The 17th annual State of Manufacturing® survey found manufacturers have deep and persistent concerns about growing regulatory burdens and taxes.

We collaborate with manufacturers on . . .

Building Design

` Renovations, Additions, New Construction

Site Improvements

` Parking, Circulation, Drainage

Facility Assessments

Space Planning

Mechanical, Electrical Upgrades

Structural Enhancements

Environmental Assessments

The 17th annual State of Manufacturing® survey found manufacturers have deep and persistent concerns about growing regulatory burdens and taxes but feel better about their own companies’ prospects than in 2024.

The Conversation Behind the Poll Numbers

Manufacturers use focus groups to discuss tariffs, the extensive new HR regulations, and the prospects of automation.

A very profitable high school manufacturing program in St. Francis is likely to be a model for other schools to follow.

Why More Training Isn’t Always the Answer to Performance

Manufacturers can tackle challenges such as safety and quality issues by finding root causes and lasting solutions.

Improve your business strategy with a system to identify and train talent.

Visit the Enterprise Minnesota website for more details on what’s covered in the magazine at enterpriseminnesota.org. Subscribe to The Weekly Report and Enterprise Minnesota® magazine today! Get updates on the people, companies, and trends that drive Minnesota’s manufacturing community. To subscribe, please visit enterpriseminnesota.org/subscribe.

Manufacturers, we need your signature resilience and resourcefulness.

Despite all the change and uncertainty they’ve faced — COVID, workforce shortages, tariffs and supply chain disruptions, and now the rollout of Minnesota’s new paid family and medical leave law — Minnesota manufacturers keep showing up, solving problems, and finding ways to succeed.

Still, it’s easy to get distracted by the issues outside our control. Headlines about tariffs, taxes, regulations, and government policies create a climate of profound uncertainty. The frustration is understandable. But the manufacturers who thrive are the ones who focus on what they can control.

You can’t adjust tariff rates, lower the cost of inputs, or predict which employees will take extended leave. But you can invest in process improvement, develop stronger relationships with customers and suppliers, cross train your people, and build a culture that helps employees enjoy their work and stay engaged. These are the levers that make a business more efficient and more resilient.

When it comes to tariff-driven supply chain challenges, look at what you can do within your organization to minimize

effects. Could you improve relationships with suppliers through better communication? Could you negotiate with customers to share the burden of cost increases? Could you reduce overall costs by cutting out manufacturing steps that are non-value add?

Even though the labor market has cooled since the pandemic, many companies still struggle to fill positions, particularly those that demand specialized training. Skilled employees continue to age, and their knowledge walks out the door on retirement day unless there’s a plan in place. Smart manufacturers keep recruiting, even when they don’t have immediate openings, to ensure a smooth transition as parts of their workforce retire. They also think creatively about solutions, like fractional roles to fill gaps in areas such as finance, quality, or human resources.

Minnesota’s new paid leave policies take effect on Jan. 1, 2026, and some companies still don’t have a solid plan to manage extended absences. By cross-training employees, companies can minimize operational disruptions. A deeper bench also helps ensure a smooth succession as workers retire.

Finally, don’t underestimate the power of culture. When employees take pride in their work and find the workplace enjoyable and flexible, manufacturers build loyalty, enjoy the benefits of long-term and engaged employees, and attract new talent more easily.

The landscape will keep shifting. Tariffs will vary, supply chain challenges will ebb and flow, and government policies will change. But external factors have always been there, and they’ll always be there. What matters is how you respond.

Manufacturers I talk with stay positive because they focus their energy inside their walls, where it matters most. When you cultivate relationships with suppliers and customers, improve processes and invest in people, you’ll find that you control more than you think.

Publisher

Lynn K. Shelton

Editorial Director

Tom Mason

Creative Director

Scott Buchschacher

Managing Editor

Chip Tangen

Copy Editor

Catrin Wigfall

Writers

Suzy Frisch

Gail Hudson

Elizabeth Millard

Robb Murray

Michele Neale

Kate Peterson

Photographers

Amy Jeanchaiyaphum

Robert Lodge

Elizabeth Millard

Contacts

To subscribe or change an address ldapra@enterpriseminnesota.org

For back issues, additional magazines, and reprints ldapra@enterpriseminnesota.org 612-455-4202

For permission to copy lynn.shelton@enterpriseminnesota.org 612-455-4215

To make event reservations events@enterpriseminnesota.org 612-455-4239

To advertise or sponsor an event chip.tangen@enterpriseminnesota.org 612-455-4225

Enterprise Minnesota, Inc. 2100 Summer St. NE, Suite 150 Minneapolis, MN 55413 612-373-2900

©2025 Enterprise Minnesota ISSN#1060-8281. All rights reserved.

Reproduction encouraged after obtaining permission from Enterprise Minnesota magazine.

Enterprise Minnesota magazine is published by Enterprise Minnesota. 2100 Summer St. NE, Suite 150 Minneapolis, MN 55413

POSTMASTER: Send address changes to Enterprise Minnesota 2100 Summer St. NE, Suite 150 Minneapolis, MN 55413

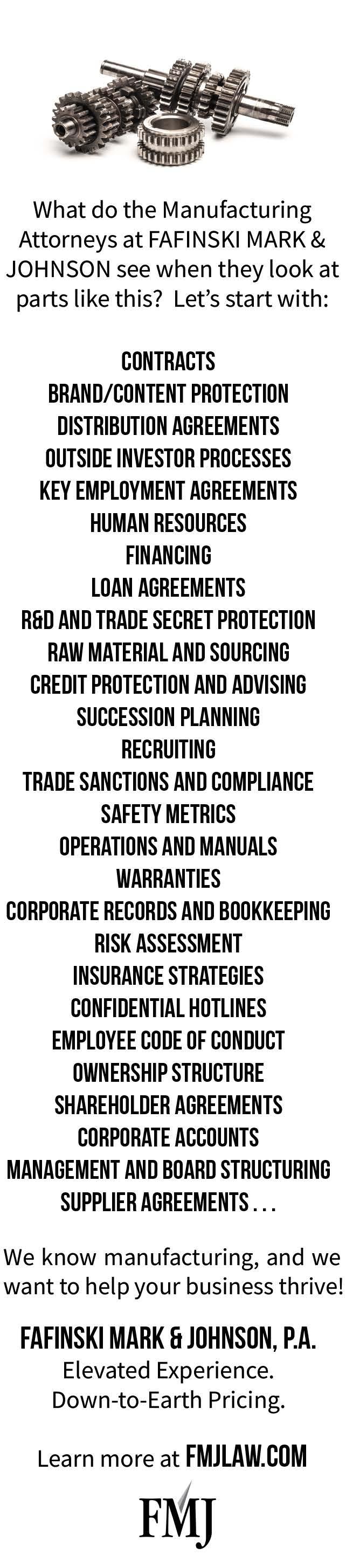

nterprise Minnesota’s Owatonna Peer Council had great interest in learning more about the impending launch of Minnesota Paid Leave (MPL). When word got out the next meeting would cover that topic, interest exploded, and the meeting drew 45 manufacturing executives from around southern Minnesota.

With MPL set to launch on Jan. 1, Enterprise Minnesota invited Sarah Dahl, an ancillary benefits consultant with Marsh McLennan Agency in Minneapolis, to share her insight with all manufacturers in the area, not just Peer Council members.

“It’s more important than ever to help companies understand the requirements,” says Bob Kill, Enterprise Minnesota presi-

dent and CEO. “This law is extraordinarily complex, and manufacturers are hungry for insight on what it takes to comply.”

The Minnesota Legislature established MPL in 2023 to allow employees up to 12 weeks of paid medical leave and 12 weeks of paid family leave, with a cap set at 20 weeks between the two. Medical leave covers an employee’s personal serious health condition — such as surgery, cancer treatment, or childbirth — that is substantiated by a medical provider.

Family leave covers family-related needs, including bonding with a new child, caring for a seriously ill loved one, taking

safety leave, or supporting a deployed military family member. Again, an authorized professional must verify the reason for the leave and the necessary duration.

Most employers with staff working in the state, regardless of company size, must offer paid time off for qualifying reasons. The law excludes federal employees, some seasonal hospitality workers, independent contractors, and the self-employed.

Employees who take approved leave will receive payments to reduce the impact of lost pay during their absence from work.

The benefit calculation starts at 90% pay replacement and grades down to 55%, but the maximum benefit is the state average weekly wage ($1,423 as of Oct. 1, 2025).

To qualify, employees must have earned at least 5.3% of Minnesota’s average annual wage in the previous year, roughly $3,700 for this year.

The legislature jumpstarted the process by allocating $668 million in benefits funding and $128 million for setup costs. The program is expected to distribute $1.6 billion in benefits and handle roughly 132,000 claims in its first year.

To cover mandatory claims, employers can enter a Minnesota state-run program

or obtain private insurance coverage from a state-approved provider. In either case, claims will be reviewed and paid by the third party — either the state or the insurer — not the employer directly.

Employers are quickly approaching several key deadlines and will need to decide soon which avenue they will take to ensure compliance with the new law. The Minnesota Department of Employment and Economic Development, which is overseeing implementation of MPL, has indicated that employers who want private plan approvals for a Jan. 1 effective date should submit their private plan applications to the state by Nov. 10.

Securing private coverage is a multi-step process for companies. “Employers should act now. Don’t wait for the deadline,” Dahl advises. Employers should work with their benefits advisors in securing quotes and navigating the private plan process.

Brian Adamek, a partner and financial planner with E-Wealth Partners in Minnetonka, didn’t attend the Peer Council meeting. However, he spends a significant amount of time these days helping employers understand their paid leave options. His company started the application process for its own coverage several weeks ago, and obtaining the documentation needed to submit an application took about two weeks. “It could take longer as companies rush to beat the deadline,” he says.

Companies that choose the state-run plan will begin collecting a 0.88% payroll tax (capped at the FICA limit) on Jan. 1. Employers may require employees to pay up to half of the tax — so 0.44% — but they can also pay the entire amount themselves. Employers will submit those taxes with their quarterly payroll taxes, beginning in April 2026.

By Dec. 1, all employers are required to notify their employees of the paid leave benefit and how they will be covered.

Experts say the decision about whether to pay into the state-run plan or opt for private insurance will come down to a mix of cost, administrative convenience, and trust in the system.

Adamek says the right answer depends on a company’s size, workforce, and appetite for administrative work. He recommends getting a quote from an insurer or insurers to see if private coverage might be less expensive than the state-run plan.

“There’s no downside, and it’s really

pretty easy,” he says.

When comparing costs, employers should note two aspects of the state plan that might reduce the burden of the program. Companies with 30 or fewer employees may be eligible to pay a lower tax rate. The state will also offer a grant program to help businesses cover the cost of backfilling positions during employee leave — up to $3,000 per leave, twice annually.

In addition to comparing costs, Adamek recommends looking at administrative issues, including how an employer’s payroll system can work with either the state or a private carrier. Taxes or premiums will be collected during each pay period, and employers will be responsible for submitting those payments each quarter, either to the state or to the insurance company.

“You should make sure you’re withholding from every paycheck, and basically after every quarter you have 30 days to make

“This law is extraordinarily complex, and manufacturers are hungry for insight on what it takes to comply.”

–Bob Kill, president and CEO, Enterprise Minnesota

payment. Will your payroll provider make that payment to the state on your behalf, or do you have to go in as the employer and push that out? We don’t know,” Adamek says, noting there are countless payroll administrators across the state. “We do know for sure that on the private side employers will have to go in and submit that premium payment by the same deadline.”

Adamek also suggests considering how claims might be processed. “Private insurers have more experience vetting claims, so the process might be smoother, at least in the first year.”

Private carriers, Adamek continues, understand the paid leave process from their experience working on similar programs in other states.

That experience matters because experts can identify the validity of claims and then pay them out promptly when they have been approved. “Employers want to make sure the claims are legitimate, and if they

Securing private coverage is a multi-step process for companies.

“Employers should act now. Don’t wait for the deadline,” Dahl advises.

are, they want their employees to receive the benefits they are paying for,” Adamek says.

Once employers decide which route to go, switching between plans is possible, but with limits. They can move from the state plan to private insurance annually. However, if they switch from a private plan to the state fund, they must stay with the state plan for at least three years.

Companies that don’t opt for private coverage will be automatically enrolled in the state plan. Dahl cautions that employers still need to notify employees by Dec. 1 of the availability of the benefit, and that they will be covered through the state-run plan. They also need to arrange to have the payroll tax withheld beginning Jan. 1 and continue wage reporting via the state’s unemployment/paid leave system.

Peer Council participants expressed concern and disappointment with MPL. Kurt Schrom, owner of Metal Services in Blooming Prairie, called the program an unnecessary mandate.

Metal Services offers health insurance and short-term and long-term disability. The company allows employees to take longer periods of leave for health care or family issues, though employees are not paid. Schrom is concerned about the length of leave employees will be allowed under MPL. “That’s going to be a bit of a challenge for us,” Schrom says.

Cost is also a concern. Since the legislation was approved in 2023, Schrom says he and his leadership team have monitored MPL and have included the program in budgeting discussions. Shortly after Dahl’s presentation, Schrom calculated that MPL will cost his company between $300-$400 per month per employee. With 60 employees, that means Metal Services will need at least $216,000 annually to pay for its share

of the program.

As employers grapple with compliance, many express angst about the impact on their businesses and question the effect on Minnesota’s business climate. “This is going to kill small businesses as we know it in this state,” one employer told the group. “There’s no better way to put it. It’s going to make people second-guess getting into business.”

Several manufacturers in attendance admitted they haven’t prepared for what

might be an onslaught of paid leave requests. Kory Klecker, general manager at Sputtering Components of Owatonna, says the manufacturers he’s spoken with are waiting for more specifics.

“This time of the year is really when companies start the budgeting process for next year,” he says. Noting that every business leader has to anticipate a certain amount of risk for each year, Klecker says the potential for losing seasoned employees for multiple weeks at a time adds to that risk. “This will definitely play a role in how much risk that business is going to assume.”

Not everyone has a bitter taste in their mouth about the program.

Mike Kronebusch, president of Midwest Metal Products in Winona, says concerns over MPL are overblown. He predicts the law will be beneficial in the long term. “It’s easy to think about today, how it’s going to affect me today. But 30 years from now, 50 years from now, 80 years from now — it might end up being a good thing.”

He believes MPL might give employees

comfort that they will at least have partial income should something bad happen to them. He says employers should look at the program as giving Minnesota a competitive edge that surrounding states do not offer.

The plan at Midwest Metal Products is a simple one.

“We’ll eat it,” Kronebusch says. “It’s like anything else; you pass the cost on to the consumer at some point, so everybody else will too. That’s why I don’t like the argument that it’s going to kill small businesses. No, you’re just going to have to charge 0.44% more.”

Like it or not, the program is coming. Dahl says she hopes the rollout of Minnesota’s program goes smoothly for both employers and employees.

“I honestly think the concept of paid leave is a great thing. I want the state program to work well,” she says. “At the end of the day, we want employees — who need time away from work either to care for a loved one or care for themselves — to get the benefit that they’re entitled to.”

Robb Murray

or almost 100 years, WINCO has been inventing resources for emergency backup power. Company President Shane Williams says the Le Center, Minn., company’s goal is to be a dynamic, nimble player in the custom generator arena.

“Our manufacturing capabilities inhouse are beyond anybody I know in the USA,” says Williams, who’s been leading the family-owned company since 2020. “We take pride in manufacturing our components that we are assembling — as many as we can.” He calls his competitors “assembly operations.”

At WINCO, some 90 employees, most of whom live within 20 miles, engineer, design, machine, fabricate, and assemble its units under one roof on a 17.5-acre campus. Company leaders say their sheet

metal manufacturing, power painting, welding, and machining capabilities give them an edge and an ability to react quickly to customer concerns, industry changes, and product innovations.

For much of its history, WINCO has supplied backup and portable standby generators for agricultural markets, equipment manufacturing markets, and mobile external machines used in residential, commercial, and industrial applications. But three years ago, Williams says the company shifted to include the oil and gas industry, data center industries, rental companies, and component equipment manufacturers.

“We’ve really expanded and explored markets to determine what customers need versus what WINCO can do,” he says.

This fall Williams says the company will roll out a large-scale green product that will reduce emissions. He calls it a once-ina-career type project. “We’re developing a first-in-industry mobile prime power generator set,” he says. “This could make or break us.”

The generator set combines multiple units in one package supplying prime power that runs off methane gas, a natural byproduct generated through oil exploration. “Instead of wasting those gases and those gases

WINCO says it is one of the first in the country to supply aftertreatment systems to reduce harmful emissions.

going into the atmosphere,” he says, “we’re developing units that are going to take those gases and convert them into energy.”

To manufacture the new natural gas system, WINCO has dedicated 100,000 square feet to two full production lines with testing capabilities.

Williams calls the generator set a convenient, flexible system (you can add or subtract with multiple units in one package) that adds and shuts off power according to

demand. The system also has the ability to run up to 1500 kVA (kilovolt-ampere), a unit of apparent power in an alternating current electrical circuit, compared to other systems that go up to 900 kVA.

To address the push by some states to ward zero-emission diesel generators in the near future, WINCO says it is one of the first in the country to supply aftertreatment systems to reduce harmful emissions on 1 to 3 megawatt units. For example, carbon monoxide emissions can be cut by 40 to 95% and a system paired with a catalytic diesel particulate filter can reduce them by up to 98%. “These generators are incred ibly expensive, depending on what priori ties are in a particular region,” Williams says, “but we want to have that ability.”

Drive for innovation

“We made other advancements in ma chine capabilities by purchasing CNC machines versus manual machines,” Williams says. CNC machines use preprogrammed instructions to precisely cut, shape, or mold materials. The company has also improved battery storage and invented a digital interface meter called “YourGen” to make their generators more user friendly. The meter alerts the user to load imbalances that might harm their equipment.

“They’ve looked into truly innovative products that most people wouldn’t even consider,” says James Thomas, an Enterprise Minnesota ISO consultant. “These are things that will truly change the world, and they’ve hired the team to research them.” Thomas is helping WINCO become certified in what he calls the “trifecta” of ISO — the internationally recognized standards for health and safety, environmental, and quality management. “For most of our clients, it’s unheard of,” he says.

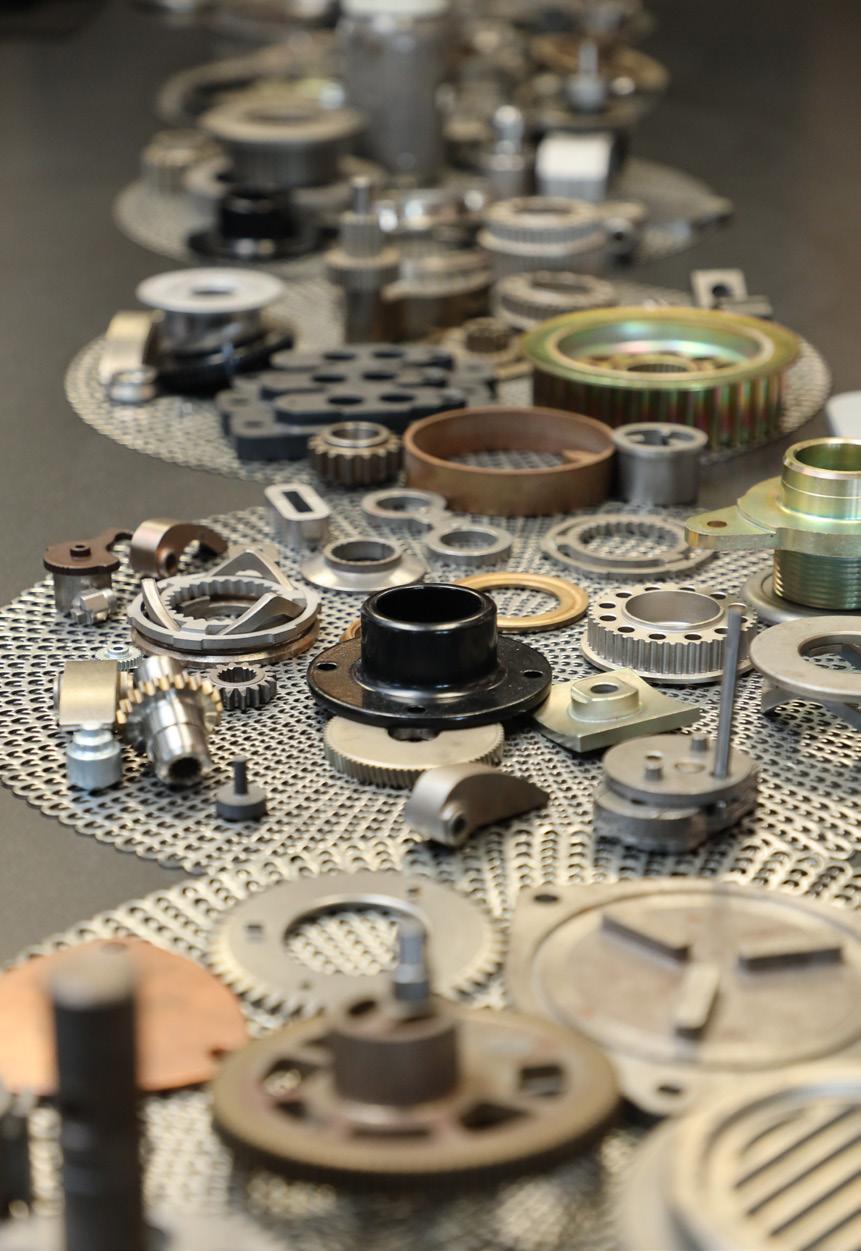

A fourth-generation Minnesota company uses advanced metallurgy to transform recycled metal into high-performing components for OEMs.

It can be oddly satisfying to watch a Toyota Camry get crunched to a fraction of its original size with the power of hydraulics. And if you thought that was the end of that Camry’s usefulness, think again.

The metal from some of those cars gets reused in a way that, again, is oddly satisfying. The mangled metal parts go through a high-temperature, high-tech recycling process that, in the end, produces a flour-like, highly purified metal powder. One, and only one, company in Minnesota for decades has been using that powder to produce metal components for everything from snowmobiles to medical devices.

From metal to metal FMS Corporation, founded in 1946 by Fred

Sweet and now led by his grandson John, has carved out a unique niche in Midwest metal parts manufacturing as the state’s only customized powder metal manufacturer. With a highly specialized process and deep family roots, the company is working to diversify its customer base across the five-state region while preparing the next generation to take the reins.

At the center of FMS’s operation is a process many outside the industry misunderstand: powder metallurgy, or PM. Not to be confused with powder coating, powder metallurgy is a way of forming metal parts by compressing the fine metal powders in a die, then fusing them together in a high-temperature furnace. It’s a process that produces extremely precise parts with little

waste, allowing manufacturers to avoid expensive machining or casting.

“PM is definitely a niche industry in North America, with most companies concentrated in Pennsylvania and focused on supplying the automotive industry,” says John Sweet, president of FMS. The powder metal industry’s automotive focus has left the Midwest region ripe for mining new customers.

It’s a process that produces extremely precise parts with little waste, allowing manufacturers to avoid expensive machining or casting.

That uniqueness has served the company well for nearly 80 years. FMS has supplied parts for Polaris, Graco, and other major manufacturers, often producing components that end up in products Minnesotans know well — snowmobiles, industrial sprayers, agricultural equipment, etc. The

company’s versatility and ability to produce high-quality, cost-effective parts have kept it competitive in a global market where scale and efficiency often determine survival.

Still, Sweet knows the company can’t afford to rely too heavily on a handful of big-name customers. The cyclical nature of industries like powersports can create peaks and valleys in demand, and FMS has been working with Enterprise Minnesota to sharpen its sales and marketing approach. The goal: to grow awareness of FMS’s ca-

The company’s versatility and ability to produce high-quality, cost-effective parts have kept it competitive in a global market.

pabilities and bring in new business across Minnesota and surrounding states.

“We’re trying to diversify our customer base,” Sweet says. “We’ve had long-term relationships with some great companies, but to really strengthen the business, we need to make sure more people in our region know who we are and what we do.”

Amy Hubler, an Enterprise Minnesota business growth consultant working with FMS, says she’s been strategizing extensively with FMS to do just that.

“In our work together, we did a deep dive into the company’s different customers and landed on one to two priority target segments that are a logical fit for FMS and offer the most opportunity as well,” Hubler says. “This is driving the marketing and sales strategy — knowing who they are going after, how they can best reach them, and what the optimal message is. FMS is taking that strategy and partnering with a digital agency to bring it to life.”

That’s no small task in an era when manufacturers are bombarded with pitches from suppliers worldwide. But FMS believes its story — a mix of specialized expertise, generational stewardship, and steady reinvestment — sets it apart. Geography helps, too. Most of FMS’s customers are in Minnesota and the broader five-state area, a geography Sweet believes is both practical and strategic. Proximity means faster turnaround times, fewer logistics headaches,

and the ability to build strong relationships with engineering teams and buyers.

At the same time, FMS is realistic about the challenges ahead. Labor shortages, rising input costs, and global competition remain stubborn headwinds. Powdered metal itself is subject to price fluctuations tied to global steel markets, and customers

long-term relationships. But as the industry evolves, he sees the need to be more proactive in showcasing FMS’s capabilities.

“We developed a two-pronged approach: education on powder metal manufacturing for those who may not know anything about it and building awareness of FMS as a key powder metal partner for those who are already familiar with the industry,” says Hubler.

are constantly pushing for cost savings. To compete, FMS has leaned on its efficiency and ability to engineer solutions that reduce waste and shorten lead times.

Over the past decade, the company has invested millions in new presses, furnaces, and secondary equipment so its plant can handle larger volumes, tighter tolerances, and more complex geometries. Those investments have allowed FMS to pursue work it couldn’t have a generation ago.

“Customers are always going to look at price,” Sweet says. “But if we can show them that our process gives them a part that performs better, costs less to machine, and gets to them on time, that’s a compelling story.”

That story is what FMS hopes to tell more broadly as it expands its marketing efforts. Sweet acknowledges that the company has historically let its work speak for itself, relying on word of mouth and

“It’s paying off as more of the marketplace is being exposed to FMS and learning about who they are, what they do, and most importantly, what sets them apart. That leads to increased requests for information and quote requests.”

“Opportunity is out there,” says Sweet. “The more people understand the advantages of powder metallurgy, the more we can grow.”

A foundation for the next generation “We’re not standing still,” Sweet says. “Every generation of leadership here has made big investments to make sure we’re ready for what comes next. That’s how we’ve stayed in business this long.”

That generational theme is central to FMS’s identity. Sweet’s son Luke, a St. Thomas University grad, is the fourth generation to step into the business, carrying forward a tradition of family ownership that Sweet says is increasingly rare in manufacturing.

“It’s something we’re proud of,” Sweet says. “There aren’t many companies left with three generations who have run the place and a fourth on the way. It gives our employees and customers confidence that we’re in this for the long haul.”

For FMS, growth doesn’t mean chasing every opportunity or abandoning its roots. It means deepening relationships in the Midwest, continuing to invest in technology, and passing down the values that have kept the company strong for nearly 80 years.

“Family ownership means you think in decades, not quarters,” Sweet says. “That’s been our approach since my grandfather started this company, and it’s how we plan to keep moving forward.”

Robb Murray

Confronted with ongoing supply chain challenges, five companies joined forces to create their own source of key products.

t’s no understatement to say that gases make the welding world go ’round. Welders use gases as a shield to protect the weld area from contamination and as a fuel for heating and cutting metal. For welding supply companies, access to key gases — oxygen, nitrogen, and argon — is critical.

Until recently, five Minnesota welding supply companies, like others in the industry, depended on huge international corporations to supply those gases. But about 10 years ago, that group, spearheaded by Brad Peterson, president of Mississippi Welders Supply Company (MWSCO), began developing an ambitious plan to build its own air separation unit — an industrial plant that can distill the air we breathe into the purified gases it distributes to its customers.

“Every small welding supply distributor dreams of coming up with the capital to build their own air separation plant,” says Peterson. “But the hurdles are just too high. The capital, the contracts, the legal work all create a barrier to entry.”

That barrier to entry falls if more companies can chip in, which is exactly why Peterson approached others in the industry.

The founding companies — A-OX Welding Supply, Huber Supply Company, Minneapolis Oxygen, and Toll Company — joined Peterson’s MWSCO, giving the project the heft it needed to get off the ground.

Located in Faribault, Absolute Air opened in January 2023, the first jointly held independent gas production facility in the Midwest. The company produces oxygen, nitrogen, and argon for its five founding members. It can also produce enough excess nitrogen and oxygen to swap for gases its member companies need but are not distilled by Absolute Air. And, it has capacity to supply gases to others in the welding supply market, as well as to the growing number of industries that rely on purified gases, including health care, food packaging, and electronics manufacturing.

Like Peterson, the other founding companies were motivated by a desire to have more control over their supply of gases.

“With the majors, you’re going to get a price increase every year and it just keeps going up. You don’t really have any control or any sense of security,” he says, noting that the major suppliers could also give preference to larger buyers, leaving smaller companies without access to supply.

The solution — building their own joint

plant — presented significant challenges, but familiarity with each other through industry interactions helped set the stage. “There was a level of trust and communication,” says Peterson.

Early in the process, Peterson tapped industry expert Ned Pontious as a consultant on the project. Pontious, who led a similar company in Idaho for 25 years, now serves as president of Absolute Air.

Peterson recruited Pontious to the Absolute Air project just days after Pontious retired as president of a company that had built air separation plants in Boise, Idaho and Moses Lake, Wash., that distribute gases within a seven-state area in the Pacific Northwest. Pontious oversaw every element of Absolute Air’s project from the acquisition of land to building the plant and beginning production.

Early on, the company confronted every conceivable pandemic-era challenge. “We had work stoppages, equipment shortages, and

supply chain interruption,” Pontious says.

A two-year project became a three-anda-half-year slog, but in early January 2023 the facility started pumping out oxygen, nitrogen, and argon. “It’s been two and a half years now, and the plant is running great,” Pontious says.

The only raw material Absolute Air needs is air, and because the facility is highly automated, it has just four manufacturing employees. Its sophisticated air separation process requires an extraordinary amount of electricity, though. Peterson says the decision to locate in Faribault was based in part on how easy it was to work with the Steele-Waseca Electric Coop. “Another key siting decision was an

economic development authority that wanted to work with us,” says Peterson. “We found that in spades with the City of Faribault.”

With the founding companies fully supplied with oxygen and nitrogen (the facility doesn’t produce enough argon to fill its members’ needs), Absolute Air is now working to expand its market reach.

“When you build a plant this big you don’t build to be 100% loaded the first day. You project growth, and we’re pretty much on our growth line. I wish we were above it,” Peterson says.

Industry trends are in Absolute Air’s favor for reaching that full load. “Gases are in great demand. If you look at all the projections for gas use in the next 20 years, it’s around a 12% annualized growth rate. If the economy’s growing by 3%, we’re in a good position,” Pontious says.

Kate Peterson

Benya Kraus joined the Southern Minnesota Initiative Foundation (SMIF) as president and CEO in early June. Prior to leading SMIF, she worked for Resource Rural, a national philanthropic fund that aims to unlock public and private capital for rural and tribal communities. She started her career as a social entrepreneur, co-founding Lead for America, a national non-profit that supports emerging leaders in returning and reinvesting in their hometowns.

How did someone who grew up in Thailand and attended college on the east coast end up leading the Southern Minnesota Initiative Foundation (SMIF)?

On my dad’s side is a six-generation farming family in Waseca County, and my mom also grew up in agriculture, but in northern Thailand, where I was born and grew up most of my life. I would spend my summers and Christmases at the family farm. After college I moved to Waseca to understand and be part of this larger legacy of stewardship and commitment to place.

That reciprocity and commitment to place was really appealing. And so, with a few other 20-something-year-olds, we started a national organization called Lead for America. It was all about trying to get talent to return and reinvest in our hometowns. We ran a fellowship program that would connect people back to the communities they loved and have them work on a big challenge facing their community. We built that out and scaled it; it is still a growing organization. We graduated our 600th fellow this past summer, and we are in 45 states now.

Through Lead for America, I came back to Waseca and built out our Minnesota operation. That’s where I got to know SMIF, which was one of our first supporters. They helped us place fellows across southern Minnesota and worked with all the other initiative foundations to do the same across the state. That led me to become very interested in how to get capital and investments to flow and stay and circulate in rural communities. So, I went to the University of Chicago for two years to get my MBA and transitioned out of Lead for America and focused on entrepreneurship and finance. I was looking to come back home to southern Minnesota and figure out how to make business and financial models work. I did that and

worked in national philanthropy for a bit, trying to get foundations to move their dollars into rural communities. That’s ultimately what led me to SMIF.

What do you see as the biggest challenge for your region?

I feel like I’m coming in at such a good time because we’ll be kicking off a pretty intensive year-long public and community engagement process to help us refine what the next five-year strategic plan will be.

But, based on the road trips I’ve taken since I started, one really big thing that I hear in almost every single conversation is concern about this demographic cliff that we’re encountering as a region. And it’s not just as a region, it is the state, it is the nation: when natural death rates will outpace natural birth rates as a country. It’s even more pronounced in our smaller rural communities sometimes.

What role do you see for businesses in the effort to retain and recruit talent?

I’m also interested in local ownership and how we make sure that part of an economic development strategy is thinking about how we keep and retain local wealth as much as possible. When you have employers and businesses that are headquartered and built from and within your community, there’s a tighter level of civic accountability and involvement from those employers in the future of their community. There’s a whole continuum around local ownership. The backbone of so many of our rural economies has been the cooperative — that’s how we’ve been able to deliver electricity, and increasingly, broadband. There are companies here that have really strong community investment components, including housing, or a new farmer-owned oat mill.

Privately owned local businesses also play a key role. I think Harmony Enterprises, Inc. is a good example of how you become a global company but retain that strong local identity, and where the ownership is reflective of the community. Who owns it — and who is able to keep the wealth and recirculate that wealth back into the community — matters a lot in rural communities.

Oftentimes we think of an entrepreneur as a founder with a new idea who is starting something totally from scratch. I think what our region will

really need is to think about entrepreneurship through acquisition. How do we prepare businesses to sell to the next generation? Also, we need to think about how we are preparing the next generation of workforce, not just to work in the business, but also to work on the business, and the financing tools or training tools to help with that. As we look at the demographic cliff, entrepreneurship through acquisition is going to be a huge thing.

How do you see SMIF supporting and then further advancing an already strong manufacturing sector in your area?

Our three biggest industries are ad vanced manufacturing, agriculture, and health care. With the introduction of AI in all these different sectors, there is a lot of potential for innovation. It’s happening already, and I hope as a regional foundation we can serve as a convener and accelerator for these connections, and see these industries not as in silos but how they converge, overlap, and intersect with each other.

Across our 20 counties, we need to think about how we can be a broker of connections and facilitate innovation. I think the future of innovation and economic vitality anywhere, but particularly in southern Minnesota, is about how we get out of silos and start melding these different sectors and ways of thinking and doing business with each other.

Redpath maximizes R&D tax credits with audit-ready documentation.

Fixed-fee, capped pricing Audit-ready documentation

Local team that knows your business

There’s also a role for us to help bring capital to our region. When I think of this 20-county region, we are blessed to have both a Mankato on one side and a Rochester on the other side and 12 regional micropolitan areas as well as our smaller rural communities. In every one of these places we’ve done listening road trips, I’ve been pleasantly affirmed that we’re not lacking a pipeline of projects and investment opportunities. We can show up in a community and our convener there will bring about 30 people who each have a project they are pursuing. Sometimes you just need to get closer to the ground, and you find out about them through the power of relationships. I do think the ingenuity and creativity and that “business school pipeline” of investible projects is here. We just have to do a better job of aligning and bringing that capital to the ideas and people who fuel our region.

The 17th annual State of Manufacturing® survey found manufacturers have deep and persistent concerns about growing regulatory burdens and taxes while feeling better about their own companies’ prospects than they did in 2024.

By Suzy Frisch

Minnesota manufacturers remain deeply pessimistic about the state’s overall business climate. In the 2025 State of Manufacturing® (SOM) survey, company leaders express strong concerns about new and recurring governmentdriven challenges, including state mandated programs like sick and safe time and paid leave. While manufacturers sense that the economy is rebounding and contributing to a more positive trajectory for their companies, concerns about government overreach dull their optimism.

The outlook among manufacturers about the overall economy this year is definitely tempered, says Bob Kill, president and CEO of Enterprise Minnesota. “Yes, there has been a rebound in profitability and revenue growth, but capital expenditures are basically flat, and I see a concern underneath all of this that is brought on by the tariffs and family leave regulations,” Kill says. “This is not the Minnesota Miracle.”

Rob Autry, whose firm Meeting Street Insights has conducted Enterprise Minnesota’s survey since its launch in 2008,

“The concern about government policies and regulation is particularly important. Over half of manufacturers mentioned that, and it’s by far the number one concern.”

–Rob Autry, founder, Meeting Street Insights

long-term confidence,” he says, adding that the overall mood is “cautiously better.”

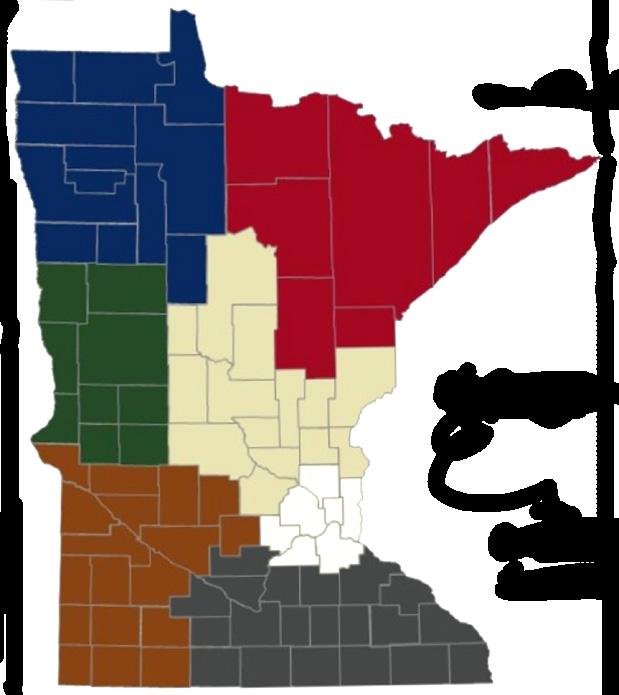

Enterprise Minnesota’s annual SOM survey has taken the pulse of manufacturers since 2008. To gather insights from across Minnesota, pollster Meeting Street Insights conducts interviews with 400 randomly selected manufacturing executives, including owners, CEOs, CFOs, COOs, presidents, vice presidents, and managing officers. Respondents represent a broad mix of manufacturers by region, employee count, and annual revenue. In addition, the survey is paired with an oversampling of 50 executives in each of the six McKnight Initiative Foundation regions.

These efforts shed light on the latest trends in key business areas, ranging from economic confidence and workforce to growth and automation. The survey has a margin of error of ±4.9%. Enterprise Minnesota also complements the polling research with focus groups held each fall across the state. These groups convey deeper insights from manufacturing leaders about the pressing issues of the day. Combined, SOM provides a comprehensive view of this vital sector in Minnesota.

When looking at the state’s seven regions, including the Twin Cities, six listed government regulations as their top concerns. Only northwestern Minnesota cited taxes (66%) over government policies (50%). Taxes and tariffs were the most common second-place worries. Concerns about government policies peaked in northeastern Minnesota at 60%, closely followed by 59% in southwestern Minnesota.

agrees that manufacturers have measured optimism this year about their industry and the economy. “There are a lot of concerns about the state’s legislative and regulatory environment that could serve as a drag on

“The concern about government policies and regulation is particularly important. Over half of manufacturers mentioned that, and it’s by far the number one concern,” Autry says. “It’s a disconnect when you look at the economic numbers and the confidence they have in their own companies, but they see a worsening business climate. I think that’s being driven by the government regulations and policies in Minnesota.”

A consistent theme in the past five years is manufacturers’ sour view of the state’s business climate. It did improve slightly from last year, with 53% stating

The State of Manufacturing survey did an oversample of 50 interviews with manufacturers in each of the six Minnesota Initiative Foundation regions.

• Northwest Minnesota Foundation

• West Central Initiative

• Northland Foundation

• Initiative Foundation

• Southern Minnesota Initiative Foundation

• Southwest Initiative Foundation

that Minnesota is a worse place to do business compared to 56% in 2024. Yet the overall trend is not positive. Since 2021, when 46% saw a worse business climate, there has been a rising consensus among manufacturing leaders that the overall business climate is not favorable.

“We still have a majority of manufacturers who believe that the business climate in Minnesota compared to five years ago is worse. Seventy

percent say it’s a less attractive place to do business, and 46% of them say it’s much less attractive. That’s a really high number,” Autry says. “There is a sense that the economy is not doing as bad as it was a year or so ago, but that doesn’t mean that the business climate has gotten better.”

That perspective definitely came through in the fall focus groups. “The common denominator was that you don’t hear a positive thing about the Minnesota business climate,” Kill says. The new benefits requirements contribute strongly to manufacturers’ negative view of the Minnesota business climate. The sick time policy went into effect in 2024, and paid leave launches in January 2026. Manufacturing leaders don’t appreciate the new payroll taxes that support the paid leave program, or the administrative burdens and potential challenges of being left without key employees, Kill says.

In fact, there was a nine-point jump in manufacturers who report that the paid leave requirement will have a major impact on their businesses, from 32% in 2024 to 41% in 2025. There also was an eight-point increase in expected major impact for the sick time policy, jumping to 37%. In total, 73% of respondents believe that required paid leave will impact their business and 72% said the same of sick time.

Though fluctuating tariffs have been at play since the beginning of 2025, they aren’t alone among the top-ranked challenges manufacturers say might impact their future growth. Increasing costs of materials ranked highest (29%), followed by attracting and retaining a qualified workforce (28%), and then tariffs (26%). Inflation, the top challenge in 2024 at 33%, fell to the seventh biggest challenge at 12% in 2025.

Manufacturers of all sizes feel very confident about their ability to navigate the current tariff and trade environment. In total, 82% noted that they are confident, including 39% who are very confident. To handle the increased tariffs, 49% of respondents are passing the costs onto customers and 47% are increasing their sourcing from domestic suppliers. Others are adjusting their financial forecasts and budgets (38%) and stockpiling key materials (32%).

During focus groups, Kill heard a mostly even breakdown between manufacturers who have experienced a negative impact of tariffs, those who believe they can navigate

tariffs, and leaders who don’t expect their companies to be affected. “There are some interesting winds in their face, but they are focusing on what they can control,” he says. “When manufacturers can control something, they feel very confident they can succeed. When there is something they can’t control, they start to pull back.”

“Economic confidence is up, fears about inflation and recession are down, and executives are more optimistic about the future of their own companies,” Autry says. There are still headwinds, but they have shifted, moving away from inflation as the chief concern. Worries about inflation saw a significant drop — 23 points — from last year, when 53% of respondents cited it as their top concern. In 2025, respondents’ top three challenges are government regulations and policies (53%), taxes (44%), and tariffs (42%).

Company size plays a major role in manufacturers’ view of their biggest challenges. Businesses with more than $5 million in revenue have deeper concerns about government policies and regulations (60%) compared to companies with less than $1 million in revenue (39%). Similarly with tariffs, 36% of small manufacturers

are worried compared to 47% of the larger companies. Smaller companies are most concerned about taxes at 49%, while taxes worry 43% of medium manufacturers with $1-$5 million in revenue and 42% of larger manufacturers.

Fig. 1 The percentage who say the business climate in Minnesota has gotten worse remains high.

“Thinking about the business climate in Minnesota compared to say five years ago, would the business climate has gotten better, gotten worse, or stayed about the same?” the percentage who say the business climate in Minnesota gotten worse remains high.

Manufacturers were highly concerned last year that the United States was heading toward economic trouble, with 41% bracing for a recession. This year, their fears about recession dropped 19 points to 22%. Instead, more manufacturers predict a flat economy for 2025, with 59% holding that view compared to 42% last year.

Looking at the economy for 2025 and 2026, manufacturers have increasing confidence that next year will be a time of economic expansion. More than double the respondents (37%) believe that the economy will be in expansion mode next year compared to this year’s 18%. In addition, manufacturers’ overall confidence in the future of their companies rose from 80% in 2024 to 87% this year.

When it comes to their own companies, manufacturers believe that 2025 will end on a good note on many measures. More respondents are anticipating increases in gross revenue at 32% compared to 24% last year. There has been a six-point jump in manufacturers who believe that their profitability will increase. But when it comes to capital expenditures, expected growth

There are still headwinds, but they have shifted, moving away from inflation as the chief concern.

is essentially flat, with 31% expecting an increase, up from 29% in 2024.

While manufacturers overall are feeling more confident, it’s not a sentiment shared equally by manufacturers of all sizes. Comparing projections for gross revenue, 29% of businesses with less than 50 employees expect increased gross revenue. For large companies with more than 50 employees, 45% project an increase. Similarly, there is a 16-point difference in leaders’ views on whether their companies will be more profitable — 24% for smaller manufacturers and 40% for larger businesses. “It’s important to note that this optimism is coming more

Still, the percentage who say the business climate in Minnesota has gotten worse remains high.

Q: “Thinking about the business climate in Minnesota compared to, say, five years ago, would you say the business climate has gotten better, gotten worse, or stayed about the same?”

Fig. 2 Three out of four manufacturers say paid leave mandates are having a negative impact on their companies.

Q: “I will read you a couple short descriptions of developments coming out of last year’s legislative session, and I want to know whether it affected your business, and if so, how much. Would you say it had a major effect, minor effect, or no effect on your business?”

Fig. 3 Costs, workforce, tariffs, and business climate are seen as the biggest challenges to growth, with inflation dropping the most this year.

are seen as the biggest

dropping the most this year.

Q: “What would you say are the one or two biggest challenges your company is facing that might negatively impact future growth?”

Government regulations, taxes, and tariffs rank as the highest concerns. Inflation concerns have really fallen off this year. Fig. 4 Government regulations, taxes, and tariffs rank as the highest concerns. Inflation concerns have really fallen off this year.

Q: “And, even though we only have a few months left in 2025, as you think about 2025 as a whole, do you think this year will be one of economic expansion, a flat economy, or a recession?”

from bigger manufacturers,” Autry says. “Smaller manufacturers are not out of the woods yet.”

Manufacturers highlighted another area of improvement in 2025 — less struggling with hiring and retaining employees. Workforce concerns are at their lowest

One reason that hiring challenges have eased might be from manufacturers’ willingness to add more automation and turn to artificial intelligence to improve operations, Kill says.

Increase

levels since COVID, Autry says, with the challenge of retaining workers listed at a historic low of 28%. Plus, concerns about hiring have declined 21 points since 2021 to 40% of manufacturers this year.

For 80% of respondents, it’s difficult to attract qualified candidates, although it’s not quite as tough as it was five years ago (87%). In addition, the number of manufacturers finding it very difficult to hire has declined. In 2021, 55% found it very difficult to attract qualified candidates compared to 32% this year.

One reason that hiring challenges have eased might be from manufacturers’ willingness to add more automation and turn to artificial intelligence to improve operations, Kill says. For the first time, manufacturers found automation and AI

tools to be assets for their companies, appreciating they increase productivity and eliminate repetitive tasks.

At companies with more than 50 employees, 93% of respondents found positive impacts from automation. They find the tools effective for supporting data analysis and decision-making, enhancing scheduling and workflow efficiency, and automating repetitive or manual tasks. In comparison, 63% of companies with fewer than 50 employees saw positive impacts.

Impediments to adopting automation include high upfront investments or costs (48%) and difficulty with integrating the technology into their current systems (29%). Yet 27% of respondents noted that they did not face challenges. Developing an approach to adopting AI and automation is still a work in progress for most manufacturers, with 61% noting that they don’t currently have a strategy. In addition, 29% of manufacturers report that they are not currently considering adopting AI or automation tools.

Survey respondents also found value in public-private organizations like Enterprise Minnesota. In total, 80% agree that these organizations are important in helping them compete, grow, and remain competitive.

EDITOR’S NOTE: Full results of the State of Manufacturing® survey can be viewed at www.enterpriseminnesota.org. They include the survey’s top-line results and edited transcripts of all focus groups.

9

Manufacturers use focus groups to discuss tariffs, the extensive new HR regulations, and the prospects of automation.

Editor’s note: This is an edited transcript of a focus group of manufacturing executives conducted at Marsh McLennan Agency in Golden Valley as part of the 2025 State of Manufacturing® survey research project. It was one of six focus groups. Transcripts of all focus groups can be found at www.enterpriseminnesota.org.

What is the state of your business today, and what do you see it looking like in 2026?

• We are about 30% machining/ medical and 12% packaging. We also do CNC parts, some O-ring gaskets, and cleanroom fabrication. We had a great Q1 of the calendar year, and we were excited about growing. Then the rug got pulled out starting at the end of April, and we experienced four months that were smaller than we expected. We were just idling. I had half my machines shut off. Now in the last three weeks everything is coming back alive. I don’t know if it was a tariff scare, but I think we’re going to finish within 8% of our forecast.

• For a while customers were just not resupplying. They slowed way down, almost as if they had too much inventory. I don’t know what happened there.

• We felt that tariff concerns were holding people back from placing orders. Also interest rates — they couldn’t get ahold of money as easily. Now that the interest rates are coming down and tariffs have kind of leveled off, we’re starting to see more orders for later in the year.

• Our biggest industry is aerospace, and that has been pretty good with increasing demand. Then the next biggest portion is defense, which has just been kind of flat, but we are waiting longer in between orders. Our last division is commercial customers, and those are all way down. So, the aerospace industry is saving us.

• With our heavy equipment — the big packaging equipment — it’s very expensive, and with the uncertainty, the interest rates, and the global chaos, the big purchases slowed down quite a bit. Now we’re starting to see those orders that have been sitting on the CFO’s desk waiting for approval come through, and that has held true for the last two fiscal quarters. At the

end of the year, we will be within 2% of our budgeted growth — we budgeted for 8% growth in fiscal 2025 and will be probably 6% growth over last year.

• We’ve seen a weakness in agriculture. We do a lot in ag storage and getting these ag companies to pull the trigger has really been tough. They’ve been holding the cards very close to the vest. With the tariff situation, can you blame them?

Since we are jumping into tariffs, do they affect your ability to plan for 2026? Do you see the tariff situation improving or are you mapping out your future for uncertainty?

• It makes us hesitant to make any big capital expenditure decisions. We’re looking more internally at cutting costs wherever we can because we have seen tariffs affect a lot of things. It was material pricing first, but now it’s trickled down into hardware and paint. So, we’re definitely cautious.

“Now we’re starting to see those orders that have been sitting on the CFO’s desk waiting for approval come through, and that has held true for the last two fiscal quarters.”

• We had to look at reducing staff at two of our machine centers because of foreign competition that plagued us earlier in the year. But we’re starting to see some things trickle back. Our third quarter is usually our lowest and it was actually our highest. So, we’re trying to continue to make up from the first half of the year in this last fourth quarter.

“I bought a two-year supply of most of our inventory just after Pres. Donald Trump took office, as we anticipated supply chain issues. We also went to our suppliers, most of them from China, and negotiated with them to reduce their prices to absorb the bulk of tariffs.”

• Tariffs have been disruptive, and of course business doesn’t like disruption. I don’t necessarily think that all these decisions are thought of with the long-term health of the U.S. manufacturing economy in mind.

• It’s been a crazy topsy turvy year. How do you predict what this president is going to do? I mean he essentially shuts down Canada. He shuts down China. How the hell are you going to manage 145% tariffs? How do you plan for that?

Given the tariffs and your own supply chains, are you thinking of bringing your overseas business back to the United States? Or is that just a pipe dream?

• I think every electric motor in the world is made in China, and if you want to buy an electric motor that is made in the United States, it is virtually impossible and it is going to be two to three times the price of what you’ve historically been paying for that kind of equipment out of Asia. The only certainty in my view with the tariffs is the ab-

solute uncertainty. There’s no way to predict what is going to happen. I bought a two-year supply of most of our inventory just after Pres. Donald Trump took office, as we anticipated supply chain issues. We also went to our suppliers, most of them from China, and negotiated with them to reduce their prices to absorb the bulk of tariffs.

• We’ve dodged that bullet because we bought substantial inventory in anticipation of that kind of turmoil. But once that inventory runs out, then we’ve got the same problem everybody else has.

• I was buying $250,000 in gaskets out of India and now they have a tariff. So I found a manufacturer that actually got me a lower price with a distribution system right out of Pennsylvania. So I’m moving it back.

What would you say your biggest challenge is for 2026?

• The biggest issue for me is finding good, quality employees. People who will show up every day and do their job and won’t

get injured half an hour after they start their work, which happens. It’s so hard to find good employees who will show up every day and who aren’t alcoholics or on some kind of prescription drug or worse. Cocaine and heroin are rampant for us in the northwestern suburbs. When we talk about bringing manufacturing back to this country, we are competing with an environment in China and Vietnam where employees work from nine in the morning until nine at night. They work six days a week and in many cases they never leave the plant. The plant is on the first floor, the living quarters are on the second floor, and the temple is on the third floor. And there is a line of people, a thousand people, around the block who want these jobs and will work those hours for not a heck of a lot of money. We are never going to beat them in manufacturing if the whole point of it is to bring employment back.

• I’m losing a lot of people to retirement. I don’t want everybody to work until they can’t walk,

and I want them to have a good life and go hang out with their grandkids, but retirement is a major issue for us.

• Finding good people is job number one. It’s almost impossible.

Is attracting workers or retaining quality workers a bigger problem?

• Quality? How about finding those who can simply write and read?

• To me, attracting and retaining are the same concept — you’re trying to get them to come in and then have them stay. The weird thing is these young people will move for a dollar more an hour. Whatever happened to loyalty and sticking around and learning a trade and becoming really good at it?

• I’m an hour and a half west of the Twin Cities. I have no problem. I have a stack of welders who want to come work for me.

“The biggest issue for me is finding good, quality employees. People who will show up every day and do their job and won’t get injured half an hour after they start their work, which happens.”

We try and treat people the way we would want to be treated. I’m not going to say we’re the highest paying in town, but we are flexible, and culture makes a huge difference. Especially to the younger ones. Being able to show that they are appreciated for their work goes a long way.

Let’s jump to automation — are you using it? Is it of interest to you and your employees based on the worker issue?

• The machine doesn’t ask for a raise, doesn’t play on its cell

phone, and doesn’t go to the bathroom for 30 minutes a day. I see it as revenue enhancement because you can do more with fewer people. Of course, because it is running it can break, there are still shift changes, but it can run lights out. That’s why I like it.

• We have not done much automation at all. We have a couple of things on the table right now, but it is a half-a-million-dollar investment, and interest rates aren’t great right now. So, we are waiting and haven’t pulled the trigger on that.

Does your company have a formal strategy for eventually incorporating AI into your company?

• We are looking at that. I’ve heard a lot of people say that AI is the next internet. Automa tion can be helpful with certain internal processes, connecting various systems together to be able to give you better infor mation and more predictive information. AI can help with things that people just don’t necessarily realize. Even having AI create marketing materials is helpful — for image genera tion, video generation, music generation.

• We’re developing an AI com ponent to our software that will pull that information once a product leaves the plant. It will report it up to accounts payable, accounts receivable, operations, inventory production, account ing, legal, every aspect of the business. And then the AI will spit down the information that allows you to make the right buying orders when you’re inventorying and connect to the marketing people so that they know what’s selling.

• We are using AI a lot for our prospecting, and we are look ing at how to integrate it with our accounting group. We have some resistance, such as a 78-year-old father who has spent 56 years with the com pany and wants to keep people, doesn’t want to look at robotics, doesn’t believe in AI.

What are your thoughts on the new paid leave law that is about to be implemented on Jan. 1, 2026? How have you planned for it? Are you angry? Are your employees ready?

• I look at our employee base and already know who is going to use it. I don’t think I’m going to have a big problem with it. I think I have two people who might try and abuse it, but all in all, I don’t think I’m going to have a big problem with it.

• It’s going to be painful for us if people take their leave. People who probably didn’t take a leave before, such as paternity leave. I think the father should be able to also take time, and everyone should be okay with that, but 12 weeks seems a bit extreme. I’m worried about it, but that is out of our control. I’m also trying to see the good of it, in terms of trying to retain the younger people, keep them happy. I think with them it’s going to work in our favor.

• We will be using the private carrier option, not the state option.

• Time for more robots.

• This has been probably the cleanest I’ve seen the state implement something. The guidance that they have put out, the FAQs, have been much better, more comprehensive, and more in line with what businesses need to know. And that’s the first that I’ve seen where I would be willing to say that out loud.

Because this is a new program, even though you may have seen smooth sailing thus far, what message would you like to send to legislators? Would you rather have something else in place? Was this program necessary to implement?

• I don’t think it was necessary after ESST [Earned Sick and Safe Time]. We currently pay for short-term disability for all our employees, so that’s going away. Now I’m sharing that cost with my employees, and I hope that they think twice about leaving on Thursday and having a bender because half of our short-

term disability goes to individuals who are kicking this or that and harming themselves. Hopefully we’ll see a change.

• This is a great state to do business unless the legislature jams legislation through without calling the other half in. Running the numbers of what this is going to cost me doesn’t include the cost involved when the people are gone. That is lost opportunity, never to be brought back. The lost productivity is worse than the math.

If you had to pick one issue out of all the things that we’ve talked about, or maybe something we haven’t talked about, what is your heartburn issue? What keeps you up at night?

• Employment. Hiring and retaining the best, quality people. People who want to grow, learn, be contributing employees rather than somebody who just shows up for a paycheck every day. Part of that is on us to create that environment, which I think we do, but

it’s still very hard, very difficult.

• I would say employment, as well.

• I think it’s just the environment. What’s the next thing that is going to try and beat us down? We’ll get over this, then there is going to

“The cost of doing business in the state of Minnesota keeps building, layer upon layer upon layer, and we will become less and less competitive and less likely to attract companies like ours to the state.”

be something else we’re going to talk about next year. I don’t know, are we building a utopia here and nobody works? That’s the trendline I’m seeing.

• The cost of doing business in the

state of Minnesota keeps building, layer upon layer upon layer, and we will become less and less competitive and less likely to attract companies like ours to the state. That’s not a place we want to be.

• It’s almost all employment related. I hear more and more about incentive programs that will keep people in the office and that will keep people working. I mean, obviously nobody’s really excited about paid family and medical leave, but I think clients are more concerned about making sure that their employees are sticking around and getting work done.

• Lost productivity is worse than the math with paid leave. What’s next? I have clients moving to Wisconsin, moving their facilities from St. Paul over to River Falls. Or they’re in outstate Minnesota and they’re just going across the state line because that is where their growth is. They’re basically saying, “Any future growth is not here in Minnesota.”

Manufacturers can tackle challenges such as safety and quality issues by finding root causes and lasting solutions.

BY KATE PETERSON

When manufacturers face safety issues or recurring quality problems, they often assume additional employee training is the answer. Enterprise Minnesota’s Sandy Borstad, a talent development expert and business growth consultant, says they should first walk through a process that identifies the root of the problem.

“In many cases, training isn’t what’s missing. What’s missing might be a clear process, a tough conversation, or aligned expectations,” Borstad says.

She calls the impulse “reactionary training” and offers an alternative to manufacturing leaders in her step-by-step process to identify and address underlying causes. She has created a “solution map” that shows companies how to respond to challenges by attacking the core of the problem.

First things first Borstad says one reason many employers use training as a default solution is the fact that it is such an effective tool to help employees do their jobs well. “We jump to training because it is so powerful. When we jump to a training solution, that’s reactionary training.”

training video to correct the same recurring error. The real fix was a simple conversation and direct instructions.

“If you don’t stop to ask the right questions, you’ll keep repeating the same mistakes,” Borstad says.

The first step in the process is to clearly define the scenario. “We want to find out what the current state is, what the future state is, and what the gap is in the middle,” Borstad says, urging leaders to outline

Borstad says companies should discuss how they will track the data, at what frequency, and how it will be shared with employees so they know they’re making progress.

Instead of reflexively pursuing training when presented with a performance issue, Borstad encourages leaders to first ask questions, much as a doctor will do when diagnosing medical issues. “When you go to the doctor with a sore knee, you don’t want them to immediately prescribe physical therapy without first asking if the issue is actually your hip, your posture, or even your shoes,” she says. “Organizations owe themselves the same discipline before they prescribe training.”

She points to a former client who blamed new hires for recurring safety violations and called for additional training. Borstad’s analysis revealed seasoned employees were behind most incidents. The problem didn’t result from lack of employee skill — it stemmed from process design, unclear expectations, and a lack of accountability. Correcting those areas produced improvements where training alone would have failed. Another large firm proposed producing a

“So often we default to training, even when it isn’t the answer,” Borstad says. “If you don’t stop to ask the right questions, you’ll keep repeating the same mistakes.”

measurable benchmarks.

She uses safety as an example, citing a company that expects to have safety incidents for less than 3% per thousand labor hours, but in reality has 6%, and in one job area specifically has 10%. “We know what we want to happen, and we know what’s really happening,” she says.

Being very specific about those measures is important. They can be safety numbers, number of errors or quality specifications, but the measures should include specific data that describes where the company is and where it wants to go. After defining the problem and determining what to measure,

With the problem defined and measures set, leaders can uncover why the issue is occurring by using observation, data, and employee feedback. The cornerstone of Borstad’s approach involves five diagnostic “buckets” to uncover what’s truly driving the issue: culture, expectations, knowledge, skills, and processes. To assess culture, Borstad says companies need to know if leadership behaviors, company values, and daily practices support the desired outcome. Simple questions can reveal weaknesses in culture. “Do employees enjoy being at work? Are they enjoying what they’re doing? Are they empowered? Do they feel a part of something larger than themselves?” Borstad asks.

She describes a safety issue that stemmed from a cultural issue. “There was a high demand for productivity. People knew how to do it safely, but they weren’t doing it that way because all the emphasis from company leadership was on productivity.”

If the cause of a problem falls in the culture bucket, it’s important to determine exactly what that issue is. Borstad offers several questions for reflection: “Do people feel like they’re being micromanaged? Are people not role modeling? It’s one thing to say something, but then another to act a different way. Maybe management or leadership isn’t walking the talk? Is it a safety culture? Is it a quality culture?”

The second step is to develop a longterm solution. Fixing cultural problems requires a plan of action and time to transform. “You have to have a plan,” she says. “You can’t just start acting like things are different.”

Nonetheless, companies often can’t wait for that long-term solution to kick in. “When culture is the root of your performance problem, you want to ask, ‘What can I do right now?’ to begin

addressing this issue.”

In the safety scenario, Borstad says the company could shift the emphasis from productivity to safety. That’s exactly what one company did. “Their morning meetings emphasized working safely with quality in mind — profitability and productivity would follow.” In the meantime, leaders could address larger cultural issues.

Another company that made ATV parts was experiencing recurring quality issues. They determined the root of the problem was culture related: Employees didn’t have a sense of the importance of their work. Leaders had their customer, the ATV manufacturer, bring ATVs to the company for employees to ride and

“You miss the best feedback when you don’t talk to the people doing the work,” Borstad says.

enjoy so they could see the end result of their work. Quality improved significantly when employees understood their work was important.

To determine if knowledge is the source of the problem, leaders must determine if employees know what to do, and if they have the information they need. “This one sounds really simple, but we miss this more often than we think we do,” Borstad says.

Issues in the knowledge bucket should be separated by “knowledge” and “skill.” Knowledge is simply information — how finished products are marked after a final step, for example. If employees struggle to remember certain steps, a job aid such as a list or chart can provide that knowledge.

“We often spend too much time telling people what to do and not enough time making it easy for them to do it,” Borstad says, who endorses job aids as a tool for ensuring employees have access to the knowledge they need.

For expectations, managers need to ensure they have made goals and roles clear. Problems often arise because employees are working from assumptions rather than defined expectations.

The questions Borstad encourages leaders to consider in this area include: Do they know what the goal is? Do they know what doing a good job is? She gives examples such as, what is acceptable

for tardiness? What is acceptable for absenteeism?

“Leaders’ roles should also be clear,” Borstad says. For example, a lead might not think it is his responsibility to make sure people are working safely. The supervisor might disagree — expectations are misaligned.

“You want to make sure expectations are clear. And you’ll want check-ins to ensure expectations are continually met,” Borstad says.

Similarly, a gap can result if employee skills are lacking. Do they have the technical ability and confidence to perform consistently? “This is where we traditionally think of the word training. At Enterprise Minnesota, we refer to this as skill development because in order to do a job well, there is a skill — technical or interpersonal — that needs to be developed,” she says.

When it comes to skill development, Borstad believes that how a skill is taught is critical — at least as important as the content. It’s important to have a system to ensure employees are learning best practices safely and consistently.

Within this bucket, leaders should identify exactly which skills and which employees need to be developed. She laments the scattershot approach if just one or two employees really need skill development. “If one leader won’t address conflict, companies often decide to train all leaders in conflict resolution because they don’t want to address a person individually. Skill development should be specific to the skill and specific to the person,” she says.

Finally, Borstad says, the real issue could be process. Is the process confusing or inefficient? Does it lead to mistakes? A confusing process is often the cause of reactionary training, Borstad says. “One of the things that I’ve heard over and over in my career is when something doesn’t make sense, when something leads to a lot of mistakes and something is hard to do, we’ll just train them on it.”