For most of us, having a mortgage is a necessary evil of home ownership and every month we shell out money to a lender to pay for it. But the truth is that having a mortgage means you are realizing the “American Dream” and you’ve got one of the greatest assets of all that can be used to your advantage.

Schedule Extra Payments

With a 30-year loan hanging over your head, most of us would like to pay that down as quickly as possible to minimize interest paid. One way to accomplish that is with a single extra payment per year. You can make one extra payment at some point in the year, make bi-weekly payments, which equates to 26 half payments vs 12 full payments, or simply round up each month to cover the cost of that extra payment. Shanon Shinkel, branch manager with NFM Lending, cautions there may be fees associated with setting up a bi-weekly payment schedule. “If you have the self-restraint to send the extra payment once a year, you can avoid the fees and accomplish the same thing,” she says. And making that extra payment will cut four to six years off your loan and save you tens of thousands of dollars in interest payments.

Apply Windfalls to Balance

Another way to pay that balance down is to apply any windfalls, such a tax refund or annual bonus to the principal. Borrowers should check with the lien holder to ensure there are no pre-payment penalties before sending additional funds.

Remove Mortgage Insurance

If you are paying private mortgage insurance, it is a good idea to consult with your REALTOR® to see if you might have enough equity to get it removed early as opposed to waiting for it to organically fall off when you have reached 20 percent equity on the original loan. Re-evaluations can only be done on homes with conventional loans while FHA loans have different rules, according to Shinkel.

Use Home Equity to Build Wealth

With the rise in home values, you could be sitting on a pile of cash that could be used for other purposes. Jim Harmelink, mortgage consultant with Lendello Mortgage, says the old thinking of paying off your mortgage to be debt free is a bit backwards. “Your house is a fantastic asset and you should use it to build even more wealth such as purchasing an investment property,” Harmelink says. Equity can also be used to pay off or consolidate other debt with higher interest rates, home improvements or simply to have an emergency fund. Harmelink also encourages people to look for other assets to help them invest in real estate. “A retirement account, such a as 401K, is a great way to come up with a down payment,” he says. “You borrow from yourself with no penalties and you pay yourself back. It’s a win-win for a first-time home buyer or an investor.”

Both Shinkel and Harmelink agree that interest rates will likely come down in the next 12 months and advise homeowners to hold off on any refinancing for now. “The experts are saying that inflation is getting under control and we should be seeing rates come down before the end of the year,” Harmelink says. Shinkel says they are watching rates very closely and have a process for contacting clients who will benefit from refinancing when the time is right.

This complimentary newsletter is brought to you by your local ERA Shields Real Estate Agent• Interest rates are easing a bit

• Multiple offers are up

• Average price is holding steady

• Days on market is Dropping

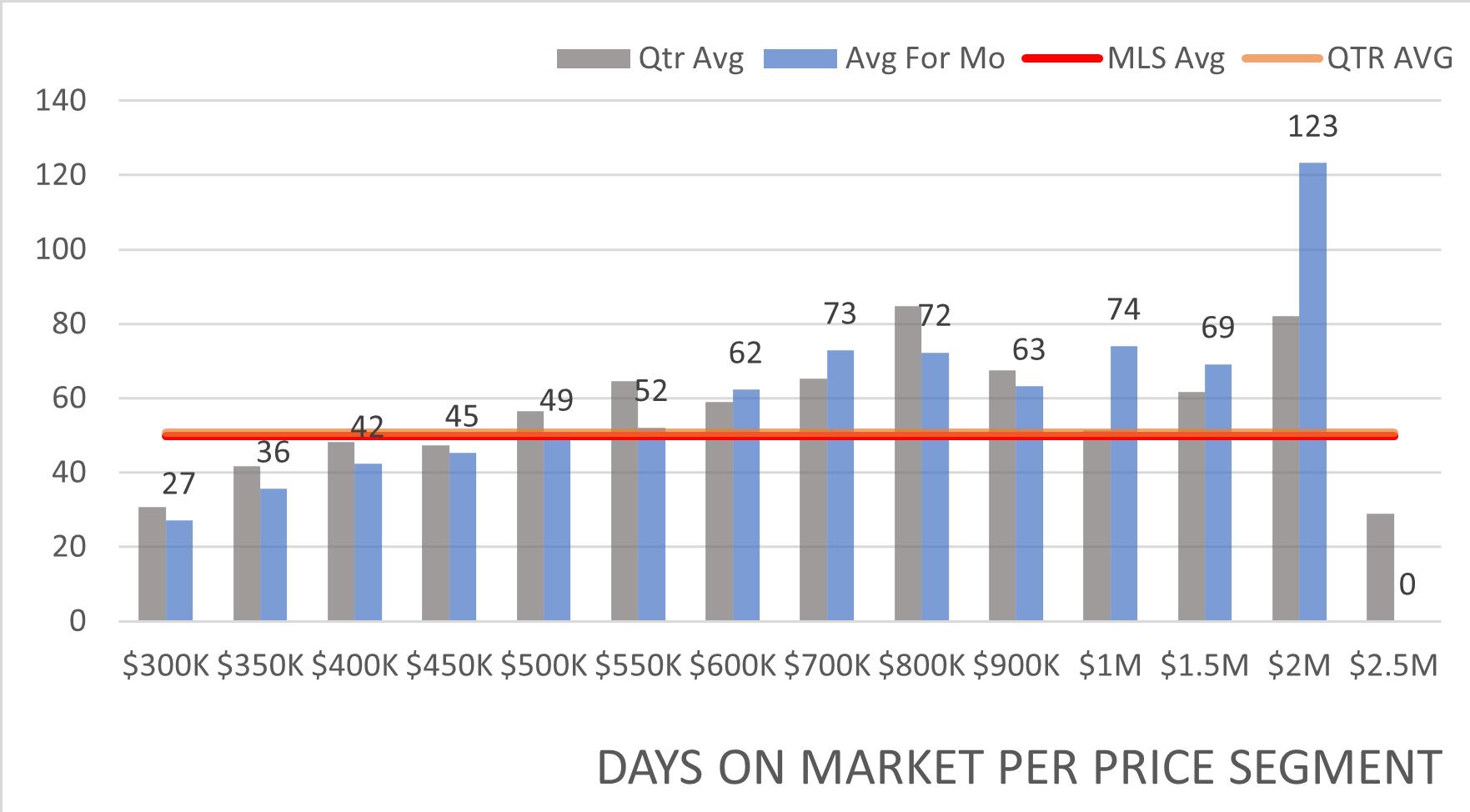

Average days on Market for March 2023 was 50. The days on market was down -9.5% over February which showed an average days on market of 55. Looking at March of 2022, average days on market was 14 which means days on market has increased by 250.2% year over year. Comparing the two years is a bit of an apples and tomatoes comparison due to the difference in interest rates.

The challenge with this metric is that a REALTOR® can list any house for any price. So sellers (or REALTORS®) with unrealistic expectations (or bad data) will affect these numbers. You can see that $300,000 - $550,000 are at or below their 3 month average which shows market strength which will bleed higher over time. $800K-$900K are also showing strength.

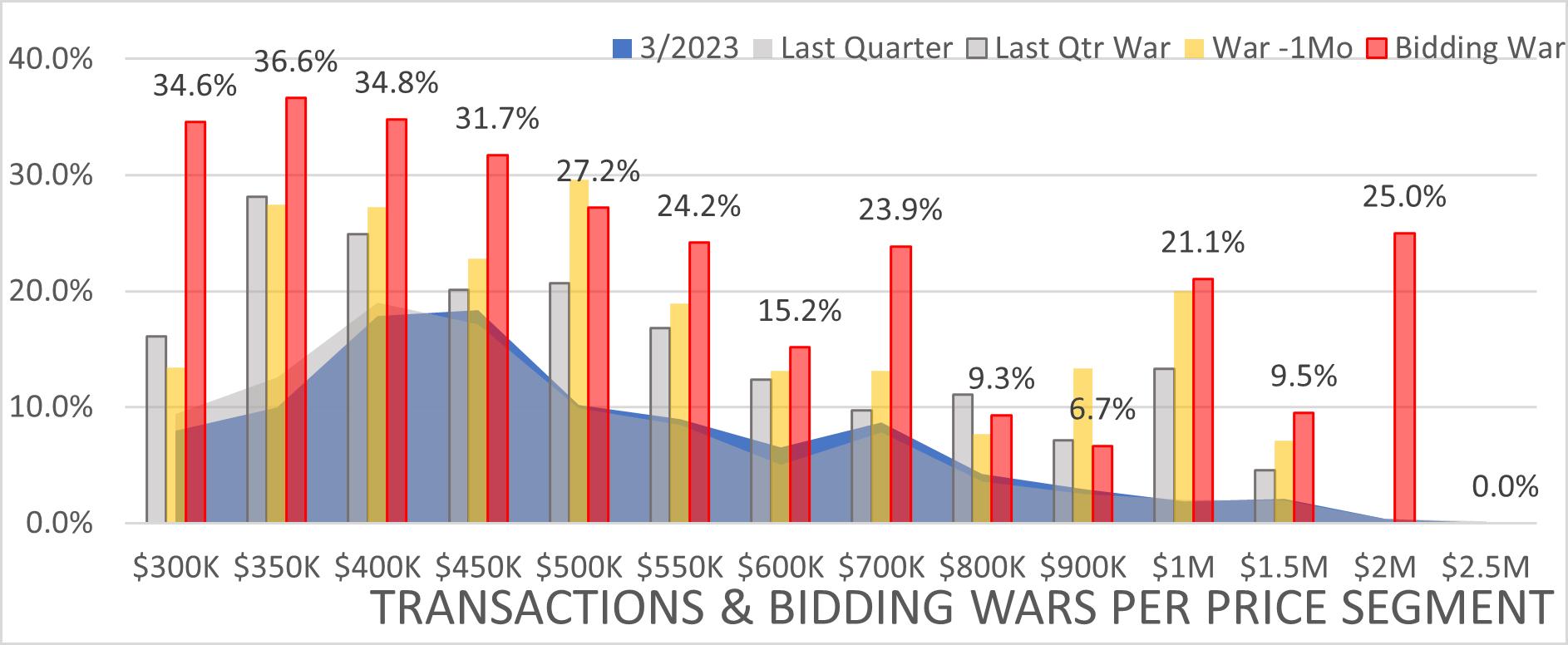

Transactions by Price: This graph shows percent of activity at the different price ranges. The “blue hump” shows you where the transactions occurred last month. The “grey hump” (or shadow) shows the previous 3 months so you can compare and see how (or if) the market is shifting. The most active price segment last month was $450K with 18.3% or 186 transactions reported. This was up 0.3% from last month. The second highest segment was $400K with 17.9% or 181 transactions reported. The blue hump shows a slight increase in $450K—$800K transactions and decline in $300K—$400K transactions.

Average days on market only tells part of the story. In order to truly understand what is going on in the market, the key is to drill into particular price segments in the specific area you are interested in. The grey bars show the average for the preceding 3 months while the blue bar was the average for the month so you can compare and see where the market is trending.

The graph shows you that average days on market varies widely in the different price ranges, but there are a lot of blue bars that are lower than the grey bars which means the market is strengthening. The lowest days on market for March being at the $300K price point at an average of 27, which was -45.7% below the MLS average of 50 days, while the highest price point for last month being the $2M price point at 123 days, which was 147.1% above the MLS average.

As you can see from the overall averages, last month (red line) was under the preceding 3 month average (orange line).

The red bars show market competition (bidding wars) for the month. The grey bars show the preceding 3 month average while the yellow bars shows you last month for comparison. Changes show how demand is shifting at the different prices. As you can see, $350K grabbed top honors in March with 36.6% of the transactions showing a bidding war.

The largest increase in bidding wars was at the $2M price range with an increase of 25.0% up to 25.0% for the month. As you can see, bidding wars are up sharply over most segments and that will drive pricing upwards. This is for all of El Paso County and different areas will have much different profiles.

As a REALTOR® at ERA Shields, I have access to fellow agents across the country and in 31 other countries and territories. If you, your family or your friends are looking for a REALTOR® in another area, chances are I can find you the perfect fit from our family of more than 40,000 brokers. Just ask! If you are currently working with a REALTOR®, this is not an attempt to solicit business.

PRICE CHANGE BY MONTH: In March 2023, the average price was $499,655, which was up 2.5% from February when pricing was $487,505. This was also down -2.63% from March 2022 when the average price was $513,143.

What is cause for concern is that the average price for the month is below the current 12 month rolling average which indicates we will not continue to see robust appreciation, at least in the short term, and may see some declines. With numbers still above the previous 12 month rolling average, I don’t see any large declines looming. You can see that average price has continued to “bob around” since November. I believe as we come into the busy selling season, next month’s numbers will be an indication of whether we are going to start to see a steady upward trend or if we are going to continue to “bob”. Pricing activity is shifting upwards which indicates that we are likely to start seeing an upward trend. With strong activity shown in the lower end, I do believe that will cause average price to rise. Another interesting trend to look at is that average price was up and average price per square foot was also up. That shows that this might be a sign of an upward trend.

Our market temporarily remains a more balanced market where a buyer can evaluate their options and make an intelligent choice based on condition and market data which is good for everyone. However, multiple offer activity is up sharply over many price segments so this might not last much longer.

Months of Inventory Available: This graph charts current activity per price range recorded last month; Red bars are homes sold, orange bars are current pending sales, and green bars are active homes available. The blue line is an approximation of months of inventory (calculated by taking active listings divided by average number of sales per month) with many regarding 6 months being the breaking point between a seller’s and buyer’s market (more than 6 months being a buyer’s market)

You can see (orange bars) that $400,000 and $450,000 are still getting the lions share of activity across the Pikes Peak Region, with $500,000 also showing strong activity. When markets get tight, buyers tend to push their price range and the pending homes show that here. Looking at the green vs red bar ratio, sales are outpacing listings up to $600,000. Anytime that is the case, it pushes markets up. Looking at the blue line, all price ranges show a seller’s market up to $2M. This indicates that we will continue to see some multiple offer situations and aggressive tendencies as buyers try to secure homes to live in.

A Message from Mike & Cathi Sullivan ERA Shields Brokers|Owners

Mike and I recently attended our nationwide ERA Fuel conference in Las Vegas. We were fortunate to be recognized as one of the top companies in ERA receiving Platinum status and placing in the top 15 companies nationally within the ERA network.

Globally ERA has Brokers all around the world. Many of these brokers attended the conference from as far away as Japan, the Caribbean, and South America! Mike and I were able to attend an International reception and we were ambassadors for Colorado.

Locally, our agents are some of the best educated real estate veterans and hardest working REALTORS® in Colorado. I was invited to speak during the conference on the main stage to share the awesome work happening in Colorado Springs and discuss our mindset, education and local successes.

Historically the housing market has cycles of ups and downs. Our years of experience at ERA Shields has conquered them all. As a team we navigate these cycles making sure that our clients receive the best representation possible, and a marvelous experience.

Finally, we honor our community by giving back where we can. We are honored to support Operation Homefront, a national charity supporting military families in Colorado. Their “Star-Spangled Babies” event is happening May 7th. If you would like to join us in supporting this event check out all the information on page 4 of this publication. Have a great Spring!

(719) 291-2212

TDavis@ERAShields.com TerryDavisRealEstate.com