JANUARY/FEBRUARY 2023

After a tumultuous three years, industry experts discuss what’s next for the world of private label

P. 10

HEALTHY PETS THE FOCUS

P. 20

FROZEN FOODS ARE HOT

P. 23

THE PULSE OF PRIVATE LABEL

4 Store Brands ● January/February 2023 ● www.storebrands.com Store Brands (ISSN-0190-9851; USPS # 0488-370) is published monthly, except January, March, May, July and September by EnsembleIQ, 8550 W. Bryn Mawr, Suite 200, Chicago, IL 60631. Subscriptions: One year, $100; two years, $182. One year, Canada $118; two years, $215 One year, foreign $135; two years, $225. One year, digital $70; two year, $130.Single copies $14 US, Canada & foreign $16. Payable in advance with a bank draft drawn on a US bank in US funds.Single copies $20. Foreign, $85. Canada Post: Canada returns to be sent to IDS, P.O. Box 456, Niagara Falls, ON, L2E6V2. Periodicals postage rates paid at Chicago, IL and additional mailing offices. Printed in USA. POSTMASTER: send all address changes to Store Brands PO Box 3200 Northbrook, IL 60065-3200. Copyright 2023 by EnsembleIQ. All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI, 48106. The contents of this publication can not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for claims and representations. VOLUME 46 NO.1 06 Editor’s Note 07 Industry News 20 Pet Products Pet health & wellness drives sales 23 Frozen Foods Category grows to meet consumer needs 25 Sustainability Private label helping reduce food waste After a tumultuous three years, what’s next for the world of private label?

Weʼre Naked Without Your Label

We’re one of the fastest growing private label manufacturers of high quality household paper in the nation. We can program our production lines to flexibly produce your products in any size, paper grade, package or bundle, or floor display configuration. In other words, we’ll produce a custom paper program you’ll be glad to put your label on.

• Full range of ultra, premium, FSC® Certified, recycled, and traditional paper grades

• Paper towels, bath tissue, napkins, and facial tissues

• Flexible custom manufacturing, packaging and displays

• For lower volume requirements, we offer our pre-packaged store brands: Azure® Ultra Premium, Daisy ®, Delicate Touch®, and Earth One™ 100% recycled.

HE RE YOUR LABEL

www.usalliancepaper.com • 631.254.3030 • info@usalliancepaper.com ©2022 U.S. ALLIANCE PAPER, INC.

GETTING BACK TO BUSINESS

PRIVATE LABEL GROWTH, EXPANDED USE OF TECHNOLOGY AMONG THE HOT TOPICS FOR THE YEAR AHEAD

Well, folks. We’re at it again.

By the time you read this, we’ll be midway through February and thinking about the warmer temperatures of spring that are just around the corner.

The New Year has had a rapid start, and things are beginning to feel a bit more normal, although most would agree that “normal” has been dramatically redefined over the past three years.

Part of the normalcy many of us are feeling is the ability to once again meet in person. At the recent FMI Midwinter Conference in Orlando, the grocery industry was out in force ready to do business and identify new ways to enhance operations, with the goal of meeting the continuallyevolving needs of their shoppers.

Most of the conversations I had with industry leaders at the conference were positive. Of the many things I learned in Central Florida, there were two topics that stood out:

(1) The continued growth of private label products. Inflation opened the eyes of many consumers to the financial benefits of store brand products. Their taste buds made them realize they can buy quality items that are less expensive.

Retailers are now moving forward with plans to expand the presence of their store brands in current categories and launch them in new product segments. As issues related to supply chain and ingredient availability lessen, suppliers again have the capacity to seek out new business, which is good news for retailers looking to fill voids in their private label assortments.

(2) Technology will play a larger-than-ever role in how retailers manage their assortments and meet the needs of shoppers. During the FMI event, I had several conversations with tech folks who pitched their products, highlighting their features and benefits. Much of what they said made sense, but the challenge with anything new is making sure to have a round peg for a round hole.

Several tech professionals expressed frustration at the “slow” rate of adoption of new technology by some in the retail/grocery industry. While this may be true, it’s important for these conversations to continue. Here’s a bit of advice: For those on the tech side, keep your messaging simple. At times, the jargon of technology can be confusing. Always keep in mind you’re talking to folks who are still trying to figure out all the features on their smartphones, myself included!

For those on the retail/grocery side, have an open mind. Institutional knowledge is a great asset, but that knowledge combined with the latest technological advances can make a business run more efficiently. Don’t get trapped in the “that’s how we have always done it” mindset.

8550 W. Bryn Mawr Ave., Ste. 200 Chicago, IL 60631 773.992-4450 Fax 773.992.4455 www.storebrands.com

BRAND MANAGEMENT

Brand Director John Schrei 248.613.8672 | jschrei@ensembleiq.com

EDITORIAL

Associate Publisher/ Executive Editor Greg Sleter gsleter@ensembleiq.com

Associate Editor Zachary Russell zrussell@ensembleiq.com

ADVERTISING SALES & BUSINESS

National Sales Manager Natalie Filster 917.690.3245 | nfilster@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Senior Creative Director Colette Magliaro cmagliaro@ensembleiq.com

Designer Jyoti Patiyar jpatiyar@ensembleiq.com

Production Manager Patricia Wisser pwisser@ensembleiq.com

Marketing Manager Rebecca Welsby rwelsby@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@storebrands.com

Chief Executive O cer Jennifer Litterick

Chief Financial O cer Jane Volland

Chief People O cer Ann Jadown

Executive Vice President, Content & Communications Joe Territo

Chief Operating O cer Derek Estey

Evolution is vital to future growth and meeting the needs of that next generation of consumers who will be tech savvy.

Evolution is vital to future growth and meeting the needs of that next generation of

6 Store Brands ● January/February 2023 ● www.storebrands.com The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

Save A Lot Focused On Shopper Needs As It Eyes Growth

As Save A Lot started 2023, the grocery chain is putting the final touches on its transformation that included selling all corporate stores and completing a refinancing that its CEO Leon Bergmann said eliminates uncertainty, lowers the cost of borrowing and sets the company up for growth.

During the recent FMI Midwinter Executive Conference in Orlando, Fla., Bergmann spoke with Store Brands about the year ahead for his company, the impact Save A Lot continues to have on the communities it serves and the importance of private label products in the grocer’s assortment.

STORE BRANDS: As we look ahead, what major initiatives are in the offing?

LEON BERGMANN: We are always looking for ways to improve and this includes a continual review of our categories. For example, we just launched a new own-brand line of fresh sausage as we are working with a new manufacturer. We are also redoing our line of pizza and bringing in a new line of HBC products. It’s all pretty exciting. We also updated our POS back office suite, which was a wise investment as our prior system was dated. We also rationalized our distribution network with the closure of two facilities. We’ve removed fixed costs out of the system but we still have plenty of capacity to grow.

SB: What impact do the fiscal decisions that have been made have on shoppers?

LB: What we do is so important for

the communities we serve. If Save A Lot was not here, there would be 250 additional food deserts in the U.S. We have a model that can serve underserved communities and do so sustainability. We provide a great service and great value to our customers, and also being able to make a profit means we’re going to be here for the long term.

SB: How important is Save A Lot’s assortment of private label products in helping serve your customers?

LB: About 70% of our sales come from private label products. The good news with our assortment is that the items we carry are at or above the national brand equivalent in terms of quality. Currently, our private label assortment features 55 brands.

SB: Is there more marketing Save A Lot can do to further raise the profile of its private label assortment?

LB: We do market our store brands, but we do need to do better, which is an initiative this year. But our customers also trust us and know what to expect from our products. While we get credit from our existing customer base, we can do a better job of getting more credit from first time shoppers.

SB: Sustainability remains a major talking point for grocers and retailers. How does this issue impact Save A Lot?

LB: This is an issue that is very much top of mind. In April, we will publish our first ESG (Environmental, Social & Governance) report. For us, a lot of what we do currently plays into the ‘S’ part of ESG. I think the big question related to this issue going forward is how much extra is the consumer willing to pay for items

CVS Names New Chief Consumer Products Officer

CVS Health has named its new incoming chief product officer for consumer goods.

Amy Bricker will join the pharmacy retailer in February and report to CVS Health President and CEO Karen S. Lynch in the newly created role, overseeing the retailer’s consumer product offerings. Bricker’s hiring was announced alongside the hiring of David Joyner, who will rejoin the company as executive vice president and president of Pharmacy Services.

"David and Amy are accomplished leaders with proven track records of anticipating and meeting customer and client needs," said Lynch. "David has deep experience in pharmacy benefit management that will help us deliver on our growth strategy for the business. Every element of our strategy puts consumers first, with a particular focus on the products and services they use to stay well. Amy's passion and proven leadership will be invaluable assets as we continue to deliver on that strategy."

Bricker has nearly 20 years of health care experience, most recently serving as president of Express Scripts, a pharmacy benefit management organization. Joyner, a former CVS Health executive, brings more than 34 years of healthcare and pharmacy benefit management experience to the retailer.

"CVS Health has unmatched opportunities to enhance and launch consumer products that make care simpler and more affordable," said Bricker. "I'm incredibly excited to join the company at a pivotal time in health care."

www.storebrands.com ● January/February 2023 ● Store Brands 7

New Sprouts Initiative Aims To Tackle Food Waste

Sprouts Farmers Market is launching its Rescued Organics program at its 130 California locations.

The program is designed to reduce food waste and supports local farmers by bringing to market imperfect organic produce that would otherwise be discarded because of imperfections that do not affect quality.

Rescued Organic produce may be misshapen, under or over-sized or slightly off-color, but has the same taste, nutrients, and quality as other Sprouts produce. The program also makes organic produce more accessible because it is offered at a reduced price.

“Five billion meals worth of edible food are left on farms each year, and the Sprouts Rescued Organics program is designed to help address that problem,” said Nick Konat, president and chief operating officer of Sprouts. “This program allows our customers to partner with us to reduce food waste by taking home delicious, high quality organic fruits and vegetables that may look a little different but are perfectly good, keeping so-called ‘imperfect’ produce out of the landfills.”

In addition to reducing food waste, the Rescued Organics program will support

Sprouts’ farmer partners. Farmers’ inability to sell imperfect produce makes farming less profitable and more difficult to operate.

“We are happy to be involved with Sprouts’ Rescued Organics program because too much perfectly good produce goes to waste, solely due to appearance, and contributes to our growing environmental and landfill problems,” said Mindy VanVleck, director of sales at Peri & Sons Farms. “Sprouts’ Rescued Organics program also allows Peri & Sons Farms to more efficiently fill our produce trucks which helps the success of our local farm and lessen our overall carbon footprint for delivery of goods.”

The Rescued Organics program is launching with 12 different varieties of local produce including potatoes, onions, grapefruit, lemons, oranges, pears, carrots, kiwi and bell peppers.

lotion, chlorine bleaching or natural rubber latex.

Drylock’s channel core is structured with three tubes that adapt perfectly to your body shape and distribute wetness evenly.

Discreet, body-close fit that no one will know you are wearing.

8 Store Brands l January/February 2023 l www.storebrands.com

New in 2023! Engineered with proprietary anti-leak channel core that will protect against leaks and odors for up to 12 hours. eacl.sales@drylocktechnologies.com 1-877-202-4652 Free from harmful ingredients. No fragrance, parabens,

Odor Protection LeakProtection UP TO

Kroger Own Brands VP To Speak At PLMA Conference

Juan De Paoli, vice president of Our Brands at Kroger, will be a featured speaker

March 24. At the conference, Store Brands and PLMA will announce the Private Label Hall of Fame Class of 2023.

“We are pleased to welcome Juan De Paoli to our annual Meeting and Leadership conference,” said PLMA president Peggy Davies. “Juan’s 20-plus years of experience, vision and talent has greatly contributed to consumer engagement with retailers’ own brands.”

De Paoli joined Kroger in 2021, and is responsible for driving Kroger’s private label vision, strategy and program development. Prior to Kroger, he served as senior vice president of Private Brands at Ahold Delhaize USA, and spent 12 years at H-E-B in its Own Brand organization.

Additional 2023 speakers include Kevin Ryan of Malachite Strategy and the Culture Matters newsletter; James E. Dillard III, executive vice president and president, Consumer Healthcare Americas, Perrigo; Roger Davidson, an industry veteran and leading consultant in the food retail industry; Tim Pollard, founder & CEO of Oratium; and Julien LeBlanc, co-founder and president, Blueprint North America.

www.storebrands.com ● January/February 2023 ● Store Brands 9

the Hyatt Regency Grand Cypress, the event brings together retailers and private label manufacturers.

By

COVER Store Brands January/February 2023 STORY COVER STORY

Following a roller coaster past three years, new challenges are on the horizon for the private label industry

Greg Sleter

The past two years have seen the changing of the calendar from December to January met with hope and a level of cautious optimism as retailers and product suppliers alike sought to put the prior year’s hurdles behind them.

For those needing a reminder, the past three years have offered mountainous challenges ranging from a global health crisis to supply chain speed bumps and price hikes not seen in a generation or two. Hoping for a normal business climate? Most experts will say they are no longer sure what normal is.

What is clear is that 2023 will offer its own unique set of opportunities and challenges, and for the private label sector, the chance to build off a strong 2022 when inflation led consumers to seek out lower-cost, store-branded products to make ends meet. In the process, many shoppers also discovered their money saving choices revealed products that rival or exceed the quality offered by legacy national brands.

“We have again seen retail brands become more accepted by the consumer and we hope that continues, even if the economy shows some improvement this year,” said Peggy Davies, president of the Private Label Manufacturers Association (PLMA).

While price will continue to be a major factor in consumer spending habits and the choices they make when shopping in-store and online, industry experts also feel there is more retailers can do to highlight the benefits of store brand products that go beyond simply being less expensive than their national branded competitors.

“Retailers need to treat their private label brands as brands,” said Barbara Connors, vice president of Strategy and Acceleration with 84. 51°, Kroger’s retail analytics firm. “They need to focus on marketing their brands to drive awareness and keep their products top of mind with shoppers. While consumers may buy the items because they are less expensive, it’s important for retailers to also highlight the quality of the items as well.”

Utilizing these long-standing tenets of marketing would also give retailers the chance to create an emotional connection with shoppers about a given retailer’s private label assortment. To do so, there’s a line of thinking among those who closely watch the private label industry that retailers need to continue evolving what motivates them when working to develop new products.

“Historically, retailers have viewed their private label assortments largely as an opportunity to enhance their margins,” said MaryEllen Lynch,

principal, Center Store Solutions with IRI. “There is now an opportunity to have consumers view products sold under a private brand as more than something they have to buy based on economics, but products they want and need.”

The need for retailers to continue working to gain consumer acceptance of their private label products will be vital given that 85% of retailers said they plan on increasing their assortments of store-branded products in 2023, said Jim Griffin, executive vice president, North American Operations with Daymon.

“Expansion in 2023 will heavily rely on a retailer or brand’s ability to focus on bolstering the key areas impacting development,” he said. “This includes establishing a unique and ownable lens to innovation, boosting sustainability measures across the board, planting both feet into omnichannel investments and securing the supply chain through partnerships.”

CONSUMER SHOPPING HABITS

The past three years have also seen the habits of consumers shift at an uncommonly rapid rate in the face of significant factors that include the COVID-19 pandemic and inflation. But which of these habits will carry into 2023 and which will diminish?

Connors said that while consumers will remain focused on price, they will also look at what they are buying through the lens of value and assess both when making purchase decisions.

“Consumers today are much savvier and have adopted new habits in an effort to maximize their budgets,” she explained.

She also said shoppers overall will remain focused on buying products that have a positive impact on their health. Noting that this topic has evolved beyond calories and the fat content of consumables, Connors said the topic of health also includes identifying products that allow them to improve immunity levels and get a better night’s sleep, for example.

Lynch added that financial concerns will remain top-of-mind for consumers

who spent much of 2022 zeroed-in on managing their household budgets in an effort to make ends meet.

“They bought less, reduced waste, chased promotions and were very intentional in choosing what to purchase, with many turning to store brand products,” she said. “I expect that to continue in the near term in 2023.”

Similar to Connors’ view about consumers seeking the best value for their dollars, PLMA’s Davies said based on conversations with private label suppliers, she expects to see more value packs on store shelves. This would not only give consumers more options when shopping for needed products, but allow retailers in the grocery channel and others to compete with the big-box stores.

Sustainability will again be a big part of the conversation, Daymon’s Griffin said, with consumers continuing to show an interest in the link between the environment, climate change, personal well-being and buying behavior.

“With a keen eye to how their individual purchasing decisions impact the world around them, more and more consumers are expecting companies to elevate their sustainability efforts,” he added. “Private brands need to be considering multifaceted goals and commitments, including product development innovation initiatives that take into account these consumer concerns and category dynamics.”

This, Griffin said, encompasses everything from acting on topics such as adjusting packaging (i.e. minimizing packaging and extending its lifecycle) to tasks that may require higher investments such as incorporating renewable energy and regenerative agriculture throughout the total supply chain.

PRODUCTS TO WATCH

Despite the many changes to doing business seen over the past three years, a constant has been the continued need to develop new products. With retailers looking to build on the growth of private label product sales from 2022, the remainder of the year is expected to see a great deal of innovation, industry experts said.

COVER STORY 12 Store Brands ● January/February 2023 ● www.storebrands.com

We expect retailers who may have been hesitant to invest to begin to firmly commit to holistic private brand marketing strategies.

—Jim Griffin, Daymon

There is now an opportunity to have consumers view products sold under a private brand as more than something they have to buy based on economics, but products they want and need.

—MaryEllen Lynch, IRI

“Innovating products around consumer trends will always be a key component of driving product development and loyalty,” Griffin said. “Now more than ever, shoppers are looking for ways to drive satisfaction in everyday life, with products that bring simple joys and excitement through familiar items while balancing the value equation.”

An area of growth Griffin expects to see in private label is innovation with dynamic flavor pairings such as sweet and spicy global flavor profiles like gochujang. Across nonfoods, he noted the introduction of products that promote shareability across social media platforms by leveraging unique and new applications of colors, scents, and formats such as within personal care products.

Connors agreed with Giffin’s assessment when it comes to flavor pairings as more consumers are showing a willingness to try foods that are spicier or “funkier.”

She also expects to see continued growth in the health & beauty segment as consumers seek products that offer fewer ingredients while providing solutions to living a healthier life. Snacking is another category with growth potential, according to Lynch, with the popularity of charcuterie boards continuing to drive interest from consumers.

Additionally, continued price hikes at restaurants is also forcing many families to reduce the amount of times they are eating out. This is allowing retailers to provide products that tap into the ongoing strong desire of consumers to cook and bake at home, she said.

“As people look to save money, this is an opportunity for retailers to challenge consumers to make meals at home and utilize the selection of store brand products offered,” Lynch added.

While there continues to be a great deal of focus on developing new products for humans, pet products is a category that PLMA’s Davies said is also on a path for growth in 2023.

She noted several private label suppliers within the pet segment are taking their first steps into the refrigerated foods

category. This category has seen activity with some national brands, but high prices are a barrier to entry for a number of consumers. Offering a more affordable private label option could allow retailers to expand the presence of fresh food for pets and give consumers more options.

WHAT TO WATCH

While there will be many topics to keep an eye on throughout 2023, there are some that will be of greater importance to retailers and suppliers.

“It will be important to move past the line of thinking that things will return to normal and instead take steps to ensure that your business is set up for unexpected changes,” Connors said. “This includes utilizing data to maximize assets in-house and making decisions that allow your team to act more nimbly.”

IRI’s Lynch said that consumers are more optimistic that there is light at the end of the tunnel regarding many of the challenges they have faced in recent years. However, she noted the retail and supplier communities are still dealing with a level of uncertainty about issues such as supply chain and sustainability. The opportunity current economic conditions are presenting retailers to build off 2022 and further boost sales of private label products could see some boost their marketing efforts to raise the profile of store-branded products.

“We expect retailers who may have been hesitant to invest to begin to firmly commit to holistic private brand marketing strategies,” Griffin said. “Brands need to learn where their customer segments spend their time and market to them on those platforms— whether that’s social, web, or email — and marry that with in-store strategies and communications.”

Use of these platforms will allow retailers to drive messaging with key communication strategies to reinforce innovation launches and educate consumers on sustainability initiatives - all of which should maximize sales, drive trial and develop shopper loyalty, he added.

www.storebrands.com ● January/February 2023 ● Store Brands 13

Retailers need to treat their private label brands as brands. They need to focus on marketing their brands to drive awareness and keep their products top of mind with shoppers.

—Barbara Connors, 84.51°

We have again seen retail brands become more accepted by the consumer and we hope that continues, even if the economy shows some improvement this year.

—Peggy Davies, PLMA

A STANDARD OF EXCELLENCE

PLMA’S 2022 SALUTE TO EXCELLENCE WINNERS SHOW THAT PRIVATE BRANDS ARE INNOVATING AND RAISING STANDARDS DURING INFLATIONARY TIMES

14 Store Brands ● January/February 2023 ● www.storebrands.com SALUTE TO EXCELLENCE

Wide Awake Sweet Cream Real Dairy Coffee Creamer

Describe this product and how it meets consumers’ needs. Made with real milk and cream and naturally flavored, Wide Awake Coffee Company’s Sweet Cream Dairy Coffee Creamer delivers the real ingredient coffee sweetener shoppers are thirsty for. What makes this product different or unique from others in its category?

Although Wide Awake Coffee Company’s wide range of high-quality coffee items have always included non-dairy creamers, a segment of shoppers was increasingly interested in a line of real ingredient real dairy creamers from the brand. How has this product served to elevate your private label assortment?

The new real dairy creamers needed to eliminate any confusion by differentiating completely from the non-dairy creamers on-shelf. We took this challenge as an opportunity, elevating each real dairy flavor profile with a new, premium look and feel. Although the brand clearly remains Wide Awake, the stylized character and clean, premium design help shoppers to “wake up” to this delicious new real-ingredient offering.

How has the product performed since its debut?

Real Dairy Creamer is a driving innovation trend in the coffee category, as coffee drinkers increasingly turn to real ingredients and authentic flavors in their daily pickme-up. This segment has seen significant growth, and Wide Awake’s cool solution for Own Brand penetration in the category is no exception. Sales figures confirm that consumers are waking up to the real ingredient taste of Wide Awake Dairy Coffee Creamer.

Full Circle Market Frozen Tropical Fruit Gems

Describe this product and how it meets consumers’ needs.

Full Circle Market Frozen Fruit Gems offer a new and innovative way enjoy guilt-free goodness in a frozen treat that really satisfies your sweet tooth.

What makes this product different or unique from others in its category?

A unique spin on frozen fruit that’s every bit as satisfying as a frozen novelty, Full Circle Market Frozen Fruit Gems are cryogenically frozen beads of super-cold fruit and fruit juice that eats like a delicious frozen snack straight off the ice cream truck! Full Circle Market Frozen Fruit Gems are only 60 calories and dairy free with no added sugars, no artificial flavors, preservatives or certified synthetic colors. How has this product served to elevate your private label assortment?

This cool, better-for-you twist on summer fun is exactly what the doctor ordered! Smart Snack approved, Full

Circle Market Frozen Fruit Gems offer a uniquely delicious summer snacking option. How has the product performed since its debut?

Full Circle Market Frozen Fruit Gems are a game changer, checking all the boxes, and blurring the line between frozen fruit and frozen novelties. As better-foryou foods continue to become increasingly popular with shoppers, the better-for-you foods market grows steadily as well, with some 49% of consumers choosing BFY products more regularly than a year ago.

Full Circle Market Plant-Based Bolognese Style Pasta Sauce

Describe this product and how it meets consumers’ needs.

Full Circle Market Plant-based Bolognese Style Pasta Sauce offers the benefits of a meatless meal with the full meat sauce flavor they are accustomed to… at a really tasty price! What makes this product different or unique from others in its category?

Made with vegetable protein and no sugar added, these certified plantbased vegan pasta sauces offer 5 grams of protein, a perfect choice for health-conscious shoppers who are seeking full-flavor better-for-you products. How has this product served to elevate your private label assortment?

Despite 36% of meat eaters trying to add more plantbased to their diet, plant-based has remained an Own Brand void in the pasta sauce category. Consumers have resoundingly called for full flavor plant-based options and Full Circle Market Plant-based Bolognese Style Pasta Sauce has answered the call. How has the product performed since its debut? Plant-based sales have experienced more than 25% growth in every U.S. region, growing twice as fast as the total U.S. retail food market. With 57% of households now purchasing plant-based foods, Full Circle Market Plant-based Bolognese Style Pasta Sauce is on-trend with flavor profile and sales numbers alike!

Crav’n Flavor Lime Fruit Bars

Describe this product and how it meets consumers’ needs. Especially during the summer months, adults seek tasty ways to cool down naturally at a price that’s right. Made with real fruit juice, Crav’n Flavor Lime Fruit Bars offer delicious, grown-up flavor at a price that brings summer relief at a really cool price!

What makes this product different or unique from others in its category?

Crav’n Flavor Lime Fruit Bars fill an Own Brand void in the category. This decidedly adult flavored novelty offers summer refreshment in a frozen fruit juice favorite… at a price that’s nice. How has this product served to elevate your private label assortment?

Crav’n Flavor Lime Fruit Bars represent an incredible opportunity for Topco Members to grow their Own Brand penetration and sales in the frozen novelties

category by leveraging this popular grown-up, frozen fruit juice novelty at a tasty price.

How has the product performed since its debut? Shoppers have responded to the real fruit juice attributes and mouth-watering, adult flavor profile of Crav’n Flavor Lime Fruit Bars. The popularity of this frozen treat has prompted the brand to expand its offering to Strawberry, Mango, Pineapple and Coconut Cream as well.

TopCare Beauty Hydrating Water Gel

Describe this product and how it meets consumers’ needs.

Dermatologist tested and oil-free, TopCare Hydrating Water Gel contains hyaluronic acid for intense hydration. What makes this product different or unique from others in its category?

In a category with limited innovation and few suppliers who can bring high quality, affordable products to market, TopCare Beauty Hydrating Water Gel offers an Own brand equivalent to the national brand’s #1 Skin Care item.

How has this product served to elevate your private label assortment?

A direct compare to the #1 skin care item from the national brand leader, TopCare Hydrating Water Gel delivers the same high quality at just a fraction of the cost.

How has the product performed since its debut? TopCare Hydrating Water Gel is making a big splash, offering top quality and affordability to shoppers.

Tippy Toes Hypoallergenic Infant Formula

Describe this product and how it meets consumers’ needs.

Tippy Toes Hypoallergenic Infant Formula is clinically proven for babies with an acute cow’s milk allergy. Made without GMO or artificial growth hormones, Tippy Toes Hypoallergenic Infant Formula contains probiotics to help support baby’s digestive health and DHA for brain support.

What makes this product different or unique from others in its category?

Hypoallergenic represented the largest own brand void in infant formula, and it is an almost $100M category that is up +14.1% YOY. For babies who are allergic to cow’s milk, hypoallergenic infant formula is their only choice in-aisle, and Tippy Toes offers 30% savings versus the national brand.

How has this product served to elevate your private label assortment?

Tippy Toes Hypoallergenic Infant Formula fills a serious need for colicky babies, providing additional high quality, non-GMO product on-shelf at a price that will make moms happy as well.

How has the product performed since its debut?

The Tippy Toes Hypoallergenic Infant Formula rollout is the biggest launch of baby formula in the last decade, providing relief to babies with an acute cow’s milk allergy, and significant savings compared to its name brand equivalents.

www.storebrands.com ● January/February 2023 ● Store Brands 15

In response to record-high inflation at the grocery store and beyond, 2022 was a record year for private label. Consumers sought quality items at lower prices across all categories, and turned to private brands like never before. Over the first 11 months of 2022, dollar sales increased by 10.6% compared to 2021, per data from IRI.

The Private Label Manufacturers Association’s annual Salute to Excellence awards showcase the best, most-innovative products to be released in a given year. The award winners in 2022 were made up of nearly 100 products across several categories, and more than 725 products from 50 North American retailers were submitted for consideration.

For Salute to Excellence, each product was evaluated by a panel of professional and consumer judges on several criteria, including taste and sensory appeal, packaging,

presentation and value for money.

Trending categories among the 2022 Salute to Excellence winners were plant-based products, specialty pastas and sauces, eco-friendly nonfoods and organic items. Products that earned praise the high honors from PLMA included:

• Walmart’s Sam’s Choice Oat Milk Chocolate Bar

• Albertsons Companies’ Signature Reserve Ravioli with Porcini Mushrooms and Truffle

• 365 by Whole Foods Market Organic Fair Trade Unsweetened Coconut Shreds

• SE Grocers Prestige Organic Chili-Flavored Extra Virgin Olive Oil

• CVS’s Total Home Stainless Steel Silicone Straws

• Sprouts Farmers Market Multi-Use Biodegradable Cleaner

Irresistibles Frozen Salted Caramel Belgian Waffles

Describe this product and how it meets consumers’ needs.

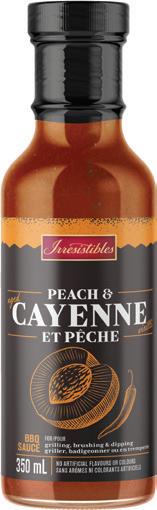

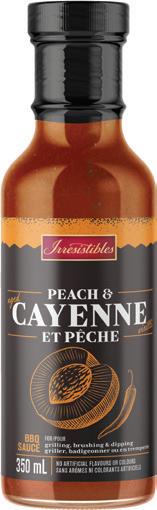

Irresistibles Peach and Aged Cayenne BBQ Sauce

Describe this product and how it meets consumers’ needs.

This Irresistibles peach and aged cayenne barbecue sauce has the sweet meets heat taste popular with today’s consumers. The sauce has a well-balanced initial sweetness from a blend of ripe peach puree, followed by a burst of heat from the fiery aged cayenne peppers. It is locally made in Canada, free from artificial colours and flavours, and unique in flavour to impress any BBQ connoisseur. What makes this product different or unique from others in its category?

Consumers have embraced the sweet plus heat trend for some time now and are looking for more complex flavours and unexpected combinations. By blending this favourite summertime stone fruit with aged cayenne peppers, we’ve developed a unique sauce bursting with familiar favourites. Perfect for grilling or dipping. Move over pineapple…peaches have arrived on the grill!

How has this product served to elevate your private label assortment?

This premium barbecue sauce combines some of Canada’s favourite flavours - sweet peach with red-hot cayenne peppers. This flavour combination along with a consumer-friendly price point makes our new sauce accessible to consumers who want a new gourmet flavour experience on grilled meats, on wings or as a dip. It’s now easier to create a restaurant style taste sensation at home.

How has the product performed since its debut?

We have received very positive comments on this new barbecue sauce. Consumers are eager to try this new and unique flavour to grill meats or use as a dip.

The Irresistibles salted caramel

Belgian waffles are lightly crispy and golden on the outside, tender and airy on the inside, and have deep pockets to catch all the delicious toppings consumers may choose. They are mildly sweet with a subtle caramel flavour and a hint of salt. These thick waffles are versatile and convenient - just thaw for an easy snack on the go, toast for a delicious breakfast topped with fruit and maple syrup, or as a decadent dessert topped warm fruit compote, candied nuts, and whip cream, or a gourmet icecream sandwich.

Frozen until ready to use, each retail unit has four waffles packaged to maintain freshness. The waffles are made locally in Canada without the use of artificial flavours, colours, or preservatives. What makes this product different or unique from others in its category?

Belgian waffles are thicker, lighter in texture and have extra-deep pockets versus traditional North American waffles. These premium waffles allow consumers to enjoy a trending flavour - salted caramel - in an innovative way. How has this product served to elevate your private label assortment?

Salted caramel is still a strong on-trend flavour that has enhanced our Belgian waffle assortment that currently consists of original, vanilla and maple. Innovation through flavour is key in providing consumers with new taste experiences to keep them engaged and excited about the private label.

How has the product performed since its debut? Since its introduction, the category has reported a sales growth of 43%. This performance along with positive feedback from our consumers speaks for success of this innovative product.

Home Exclusives Picnic Backpack Set

Describe this product and how it meets consumers’ needs.

This luxury Home Exclusive picnic backpack is specifically designed for consumers who want the convenience and ease of eating in the great outdoors.

The backpack doubles as a cooler for food and drink and comes with 30 pieces (enough for four people) including cutlery, dishes, glasses, cotton napkins, cutting board, bottle opener and salt & pepper shakers. The backpack itself has adjustable straps, is made of durable Jacquard polyester, and has an insulated food compartment to keep food and beverages fresh. What makes this product different or unique from others in its category?

Anyone can put all the necessities for a picnic in a normal backpack. Why would you when there is a compact, ergonomically shaped, and comfortable backpack that is insulated to keep food fresh and contains all the necessary accessories needed for a picnic for four. All you have to bring is the food and drink. Normally found in specialized stores, consumers can now conveniently buy this picnic backpack at their local pharmacy for an affordable price. How has this product served to elevate your private label assortment?

Traditional backpacks have been used to carry food when planning to eat outdoors. To elevate the outdoor dining experience and aid in food safety, this picnic backpack was created for consumers who want the convenience to purchase a ready to go picnic set, at an affordable price and can be purchased from their local pharmacy versus going to a specialty store. How has the product performed since its debut? Consumers are excited to be offered this perfect companion for outdoor activities: an all-inclusive luxury backpack for a picnic as you wished.

16 Store Brands ● January/February 2023 ● www.storebrands.com SALUTE TO EXCELLENCE

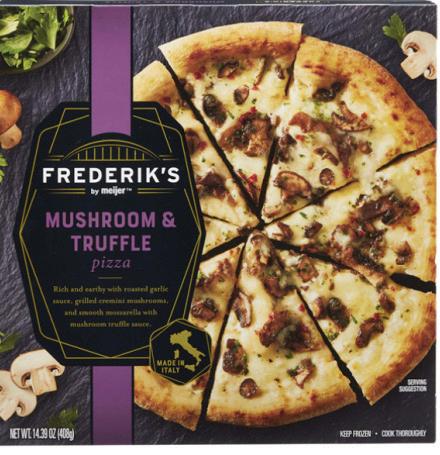

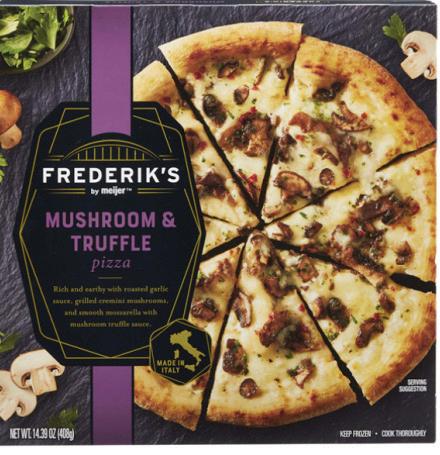

• Aldi’s

Earth Grown Non-Dairy Mocha Fudge

Almond Milk Frozen Dessert

• Meijer’s Fredrik’s Mushroom & Truffle Pizza

• Price Chopper’s PICS Everything Hot Dogs

• Wakefern’s Paperbird Heavy Duty Clear Forks

• Weis Markets’ Weis by Nature Sugarcane Dinner Plates

• Dollar General’s Heartland Farms Baked Dog Treats, and many more.

“I congratulate all the retailers that participated in this year’s award program,” said PLMA President Peggy Davies at the time of the announcement. “These awards prove that store brands are leading the retail industry and giving shoppers the high-quality, high-value and greattasting products they want.”

The award-winning products were on display at PLMA’s 2022 Private Label Trade Show last November in Chicago, Ill., and included items from Topco Associates, Metro Inc. and Walgreens among others. The full list of winners can be found at plmawinners.com.

With private label slated for another strong year in 2023, PLMA has several virtual and in-person events planned throughout the year. The group’s 2023 Annual Meeting & Leadership Conference will be held March 22-24 in Orlando, Fla., and feature a breakfast keynote from Juan De Paoli, VP of Our Brands at Kroger, in addition to a slate of other speakers from around the industry.

PLMA’s 2023 Private Label Trade Show will take place Nov. 12-14 once again at the Donald E. Stephens Convention Center in Chicago, Ill.

Congrats to Walgreens Brand Salute to Excellence Product Winners

Infinitive Mini Wireless Charger for Apple Watch

Describe this product and how it meets consumers’ needs.

The Infinitive Mini Wireless Charger for Apple Watch is a compact and portable charging solution for Apple Watch users. It connects via USB-A port of your computer, socket, or power bank for a full charge within 2-2.5 hours. The mini and wireless design makes it easy for consumers to take and use anywhere, without the hassle of an extra charging cable.

What makes this an award-winning product?

Walgreens ensured that this item meets consumers quality expectations of a standard Apple Watch charger, including the magnetic induction charging plate, but offered both a compact and portable option. Unlike standard chargers, there are no cords or blocks needed, making this item perfect for travel, work, school, and home to declutter and streamline the consumers’ ever-growing device assortment.

How has this product served to elevate your private label assortment?

This product is exclusive to the Walgreens Infinitive brand, and does not have a national brand equivalent. Because this is a proprietary owned brand offering, Infinitive is proving to be a great value, high quality, and an innovative option for consumers, furthering their trust and loyalty in Walgreens owned brands for their consumer electronics needs.

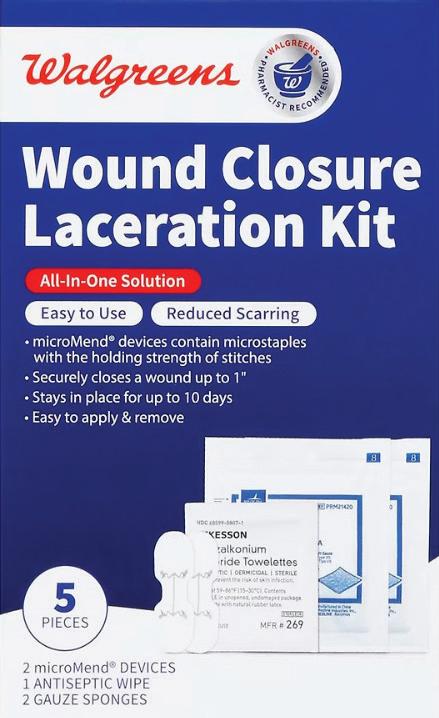

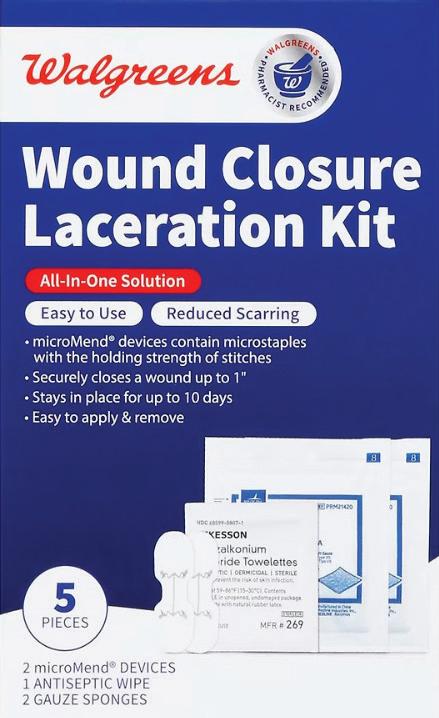

Wound Closure Laceration Kit

Describe this product and how it meets consumers’ needs.

The Walgreens Wound Closure Laceration Kit is an all-in-one solution that is super easy to use. It can be used to treat and secure a wound or laceration up to 1 inch. The microstaple wound closure devices are virtually painless and fast to apply and remove. They have the holding strength of stitches and stays in place for up to 10 days to achieve excellent healing and reduced scarring.

What makes this an award-winning product?

Unlike other first aid kits or wound care kits that have been common in the First Aid department for years, the Walgreens Wound Closure Laceration Kit is for more severe cuts and lacerations. This product is very easy to use and is proven to reduce scarring as well. The microMend® devices in the kit contain microstaples with the holding power of stitches. This is truly a new, innovative, advanced wound care solution for Walgreens customers.

How has this product served to elevate your private label assortment?

Within the First Aid category, Walgreens brand plays a critical role for our shoppers. This product can be used to treat and secure a wound or laceration up to 1 inch. This product can save customers and patients from having to make an urgent care or ER visit.

www.storebrands.com ● January/February 2023 ● Store Brands 17

Speaking with… Paola Sarco, Exhibition Manager, TUTTOFOOD

In May 2023, TUTTOFOOD, Italy’s leading Food & Beverage exhibition, will open in Milan Italy. In anticipation of the industry event, Store Brands reached out to Paola Sarco, Exhibition Manager of TUTTOFOOD, to find out what the event holds for grocery retailers who want to optimize their store brand programs.

Store Brands: What is the TUTTOFOOD exhibition about?

Paola Sarco: TUTTOFOOD is Italy’s leading exhibition, and among the top four in Europe, for the entire Food & Beverage value chain. Its uniqueness resides in its ability to bring smallto medium-sized producers and large Italian and international companies together under the same roof, combining insights into vertical sectors with a complete overview on the Food & Beverage industry. It also offers a rich program of events.

SB: Why is TUTTOFOOD an important event for US grocery retailers to attend?

PS: While other vertical events dedicated to the private label market exist in Italy, TUTTOFOOD is the exhibition of choice for Italian and other foreign companies to present their offerings — especially their more innovative products — to international buyers. At TUTTOFOOD, grocery retailers of any size can find a selection of top potential white label products they won’t find at other events. The international offerings will be even wider this year, ranging from countries like Spain, Greece and Turkey to new entries such as Sweden, Thailand and Latin America.

SB: Do you have examples of private label product categories and companies that will be represented at the 2023 expo?

PS: Private label is a feature across all sectors at TUTTOFOOD. Seafood, frozen, and meat are among categories that have almost reached full capacity already, and therefore are where private label products will be particularly well represented. Moreover, the new Green Trail route, that will be identified with a logo and dedicated signing, will help visitors find products that meet the most up-todate nutritional profiles including natural and organic to free-from, rich-in, and plant-based. We’ll also

have many PDO and PGI consortiums like Parmigiano Reggiano, Buffalo Mozzarella or Tuscan Prosciutto that offer high-quality options for this segment.

SB: Are there educational sessions that will be of interest to grocery retailers looking for information on store brands?

PS: Our exclusive format Retail Plaza by TUTTOFOOD will be of particular interest for grocery retailers. It will cover emerging retail trends in an environment where experts, producers and retailers share hints and insights more thoroughly than elsewhere. Sustainability across supply chains, innovation along the value chain, and changes in consumer culture and purchasing habits will be hot topics in the 2023 edition. A special focus will be on digital transformation, especially in terms of app development and enhanced telco infrastructure. That is important considering that e-commerce grew by 50 percent between 2019 and 2021. Retail Plaza is traditionally a meeting point for top players. Previous editions have included names like Végé, Conad, Carrefour, Glovo, Deliveroo, Penny Market.

SB: How can retailers stay informed about new products and innovations throughout the year?

PS: TUTTOFOOD is not only an exhibition — it’s also a community where actors along the F&B value chain meet and share information. Between exhibitions, we have a rich program of webinars and events in Italy and abroad, ranging from networking opportunities on destination markets (including the US), to workshops and conventions, often in collaboration with expert third parties. We issue a monthly online magazine that presents innovative trends, market analyses and exhibition news, and an Ambassador program featuring top international food influencers that helps us stay up-to-date with the latest consumer trends.

➤ FOR MORE INFORMATION, VISIT WWW.TUTTOFOOD.IT/EN/.

ADVERTORIAL

HEALTH & WELLNESS UNLEASHED

CONTINUED GROWTH IN PET OWNERSHIP IS PROVIDING NEW PRIVATE LABEL PRODUCT OPPORTUNITIES FOR RETAILERS

By Zachary Russell

By Zachary Russell

More Americans are owning pets than ever before.

According to the American Pet Products Association (APPA), the vast majority of U.S. households (70%) in 2022 owned at least one pet. This is an increase of three percentage points from 2019, when the first year of the COVID-19 pandemic a year later had a dramatic increase in pet ownership.

With more consumers owning a furry friend (or two, or three) comes increased opportunities for pet retailers to grow their private label portfolio and reach more pet parents. In the pet food sector, ADM, a manufacturer of animal nutritional ingredients, recently made note of five trends that are influencing pet health and wellness. Many of the trends show overlap between the needs of humans and their animals, including a focus on overall health, and the desire for premium, clean label nutrition offerings that offer preventative health benefits.

“As with human nutrition, ‘one-size-fits-all’ solutions may not be ideal for maintaining the lifelong wellness of every pet,” ADM said in its report. “The industry is shifting to a new approach, with a deeper understanding of how cats and dogs eat, sleep, play and behave throughout their lives. Unsurprisingly, human supplement trends tend to guide proactive solutions for pet well-being.”

As for what benefits consumers are looking for in their pet’s food and treat products, the list is long.

“Top concerns supported by pet supplements include anxiety and calming, mobility and joints, immune function, skin and coat, liver and kidney, and digestion,” said ADM. “Customized nutrition strategies that cater to an individual pet’s specific needs can enhance development and healthy aging.”

Pet product retailers are already taking notice of these trends. In 2022, Petco launched its WholeHearted Fresh Recipes brand of frozen nutrition for dogs, introducing

20 Store Brands ● January/February 2023 ● www.storebrands.com TRENDS

PET TRENDS

a private label competitor for name-brand premium dog foods such as Hill’s Pet Nutrition, Champion Pet Foods, JustFoodForDogs, The Honest Kitchen and more. Formulated in partnership with JustFoodForDogs, WholeHearted Fresh Recipes offers human-grade ingredients formulated under veterinary guidance to help support pets’ ideal weight, urinary and gut health, joint support, and skin and coat protection.

“Petco continues to invest in pet nutrition without artificial ingredients in direct response to strong growth in pet parent demand for high-quality, minimally processed pet food,” said Shari White, senior vice president of Merchandising for Food and Treats at Petco. “As we see the pet humanization and premiumization trends continue to grow, pet parents will increasingly seek out high-quality, fresh and human-grade food for their pets.”

E-commerce pet retailer Chewy’s premium pet food and treat brands have increased sales in the past year, as consumers are seeking more human-grade protein options for their dogs, similar to foods they would pick out for themselves at the grocery store. American Journey, one of the retailer’s private dog food brands, offers formulas derived from beef, chicken, duck, lamb, venison and salmon.

“Traditional proteins are the most sought after ingredient in dog food, which aligns with our protein-first commitment from our dog food brand, American Journey,” said Nate Deno, vice president of Merchandising and Private Brands at Chewy. “American Journey’s portfolio offers high-quality meals that offer complete and balanced nutrition.”

Additionally, Deno noted that Chewy’s proprietary dog food and treat brand Tylee’s has seen success in the past year, as the brand specializes in human-grade, whole food formulas packed with protein, antioxidant-rich fruits, veggies and “superfoods.”

“As consumers seek minimally processed, limited-ingredient diets, some of our best-selling products answering to

these desires are our single-ingredient and freeze-dried formulas like Tylee’s Chicken Jerky Dog Treats, Tylee’s Salmon Human-Grade Freeze Dried Dog Treats and Tylee’s FreezeDried Meals for Dogs,” he said.

The increased interest in health and wellness doesn’t stop at food and treats. Chewy has seen its Vibeful wellness brand of pet supplements take off as well, as more pet parents seek preventative wellness solutions for their pets, just as they have done for themselves since the onset of the COVID-19 pandemic.

“The Vibeful assortment helps pet parents establish effective wellness routines through products that support pets’ digestive development, hips and joints, skin and coats, urinary tracts, immune systems and anxiety,” said Deno. “As consumers become more conscientious about their pets’ health and take proactive and preventative actions, we’re glad our high-quality supplement options can be an integral part of their approach to health and wellness. A few of our most popular supplements are the 10in-1 multivitamin soft chews, mobility and joint chews, probiotic powder and wild Alaskan salmon oil.”

While the demand for these types of higher-quality dog and cat foods and supplements has risen, it hasn’t been without some bumps in the road. Like many other categories, supply chain woes, ingredient shortages and higher production costs due to inflation have impacted the pet food sector. Kurt McCracken, vice president of Business Planning & Category Development at Simmons Pet Foods, detailed the production challenges during Store Brands’ recent Trends in Pet Products webinar.

“Industry-wide in the last year or two, wet pet food was challenged around supply across the entire manufacturing base and dry [pet food] is going through probably what wet was going through in the past year or two,” said McCracken. “That’s one of the biggest challenges overall with the rise of ingredient costs: ‘what are substitutes,’

www.storebrands.com ● January/February 2023 ● Store Brands 21

Based on our own studies, customers tell us that post-COVID, they are more likely to take their pets with them on daily errands. To help make traveling near and far with pets easier, we’ll launch new items such as pet strollers, water bottles, travel bowls, food storage solutions, pet carriers and backpacks.

— Nate Deno, Chewy

Chewy’s Vibeful brand of pet supplements had a strong year in 2022, according to the company.

‘what do you have to change in the formulas’ when there’s potentially a shortage of ingredients.”

With more Americans welcoming pets into the family also comes an increased need for products in the non-food pet space. Outside of pet food, treats and supplements, 2022 was a big year for many pet retailers when it came to creating new private label pet apparel and accessory products.

Last spring, PetSmart expanded its Arcadia Trail brand to include more outdoor pet gear, such as a dog shade tent, an inflatable dog bed, an elevated cot, a sleeping bag, a high-visibility life jacket, water-friendly dog toys and more. Just prior, Petco and online outdoor retailer Backcountry released a collaborative set of outdoor products that included beds, collars, jackets, leashes and other items.

“Based on our own studies, customers tell us that postCOVID, they are more likely to take their pets with them on daily errands,” said Deno, describing what types of new products Chewy has in store for 2023. “To help make traveling near and far with pets easier, we’ll launch new items such as pet strollers, water bottles, travel bowls, food storage solutions, pet carriers and backpacks.”

Additionally, he noted that as pets age, their needs

evolve both in terms of nutrition and products used to help care for these pets. As a result, Deno said Chewy will be enhancing its line of supplies to help support pets as they mature, adding options such as pet stairs, orthopedic beds and car ramps to make it easier on our senior pets to remain happy and active.”

When it comes to creating new private label products, Petco says hearing directly from its shoppers is important, as trends continue to evolve with time. Listening to consumers seems to be paying off for the retailer. For Q3 of 2022, Petco’s comparable sales grew 4.1% year-overyear and 19.6% on a two-year basis, with no signs of pet growth slowing down.

“We also utilize our own pet parent community to get feedback on new ideas, concepts and products, as well as consult multiple insight and trend forecasting resources for not only pet trends but also human trends, knowing the two are interconnected,” said Jenn Kovacs, vice president of Merchandising for Dog and Cat Supplies at Petco. “We meticulously review and identify trends across color palettes, graphic direction, functionality, fabrications and styling to create a final product the customer is sure to love.”

PET TRENDS 22 Store Brands ● January/February 2023 ● www.storebrands.com

Petsmart’s Arcadia Trail brand offers an array of outdoor products as consumers look to travel with their pets more in the future.

FROZEN STAYS HOT

CONVENIENCE, HEALTHY EATING ARE KEY FACTORS DRIVING SALES ACROSS THE CATEGORY

By Zachary Russell

Frozen food is expected to keep growing over the next 12 months, a continuation of a trend that started during the pandemic as more consumers turned to the category for solutions to meet their daily meal needs.

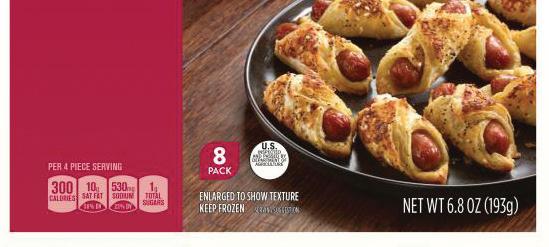

Products across the many segments that comprise frozen food are seeing sales gains for a variety of reasons. For some, shoppers looking to eat healthier are seeking frozen selections of fruits, vegetables and seafood. For others, convenience is key and items such as frozen pizza and meal solutions are also seeing a boost in sales.

According to a recent report from Bonafide Research, frozen fruits, vegetables, meats and frozen meals are expected to grow at a compound annual growth rate (CAGR) of 4.76%, with the category reaching a value of $296.55 billion by 2027. Bonafide Research cited decreased grocery visits, and thus a need for longer lasting food, at the beginning of the pandemic as a reason for many consumers’ switch to frozen foods. The category’s growth was later impacted by high prices in the produce aisle and fear of food shortages, causing consumers to stock up on their frozen favorites.

Frozen potatoes and meat & poultry make up roughly 55% of the frozen food market share, as customers search for hearty options in the frozen aisle, increasingly from private brands, as 2022 was a record year for store branded food and beverage items.

An up-and-coming segment of frozen, plant-based, is ex-

pected to register the fastest growth rate of around 11% during the forecast period, according to Bonafide Research.

“We expect continued growth [in 2023] in plant-based products and in consumers’ plant-forward diets,” said Julie Henderson, vice president of Communications at the National Frozen & Refrigerated Foods Association (NFRA), a trade group made up of retailers, suppliers, distributors and more who work in the frozen and refrigerated food categories. “Plant-based products don’t make up a large percentage of frozen department sales in most categories, but they are a driver of growth. Plant-based products showed up across the frozen food department,

www.storebrands.com ● January/February 2023 ● Store Brands 23

FOODS FROZEN FOODS

We are living in a culture where people are not eating the typical three meals a day, so snacks and meals may be interchangeable and many types of products can fit the small plate trend.

— Julie Henderson, National Frozen & Refrigerated Foods Association

even in indulgent categories like ice cream.”

Experts said plant-based products and better-for-you, clean label products are on the rise, along with frozen fruits and vegetables, showing that consumers are looking to the freezer aisle for healthy meals and cooking ingredients. According to IRI data, frozen fruit and vegetable sales for the 52-week period ended Jan. 1, 2023, were $7.6 billion, a 8.9% dollar sales increase compared to 2021. In the last quarter of 2022, dollar sales increased 15.6%.

“The ready meal and frozen vegetables segments are expected to see significant growth, and the retail and online distribution channels are expected to hold the largest share of the market,” research firm Astute Analytica noted in a recent frozen food report. “Companies operating in the frozen food industry in North America should focus on meeting the evolving needs of consumers and capitalizing on the growing trend of online grocery shopping to stay competitive.”

Astute Analytica also reported that sales of familiar frozen food segments such as pizza, appetizers and desserts are growing at a faster pace than the overall market, signaling the ongoing shift of consumers seeking convenient options in the category. Astute also found that the frozen food aisle is becoming increasingly competitive, with private label brands gaining share.

“We are living in a culture where people are not eating the typical three meals a day, so snacks and meals may be interchangeable and many types of products can fit the small plate trend,” said Henderson. “Particularly the breakfast category has seen manufacturers focus on portable and grab-and-go options.”

Inflation continues to impact the grocery sector despite some recent signs of cooling. According to IRI’s Inflation

FROZEN FOODS

Tracker, most food categories have remained within the same price range from November of last year to the first several weeks of January. With inflation remaining high, including in the freezer aisle, Henderson said that strong growth potential is expected to continue, giving retailers more of an opportunity to leverage their private brands.

“During inflationary times, we know eating away from home is curtailed,” she said. “This creates an opportunity to drive consumers to frozen.”

Examples of retailers adding new private label products to the freezer aisle in 2022 include United Natural Foods, Inc. (UNFI) expanding its Woodstock brand with six new organic pasta items, and Albertsons Companies relaunching its Waterfront Bistro line of frozen seafood.

In September of last year, two of the four winning companies in Wakefern’s Own Brands Supplier Innovation Summit offered products in the frozen category. GlutenLibre was founded by two bakers who met in manufacturing 15 years ago, and the company offers certified gluten-free and vegan plant-based frozen dumplings. It uses only allnatural ingredients with no artificial flavors or colors, preservatives, nitrates, hormones or antibiotics.

Another winner, The Perfect Bite Company, offers a “fresh take on frozen,” and has built its business by offering a foundation of foods including breakfast, single-serve meals, bowls and value-added vegetables and grains.

“Private brands have definitely benefited from the recent past and current environment,” said Henderson. “The combination of economic downturn, pandemic response and supply chain issues forced consumers to private brands. That experience created increased trust and quality perceptions for private brand products.”

24 Store Brands ● January/February 2023 ● www.storebrands.com

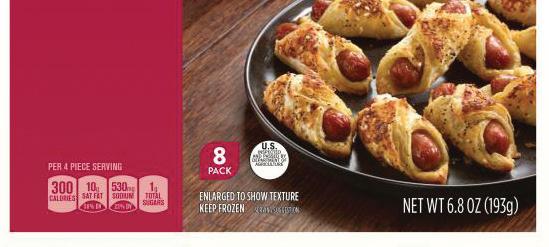

Shoppers are looking for more affordable snack solutions and ingredients in the frozen aisle, including private label appetizers (left) and fruit (below).

COMBATING FOOD WASTE WITH PRIVATE LABEL PRODUCTS

RETAILERS AND SUPPLIERS ARE FINDING WAYS TO REUSE FOOD THAT WOULD OTHERWISE END UP IN LANDFILLS

By Zachary Russell

By Zachary Russell

As retailers remain focused on sustainability, the topic of food waste is growing in the overall conversation, joining hot button topics including reducing carbon emissions, sustainable packaging and issues around how produce is grown and harvested.

According to numbers from Recycle Track Systems, about 30% of food in American grocery stores is thrown away, adding up to roughly 16 billion pounds of food waste every year. Food, including from grocery stores, restaurants and households, takes up more space in landfills than any other product.

At the intersection of curbing food waste and private label is Imperfect Foods. Founded in 2015, the online grocer works directly with farmers and producers to rescue and redistribute food, as well as develop private label goods across multiple grocery categories. Last September, Imperfect Foods was purchased by Misfits Market, another online grocer that recently launched its first private brand.

“Scale matters, especially in online grocery, so the increased scope of our combined organization and customer reach is a major benefit,” said Morgan Drummond, senior director of Private Label at Misfits Market. “As we integrate

operationally, our purchasing power and customer reach will grow, unlocking efficiencies in how we do business and how much more food we can rescue from lesser outcomes with a broader customer base.”

The process of diverting food waste, known as ‘upcycling’, has a large potential to change the game when it comes to sustainability. The Upcycled Food Association works with retailers, including Imperfect Foods and Misfits Market, and connects them with ingredient suppliers to create Upcycled Certified products. According to information from SPINS, a data organization focused on natural and organic products, the group’s certified products are gaining attention from consumers. Upcycled Certified product sales increased 21% year-over-year in 2022, outpacing other better-for-you and sustainable categories such as non-GMO, certified organic and plant-based.

“While the majority of food waste happens in the home – nearly 40% – an additional 35% of food waste happens on the farm and during the manufacturing process,” said Angie Crone, CEO of the Upcycled Food Association. “This is where upcycling and the Upcycled Certified program can have an incredible impact as innovative businesses are learning to take imperfect produce or manufacturing byproducts

www.storebrands.com ● January/February 2023 ● Store Brands 25

SUSTAINABILITY

that are nutritious and meet all the food safety standards, and upcycle them into creative, delicious foods for consumers. Examples include discarded cacao fruit, spent brewer’s grain, imperfect or slightly bruised produce that don’t meet rigorous retail specifications. The list goes on and on.”

Imperfect Foods’ and Misfits Market’s private label items include many canned goods and bagged snack items, showcasing how upcycled foods can be turned into unique products that consumers love.

“One of our most successful private label products is our Odds & Ends Organic Pumpkin Purée,” said Drummond. “Our supplier partner had an excess amount of purée from the recent harvest where the brix (sugar) content exceeded their specification for their own brand as well as other customers. While a bit sweeter than most canned pumpkin, it makes an even more delicious pie or pumpkin bread, and it is a fantastic value to our customers.”

Drummond added that she is also excited about the Imperfect Foods White Jasmine Rice, which will launch in the coming weeks. This U.S.-grown rice is sourced to rescue broken kernels, above the 4% tolerance typically allowed.

“Our ‘barely broken’ rice cooks the same as regular rice and has the same great taste we all love,” she said.

Drummond said that when it comes to creating new products, working closely with suppliers is paramount, as supply partners provide the raw ingredients that would otherwise be going to waste. According to the U.S. Department of Agriculture, the portion of the U.S. food supply that ends up being wasted is estimated at between 30% and 40%.

“As someone that focuses on product development across numerous categories, I can tell you that another challenge is just knowing where to start and what production streams result in various rescue opportunities,” said Drummond. “That drives me to lean on my supplier partners as subject matter experts – to educate me on where inefficiencies might exist – so I can act as a creative thought partner. Together, we find win-win solutions that expand our mission-driven assortment while providing another potential revenue stream to them.”

Kerry, a manufacturer of taste and nutrition ingredients for food and beverage products, is one supplier that has started to dabble in upcycling. The company’s powdered cheese of-

ferings are made by repurposing cheese scraps in the production process, which avoids additional cheese production, saving further energy and emissions. Kerry said that 10,000 kilograms (22,046.23 pounds) of its upcycled cheese powder helps avoid 11,856 kilograms (26,138 pounds) of cheese waste and 55,586 kilograms (122,546.15 pounds) of CO2e. This waste diversion is the equivalent to 312 wheels of parmesan cheese.

“At Kerry, due to our novel sourcing model, scientific skill set and technical capabilities, we are uniquely positioned to upcycle this cheese into delicious, high-quality and shelf-stable cheese powders that deliver an authentic cheese taste,” said Carmel Collins, global portfolio director of Dairy Taste for Kerry in an announcement of the powdered cheese’s sustainability impact last November. “By doing this, we are maximizing the potential of the food source and the resource it takes to manufacture the cheese in the first place, whilst simultaneously minimizing food waste.”

The company also recently announced its sponsorship of The Kerry Upcycled Food Foundation Fellowship in partnership with the association’s Upcycled Food Foundation nonprofit. The fellowship aims to educate consumers about the environmental and social benefits of upcycled foods.

Shortly after the acquisition of Imperfect Food, Misfits Market announced a food product development challenge with the Upcycled Food Association to continue its efforts of diverting food from landfills and into private label products. Food entrepreneurs sent the retailer products that repurpose excess food or waste, and finalists will pitch their creations to a panel of judges at the upcoming Natural Products Expo West convention in March.

While food waste will likely remain a problem for the foreseeable future, upcycling is beginning to play a major role in the future of sustainability, with plenty of opportunities emerging in the world of private label.

“In 2023 we are doubling down on building consumer awareness and demand for Upcycled Certified products,” said Crone. “New products are entering the space at a feverish pace. We are focused on ensuring the public is aware of Upcycled Certified, and how supporting businesses that produce these products can empower consumers to reduce food waste and enjoy nutritious, delicious products.”

SUSTAINABILITY 26 Store Brands ● January/February 2023 ● www.storebrands.com

Imperfect Foods’ seasonal private label items

As we integrate operationally, our purchasing power and customer reach will grow, unlocking efficiencies in how we do business and how much more food we can rescue from lesser outcomes with a broader customer base.

— Morgan Drummond, Misfits Market

INSIDE RETAIL State of the Industry Quarterly Report

What key trends and developments shaped the retail industry in Q4 2022? Between announced mergers, macroeconomic headwinds, consumer behavior changes and more, the last quarter of this year echoed the volatility seen across 2022. Uncover the top insights, developments and retail performances that emerged in Q4 and receive an overview of the state of the retail industry during the critical holiday shopping season from Elizabeth Lafontaine,

chief retail analyst at Retail Leader Pro

.

KEY TAKEAWAYS

Consumers are focused on mission-driven shopping behaviors, allowing them to mix and match purchases at different chains to satisfy their needs.

TikTok’s new foray into e-commerce and shopping should certainly present some opportunities for grocery, CPG and general merchandise brands. Do not shy away from investments even during what will be a challenging retail year, because the consumer still holds high expectations. The holiday season may have been elongated a bit too far this year; need to be cautious of the impact on consumer spending and attention span.

From a strategic perspective, now is the time to understand what matters most to your core customer and how to build technologies and strategies that speak to that need.

Elizabeth Lafontaine Chief Retail Analyst Retail Leader Pro

Elizabeth Lafontaine Chief Retail Analyst Retail Leader Pro

Visit RetailLeader.com/pro to start your 14-day, risk-free trial today and read the full report

Seneca, we're still

things the way we always have - the right way.

grow

our

by

FARMERS

Please visit www.SenecaFoods.com to learn more about our company, people and products.

At

doing

Think globally,

locally. of

produce is grown

AMERICAN

99%

By Zachary Russell

By Zachary Russell

By Zachary Russell

By Zachary Russell

Elizabeth Lafontaine Chief Retail Analyst Retail Leader Pro

Elizabeth Lafontaine Chief Retail Analyst Retail Leader Pro