The home furnishings industry is no stranger to today’s economic challenges. With high home interest rates, inflation, and layoffs tightening budgets, many shoppers are becoming more cautious about their purchases and choosing to save rather than spend on home goods.

These various obstacles have made today’s competition fiercer than ever, making it crucial for home furnishings brands to understand how their customers prefer to shop and what will drive them to make purchases in today’s market.

The solution lies in a robust omnichannel strategy that caters to diverse consumer preferences. While the pandemic fueled a surge in online shopping, its aftermath has recovered interest in traditional in-store experiences, with houseware retailers seeing steady foot traffic throughout 2023. By seamlessly blending these two shopping methods and adapting to customer preferences, businesses can stay competitive and resilient in this evolving market.

BigCommerce surveyed over 3,000 consumers across the US to uncover what motivates them to purchase home goods. In this report, home furnishings brands can explore the latest consumer shopping behaviors and gain valuable insights to help them elevate their omnichannel business.

BigCommerce conducted a consumer survey in August 2024. There were 3,007 participants total across the Northeast (792), Southwest (382), West (316), Southeast (883), and Midwest (634) of the United States. The survey required all respondents to be 18 or older and to have purchased at least one home furnishings product online in the last 12 months.

All data referenced in this report is sourced from BigCommerce’s consumer survey unless stated otherwise. Unless indicated differently, the report highlights aggregated data.

With the pandemic over, in-person shopping is back in full swing, with 48% of consumers preferring to purchase home furnishings instore, 28% favoring online shopping, and 24% having no preference.

Despite the majority favoring in-store purchases, more shoppers prefer to find inspiration for how they furnish their home digitally, with home improvement shows (48%) and home decor websites and blogs (47%) more popular than in-store browsing (40%).

Given this diverse mix of consumer preferences, home furnishings brands need to optimize their customer journey across today’s various touchpoints and gain insights into what products consumers buy online to maximize sales. Taking a diversified marketing approach that combines traditional advertising, such as TV show product placements, with modern tactics like SMS text messaging, can engage a much broader audience and generate more sales.

Bedroom essentials (Bedding, pillows, mattresses)

Home decor (Rugs, wall art, lighting fixtures)

Storage and organization (Cabinets, shelving, storage bins)

Miscellaneous (Pet furniture, entertainment centers)

Indoor furniture (Couches, tables, desks)

Outdoor furniture (Patio sets, outdoor chairs, hammocks)

When it comes to today’s digital touchpoints, social media (48%) reigns king in product discovery. This is likely because of the abundance of content available on platforms like Instagram and TikTok, which can inspire viewers. Platforms that offer short-form video content also allow consumers to see products from an actual user’s experience and at different angles, making it easier for them to visualize how the items would fit into their own lives.

In today’s day and age, a strong social media presence is essential for building brand awareness and showcasing products. Partnering with influencers can further enhance a brand’s visibility and foster greater trust among consumers, especially when collaborating with ones that resonate with their target audience.

When it comes to searching for specific products, online marketplaces — such as Amazon and eBay — and big-box store websites — like Walmart and Target — are tied as the top browsing channels, both favored by 64% of consumers.

This popularity is likely due to the wide selection of products and brands these sites offer, along with the familiarity and trust consumers have in them. Because of this, many shoppers now use these sites as virtual showrooms that replace the in-store experience.

Home furnishings brands should capitalize on this by listing their products on these platforms, increasing visibility and making shoppers more likely to buy their items.

Online marketplaces and big-box store websites are also the favored choice for purchasing (54%), with most consumers opting to buy mid-priced items ($100 – $499) from these channels.

It’s notable that shoppers prefer these channels over a brand’s direct website (39%). Big-box store promotions or features like Amazon’s free two-day shipping could drive this preference. To stay competitive, brands should compare their website offerings to these popular channels and prioritize listing products that fall within a mid-priced range — such as rugs and coffee tables.

Managing these different feeds can be overwhelming and time-consuming. To streamline this process, home furnishings brands can take advantage of BigCommerce’s partnership with Feedonomics, which offers a seamless solution for managing various sales and advertising channels.

Brands like Houzer have seen remarkable success since taking advantage of BigCommerce’s partnership with Feedonomics. When Michael Challinger, CEO, started the brand’s digital transformation, he wanted to ensure he had the best technology to meet his lofty business goals — and he found it with BigCommerce and Feedonomics. Since migrating to BigCommerce and implementing this omnichannel tool, Houzer has seen a 150% increase in transactions.

“If you’re a brand that’s selling across omnichannel and aspires to sell direct-toconsumer, or if you’re a brand with complex products or complex customers, there’s nothing else but BigCommerce and Feedonomics,” remarked Challinger.

Buy Online, Pick Up in Store is no longer a perk – it’s an expectation.

Consumers who have used BOPIS or curbside pickup to purchase home furnishings in the last 12 months

To cater to the shoppers who don’t have a strong preference for in-store or online shopping, consider offering options that seamlessly blend both experiences — like Buy Online, Pick Up in Store (BOPIS).

69% of shoppers reported using BOPIS in the past year.

BOPIS enhances the shopping experience by allowing customers to pick up their items at a time that’s convenient for them. This feature also saves shoppers money on shipping costs — especially for larger items — making them more likely to complete a purchase.

With so many shoppers enjoying the ease of BOPIS, brands that offer this feature have the opportunity to drive more sales and increase their repurchase rates.

80% of shoppers reported buying additional items when picking up their orders.

Don’t miss out on the opportunity to boost revenue. With BigCommerce’s powerful APIs, home furnishings brands can seamlessly incorporate BOPIS into their online store. Explore how to integrate this feature with BigCommerce’s BOPIS guide.

While many shoppers have a preference for in-store or online shopping, a compelling promotion can often persuade them to switch from their preferred buying method. In fact, 82% of shoppers who prefer in-store purchases will likely buy online when an onlineonly promotion is offered. Similarly, 76% of those who favor online shopping will likely purchase at a physical store if presented with an in-store-only promotion.

It’s worth noting that fewer online shoppers would switch to in-store shopping, even with a promotion. This is likely because many of these shoppers prefer the convenience of being able to purchase at any time of the day (43%).

Home furnishings brands should prioritize offering promotions like percentage discounts, as 61% of in-store shoppers and 58% of online shoppers reported that these would attract them to try a different buying method. Both groups of shoppers also showed a strong preference for buy one, get one free deals and free gifts with purchase.

of shoppers who prefer in-store purchases will likely buy online when an online-only promotion is offered

of those who favor online shopping will likely purchase at a physical store if presented with an in-store-only promotion 82% 76%

When it comes to receiving promotions, email is the preferred channel for most consumers. Home furnishings brands should capitalize on this by sending promotional emails tailored to individual customers. Personalizing these communications makes shoppers feel valued and as though they are receiving an exclusive offer. This approach increases the likelihood of shoppers using the promotion and helps foster brand loyalty.

With BigCommerce’s robust tech partner ecosystem, brands can combine the power of tools like Klevu and Klaviyo to send personalized, automated promotional emails.

How consumers prefer to receive promotions from home furnishings brands

Daily deals marketplace UntilGone uses AI to craft personalized email communications based on a consumer’s browsing history. These tailored messages have significantly boosted customer engagement, revenue, and team efficiency.

“We used to randomly select bestsellers from the last 90 days for the transactional emails, and since making AI-driven recommendations, we’ve seen a 200% increase in revenue. The AI recommendations have also allowed us to automate many of our email campaigns, saving the team a great deal of time,” explained Richard Bell, President and Owner of UntilGone.

Although other communication methods ranked lower, it’s still crucial to invest in sending promotions through channels like text message. Even if a brand has fewer subscribers to SMS, those subscribed tend to be more engaged and more inclined to use promotions.

Consumers want sustainable products but most are unwilling to pay more than 10% extra.

As more consumers prioritize going green, there is a growing preference for sustainable products.

The home furnishings industry isn’t immune to this, as more shoppers look to buy energyefficient items (39%) and products with minimal or recycled packaging (34%).

While there is a strong demand for ecoconscious home goods, the majority of consumers are not willing to pay more than 10% extra for products that align with their sustainability preferences, with most unwilling to pay any additional cost.

To attract eco-minded shoppers, home furnishings brands should explore cost-effective ways to incorporate sustainable practices into their products. Highlighting energy efficiency and environmentally friendly packaging on product pages and shipping materials can help differentiate them from competitors.

Brands like Molly Mutt showcase their commitment to sustainability through a dedicated page on their ecommerce site, raising customer awareness of their green initiatives. Home furnishings brands looking to increase visibility of their eco-conscious practices should consider creating a similar page.

How much more consumers are willing to pay for sustainable home furnishings

Shoppers who use tools like AI, AR, and VR are more confident in their purchase decisions.

Consumers who have used the following technology tools to influence their purchase decisions

Never used one of these tools

Virtual showrooms that replicate a brand’s physical store so shoppers can browse products digitally

Augmented reality preview placements that allow shoppers to view a 3D display of a product in their home

With the rapid advancement of technologies like artificial intelligence (AI), augmented reality (AR), and virtual reality (VR), businesses have a unique opportunity to enhance the user experience both online and in-store.

While the majority of survey respondents have never used one of these emerging technologies, 47% of those who have reported feeling more confident in their purchase decisions. This indicates that more consumers will start to rely on these tools to inform their purchases as they become more integral in the shopping experience.

To stay ahead of the competition, home furnishings brands should consider integrating the latest technologies into their businesses. Offering online AR preview placements can help shoppers better visualize products in their own homes. Similarly, VR tools can allow shoppers to explore a brand’s offerings through in-store installations or connecting their headsets to an online virtual showroom.

Brands like UPLIFT Desk take advantage of AR technology, allowing shoppers to view 3D configurations of their desks in their own homes. This offering amplifies the customer experience and makes shoppers more comfortable purchasing furniture online.

“When you buy online, you don’t know what the product is going to look like in your space. As we move into a world with augmented reality, we’re able to build the tools and products that help a customer visualize and understand it,” explained Daniel Burrow, Vice President of Growth at UPLIFT Desk.

BigCommerce provides a range of tools that enable brands to incorporate these cuttingedge technologies into their online stores. Explore the platform’s suite of AI-powered innovations and partner integrations designed to boost engagement, streamline operations, and empower new, creative ways to attract and convert shoppers.

feel more confident in their purchase decision after using AI, AR, and VR 47%

More than two-thirds of shoppers expect to see Buy Now, Pay Later options. It somewhat influences

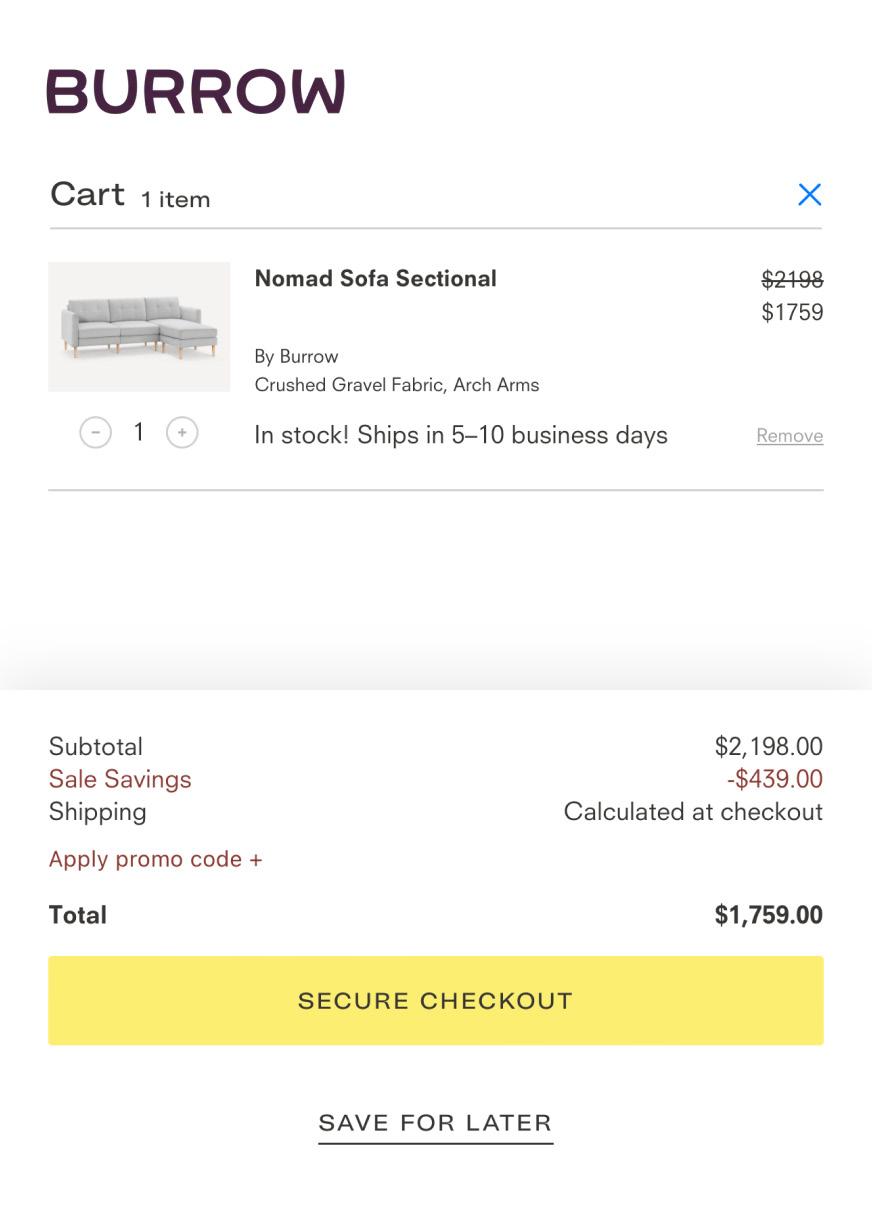

In today’s economic climate, more consumers are opting to save on home furnishings. Flexible payment options — like Buy Now, Pay Later (BNPL) — are the key to driving sales in this market.

With 69% of shoppers expecting to see this payment option and 20% unwilling to make a purchase without it, BNPL has become essential.

BigCommerce partners with a variety of tools that enable brands to easily offer BNPL. Explore how to generate more sales with integrations like Afterpay, Affirm, and Klarna

Brand’s like QE Home take advantage of tools like Afterpay to provide shoppers with a flexible way to pay for home goods. Since implementing BNPL, they’ve seen a significant amount of shoppers opt for paying in installments.

When it comes to which products shoppers prefer to use BNPL for, big-ticket items are at the top of the list — a trend that isn’t surprising, as many consumers may find it challenging to buy these items in full.

With so many shoppers expecting BNPL, home furnishings brands should prominently feature this payment option on their homepage and product detail pages.

Items consumers are more likely to purchase using Buy Now, Pay Later versus paying in full

For many home furnishings shoppers, the primary reason for buying in-store is the ability to assess an item firsthand. In fact, 65% of consumers prefer to see and touch a product before making a purchase, and 59% want to ensure the quality and durability of the item.

While it may not be possible to translate this hands-on experience to the online user journey, there are some strategies home furnishings brands can use to help shoppers feel more comfortable purchasing online.

One of the most effective ways to ease online shopping anxiety is by offering a top-tier return policy.

of consumers prefer to see and touch a product before making a purchase 65%

want to ensure the quality and durability of the item 59%

Over

Factors in a return policy that are most likely to influence consumers to purchase home furnishings online

A flexible return policy can provide the reassurance shoppers need to make online purchases. While a free return policy is often enough to persuade most shoppers to buy online, offering unique services like return pickup can be a game-changer for larger, high-ticket items.

Oftentimes, shoppers prefer to assess bulky items, like couches, in-store to avoid the potential expense and hassle of returns.

By offering a free pickup service, brands can give customers the confidence to order these items online, knowing that returns will be as convenient and stress-free as possible.

Home furnishings brands should prominently feature their return policy details throughout their websites and marketing materials. By making shoppers aware of these unique offerings, businesses can significantly increase their chances of winning over customers and standing out against competitors.

As in-store shopping resumes postpandemic and inflation and high home interest rates persist, consumer behaviors continue to evolve.

For home furnishings businesses to thrive in this challenging landscape, it’s crucial to understand how their audiences prefer to shop and what they value in a brand. With this insight, brands can make strategic adjustments to their business models that differentiate them from competitors.

From the thousands of consumers surveyed, it’s clear that today’s home goods shoppers have diverse preferences regarding online versus traditional in-store shopping. To be resilient, brands need to offer a seamless shopping experience across all channels, catering to varying consumer expectations.

In addition to a robust omnichannel presence, finding unique ways to stand out based on consumer desires can help home furnishings businesses foster deeper connections with customers, ultimately driving more sales. Embracing sustainability, staying ahead of technological advancements, promoting Buy Now, Pay Later options, and offering a flexible return policy are all key strategies for attracting consumers and building a loyal customer base in today’s market.

Explore BigCommerce’s Home and Garden Solutions page to see how home furnishings brands can take their businesses to the next level with BigCommerce.

Craft modern, omnichannel ecommerce experiences that showcase your unique brand — that your customers will love.

REQUEST A DEMO TODAY

Annie Laukaitis is a skilled Content Marketing Writer at BigCommerce, where she uses her writing and research experience to create compelling content that educates ecommerce brands. Before joining BigCommerce, Annie developed her skills in marketing and communications by working with clients across various industries, ranging from government to staffing and recruiting.

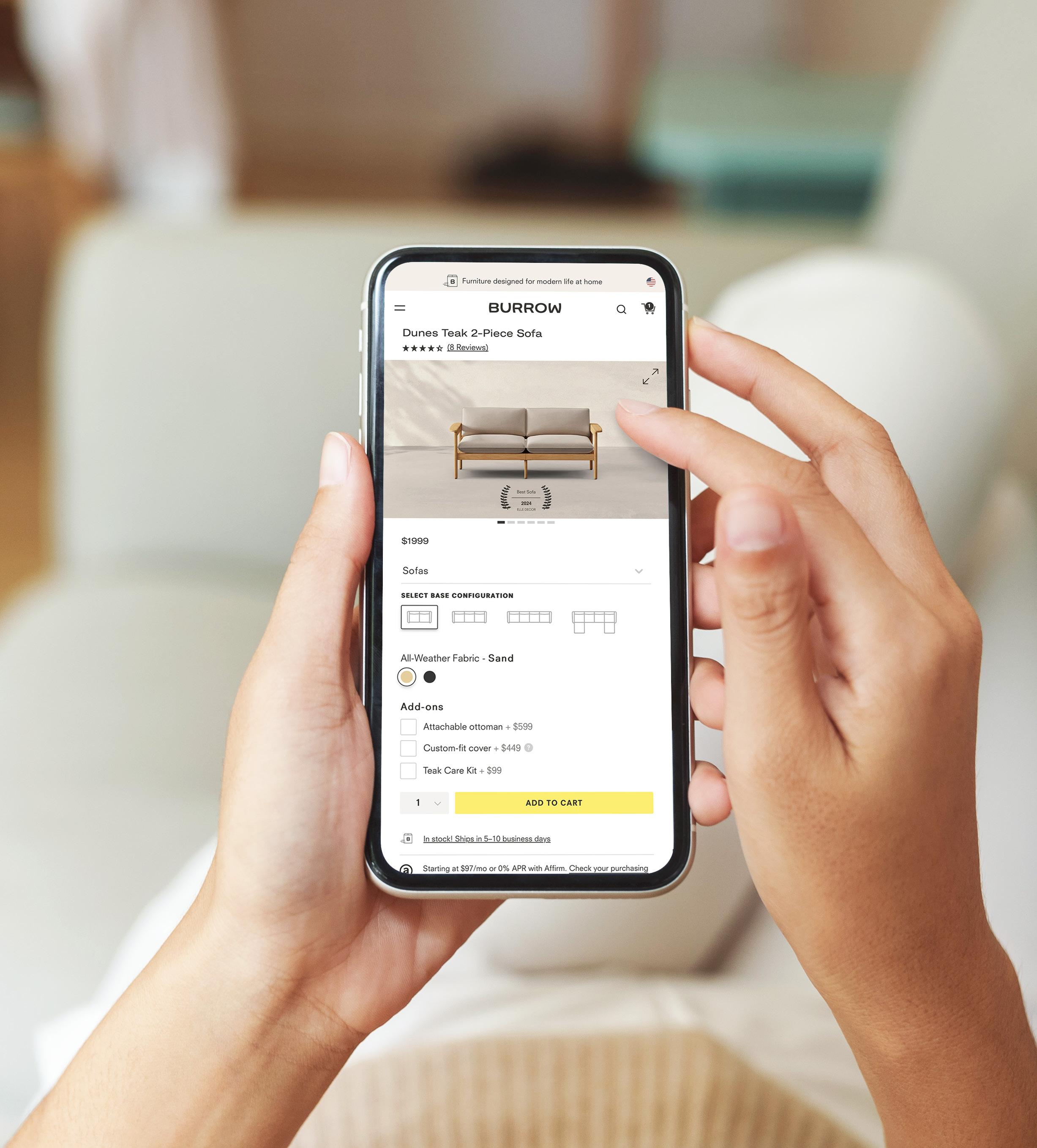

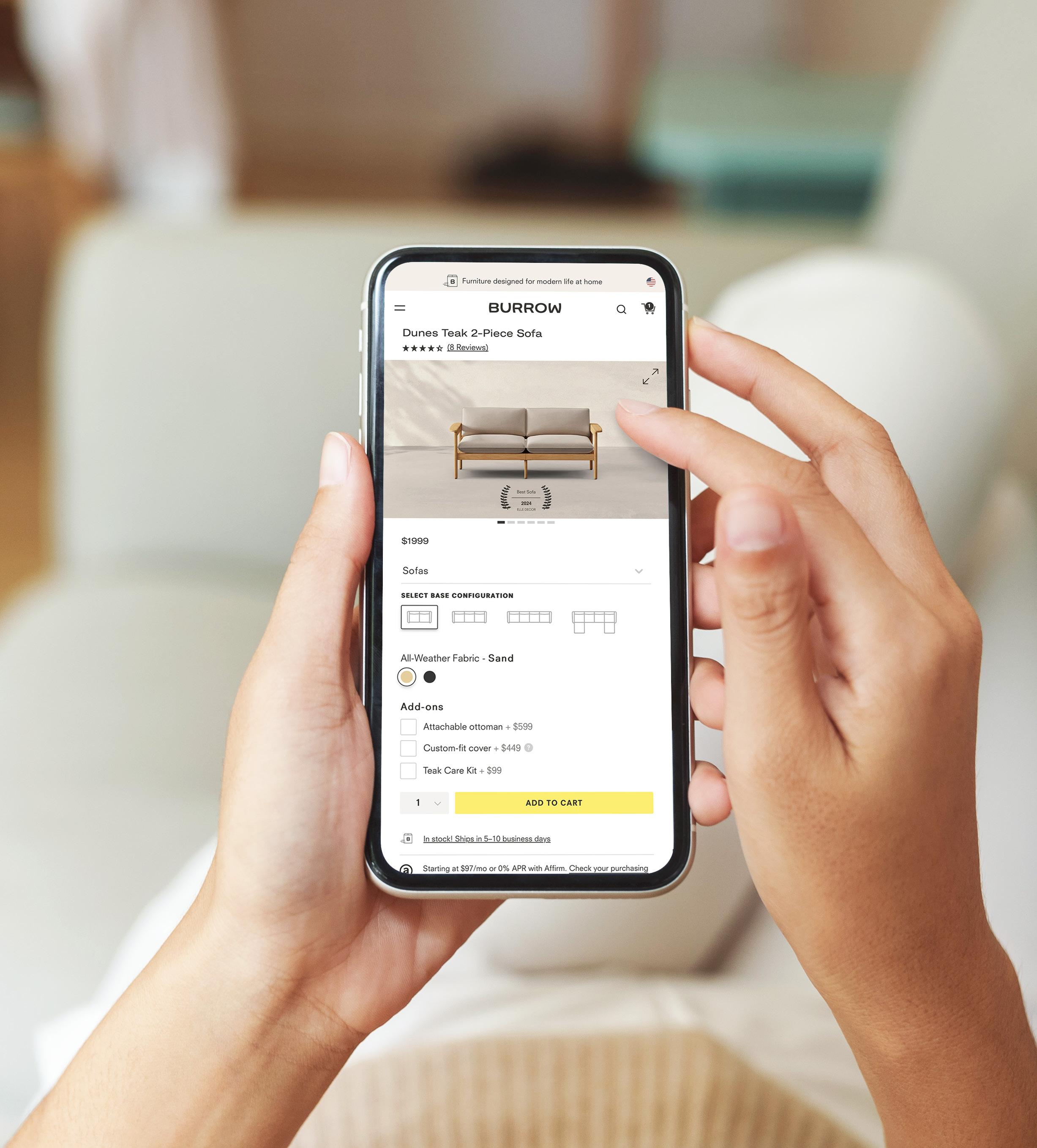

BigCommerce (Nasdaq: BIGC) is a leading open SaaS and composable ecommerce platform that empowers brands and retailers of all sizes to build, innovate, and grow their businesses online. BigCommerce provides its customers sophisticated enterprise-grade functionality, customization, and performance with simplicity and ease-of-use. Tens of thousands of B2C and B2B companies across 150 countries and numerous industries rely on BigCommerce, including Burrow, Coldwater Creek, Francesca’s, King Arthur Baking Co., Ted Baker, United Aqua Group, and UPLIFT Desk. For more information, please visit www.bigcommerce.com or follow us on X and LinkedIn.