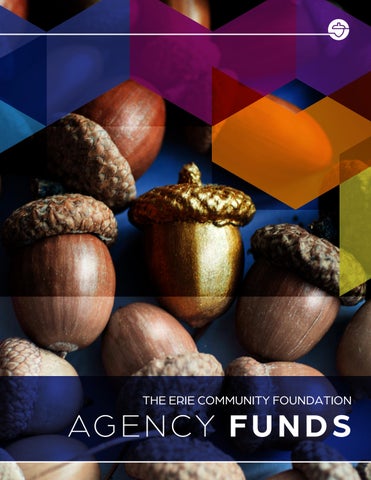

AGENCY FUNDS

“FOR ME, IT'S RIGHT IN THE NAME... COMMUNITY. THE FOUNDATION HAS CREATED A COMMUNITY AMONG SO MANY ORGANIZATIONS TRYING TO MAKE A DIFFERENCE IN THE LIVES OF SO MANY PEOPLE. HAVING A NETWORK AS A RESOURCE IS INVALUABLE IN THE GOAL OF WORKING TOGETHER.”

SISTER VALERIE LUCKEY DIRECTOR EMMAUS MINISTRIES

ARE YOU READY FOR AN AGENCY FUND?

An agency fund provides your nonprofit with a reliable and stable income source that allows you to successfully fulfill your mission. The fund will continue to grow indefinitely while your nonprofit can access grants annually.

AGENCY FUNDS AT-A-GLANCE

• Require a minimum of $25,000 to establish.

• Gifts into the fund must only come from your nonprofit.

• Gifts out of the fund can only support your nonprofit.

• Each spring, 4% of the balance of the fund (based on a five-year average) is available for your nonprofit to take as a distribution.

• Your nonprofit may request additional distributions as necessary with approval from the Foundation’s Board of Trustees.

• For tax purposes, this fund, while property of the Foundation, remains on your books as an asset and on our books as a liability.

At The Erie Community Foundation, we work with Cambridge Associates, considered the gold-standard in the country for community foundations and endowments.

• Cambridge Associates (C|A) advises some of the largest universities and organizations in the country.

• All asset allocation decisions are made locally by our investment committee.

• The goal of the portfolio is to average annual returns of 8%.

• C|A offers access to unparallelled private investment opportunities at discounted buy-in rates due to their size and scope.

“IN RECENT YEARS, AS FUNDS FOR HUMAN SERVICES ARE STINGINGLY HARD TO COME BY, OUR ERIE COMMUNITY FOUNDATION AGENCY FUND AIDS US IN FILLING IN GAPS, SO OUR SERVICES CONTINUE TO HELP THE PEOPLE WE SERVE WHO ARE IN SO MUCH TRAUMA.”

PAUL LUKACH EXECUTIVE DIRECTOR CRIME VICTIM CENTER

WHY ESTABLISH AN AGENCY FUND AT THE ERIE COMMUNITY FOUNDATION

INSPIRE

With a legacy spanning nearly 100 years, The Erie Community Foundation has been deeply embedded in Erie's philanthropic landscape for generations. We support your mission effectively, assisting in the creation of a sustainable funding source for unrestricted income. We handle all the details and administrative support. At the Foundation, we go beyond traditional services, providing Erie-centric expertise to ensure impactful growth for your fund.

ENGAGE

Through tailored guidance and ongoing support, our philanthropic services team will cultivate a direct and personal relationship with your nonprofit. Our team has long-standing connections to the nonprofit and philanthropic community in Northwest Pennsylvania and is ready to assist however we can to encourage your fund to grow over time.

EMPOWER

Through a robust network of donors, nonprofits, community leaders, volunteers, and grantees, we collaborate to amplify the impact of philanthropic endeavors across our community. Together, we strive for inclusive and sustainable solutions to local challenges.

TRANSPARENCY

Transparency and accountability are core values at the Foundation. We provide you with access to comprehensive information through our private fund portal, ensuring transparency in fund management.

“I’VE ALWAYS ENJOYED WORKING WITH THE ERIE COMMUNITY FOUNDATION TEAM. THEY ARE RESPONSIVE AND SEEM TO TRULY CARE ABOUT THE WELL-BEING OF OUR LOCAL AGENCIES AND THE MISSIONS WE SERVE. WITH SUCH A SIZEABLE AMOUNT TO WORK WITH AND A DEDICATED TEAM OF INVESTMENT ADVISORS, THE FOUNDATION TAKES A SOMEWHAT DIFFERENT APPROACH TO INVESTING THAN SOME OF OUR BANKS AND FIRMS. THERE IS A SCALE THAT OTHERS ARE NOT ABLE TO TAKE ADVANTAGE OF.”

LINDA MOORE EXECUTIVE DIRECTOR

ERIE SIGHT CENTER

OUR INVESTMENTS

The Erie Community Foundation manages funds for the long term to maximize the power of your fund. The Foundation administers more then 900 charitable funds through a careful and strategic pooled investment program.

The Foundation uses the premier investment advisory group in the country for endowments and community foundations: Cambridge Associates, who represents some of the most prestigious organizations and universities in the nation and is widely considered the gold-standard of investment advisors.

To ensure long-term purchasing power and growth of your fund, the Foundation sets a recommended distribution percentage which is reviewed annually.

If you were to invest $50,000 today, the support to your nonprofit over the next 100 years would substantially increase:

25 YEARS

50 YEARS

100 YEARS Fund Value $961,000 Income Distributed $1,215,000

“THE FOUNDATION’S COMMITMENT TO LOCAL PHILANTHROPY, FUND GROWTH, AND GRANT PARTNERSHIPS ALIGNS WITH THE YMCA’S FOCUS ON YOUTH DEVELOPMENT, HEALTHY LIVING, AND SOCIAL RESPONSIBILITY IN OUR REGION. PARTNERING WITH ECF STRENGTHENS THE Y’S ABILITY TO SERVE ERIE’S EVOLVING NEEDS EFFECTIVELY AND SUSTAINABLY.”

JIM MCELDOWNEY CHIEF EXECUTIVE OFFICER YMCA

OUR PORTFOLIO

Diversified portfolio investments are essential to accomplish investment goals. At The Erie Community Foundation, we seek a real return objective at a tolerable risk level by investing in the following assets:

GLOBAL EQUITIES are comprised of equity investments in U.S. and non-U.S. companies, including emerging and frontier markets, diversified by country, economic sector, and market capitalization. The principal purpose of global equities is to provide for long-term growth of the capital pool.

PRIVATE INVESTMENTS include private equity/venture capital and private real estate/ natural resources/infrastructure, and other non-marketable securities. These investments are intended to outperform traditional equity investments over the long term and consider liquidity in the context of the overall portfolio.

DIVERSIFYING ASSETS help reduce the return volatility of the overall portfolio, while generating long-term returns between global equity investments and fixed income investments. These investments, diversified by manager and strategy, are comprised of funds with high levels of transparency, reasonable liquidity, and little portfolio leverage.

FIXED INCOME investments minimize risk by reducing the overall volatility of returns. Components of fixed income investments may also serve as a partial hedge against periods of prolonged economic contraction. Most of the fixed income portfolio is comprised of high-quality government and corporate securities, which typically outperform other fixed income securities in an economic contraction or short-term economic shock.

HISTORY

The Erie Community Foundation traces its history back to 1935, when Elisha H. Mack, co-founder of the Boston Store, created a charitable endowment fund. From 1935 to 1969, that single fund fueled regional philanthropic efforts. Through the diligent efforts of Edward Doll and Enoch Filer, Mr. Mack’s fund was transformed into a public charity, becoming The Erie Community Foundation in 1971.

Today, we are constantly expanding our collection of nearly 900 different endowment funds, all created locally. Some funds are established during a donor's lifetime, others via a bequest. Additionally, nearly 200 local nonprofit organizations have chosen to build endowments under the administrative umbrella of The Erie Community Foundation

OUR MISSION:

The Erie Community Foundation’s mission is to inspire, engage, and empower donors and communities across the region, today and tomorrow.

OUR VISION:

We envision a united, vibrant, and thriving region for all.

OUR BRAND PROMISE:

The Erie Community Foundation is a trustworthy and permanent steward of greater Erie’s generosity. Through the power of collective giving, we invest in solutions that transform lives.