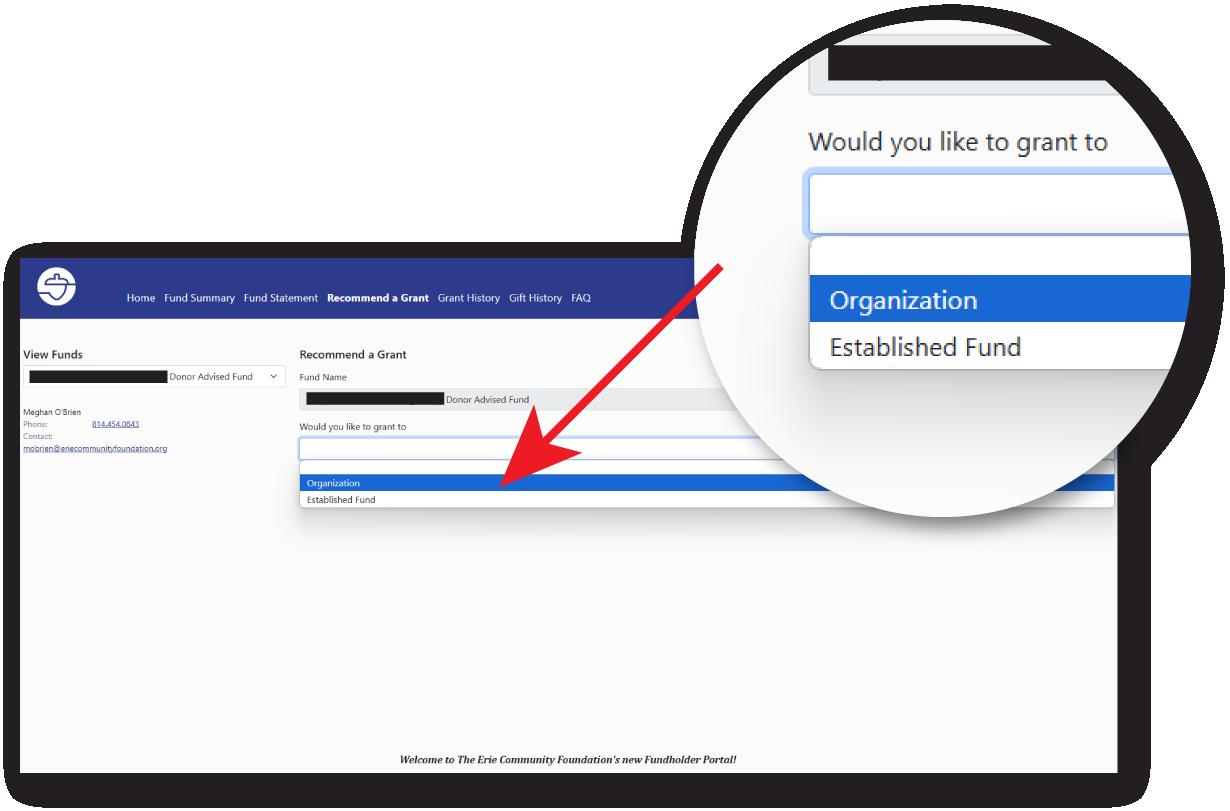

TO RECOMMEND A GRANT:

In the donor portal, click on Make a Grant Recommendation

Next, from the dropdown menu, select whether you would like to give to an organization or an established fund

GIVE TO AN ORGANIZATION:

1. Fill out Organization Name.

▪ If the name of your desired organization doesn’t appear on the list, you can choose to find the nonprofit using the provided charity search link or choose to enter the information yourself.

▪ As mentioned, our staff will conduct an independent review to ensure the grantee is a qualified recipient and the recommendation is consistent with our charitable purposes. If we cannot confirm the recipient is an eligible organization, we will contact you.

2. Fill out the Amount you’d like to donate.

3. From the Grant Type dropdown, select either General Operating or Restricted.

▪ If choosing General Operating, all you need to do to finalize your donation is review the checkboxes at the bottom of the page.

▪ If choosing Restricted, please enter a purpose for your donation, and then proceed with the bottom checkboxes.

4. Click Submit.

GIVE TO AN ESTABLISHED FUND:

1. Select the fund you would like to contribute to from the Gift Fund section.

2. Fill out the Amount you’d like to donate.

3. Select the Date Requested.

4. Fill in any necessary information in the Purpose of Grant section.

5. Review the checkbox at the bottom of the page and click Submit.

Once your grant recommendation is submitted, and after a brief period of due diligence, the funds will be sent to the nonprofit organization via check. This check will be accompanied by a letter from the Foundation, stating your Donor Advised Fund has recommended a gift to the specified nonprofit. If your fund has been established anonymously, your personal information will not be shared – only the name of the fund. This process typically takes between 10-14 business days.

ELIGIBLE ORGANIZATIONS

Organizations classified under Internal Revenue Code Section (IRC) 501(c)(3), including those qualified under IRC 509(a)(1)-(4) and 170(b)-(c), which can also include governmental entities like school districts and tribes, are also eligible to receive grants from the Foundation.

GRANTMAKING LIMITATIONS

While most grant requests will be approved, some require additional due diligence and must meet specific criteria to be approved.

QUESTIONS?

If you have any issues or concerns with your fund, or have questions about logging into your donor portal, please contact Marissa Litzenberg, our Philanthropic Services Associate, at MLitzenberg@ErieCommunityFoundation.org or 814.413.7355

OTHER DONOR ADVISED FUND USES AND RESTRICTIONS

MEMBERSHIPS

Donor Advised Funds can cover the cost of a membership if the organization confirms the full membership amount is 100% tax deductible. Your grant recommendation must also confirm you waive all benefits beyond the incidental or insubstantial benefits related to the membership.

EVENTS AND SPONSORSHIPS

Funds can be used to support fundraising events but not to purchase event tickets.

You may recommend a grant to support a charitable event by indicating in the grant purpose that you are not attending the event, or you are attending but will personally pay the ticket price separately.

SCHOLARSHIPS AND TUITION

Your Donor Advised Funds can support a scholarship program administered by a 501(c)(3) public charity or educational institution but not an individual.

GRANTS TO OUT-OF-STATE OR INTERNATIONAL NONPROFITS

The Foundation’s funds are established to benefit Erie and the surrounding community. However, we understand donors may have close ties with other communities outside of Erie and may recommend grants to other qualified public charities or universities. International grants can be made when an organization has nonprofit status in the U.S.

FREQUENTLY ASKED QUESTIONS

How does the Foundation calculate the annual distribution amount for my endowed fund?

The spending policy, approved annually by the Board of Trustees, is designed to ensure the real value of the portfolio is maintained over time. Annual spending from your fund is comprised of two components:

• Target grantmaking rate at 4% is calculated on the average end of month market values for the 57 months ending September 30th. The "available to spend" on your fund reports is the amount available for grants.

• Community Impact Fees and Investment Related Expenses are assessed quarterly.

Is my Donor Advised Fund required to distribute every year?

No. Since Donor Advised Funds are designed to benefit the community, our policy requires you make grant distributions at least once every three years.

Is there a minimum amount to each grant I award?

Yes. Each grant must be a minimum of $250.

How long does it take for my grant request to be processed?

From the time you make a grant recommendation, it usually takes 10-14 business days for the gift to arrive at the nonprofit.

Who can make grant recommendations from the fund?

The donor listed in the original fund agreement, as well as those appointed by the donor in the fund agreement, may request grant recommendations from the fund.

Can I recommend a grant from my fund to an organization if I sit on the organization’s board?

Yes, if you do not receive a personal benefit from the grant.

Can other people donate to my Donor Advised Fund?

Yes. Individuals can donate to your Donor Advised Fund through our website or by sending a check to the Foundation. Make sure the name of your fund is included on the check’s memo line.

What happens to my fund at the end of my lifetime?

Following the advising period, your fund will make distributions according to instructions you provided the Foundation in the fund agreement. You may also name successor advisors to make grant recommendations and continue your family’s legacy of giving.

What if the designated nonprofit organization ceases to exist or my charitable cause becomes obsolete?

Community foundations can redirect distributions from the fund if circumstances change. When this happens, the Foundation will grant funds in a way that aligns as closely as possible to your original charitable intent.

Can the Foundation provide legal or tax advice about the types of assets to donate?

No. We cannot provide this type of advice and recommend you consult with professionals to determine legal and tax implications about donations. Professional advisors can also contact us to discuss more complex gifts.