Increasing the Likelihood of Security Proposal Approval by Effectively Communicating Through the "Language

of Business"

Kevin Koharki, MBA, PhD

&

Moe Salahuddin, MBA

Title Sponsor

Increasing the Likelihood of Security Proposal Approval by Effectively Communicating Through the "Language

Kevin Koharki, MBA, PhD

&

Moe Salahuddin, MBA

Title Sponsor

Kevin Koharki: Kevin consults with, provides keynote speeches for, and advises some of the world’s largest firms (e.g., Fortune 100) across various industries such as banking, insurance, distribution, manufacturing, aerospace and defense, law firms, among others. He specializes in developing employees’ and Executives’ financial acumen so they understand and can communicate the financial value of their work, optimizing CEOs’ capital allocation priorities across their respective organizations. He is a sought-after keynote speaker for firms of all sizes, as well as various trade organizations, such as the American Institute of Aeronautics and Astronautics. Firms seek Kevin out because he is an expert financial analyst who has analyzed hundreds of firms over a 20-year career (including as an M&A analyst). He can be reached at 765-637-3206, caecoachllc@gmail.com, www.caecoach.org, or on LinkedIn.

Moe Salahuddin: Moe has approximately 26 years of industry experience. He has taken on progressively responsible roles in security, investigations, and emergency management at four Fortune 40 companies, the #1 ranked hospital in the Midwest, and currently with Wesco International. Moe double-majored in Political Science and Social Justice from NEIU, earned a certificate in Change Management from Northwestern University, as well as an Executive MBA degree from Purdue University and an International Master's degree in Management from TIAS University in Netherlands. He can be reached on LinkedIn.

• "If I knew this material when we started our company, we would have saved hundreds of thousands of dollars early on, and likely millions over time." -

Glenn Weatherly - Green Beret - Co-founder and CEO of Xiphos Corporation

• Despite what you may have heard, numbers tell a story

• Clients repeatedly tell me that during downturns budget cuts occur most often when projects cannot be financially justified to firm leadership

• Management's primary responsibility

• The "language" management communicates in

• A matter of trust

• Where security costs "fit in" to financial statements

• Case studies

Increase financial performance

Increase firm value

Be good corporate, social, and global citizens

None are achievable without proper capital allocation

Don't take it from me. Read Warren Buffett's 1987 Annual Letter to Shareholders

• Firms must invest in activities that drive growth and value over time

• R&D, advertising, facilities, equipment, etc.

• Each $1 invested must generate an adequate return

• If returns are too low, firm value will decline over time

• WARNING: This is not ONLY the CEO's responsibility!

• Your Goal: Prove to C-Suite/executives that you understand this concept by showing you understand how your decisions influence financial performance

• C-Suite communicates in the "language of business"

• This language is comprised of both accounting and finance

• Requires an ability to read, interpret, and analyze financial statements

• To justify investment, minor "fluency" in this language is required

• Don't worry, you do not need a degree in accounting nor finance

• Your Goal: Develop an ability to communicate effectively using this language, as successful business cases/proposals depend on it

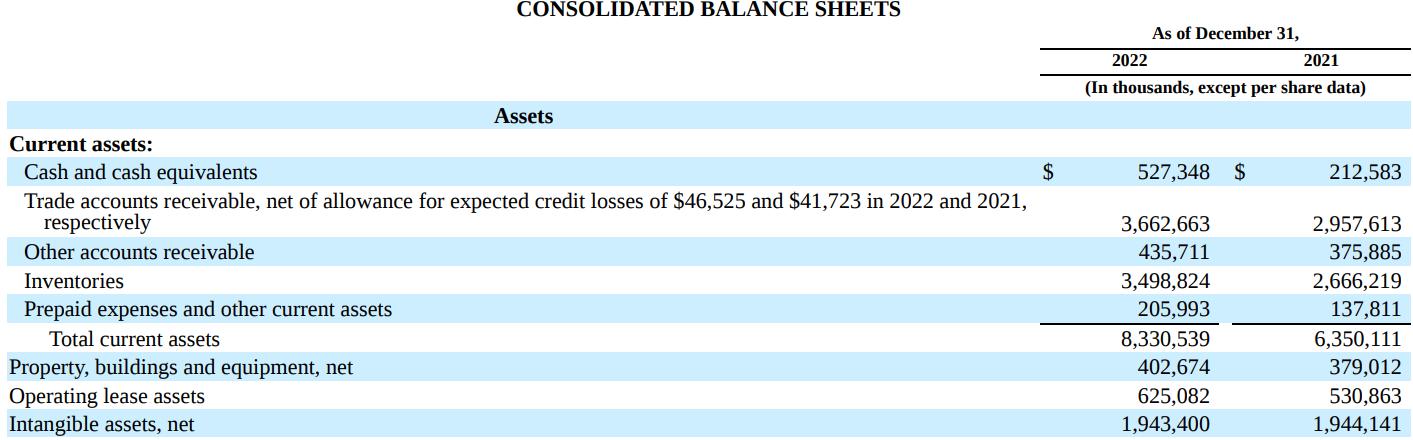

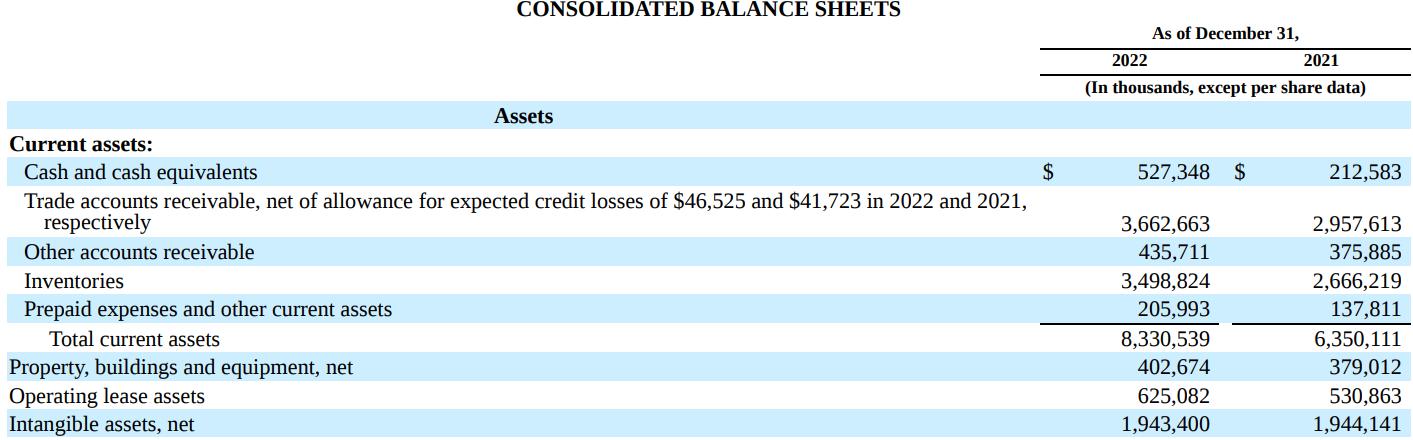

• Cash is a firm's "oxygen" and is thus, precious

• Cash for security projects can be allocated to three categories:

1) Cost of Goods Sold (COGS): Costs associated with creating inventory

• Raw materials, shipping, direct labor, "shrink"

2) Operating expenses (OpEx): Costs incurred to run daily operations

• Salaries, R&D, advertising, among others

• Expensed immediately on the income statement

3) Capital expenditures (CapEx): Investments in long-term assets

• Buildings, equipment, land, and their "improvements"

• Expensed over time on the income statement via "depreciation"

• C-Suite will likely only see your proposals as "cash consumers", unless you can convince them otherwise

• Knowing the "language" is necessary

• Can your project(s) reduce costs immediately or over time, and thus save cash?

• If so, what impact does this have on the financial statements?

• Hint: see below

• Will your proposal impact COGS, OpEx, or CapEx?

• Well, it depends!

• "Two key factors impacted our second quarter gross margin relative to our original expectations. The first was the impact of higher inventory shrink, organized retail crime and theft in general, an increasingly serious issue impacting many retailers."Lauren Hobart, CEO

• "Gross profit in the second quarter was $1.11 billion or 34.42% of net sales and declined 161 basis points compared to last year. This decline was driven by lower merchandise margin of 254 basis points..... In addition, we experienced a meaningful headwind from higher-than-expected shrink, which represents a third of our merchandise margin decline." - Sandeep Gupta, CFO

• "Our revised 2023 non-GAAP EPS guidance of $11.50 to $12.30 takes into account our Q2 results as well as our latest views on gross margin for the back half of the year, including higher levels of shrink." - Lauren Hobart, CEO

• Do you trust your ability to get a proposal fully funded?

• Do you know how your proposals will impact financial performance?

• Can management trust you to carry out their #1 responsibility?

• Do they know that you can communicate clearly using the language of business?

• Has management instilled trust throughout the organization by developing employees "financial mindset"?

• Do you know what management's goals are and how you can help achieve them?

• Trust requires both parties to speak the same language and understand each others' goals and objectives

• Better capital allocation decision-making

• Key driver of firm valuation over time!

• More effectively manage your firm's "oxygen" (e.g., cash)

• Reduce likelihood your budgets/projects get cut during downturns

• Increase likelihood of winning bids and/or funding requests

• Develop skillset necessary to reach senior management and/or C-Suite levels

• Better negotiate with superiors, customers, and vendors

• Gain a skillset to better manage your personal finances

• All firms create annual financial statements

• Public firms file these statements in a 10-K with the SEC

• FASB (Financial Accounting Standards Board) creates the standards for how financial information is presented

• Known as U.S. GAAP (Generally Accepted Accounting Principles)

• Understanding a firm's 10-K helps you determine your internal strategy as a security professional, or business development to help clients

• Change the way you perceive financial administration or customer entry strategy

• Security InfoWatch Article, “Physical Threats Skyrocketing Globally, but CEO’s Are Unprepared”1

• Significant increases in rising threats from 2021 to 2022 in 3 categories

• Increase in threats to infrastructure and technology - 688% globally and 807% in the U.S.

• Transportation accidents – 211% globally and 296% U.S.

• Extreme Weather – 72% globally and 42% in the US

• Insurance Business Article estimates, George Floyd riots will cost approximately up to $2 billion dollars in losses.2

• Wesco, about 800 locations globally (Undisclosed location)

• 2 murders less than 100 yards at a gas station from location, common to have employee vehicle break-ins, delivery truck batteries stolen, and gas siphoned

• Drug addicts running around parking lot, entering reception area and breaking into the building

• Employees not wanting to come into work

• Loss of productivity

• Reduced engagement

• Reduced engagement increases risk tolerance and increased shrink, loss of intellectual property with turnover of staff

• “Employers spend an average of 33% of workers annual salary to replace just one employee” 3

• We did implement a security plan to make employees feel safe and return to the office. This required funding.

What’s Next?

• What financial impact would these events have on your company?

• Stock price impact

• Brand name degradation

• Employees engagement and coming into the office

To solve for threats, we need funding. To get funding we need to understand the following:

• Where does this expense go? OpEx or CapEx

• What’s the difference?

• SG&A (Selling, general and administrative)

• Part of your OpEx

• Actual FTE headcount

• Contract staff reduced pay possible increased turnover – fixed/scalable forecasted cost

• CapEx (Capital Expense) is part of capital, usually one-time expenses that are budgeted for yearly, can can be depreciated in cost over a period of time which reduces initial spend and justify your funding

• OpEx (Operating Expense) these are expenses that reoccur every year and part of your annual forecast for spend the following year

• Including in all corporate annual report's filings

• What are the top financial issues security professionals face internally?

• Where does that issue fall within the financial report?

• How do you use this to create a strategy or business

• Development opportunity by first understanding the numbers

• Obtaining Capital (aka money for our projects)

• Executive Protection

• Under what line-item category do FTE fall under?

• Forecast annual SG&A for increase or decrease

• If you own a private EP company, does your gun fall under OpEx or CapEx?

• Where can you depreciate the cost?

• Where do the bullet of your gun fall under?

• Hiring armed contracted staff for a single one-time event?

• After determine special detail schedule, determine expense vs value and profit

Option 1: Contract security officer at 24x7 at $30/hr. Equates to $5,040 per week or $262,080 per year

Option 2: Install an automatic revolving door with card reader for $200,000

Extract data on all inbound inventory purchases minus any sales/order of product

Will give you a very good approximate of inventory-on-hand

Cycle counts on high-risk product

High-risk are easily resold in black-market

Where do you find this information on the Annual Financial Report?

• Discrepancies - provide actual shrink number

• When compared to other facilities, correlate common missing SKUs to identify losses

• Next steps on investigations or asset protection methods

• By identifying loss numbers, you can use this to do two major things:

• Change posture from reactive to proactive – identifies where to investigate losses

• Can be used as justification to hire personnel based on losses

• Be careful as not all losses are theft; some are process related issues

• Value-add for yourself or your team if you are a business problem solver

1https://www.securityinfowatch.com/security-executives/article/53058758/physical-threats-skyrocketingglobally-but-most-ceos-unprepared

2https://www.insurancebusinessmag.com/us/news/breaking-news/insurance-costs-for-george-floyd-riotswill-be-most-expensive-in-history-233905.aspx

3https://www.terrastaffinggroup.com/resources/blog/cost-of-employeeturnover/#:~:text=According%20to%20Employee%20Benefit%20News,manager%20making%20%2460%2C00 0%20a%20year

• Of course, include all technical details of the project

• Identify all potential cost savings

• Use conservative assumptions and test them where possible

• Probability of the event occurring, cash and/or time spent vs. saved

• Identify number of potential problems/issues solved

• Include key metrics that highlight proposal's financial benefits

Understand

Be

Communicate

https://www.linkedin.com/in/kevinkoharki-7298587/