H U D

H O M E S Using Down Payment Assistance on a HUD Home

H O M E S Using Down Payment Assistance on a HUD Home

REAL ESTATE MAGAZINE

PUBLISHER:

ERIC LAWRENCE FRAZIER

PRODUCTION TEAM:

•Alvin Magua

•Leonna Rose Berame

•Sharon Rose Barellano

SCAN

• 1542 DECKER CANYON RD

• 20381 PET HILL DR

• 2125 W AVE

• 7310 CARDINAL RD

• 532 W 2ND ST

• 1737 ALFORD DR

• 22600 SUNRISE CT

• 320 LANNIS CT

• 1615 LAVELLE SMITH DR

• 1904 DOUGLAS DR

• 6716 RAPPAHANNOCK WAY

• 2011 W KATELLA AVE

• 1439 NEW ENGLAND DR

• 10707 CAMARILLO ST

• 430 GOLDEN SPRINGS DR

• 5077 DIABLO DR

• 3393 SODA WAY

• 2057 PENSTONE LOOP

• 1674 79TH AVENUE

• 42865 NORMANDY LN

• 6770 BUTTE AVE

• 25680 TROY LN

• 19215 HUPA RD

• 45318 ROAD 415

• 47112 ROAD 620

• 32157 NAVAJO CT

• 250 WHITE ST

• 809 OAK ST

• 13292 SURF LN

• 4120 WILLOW TRL

• 2101 W TOKAY ST

• 150 FIR LANE

• 1121 5TH ST

• 15300 PALM DR

• 1800 JACKSON ST

• 8173 VIBURNUM AVE

• 140 WAYMAN LN

• 46390 ALAMOSA RD

• 14530 COLTER WAY

• 21232 WELLESLEY AVE

• 2475 EASTLAKE DR

• 1774 S DINKY CREEK

• 3246 SHAMROCK AVE

• 8105 LA RIVIERA DR

• 14627 GREENBRIAR DR

• 10280 CIMARRON TRAIL

• 26200 REDLANDS BLVD

• 711 N PRESTON DR

• 26901 BEAR DRIVE

• 715 S BRADLEY RD

• 568 WALNUT COURT

• 19240 MIDDLE CAMP

• 14777 PALM DR

• 2050 RAINBOW DR

• 35216 MAPLE ST

• 3425 HICKORY ST

• 1440 PEACH TREE LN

• 506 LAKEWOOD WAY

• Editor’s Note

• What is my Home Worth?

• Eric Frazier Contact Information

• Eric Lawrence Frazier MBA - Principal Advisor

• 2025 Loan Limits

• 2/1 Buydown Rate Program

• Credit

• First Time Home Buyer

• For Realtors

• Foreclosure

• Informational

• Moving Up

• Rent vs Own

• Self Promotion

• Government: FHA

• Government: Streamline

• Government: USDA

• Government: VA

• HUD Slashes Red Tape to Cut Homeownership Financing Costs

• U.S. Department of Housing and Urban Development Announces Key Senior Leadership Appointments

• HUD Secretary Scott Turner Celebrates Final Passage of the One Big Beautiful Bill

• HUD Announces New Headquarters, Ending Era of Costly Repairs, Health Hazards

• You Don’t Have to Be a First-Time Buyer to Buy a HUD Home

• Yes, You Can Have Two FHA Loans — Here’s How!

• Divorced? You Can Still Get a New FHA Loan — Even if Your Ex Keeps the House

• Beat Investors — How HUD’s 15-Day Exclusive Buyer Period Works

• Using Down Payment Assistance on a HUD Home

• Buy It + Fix It — Using a 203(k) Rehab Loan on a HUD Home

• The Hidden Costs (and Hidden Savings!) of Buying HUD Foreclosures

• FINAL MAGAZINE FEATURE How to Win a HUD Bid: Insider Tips to Beat the Competition

• How to Use Basic FHA 203(b) Financing to Buy a HUD Home

• How Investors Buy HUD Homes — And What You Should Know

• What Is a HUD Buyer’s Broker — And Why Does It Matter?

• FHA Loan Limits: How They’re Set, Why They Matter, and What Every Buyer Should Know

As we turn the page into July, we find ourselves not just in the heat of summer, but in one of the most critical windows of opportunity for real estate action The second half of the year has officially begun, and if the first six months were about navigating market signals, July is about making bold, informed moves.

There’s no sugar-coating the realities out there yes, interest rates are still causing tension, inventory remains tight in many regions, and affordability continues to challenge buyers across the spectrum. But what we’ve learned over the years is this: challenging markets often present the greatest opportunities for those who are prepared, educated, and willing to think differently.

That’s why this month’s issue of HUD Homes Magazine is more than just a catalog it’s your roadmap to real estate empowerment

HUD homes are still flying under the radar in most markets, and that’s exactly why they matter. These properties many of them tucked inside strong, stable neighborhoods offer a low barrier to entry for buyers who might otherwise feel locked out of the market. They also create incredible upside potential for investors who understand how to evaluate properties with both vision and discipline

Whether you’re a buyer aiming for homeownership without overextending your budget or an investor building a long-term strategy, HUD homes offer something few other listings do: a real chance to build equity from day one. And through my program, that pathway becomes even clearer, where commission dollars can be redirected to cover your down payment or closing costs, reducing your financial hurdle from the outset

As we turn the page into July, we find ourselves not just in the heat of summer, but in one of the most critical windows of opportunity for real estate action. The second half of the year has officially begun, and if the first six months were about navigating market signals, July is about making bold, informed moves.

There’s no sugar-coating the realities out there yes, interest rates are still causing tension, inventory remains tight in many regions, and affordability continues to challenge buyers across the spectrum. But what we’ve learned over the years is this: challenging markets often present the greatest opportunities for those who are prepared, educated, and willing to think differently.

That’s why this month’s issue of HUD Homes Magazine is more than just a catalog it’s your roadmap to real estate empowerment.

HUD homes are still flying under the radar in most markets, and that’s exactly why they matter These properties many of them tucked inside strong, stable neighborhoods offer a low barrier to entry for buyers who might otherwise feel locked out of the market They also create incredible upside potential for investors who understand how to evaluate properties with both vision and discipline.

Whether you’re a buyer aiming for homeownership without overextending your budget or an investor building a long-term strategy, HUD homes offer something few other listings do: a real chance to build equity from day one. And through my program, that pathway becomes even clearer, where commission dollars can be redirected to cover your down payment or closing costs, reducing your financial hurdle from the outset.

This issue of HUD Homes Magazine is designed with one purpose: to help you buy smarter, faster, and with greater confidence Every page brings you closer to that goal. Here’s what you’ll find inside:

Dozens of current HUD listings across California with full-color photos, key property specs, and the most up-to-date pricing.

Direct links to each listing on HUDHomestore.gov, where you can confirm availability, check bidding periods, and submit your offer with precision.

Most importantly, I want to remind you: you don’t have to go it alone. As a licensed real estate professional, mortgage advisor, and HUD-approved specialist, I’m here to help you navigate this process from start to finish. Through my unique buyer’s assistance program, I offer financial coaching and strategic support, often allowing you to redirect commission dollars toward your closing costs or down payment.

That’s not a gimmick. That’s a real solution for real buyers.

So if you’re serious about homeownership and ready to take a step that could change your financial future start here. Study the listings. Explore the financing options. Share this magazine with someone you care about And when you're ready, schedule a consultation with me. We’ll review your goals, run the numbers, and build a plan that’s tailored to you.

July is a month of action. Let's make it count.

To your future, your home, and your peace of mind

Warm regards, Eric Lawrence Frazier, MBA Your HUD Homes Specialist & Trusted Advisor CA DRE #01143484 | NMLS #451807 �� www.ericfrazier.com | www.thepowerisnow.com �� Book your consultation: calendly.com/ericfrazier/realestate-mortgage-consultationclients

Eric Lawrence Frazier, MBA - Principal advisor

Did you see headlines saying that home sales are down? If that made you question if it’s still a good time to sell your house, here’s some perspective for you.

Sure, sales have slowed compared to the frenzy of a few years ago. But that doesn’t mean the market’s at a standstill.

Over 11K homes are still selling every single day – not including new construction. That’s 460 an hour. Or roughly 8 each minute. Serious buyers are still out there. Let’s make sure they see your house.

Eric Lawrence Frazier, MBA - Principal advisor

Lawrence Frazier, MBA

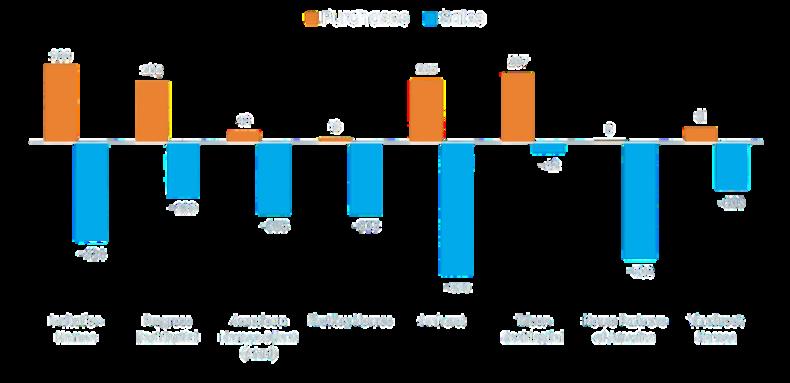

Single-Family Home Purchases and Sales in Q2 2025 (Through June 23) by Investor

Remember all the headlines about investors buying up homes? They didn’t tell the whole story. Investors were never buying a huge share – and now, many of the large ones are actually selling more than they’re buying.

Why? Slower price growth and higher rental costs mean the quick profits they were chasing just aren’t there.

But that’s not why you’re buying. You’re looking for stability, a place to call your own, and long-term value.

Let’s talk about what’s available and what you’re looking for.

Eric Lawrence Frazier, MBA - Principal advisor

Lawrence Frazier, MBA

Lawrence Frazier, MBA

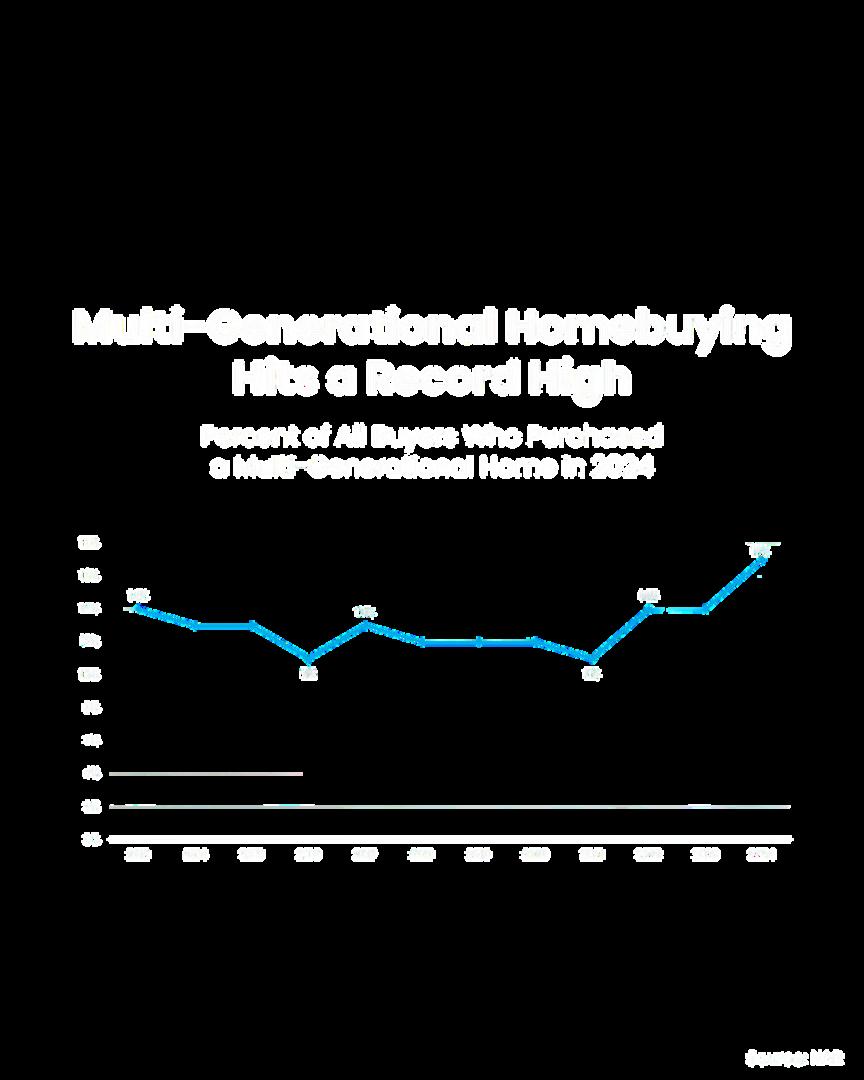

Nearly 1 in 5 buyers today are purchasing a home with their parents, adult kids, or extended family – and affordability is a big reason why. When mortgage rates and home prices are high, teaming up can be the key to making homeownership possible. You can share expenses and maybe qualify for a bigger home than you’d be able to get on your own. Buying solo isn’t the only way in. Let’s talk creative solutions.

Eric Lawrence Frazier, MBA - Principal advisor

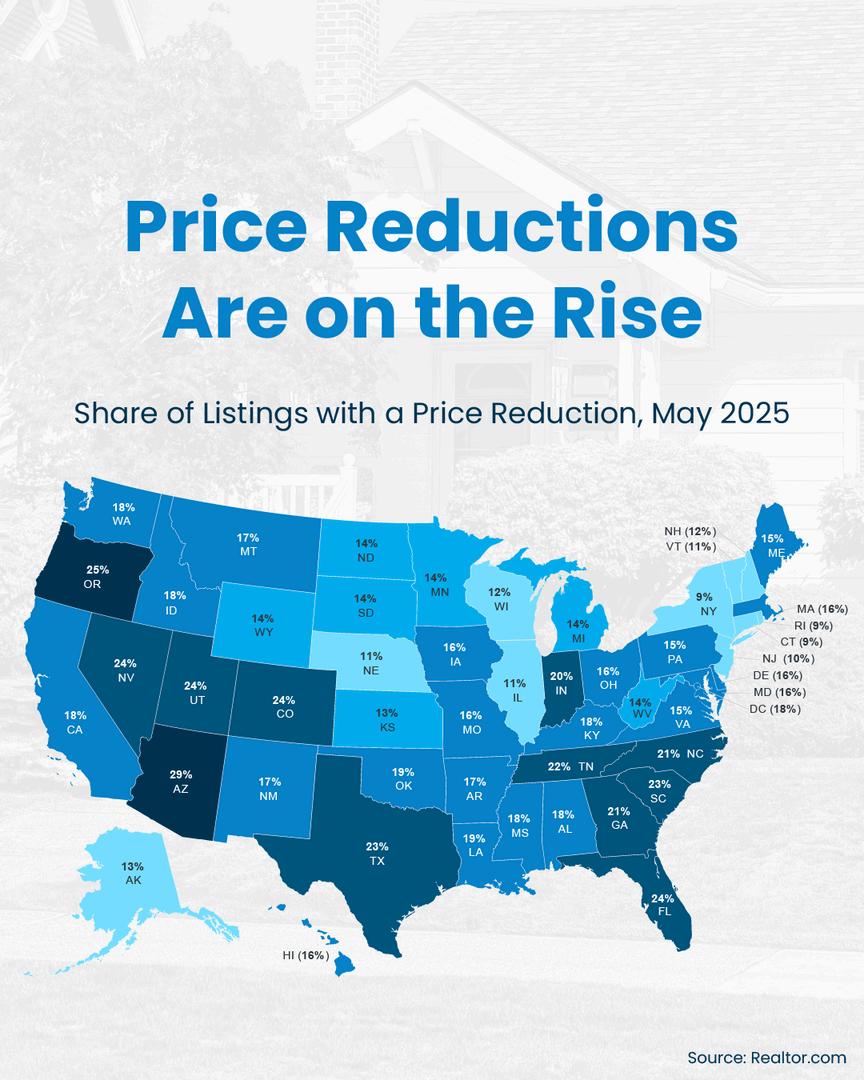

The market is shifting, and sellers who aren’t up to date are falling behind. But you don’t have to be one of them.

Today, nearly 1 in 5 homeowners are reducing their asking price to try to draw buyers back in. And that’s what happens when homes are priced based on last year’s headlines, not this year’s reality.

Because, in today’s market, if your asking price isn’t compelling, it’s not selling. But homes priced right are still selling – and for top dollar – they just need a local agent’s expertise to hit that perfect number.

Let’s talk about what’s happening in your neighborhood, even if you’re not ready to sell today. This way, you’re always in the know when the timing is right for you.

Eric Lawrence Frazier, MBA - Principal advisor Real estate & mortgage | business | finance | CA DRE

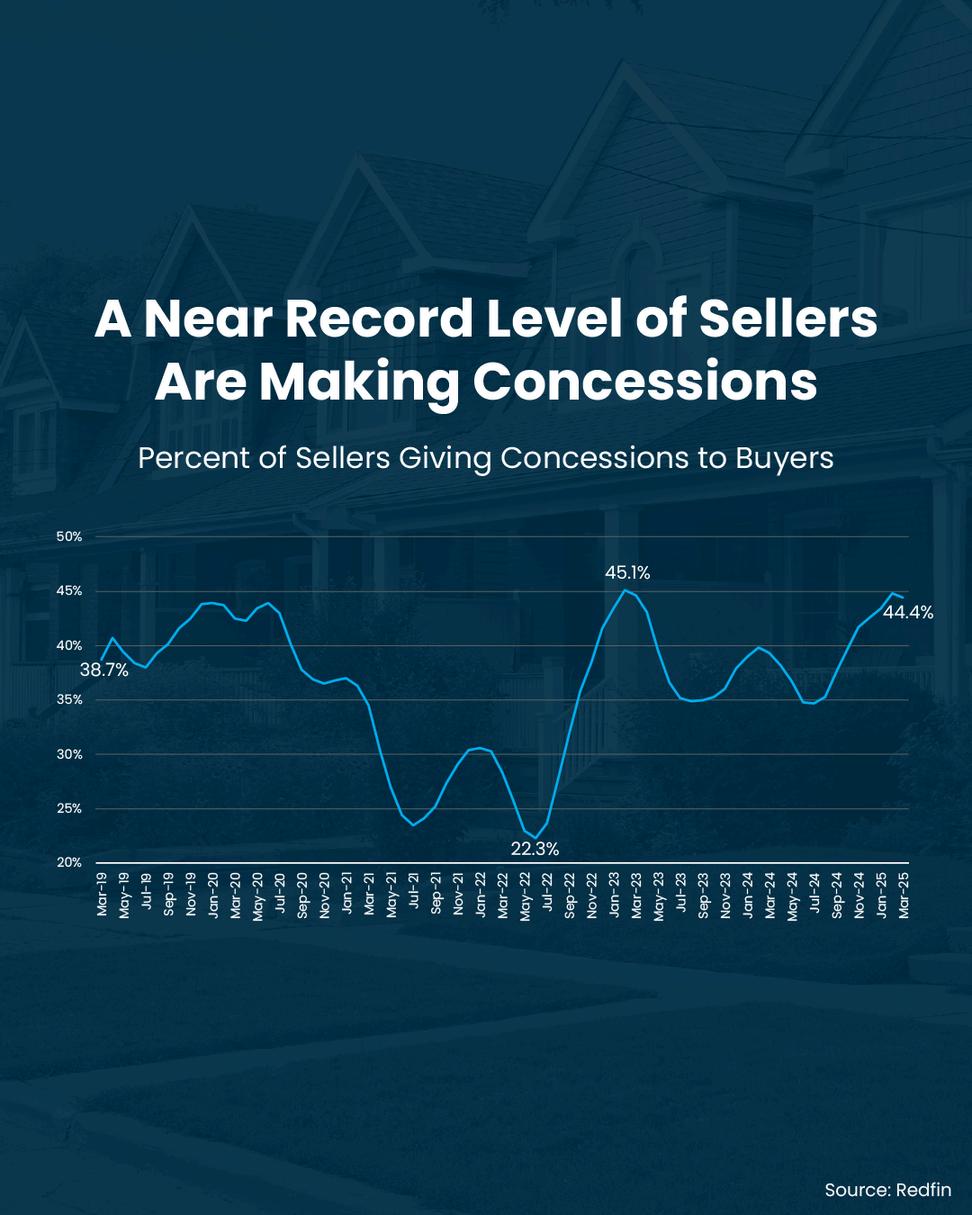

As the market shifts, nearly 44% of today’s sellers are offering concessions. That includes throwing in perks for buyers like repair credits or help with closing cost. But here’s the key. Concessions aren’t losses. They’re tools. And the homeowners who understand that are winning – big time. The savviest sellers are using concessions to bridge gaps, sweeten offers, and get across the finish line.

Eric Lawrence Frazier, MBA - Principal advisor

Lawrence Frazier, MBA

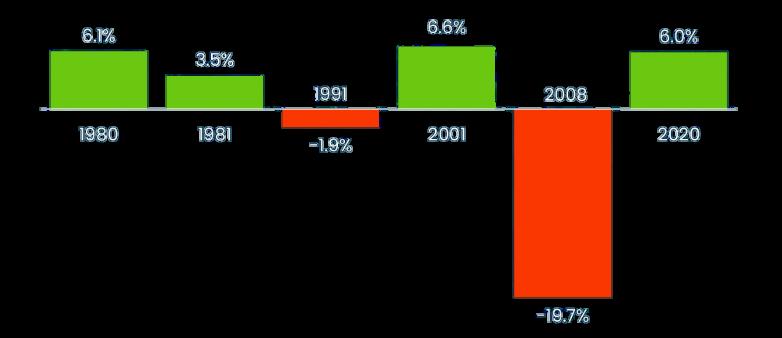

Home Price Change During The Last 6 Recessions

Are you waiting for a recession before you make your move? A recent survey shows 3 in 10 homebuyers are because they think rates and prices will fall in an economic slowdown.

But here's some important context that may change your perspective. In 4 of the last 6 recessions, home prices actually went up.

That’s right. Price drops aren’t a guarantee. The big drop in 2008 was the exception, not the rule.

Let’s talk about a smarter plan for today’s market.

Eric Lawrence Frazier, MBA - Principal advisor

A lot of sellers are setting their asking price too high today. And that’s leading to more price cuts.

Roughly 1 in 5 sellers are dropping their asking price right now – and a lot of times it’s because they started too high to begin with.

And in today’s more balanced market, buyers have more options and less patience for anything overpriced. That’s why: if your price isn’t compelling, it’s not selling.

To find the price that draws in buyers and sets you up to sell quickly, lean on an agent’s expertise. Message me and let's talk about the right pricing strategy for your house.

Eric Lawrence Frazier, MBA - Principal advisor

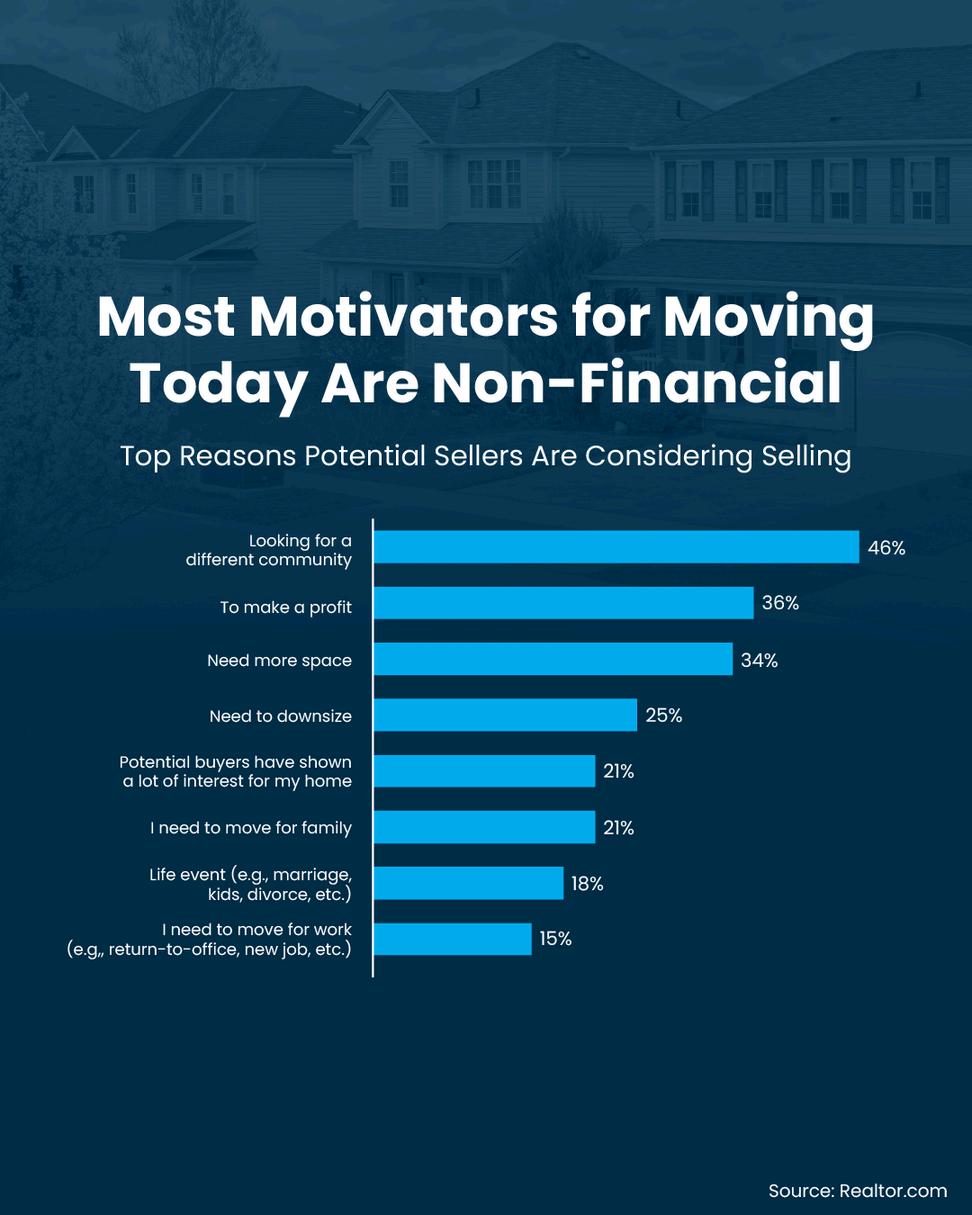

Homeownership isn’t primarily financial anymore. Across all demographics, emotional and lifestyle factors consistently outrank wealthbuilding as motivators.

Owning a home is about so much more than just building wealth (though that’s a part of it).

For many people, it's more about creating stability, putting down roots, and having a place that’s customized exactly how they like it. And it’s actually those emotional, non-financial perks that are top motivators for homebuyers today Because at the end of a long day, home is the thing that grounds you.

Eric Lawrence Frazier, MBA - Principal advisor

Eric Lawrence Frazier, MBA - Principal advisor

The low mortgage rate you have right now might be hard to give up, but sometimes life has other plans.

And when your needs change, your house may need to change too – even if that means leaving your low rate behind. And more homeowners are realizing that today.

Eric Lawrence Frazier, MBA - Principal advisor Real estate & mortgage | business | finance

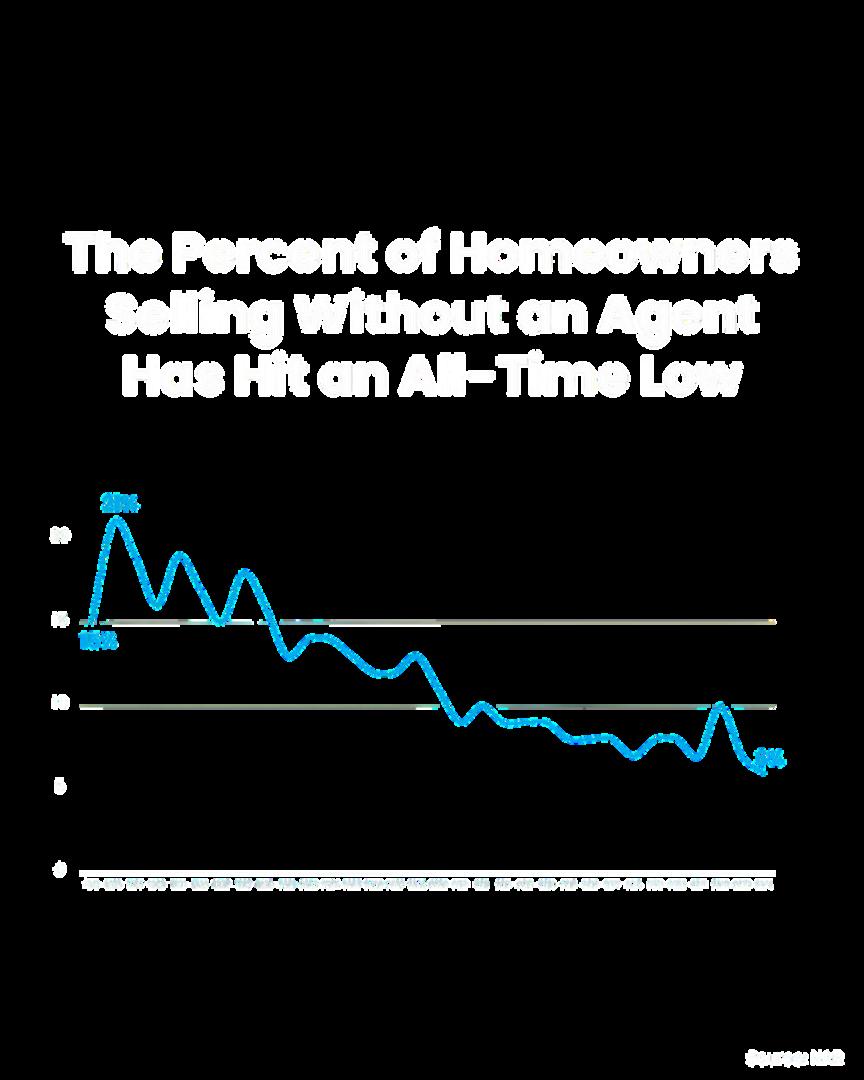

Fewer people are selling their house without an agent than ever before.

And it’s no surprise why. Pricing a house right, handling all the legal documentation, and making the house stand out takes experience – especially in today’s shifting market.

That’s why working with a real estate agent is so important. That way you don’t have to figure it all out yourself.

Eric Lawrence Frazier, MBA - Principal advisor

FHA eliminates 12 costly and burdensome policies in sweeping rollback

WASHINGTON – U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner announced the Federal Housing Administration (FHA) is rescinding more than 12 sub-regulatory policies under its Single Family mortgage insurance program. These sweeping changes cut red tape, help reduce the cost of homeownership, and eliminate financial and regulatory burdens. The rescissions span the loan origination process from the point of mortgage application submission through FHA’s issuance of an insurance endorsement on the mortgage.

“These rescissions are bold, necessary, and long overdue,” said HUD Secretary Scott Turner. “Under President Trump’s leadership, we’re slashing red tape that drives up costs and shuts families out of the market. Every hardworking American deserves a fair shot at owning a home - the American Dream should never be buried under a pile of regulations. These changes open doors for families and lenders, unlocking opportunities nationwide.”

Today’s policy retractions, executed through a series of Mortgagee Letters (ML), are aimed at eliminating policies that directly or indirectly increase the cost of home ownership for aspiring first-time buyers. The removal of these requirements will strengthen the housing market, reduce unnecessary regulations, increase America’s affordable housing supply, reduce financing costs, and save taxpayer funds by creating a more efficient FHA lending process. Specifically, the FHA:

Rescinded Outdated and Costly FHA Appraisal Protocols. By removing antiquated and burdensome procedural steps that an appraiser must complete during each assignment, FHA is better aligning its appraisal policies with industry standards and reducing unnecessary costs and delays that are passed through to homebuyers. During the first Trump Administration, HUD made targeted technology investments through FHA Catalyst that have substantially improved FHA’s collateral valuation analytics. As a result, FHA is now able to extend the benefit of these investments to borrowers, lenders, and taxpayers in the form of streamlined appraisal procedures, lower costs, and quicker turn times.

Rescinded Full-Time Direct Endorsement Underwriter Requirements. By rescinding its previous full-time employment requirement for Direct Endorsement underwriter eligibility and now allowing part-time employment, lenders will have increased flexibility to more effectively manage their staffing needs, reduce origination costs, and encourage greater participation in FHA programs.

Rescinded the Supplemental Consumer Information Form (SCIF) Collection Requirement. Rescinding the required collection of the SCIF removes a requirement that had limited benefit and was an additional collection burden for lenders.

Rescinded the Federal Flood Risk Management Standard (FFRMS) for New Construction Eligibility. Rescinding the FFRMS restores the previous established policy, thus removing what would have been limits on the land available for development and eliminating increases in the cost of construction for FHA-insured single-family properties, which would have exacerbated the insufficient supply of affordable housing for the next generation of homebuyers

White House Press Secretary Karoline Leavitt discussed HUD’s Foster Youth to Independence (FYI) program during a White House press briefing.

Rescinded the Mandatory Pre-Endorsement Inspection Requirements for Properties Located in Presidentially-Declared Major Disaster Areas. Modifying FHA disaster inspection requirements aligns FHA’s policies with industry standards and allows lenders the discretion to assess property condition and determine appropriate risk-based actions prior to endorsement. This update reduces costly and unnecessary delays and will improve the bandwidth of home property inspectors that are often overwhelmed following a natural disaster. This announcement, made during National Homeownership Month, underscores HUD’s ongoing commitment to expand homeownership opportunities for Americans.

WASHINGTON – This week, the U.S. Department of Housing and Urban Development (HUD) announced several key leadership appointments Under the direction of HUD Secretary Scott Turner, Jonathan “Drew” McCall, Todd Thurman, and Reid Wilson will serve in critical senior-level roles ensuring HUD carries out its renewed mission to foster strong communities by increasing access to quality, affordable housing, expanding housing supply, and unlocking homeownership opportunities for all Americans. These appointments follow the swearing-in of Andrew Hughes, former HUD Chief of Staff, as Deputy Secretary.

Drew McCall will serve as HUD’s Chief of Staff. In this role, he will oversee internal operations and collaboration across the Department to ensure HUD continues to serve rural, tribal, and urban communities at the highest standard. McCall most recently served as Deputy Chief of Staff to Secretary Turner. During the first Trump administration, McCall served as Deputy Chief of Staff to Dr. Ben Carson, the 17th Secretary of HUD.

Todd Thurman, former Senior Advisor to Secretary Turner, and Reid Wilson, former HUD White House Liaison, will now serve as Deputy Chiefs of Staff, coordinating cross-agency priorities and leading the execution of the Department’s daily functions. Both Thurman and Wilson also served under former HUD Secretary Carson.

“Our robust team at HUD is stronger than ever,” said Secretary Turner. “Drew, Todd, and Reid have proven track records of exceptional public service. Their devotion to the mission of HUD and innovative skills will help us maximize our operations so we can better serve the Americans who depend on us I’m grateful and proud of them for ans of Ho

Legislation Delivers Historic Tax Relief, Makes Opportunity Zones Permanent

WASHINGTON - U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner today released the following statement after the final passage of President Trump’s One Big Beautiful Bill, clearing the way for the historic legislation to be signed into law:

“The President’s One Big Beautiful Bill will revitalize and uplift rural, tribal, and urban communities across America, delivering the largest deficit reduction in decades, providing the biggest tax cut ever for working-class Americans, and expanding the benefits of Opportunity Zones so this transformative policy can have an even greater impact,” said HUD Secretary Scott Turner. “I’m especially pleased to see Opportunity Zones made a permanent part of our tax code, providing much-needed continuity. Additional enhancements, including a rolling designation cycle and expanded investment incentives for underserved rural communities, will build on the momentum of Opportunity Zones, which have already lifted more than one million Americans out of poverty, attracted more than $89 billion in investment, increased housing supply by more than 300,000 new residential addresses, and created more than half a million jobs. Thanks to President Trump’s bold leadership, our nation’s fiscal sanity is restored and our country’s financial future is better and brighter than before. The One Big Beautiful Bill is a massive victory for the American worker the American small business owner and the American fami

WASHINGTON - U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner announced the relocation of HUD headquarters from the Robert C Weaver Federal Building to 2415 Eisenhower Avenue in Alexandria, Virginia. The move would unlock several hundred million dollars in taxpayer savings, address serious health and safety threats, enhance the Department's work culture, and present an opportunity for greater collaboration and service to the American people.

“It is time to turn the page on the Weaver Building and relocate to a new headquarters that prioritizes the well-being of HUD employees and properly reflects the passion and excellence of our team,” said HUD Secretary Scott Turner. “There are serious concerns with the current state of HUD’s headquarters including health hazards, leaks, and structural and maintenance failures. Many of these risks will needlessly and irresponsibly continue to absorb taxpayer dollars. Relocating is about more than just changing buildings; it’s about a mission-minded shift that we hope will inspire every employee. Under President Trump’s leadership, we are advancing this vision and instituting a new American Golden Age.”

“Virginia is a great place to be headquartered, and we are excited to welcome the Department of Housing and Urban Development and their over 2,700 headquartersbased employees to the best state in America to live, work, and raise a family,” said Virginia Governor Glenn Youngkin. “Since the Trump Administration started transforming the federal government to better serve the American people, our team has been focused on seizing the new opportunities that this presents for the Commonwealth Virginia is the proud home to many public and private sector headquarters, and we thank HUD leadership for trusting us and are committed to supporting your important national mission.”

“The decision to relocate HUD’s headquarters is a move that reflects our commitment to fiscal responsibility and mission effectiveness,” said Michael Peters, Commissioner of GSA’s Public Buildings Service. “The Robert C. Weaver Federal Building requires hundreds of millions in long-term repairs and this move will ensure they quickly have access to a modern work environment that fits their needs.”

For decades, the Robert C. Weaver Building has been plagued by severe long-term infrastructure, safety, health, and operational challenges. It has deteriorated well beyond the point of cost-effective repair, creating significant financial obligations for the federal government if occupancy is maintained. Building conditions and financial liabilities for the Robert C. Weaver Building include outdated core infrastructure, ongoing structural issues, environmental and health risks, safety failures, and security and compliance deficiencies. The building would require nearly half a billion dollars over the next four years to meet minimum federal standards.

When people hear “HUD homes,” they almost always think, “That’s only for first-time homebuyers, right?” Wrong. This is one of the most common myths in real estate and busting it could save you thousands on your next move, whether you’re moving up, downsizing, or simply changing cities.

The confusion comes from the fact that many HUD homes are priced lower than comparable homes on the open market — and they’re often older, foreclosed homes that need a little TLC. Naturally, they look appealing to first-time buyers trying to break into the market. But the truth is, HUD’s guidelines don’t say “first-time buyer only.”

In fact, anyone who plans to live in the home as a primary residence can buy during HUD’s exclusive owner-occupant period, which is usually the first 15 days the property is listed for sale. After that? The door opens for investors too.

First-time buyers (of course)

Move-up buyers wanting a bigger home

Downsizers wanting less maintenance or a single-story

Divorced buyers starting over

Families relocating for work

Military families using VA or FHA financing

HUD’s mission is to expand homeownership. That’s why the first 15 days are reserved for people who plan to live in the property. If you’re shopping for a new primary residence even if you’ve owned a home before you’re first in line. This “priority window” means you’re not competing with cash investors and flippers during the early stage But once day 16 hits, all bets are off the bidding opens to everyone, and investors love these deals.

Take the Johnsons They bought their starter home 8 years ago but now have two kids, a dog, and a remote work situation. They’re ready to move up from a two-bedroom condo to a four-bedroom house. They find a HUD-owned home in their neighborhood that’s been foreclosed on, needs minor repairs, and is listed 15% below market value. They bid during the exclusive period and win. The result? They moved up without breaking the bank and they didn’t have to compete with cash buyers trying to flip the place for profit.

HUD properties are sold “as-is,” but the listing price is based on an FHA appraisal. The goal is to recover what’s owed on the FHA loan, but in many cases, the pricing is set to attract owner-occupant buyers, so you’ll often find these homes are discounted compared to comparable local listings. For example, according to recent HUDUser.gov data, the average sales price for HUD homes in California was about 15–20% below local market averages last quarter. For families moving up, that’s real money left in your pocket.

• Find a HUD-certified broker. Not every agent can submit bids on HUD homes they must be HUD-registered.

• Check the local HUD Homestore daily. New listings drop weekly, and the best deals don’t last long.

• Have your financing ready. A strong FHA or VA pre-approval helps you win the bid during the owner-occupant window.

Q: Can I buy a HUD home with conventional financing?

A: Yes! HUD accepts cash, conventional, FHA, or VA you choose.

Q: Can I use down payment assistance?

A: Absolutely. Many state and local DPA programs work with HUD homes

Q: Can my spouse buy if I already own a home?

A: If you’re buying together, you both must live there as your primary residence. If divorced or separated, you may qualify separately.

Pro Tip: Use Local Stats

Did you know? In 2024, HUD sold over 1,200 homes in California alone, with the average owner-occupant discount ranging from 10%–20% below retail listings. (Source: HUDUser gov, CA Market Highlights)

“You Don’t Have to Be a First-Time Buyer to Buy a HUD Home”

�� Ready to Find Your Next HUD Home?

There’s never been a better time to discover what HUD homeownership can do for you whether you’re buying your first home, moving up, or starting fresh.

Scan the QR Code to schedule your free, no-obligation HUD Homebuyer Consultation.

• Learn what you qualify for

• See local HUD listings before they’re gone

• Get insider strategies to win the bid and save equity

�� Prefer to explore your mortgage options first?

Scan the second QR Code to download my Mobile App your one-stop hub for listings, mortgage calculators, and educational videos to guide you every step. The power is now. Let’s open the door to your next home together.

Eric Lawrence Frazier, MBA - Principal advisor

Yes, You Can Have Two FHA Loans Here’s How

If you’ve ever heard “You can only have one FHA loan at a time,” you’re not alone. But it’s not always true. The FHA does make exceptions for real-life situations, and knowing this can open up housing options you didn’t know you had.

HUD’s policy is that an FHA borrower can only have one FHA-insured mortgage at a time, except under specific circumstances. Here are two of the biggest ones:

If you’re relocating for work and the new home is more than 100 miles away, you can keep your current FHA-financed home as a rental and buy a new primary residence with another FHA loan.

Example:

Imagine you live in Riverside, CA, and your employer relocates you to Sacramento. That’s a 400+ mile move you can keep your Riverside home as an investment property and still get a new FHA loan for your Sacramento home.

If your family grows significantly and your current home is no longer adequate say, you have twins and need more bedrooms you may qualify for a second FHA loan for a larger home, keeping the first as a rental.

Important: You must document the reason, like birth certificates, adoption papers, or legal guardianship.

Provide proof of relocation: Employer letter, new job contract, or transfer paperwork. Show that your current home is too small: Include evidence of increased family size. Be prepared for stricter underwriting: You’ll need to prove you can afford both payments (or that the rental income will cover the first mortgage).

If you and your ex owned a home together with an FHA loan and the divorce decree says your ex gets the house, you can get a new FHA loan for yourself. You may need to get removed from the old loan to avoid counting the debt against you.

Yes! According to HUD data, thousands of buyers every year qualify for exceptions because of job transfers and family changes. For example, the U.S. Census shows that more than 6 million people move long distances for work every year. That’s a huge pool of potential buyers who may not know they’re eligible.

Talk to an experienced FHA lender not every loan officer knows how to handle exceptions.

Get pre-approved early so you know your qualifying limits. Use a HUD-approved broker when shopping for HUD homes to get priority during the exclusive owner-occupant period.

Q: Can I just lie and say I’m relocating?

A: Absolutely not this is mortgage fraud. You need real, documented reasons.

Q: Do I have to live in the new home for a year?

A: Yes, you must certify you’ll occupy the new home as your primary residence.

Q: Can I use rental income from my old home to qualify?

A: Usually, yes if you have a signed lease and meet lender guidelines

Stat Box

Did you know? Over **25% of FHA borrowers move 100+ miles for work or family each year. (Source: U.S. Census, HUD guidelines)

“Yes, You Can Have Two FHA Loans — Here’s How!”

�� Discover If You Qualify for a Second FHA Loan

Life changes and your mortgage should keep up. Whether you’re moving for work, expanding your family, or starting fresh after a life event, I’m here to help you unlock HUD and FHA programs you didn’t know existed.

Scan the QR Code to schedule your personalized FHA Eligibility Check.

• Confirm if you can qualify for a second FHA loan

• Get clear answers about your options

• Work with a trusted, licensed mortgage advisor

�� Prefer to run your own numbers first?

Scan the second QR Code to download my Mobile App your one-stop resource for mortgage calculators, HUD listings, and educational videos.

You don’t have to settle for “one and done ” Let’s make your next chapter happen smartly, safely, and affordably.

Eric Lawrence Frazier, MBA - Principal advisor

• H1: Divorce & FHA Loans — What You Didn’t Know

Divorce changes everything your home, your finances, and your future housing options. One of the biggest misunderstandings I see is that many newly divorced buyers think they’re “stuck” if they had an FHA loan with their ex-spouse. The good news? You’re not

HUD’s guidelines make it clear: if you’re no longer responsible for the original mortgage or if you can document you’re legally separated from that debt you can qualify for a new FHA loan for your next home.

When a couple divorces, the house often goes to one spouse. But if both names stay on the loan, that debt can count against you when you apply for another mortgage. Many people think they can’t move forward until the old loan is paid off but that’s not true if you handle it properly.

Here’s how to protect your buying power:

• Quitclaim Deed vs. Refinance:

A quitclaim deed transfers ownership but does not release you from the mortgage. A refinance or assumption by your ex is usually needed to remove you from financial liability

Most lenders want to see that the divorce decree clearly states who is responsible for the house and the mortgage. If your ex is awarded the property and agrees to keep the loan, you may be able to show you’re no longer obligated.

•

Show that your ex has been making payments solo for the last 12 months Lenders love documentation!

Imagine Sarah and Mike owned a house together with an FHA loan They divorce Mike stays in the house, refinances into his name, and Sarah is released from the old FHA mortgage. Sarah can now apply for a new FHA loan for her own home even if it’s within months of the divorce.

If your ex refuses to refinance, you may still be on the hook for the debt even if you no longer live there. That’s why it’s so important to address the mortgage in your divorce agreement. Consult your attorney and your lender early to avoid surprises.

If you’re newly single, buying a HUD home can be a smart way to reset your housing situation without overpaying. You’re eligible for the owner-occupant exclusive bidding period just like any other buyer who plans to live in the property.

Q: How soon after divorce can I buy?

A: Once you’re legally separated from the original mortgage obligation and meet lender guidelines, you can apply anytime.

Q: Can I use my ex’s income to qualify?

A: No. Only your income counts. But child support or alimony may help you qualify if it’s court-ordered and documented.

Q: What if I want to keep the house instead?

A: Then you’d refinance to buy out your ex’s share. That’s a separate topic talk to your lender!

Pro Tip: Local Reality

Did you know? Over 230,000 Californians divorce every year, and housing is one of the biggest stress points. Knowing your FHA and HUD options can help you start fresh with confidence. (Source: CA Dept. of Public Health, HUDUser.gov)

�� Start Fresh — Secure Your Next Home After Divorce

Life goes on and your housing should too. If you’re divorced or in the process, don’t assume you have to wait years to qualify again. As a HUD listing broker and licensed mortgage advisor, I’ll help you navigate your best options.

• Scan the QR Code to schedule your free Divorce & FHA Homebuyer Consultation.

• See if you qualify for a new FHA loan

• Understand how to handle your current mortgage

• Find HUD listings before investors do

�� Want to run the numbers first?

Scan the second QR Code to download my Mobile App mortgage calculators, listings, and educational videos, all in one place.

Eric Lawrence Frazier, MBA - Principal advisor Real estate & mortgage

business

finance

• H1: How to Beat Investors with HUD’s 15-Day Rule

There’s a little-known advantage baked right into the HUD home buying process and smart buyers use it to get great deals before investors even see them. It’s called the exclusive owner-occupant period, and if you’re looking for a home to live in, this can be your secret weapon.

What Is the HUD Exclusive Listing Period?

When HUD acquires a foreclosed home, it wants to help families, not just investors. For most HUD homes, the first 15 days are reserved for buyers who plan to live there as their primary residence owner-occupants, nonprofits, and government agencies.

Investors, flippers, and cash buyers have to wait.

Once the exclusive period ends, investors swoop in usually with cash offers and competition skyrockets. If you know how to bid during that early window, you’re ahead of the game.

How the 15-Day Period Works

• Days 1–10: HUD reviews bids from owner-occupants, nonprofits, and government agencies daily. The “winning” bid must meet HUD’s minimum net acceptable.

• Days 11–15: HUD may hold bids until day 16, giving priority buyers extra time to submit.

• Day 16 Onward: Investors can submit offers, and the buyer pool expands dramatically.

Let’s say you find a HUD home in your city. It’s priced at $300,000, but comparable homes in the neighborhood are selling for $340,000. If you submit your bid during the owner-occupant period, you have a window where flippers can’t outbid you with cash If you wait, that same property may have 10 investor offers competing against you.

• Get pre-approved before you shop: You must submit proof of financing with your bid

• Work with a HUD-registered broker: Only they can submit your bid on the HUD Homestore.

• Act fast: Good homes get multiple offers during the priority period

• Know the numbers: Always review the Property Condition Report HUD sells homes as-is.

Q: Can I bid below the list price during the exclusive period?

A: Yes, but if your bid doesn’t meet HUD’s minimum net, it may be rejected.

Q: What happens if no owner-occupant bids are accepted?

A: The home stays on the market, and investors can bid after day 15.

Q: How do I find these listings?

A: Search the official HUD Homestore daily, or work with a broker who sends you new listings instantly.

Pro Tip: Local Stat

HUDUser.gov indicates that owner-occupants purchase approximately 70% of HUD homes sold in California each year; however, they have a significantly better chance of success when they act within the exclusive period. Don’t miss your window!

�� Get Ahead — Win Your HUD Deal Before Investors Do

You deserve first shot at the best HUD deals. As a trusted HUD listing broker, I help buyers navigate the exclusive owner-occupant window to secure homes for less.

✅ Scan the QR Code below to schedule your free HUD Buyer Strategy Session:

• Learn exactly when to bid.

• Get insider tips to make your offer stand out.

• See local HUD listings before investors.

�� Want to browse listings and run your mortgage numbers?

Scan the second QR Code to download my Mobile App your all-in-one tool for HUD deals, payment calculators, and real estate education.

�� The power is now grab your first chance before investors even get theirs.

Eric Lawrence Frazier, MBA - Principal advisor

For many buyers, the biggest obstacle to buying a home isn’t qualifying for a mortgage it’s saving enough money for the down payment and closing costs. What most people don’t realize is that you can combine HUD homes with down payment assistance programs (DPAs) to dramatically lower the cash you need up front.

HUD homes are already priced below market in many cases. They’re foreclosed properties that the Department of Housing and Urban Development is selling to get them back into the hands of owner-occupants. That alone can save you thousands but when you layer on state or local DPA, you can make homeownership happen much sooner than you think

Down payment assistance comes in many forms: grants, forgivable loans, matched savings, or community development funds Most states, cities, and counties offer programs specifically for first-time or moderate-income buyers. Some employers and nonprofit housing agencies do, too.

The best part? These programs work beautifully with FHA loans which is the financing used by most people buying HUD homes You’re not locked out because the home is a foreclosure. HUD accepts most normal financing.

.Example: How It Adds Up

Suppose you find a HUD home listed at $300,000 With FHA financing, your required

down payment is just 3.5% that’s $10,500. But if you qualify for a local DPA grant covering 3%, you’re suddenly coming up with just $1,500 at closing (plus closing costs) That can be the difference between waiting years and buying now

HUD’s mission is to help owner-occupants become homeowners, not to sell off homes to cash investors at the highest possible price That’s why they offer the exclusive owneroccupant period the first 15 days the property is listed so regular buyers have the best shot. If you’re pre-approved, using a HUD-registered broker, and have DPA lined up, you’re in the best position to win the bid.

Q: Can I combine DPA with a 203(k) renovation loan?

A: Sometimes. Many state and local programs allow it if the loan stays FHA. Always check with your lender first.

Q: Do I have to repay the assistance?

A: Some programs are grants you never repay Others are forgivable after you live in the home for a certain number of years.

Q: Will I pay higher fees?

A: Usually no. But be sure you understand the terms some programs add a small lien that’s forgiven later.

Always work with a lender and a HUD-certified agent who understand how to stack DPA with HUD’s special sales process. And be prepared to move fast good deals don’t last long once they hit the HUD Homestore.

Homeownership may be closer than you think especially when you layer HUD’s discounted pricing with local down payment help. I’m here to show you how.

Scan the QR Code to schedule your free Down Payment Assistance Strategy Session.

• Learn exactly what grants and programs you may qualify for

• See HUD listings that fit your budget

• Get clear steps to make a winning offer

The power is now. Let’s make homeownership happen together.

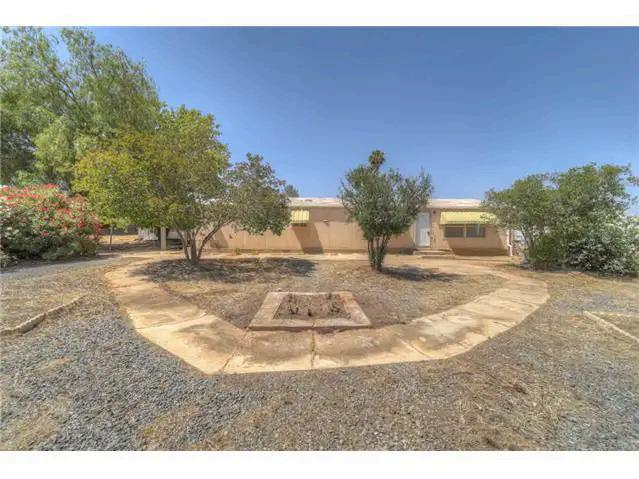

Not every affordable home comes move-in ready but that shouldn’t stop you. Many buyers see a great HUD home price in Riverside County or anywhere in Southern California, but they worry: “How will I pay for the repairs?” The answer for many is the FHA 203(k) renovation loan — a flexible tool that lets you buy the home and fund the work with one mortgage.

HUD homes are foreclosed properties sold as-is. Some need only cosmetic touch-ups; others may have bigger repairs. Many lenders won’t finance a home that can’t pass a basic appraisal. That’s where the 203(k) comes in.

Unlike a standard FHA loan, a 203(k):

• Allows you to roll the cost of eligible repairs and improvements into your mortgage.

• Protects you from surprise out-of-pocket costs after closing.

• Helps you build instant equity by improving the property’s value right away.

Imagine Jaden, a single mom in Riverside County. She finds a HUD home listed for $300,000 in a neighborhood where comparable homes sell for $350,000 but this one needs a new roof and updated bathrooms.

With a standard FHA loan, she’d need $20,000–$40,000 cash for repairs after closing With a 203(k), she rolls that cost into her mortgage. Her lender approves a $340,000 total loan amount. The contractor does the work after closing, and when it’s done, the home’s new appraised value is $365,000. Jaden moves in with a safe, updated house and built-in equity.

There are two versions:

Limited 203(k): For minor repairs and upgrades (up to $35,000 in work).

Standard 203(k): For major renovations, structural changes, or projects over $35,000.

• Roofs, windows, HVAC

• Kitchen and bathroom remodels

• Flooring, paint, plumbing

• Energy efficiency improvements

• Accessibility upgrades

• Major structural work (Standard 203(k) only

The Step-by-Step Process

1.Find a HUD home that needs work.

2.Get a 203(k)-savvy lender — not all lenders offer this.

3.Work with a HUD-certified broker who understands the timeline.

4.Get bids from licensed contractors they must be approved.

5.Close the loan the repair funds go into escrow.

6.Contractors complete the work in phases; an inspector verifies each step.

7 Move in once the home is ready

Myths to Watch For

Myth: “203(k) loans are only for flippers.”

Fact: They’re only for owner-occupants you must live in the home

Myth: “They’re too complicated.”

Fact: They do take more planning but the payoff is huge if you want affordable housing with upgrades.

Always read HUD’s Property Condition Report. Know what repairs you’ll need before you bid. A good broker and lender can help you run the numbers.

Yes! Wherever HUD homes exist from the Inland Empire to Texas to North Carolina 203(k) loans can turn a fixer into your forever home. It’s one of the most underused ways to create value in real estate.

Transform a HUD Fixer Into Your Dream Home

If you’re tired of losing bidding wars for move-in ready houses, this is your competitive advantage. Find a good deal, make it better, and build wealth all at once

Scan the QR Code below to schedule your free Renovation Loan Strategy Session.

• Understand how the 203(k) works

• Get referrals to trusted contractors

• Learn how to bid smart on HUD REOs

�� Want to run the numbers or browse listings?

Scan the second QR Code to download my Mobile App with mortgage calculators, listings, and educational videos to guide you every step of the way.

The power is now. Let’s turn that fixer into your future.

Eric Lawrence Frazier, MBA - Principal advisor

When people hear the word “foreclosure,” they often picture headaches: hidden repairs, sketchy title issues, or all-cash investor bidding wars. But buying a HUD foreclosure is different. These properties known as HUD REOs (Real Estate Owned) come from FHA-backed loans that defaulted. Once HUD takes possession, their mission is to stabilize neighborhoods by helping real buyers become homeowners again

If you know how the HUD system works, you can turn a bank-owned foreclosure from a risky guess into one of the most transparent, fair, and affordable paths to owning your home. But there’s a catch: those hidden savings come with hidden costs you must plan for.

HUD REOs are not like auction foreclosures or short sales that can drag on for months. The process is structured, well-documented, and open to everyone not just investors. HUD homes are appraised by FHA-approved appraisers. They’re listed at fair market value and often discounted to sell quickly. And during the exclusive owner-occupant period the first 15 days regular homebuyers get a head start before investors can even submit a bid.

In Riverside County, throughout Southern California, and nationwide, smart buyers can use this window to snap up homes below local market value. But you need to know what it really costs so you don’t get caught off guard.

Where the Savings Come From

The biggest advantage is the pricing HUD wants to get foreclosures off their books and into the hands of homeowners fast. They don’t haggle like private sellers do. They set a fair price, adjust it if needed, and accept sealed bids that meet their minimum net.

Local HUD REO data shows that in California, buyers regularly pick up homes 5%–20% below neighborhood comparables. That means a house that would sell for $450,000 in a typical listing might show up as a HUD home for $400,000 or less — especially if it needs some repairs.

Don’t let the word “discount” fool you — there is no free lunch. HUD homes are sold strictly as-is. They want to move the property; they’re not fixing it for you. If you plan ahead, these costs are manageable and they usually still keep your total price well under market. Here’s what to expect:

HUD provides a Property Condition Report (PCR) always read it. But you should also hire your own professional inspector. Depending on the size of the home, expect to spend $400–$700.

Why it matters: If the roof leaks or the plumbing needs repair, it’s better to find out before you close. Unlike a retail seller, HUD won’t credit you for these costs.

Your biggest variable. Some HUD homes just need paint and carpet. Others need a new roof, upgraded HVAC, or major systems work

Typical rule of thumb: budget 1%–3% of the purchase price for immediate repairs.

A great option is the FHA 203(k) renovation loan, which lets you finance repairs as part of your mortgage but that’s another strategy altogether

HUD does not keep the utilities on. If you need the gas, water, or electricity activated for your inspection or appraisal, that’s on you. Expect deposits of $100–$500 depending on local utility companies

Closing costs are similar to any other purchase escrow, title insurance, recording fees, loan origination fees. HUD may allow you to roll up to 3% of your closing costs into your offer but only if your net bid meets their minimum. Always budget your share.

Here’s how this might look in real life.

Let’s say a buyer in Corona, CA finds a HUD home listed for $410,000. Comparable homes in that neighborhood sell for about $445,000 but this one needs a bit of work.

This buyer might budget like this:

Professional home inspection: $650

Utility activation: $250

Basic repairs and updates: $8,000 (paint, carpet, minor plumbing fixes)

Closing costs: standard 2%–3% range

The “hidden costs” total around $9,000–$12,000. But because the buyer started with a price that’s $35,000 below market, they’re still ahead even after upgrades. That’s the power of buying smart, not just cheap.

Too many first-time HUD buyers focus only on the list price and overlook the real costs that come after. Here are three mistakes to avoid:

✅ Skipping the Inspection

Yes, you save a few hundred dollars but risk a $5,000 repair surprise.

✅ Lowballing the Bid

HUD won’t counter If you don’t meet their minimum net, your offer is rejected no doovers until they re-list or adjust the price.

✅ Not Budgeting for Repairs

A paint-and-carpet fixer might be simple, but bigger issues like HVAC or roofs need real money Know your numbers

This strategy isn’t unique to Riverside or SoCal. HUD REOs are sold this way in all 50 states. Whether you’re buying in the Inland Empire, Sacramento, Arizona, or Texas, the “as-is,” sealed-bid system works the same way. The only difference is how local market prices and repair costs pencil out.

• Equity Potential: Your real gain is that built-in equity when you close. A modest fixer might be worth $10K–$30K more than you paid once you update it.

• No Seller Drama: No seller pulling out at the last second HUD wants it sold

• Fewer Surprises: The clear PCR, standard contracts, and structured bids mean fewer “he said/she said” conflicts.

Recent data from HUDUser.gov shows that in 2024, HUD sold over 1,200 homes in California alone with average discounts ranging from 10%–20% compared to comparable retail listings. In Riverside County specifically, buyers using the owneroccupant period saved thousands by bidding smart, inspecting carefully, and budgeting for realistic repairs.

✔ Always compare the all-in cost (purchase + repairs + closing costs) to local comps.

✔ Use a trusted inspector who understands older properties.

✔ If the repairs are bigger than you can cover, ask about a 203(k) loan or negotiate contractor bids up front.

✔ Never assume your regular agent knows HUD. Always work with a HUD Buyer’s Broker who’s NAID-certified and familiar with the sealed bid process.

✅ Get pre-approved before you bid.

✅ Read the Property Condition Report line by line.

✅ Hire an inspector, even if it costs you.

✅ Budget for repairs double-check with a contractor if needed.

✅ Work with a HUD Buyer’s Broker to guide you through the bid, escrow, and closing

HUD foreclosures can be your best opportunity to get into a neighborhood you love, with instant equity and a monthly payment you can afford But your real savings come when you know exactly what you’re buying and what it costs to bring it up to your standard.

✅ Scan the QR Code to schedule your free HUD Cost & Savings Strategy Session.

• Learn how much you could save vs. retail listings

• Get local estimates for real repair costs

• See how to bid smart and keep more equity in your pocket

�� Want to run numbers and browse listings first?

Scan the second QR Code to download my Mobile App your all-in-one hub for calculators, local HUD REOs, and videos that show you step-by-step how to win.

The power is now. Let’s make sure you’re saving wisely, not guessing blindly.

Eric Lawrence Frazier, MBA - Principal advisor

Real estate & mortgage | business | finance | CA DRE #01143484 - NMLS ID #461807

Buying a HUD home isn’t like making an offer on a traditional listing. There’s no back-andforth with a seller. No tense phone calls to “see what they’ll take.” And no second chances if you submit a sloppy bid. HUD uses a sealed bid system you get one shot to meet their minimum net. If you don’t, your offer is rejected outright.

That might sound intimidating But the truth is, the HUD bid process is one of the fairest and most transparent ways to buy a foreclosure as long as you know how to play by the rules.

When HUD acquires a foreclosed home, they list it through the HUD Homestore, an online portal open to the public. But not every real estate agent can help you submit an offer only brokers with an active NAID number can submit bids on your behalf. That’s why working with a HUD Buyer’s Broker is non-negotiable if you’re serious about winning.

The basics:

Every HUD home is assigned a “list price” based on a recent FHA appraisal. The first 15 days (sometimes longer) are reserved for owner-occupants, nonprofits, or government agencies This is the best window for regular buyers to avoid competing with cash investors.

After the exclusive period, unsold properties open up to all bidders, including investors.

During the exclusive period, HUD reviews offers daily. If your net bid meets or exceeds their minimum, they’ll accept it If not? No negotiation it’s simply rejected

Some buyers panic and think they need to bid in the first hour the home is listed. But here’s the truth: what matters isn’t speed it’s submitting a complete, realistic bid that meets HUD’s net.

Your offer should be:

Accurate all forms filled out correctly

Fully documented with your lender’s pre-approval letter

Competitive your bid amount needs to pencil out for HUD

Teaching Scenario: A Typical Example

Here’s how this plays out in real life

Imagine a young couple, first-time buyers in Moreno Valley. They find a HUD home listed at $315,000 in a neighborhood where similar move-in ready homes are selling for $340,000. The house needs a few cosmetic updates fresh paint, new carpet but nothing major

They figure they can save $25,000 by scoring this HUD deal. But instead of bidding close to list price, they submit an offer at $300,000, hoping to negotiate. They’re shocked when they find out a few days later that HUD rejected their bid no counter, no second chance. A week later, the exclusive period ends and an investor bids $315,000 full list — and wins it.

Moral of the story? Unlike a traditional listing, there’s no “lowballing and see what happens.” HUD wants an offer that meets their minimum net. If your number is too low, they simply move on.

The list price isn’t just pulled from thin air it’s based on a recent FHA appraisal. But that doesn’t mean it’s perfect. Your broker should run comps to see what similar homes have sold for in your neighborhood. If the list price is already 10%–15% below market, you might be wise to bid at or near asking.

This is the single biggest factor HUD won’t share their minimum net number publicly but an experienced HUD Buyer’s Broker can help estimate it. Your net bid is the total amount minus any buyer’s agent commission and seller-paid closing costs. For example, if you ask HUD to pay 3% of your closing costs, that reduces your net. Sometimes that alone can sink your bid if you’re on the margin.

Nothing sinks a bid faster than incomplete paperwork. Have your pre-approval letter, earnest money deposit, and signed forms ready before you submit your offer. Remember: your bid is legally binding

Too many buyers think they’ll be “smart” and wait until the last minute, so they don’t bid too high. In reality, your best shot is often in the first few days of the exclusive owneroccupant window. If you wait too long, you risk multiple owner-occupant bids being submitted all at once raising the competition. Your broker can watch the status and help you time your move.

HUD’s Property Condition Report (PCR) is your roadmap. If you see major issues roof damage, HVAC problems budget for them in your financing plan. Don’t assume you’ll get repairs or credits. There’s no post-acceptance negotiation with HUD. Your offer is for the property as-is.

Lowballing the Bid

No back-and-forth. One shot. Be realistic. Missing Paperwork

Incomplete forms, missing pre-approvals, or sloppy contracts mean rejection. Working with the Wrong Agent

Many agents aren’t HUD-registered. If they don’t have a NAID, they can’t submit your bid period.

HUD listings update constantly. A good buyer’s broker will check the Homestore daily and keep you informed about price reductions or new listings.

Q: What happens if two bids are identical?

A: HUD awards the offer with the highest net to HUD. If there’s still a tie, the earliest submitted bid may win. Timing matters.

Q: Can I renegotiate after HUD accepts my bid?

A: No. The property is sold as-is. Once your bid is accepted, your only option is to proceed or cancel under your contract contingencies.

Q: Can investors outbid me during the exclusive period?

A: No Investors can only bid after the exclusive owner-occupant window ends

Q: Will HUD accept cash offers first?

A: No. Cash offers don’t get priority over financed offers the winning factor is the highest acceptable net to HUD.

Does This Apply Outside SoCal?

Yes the sealed bid system works the same in all 50 states. Whether you’re buying in Riverside, Phoenix, or Atlanta, the key principles don’t change: meet the net, bid strong, and submit a clean, complete offer

Many successful HUD buyers save thousands by:

Understanding local comps

Using a trusted HUD Buyer’s Broker

Bidding realistically during the owner-occupant period

Having financing and paperwork lined up in advance

Pro Tip: How a HUD Buyer’s Broker Gives You the Edge

A licensed HUD Buyer’s Broker isn’t just a paper-pusher they understand how to:

Estimate HUD’s net minimum

Guide you on sealed bid strategies

Submit error-free offers

Watch for daily listing updates

Help you move quickly before the investor window opens Your Smart Bid Checklist

✅ Pre-approval letter and lender lined up

✅ Earnest money funds ready

✅ Review comps with your broker

✅ Read the Property Condition Report

✅ Submit your best realistic offer early in the exclusive period

✅ Track your bid status with your broker

Ready to Make a Winning Offer

Don’t let an avoidable mistake cost you a home that could build your future wealth. Bidding smart isn’t complicated but you do need an advisor who understands the system inside and out.

Scan the QR Code to schedule your free Winning HUD Bid Strategy Session.

• Learn exactly how the sealed bid system works in your market

• Get comps and net estimates before you offer

• See local listings before investors do

�� Prefer to learn at your own pace?

Scan the second QR Code to download my Mobile App your 24/7 hub for HUD REOs, calculators, and videos that show you exactly how to win your next bid.

The power is now. Let’s help you make a winning offer and get the keys to your new home, on your terms.

Eric Lawrence Frazier, MBA - Principal advisor

mortgage

When buyers think of FHA loans, they often imagine a basic starter home but not a foreclosure. That’s one of the biggest myths in the business. In reality, FHA 203(b) financing is the standard FHA loan that works beautifully with HUD-owned homes and it can help you get into a property for as little as 3.5% down.

In Riverside County and throughout Southern California, where housing prices have edged higher in recent years, this strategy is one of the smartest ways for buyers not investors to secure a good home at a lower price point with flexible qualifying guidelines.

Why FHA 203(b) and HUD Homes Are a Perfect

Here’s the simple truth: HUD homes exist because someone defaulted on an FHA loan. The property then goes back to HUD. But once it’s listed on the HUD Homestore, it’s still fully eligible for normal FHA financing just like any other resale home.

Unlike traditional foreclosure auctions, you don’t have to pay all cash. You don’t need a huge down payment. You don’t need to stress over complicated title problems. You just need to bid smart, get your financing lined up, and understand what the “as-is” condition means for your loan approval.

FHA 203(b): The Basics

The 203(b) is the official name for your standard FHA purchase mortgage. Here’s why it’s so popular and powerful when paired with a HUD REO:

Low Down Payment: Only 3.5% down if you qualify.

Flexible Credit: FHA allows higher debt-to-income ratios than many conventional loans

Owner-Occupant Focus: You must live in the home as your primary residence which fits perfectly with HUD’s goal to put homes in the hands of families, not flippers.

A Teaching Example: Riverside County Buyer at $600,000

Let’s walk through how this might look for a real buyer scenario.

Imagine you’re a first-time buyer in Riverside County. You find a HUD-owned home listed at $600,000, while similar turnkey homes in the neighborhood are selling for $650,000. The home needs minor cosmetic updates fresh paint, new flooring, nothing major You decide to buy with an FHA 203(b) loan.

Here’s the math:

Purchase price: $600,000

Down payment (3 5%): $21,000

Estimated closing costs: $12,000 (these can vary your lender can help estimate them)

Minor repairs/updates you plan to do: $8,000 out of pocket (since 203(b) doesn’t roll rehab costs in)

So you’re all in for about $41,000, instead of needing 10%–20% down plus updates. Bonus: Because the home is listed $50,000 below local comps, you’re starting with builtin equity once you make your cosmetic updates.

How the Process Works

Step 1: Get Pre-Approved

Work with a lender who does FHA loans every day. They’ll review your credit, income, and debts and confirm you qualify for 3.5% down.

Step 2: Find the Right HUD Home

Use the HUD Homestore website or let your HUD Buyer’s Broker send you daily updates. Remember, only HUD-registered brokers can submit your sealed bid.

HUD uses a sealed bid process no back-and-forth negotiation. If your bid meets HUD’s minimum net, they accept it. If not, you lose your shot until the next round.

HUD homes are sold as-is. HUD provides a Property Condition Report (PCR), but always get a professional home inspection too. This protects your loan approval and helps you budget for updates.

Your lender orders an FHA appraisal to confirm the home meets FHA’s basic safety and livability standards. Small cosmetic fixes are usually fine. Major issues (like structural damage) may require repairs or a different loan type.

Once your loan is approved, you sign closing documents, pay your down payment and closing costs, and get your keys!

Myth #1: FHA won’t lend on foreclosures

Truth: FHA 203(b) is designed to work with HUD REOs it’s the original default loan type.

Myth #2: I need perfect credit

Truth: FHA is flexible. Many buyers qualify with credit scores in the mid-600s (sometimes lower with strong compensating factors).

Myth #3: I can use 203(b) for major rehab work

Truth: If the home needs big repairs, you’ll likely want a 203(k) rehab loan instead 203(b) is best for move-in-ready or light fixers.

Myth #4: I have to pay cash to get the best deal

Truth: Cash doesn’t win automatically. HUD accepts the highest net offer, whether it’s financed or cash

Q: Can I combine 203(b) with down payment assistance?

A: Yes many local DPA programs work great with FHA. That means your true out-ofpocket could be even lower than 3.5% down.

Q: What if the house doesn’t pass the FHA appraisal?

A: FHA requires the home to meet basic health and safety standards. Small issues (like old paint or minor repairs) are usually fine. Major issues can sometimes be fixed before closing or financed with a 203(k) instead.

Q: Can investors use FHA 203(b)?

A: No this is only for owner-occupants. You must live in the property as your primary residence.

HUDUser.gov data shows hundreds of HUD homes sold in California each year go to buyers using basic FHA financing. In Riverside County, the median purchase prices are right in line with first-time buyer budgets especially when the average HUD REO is 10%–15% below comparable listings. That’s real savings plus manageable upfront costs.

• Submitting a lowball bid that doesn’t meet HUD’s minimum you’ll lose the deal outright.

• Skipping your own inspection the PCR is helpful but not a replacement for a full licensed inspection.

• Not budgeting for basic updates the 203(b) won’t cover rehab costs. Plan ahead for new carpet, paint, or appliances if needed.

HUD’s system is standardized in all 50 states. The same FHA 203(b) guidelines apply whether you’re buying in the Inland Empire, LA County, Arizona, or Georgia. The key difference is your local price point and how much repair cost you might need to budget.

Get pre-approved for FHA 203(b)

Work with a HUD Buyer’s Broker who can submit your bid

Check daily listings and move fast during the owner-occupant window

Read the PCR and order your own inspection

Budget your down payment + closing costs + any “as-is” repairs

Submit a realistic bid that meets HUD’s net

Ready to Make FHA Financing Work for You?

The truth is, you don’t need 20% down or perfect credit to own a home and you don’t have to settle for paying retail prices either. When you pair HUD’s discounted pricing with the low barrier of entry of an FHA 203(b), you open doors you might have thought were closed.

Scan the QR Code to schedule your free FHA + HUD Strategy Session.

• Learn exactly what you qualify for

• Find out how to combine DPA if available

• Get daily HUD listings that fit your budget

Prefer to run numbers first?

Scan the second QR Code to download my Mobile App your all-in-one tool for mortgage calculators, local listings, and educational videos that guide you step by step.

The power is now. Let’s open the door to your next home affordably, wisely, and confidently.

Eric Lawrence Frazier, MBA - Principal advisor

Real estate & mortgage | business | finance | CA DRE #01143484 - NMLS ID #461807

When most buyers hear “HUD home,” they think of programs for first-time buyers and families who plan to live in the property and they’re right, mostly. HUD’s mission is to get foreclosed homes back into the hands of owner-occupants. But what many people don’t realize is that HUD homes are open to investors, too — just not right away.

If you’re a first-time buyer or move-up buyer in Riverside County or anywhere in Southern California, you need to understand how investors play the game. Because when the 15day exclusive owner-occupant window closes, the competition changes overnight and cash buyers are ready to swoop in Knowing how they buy helps you act smarter and faster.

HUD sells foreclosed FHA properties in a structured way Every new listing starts with an exclusive listing period:

For most single-family homes, it’s the first 15 days.

During this window, only owner-occupants, nonprofits, and government agencies can submit bids.

No investors no flippers no outbidding by cash buyers with no intention of living there.

Once the exclusive window ends and the property hasn’t sold, investors can submit offers. HUD accepts the highest net bid, whether it comes from a homeowner or an investor

Why Investors Love HUD Foreclosures

Watch New Listings Daily: Great deals don’t last long. Work with your HUD Buyer’s Broker to check the HUD Homestore every day.

Bid Realistically: Investors don’t waste time lowballing and neither should you. Submit your strongest bid during the exclusive period

Have Financing Ready: You need a rock-solid pre-approval letter and proof of funds for your earnest money. If your offer is incomplete, HUD will reject it.

Understand HUD’s Net: If you ask for closing cost assistance, remember that lowers HUD’s net proceeds. Your broker can help estimate if your offer still meets HUD’s minimum

If you’re an investor, the rules are clear:

You can only bid after the exclusive owner-occupant period ends. You must use cash or investor financing no FHA owner-occupant loans

You cannot occupy the property to get around the rules that’s fraud.

Investor FAQ

Q: Can an investor submit a bid during the owner-occupant period if they plan to live there “later”?

A: No you must certify that you’ll occupy the home as your primary residence for at least 12 months. False certification is mortgage fraud.

Q: What loan types can an investor use?

A: Investors typically use conventional investor loans, private lending, or cash. FHA loans require owner-occupancy.

Q: How do investors calculate if a HUD home is worth it?

A: They compare the list price + repair costs + closing costs to the neighborhood’s afterrepair value (ARV) and expected rental income.

Many buyers think they’ll have time forever — but once the exclusive window closes, they face competition from investors who can close fast.

Underestimating the Sealed Bid

If you bid too low, HUD won’t counter. Investors know how to bid to win you should too.

Only a registered broker can submit your bid. Many general agents don’t know HUD’s process don’t risk it.

According to HUDUser.gov, about 70% of HUD homes in California are sold to owneroccupants but that means 30% still go to investors. In Riverside County, where median prices have grown steadily, more flippers and buy-and-hold investors are eyeing HUD homes every year. Acting smart during your exclusive window is your best move.

These rules hold true in every market from Riverside County to Phoenix to Atlanta. If there’s a HUD REO listed, the same system applies: owner-occupants first, investors later. Knowing how the timeline works is the key to staying ahead.

Work with a HUD Buyer’s Broker who’s NAID-certified

Check new HUD listings daily

Have pre-approval and funds lined up

Read the Property Condition Report and budget for repairs

Submit a realistic offer during the exclusive window don’t wait for day 16

Know your numbers: purchase price, repairs, ARV, rent potential

Have financing or cash lined up for a quick close

Work with a broker who understands investor timelines and bid strategies

Remember: you can only bid after the exclusive owner-occupant period ends

A lot of buyers miss out because they underestimate the competition waiting in the wings. The investor window opens on day 16 and your dream home can vanish overnight if you’re not prepared.

Whether you’re an owner-occupant who wants to lock in a great deal or an investor looking for your next opportunity, understanding how HUD’s timeline works is your best edge

Scan the QR Code to schedule your free HUD Buyer or Investor Strategy Session.

• Learn when to bid, how much to bid, and how to win

• Get daily local listings and real-time status updates

• Understand your options for financing and repairs

Want to compare numbers and learn on your own?

Scan the second QR Code to download my Mobile App your all-in-one tool for calculators, listings, and educational videos about buying HUD homes smartly.

The power is now. Don’t get left behind when the window closes let’s make your next move together.

Eric Lawrence Frazier, MBA - Principal advisor

mortgage

When you hear “HUD homes,” you might assume every real estate agent can help you buy one. But here’s the truth: HUD has its own system and its own rules.

Only brokers and agents with an active NAID number can legally submit bids on HUDowned foreclosures through the HUD Homestore. This is why working with a HUD Buyer’s Broker is so important and so misunderstood.

If you’ve ever wondered what makes a HUD Buyer’s Broker different from a regular agent or from a HUD Listing Broker this is your evergreen guide. Knowing the difference can save you time, money, and stress.

A HUD Buyer’s Broker is a licensed real estate broker or agent who has gone through the extra steps to register with HUD, maintain their annual NAID certification, and follow HUD’s strict bidding rules.

Only a broker with an active NAID (Name and Address Identification Number) can submit your sealed bid on a HUD foreclosure.

Think of your HUD Buyer’s Broker as your licensed guide through HUD’s unique buying process.

They can:

Find new listings on the HUD Homestore

Help you evaluate the Property Condition Report (PCR)

Explain the exclusive owner-occupant window

Prepare and submit your sealed bid electronically

Track the status, price changes, and re-listings

Walk you through escrow and closing with a HUD-approved title company

How Is This Different From a HUD Listing Broker?

This is where buyers often get confused.

A HUD Listing Broker is an exclusive broker HUD selects to list, market, and show specific HUD properties on behalf of the government

They work for HUD’s Asset Management contractor. Their job is to handle signage, open houses (where allowed), lockbox management, and getting the home sold according to HUD rules.

A HUD Buyer’s Broker is totally different:

They don’t work for HUD or get special deals they work for you, the buyer. They can represent you on any HUD listing in your area.

They have no exclusive inventory but have full access to submit bids.

They protect your interests, explain your bid options, and help you understand your contract responsibilities.

Key Point:

Just because you find a property listed by a HUD Listing Broker doesn’t mean you have to work with them directly. You can and often should bring your own HUD Buyer’s Broker to represent you.

Teaching Example: How This Works in Riverside County

Imagine you find a HUD home listed for $600,000 in Riverside County a good deal because similar homes in the area sell for $650,000. You call the number on the sign — that’s the Listing Broker.

Their job is to show you the property and help HUD sell it. But they might not explain all your local financing options, help you budget for repairs, or check daily for new listings that better fit your needs.

If you’re working with a dedicated HUD Buyer’s Broker, they’ll do the extra work:

Pull comparable sales so you know what the home is really worth.

Help you budget your total all-in costs: down payment, closing costs, and repairs. Walk you through the sealed bid process so you submit your strongest offer during the exclusive owner-occupant period

Watch the HUD Homestore daily for price drops or re-listings so you don’t miss out if a bid is rejected. Why the NAID Number Matters

HUD doesn’t just let anyone bid

Every broker or agent who wants to submit bids on the HUD Homestore must register, verify their licensing and insurance, and renew their NAID status regularly.

If your agent doesn’t have an active NAID, they simply can’t submit your bid no exceptions.

You could find your dream home but lose it because your agent didn’t follow the process.

Myth 1: “Any Realtor can help me buy a HUD home.”

Wrong. Only a NAID-registered broker or agent can legally submit your bid.

Myth 2: “I have to work with the Listing Broker.”

False. You can always bring your own Buyer’s Broker and you should if you want someone fully focused on your side of the table.

Myth 3: “The Listing Broker gets me a better deal.” Incorrect. HUD accepts the highest net offer not who submits it. A Buyer’s Broker helps you bid smart, not just fast.

Myth 4: “Working with a Buyer’s Broker costs more.”

Nope HUD pays the buyer’s broker commission as part of the sale, just like a traditional deal. Your representation comes at no extra out-of-pocket cost.

Real Benefits of Working with a HUD Buyer’s Broker

Insider Knowledge

We understand HUD’s sealed bid system, net proceeds, and daily status updates.

We watch for price reductions, extensions, or properties that go back on the market.

✔ Local Expertise

We know Riverside County and Southern California neighborhoods so you don’t overpay or overlook hidden costs.

✔ Trusted Referrals

Need an FHA lender, inspector, or contractor who understands HUD’s “as-is” nature? We’ve got you covered.

✔ Guided Strategy

We help you time your bid, budget for repairs, and keep you ahead of investor competition.

Q: Can I still use my lender if I have a Buyer’s Broker?

A: Absolutely. Your lender and your broker work together to get you pre-approved, submit your bid, and close on time.

Q: How do I know if an agent is HUD-registered?