↑ Andy Ayim MBE, entrepreneur and advocate

FEATURES EDITOR Patricia Cullen patricia.cullen@bncb2b.com

CEO Wissam Younane wissam@bncpublishing.net

MANAGING DIRECTOR Rabih Najm rabih@bncpublishing.net

ART DIRECTOR Simona El Khoury

EDITORIAL TEAM Tamara Pupic, Aalia Mehreen Ahmed

MEDIA SALES MANAGER Olha Kovalova olha.kovalova@bncb2b.com

GENERAL MANAGER Daniel Malins daniel@bncb2b.com

REGIONAL DIRECTOR Andy B

CONTRIBUTING WRITERS

Omar Hamdi, Pip Wilkins, Abigail Fisher, Jolyon Bennett, Alex Martinez and Andrea Reynolds

SUBSCRIBE

Contact subscriptions@bncb2b.com to receive Entrepreneur United Kingdom every issue.

COMMERCIAL ENQUIRIES sales@bncb2b.com

WWW.ENTREPRENEUR.COM/EN-GB

Access fresh content daily on our website

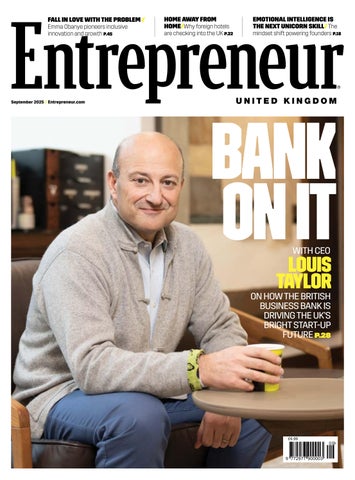

What does it take to build the future of the UK economy? This month, Entrepreneur UK sat down with Louis Taylor, CEO of the British Business Bank, for a rare and timely conversation on how capital, confidence, and calculated risk are powering the next generation of founders. As Taylor points out, the biggest bottleneck often comes at the scale-up stage, where risk-averse institutional investors hesitate to back bold

growth. Bridging that gap, and changing how institutions view entrepreneurial risk, is central to Taylor’s vision. But money isn’t the only currency that matters in today’s entrepreneurial landscape. In this issue, we also ask a more provocative question: should entrepreneurs help run the country? In a time of political fatigue and economic reinvention, we explore what founder mindsets could bring to the halls of power - and what might get lost in translation.

Elsewhere, Andy Ayim MBE shares why emotional intelligence is the next unicorn skill - and why human-centred leadership is fast becoming a competitive edge in boardrooms and beyond. Also inside: a deep dive into why franchisors are obsessed with exits, what’s transforming the UK tech investment landscape, and how to plug your brand into the TikTok growth engine.

Plus, real-world advice on AI-powered cybersecurity, funding strategies that actually work, and how to build a company people want to work for. In times of change, hope becomes a powerful currency. The stories in this issue show that with courage and clear purpose, entrepreneurs have the potential to shape a future that is both innovative and inclusive.

Hope you enjoy the read!

Patricia Cullen Features Editor, Entrepreneur United Kingdom

by Patricia Cullen

The UK stands at a crossroads. With growing economic inequality and a changing workforce, there’s a real question about whether entrepreneurs - those who create, innovate, and solve problems - should play a bigger role in running the country. Many believe this fresh perspective could breathe new life into both our economy and democracy, driving growth, trust, and shared success.

A palpable frustration simmers beneath the surface of public life in the UK today. Political discourse often feels stuck in endless cycles of debate, delay, and deflection. Voters are disillusioned, trust in government institutions is waning, and the urgent issues facing the countryfrom housing shortages and public health pressures to the seismic shifts brought on by automation and AI - feel increasingly out of reach for traditional politicians. And as things continue to shift, one question keeps coming up: Should the nation be led by those who have already successfully built things - entrepreneurs,

business leaders, innovators - rather than career politicians and bureaucrats? This debate is not new, but its intensity has grown with the rapid pace of technological, social, and economic change. Advocates argue that the skills, accountability, and real-world experience that entrepreneurs bring are desperately needed in government. Critics warn of the risks of bringing business mindsets into public service, citing differences in goals, incentives, and democratic accountability.

Entrepreneur UK spoke to five figures who know what it’s like to straddle business and policy. Serena KernLibera, a former senior government strategist now in the private sector, offers rare insight into how policy

and enterprise can align. Jason Stockwood, an entrepreneur and former political candidate, makes the case for more accountability in politics. Gerard Boon, a broker advising entrepreneurs who have stepped into government roles, sheds light on the barriers they face. Serial entrepreneur Mike Greene advocates for ministers with direct sector experience. And Rose Ross, founder of the Tech Trailblazers Awards underscores the need for diversity in policymaking. Together,

→ Serena Kern-Libera is COO at LinkGevity Limited, former Head of Global Trade Strategy at the Bank of England, UK Market Access Policy lead at HM Treasury, and Chief of Staff to the Chancellor.

their voices paint a picture of what is at stake - and what might be possible.

That cross-pollination of experience - from business into government - is something Serena KernLibera knows firsthand. As Chief Operating Officer at LinkGevity, a biotech start-up, and a former senior leader in government, including roles at the Bank of England, HM Treasury, and as Chief of Staff to the Chancellor, she

brings rare insight into how policy and enterprise can align. “Coming from outside politics gives you the ability to truly step into the shoes of those directly affected by policy changes.” She recalls how her varied background informed post-Brexit trade strategy: “We were able to translate industry asks into a final agreement that met their priorities as well as the government’s wider economic agenda... I think that was because the government both listened and executed.” Looking ahead, she sees massive opportunity in deepening engagement with entrepreneurs, especially in emerging technologies: “A more open, cross-sector government is one that keeps its finger on the pulse of emerging technologies, engages deeply, listens actively, and consistently follows through to enable entrepreneurs to turn world-class ideas into world-class outcomes.” She goes on to say that when it comes to emerging, cutting-edge technologies, there’s an opportunity to go further in partnering with entrepreneurs, showing what’s possible when business insight shapes policy that not only listens, but delivers.“The UK has the talent and skills to lead globally, but we need to ensure the right practical conditions are in place - from how

“

A more open, cross-sector government is one that keeps its finger on the pulse of emerging technologies, engages deeply, listens actively, and consistently follows through to enable entrepreneurs to turn world-class ideas into world-class outcomes”

→ Gerard Boon, Managing Director of Boon Brokers

bridging business and public life. With senior leadership roles at companies including Travelocity, Match.com, and Simply Business, and as joint majority shareholder of Grimsby Town FC, Stockwood has spent decades building and scaling organisations. His recent foray into politics as the Labour Party candidate for the 2025 Greater Lincolnshire mayoral election marks a new chapter - a commitment to bringing entrepreneurial thinking to policymaking. “People from outside politics bring lived experience of what works, what fails, and how to adapt when real life kicks in,” he explains. His critique of current politics is blunt but fair: it is full of commentators who discuss but rarely build. “Some of the most talented people I know run businesses, create jobs, and spend hours moaning about how broken politics is. My challenge to them is simple: if you are smart enough to build a business, you are smart enough to fix a policy. Stop complaining and step up.” This call to action is about more than rhetoric. For Stockwood, the

Jason Stockwood, a UK-based businessman, offers a case study in

entrepreneurial mindset brings something sorely missing in politics: accountability. “If something doesn’t work, you do not write a press release, you fix it. That mindset is missing in politics.” He envisions a future where the government is a collaborative

“

→ JASON STOCKWOOD is an English businessman who is joint majority shareholder and former chairman of Grimsby Town F.C

People outsidefrompolitics bring lived experience of what works, what fails, and how to adapt when real life kicks in”

ecosystem: “In ten years, a cross-sector government should include business leaders, entrepreneurs, and public servants working side by side.” Stockwood warns of a democratic crisis if policymakers fail to create an economy that benefits all: “Business leaders know how to fix problems, balance interests, and deliver outcomes. If we get this right, business and democracy will thrive together. If we don’t, we should not be surprised when people lose faith in both.”

Gerard

Boon is managing

director of Suffolk based

Boon Brokers, a firm that works with clients who have experience in both business and government. While he can’t name names, Boon offers an insider’s perspective on what happens when entrepreneurs step into public life. “We have a number of clients who currently work in parliament and assist in policy-making for the country. Those clients previously ran their own businesses.” Despite their skills and accomplishments, Boon says the consensus is stark: working in government is “thankless” and financially unrewarding. “It’s no wonder that the government functions far less

efficiently than large-scale businesses, as the incentives are not good enough to optimise their operations.” He argues that attracting private-sector talent to the government requires overhauling outdated systems and incentives. Bureaucracy, he says, remains a core barrier: “As there is no competitive pressure in government, like there is in the private sector, there is little to no incentive to improve the speed of decision making.” Without structural reform, he warns, the best minds may continue to sit it out. “Our clients have expressed that the government need to significantly improve the talent level of its civil servants and attract the brightest minds from the private sector, with real world experience, to improve public affairs. Otherwise, with its current labour incentives, the government will breed a complacent work force.”

Serial entrepreneur Mike Greene, a contestant on Channel 4’s Secret Millionaire, builds on this argument with a focus on sector-specific expertise in government leadership. “In my view, the best person to be a Housing Minister is someone who understands construction.” Greene makes a compelling case for practical, lived experience across departments: “In Health, it makes sense to involve those who have walked the corridors of hospitals…not

BETTER INFORMED POLICYMAKERS WITH INPUT FROM REAL EXPERTS... WILL MAKE BETTER POLICIES. IF ENTREPRENEURS HAVE A SEAT AT THE TABLE, GOVERNMENTS WILL BE ABLE TO CREATE BETTER FINANCIAL, TAXATION, BUSINESS, IMMIGRATION, EDUCATION AND BUSINESSRELATED POLICIES”

just as figureheads, but as ministers or at the very least, as core advisors.” He believes that if the government is to serve its people effectively, it needs to bring in people who actually speak the language of those people - not just in words, but through a firsthand perspective. “We need people in power who have lived the journey: who’ve known the pressure of payroll, the highs and lows of growth, the reality of regulation, and the risks of entrepreneurship. They should be practitioners, not preachers - giving qualified advice, not theoretical opinion,” he adds.

Rose Ross, founder of the global tech start-up platform Tech Trailblazers, reinforces this point with a focus on representation and reach. Ross warns of the risks of ignoring diverse, ground-level insights in fast-moving sectors like tech. “There is a danger that politicians and civil servants are predominately exposed to senior people within the tech industry and industry itself. The failure to hear the opinions, insights and suggestions from the start-up community, academia and front-line practitioners doesn’t give the best context for balanced decision-making.” She argues that involving entrepreneurs in policymaking is essential for effective governance: “Better informed policymakers with input from real experts... will make better policies. If entrepreneurs have a seat at the table, governments will be able to create better financial, taxation, business, immigration, education and business-related policies… This will be better for entrepreneurs and, with a healthy and supportive approach to innovation, better for the UK.”

Together, Kern-Libera, Stockwood, Boon, Greene and Ross’s perspectives illuminate a shared truth: real change requires doers, not just desk workers. Their insights suggest that practical experience, accountability, and sector expertise can inject much-needed energy and innovation into policymaking. From the boardroom to the classroom, the factory floor to frontline trade negotiations, these voices represent the breadth of what a cross-sector government could look like - one rooted in practical knowledge and lived experience, not just political theory. Yet the path is far from straightforward. The obstacles are institutional, cultural, and economic. Government roles often lack competitive compensation and incentives to attract top entrepreneurial talent. Bureaucracy slows action. And political culture often prioritises loyalty and rhetoric over practical expertise. But

the rewards of change could be transformational. Imagine ministers who understand the industries they oversee. Policy shaped by those who have created jobs and faced market realities. Government that moves with the agility and accountability of a successful business. Such a shift could restore public trust and deliver solutions that work for everyone.

The call for builders to lead is growing louder. Entrepreneurs like Stockwood, advisors like Boon, and seasoned leaders like Greene, Ross, and Kern-Libera argue persuasively that the government must evolve - or risk losing faith on all fronts. The question is no longer whether business experience is valuable in politics, but how to make it happen on a meaningful scale. If the government can open its doors to builders - those who fix, innovate, and deliver - it may yet build a future where democracy and enterprise thrive side by side.

One entrepreneur’s mission to future-proof the public-sector. by

PATRICIA CULLEN

In an age of tightening budgets and rising public demand, artificial intelligence (AI) might seem like a luxury. But for the UK’s overstretched councils, it’s becoming a lifeline. It doesn’t involve street protests or political grandstanding. Instead, it’s powered by data, algorithms, and a belief that the UK public sectoroften caricatured as slow, bloated, and technologically behind - can not only keep pace with innovation, but it can lead it.

At the heart of this movement is Martin Neale, the 61-year-old founder and CEO of ICS.AI, a company helping councils transform how they serve citizens through practical, scalable applications of AI. Neale’s story doesn’t begin in a Silicon Valley garage. It begins in 2018, when, at the age of 55, he did something most financial advisors would balk at: he cashed in his pension to launch a tech start-up focused entirely on the public sector. “Fundamentally, it came down to belief,” Neale says. “Belief in the value and transformative power of AI in the public sector, and confidence that it was going to make a huge difference. My excitement for technology hasn’t dimmed and I’ve always

been a lover of innovation.”

At the time, AI was beginning to reach a critical tipping point. The breakthrough, as Neale saw it, came in 2016, when major cloud providers like Microsoft, Amazon, and Google began commoditising AI capabilities. What once cost millions to test and deploy could now be accessed for pennies. “It was clear AI was going to explode,” he says. “And while I’ve been pleasantly surprised by the scale of that growth, its inevitability was obvious back then.” What’s less obvious is just how quickly the UK public sector has embraced AI in meaningful, operational ways. Contrary to the image of government bureaucracy bogged down by outdated legacy systems,

↓ Martin Neale, CEO of ICS.AI

“THE UK IS COMMITTED TO PROVIDING A HIGH LEVEL OF STATE SUPPORT, BUT LIKE ALL WESTERN DEMOCRACIES, IT FACES THE PRESSURES OF AN AGEING POPULATION AND THE KNOCK-ON EFFECT ON TAX REVENUES. NECESSITY REALLY IS THE MOTHER OF INVENTION”

Neale believes the UK is actually ahead of much of the world when it comes to real-world AI deployment in public services.

“It comes down to economics and necessity,” he explains. “The UK is committed to providing a high level of state support, but like all Western democracies, it faces the pressures of an ageing population and the knock-on effect on tax revenues. Necessity really is the mother of invention.”

That fiscal squeeze has driven innovation in unlikely places - council offices, healthcare trusts, and public housing departments - where AI is now quietly streamlining operations, handling citizen queries, and identifying inefficiencies at scale.

The company is doubling year-on-year, and it’s done so without the flash that tends to dominate tech headlines. There are no moonshot promises or glossy investor decks. Just a focus on delivering outcomes that matter - and doing so repeatedly. In many ways, Neale’s vision can be summed up in a comparison he draws with one of the most influential – and controversial – names in tech: Palantir. “Palantir, for those unfamiliar, is a highly successful US AI and data analytics company,” Neale explains. “One of the things that propelled them was their ability to simplify the engagement and decision-making process for organisations, cutting through ‘pilot paralysis’ with an effective, repeatable model.”

ICS.AI has taken a similar approach in the UK public sector, creating what Neale calls a “go-to-market mechanism” - essentially a framework that enables councils and public bodies to easily buy, deploy, and see measurable returns on AI investments. It’s an approach designed not for headlines, but for results.

“For Derby City Council, we

helped them identify £7.5m in savings from their AI transformation,” he says.

“Using a process we can apply elsewhere. It’s about enabling measurable, scalable impact.”

Yet Neale is quick to note that success in this space isn’t just about savings – it’s about sustainability and ethics. In an era where concerns about AI misuse,

bias, and transparency are dominating global discourse, ICS.AI has built its platform with public trust in mind from the ground up.

“In the public sector, ethics aren’t optional,” Neale says. “Security, accessibility, engagement, and ethics must be woven into how you design and deploy AI. That’s been our approach from day one.” He believes this

mindset gives the UK a unique advantage - one that could position it as a global leader in ethical AI specifically designed for public service delivery.

“Our platforms are often the first in the world to solve certain problems. That gives the UK a head start in applying these lessons to other countries that are slower to adopt,” he says. “If we continue to embed ethics as a core principle, while sharing and exporting

our expertise, the UK can cement its role as a leader in ethical AI for public services.”

That message appears to be resonating far beyond the UK. ICS.AI is now seeing growing international interest in its model - not from tech giants or venture capitalists, but from other governments who are beginning to grapple with the same demographic and economic pressures that have long defined UK

policymaking. But for all the attention and expansion, Neale remains focused on the mission that drove him to launch ICS.AI in the first place: building solutions that genuinely work for public bodies - and by extension, the people they serve.

“Customers aren’t buying AI for its novelty; they’re investing because they expect tangible outcomes that weren’t possible before,” he says. “Entrepreneurs need to work backwards from that.” It’s advice he offers freely to the next wave of tech founders, especially those building mission-driven ventures in risk-averse sectors like health, education, or government. “Start by clearly articulating the benefits so customers can build strong business cases. Then ensure those benefits are actually realised, so clients become advocates for you in the marketplace. That advocacy is what drives sustainable growth.”

He’s also bullish on the need for an ‘AI-first’

“In the public sector, ethics aren’t optional. Security, accessibility, engagement, and ethics must be woven into how you design and deploy AI ”

mindset – not just in tech, but across the broader business community.

“Entrepreneurs shouldn’t wait to be forced into AI adoption by competitors –they need to be proactive,” he says. “AI gives organisations the ability to work faster and more effectively, and embracing that early is an advantage.”

For a man who put his retirement on the line to launch a company in a sector often seen as stuck in the past, Neale’s outlook is refreshingly forward-looking. He isn’t chasing the next funding round or betting on a flashy exit. He’s betting on the power of AI to help governments do more with less – and on the idea that deep, sustainable change often begins in the places you least expect. The public sector has its challenges, but it also has the most to gain from getting this right.

In most businesses, planning your exit before you start sounds like madness. In franchising, it’s the norm - and for good reason. by PIP WILKINS

Since 1977, the BFA has championed ethical business practices and high standards in franchising; we work hard to ensure franchisees choose

the right franchise for them, which often means franchisors asking why they want to invest and what their end goal is. Do they want to sell it, hand it over to their children or keep it until they retire? A franchisee’s end destination will help the franchisor determine the route they take, what their priorities are for the business, and when and how they take action.

Know your destination

When talking to franchisors, and even before you’ve settled on your dream franchise, be ready to answer the question “Where do you want your business to be in five years?”

Plan the path

Jo White and husband Ryan, head up the pet care franchise We Love Pets, whose franchisees manage teams of staff who provide dog sitting, pet feeding and home boarding. Jo says: “We always tell potential franchisees to consider their exit strategy, even before they invest in our franchise. Your intention changes the way you run your franchise, your growth targets, and the decisions you make.”

Imogen Clarke, Head of Franchise Development at home care franchise Home Instead, says: “We always put the ‘exit goals’ question to prospective franchisees. Many say that they were not considering an exit strategy when they joined.”

About franchising

The UK has more than 1,000 franchise

systems, according to the latest British Franchise Journal sponsored by NIC local. Franchise agreements typically last five to ten years.

When goals shift

She adds: “Few people have a clear goal, such as owning a business for 12 years and selling when the revenue or business performance gets to x amount. We explain that it’s important

for us to understand their overall goals so we can help them achieve them, and for them to understand what they want from buying a business.”

What if exit plans change?

Franchise development managers commonly raise this with franchisees in business development calls. Tracey Alexander, who has been the We Love Pets franchisee for Reading, says her exit plans could change in the future. “My eightyear-old son William might take over the business, but it’s too soon to consider that seriously. In the future I could sell off some parts of my area and operate a smaller territory myself.”

Time to prepare

Jo adds: “We ask franchisees selling to give us two years’ notice, so there’s time to build up the business in ways that enhance its attraction for buyers.” At Home Instead, Imogen says: “The

most unusual exit goal I’ve heard is someone who wanted to own a business for x amount of time, so at some point they’d be able to set up a Home Instead franchise in the US.”

Plot twist

Goals can change fast. Jo says: “You can have people wanting to invest in multiple units, but in a matter of months perhaps they’ve had a health scare or they’ve welcomed their first grandchild and now they want to sell.”

Coaching through change

However, she says: “Sometimes franchisees suddenly decide to exit and it appears to come from nowhere. It’s rare but we tread carefully, to ensure this isn’t an impulsive decision based on something that will be short term pain, perhaps in their personal life. We can have open conversations to check if that’s something they’re

“Few people have a clear goal, such as owning a business for 12 years and selling when the revenue or business performance gets to x amount. We explain that it’s important for us to understand their overall goals so we can help them achieve them, and for them to understand what they want from buying a business”

ready for right now.” The BFA can help you through each step from franchise choice to exit. Our strapline, ‘Discover Your Tomorrow,’ reflects our commitment to helping new franchisees take their first step towards a successful business future. Consider us your ‘friend in franchising’ and if you can’t find the answer on our website, call us, we’re here to help.

Family legacies

“We didn’t specifically think about exit when we bought our business. We were more focused on growth, though that ultimately prepares you for exit,” says Stuart Hart, the Home Instead franchisee for Ruislip and Harrow. “We wanted to deliver high quality care and Home Instead’s model enabled us to deliver that to clients as well as building a business. “We are doing that, but now our son has joined us in the business and will become our General Manager soon.

We are now focused on creating a legacy for him as well as expanding. We’d love to own multiple businesses with Home Instead, and that’s our strategy.”

The best way to start a franchise is to know how you’ll leave it; visit our website www.thebfa.org for more advice on investing in a franchise business.

Pip Wilkins is the Chief Executive of the British Franchise Association (BFA), bringing over 25 years of dedicated experience in the franchising sector. Having progressed through various roles within the BFA, Pip has gained a comprehensive understanding of the broader franchise industry, earning widespread respect for her deep expertise and unwavering commitment. She lives in Devon and is an avid Chelsea FC fan.

Inside the mindset shift that’s turning founders into human-centred leaders - and start-ups into powerhouses.

by ENTREPRENEUR UK STAFF

While much of the start-up world chases growth at all costs, Andy Ayim MBE, an advisor, facilitator and entrepreneur, whose work spans companies from Google to Uber, is asking a different question: what happens when founders lead with emotional intelligence, not ego? “Companies are the sum of the people they employ,” Ayim says. “To embed a mindset, I believe you have to start with the individual and understand internally what they think and feel.” This philosophy - centred not on productivity hacks or frameworks, but on emotional intelligence - has earned Ayim a reputation as one of the most thoughtful voices in UK entrepreneurship. In a conversation that moves from AI and remote work to trauma and truth-telling, he lays out a clear case for why humancentred leadership is not a soft skill - it’s a survival skill.

The mindset behind the metrics

It’s easy to talk about values. Much harder to change behaviour. Ayim argues that most start-up culture change efforts fail because they skip the most vital step: understanding what’s happening inside each person. “By this, I mean it is important to understand how people process their feelings and thoughts, things such as their beliefs, attitudes and values,” he explains. “This is what influences their mindsets and how they show up -observable behaviours.” He shares an example: someone in a team might carry a deep-seated belief that they’re “not good enough,” stemming from childhood experiences. That belief, unless surfaced and challenged, will subtly shape their work, their relationships, and their sense of agency. “When you understand things like this, you can meet people where they are and ground them with a simple question, ‘What is true?’ This question can allow an individual to process and discover that what is true is that they are enough.”

This isn’t therapy disguised as leadership - it’s practical emotional work that enables people to show up more fully. And for Ayim, it’s the foundation of any high-performing culture.

As a start-up scales, founders quickly shift from building products to building people. Many stumble. Ayim has seen it time and time again: well-meaning founders mistaking friendliness for psychological safety. “Start-ups don’t come with a manager manual. As a founder, you might be brilliant at managing products, timelines and pitch decks, but people are not tasks to be optimised. They are whole human beings, with hopes, fears and brilliance waiting to be unlocked.”

The ‘family feel’ often lauded In early start-up culture can become a trap - masking avoidance of the hard stuff: feedback, accountability, conflict. “That ‘family feel’ culture can create warmth, but it can also mask avoidance. Avoidance of hard conversations. Avoidance of accountability and ownership. Avoidance of truth.” Ayim calls on founders to reject the popularity contest, and instead, step into leadership that holds both care and candour. “True leadership isn’t about being liked. It’s about creating the conditions where people feel they belong and can do their best work. Where your people can take risks, speak openly and honestly, and grow.” In his view, the ultimate competitive advantage isn’t code or capital. It’s culture. “Because when your team feels seen, safe, and stretched - not just supported but sharpened - that’s when they do their best work. That’s when culture becomes your competitive advantage.”

The rise of human-centred entrepreneurship in the UK Ayim sees a shift emerging among a new generation of UK entrepreneurs. One that’s less interested in hustle culture and more committed to building with intention. “I believe we’re moving from founder-led hustle to human-led culture. The most forwardthinking UK entrepreneurs are realising that success isn’t just about scaling products, it’s about scaling people.” This shift, he argues, is urgent. With AI, hybrid work, and shifting generational values, the rules of engagement are being rewritten. But the foundation remains unchanged: how we feel impacts how we perform. “Human-centred leadership is no longer a nice-to-have, it’s the engine for innovation, retention, and fulfilment. I see a growing shift toward leaders who prioritise emotional intelligence, create space for truth-telling, and build cultures where people feel seen, safe and stretched.” The businesses that will stand out in the next decade, Ayim says, will innovate not only in what they build - but in how they lead.

for building emotional intelligence

It’s one thing to value empathy. It’s another to practice it. Ayim offers a practical tool called See–Hear–Speak, learned from a team at Psalt, as a transforma- }}

“True leadership isn’t about being liked. It’s about creating the conditions where people feel they belong and can do their best work. Where your people can take risks, speak openly and honestly, and grow

tive emotional intelligence framework for founders.

“It begins with seeing the whole person, not just their output. Then, hearing - listening deeply to understand, not to fix. Finally, speaking with care by asking, ‘What can I do to support you?’” This kind of emotional presence fosters what psychologists call psychological safety - the single most predictive factor in high-performing teams, according to Google’s own research.

“This simple practice builds emotional presence and psychological safety, the foundations of every growing start-up.” This isn’t about being “soft” on people - it’s about unlocking their full potential.

Three practices that will define the next decade

When asked what specific leadership practices UK start-ups should embrace over the next 10 years, Ayim doesn’t hesitate. “The start-ups that stand out won’t just innovate in what they build, but in how they lead.” He breaks it down into three core practices:

} Listening before leading “Founders who stay curious about how their people feel and think will build cultures rooted in trust, not just talent.”

} Courageous conversations

“Replacing avoidance with care and candour will create environments of truth, accountability, and growth.”

} Designing for belonging

“Building teams where every person feels safe, seen and stretched will

turn inclusion from a statement into a system.”

The goal isn’t just better culture - it’s scaling people.

“In short, human-centred leaders won’t just manage people, they’ll multiply potential. And that will be their unfair advantage.”

Ayim isn’t blind to the rapid evolution of workhe embraces it. But while others fear AI will replace human jobs, he sees it differently. “Don’t try to compete with AI, see it as a co-pilot that complements the unique brilliance and creativity of your people.”

The real edge, he says, isn’t speed or data. It’s empathy, imagination, and human connection. “AI can handle repetition, but only humans can bring deep empathy, emotional intelligence, and courageous imagination to the table.”

In an increasingly remote and tech-first world, it’s not the tools that make the difference. It’s the environment leaders create. “Culture becomes your anchor.

The leaders who win won’t just adopt new tools; they’ll create environments where people feel they belong, are challenged, and are trusted to lead.”

Ayim doesn’t offer silver bullets. What he offers is deeper: a way of thinking about leadership that is anchored in humanity, scalable with purpose, and essential for the unpredictable future we’re all stepping into. “The future belongs to founders who prioritise human connection.” He leaves us with a

“IN SHORT, HUMAN-CENTRED LEADERS WON’T JUST MANAGE PEOPLE, THEY’LL MULTIPLY POTENTIAL. AND THAT WILL BE THEIR UNFAIR ADVANTAGE”

challenge - a mindset shift that sounds deceptively simple, but could reshape everything: “People are not

tasks to be optimised.” In a world chasing productivity, it might be the most revolutionary idea of all.

Debbie

by ENTREPRENEUR UK STAFF

Debbie Wosskow OBE is one of the UK’s most influential female business speakers, renowned for her multi-exit entrepreneurial career and leadership in driving gender equity. She co-founded Mantra PR at just 25, launched Love Home Swap - growing it to over 100,000 homes in 150 countries before its multimillion-pound sale - and went on to create AllBright and Maidthorn Partners. In this exclusive interview with Entrepreneur UK, Wosskow reflects on the key lessons of scaling a business - what she calls the 3 G’s: graft, grace and grit.

What are the key lessons business owners should know about scaling a business successfully?

I started my first business 26 years ago and I have built three businesses to exit. When I think about investing - or what’s next - I always come back to the three Gs. The first is graft. I’m a northerner and graft is everything. It’s just about hours in. In an entrepreneurial career, you can’t underestimate the sheer volume of work required. The second G is grace, especially grace

under pressure. For me that is about building relationships and building networks. Networks have been the absolute bedrock of my career. As you move through the entrepreneurial journey, protecting those relationships and not burning bridges becomes absolutely critical. The final and most important G for me is grit. I think that grit trumps genius every day of the week. I reflect on this in my book, Believe, Build, Become: How to Supercharge Your Career, and it’s the heart of my podcast, Grit and Grace. Yes, I care about metricsrevenue, product–market fit, all the numbers. But in the end, temperament is everything. Attitude is what wins.

→ Debbie Wosskow,

OBE co-chair of the Invest in Women Taskforce, co-founder of Mantra PR, co-founder of Maidthorn Partners, co-founder of AllBright & Executive Chair of The Better Menopause

How can businesses foster a culture of innovation to stay competitive in today’s market?

I approach innovation from both ends of the spectrum - big business and start-ups. I am expert in turning an idea and an innovative thought into a business that raises capital and scales but I also do big company work, whether that is on the board of Channel 4 or the senior advisor role for McKinsey, or indeed chairing the Investing in Women Taskforce for the Chancellor. I’m increasingly struck by how much innovation depends on networks. It’s about making sure that you surround yourself with real diversity of thought. I’ve done a lot of

work with people across the world who are true technology innovators. I see my role as founder CEO is to harness those ideas and turn them into a culture and a vision that drives revenue and scale. And doing that from the UK matters, because innovation needs to sit firmly at the heart of our growth agenda.

What’s the biggest leadership lesson you’ve learned that every business owner should apply?

We all need to learn how to fail. I wasn’t very good at thinking about failure in my earlier career. Founding a business in the late ’90s and raising capital as a woman was very unusual. I see failure as teaching me lessons about myself. I also think that we need to learn how to fail on our way to success. I think good entrepreneurs are constantly pivoting - both in their careers and their ideas. None of the businesses I’ve sold ended up looking exactly like the idea I started with - and that’s part of the process and part of what keeps me going as an entrepreneur into my 50s and beyond.

→ Ralph Porciani, CEO of JA Resorts & Hotels

by PATRICIA CULLEN

As international travel rebounds and guest expectations evolve, a shift is underway in the UK hospitality landscape: foreign hotel brands are moving in - not with brash takeovers, but with carefully chosen investments grounded in heritage, location, and long-term value. Among them is JA Resorts & Hotels, the Dubai-based group making its UK debut with two Scottish properties. For CEO Ralph Porciani, a native of Dumbarton, it’s both a strategic move and a personal return. But JA is far from alone. From luxury groups to boutique operators, global players are increasingly viewing the UK - notably Scotland - as a natural extension of their brand story. The draw? A blend of cultural cachet, loyal outbound travellers, and properties that offer character over conformity

BY PROTECTING THE HERITAGE OF THESE PROPERTIES WHILE BRINGING IN THE STRENGTH OF JA’S SERVICE ETHOS, THE AMBITION IS TO ADD VALUE IN A WAY THAT FEELS NATURAL, NOT IMPOSED. OVER TIME, THAT BALANCE IS WHAT HELPS A NEW ENTRANT STAND APART”

Why was the UK – particularly Scotland – chosen as the next chapter in JA Resorts & Hotels’ growth story?

The UK has long been one of our most important international markets, with many guests returning to our resorts in Dubai and the Indian Ocean year after year. Scotland, in particular, has always drawn travellers, both from within the UK and from the Middle East; thanks to its heritage, cooler climate, leisure offering, and natural beauty. This step was enabled by our parent company, Dutco Group, whose acquisition of Mar Hall and The Bruntsfield created the foundation for JA Resorts & Hotels to bring our operational expertise and guest-first philosophy to the UK. It felt both natural and sustainable: entering a destination our guests already value, while broadening our international footprint in a considered way. On a personal note, having

grown up in Dumbarton and begun my career here, Scotland holds special meaning for me. Bringing JA’s ethos of authentic, nurturing hospitality back to a place so close to my own roots makes this chapter particularly rewarding.

This move into the UK marks a major milestone. What made now the right time for JA Resorts & Hotels to expand beyond your traditional markets?

Over the past four decades, JA Resorts & Hotels has evolved into an experience-led hospitality group with a portfolio spanning beach, mountain, city, and island stays. Heritage has always been central to our identity from JA Beach Hotel and JA Hatta Fort Hotel, both founded in 1981 and adding two storied Scottish properties continues that tradition. Dutco Group’s acquisition of Mar Hall and The Bruntsfield

↓ Alistair Bruce, General Manager of The Bruntsfield, Ralph Porciani, CEO of JA Resorts & Hotels and Andy Roger, Resort Director of Mar Hall Golf & Spa Resort

align with our values. Our repositioning as an experience-led group has prepared us to steward heritage properties, established and newly added with the same respect, individuality, and authenticity that define our resorts worldwide.

and the role of JA is to respect that individuality while refining service, enhancing guest journeys, and creating experiences that connect multigenerational travellers to nature, sport, wellness, culture, and to one another. The challenge is not simply

provided the foundation for JA to bring its operating expertise to the UK. This represents a natural extension of our journey: strengthening our position in key source markets such as the UK, Middle East, and the Americas, while entering a destination that speaks to travellers looking for distinctive and meaningful stays. This is not growth for its own sake, but careful expansion into places that

The UK hospitality sector is both mature and highly competitive. What excites you most – and what challenges do you anticipate as a new entrant? The most exciting aspect is the opportunity to introduce JA’s philosophy of experience-led hospitality into a market where history and tradition already run deep. Both Mar Hall and The Bruntsfield carry distinct character,

about entering a mature market, but about earning trust within it. That requires consistency, authenticity, and sensitivity to local nuances rather than applying a one-size-fits-all approach. By protecting the heritage of these properties while bringing in the strength of JA’s service ethos, the ambition is to add value in a way that feels natural, not imposed. Over time, that

“THE UK IS BOTH A MATURE MARKET AND A NATURAL GATEWAY INTO EUROPE, MAKING THIS STEP MORE THAN A SINGLE INVESTMENT. IT PROVIDES A FOUNDATION IN A REGION THAT IS STRATEGICALLY IMPORTANT AND CULTURALLY CONNECTED TO JA’S FUTURE AMBITIONS

balance is what helps a new entrant stand apart.

For other business leaders looking to expand internationally, what has been your biggest lesson so far in entering a new and competitive market like the UK?

Every market has its own nuances, and the greatest lesson is to listen before you lead. Scotland is close to my heart, I grew up in Dumbarton and began my career here - and I understand the importance of respecting the country’s strong sense of place. Preserving the unique history and character of Mar Hall and The Bruntsfield, while introducing JA’s global standards and service philosophy, has reinforced that staying true to identity matters most. Both guests and local communities connect more deeply when a property and destination’s authentic character is protected and celebrated. For JA, the role is to act as a custodian of these heritage properties while elevating them in a way that feels natural. Striking the right balance between local character and international expertise is what builds trust, and ultimately what ensures longevity in any new market.

Looking ahead, do you see the UK becoming a strategic hub for JA’s European expansion – or is this more of a selective, standalone investment?

For us, growth is approached with intention, always guided by

destinations that align with JA’s vision and values. The UK is both a mature market and a natural gateway into Europe, making this step more than a single investment. It provides a foundation in a region that is strategically important and culturally connected to JA’s future ambitions. The focus remains on expansion that is authentic and sustainable. The UK marks the beginning of a new chapter, one that strengthens JA’s global presence while leaving the flexibility to explore further opportunities across Europe when the conditions align. Supported by Dutco Group’s long-term vision, this is a measured step forward that can create further opportunities in the future.

With evolving guest expectations and rapid shifts in hospitality tech, how is JA planning to innovate within your new UK properties over the next 3–5 years?

Innovation is not about technology for its own sake, but about enhancing the guest journey in ways that feel natural and meaningful. Over the next few years, seamless digital touchpoints will be introduced across the UK properties, from booking through to in-stay personalisation; allowing guests to engage on their own terms. Equally important is keeping the human connection at the heart of hospitality. Technology should support, not replace, the warmth of service. With smart systems complemented by attentive

teams, preferences can be anticipated and recognition delivered consistently, whether the stay is at Mar Hall, The Bruntsfield, or one of JA’s resorts in Dubai or the Indian Ocean. Sustainability will also remain part of this innovation agenda. With both UK properties already holding

strong accreditations, data-driven tools will be used to reduce energy use and waste while maintaining comfort. The goal is simple: to build trust, make stays easier, and leave a lighter footprint.

Analysis

Ultimately, JA Resorts & Hotels’ expansion into the UK may carry personal weight for Porciani, but it also reflects a

broader calculation playing out across the sector: the UK remains a prize market for global hospitality brands seeking both credibility and connection. In a landscape rich with history and visitor loyalty, the opportunity lies not in reinvention, but in restoration - with a modern lens. As international operators continue to look beyond their home turf, the UK’s appeal endures: stable, storied, and still full of potential.

BANKROLLING DREAMS AND CHECKING RISKS - HOW THE BRITISH BUSINESS BANK FUELS THE UK’S NEXT BIG MOVES.

by PATRICIA CULLEN

When Louis Taylor was CEO of Standard Chartered in Vietnam, a sudden problem with his own bank account gave him an unexpected jolt of empathy - and shifted his entire outlook. “I’d get a lot of complaints from customers about things on their accounts. They were vociferous,” he recalls. “Then, one day, something went wrong with my own account - and my blood pressure went through the roof. You suddenly think - this is what it feels like to be a customer when things don’t go right.”

That moment didn’t just explain the customer experience - it reframed Taylor’s entire leadership mindset.

“Alignment is really important,” Taylor says, “but so is being approachable and staying in tune with what the organisation is there to do - and what it’s experiencing in the market. And finally, a leader needs to put themselves in the mindset of their customer as much as possible.”

Now, as CEO of the British Business Bank, the UK’s government-backed institution that supports small and medium-sized businesses by improving their access to finance, he is challenging the status quo in how Britain funds its entrepreneurs. In a start-up landscape tangled with red tape and scarce

capital, his guiding question is simple: “Are our processes built to help founders succeed, or just to make our own jobs easier?”

It’s a question grounded not in theory but in lived experience - and it fuels Taylor’s mission to strip back bureaucracy and rethink how the UK backs its builders. “Who are we there to serve?” he says. This straightforward, almost obvious truth forms the heart of Taylor’s philosophy - one shaped far beyond the boardroom, where it matters most: on the ground.

At a time when headlines warn of economic slowdowns, volatile investment, and founders struggling to secure funding, the British Business Bank is recalibrating its approach. “The

“

THE GOVERNMENT HAS UNDERSTANDABLE DEMANDS - BUT THEY’RE NOT ALWAYS VALUEMAXIMISING IN A COMMERCIAL SENSE. OUR JOB IS TO TRANSLATE THOSE INTO SOMETHING THAT STILL WORKS IN THE REAL WORLD”

BE REALISTIC, BUT BE AMBIENTLY POSITIVE ABOUT YOUR PROSPECTS. DON’T UNDERPLAY HOW GOOD YOU ARE. KNOW YOUR NUMBERS, UNDERSTAND YOUR MARKET - BUT BACK YOURSELF”

funding journey isn’t uniform all the way through the different stages,” Taylor says, referring to the difficulties entrepreneurs face today. “The earliest stage is not necessarily the hardest time, but it’s definitely pretty tricky out there.”

Since its creation in 2014, the British Business Bank has built up a series of capabilities, a wide range of programmes - funds,

guarantees, loans, and equity schemes - targeting different stages of business growth. But Taylor acknowledges that the system became fragmented. “We had lots of programmes individually, and the handovers weren’t easy. The siloed nature made it hard.”

Now, that’s changing. “We’re creating a single banking business, a single investment business,” he

explains. “We want to provide solutions, rather than push programmes or interventions. It comes back to customer-centricity.” He aims to deliver what he calls “a continuum of solutions” - a clear, consistent, and coherent pathway for founders

struggling to make sense of the complex funding maze. The Bank plans to strengthen its existing capabilities and put them to more effective use. Reflecting on the state of the UK’s entrepreneurial ecosystem, Taylor sees genuine cause for optimism. “Of course, we could do better - there are things that need fixing,” he acknowledges. “But there’s also a lot that’s working well. If we ignore the good, we’ll never improve on what’s already strong.”

Serving entrepreneurs while also answering to the government isn’t

always seamless. One of the more delicate balancing acts Taylor manages is reconciling the British Business Bank’s public mission and the risk-driven mindset that entrepreneurs embody. “Alignment is really important,” Taylor says. “But it’s about making sure our business teams deliver for SMEs and entrepreneurs on as commercial a basis as possible.” As Taylor puts it, “Entrepreneurs are fundamentally value maximisers, yet our shareholder is a government - which is a loss minimiser.” The challenge is both philosophical and practical: how does a public bank juggle

“

BEING FUNDABLE ISN’T JUST ABOUT THE TECH OR THE MARKET TRENDS. IT’S ABOUT DELIVERING CONSISTENT, CREDIBLE VALUE AND STAYING TRUE TO THAT”

high-risk, high-reward ambition with the caution Westminster expects? “There’s quite an alignment of outcomes,” he argues. “Entrepreneurs want capital, support, market access. The government wants stronger growth, innovation, and ideally not to lose money in the process. So where we’re able to operate best is where there is that mutuality of interest.”

He admits the British Business Bank’s frontline teams can be caught between the competing expectations. “Our Executive Committee’s role is partly to insulate those teams from political pressures that might not maximise commercial value, translating those stipulations into workable solutions.” It’s a pragmatic stance, acknowledging the challenges while keeping focus on outcomes that benefit both the

public and entrepreneurs.

“The government has understandable demandsbut they’re not always value-maximising in a commercial sense. Our job is to translate those into something that still works in the real world.” That balancing act will be tested even more as the Bank prepares to raise thirdparty capital for the first time. “We’re going to find out whether our track record is good enough,” Taylor says with confidence. “I think it is.”

The funding bottleneck

The CEO thinks the UK ecosystem is in pretty good shape, broadly speaking. The data backs him up. “850,000 new companies

I THINK THE BIGGEST BARRIER IS WHEN ENTREPRENEURS START TO NEED INSTITUTIONAL FINANCIAL HELP. THAT’S WHEN THE RISK APPETITE OF THOSE INSTITUTIONS KICKS INPARTICULARLY AT THE SCALE-UP STAGE - AND THAT’S WHEN IT BECOMES MOST DIFFICULT TO GET THE MONEY THEY NEED TO REALLY GROW”

were registered with Companies House last year. Not all of them are high-growth ventures, but a significant portion were,” he adds. For all the talk of Britain as a start-up nation, there’s a hard truth that founders learn the moment they try to grow: the leap from start-up to scale-up is where many stumble - not for lack of talent or ambition, but for lack of capital. And not just any capital, but patient, risk-tolerant investment that understands the long game. Taylor is blunt about it. “I think the biggest barrier is when entrepreneurs start to need institutional financial help,”

he says. “That’s when the risk appetite of those institutions kicks in - particularly at the scale-up stage - and that’s when it becomes most difficult to get the money they need to really grow.”

It’s a well-worn gap in the UK market: early-stage founders can often scrape together seed capital from angel investors or government-backed schemes, but when the time comes to raise serious money - to enter new markets, hire experienced teams, develop IP - the funding well runs dry. And it’s not because the ideas aren’t good.

“We’ve got to get our investment institutions, who are

professionally managed but also professionally risk-managed, to appreciate the absolute goldmine of opportunity that British entrepreneurialism represents,” Taylor says. “Not just in consumer businesses, but in innovative tech and science-led companies as well. We’re amazing at this stuff.”

The ambition is there. The ideas are there. What’s missing, often, is the capital that meets founders where they are - especially those building beyond London, or outside of traditional industries. That’s part of why the British Business Bank exists. But even Taylor admits that

government funding can only do so much. “The far bigger solution is marketdriven,” he says. “And that means a cultural shift in how British institutions view entrepreneurial risk.”

Realism, resilience - and a little optimism

Some entrepreneurial traits, Taylor believes, are universal. “Resilience, belief, willingness to experiment and course-correct,” he says. Regardless of geography, founders must be able to build what he calls “a consistent, credible investment proposition from your business - identifying a problem, why you are the solution, whether

what you do works, and whether it’s deliverable.” But spend enough time speaking to British entrepreneurs and a different pattern emerges: caution. It’s not that UK founders lack ambition - but many still feel compelled to hedge their bets, downplay their potential, or even apologise for aiming high. Taylor recognises it. “There’s a greater degree of optimism in the US among entrepreneurs,” he observes. “In the UK, perhaps a greater degree of realism. And while both traits have their strengths, they can also go too far.”

His solution? Something he calls ambient positivity. “Be realistic,” he says, “but be ambiently positive about your prospects. Don’t underplay how good you are. Know your numbers, understand your market - but back yourself.” It’s advice that’s rooted not in motivational fluff, but in credibility. For Taylor, today’s - and tomorrow’s - fundable founder must demonstrate substance: a clear proposition, a validated product, and a market that wants it. “This isn’t linear,” he adds. “It’s iterative. It takes resilience, creativity, and integrity.” Taylor stresses that successful foundersnow and into the future - must clearly define the problem they’re solving, articulating why their solution works, and proving that the market wants it.

Historically the British Business Bank was sector agnostic, particularly in the early stage. Following a recent government spending review, Taylor explains that the British Business Bank was given £4bn to back the new industrial strategy sectors - the eight key industrial sectors, aiming to catalyse growth where the country can really lead. “These sectors cover a significant part of the economy,” he says, “and none exist in isolation. For example, advanced manufacturing overlaps with agriculture, even if agriculture itself isn’t one of the eight sectors we’re backing directly.” This targeted approach aims to not

only support existing innovators but also to attract new investment - especially from private third-party sources that can multiply the British Business Bank’s efforts. “We’re hoping to catalyse third-party money alongside us to create a much larger pool of capital backing innovation in the UK,” Taylor explains. This strategy reflects a nuanced understanding of the entrepreneurial ecosystem. Public funds can seed and support, but long-term growth depends on private investment confident in British innovation’s potential.

“

SCALING DOESN’T HAVE TO FEEL LIKE A LEAP INTO THE UNKNOWN. WITH THE RIGHT INFRASTRUCTURE, IT BECOMES A JOURNEY OF STEADY FORWARD MOMENTUM.”

Looking ahead to 2030 and beyond, Taylor envisions founders who will thrive by sticking to the fundamental values of business - clear purpose, solid execution, and integrity - rather than chasing fleeting fads or flashy trends. It’s a reminder that, even in a fast-changing world, the basics remain the bedrock of lasting success. While

technologies and markets will evolve, these core traits remain vital. In a world of constant change, those qualities will be your greatest assets.

“Being fundable isn’t just about the tech or the market trends,” he reflects.

“It’s about delivering consistent, credible value and staying true to that.”

Britain’s bold business reboot

In a climate where uncertainty dominates and growth feels harder to grasp, Taylor’s leadership at the British Business Bank offers something rare: measured optimism rooted in action. His approach isn’t about empty promises - it’s about strengthening a startup ecosystem where founders are understood, supported, and empowered to succeed. For UK entrepreneurs, that means embracing realism without surrendering hope, thoughtful discipline without sacrificing creativity, and purpose with integrity. Scaling doesn’t have to feel like a leap into the unknown. With the right infrastructure, it becomes a journey of steady forward momentum.

As the British Business Bank sharpens its focus - championing innovation-led sectors and drawing in private capital - it’s mastering the delicate balance between public good and entrepreneurial drive. In doing so, it affirms a vital truth: The UK’s future rests on leaders who are grounded, resilient, and unafraid to build. Taylor sees this as a moment to embody what he calls “ambient positivity,” and to recognise what’s already working in UK entrepreneurship - not just what needs fixing. For now, there’s one clear challenge ahead:

“We’ve got to find a way to bring the quality of UK entrepreneurship to the attention of our major investment institutions - because they should be backing it far more than they currently do.” Britain’s founders don’t need permission - they need belief, backing, and the capital to match their ambition. The horizon is wide open. The question is: who’s ready to claim it?

The world’s largest business event is returning to London this November, packed with opportunities to start or scale your dream business.

25.000 200 500

The UK’s most highly anticipated business event of the year—The Business Show, is making its return to London, a city renowned for innovation, opportunity, and global entrepreneurial spirit.

Taking place in the heart of this iconic business capital, at the Excel, this year’s show promises to be more impactful than ever, drawing in over 25,000 entrepreneurs, small business owners, investors, and professionals from across the country and beyond.

Whether you’re a start-up founder taking your first steps, a scale-up ready to expand globally, or a seasoned entrepreneur seeking fresh ideas and connections, The Business Show is the ultimate platform to learn, network, and grow.

One of the most exciting focuses of this year’s event is the transformative power of digital platforms in reshaping how businesses grow and scale.

Social media has moved far beyond brand awareness and community building—it has become a powerful monetisation engine and a direct line to consumers.

This year, we’ll dive into how platforms like TikTok, YouTube, and emerging creator tools are giving rise to a new generation of entrepreneurs.

Sessions will explore how short-form video content, influencer marketing, and platform monetisation are enabling businesses of all sizes— even one-person operations—to

build massive audiences, drive sales, and create global impact in record time.

You’ll hear from digital creators who’ve turned content into commerce, business owners who’ve grown entire brands off the back of viral content, and experts who will help you decode the algorithms and tactics for success.

In a major highlight of the show, some of the UK’s most well-known and respected investors will be taking the stage.

These include Dragons from BBC’s Dragons’ Den—individuals who have not only built businesses of their own but have invested in dozens of small and medium enterprises across the UK.

Think of it as the business version of speed dating. You’re seated across from another entrepreneur, investor, or your next big client. A bell rings.

You’ve got two minutes to make a memorable impression, exchange ideas, and plant the seeds of a future partnership.

Then—ding!—you’re on to the next. New face, new story, new opportunity. It’s fast. It’s focused. And it’s fun.

Across both days, our seminar theatres will host leading speakers from across the UK, covering the most relevant and up-to-date topics in modern day business.

Want to know more about speaking, exhibiting, or sponsorship opportunities?

These speakers will provide you with practical tools and strategies that you can use to enhance your daily operations and also support the long-term growth of your business.

Led by some of the UK’s most forward-thinking companies, our masterclasses offer a more focused look at proven strategies to grow your business.

Released in the run-up to the show, these sessions cover popular and on-trend topics—past themes include property investment, finance, and marketing.

This year’s lineup is shaping up to be just as exciting—check our website soon for updates.

Your free ticket gives you access not only to The Business Show, but also to two co-located events—each offering valuable insights to elevate your business and professional development. Whether you’re looking to expand internationally or invest in growth opportunities for yourself and your team, these events are here to help you move your business forward.

Going Global Live is the leading event for businesses looking to expand internationally, export products, or establish operations overseas. From navigating post-Brexit trade to mastering global imports and exports, it offers essential insights and connects you with top minds in international business.

The CPD Expo is the UK’s premier event for professionals eager to continue learning, stay up-to-date, and advance their own and their team’s careers.

At the event, you can earn CPD points and network with like-minded individuals dedicated to skill development and staying ahead in their fields.

by ABIGAIL FISHER

Some brand teams may feel that TikTok isn’t for them - but it’s not just a trendy social platform or one aimed exclusively at Gen Z. It’s a global engine of awareness, discovery, and influence, where consumer decisions are made in seconds and startup brands can achieve global fame overnight. That said, success on TikTok isn’t accidental or a given. There’s always a clear strategy behind the brands that get it rightand a fine line between cultural relevance and

GOING VIRAL ISN’T ALWAYS THE GOAL, AND IT SHOULDN’T BE YOUR FIRST ONE. RELEVANCE SHOULD BE. THE FASTEST-GROWING BRANDS ARE THE ONES THAT EMBED THEMSELVES WITHIN THE RIGHT COMMUNITIES EARLY, AND GROW FROM THE INSIDE OUT”

trying too hard. Knowing you should be on TikTok isn’t the same as knowing how to show up effectively - it takes a deep understanding of the platform, its culture, and its creators to strike the right tone. Here are 5 strategies for tapping into the TikTok growth machine.

} Creator-first: Trusted voices are cultural currency

Creators are a modern version of word-of-mouth. They hold trust, shape conversations, and when you partner with the right ones, they can dramatically accelerate brand traction. 84% of consumers trust creator recommendations

more than traditional ads, and TikTok’s creator-first ecosystem rewards authenticity. Skin+Me, a British skincare brand, grew fast by leaning into creator-led storytelling. They didn’t run overly glossy campaigns - instead, they worked with relatable creators who actually use the product and filmed ‘day in the life’ routines that felt raw, personal and believable. That authenticity helped build loyalty quickly, because their talent choices weren’t just seen as influencers doing a job - they were seen as community members.

Takeaway: Don’t force a script. Partner with creators who genuinely like

and care about your product or niche, and let them speak in their own voice - that’s what resonates with their audience. It’s not about control or scripting every word; it’s about what’s credible, and in turn, going to build consumer trust.

} Speak the platform’s language - not just your own

Repurposing brand content that was made for Instagram or YouTube won’t work here. To succeed, you need to be fluent in the style, the humour, the pacing, and the native behaviours of the platform. Whether you’re using a trending format or jumping on a

viral sound, the content still needs to be original. The algorithm prioritises posts that are both engaging and fresh, not carbon copies. That means understanding what’s trending and adding something new - even your product-focused content should be tailored to TikTok’s native style: short, sharp, relevant and creative.

This doesn’t mean starting from scratch every time, it means starting with TikTok in mind if you want to get traction there. Later, great content can be adapted and scaled across other channels, but in terms of format - it isn’t one size fits all. Every platform has its nuances. Creators can play a powerful role here - they live and breathe hacking the algorithm and often spot cultural shifts long before brands do. They’re your cultural currency. Takeaway: Design content with TikTok in mind from day one. Focus on what works here, not elsewhere - then scale from there. Create natively first, repurpose second.

} Focus on the right communities, rather than the broadest audience Going viral isn’t always the goal, and it shouldn’t be your first one. Relevance should be. TikTok’s power lies in its micro-communities, such as #MoneyTok, #SkinTok, #BeautyTok, #CleanTok, #FitTok, and #SustainabilityTok - each has its own tone,

references, and trusted top creators. The fastest-growing brands are the ones that embed themselves within the right communities early, and grow from the inside out.

Takeaway: Use TikTok search and community tools to understand where your audience really lives. Then work with creators who are already native to that space, giving them enough of a brief to communicate the brand to that audience - but letting them do it in an authentic way.

} Repurpose, localise and scale creator assets

One smart creator partnership can fuel your entire content funnel - from awareness-driving stories, to product cutdowns, to retargeted assets that convert. When we worked with Wonderskin, we produced over 300 assets using just 12 creators. That was only possible because we built a content strategy upfront: planning hooks, shot types, and platform edits that were then optimised to support different objectives. With sharp editing, localisation for different regions, and a clear creative strategy tailored to each platform and audience, it’s possible to scale your message without scaling your spend. Takeaway: Don’t brief for a single post. Brief for a full asset suite. Agree usage and formats in advance, outline your editing plan, and make sure your creators capture enough raw footage to allow for cutdowns, translations, and platform-specific tweaks. This is how you build a high-performing content engine – not a one-hit-wonder.

} Move at the speed of culture - but with structure behind you TikTok moves fast, and so should you – but reacting in real time only works if you’ve built in the structure to do it properly. Cultural moments, product drops, trending formats… these are all huge opportunities, but only if you’re genuinely ready to move. 53% of consumers say they’re more likely to

TIKTOK MOVES FAST, AND SO SHOULD YOU - BUT REACTING IN REAL TIME ONLY WORKS IF YOU’VE BUILT IN THE STRUCTURE TO DO IT PROPERLY. CULTURAL MOMENTS, PRODUCT DROPS, TRENDING FORMATS… THESE ARE ALL HUGE OPPORTUNITIES, BUT ONLY IF YOU’RE GENUINELY READY TO MOVE”

buy from brands that respond quickly to cultural moments, but very few startups are set up to act on that at the moment.

Takeaway: Build a forward-facing cultural calendar that includes seasonal peaks, retail dates, and relevant awareness days. Create an appropriate approval process that allows for speed, without sacrificing brand safety.

Most importantly, always leave 20–30% of your content schedule open for last-minute opportunities

that align with trends or conversations in real time, with someone monitoring conversations so they’re not missed. A TikTok strategy shouldn’t just be focussed on chasing a viral moment. It should be about relevance, trust, and consistency - showing up where your audience is, in a way that feels natural and unforced.

The brands seeing real traction aren’t always the loudest or the biggest, they’re the ones that understand the platform, partner with the right creators, and build content strategies designed to evolve and grow. Remember, TikTok rewards authenticity, even if you start by tapping into smaller communities. You don’t need a massive budget or a viral hit. You need a sharp message, a clear brand identity, creators who genuinely understand and care about your brand, and a team with the capacity to move at the speed of online culture. That’s what drives sustainable growth - and that’s how brands can harness the driving power of this phenomenal platform.

Abigail Fisher is Business Director at Influencer, the global creator marketing agency helping brands connect with culture through strategic, creator-first, insight-led campaigns. With over eight years of experience in the creative and creator industries, Abigail has led full-funnel campaigns and branded content solutions for some of the UK’s biggest brands.

The UK’s tech and investment landscape is evolving fast. At the forefront of this transformation is London-based IMS Digital Ventures, an investment house with multiple asset classes across venture building, private credit, real estate, and hedge fund stakes - all while delivering an eye-watering 100% internal rate of return. One of its founding partners, Manuela Burki, offers an insight into the firm’s early vision, its unique model, and what the future holds for UK start-ups and family offices.

“There are three key parts to it,” Burki explains when asked what inspired IMS Digital Ventures and propelled its remarkable success. “We learned early on that there is a

critical gap between capital and capability. An MVP, even with good tech, won’t get you far without operational firepower, regulatory fluency (especially in emerging sectors like tokenisation), and distribution.” This understanding became the foundation of IMS’s hybrid approach: “Merging operational experience with an ecosystem advantage driven by an internal R&D lab that focuses on proprietary, defensible tech. It’s how we beat industry benchmarks across the board.”

This model not only accelerates start-ups’ journeys but also offers family offices an attractive way to engage.

According to Burki, “There is a changing of the guard for family offices with a new generation of decision makers

who want to be in on the action. But unless you have built up in-house capabilities and have exceptional access to entrepreneurs and spare resources to be hands-on with your investment, knowing which early-stage tech companies to invest in is hard.”

The challenges of vetting technology, helping with distribution, and pivoting when necessary make traditional investment

“

WE WERE NEVER DISTRACTED BY THE TECH INDUSTRY’S HYPE CYCLES. FOR EXAMPLE, B2B SAAS HAS GOTTEN A LOT OF ATTENTION IN THE LAST FEW YEARS BUT WE WERE THERE BEFORE IT WAS COOL”

approaches risky, she says: “A venture builder model that is backed by a network of investors like you, each one bringing something unique to the table, is an incredibly powerful way to strategically structure venture capital investing.”

IMS’s strategy is defined by a long-term vision that operates independently of market noise. Burki notes, “We were never distracted by the tech industry’s hype cycles. For example, B2B SaaS has gotten a lot of attention in the last few years but we were there before it was cool.” They focus instead on “underexplored categories with asymmetric upside where our tech is a serious threat or deterrent to other competitors.” And while the crypto boom dazzled many, IMS took a more measured approach: “We often joke we were the last ones to invest in crypto. All of our blockchain and NFT investments are backed by real-world assets with serious industry use cases and have liquid secondary markets.”

On the broader UK fintech landscape, Burki is optimistic about the nation’s potential to become a hub for tokenised real-world assets (RWAs) like real estate. “The UK recognises that long-term investor and industry confidence in cryptoassets depends on clear and competitive regulation.” The recent FCA draft legislation around cryptoassets and stablecoins is a step in the right direction. She adds, “We believe that the UK can merge its financial legacy with forward-thinking policy to position it as a leading market for fintech. It’s about recognising the role that crypto can play as a credible,

positive force for growth.”

While the UK trails markets like Dubai or Switzerland on crypto regulation, Burki believes it can lead in RWAs: “RWAs are a natural extension of the UK’s institutional base and asset management space. Take the forces shaping real estate in the UK today. Over £260bn in UK property wealth is held in UHNW portfolios. Higher-end properties fell 1.6% compared with 0.6% for smaller properties in London. Tokenisation can create liquidity and infrastructure for broader participation as investors favour smallerticket, cross-border access in a time of general market uncertainty.”

When it comes to start-ups, Burki highlights challenges unique to the UK: “UK-based start-ups are in a big market but face their own challenges, and specifically ones that slow them down just as they are trying to scale-up.” In the US, corporates are less cautious about early-stage procurement, and in Asia or the Middle East, governments often act as early adopters. But in the UK, start-ups must navigate “tougher processes to get early validation.” She points to IMS’s AI cybersecurity company Blacklight as a case study, where “it takes so much time and effort to get contracts over the line with governments and tier-one clients in the financial industry.”

The venture builder model, Burki argues, can provide vital legitimacy, reassurance, and hands-on support during these fragile early phases. This approach is especially timely, as the traditional “blitzscaling” mindset loses favour: “The

‘T

/Scale

→ Manuela Burki, one of the founding partners of IMS Digital Ventures.

“

WE BELIEVE THAT THE UK CAN MERGE ITS FINANCIAL LEGACY WITH FORWARD-THINKING POLICY TO POSITION IT AS A LEADING MARKET FOR FINTECH. IT’S ABOUT RECOGNISING THE ROLE THAT CRYPTO CAN PLAY AS A CREDIBLE, POSITIVE FORCE FOR GROWTH”

blitzscaling playbook doesn’t sit well with investors any more, especially with family offices and HNWIs who are increasingly turning to venture capital as a way of diversifying their portfolios.” Today’s investors demand resilience, defensible IP, and clear paths to profitability: “A good venture builder provides proven experience with teams that have fought on the VC battlefield and understand how to scale defensible IP portfolios that align with future market needs.”

The UK’s venture capital ecosystem also depends heavily on international capital for later-stage companies. Burki observes, “Different investor profiles from markets like Singapore or Dubai are backing UK tech start-ups in verticals such as fintech and AI. Other UK start-ups look to the US, offering competitive valuations and a way to diversify into other markets.” This global

connectivity imposes additional demands on founders who must “travel, build relationships, create compelling go-to market strategies in international markets, and fend off global tech competitors.”

IMS’s hybrid model bridges these gaps: “We merge operational expertise with a well connected global partnership of family offices that have real skin in the game to support our portfolio companies.”