ERIC LAWRENCE FRAZIER

REAL ESTATE MAGAZINE

PUBLISHER:

ERIC LAWRENCE FRAZIER

PRODUCTION TEAM:

•Alvin Magua

•Leonna Rose Berame

•Sharon Rose Barellano

SCAN

Dear Reader,

Here we are June 2025. Halfway through the year already. Can you believe it? If May is about renewal and growth, June is about momentum. It’s the turning point the moment we pause, evaluate how far we’ve come, and decide how we want the rest of the year to unfold.

And when it comes to real estate, momentum is everything.

You may still be hearing headlines about interest rates, inflation, and job market fluctuations. You might feel torn between fear and optimism. But let me offer this truth: Real estate is not about timing the market it’s about time in the market It’s about making informed decisions now that can build wealth over years. Ownership isn’t just a dream it’s a vehicle for generational transformation.

That’s where HUD comes in.

HUD homes remain one of the most accessible and underutilized opportunities in today’s market. Whether you're a first-time buyer trying to get your foot in the door or a seasoned investor searching for high-potential properties there’s something in this space for you. Especially in California, where the market is dynamic and competition is fierce, knowing how to navigate the HUD process gives you a powerful edge

Inside this June issue of HUD Homes Magazine, we’ve leveled up the experience for you This month, you’ll discover:

The latest HUD listings across California with updated pricing, photos, and property details you can use immediately

Eric Lawrence Frazier, MBA - Principal advisor

Our new “Financing Snapshot” flyers, giving you a side-by-side look at estimated down payments, monthly payments, and loan types for each home.

An updated guide to FHA programs, including 203(k) rehab loans and how to buy with limited cash and less-than-perfect credit

Step-by-step strategies for submitting a winning bid especially during that exclusive Owner-Occupant Priority Period.

Investor insights because if you’re buying to build, flip, or hold, there are strategic opportunities you’ll want to move on fast.

And just like last month, you’ll find direct links to HUDHomestore.gov for each property. Why? Because real estate is fast-moving, and we want you making decisions based on the most up-to-date information. A home listed today could be under contract tomorrow so stay sharp, stay ready.

Most importantly, I’m still here as your trusted partner in this process. My financial coaching program continues to be a game-changer for buyers allowing the commission that would normally be paid to me to be applied toward your down payment and closing costs. It’s not just about buying a house. It’s about buying wisely.

If you haven’t already scheduled a consultation, now’s the time Whether you’re ready to act or still mapping out your finances, I’ll meet you where you are with real solutions, trusted expertise, and a strategy designed just for you.

So let this June be a turning point not just on the calendar, but in your life. Flip through every page of this magazine. Click the links. Share it with someone who needs to know that homeownership is still within reach And remember: When you’re ready to take that next step I’ll be right here licens

To yo

Warm

Eric L

Your

TABLE OF CONTENT

• Editor’s Note

• What is my Home Worth?

• Eric Frazier Contact Information

• Eric Lawrence Frazier MBA - Principal Advisor

REAL ESTATE ARTICLES and BLOGS

• Andrew Hughes Confirmed as Deputy Secretary of U.S. Department of Housing and Urban Development

• ICYMI: HUD Doubles Down on Commitment to Supporting America’s Foster Youth During National Foster Care Month

• HUD Secretary Scott Turner Celebrates June as National Homeownership Month

• Juneteenth

• Why Today’s Foreclosure Numbers Aren’t a Warning Sign

• Paused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

HUD LISTING

• 546 DIANA PL

• 1121 5TH ST

• 113 ASBURY DR

• 320 LANNIS CT

• 45318 ROAD 415

• 47112 ROAD

• 1022 RUBY DR

• 1215 S ST

• 150 FIR LN

• 10707 CAMARILLO ST

• 1674 79TH AVENUE

• 5077 DIABLO DR

• 1440 PEACH TREE LN

• 3393 SODA WAY

• 1633 CALLE NUEVE

• 1800 JACKSON ST

• 18750 HILLTOP RD

• 715 S BRADLEY RD

• 6000 MANGANITE ST

• 2101 W TOKAY ST

• 13292 SURF LN

• 813 GRANT ST

• 524 LOMA ST

• 3320 SPRINGE ST

• 35216 MAPLE ST

• 1542 DECKER CANYON RD

• 1161 COUNTRY CLUB N BLVD

• 22600 SUNRISE CT

• 2475 EASTLAKE DR

• 1774 S DINKY CREEK RD

• 2011 W KATELLA AVE

• 863 N MARVIN DR

• 17109 MILLBROOK DR

• 2059 COUNTRY CLUB BLVD

• 19557 DONKEY HILL RD

• 14627 GREENBRIAR DR

• 688 W SAMPLE AVE

• 8105 LA RIVIERA DR

• 8173 VIBURNUM AVE

• 10280 CIMARRON TRAIL

• 26901 BEAR DRIVE

• 15300 #209 PALM DR

• 809 OAK ST

• 8725 ROCKY MOUNTAIN RD

• 506 LAKEWOOD WAY

• 46390 ALAMOSA RD

• 15815 RANCHO TEHAMA RD

• 21321 CONKLIN COURT

• 66270 BUENA VISTA AVE

Eric Lawrence Frazier, MBA

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

Are you feeling like buying your first home is out of reach? FHA home loans might change your mind.

With smaller down payment requirements than the typical conventional loan and often lower mortgage rates too, FHA loans are helping more first-time buyers make the leap from renting to owning.

You can see how much of a difference it can make for your down payment

This type of loan is built to make homeownership more achievable Connect with a trusted lender to find out if this could be an option for you

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

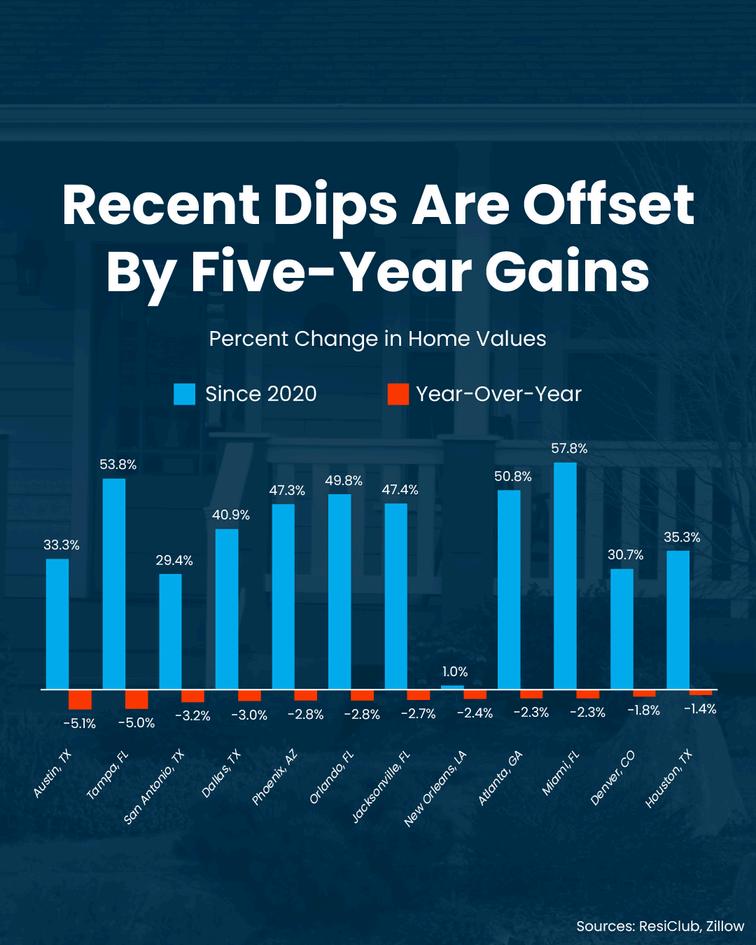

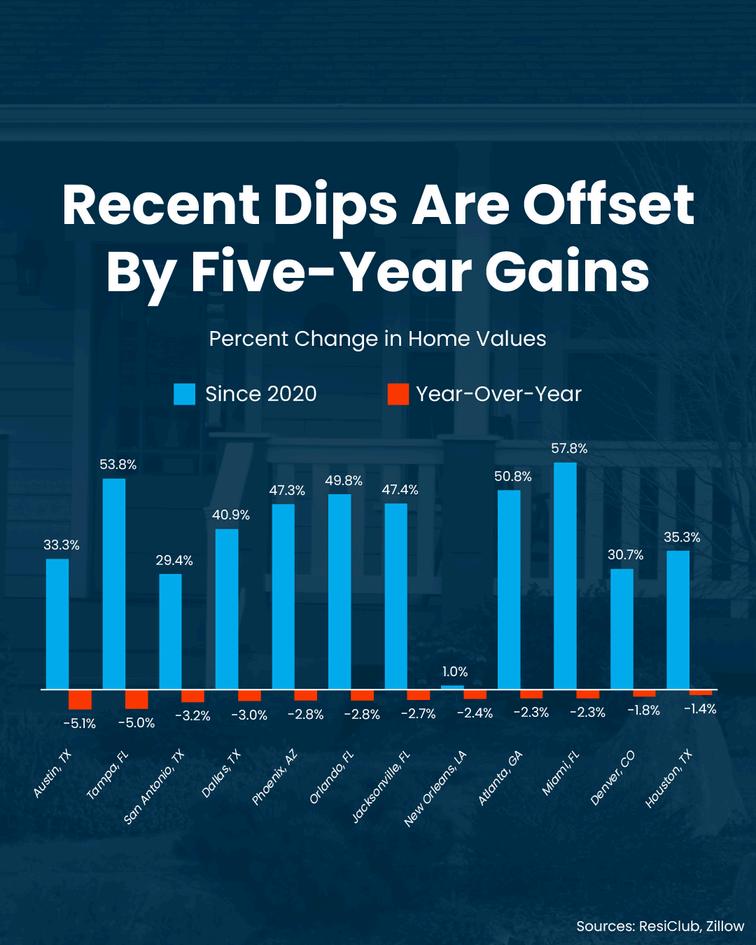

Are you worried about recent headlines saying home prices are dipping? Here's some perspective for you.

In most places, prices are still rising, just at a much slower pace And even in spots where prices have dropped, it was only a slight decline. Not a big crash.

You need to put those drops in context Over the past five years, home prices rose by an average of 55% nationwide. That long-term gain far outweighs any short-term shift.

Remember the five-year rule: home values usually rise over time Even if prices drop a bit for a year or two, they tend to bounce back (and then some) over time. If you want to know what’s happening to home prices in our area, Contact me

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

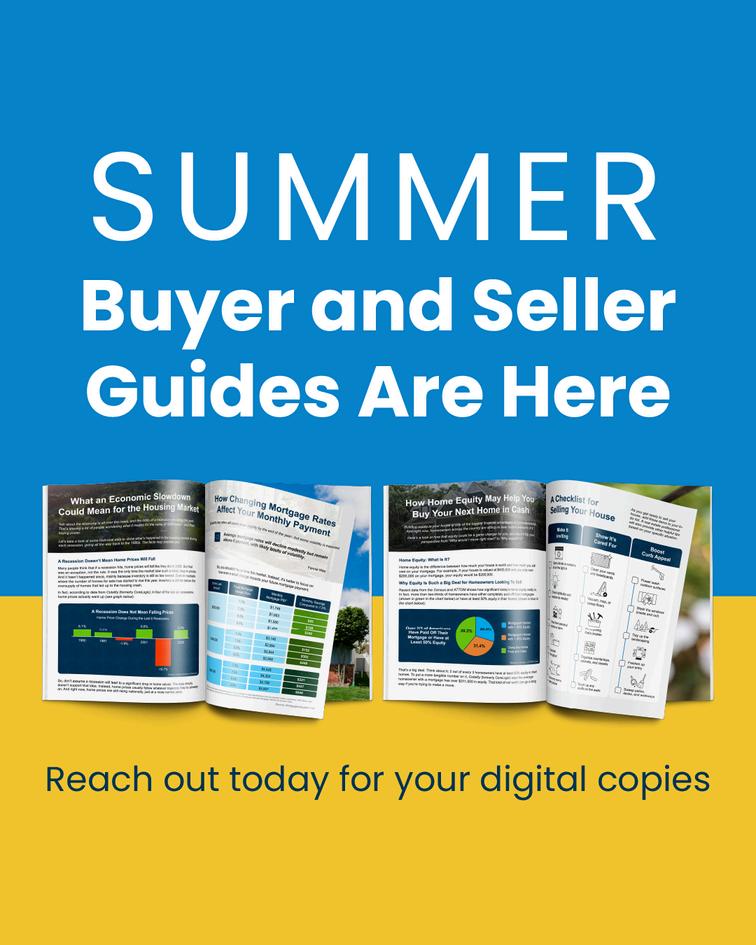

Are you planning to move this summer? You’re going to want the just-released Summer Buyer & Seller Guides

These guides break down everything you need to know – from market shifts to expert forecasts – so you can make confident, strategic moves whether you’re buying or selling

Do you want the information serious buyers and sellers are using to stay ahead? Let’s talk about it

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

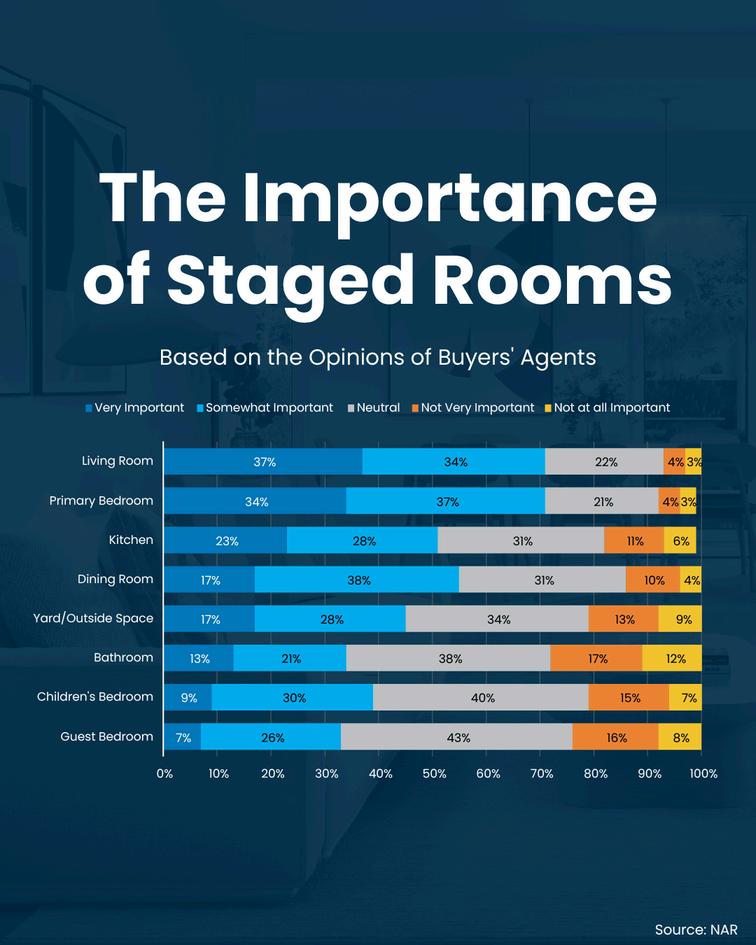

Staging your house matters more than ever But that doesn’t mean you need to turn your whole house into a showroom.

Sometimes re-arranging furniture or de-cluttering is all it takes And, if you’re not sure where to start, this list could help. It breaks down the top rooms buyers care about according to their agents.

If you lean on your agent’s advice to showcase these important rooms, you could see your house sell quickly and for more money.

Which room in your house is your showstopper? Contact me and let’s make sure buyers think so, too

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

Are you holding out for 3% mortgage rates? Here’s what you need to know

Those rates were a rare response to a very specific moment in time – not the norm. That’s why experts say they’re not coming back And, think about it: if rates do come down, what do you think everyone else is going to do?

That’s right – they’ll jump back in too And more buyers = more competition for you

So, if you’re ready and able to buy now, let’s talk about tools and resources that can help Because trying to time the market to get a specific rate might be a missed opportunity

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

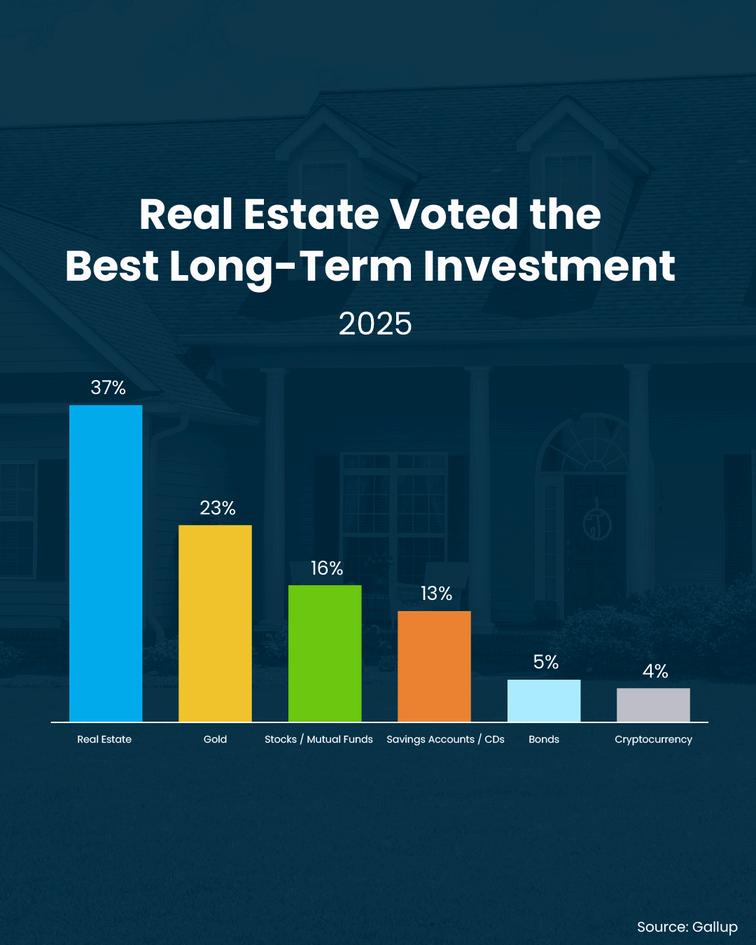

While headlines love to stir up doubt, here’s one stat that cuts through the noise

For the 12th year in a row, Americans say real estate is the best long-term investment, beating out stocks, gold, and bonds

And why is that? It's because homeownership is one of the most steady, reliable ways to grow real wealth over time

Let's find a way for you to break into the housing market and start building your net worth today

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

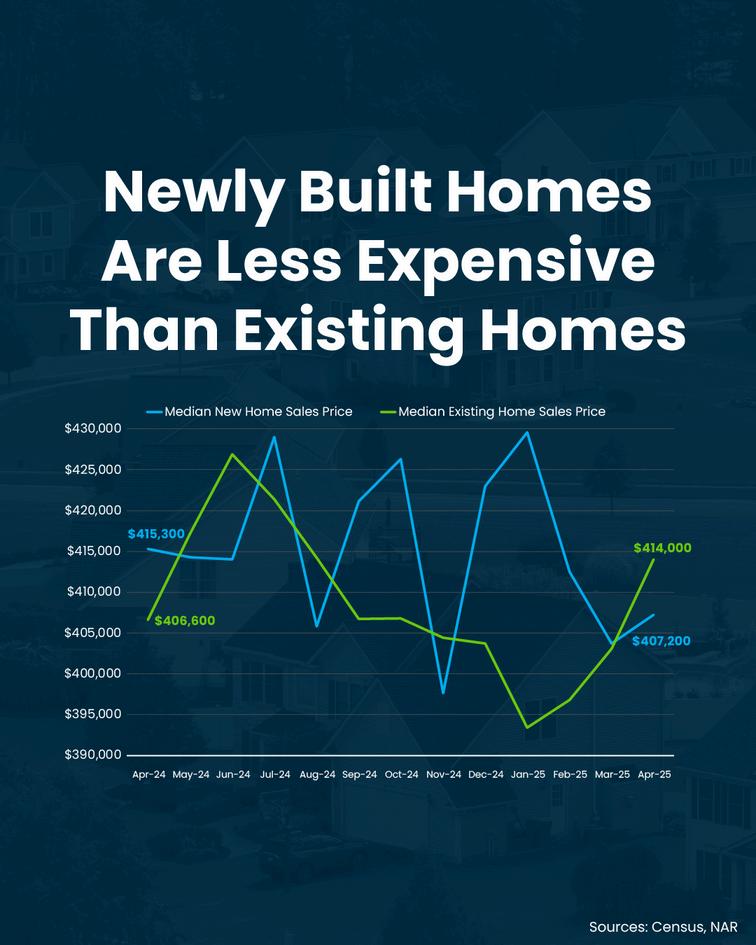

Do you think buying a brand-new home is going to cost way more than an existing one? You should know that’s not necessarily true – especially right now

According to the latest data, newly built homes are actually selling for less than existing ones Why? Builders are offering smaller floor plans, price cuts, and incentives to attract today’s budget-conscious buyers.

You might be able to get a modern, move-in ready home for less than you think

Let’s talk about what’s available and see if a newly built home could be a smart move for you

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

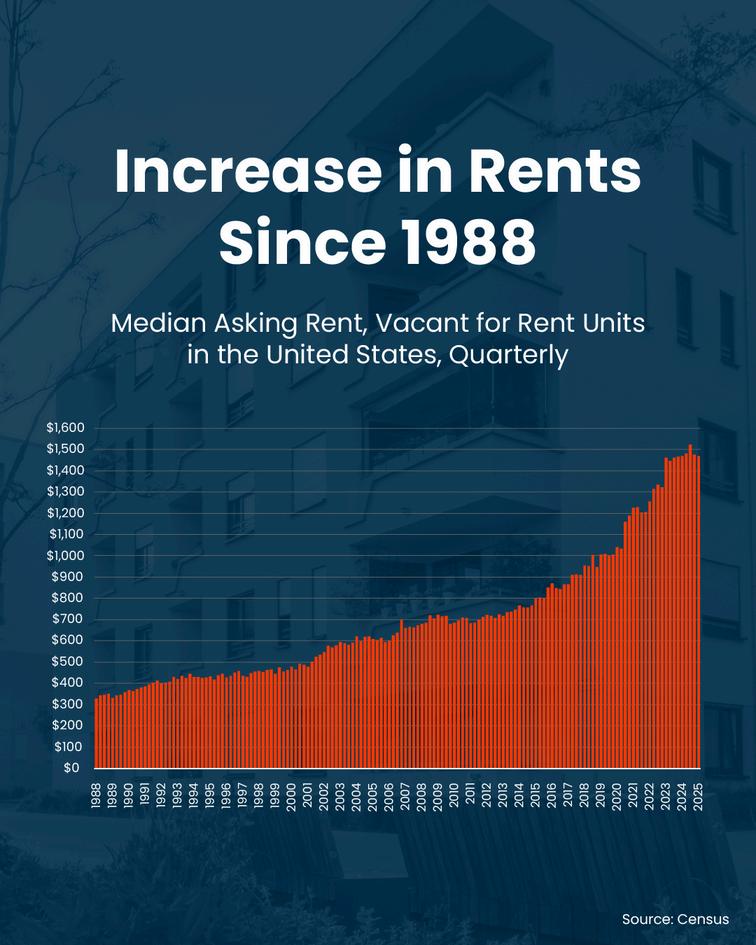

With rising home prices and high mortgage rates, renting might feel like the safer option today And in some cases, it is. But here’s the thing…

When it comes to your long-term future, you don’t want to be permanently stuck in the rental trap.

History shows rent has been rising for decades And every dollar you spend on rent builds your landlord’s wealth – not yours

That’s a cycle you can get stuck in pretty quickly And without a plan, it can be hard to get out

Want to break out of the rental trap? You don’t have to buy today, but Contact me and we’ll set a strategy that works for you, your budget, and your timeline.

BACK TO CONTENT

BACK TO CONTENT

BACK TO CONTENT

Are you worried about recent headlines saying home prices are dipping? Here's some perspective for you.

In most places, prices are still rising, just at a much slower pace And even in spots where prices have dropped, it was only a slight decline. Not a big crash.

You need to put those drops in context Over the past five years, home prices rose by an average of 55% nationwide. That long-term gain far outweighs any short-term shift.

Remember the five-year rule: home values usually rise over time Even if prices drop a bit for a year or two, they tend to bounce back (and then some) over time. If you want to know what’s happening to home prices in our area, Contact me

ANDREW HUGHES CONFIRMED AS DEPUTY SECRETARY OF U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

WASHINGTON - The U S Senate today confirmed Andrew Hughes as the Deputy Secretary of the U.S. Department of Housing and Urban Development (HUD) with a vote of 51-43.

In this role, Hughes will serve as HUD’s Chief Operating Officer, working under the leadership of the Trump administration and Secretary Scott Turner to restore HUD to its core mission of fostering strong communities that support quality, affordable homeownership opportunities and promoting economic development and selfsufficiency for all Americans.

“Andrew Hughes is a servant leader and is the right person, at the right time for this assignment to carry out HUD’s mission,” said HUD Secretary Scott Turner. “I had the pleasure of serving alongside him during the first Trump administration and witnessed firsthand his leadership, wisdom, and love for this country. We share a clear vision for HUD’s future, and it is truly a blessing to have him in this role. He will serve the American people well ”

“Serving at HUD is more than a job - it's a calling,” said Deputy Secretary Hughes. “I’m humbled to help lead an agency that expands opportunity for all communities - rural, tribal, and urban. Together, under the leadership of President Trump and Secretary Turner, we’re focused on ensuring more Americans can achieve not just housing, but the stability, selfsufficiency, and upward mobility that define the American Dream ”

As Deputy Secretary, Hughes will play a vital role in implementing HUD’s mission and managing the day-to-day operations of the department. His nomination was endorsed by former HUD Secretary Ben Carson, Senator Tim Scott, chairman of the Senate Banking Committee, and numerous housing and community development organizations.

On April 10, 2025, Hughes testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs. His full testimony is available here. Hughes previously served as HUD Chief of Staff under the leadership of Ben Carson, the 17th Secretary of HUD, and most recently served as Chief of Staff under HUD Secretary Scott Turner. Hughes is the youngest Deputy Secretary in HUD’s history.

ICYMI: HUD DOUBLES DOWN ON COMMITMENT

TO SUPPORTING AMERICA’S FOSTER YOUTH DURING NATIONAL FOSTER CARE MONTH

WASHINGTON – In a series of announcements during the month of May, U S Department of Housing and Urban Development (HUD) Secretary Scott Turner highlighted the department’s commitment to America’s foster youth during National Foster Care Month Under President Trump’s leadership and in collaboration with the Office of the First Lady, HUD has awarded $4.8 million to date for youth aging out of foster care under the Foster Youth to Independence (FYI) program, and announced $10 million in Family Unification Program (FUP) voucher assistance.

President Trump declares May as National Foster Care Month

On May 7th, President Trump declared the month of May as National Foster Care Month, calling upon all Americans to find ways to support children and youth in foster care, and to recognize the invaluable contributions of foster parents and other caregivers.

HUD Provides $1.8 million to Support Youth Aging Out of Foster Care on Anniversary of First Lady Melania Trump’s BE BEST Initiative

HUD collaborated with the Office of the First Lady on the seventh anniversary of the First Lady’s BE BEST Initiative to announce $1.8 million to support youth aging out of foster care through the FYI program. The investment will assist more than 100 young Americans across 11 states aging out of the foster care system with temporary, supportive funding to prevent homelessness for a duration of 36 months. Launched by Mrs. Trump in 2018, BE BEST is dedicated to promoting the well-being of children with a renewed emphasis on supporting foster youth through initiatives like Fostering the Future.

First Lady Melania Trump Secures $25 Million Investment in President’s FY26 Budget for Foster Youth

In honor of National Foster Care Month, First Lady Melania Trump announced on Thursday, May 8th that she secured a $25 million investment in the President’s FY26 Budget to provide housing and support to foster youth.

“I am proud to have successfully secured $25 million to provide housing for individuals aging out of foster care. This is another essential measure that ensures the safety, welfare, and autonomy of those in the foster community,” commented First Lady Melania Trump.

The First Lady continued, “Secretary Scott Turner’s commitment will provide thousands of youth transitioning out of the foster care system with dedicated rental assistance and other supportive services to promote stability and self-sufficiency.”

HUD Provides $1.3 million to Support Youth Aging Out of Foster Care

On May 30th, Secretary Turner announced an additional $1.3 million dollar investment across 10 states under HUD’s Foster Youth to Independence (FYI) program to assist young Americans aging out of the foster care system with temporary, supportive funding to prevent homelessness. The announcement will impact more than 100 young Americans.

HUD Announces More Than $10 Million to House Families and Youth and Promote Self-Sufficiency

On May 19th, HUD awarded more than $10 million in Family Unification Program (FUP) voucher assistance funding for youth and families who lack safe and adequate housing. The award funds 573 vouchers at 11 public housing agencies (PHAs) across four states

“A pathway to self-sufficiency is now one step closer as HUD works with localities to provide flexible funding for rental assistance and supportive services to foster youth and to keep foster-care-involved families together," said Secretary Scott Turner. “This commitment from HUD will help lay the groundwork for a future with greater opportunity and strong family values.”

First lady Melania Trump scores win for America's foster youth with $25M investment

“‘At HUD,’ [Secretary Turner] added, ‘we are glad to be able to deliver on [The First Lady’s] vision to support thousands more foster youth by creating dedicated funding in the president’s FY26 budget to provide housing for young adults under the age of 25 exiting the foster care system without a home to go to ’”

Melania Trump Secures $25M Investment for Foster Youth

“The Department of Housing and Urban Development (HUD) allocated the funds toward its Foster Youth to Independence program (FYI) in recognition of the seventh anniversary of the first lady’s Be Best initiative.”

HUD, Melania Trump’s ‘Be Best’ invest $37,000 into housing for local foster youths

“Fairmont-Morgantown Housing Authority Executive Director Christal Crouso told 12 News that the organization was happy to learn that these vouchers were on the way ‘Often [youths aging out of the foster care system] have limited support systems, so being able to provide them with stable housing is crucial to their success,’ Crouso said.”

$1.3M Lifeline for Foster Youth: HUD’s Bold Move to End Homelessness

“The announcement of new funding aligns with President Trump’s proclamation of May as National Foster Care Month, a time dedicated to raising awareness of the challenges foster youth encounter as they transition into adulthood. The FYI program not only tackles immediate housing needs but also equips participants with the tools to succeed in their educational and professional endeavors ”

HUD Expands Foster Youth Housing Support in Virginia

“Foster Youth Housing Support just got a vital boost in Virginia. The U.S. Department of Housing and Urban Development (HUD) recently awarded $43,640 to the Lynchburg Redevelopment and Housing Authority for a $1.8 million expansion of the Foster Youth to Independence (FYI) initiative.”

First Lady Melania Trump announces $25 million investment to aid foster youth

“Finding housing is a common challenge for young adults who transition out of the foster care system. According to the National Foster Youth Institute, approximately 23,000 young adults exit the foster care system without securing permanent housing each year Twenty percent of those young adults become instantly homeless. HUD Secretary Scott Turner thanked the First Lady for securing the funding, calling it a ‘game changer.’”

HUD Allocates Over $10M to Support Youth and Family Housing Stability

“The U.S. Department of Housing & Urban Development (HUD) has awarded more than $10 million in Family Unification Program (FUP) voucher assistance funding for youth and families who lack safe and adequate housing. HUD’s award will fund 573 vouchers at 11 public housing agencies (PHAs) across California, Illinois, Minnesota, and Utah.”

Background:

The U S Department of Health and Human Services (HHS) estimates that more than 20,000 young people age out of foster care each year. The National Center for Housing and Child Welfare (NCHCW) estimates that approximately 25 percent of these young people experience homelessness within four years of leaving foster care and an even higher share are precariously housed.

Follow @SecretaryTurner on X, FB, and Instagram.

HUD.gov

HUD SECRETARY SCOTT TURNER

CELEBRATES JUNE AS NATIONAL HOMEOWNERSHIP MONTH

WASHINGTON - U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner today declared June as National Homeownership Month, celebrating the power of homeownership to build stronger communities and spotlighting HUD’s role in restoring the American Dream of homeownership.

“National Homeownership Month is a time to celebrate how HUD helps support and expand opportunities for American homeownership nationwide,” said Secretary Turner “We have achieved so much under President Trump’s leadership in the past few months alone: cutting regulations, pursuing innovative housing solutions, and helping American families, including many first-time homebuyers, to make the American Dream a reality. These accomplishments are only the beginning as we advance the Golden Age of homeownership for rural, tribal and urban communities.”

Watch: Secretary Turner Commemorates Homeownership Month

Throughout National Homeownership Month, HUD is reaffirming its commitment to supporting rural, Tribal, and urban communities with access to safe, quality and affordable homeownership opportunities Recent accomplishments include:

Removing Regulatory Red Tape

HUD is streamlining pathways to build and manufacture homes by eliminating burdensome regulations such as the Affirmatively Furthering Fair Housing (AFFH) rule

Increasing Housing Supply & Affordability

HUD is supporting Opportunity Zones and Manufactured Housing Programs – one of the most affordable and nonsubsidized housing options, representing 10% of new singlefamily home starts and the homes of 22 million people in the United States

Serving Native American Communities

HUD is empowering Native American homeownership through its Section 184 program, which has guaranteed over 58,500 mortgages, representing $10.5 billion in investments to Tribes, Tribal housing authorities, and Tribal members. It’s one of the lowest-cost, lowest-risk, and highest impact tools available

Expanding Access to American Homeownership

HUD is helping over 7 million households through the Federal Housing Administration (FHA), one of the world’s largest mortgage insurers. Since January 20, 2025, FHA has insured 236,000 mortgages - including 140,000 for first-time homebuyers. Additionally, nearly three quarters of Ginnie Mae's 2025 issuances have backed first-time homebuyers, who make up nearly 40% of Ginnie Mae’s total portfolio

Supporting Resilience & Disaster Recovery

HUD is supporting disaster recovery with extended FHA moratoriums in areas such as California and Florida providing flexibility to families in the Presidentially Declared Major Disaster Area

They were deliberately held hostage. Slaveowners knew. They didn't care. And the government did nothing until it sent in troops. That's what it took to free the last of us: armed intervention.

Juneteenth is often called a celebration. But let's be honest: It's a correction an embarrassing footnote to t Proclamation. It's the story of a people who had to be rescued from a law that was a

Juneteenth vs. Memorial Day: A Reckoning of the Dead

Every May, this country bows its head for Memorial Day, honoring th uniform. And rightly so.

But who mourns the millions who died in chains?

Over 2 million Africans died during the Middle Passage, their bod the Atlantic.

Millions more were worked, beaten, raped, and starved to death d Over 180,000 Black soldiers fought in the Civil War to secure 40,000 of them died.

After the Emancipation Proclamation, thousands more di plantations, left homeless, frozen to death, starved to death. Th over returning to their slave masters.

So I ask:

Where is the day for them?

Where is the memorial for the enslaved child who died crossing a cold Where is the holiday for the mother who gave birth to a child and h saw either live free?

Juneteenth should be our Memorial Day. Not for parties. Not for parades. For mourning. Organizing. And demanding justice.

So when the Founders signed the Declaration of Independence, proclaiming “ are created equal”, they weren’t talking about us.

When the U.S. Constitution was ratified, they made sure to count us as three-f a person not because they forgot us, but because they meant to exclude us

These weren’t accidents.

They were designs.

Two of the most celebrated documents in human history were written to e the very people who built this country.

Freedom That Required Force: Executive Orders as Our Only Weapon

Let’s be clear:

The Emancipation Proclamation was not enough.

It took Executive Order No. 3 and federal troops to make freedom real.

And it wouldn’t be the last time

Desegregation? Executive order.

Ending job discrimination in the federal workforce? Executive order. Fair housing enforcement? Executive order.

And now, in 2025, the rollback of our rights is happening one executive o a time.

Because America writes laws for Black people with no teeth

And justice for Black America has always needed a president with a pen military behind him.

If the DOJ is still handing out these fines in 2024 and 2025, you

really changed?

Reparations Paid—to Everyone But Us

Let’s talk facts.

The U.S. government has paid reparations before: Japanese Americans interned during WWII received $20,000 e Native American tribes: Over $3 billion in settlements mismanagement (various years).

Holocaust survivors: Supported by U.S. diplomatic and financia over $70 billion from Germany.

Rosewood Massacre survivors: Florida paid $150,000 to survivors.

Black farmers: Over $1 billion paid in the Pigford v. Glickman case.

And yet not a single federal dollar to the descendants of slaves. Why not us?

State-Level Reparations: Illinois Leads While Others Talk

Let’s give credit where it’s due: Evanston, Illinois (2019): First U.S. city to implement repa cannabis tax revenue. Up to $25,000 per household for ho payments. (PBS)

Illinois State Reparations Commission (2022–present): A full reparations with statewide hearings. (Illinois.gov) Chicago Reparations Task Force (2024): Established und Johnson to create a citywide reparations agenda. (Chicago.gov)

So if cities and states can do it, what’s stopping Congress?

An

Indictment on

Us: Where Are Our Leaders?

H.R. 40 introduced in 1989 by John Conyers has been reintroduced

since.

It doesn’t guarantee reparations. It just studies them. And even that can’t get a vote.

What are we doing?

We have the power. But we’re not applying the pressure.

The Playbook Is Obvious—But We Keep Falling for It

Every time we rise, they distract us: A holiday. A statue. A resolution. A concert. A grant. A “Black Excellence” showcase. And we fall for it every time. We sing. We dance. We clap. We barbecue.

And we forget.

The Power Is Now Or Never

Black America, wake up. Juneteenth is not a stage. It is not a show It is not a fair.

Fraternity and sorority chapter

Civil rights organization

Black business coalition

Elected official

Reclaim this day.

Reclaim your courage.

Reclaim your purpose.

Because we owe the millions who died in chains, in fields, in cold gu battlefields, and in today’s jail cells something more than ribs and red

We owe them justice.

And if we don’t demand it now we may never get another chance.

Thank you for reading this blog. I appreciate your continued su awareness about the issues that impact our communities the mo this blog and explore my other articles and videos each one cre empower, and uplift. Together, we can challenge the systems that h push forward policies that open the doors to opportunity for all.

Eric Lawrence Frazier, MBA

Your trusted advisor in business and wealth www.ericfrazier.com | www.thepowerisnow.com NMLS #451807 | CA DRE #01143484

�� Schedule a consultation: https://calendly.com/ericfrazier/real-e consultation-clients

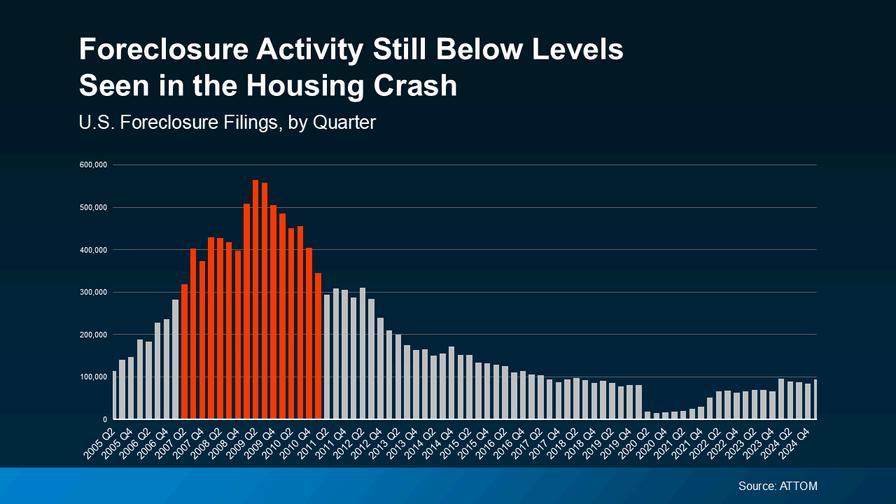

Why Today’s Foreclosure Numbers Aren’t a Warning Sign

When it feels like the cost of just about everything is rising, it’s only natural to wonder what that means for the housing market. Some people are even questioning whether more homeowners will struggle to make their mortgage payments, ultimately leading to a wave of foreclosures. And recent data showing foreclosure filings have increased is only feeding into this fear. But don’t let that scare you.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

This Isn’t Like 2008

While it’s true that foreclosure filings ticked up in the latest quarterly report from ATTOM, they’re still lower than the norm – and way below levels seen during the crash. And it’s a lot easier to see if you graph that out.

If you compare Q1 2025 (on the right side of the graph) to what happened in the years surrounding the 2008 crash (shown in red), it’s clear the market is in a completely different place (see graph below):

Back then, risky lending practices left homeowners with mortgages they couldn’t afford. That led to a wave of foreclosures, which flooded the market with distressed properties, a surplus of inventory, and caused home prices to drop dramatically.

Today, lending standards are much stronger, and most homeowners are in a much better financial position. That’s why filings are so much lower this time.

And just in case you’re looking at 2020 and 2021 and thinking we’ve ramped up since then, here’s what you need to know. During those years, there was a moratorium designed to help millions of homeowners avoid foreclosure in challenging times That’s why the numbers for just a few years ago were so incredibly low

So don’t compare today to that low point If you look at more normal years like 2017-2019, overall foreclosure filings are actually down from what’s typical – and way down from the volume during the crash

Of course, no one wants to go through the process of foreclosure And the recent increase is emotional because it’s real lives that are impacted – let's not discount that. It’s just that, as a whole, this isn’t a signal of trouble in the market.

Why We Haven’t Seen a Big Surge in Foreclosures

And here's something else to reassure you: homeowner equity. Over the past few years, home prices have risen significantly. That means today’s homeowners have built up a solid financial cushion. As Rob Barber, CEO at ATTOM

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . . ”

Basically, if someone falls on hard times and can’t make their mortgage payments, they may be able to sell their home instead of going into foreclosure That’s a huge contrast to 2008, when many people owed more than their homes were worth and had no choice but to walk away

Don’t discount the strong equity footing most homeowners have today. As Rick Sharga Founder and CEO of CJ Patrick Company, explains in a recent Forbes article:

“ a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners including those in foreclosure possess an unprecedented amount of home equity.”

Bottom Line

Even with the recent increase, foreclosure numbers are not at the levels seen during the 2008 crash. Plus, most homeowners today are in a much stronger equity position, even with rising costs

If you are a homeowner who’s facing hardship, talk to your mortgage provider to explore your options

Are you holding out for 3% mortgage rates? Here’s what you need to know

Those rates were a rare response to a very specific moment in time – not the norm. That’s why experts say they’re not coming back And, think about it: if rates do come down, what do you think everyone else is going to do?

That’s right – they’ll jump back in too And more buyers = more competition for you

So, if you’re ready and able to buy now, let’s talk about tools and resources that can help Because trying to time the market to get a specific rate might be a missed opportunity

Paused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

It’s not really a surprise that 70% of buyers paused their home search last year Maybe you were one of them And if so, no judgment Conditions just weren’t great Inventory was too low, prices were too high, and mortgage rates were bouncing all over. That made it really hard to find a home you loved – and could afford. And why sell if you’re not sure where you’re going to go?

But here’s the thing: the market’s shifting And it might be time to hit play again The Inventory Sweet Spot

More homeowners are jumping back into their search to make a move this year. Builders are finishing more homes And together, that’s creating more options for you when you move – maybe even the home you’ve been waiting for

More homes = more possibilities.

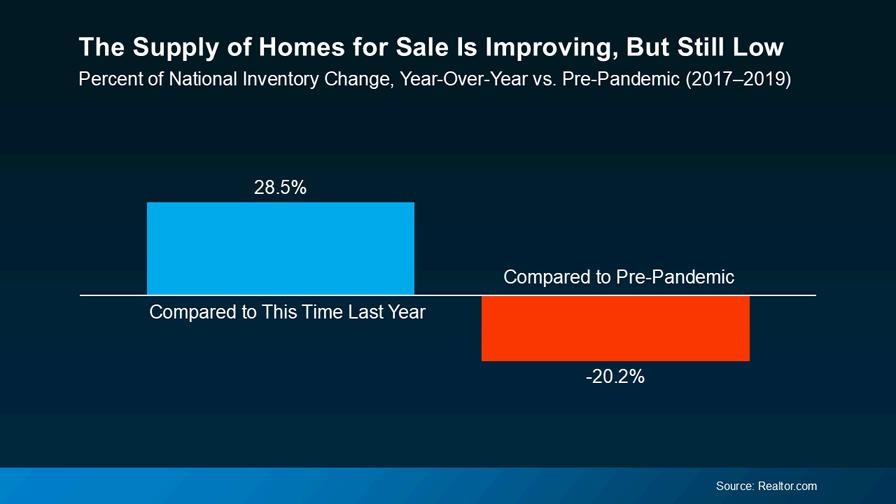

But there’s more to it than that When you sell, you don’t want to feel like it’s impossible to find your next home At the same time, you also don’t want inventory to be so high, it takes ages for your house to sell. Right now, you’ll get the best of both worlds. This data will help paint the picture for you. According to Realtor.com, inventory has jumped 28.5% since this time last year, but it’s still below pre-pandemic levels in most markets – and here’s why this is such a sweet spot (see graph NEXT):

Basically, there are more homes to choose from when you make your move, but not so many that you’ll struggle to sell your current house Your home should sell quickly if you work with an agent to make sure it’s priced right and prepped to impress.

More options. Less chaos. Solid demand: That’s the real sweet spot.

But here’s something else to consider. Data from Realtor.com also shows inventory has been on the rise for 17 straight months And experts agree it’s likely to continue climbing throughout the year As Lance Lambert, Co-Founder of ResiClub explains:

“The fact that inventory is rising year-over-year . . . strongly suggests that national active housing inventory for sale is likely to end the year higher.” So, this may actually be the best time to sell. Your house may stand out more now than it would as the year goes on and inventory grows even more Wait too long, and you may be one of many trying to stand out later this year

Bottom Line

If you’ve been waiting for the housing market to give you a sign – it just did. Whether you’re looking to move up, scale down, or relocate completely, this might be the best balance we’ve seen in a while

What’s holding you back from taking advantage of this sweet spot? Let’s talk through it and see what’s possible