WEB: www.ericfrazier.co

•Thepowerisnowmedia.com

•Alvin Magua

•Leonna

WEB: www.ericfrazier.co

•Thepowerisnowmedia.com

•Alvin Magua

•Leonna

• What is Politics?

• Legal Disclosure Requirements for Sellers in Palm Springs

• Leveraging Market Duration in Negotiations: A Seller's Guide in Palm Springs

• Understanding Fees and Penalties for Early Mortgage Payoff in Palm Springs

• Understanding Disclosure Obligations in "As Is" Property Sales in Palm Springs

• The Influence of International Buyers on the Palm Springs Market

• Understanding Buyer Motivations: Why People Choose Palm Springs as Their Home Base

• Assessing Long-Term Value: What Makes a Property Appreciate?

• The Importance of Landscaping Choices in Enhancing Property Appeal

• Understanding How Climate Adaptation Strategies Are Influencing New Developments

• Assessing the Viability of Co-Ownership Models for Luxury Homes in Palm Springs

Real Estate RoundTable - Interview

Johnathan Hughes CEO of Five Star

Global - Part 1

Real Estate RoundTable - Interview

Johnathan Hughes CEO of Five Star

Global - Part 2

Real Estate RoundTable - Interview

Johnathan Hughes CEO of Five Star

Global - Part 3

Market Update With Mike Harrison

Part 1

Market Update With Mike Harrison

Part 2

The Power Is Now Media News

Correspondent Program

By Eric Lawrence Frazier, MBA | Editor-in-Chief, HUD Magazine

April is more than a month it’s a movement Across the country, housing advocates, government leaders, nonprofit organizations, and everyday citizens take this time to honor Fair Housing Month, commemorating the passing of the Fair Housing Act of 1968 Over 50 years later, the battle for equity in housing continues, shaped by evolving policies, persistent disparities, and the daily realities facing millions of Americans.

At HUD Magazine, our mission is not only to inform but to inspire. To highlight opportunities, reveal challenges, and champion the belief that housing is a human right. In this special April edition, we turn our focus to California, where HUD homes foreclosed properties insured by the Federal Housing Administration (FHA) represent one of the most overlooked avenues for affordable homeownership, community revitalization, and wealth-building.

The Promise of Fair Housing

The Fair Housing Act was born out of protest and hope Signed into law just days after the assassination of Dr. Martin Luther King Jr., it was a clear response to decades of discriminatory practices that had locked Black families and other marginalized groups out of homeownership. It outlawed redlining, restrictive covenants, and the refusal to rent or sell housing based on race, religion, national origin, sex, or family status. Over time, protections have expanded to include disability, gender identity, and sexual orientation.

But laws are only as strong as their enforcement. In 2025, we find ourselves at a crossroads. The Trump administration, under HUD Secretary Sean Boyd Turner, has terminated the Affirmatively Furthering Fair Housing (AFFH) rule, a 2021 regulation that required municipalities to assess and address segregation in order to receive federal funding. In parallel, HUD has begun canceling contracts with nonprofits engaged in housing equity and DEI (Diversity, Equity, Inclusion) work shifting the focus of the agency toward deregulation and local control

These actions raise urgent questions What happens when federal oversight is reduced? What is the role of HUD-funded housing counseling centers, many of which serve first-time buyers navigating complex systems? And who benefits when fair housing enforcement is weakened?

These are not abstract debates they have real consequences for real people. That’s why this magazine exists: to track these changes, understand their impact, and serve as a watchdog for the policies shaping our neighborhoods.

In California, where housing affordability remains one of the state s most pressing concerns, the HUD Homestore is an underutilized tool. As of this month, there are dozens of HUD-owned properties listed across the state spanning major metros like Los Angeles, San Diego, Fresno, Sacramento, and the Inland Empire. These properties, once FHA-insured homes lost to foreclosure, are now available at deeply discounted prices often below market value

�� HUD Listings – California: https://www.hudhomestore.gov/searchresult?citystate=CA

These listings are a gateway to homeownership particularly for first-time buyers, working families, veterans, and investors committed to rebuilding neighborhoods. With low down payment requirements, repair escrow financing, and priority bidding periods for owner-occupants, HUD homes offer a pathway to stability in a time of uncertainty

According to the October 2024 Foreclosure Market Report by ATTOM Data Solutions, California ranked among the top three states for foreclosure starts, with 2,915 new cases in a single month Metro areas like Riverside (1 in every 1,978 homes) and Fresno (1 in 2,257) saw alarming activity. This trend reflects growing economic strain but also presents an opening for those ready to act.

�� Source: ATTOM Data – Foreclosure Market Report https //www attomdata com/news/mostrecent/october-2024-foreclosure-market-report

As real estate professionals and advocates, we must not only monitor these trends we must educate the public about the opportunity HUD homes represent. These aren’t just buildings they’re building blocks for generational wealth

Our role at HUD Magazine is clear:

To bring awareness to the inventory of HUD homes available for sale

To highlight the incredible opportunities they represent for first-time homebuyers, investors, and nonprofits

To track and analyze HUD policy changes including those from the Trump administration that impact housing access, counseling, and funding

And to provide real estate professionals, buyers, and community leaders with tools, insights, and truth in an ever-shifting market

We are not here to sell you a dream we are here to equip you with facts so you can chase it for yourself. We believe that the American Dream is still alive, but it must be defended, redefined, and made truly accessible to all.

Fair Housing Month comes amid shifting policies Deregulation may empower some but leave others behind, as cuts to DEI grants and housing counseling heighten risks for vulnerable families. Stay vigilant ask officials about Fair Housing plans, support local organizations, and use your platform to uplift, not exclude

�� HUD Press Office: https://www hud gov/press

�� NAR Fair Housing Month Resources: https://www.nar.realtor/fair-housing/fair-housing-month

�� Politico: “Trump scraps Biden-era fair housing rule”

https //www politico com/news/2025/02/26/trump-scraps-fair-housing-initiative-00206274

�� Associated Press “Administration to slash funding for fair housing enforcement”

https //apnews.com/article/d0c6e3b4b030787a1f60a7dc153153dd

Whether you’re a buyer, broker, policy analyst, or just someone who believes in equity, I hope this issue speaks to you. It’s not just about data it’s about people. It’s about families who dream of a front porch. Veterans looking for stability. Investors rebuilding blighted blocks. And everyday Americans trying to reclaim their place in the housing market

Thank you for reading. Thank you for believing. And thank you for standing with us as we celebrate Fair Housing Month, spotlight California HUD homes, and monitor the state of housing justice in 2025

C A L I F O R N I A

H U D L I S T I N G

Let’s be real You’ve probably found a few homes you like online, even if we haven’t chatted about them yet.

But here’s the thing: You can’t control when the right home shows up – but you can be ready for it

Truthfully, if you’re just browsing, you should still get pre-approved.

Even if you’re not ready to buy right now, that’s okay. Let’s just have a conversation to make sure youre set up for success when the right one comes along

What’s one of the smartest things you can do even before youre ready to buy? Get pre-approved.

While it may sound like something you can wait and do until after you’re serious, waiting too long is a mistake

Doing this essential step early on gives you clarity on what you can borrow, your realistic price range, and what your future monthly payment could be. When you know your numbers – and you’ve been cleared financially by a lender – you can act quickly when the right home hits the market

Even if you’re just thinking about looking or casually starting a search, DM me and let’s chat. This way, you’re not falling in love with homes that are outside of your price range – or missing out on ones that aren’t

Do you think the housing market is about to crash? The experts (and the data) say otherwise

Home prices are still rising at the national level, just not as fast as they were in recent years. And that’s not a sign of a crash. It’s a sign of more balance.

As more homes hit the market, buyers have more options, and that slows down how quickly prices rise It’s not falling prices It’s a healthier pace of home price growth. How does knowing prices are still rising, but more slowly, affect the way you’re thinking about your next move?

So far, the average individual tax refund this year is $3,170. Of course, your number may be different

But, if you’re getting a refund this year, you could use it to help with some of the upfront costs of buying a home, like your down payment or closing costs.

Because every dollar gets you one step closer to your goal – and your refund could give your homebuying savings an extra boost What would having your own home mean for you or your family this year?

It's peak homebuying season, and that could mean more competition for you

If you’re ready for a home you’ll love, don’t just hope for the best. Work with an agent who can help you make a strong, smart offer that stands out. They know simple strategies to boost your chances based on what’s working for other buyers in your area

What’s one thing you’d want to know before making an offer on a home?

While you may be tempted to skip the home inspection to try to make your offer stand out this spring, just know that’s a gamble that may not pay off Even though a home might seem move-in ready, an inspection could uncover underlying problems you didn’t see in your walk-through. And information is power.

It helps you avoid unpleasant surprises Plus, if any issues are found, your agent can help you negotiate with the seller on the repairs

What questions do you have about what to expect from an inspection?

Retirement should feel like freedom, with more time for travel, hobbies, and spoiling your grandkids. But with the cost of living up 23% in just the last five years, you also need to make sure your savings will support the lifestyle you’re dreaming about

If your current home feels too big, too expensive, or not quite right for what’s next, downsizing or relocating could help you stretch your dollar further and create space for what really matters.

What would make this next chapter feel like your best one yet? Let’s talk about how a move could help make it happen.

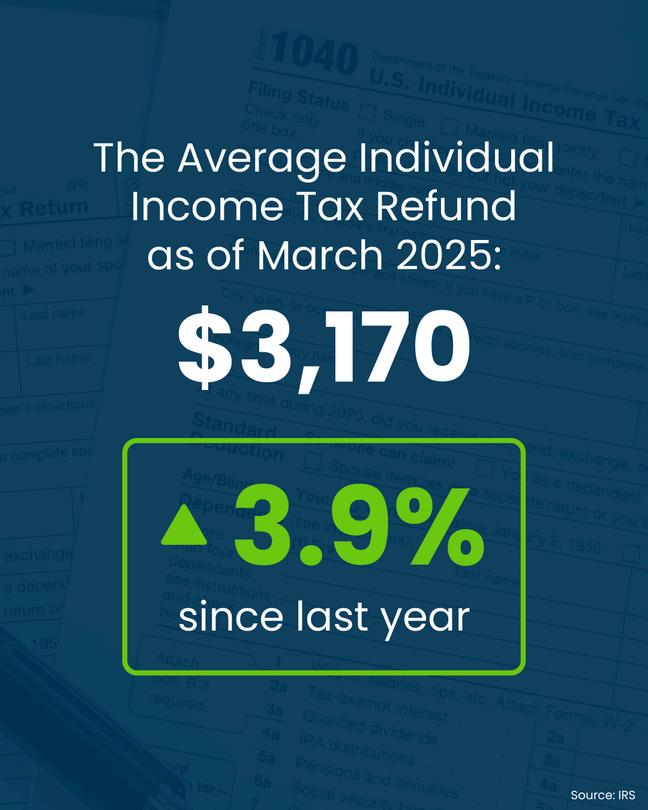

No matter what you may be hearing or seeing online, the fact that new construction has ramped up lately isn’t cause for alarm Here’s why Nationally, builders aren’t overbuilding – they're just catching up.

Coming out of the housing crash, builders pulled production way back, and that led to a long period of underbuilding You can see that in this data So, even though we’re building more homes right now than we have in the last few years, there’s still a significant gap to make up after not building enough homes for over a decade.

But like anything else in housing, this varies by area Some places will have more newly built homes, and others will have fewer Want to know what’s happening in our local market?

House hunting just got a little easier.

You have more homes to choose from – and that’s a big change after years of really low inventory. And the best part? The number of homes that have just been put on the market is picking up, giving you additional fresh options and a better chance of finding a home that fits your needs. Whether you’re buying your first home or thinking about a move, now’s a great time to kick off your search

What features or neighborhoods are at the top of your wish list right now?

Overpricing your house could cost you more than you think. Data shows the longer a house sits, the less it sells for And here’s why If a house is priced at or just below market value, it typically sells quickly But if a house is priced too high, it lingers.

As time wears on, it's more likely you’ll have to accept a lower offer, or you’ll need to make a price cut to draw buyers back in And that’s not the experience you want Want to make sure your home sells quickly and for the best price?

Let’s talk. With an agent’s expertise on your side, it’s easy to price it right.

Are you feeling frustrated by the lack of options in your price range? Here’s some advice. Check out townhomes. Because they’re usually smaller, they can be more affordable, too And there are more hitting the market than we’ve seen in years That gives you more options, potentially in your price point

So, let’s chat if you want to see if this type of home would make sense for you and your lifestyle.

In the meantime, let me know: what matters most to you? Space, location, or price?

Recession talk is heating up – but what does that mean for housing? Here’s what historical data tells us.

If a recession happens, many people assume home prices will crash like they did in 2008 But history tells a different story

In 4 of the last 6 recessions, home prices actually went up. That means 2008 was the exception, not the rule. During recessions, prices usually follow whatever path they’re already on. And, right now, prices are still rising nationally.

How does knowing home prices haven’t typically dropped in past recessions change the way you think about buying or selling?

While we’re still below pre-pandemic inventory levels, the number of homes with a for-sale sign in the yard is going up by the day And breathe a little sigh of relief, because they’re taking a few days longer to sell, too.

Not only does that give you more choices when you move, it means you have more time to make thoughtful decisions while you’re at it And oh, by the way –there will be demand for your house when you move because buyers are heating up right now. Win. Win. So, if you pressed pause on your search last year because you couldn’t find the right fit, this could be your moment to start looking again.

What will it take to reignite your home search? Let me know, and we’ll make it a priority.

On average, homes are staying on the market about a week longer than they did at this time last year. And in real estate, those few extra days can be gamechanging. More time means more space to list your home, find your next one, and make smart decisions without the rush.

And yes, well-priced homes are still selling quickly The market’s cooling just enough to be the sweet spot you’ve been waiting for: less chaos, more control, and solid demand.

Want to know how many days it takes to sell a home in our market?

With more homes for sale, some sellers are coming around to the idea of concessions

From adjusting the price to helping with closing costs, throwing in a home warranty or appliances, even giving you credit so you can make repairs, sellers may be more willing to compromise But making sure you know how to ask and what to ask for is key That's why it’s important to have the right agent by your side.

Which concession would make the biggest difference for you? Let me know, and we’ll factor that into your home search

Spring is here, and so is the busiest season in real estate That means competition may be picking up If youre thinking about buying a home, here’s what you can do about it. Get pre-approved for your home loan before you even start house hunting. It helps you know your budget and will make your offer look stronger for sellers.

Reach out to a lender to make sure you’re ready when you find the one Waiting too long to get your pre-approval could mean the perfect home slips away.

What’s your plan to stand out in this competitive spring market?

Let’s get something clear right from the start: I am not running from politics I’m running to it. Why? Because you can’t talk about faith, family, or finance without talking about the invisible (and sometimes very visible) hand of politics. It is woven into every decision we make, every policy we follow, and every freedom we enjoy or fight for

Politics isn’t just about who holds office or what party you check on a ballot. It’s about the rules that govern how we live together. It’s about leadership It’s about vision It’s about the collective will of a people and what we choose to elevate, enforce, or ignore Politics is not just in Washington it’s in your wallet, your worship, and your way of life.

So what is politics?

At its core, politics is the organized conversation of values what we, as a society, choose to protect, promote, and pass on. It’s about power, yes, but not just the kind that dominates. It’s about the power to influence, to shape culture, to guide laws, to decide which voices are heard and which are silenced. It’s the debate between competing ideas about the good life, and whose vision of that life gets to lead

That’s why I believe politics must be addressed head-on in Faith, Family, Finance Not as a separate section, but as a thread woven into all three. Because let’s be honest: every meaningful issue in our lives has political implications. And pretending otherwise doesn’t make you more spiritual, more focused, or more faithful. It just makes you less informed and more vulnerable.

Let’s start there Faith has always had a political dimension Jesus didn’t die of old age He was executed by the state. The prophets of old challenged kings and spoke truth to power. The early church clashed with Rome not because they were unruly citizens, but because they believed in a higher authority. Faith shapes conscience, and conscience challenges systems.

Today, your ability to pray at work, your right to religious freedom, your freedom to gather and worship these are all political privileges. When legislation threatens them, that’s not “just politics” that’s personal That’s spiritual So if your faith means anything at all, it should inform how you engage with the world around you, including the political structures that shape it.

Politics in Family

What about family? Oh, there’s politics there, too front and center

Who defines marriage? Who determines parental rights? Who controls what’s taught in schools, what children are exposed to, and whether a child is protected or left behind? All of these are political questions The state has always had its hands on the family in good ways and in bad From child tax credits to foster care systems, from housing policies to healthcare laws, Politics isn’t just on the news. It’s at your kitchen table

So yes, if we are going to be good stewards of our families, we must be aware of the political decisions being made in our name. Ignorance isn’t an option. Silence isn’t protection. And disengagement is a luxury we can no longer afford

And now, to the one everyone feels most directly, it s money Finances

Your paycheck is political So is your mortgage rate So, can you start a business, invest in real estate, buy insurance, or even retire with dignity? Who controls interest rates? Who regulates the banks? Who bails them out when they fail, and who gets left holding the bag? Those are political decisions They shape the economy you live in and the opportunities available to you.

If you are a working person trying to build generational wealth, politics is already in your portfolio. Tax policy, inflation, student loans, healthcare premiums, rent prices, zoning laws it’s all political And guess what? The less we pay attention, the more we pay in other ways. I’ll keep writing about these things: understanding the game is the first step in winning it

Let me say this clearly: I’m not here to preach partisanship I’m not red I’m not blue I’m Eric I am a believer, a father, a husband, a businessman, a consultant, and a citizen. I serve no party. I serve truth, wisdom, and what works My loyalty is to people and principles not platforms

Politics has become a dirty word for many people because we’ve allowed it to become synonymous with corruption and division. But that’s not politics’ fault that’s our fault. We abandoned the space, and now we’re surprised when others fill it with nonsense I say it’s time we took it back

Let us return to a vision of politics that is not just about fighting for power but fighting for purpose Politics is not just about elections but values about caring enough to speak up, show up, and shape the world we leave behind

In This Magazine

That’s why every Faith, Family, and Finance issue will include stories and insights that intersect with political realities. Not to stir up division but to stir up awareness. Not to polarize but to prepare. You’ll see it in articles about economic policy, public education, housing justice, financial equity, and the spiritual implications of legislation. You’ll read commentary on how political decisions ripple through your faith, family, and finances whether you vote or not

This isn’t a political magazine It’s a life magazine But life is political And if we’re going to live it fully, we need to understand how the systems around us work and how we can work within them to protect what matters most

So, no, I’m not running from politics I’m running to it with my Bible in one hand, a calculator in the other, and my family right behind me.

S Selling a home is a significant milestone, but it comes with responsibilities, especially when it comes to legal disclosure

In Palm Springs, like many other parts of California, sellers are required by law to disclose certain information about their property to potential buyers. This process is not just a formality; it’s a crucial step in ensuring transparency and building trust between the seller and buyer. Understanding what must be disclosed can prevent legal issues down the line and help facilitate a smoother transaction. In this article, we’ll explore the specific legal disclosure requirements for sellers in Palm Springs, shedding light on what information must be shared and why it matters.

At the heart of legal disclosures in Palm Springs are material facts—information that could influence a buyer’s decision to purchase or affect the property’s value or desirability. Sellers are obligated to disclose any material facts about the property, including any issues that might not be immediately visible. This can range from structural defects to past pest infestations. For instance, if the property has a history of flooding, or if there are cracks in the foundation, these are considered material facts that must be disclosed.

In California, one of the primary documents used to fulfill disclosure obligations is the Transfer Disclosure Statement (TDS). This form is mandatory for most residential property sales and requires the seller to answer a series of questions about the condition of the property. The TDS covers a wide array of topics, including the condition of the roof, plumbing, electrical systems, and the presence of any environmental hazards. It’s essential for sellers to fill out this form accurately and thoroughly, as any omission or misrepresentation can lead to legal consequences.

Another important document in the disclosure process is the Natural Hazard Disclosure (NHD). Palm Springs, with its unique geographical features, requires sellers to inform buyers if the property is located in a designated natural hazard zone, such as a flood zone, earthquake fault zone, or a high fire hazard area. This disclosure is vital for buyers to assess potential risks and make informed decisions about purchasing a property in these areas.

Beyond the TDS and NHD, there are other disclosures that sellers in Palm Springs may need to provide, depending on the specifics of the property For example, if the home was built before 1978, federal law mandates that sellers disclose any known presence of lead-based paint. Sellers are also required to disclose if the property is located in a Mello-Roos district, which may result in additional taxes. If the home has been the site of a death within the past three years, this too must be disclosed under California law.

Failing to disclose the required information can have serious repercussions. If a buyer discovers undisclosed issues after the sale, the seller could be held liable for damages This could result in costly legal battles, financial compensation, or even the rescission of the sale. Therefore, it’s in the seller’s best interest to be as transparent as possible during the disclosure process.

Understanding and adhering to legal disclosure requirements is essential for any seller in Palm Springs. Not only does it protect you from potential legal troubles, but it also fosters a trustworthy relationship with your buyer. By being open about your property’s condition, you help ensure a smoother transaction and a more satisfied buyer.

If you’re cons dering selling your home in Palm Spr ngs, don’t nav gate the disclosure process alone Contact Brandy Nelson at 760-592-1571 or visit our website at (Understanding and adhering to legal disclosure requ rements s essential for any seller in Palm Spr ngs Not only does t protect you from potent al legal troubles, but it also fosters a trustworthy relationship with your buyer By being open about your property’s condition, you help ensure a smoother transaction and a more satisfied buyer.) for expert guidance. Our team will ensure you meet all legal requirements, helping you avoid pitfalls and successfully close your sale

The best week to list your house this year is just around the corner, and if you want to make the most of it, now’s the time to start prepping

With just a few weeks to go, I can help you focus on tasks that’ll make the biggest impact in the shortest time. What’s one thing you’d need to do before you’d feel ready to list?

The spring market is already in full swing And right now, we’re seeing:

More homes for sale. Slower price growth. Stabilizing mortgage rates. And more buyers.

And if you’re thinking about buying or selling this season, I’d love to explain what this means for your move How do you think these shifts could impact your plans to buy or sell this spring?

wwhen it comes to selling your home in Palm Springs, negotiation strategies can make or break a deal

One underutilized yet powerful tool in a seller’s arsenal is the duration a property has been on the market. By understanding and strategically leveraging the market duration, sellers can create favorable outcomes during negotiations, aligning with both personal objectives and current market trends

In the Palm Springs real estate market, where demand and supply can fluctuate significantly, the duration your property has been listed can send strong signals to potential buyers. Whether your home has been on the market for just a few days or several months, understanding how to use this information strategically can provide you with an edge during negotiations

As the market shifts, with some homes lingering longer due to higher interest rates and reduced affordability, buyers become more observant of listing durations. Sellers who know how to frame this aspect of their property can turn what might seem like a disadvantage into a compelling negotiating point.

Making Market Duration

In the world of real estate, every detail counts, and market duration is no exception. Whether your property is fresh on the market or has been available for a while, understanding how to use this information to your advantage can lead to more successful negotiations. By staying informed and flexible, sellers in Palm Springs can turn the market duration into a powerful tool, ensuring that both they and their buyers walk away satisfied

If your property has been on the market for an extended period, it can be tempting to see this as a negative. However, this duration can be reframed as a testament to your flexibility and willingness to negotiate Buyers may perceive a longer market duration as an opportunity to secure a better deal, which you can use to draw them into negotiations. For instance, by offering concessions like paying for closing costs or agreeing to a quicker closing timeline, you can make your listing more attractive.

Understanding current market trends is crucial. For instance, the Palm Springs market has seen a slight slowdown, with homes staying on the market longer due to economic factors like rising interest rates. By aligning your strategy with these trends, you can set realistic expectations for buyers If the average days on the market have increased, emphasizing that your property’s duration aligns with these trends can reassure buyers that the listing is not stale but rather a reflection of broader market conditions

For homes that have just been listed, the urgency can be leveraged to create a sense of competition among buyers A new listing in a market with limited inventory can be positioned as a rare opportunity. Conversely, for homes with longer durations, you can frame the extended time on the market as a benefit, indicating that the property has been wellmaintained and carefully considered by many buyers, making it a trustworthy investment.

Sellers who are informed about their market conditions can significantly enhance their negotiation strategies. Understanding why some homes sell faster while others take longer helps in adjusting the listing price or offering incentives For example, properties that have been on the market for a longer time might need minor adjustments in pricing or additional marketing efforts to refresh interest

In Palm Springs, where the market can shift due to seasonal factors and broader economic conditions, sellers who are proactive about using market duration to their advantage are more likely to achieve their desired outcomes Knowing when to stand firm and when to offer concessions based on how long your property has been listed can make all the difference

Ready to sell your home in Palm Springs and maximize your negotiation potential? At Brandy Nelson Associates, we bring our vast real estate experience to the table, helping you navigate the market with confidence. Visit us at (https //brandynelson.com/) or call 760592-1571 to start your journey towards a successful sale today

At Brandy Nelson Associates, we leverage vast real estate experience to offer precise and insightful information, making your market navigation both confident and informed.

Understanding Fees and Understanding Fees and Penalties for Early Mortgage Penalties for Early Mortgage Payoff in Palm Springs Payoff in Palm Springs

In California, state laws provide certain protections for borrowers regarding prepayment penalties. According to California Civil Code § 2954.9, for loans secured by owner-occupied residential real property containing four units or less, borrowers are generally entitled to prepay their loans at any time. However, lenders may impose prepayment charges under specific conditions:

Timeframe: Prepayment penalties can only be applied if the prepayment is made within the first five years of the loan's execution.

Penalty Limits: Borrowers can prepay up to 20% of the original principal amount in any 12month period without incurring a penalty. For any amount prepaid beyond this 20% threshold, the prepayment charge cannot exceed six months' advance interest on the excess amount.

It's important to note that these provisions apply to specific types of loans, and certain exemptions may exist. For instance, different rules may apply to loans secured by deeds of trust or mortgages given back to the seller by the purchaser on account of the purchase price.

Lenders rely on the interest payments from loans as a primary source of revenue. When a borrower pays off a loan early, the lender misses out on the anticipated interest income. Prepayment penalties serve as a form of compensation for this lost revenue. Additionally, these penalties can act as a deterrent against refinancing during periods of declining interest rates, ensuring that lenders maintain a stable income stream.

aying off your mortgage ahead of schedule can be a strategic move toward financial freedom.

However, it s essential to understand the potential fees and penalties that may accompany early mortgage payoff, especially in regions like Palm Springs. By comprehending how these charges are calculated, the reasons behind their existence, and strategies to mitigate them, homeowners can make informed decisions that align with their financial goals.

A prepayment penalty is a fee that lenders may charge borrowers for paying off all or part of their mortgage loan before the scheduled term. These penalties are designed to compensate lenders for the interest income lost due to the early repayment The specifics of prepayment penalties, including their applicability and calculation, can vary based on the loan agreement and state regulations.

Homeowners looking to pay off their mortgages early can consider the following strategies to minimize or avoid prepayment penalties: Review Loan Agreements Carefully Before finalizing a mortgage, thoroughly examine the loan documents to understand any prepayment penalty clauses. Being aware of these terms upfront can help in planning future financial decisions 1. Negotiate Terms with Lenders: Some lenders may be open to negotiating the terms of prepayment penalties It's advisable to discuss this aspect during the loan origination process to seek more favorable conditions. 2.

Utilize Penalty-Free Prepayment Allowances: As per California law, borrowers can prepay up to 20% of the original principal amount annually without incurring penalties Strategically planning prepayments within this limit can reduce the overall interest paid without triggering penalties. 3 Consider Loan Refinancing Options: If prepayment penalties are substantial, exploring refinancing options with more favorable terms and lower or no prepayment penalties might be beneficial. 4.

Understanding the nuances of prepayment penalties is crucial for homeowners aiming to achieve financial flexibility through early mortgage payoff In regions like Palm Springs, being informed about state-specific regulations and the terms of your loan agreement can empower you to make decisions that align with your financial objectives By proactively addressing potential penalties and employing strategic approaches, you can navigate the complexities of early mortgage payoff effectively.

hen buying a property sold "as is," it’s vital to understand the disclosure obligations of the seller. An "as is" sale means the buyer agrees to purchase the property in its current condition, without expecting repairs or improvements.

However, this does not exempt the seller from their legal responsibility to disclose known material defects that could affect the property's value or desirability. Understanding these obligations is critical to ensure a smooth and transparent transaction for both buyers and sellers.

In an "as is" transaction, sellers must disclose known material facts that could impact a buyer’s decision to proceed with the purchase. These disclosures typically include issues such as structural damage, faulty plumbing or electrical systems, roof leaks, or the presence of mold or hazardous materials. Failure to disclose such information even in an "as is" sale can lead to legal consequences, including claims of misrepresentation or fraud.

It’s important to note that disclosure laws vary by location, but sellers are generally required to provide a standardized disclosure form outlining any known defects. This legal safeguard ensures buyers are informed about the property's condition, enabling them to make educated decisions.

A common misconception among sellers is that selling a property "as is" eliminates the need for disclosures. This is not true. Sellers must still disclose known defects, and failing to do so can result in lawsuits.

For buyers, one pitfall is assuming that purchasing an "as is" property means they have no recourse if undisclosed problems are discovered later. If a seller intentionally withholds information about a defect, the buyer may have grounds to pursue legal action. This makes understanding the legal framework of disclosures critical in these transactions

Buyers must exercise due diligence when considering an "as is" property. This begins with hiring a professional home inspector to thoroughly evaluate the property’s condition. Review the seller’s disclosures carefully, and don’t hesitate to ask questions about any concerns.

Buyers should also consider purchasing owner’s title insurance, which protects against potential title issues that might not be apparent during the sale process Additionally, consulting with a real estate attorney can help ensure all legal bases are covered.

While "as is" property sales may seem straightforward, disclosure obligations remain a critical aspect of the process. Sellers must be transparent about known defects, and buyers must approach these transactions with caution and diligence. By understanding these responsibilities, both parties can avoid disputes and ensure a fair and successful deal

If you’re buying or selling an "as is" property, Brandy Nelson Associates can guide you every step of the way. Visit https://brandynelson.com, email us at brandy@brandynelson.com, or call (760) 238-0552 for professional real estate assistance tailored to your needs.

Avoiding Title Pirates: What Every Homebuyer Needs to Know Investopedia Retrieved January 21, 2025, from https://www.investopedia.com/avoiding-title-pirates-8758908

Disclosure Guidelines: What Should I Disclose When Selling My House? Kring & Chung Attorneys LLP. Retrieved January 21, 2025, from https://www.kringandchung.com/news-eventspublications/publications-8/disclosure-guidelines-what-should-i-disclose-when-selling-myhouse-news/

Despite the allure of Palm Springs, international buyers encounter several challenges:

TThe Palm Springs real estate market has long been a magnet for international buyers, whose investments have significantly influenced local property dynamics.

Understanding the trends, challenges, and opportunities associated with global investment is crucial for residents and stakeholders in the area.

Nestled in the Coachella Valley, Palm Springs is renowned for its stunning landscapes, favorable climate, and vibrant cultural scene. These attributes have not only attracted domestic buyers but also piqued the interest of international investors seeking vacation homes, rental properties, or secure real estate investments The influx of foreign capital has played a pivotal role in shaping the local housing market, influencing property values, availability, and community demographics. This article explores the impact of international buyers on Palm Springs' real estate, highlighting current trends, potential challenges, and emerging opportunities

International buyers have consistently contributed to the Palm Springs real estate market. Notably, Canadian investors have been prominent, drawn by the region s appealing climate and lifestyle According to data, foreign buyers, largely from Canada, represent 14% of remote owners in the area. Additionally, a significant portion of remote owners, approximately 67.8%, come from other California cities, with the state closest in sales to California being Washington at 6%.

The preference among international buyers often leans towards attached homes, with 73.6% of such properties being remotely owned. This trend underscores the appeal of low-maintenance properties that can serve as vacation homes or rental investments.

Currency Fluctuations: Variations in exchange rates can affect purchasing power, making real estate investments more expensive or less predictable Regulatory Hurdles: Navigating local real estate laws, taxation policies, and ownership regulations requires due diligence and often professional assistance.

Market Dynamics: The Palm Springs real estate market has shown signs of cooling, with average home prices dropping 9% compared to the previous year. This shift towards a buyer's market, characterized by increased inventory and longer selling times, can influence investment decisions.

Despite these challenges, Palm Springs offers several opportunities:

Favorable Market Conditions: The recent cooling of the market, indicated by a 9% drop in average home prices, presents potential bargains for buyers ready to invest.

Rental Income Potential: The city's popularity as a tourist destination ensures a steady demand for short-term rentals, providing a lucrative income stream for property owners.

Long-Term Appreciation: Despite short-term fluctuations, Palm Springs' real estate has historically appreciated, offering potential long-term gains.

International buyers have undeniably left an indelible mark on Palm Springs' real estate landscape. Their investments have contributed to the area's growth and diversity, shaping market trends and property values. While challenges exist, the opportunities presented by the current market dynamics make Palm Springs an attractive destination for global investors. For residents and stakeholders, staying informed about these influences is essential to navigate and thrive in the evolving real estate environment.

If you're considering exploring the Palm Springs real estate market, whether as a buyer, seller, or investor, Brandy Nelson Associates is here to assist you With our deep local expertise and commitment to client satisfaction, we can help you navigate the complexities of the market to achieve your real estate goals. Visit our website at https://brandynelson.com/, email us at brandy@brandynelson.com, or call us at (760) 238-0552 to get started today.

From an economic perspective, Palm Springs offers several benefits. The city boasts lower property taxes compared to other major cities in the state, making homeownership more accessible and financially attractive. This aspect is particularly appealing to retirees and individuals seeking a cost-effective yet highquality lifestyle.

Additionally, the cost of living in Palm Springs is relatively lower than in other metropolitan areas, allowing residents to enjoy a comfortable lifestyle without the financial strain often associated with larger cities The availability of quality healthcare facilities, such as the Desert Regional Medical Center and Eisenhower Health, further enhances the city's appeal, especially for retirees.

PPalm Springs has long been a sought-after destination, not just for vacationers but also for those seeking a permanent residence.

Understanding the motivations behind this choice offers valuable insights into the city's unique appeal. This article explores the key factors driving individuals to establish Palm Springs as their primary home, focusing on lifestyle preferences, economic advantages, and distinctive community offerings

One of the most compelling reasons people choose to reside in Palm Springs is its exceptional climate. With over 350 days of sunshine annually, residents enjoy a plethora of outdoor activities year-round. The city s natural beauty, framed by the San Jacinto and Santa Rosa mountains, provides a stunning backdrop for daily life. Outdoor enthusiasts can indulge in hiking, biking, and golfing, taking full advantage of the scenic surroundings.

Moreover, Palm Springs is renowned for its mid-century modern architecture, attracting those with an appreciation for design and aesthetics. The city s commitment to preserving this architectural style ensures a unique and visually appealing environment for its residents.

Palm Springs is celebrated for its inclusive and diverse community. With one of the highest per-capita LGBTQ+ populations in the nation, the city fosters a welcoming atmosphere for all. Numerous LGBTQ+-owned businesses, events, and organizations contribute to a vibrant social scene, promoting a strong sense of belonging among residents.

The city s cultural landscape is equally rich, hosting annual events like the Palm Springs International Film Festival and Modernism Week. These events, along with local galleries, theaters, and live music venues, ensure a dynamic and engaging environment for residents.

In conclusion, the decision to make Palm Springs a primary residence is influenced by a combination of favorable lifestyle factors, economic benefits, and a supportive community environment. The city's sunny climate, architectural charm, and inclusive culture create a compelling case for those seeking a new place to call home.

If you're considering making Palm Springs your home, Brandy Nelson Associates is here to assist you in finding the perfect property. Visit our website at https://brandynelson.com/, email us at brandy@brandynelson.com, or call us at (760) 238-0552 to start your journey toward owning a home in this exceptional city.

nderstanding the factors that contribute to property appreciation is essential for homeowners and investors aiming to maximize long-term value. While the real estate market is influenced by various elements, key drivers such as location, market trends, and property improvements play pivotal roles in determining a property's appreciation over time.

The adage "location, location, location" holds significant truth in real estate. A property's geographical position greatly influences its value and potential for appreciation. Proximity to quality schools, for instance, is a major consideration for many buyers. Homes situated near reputable educational institutions often command higher prices due to the demand from families seeking excellent education opportunities Additionally, access to amenities such as parks, shopping centers, and healthcare facilities enhances a property's desirability. Conversely, properties located in areas with high crime rates or lacking essential services may experience slower appreciation or even depreciation.

Market dynamics, particularly the balance between supply and demand, significantly impact property values. In regions where demand outpaces supply, property values tend to rise. For example, areas experiencing job growth attract more residents, increasing the demand for housing and driving up prices. Conversely, an oversupply of homes can lead to stagnation or decline in property values. Staying informed about local economic developments, employment opportunities, and population growth trends can provide valuable insights into potential property appreciation.

Investing in property improvements is a tangible way to boost a property's value. Upgrades that enhance functionality, aesthetic appeal, or energy efficiency can make a property more attractive to buyers. Renovations such as modernizing kitchens and bathrooms, adding energy-efficient windows, or improving landscaping not only increase immediate value but also contribute to long-term appreciation However, it's crucial to consider the cost of improvements relative to the expected increase in property value to ensure a favorable return on investment.

Environmental considerations are becoming increasingly important in property valuation. Areas prone to natural disasters such as wildfires, floods, or hurricanes may see a negative impact on property values. For instance, regions experiencing frequent wildfires have faced challenges in maintaining property values due to increased insurance costs and potential risks. Homeowners and investors should assess environmental risks and consider mitigation measures to protect property value.

Assessing long-term property appreciation requires a comprehensive understanding of various influencing factors. Location remains a fundamental determinant, with proximity to quality schools, amenities, and safe neighborhoods enhancing value. Market trends driven by supply and demand dynamics also play a critical role, as does the strategic implementation of property improvements. Additionally, environmental factors and climate risks are increasingly impacting property values, underscoring the importance of thorough due diligence. By considering these elements, homeowners and investors can make informed decisions to foster property appreciation over time.

Navigating the complexities of property appreciation requires expertise and local market knowledge. At Brandy Nelson Associates, we specialize in providing personalized real estate guidance to help you make informed investment decisions Whether you're looking to buy, sell, or invest, our team is here to assist you every step of the way. Contact us today at (760) 238-0552 or email brandy@brandynelson.com to schedule a consultation Visit our website at https://brandynelson com/ for more information Let s work together to achieve your real estate goals.

of Landscaping of Landscaping

Choices in Choices in Enhancing Enhancing Property Property Appeal Appeal

n today's competitive real estate market, the exterior appearance of a property plays a pivotal role in attracting potential buyers and enhancing market value. Thoughtful landscaping not only boosts curb appeal but also contributes to the property's overall functionality and sustainability. As climate considerations become increasingly important, integrating climate adaptation strategies into landscaping and property development is essential for long-term value and resilience. First impressions are crucial in real estate transactions. A well-maintained and aesthetically pleasing landscape can significantly increase a property's perceived value. According to real estate experts, properties with attractive landscaping can see an increase in value by up to 20%.

Elements such as healthy lawns, colorful flower beds, and neatly trimmed hedges create an inviting atmosphere that appeals to potential buyers.

Beyond aesthetics, functional outdoor spaces add tangible value. Features like patios, decks, and garden seating areas extend living spaces, offering areas for relaxation and entertainment. Incorporating native plants and sustainable practices not only reduces maintenance costs but also appeals to environmentally conscious buyers. For instance, using drought-resistant plants in arid regions conserves water and aligns with sustainable living practices.

As climate change impacts become more pronounced, integrating climate adaptation strategies into property development is imperative. Housing plays a frontline role in addressing climate challenges, with the residential sector accounting for a significant portion of global greenhouse gas emissions. Implementing energy-efficient designs, utilizing sustainable materials, and incorporating green spaces are essential steps in creating resilient communities.

Incorporating natural elements like trees and shrubs can provide shade, reducing reliance on air conditioning and lowering energy costs. Additionally, green roofs and walls can improve insulation and manage stormwater runoff, mitigating the effects of heavy rainfall and reducing the urban heat island effect. These strategies not only enhance the property's resilience to climate impacts but also contribute to the wellbeing of its occupants.

Incorporating climate adaptation measures can sometimes conflict with heritage preservation efforts For example, in Paris, the installation of shutters—a costeffective cooling measure faces resistance due to heritage concerns. Balancing the need for climate resilience with the preservation of historical aesthetics requires thoughtful planning and collaboration between stakeholders.

Thoughtful landscaping and the integration of climate adaptation strategies are essential components in enhancing property appeal and market value. By creating aesthetically pleasing and functional outdoor spaces, property owners can attract potential buyers and achieve higher returns on investment. Moreover, adopting sustainable practices and resilient designs ensures that properties remain valuable and livable in the face of changing climate conditions. As the real estate market evolves, prioritizing these elements will be key to meeting the demands of modern buyers and building sustainable communities.

Transform your property into a buyer’s dream with expert real estate guidance from Brandy Nelson Associates. Whether you re selling or buying, our team specializes in maximizing property appeal and market value through proven strategies. Ready to make the most of your investment? Contact us today to discuss how we can help you achieve your real estate goals. Visit our website at https://brandynelson.com/, email us at brandy@brandynelson.com, or call us at (760) 238-0552 to get started. Let’s work together to turn your vision into reality!

IIn recent years, the real estate sector has increasingly recognized the imperative of integrating climate adaptation strategies into new developments. This shift is not merely a response to environmental concerns but also a strategic move to enhance property resilience, reduce operational costs, and meet the growing demand for sustainable living

A notable example of this trend is observed in Palm Springs, where developers are proactively incorporating sustainable designs, water conservation measures, and energy-efficient technologies into their projects

Sustainable design is at the forefront of modern real estate development. In Palm Springs, developers are embracing architectural practices that minimize environmental impact while maximizing efficiency and comfort. This includes the use of locally sourced and renewable materials, such as bamboo and recycled wood, which have lower embodied energy than traditional construction materials Additionally, energy-efficient materials like low-emissivity glass and advanced insulation are becoming standard, reducing the need for artificial heating and cooling. These practices not only contribute to environmental preservation but also result in long-term cost savings for property owners

Water scarcity is a pressing issue, particularly in arid regions like Palm Springs. To address this, developers are implementing innovative water conservation techniques. Rainwater harvesting systems capture and store rainwater for non-potable uses such as irrigation and toilet flushing, significantly reducing reliance on municipal water supplies. Low-flow fixtures, including faucets and showerheads, are installed to decrease water consumption without compromising functionality. Moreover, greywater recycling systems treat and reuse water from sinks and showers for landscaping purposes, promoting sustainable water use throughout the development.

The integration of energy-efficient technologies is transforming the real estate landscape. In Palm Springs, developers are incorporating renewable energy sources, such as solar panels, to power homes and communal areas. For instance, Babcock Ranch, a solar-powered community, utilizes an 880-acre solar field to meet its energy needs, showcasing the potential of renewable energy in residential developments Additionally, energy-efficient lighting systems, like LED fixtures, and smart home technologies that optimize energy consumption are becoming commonplace. These advancements not only reduce the carbon footprint of properties but also offer residents significant savings on energy bills

The incorporation of climate adaptation strategies in real estate development is no longer a niche consideration but a mainstream necessity. By adopting sustainable designs, implementing water conservation measures, and integrating energy-efficient technologies, developers in Palm Springs are setting a benchmark for future projects. These practices not only address environmental challenges but also enhance property value and appeal to the growing segment of eco-conscious consumers As the real estate market continues to evolve, embracing these strategies will be crucial in building resilient, sustainable communities.

Are you interested in exploring properties that prioritize sustainability and resilience? At Brandy Nelson Associates, we specialize in connecting clients with developments that incorporate cutting-edge climate adaptation strategies. Visit our website at https://brandynelson.com/, reach out via email at brandy@brandynelson.com, or call us at (760) 238-0552 to discover how we can assist you in finding your ideal eco-friendly property.

Wehavejustreleasedthelatestfurnitureproducts specificallyforyourlivingroom Getitsoon

Straightforward Guide Every Seller Should Read Before Listing

Supply & Demand

Substitution

Contribution

Regression

Progression

Did you take your house off the market late last year? If so, it’s time to reassess.

Buyer activity is already picking up heading into the peak homebuying season this spring. So, now’s the time to talk to your agent about putting it back on the market with a fresh strategy – better pricing, stronger marketing, and a plan that gets results. What would you want to do differently this time around?

Change

Conformity

What Impacts Your Home’s Value?

Condition

Location & neighborhood trends

Comparable sales

Supply & demand Days on market

Common Pricing Mistakes to Avoid

Overpricing based on emotion

Ignoring your agent’s advice

Listing to “test the market”

Assuming upgrades always increase value

The allure of owning a luxury home in Palm Springs is undeniable. With its iconic mid-century architecture, year-round sunshine, and vibrant cultural scene, it's no wonder that many aspire to have a residence in this desert oasis. However, the substantial financial commitment and ongoing maintenance can be daunting. Enter the concept of co-ownership—a model that's gaining traction among prospective homeowners seeking to share the benefits and responsibilities of luxury property ownership.

Co-ownership involves multiple parties jointly purchasing and owning a property. Each co-owner holds a fractional interest, allowing them to enjoy the property without bearing the full financial burden alone. This model is distinct from timeshares; while timeshares typically grant usage rights for a specific period without actual ownership, co-owners possess a tangible share of the property, often structured through a limited liability company (LLC).

1

Cost Efficiency: By dividing the purchase price and ongoing expenses among co-owners, luxury properties become more accessible. This shared financial responsibility extends to maintenance, taxes, and utilities, making ownership more manageable.

1.

Regulatory Compliance: Palm Springs has implemented specific ordinances to regulate co-owned housing units For instance, Ordinance 2100, adopted on July 9, 2024, establishes a regulatory program to minimize adverse effects on surrounding neighborhoods. It limits the number of coowned housing units to 30 and provides a permitting process with operational requirements.

2.

Management Complexity: Co-ownership necessitates clear agreements detailing usage schedules, decision-making processes, and dispute resolution mechanisms. Without a professional management company, coordinating among multiple owners can be challenging

Resale Considerations: Selling an individual share in a co-owned property may be more complex than selling a wholly-owned property. Potential buyers must be compatible with existing co-owners, and the niche market can affect liquidity

Engaging in co-ownership requires a thorough understanding of the financial landscape:

3.

Reduced Vacancy: Traditional second homes often remain unoccupied for significant portions of the year Co-ownership ensures higher utilization rates, maximizing the property's value and reducing periods of inactivity.

2. Diversified Investment: Pooling resources allows individuals to invest in multiple properties across different locations, diversifying their real estate portfolio and mitigating market-specific risks.

If you're considering co-ownership opportunities in Palm Springs, partnering with experienced professionals can make all the difference. At Brandy Nelson Associates, we specialize in guiding clients through the intricacies of shared property ownership, ensuring informed decisions and seamless transactions. Explore our services at https://brandynelson.com/, reach out via email at brandy@brandynelson.com, or call us at (760) 238-0552 Let's make your dream of owning a luxury home in Palm Springs a reality.

1.

Initial Investment: Each co-owner contributes to the down payment and closing costs proportionate to their ownership share

2.

Ongoing Expenses: Regular costs, including maintenance, insurance, and property management fees, are typically divided among co-owners. It's crucial to establish a clear budget and payment schedule to prevent disputes

Exit Strategy: Co-owners should agree on terms for selling individual shares or the entire property Having a predefined exit strategy ensures smoother transitions and protects everyone's investment. 3.

Co-ownership of luxury homes in Palm Springs presents an innovative solution for those looking to enjoy high-end real estate without the full financial strain. While the benefits are compelling, it's essential to navigate the associated challenges with due diligence. Prospective co-owners should engage in open communication, seek legal counsel, and consider professional management to ensure a harmonious and profitable ownership experience

PRINCIPAL