Unlock the intelligence inside your refrigeration systems & cases for greater savings

• Continuous, real-time insights address problems faster

• Minimize downtime and reduce emergency and overtime calls

• Automatic leak detection to limit impact and comply with regulations

• Optimize service spend to maximize equipment health and performance

• Actionable data to save retailers money and extend equipment life

BIG IMPACT

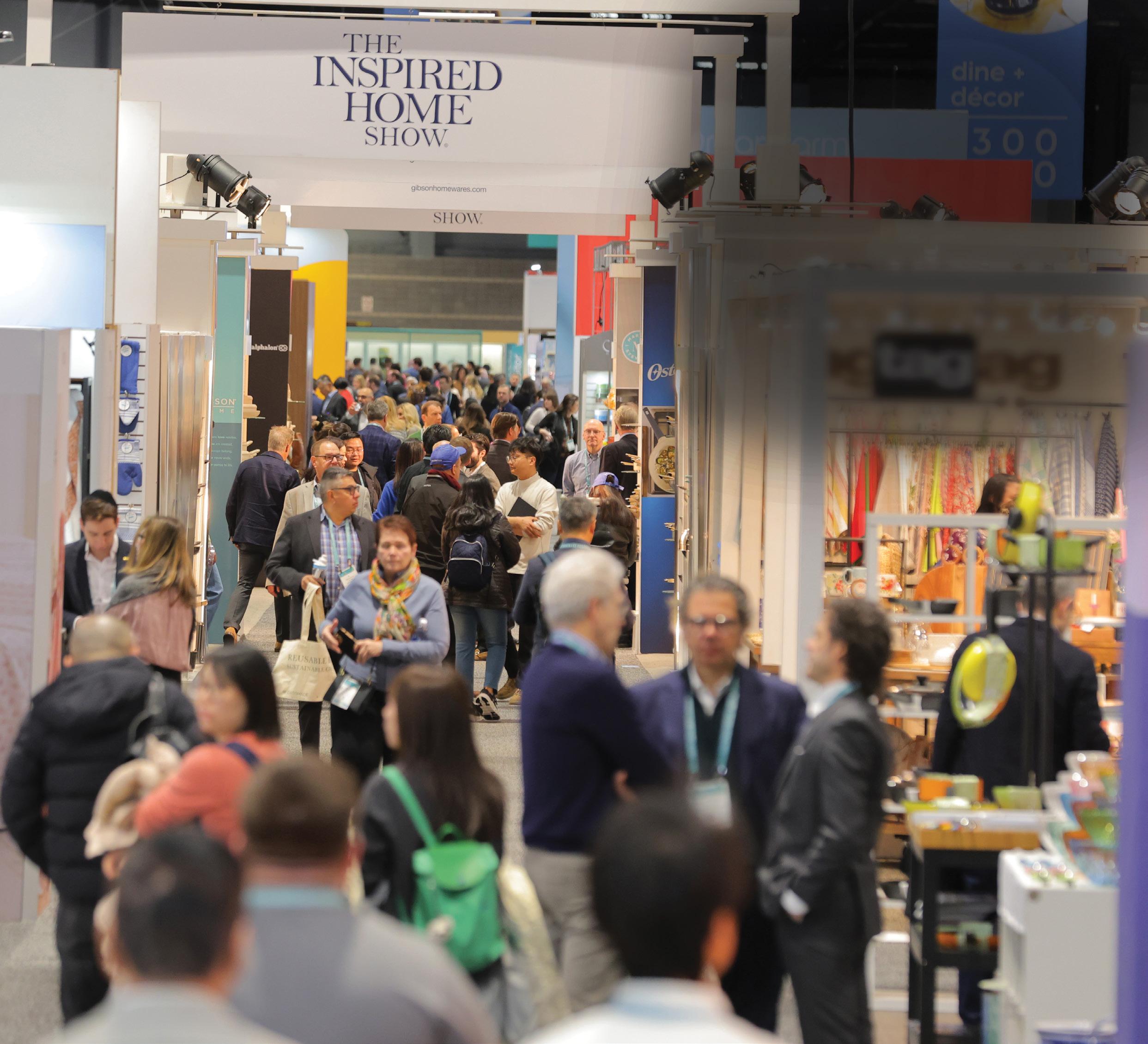

Award honorees excel at ESG

PROTEIN PRICES

How beef and pork are faring with consumers

FEEL THE CHILL

Frozen seafood offers novelty, convenience

64 FEATURE Decoding 2026 Grocery Trends

According to Whole Foods Market, fiber is the new protein, while tallow is taking over.

66 TECHNOLOGY How Intelligent Retail Will Reshape the In-Store Experience for Shoppers and Associates

Diebold Nixdorf is employing AI-powered technologies to transform the grocery store.

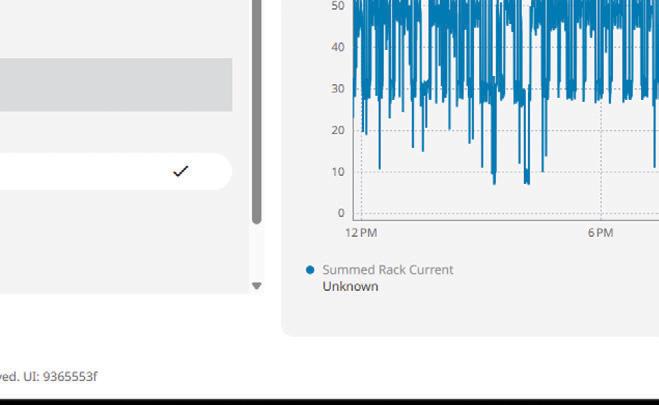

68 EQUIPMENT & DESIGN Predictively Intelligent Grocery Refrigeration

Connected solutions and real-time insights are reducing costs, preventing downtime and transforming operations.

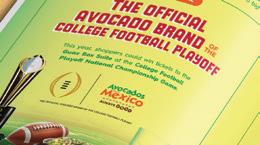

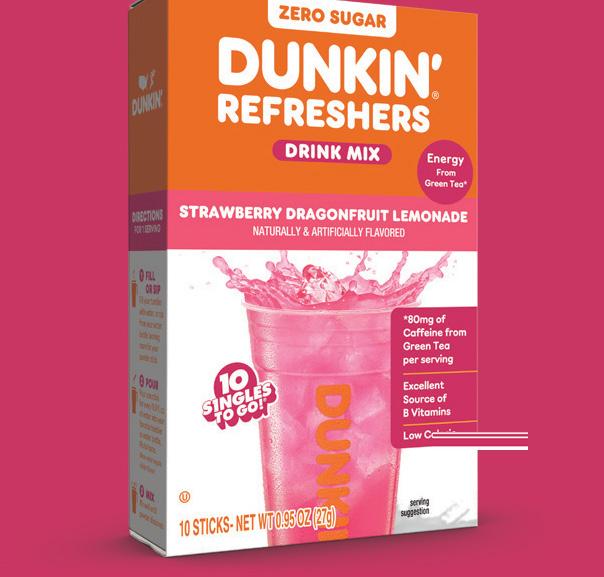

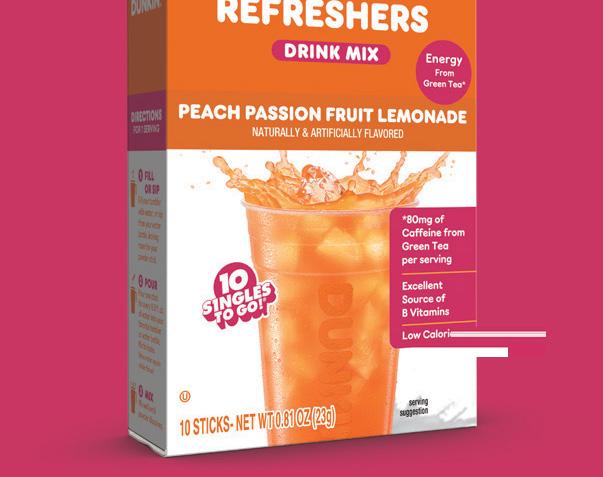

70 FEATURE How Co-Marketing Fuels Shopper Discovery and Loyalty

Recent collaborations have generated buzz and grabbed attention at retail.

BRAND MANAGEMENT

SENIOR VICE PRESIDENT, GROUP BRAND DIRECTOR Eric Savitch esavitch@ensembleiq.com

EDITORIAL

EDITORIAL DIRECTOR & ASSOCIATE PUBLISHER Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS

Jim Dudlicek, Mike Duff, Debby Garbato, Jenny McTaggart and Barbara Sax

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER Tammy Rokowski (INTERNATIONAL, SOUTHWEST, MI) 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALES MANAGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Johanna Lupardus (CT, DE, MA, ME, RI, SC, TN, NH, VT, MD, VA, KY) 330-990-4635 jlupardus@ensembleiq.com

PROJECT MANAGEMENT/PRODUCTION/ART

PRINT DESIGNER Catalina Carrasco cgonzalezcarrasco@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Maria del Mar Rubio mrubio@ensembleiq.com

SENIOR DIRECTOR OF MARKETING Nicola Tidbury ntidbury@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Single copy price $18.20, except selected special issues. Foreign single copy price $21.80, except selected special issues. Subscription: $134 a year; $246 for a two year supscription; Canada/Mexico $182 for a one year supscription; $249.90 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $182 a one year supscription; $249.90 for a two year supscription (call for air mail rates). Digital Subscription: $78 one year supscription; $144 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing of ces. Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Copyright ©2024 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Micro lms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

By Gina Acosta

If you hang around grocery leaders long enough, you learn that nothing stays still for very long. Stores evolve. Shoppers evolve. Technology evolves. And if we’re lucky, we evolve, too. This month, as we close our nal Progressive Grocer issue of the year, I’m sharing something personal: After the highlight of my professional life serving as an editor at Progressive Grocer, I’ve made the decision to turn the page.

Writing this column is HARD. Not because I’m unsure of the decision, but because of what Progressive Grocer represents — not just to the industry, but to me. PG isn’t a publication. It’s a living, breathing community shaped by people who care deeply about feeding families, serving neighborhoods, growing brands and strengthening the backbone of our economy. To have been trusted as one of its storytellers has been the honor of my career so far.

When I joined PG, I never imagined how profoundly this work would shape my life. Grocery retail is an industry built on relationships — real ones — and I got a front-row seat to the passion, resilience and leadership that drive it forward. I think of the late-night interviews squeezed in between ights, the store tours where executives proudly showed us the innovations hidden in their backrooms, the conversations that sparked new ideas, and the retailers who spoke with such clarity about purpose that it stayed with me long after the story went to print.

Over the years, I’ve had the privilege of covering some of the most pivotal shifts in grocery: the rise of AI and data automation, the reimagining of store formats, the renaissance of private brands, the surge in digital commerce, and the ongoing reinvention of fresh food and foodservice. What I will remember most, though, is not the trends but the people behind them. The leaders who gave us un ltered insights. The associates who shared their pride in what they do. The innovators who reminded us that bold ideas start small. The entrepreneurs who poured everything they had into serving a single community better than the day before.

I want to express my deepest gratitude to the PG editorial team of Bridget Goldschmidt, Emily Crowe, Marian Zboraj and Samantha Schober. Their intelligence, grit, empathy and commitment to excellence are the fuel behind every issue, every newsletter, every live event and every award-winning piece of journalism. They have taught me more than they know. Working alongside them has been one of the greatest joys of my professional life.

To our sales and production teams: Thank you for being our partners in every sense of the word. You elevate our work, bring it to audiences far and wide, and tirelessly ensure that what we build is both meaningful and sustainable. Your belief in PG’s mission is a force.

To the industry: Thank you for opening your doors, your of ces, your minds and your hearts to us. Thank you for trusting us with your stories — stories of transformation, challenge, innovation and humanity. Thank you for treating us not just as reporters, but also as collaborators in your growth. That generosity is not something I take lightly.

And nally, to our readers: You are the reason that this brand has endured for more than a century. You show up — day after day — to do the essential work that keeps the world fed. Your passion is what inspires ours. You have my respect and my gratitude, always.

As for what’s next, I’ll simply say: I am excited. The work of storytelling, convening and lifting up the grocery industry remains in my blood, and I will continue championing the people and ideas that move this essential community forward.

Gina Acosta Editorial Director and Associate Publisher gacosta@ensembleiq.com

National Fiber Focus Month

National Hot Tea Month

National Meat Month

National Menudo Month

National Oatmeal Month

National Slow Cooking Month

National Soup Month

1

New Year’s Day

Global Family Day

4

National Trivia Day. Run an online contest on littleknown supermarket facts, with a gift card as the grand prize.

5

Today would have been the 80th birthday of beloved actress Diane Keaton, so highlight her favorite healthy snacks of microwave popcorn, raisins and nuts.

11 International Thank-You Day. Now is the time to express gratitude to the associates and customers who make your business what it is.

12

Stick to Your New Year’s Resolution Day. C’mon, you can do it!

6

Dry Bean Day. Offer a range of recipes using this highprotein, high- ber pantry staple.

13

Korean American Day. Pay tribute to this vibrant culture in the United States by spotlighting the cuisine of its ancestral country.

7

I Am a Mentor Day. Use the occasion to offer career advice to a co-worker.

14

Organize Your Home Day. Help customers get their houses in order with tips on storing food and other items.

8 National Bubble Bath Day. Urge customers to treat themselves with a long soak in the tub.

15

Women’s Healthy Weight Day. Have your retail dietitian help female shoppers stick to realistic wellness goals.

2

World Introvert Day. Show some understanding for your more reserved colleagues and customers.

9

National Apricot Day. These small, orange-yellow stone fruits are related to peaches.

16

Prohibition Remembrance Day. Raise a glass to mark this occasion, but please drink responsibly.

3

Drinking Straw Day. We fondly remember sipping chocolate milk through our reusable crazy loop straw during childhood.

10

National Cut Your Energy Costs Day. Look for ways you can slash expenses in this area throughout your store(s).

17

National Hot Heads Chili Day. For some folks, there’s no such thing as too spicy.

18

Winnie the Pooh Day. This silly old bear is a big fan of “hunny.”

25

19

World Quark Day. Familiarize shoppers with this fresh, soft, unripened cheese popular in Central and Northern Europe. 20

National Florida Day. The Sunshine State is known for more than just oranges. 26

National Spouse Day. How about a couple’s trip to the supermarket?

National Coffee Break Day. Suggest some elevated brews and accompanying snacks to make this eating occasion memorable.

27

To mark Mozart’s birthday – he was born on this date in 1756 – enliven the aisles with his immortal music.

21

International Sweatpants Day. We guarantee that many of your customers will be celebrating by wearing their favorite comfy pair.

22

Come in From the Cold Day. Entice chilly shoppers with plenty of hot foods and beverages.

28

Global Community Engagement Day. Make it a priority to engage with the neighborhoods that your store(s) serve.

29

National Carnation Day. Nothing perks up a lapel more than this ubiquitous bloom.

23

National Pedro Day. Not just Mr. Pascal, but everyone with the same rst name.

24

National Compliment Day. Don’t say it if you don’t mean it, though.

30

National Croissant Day. Provide a range of these delectably aky baked goods in your bakery department.

31

Scotch Tape Day. This ubiquitous product has been around since 1930.

1

Pork Rind

Appreciation Day. This underrated snack deserves a little more love.

8

Autism Sunday. Introduce quiet hours in your store(s) for those with sensory processing dif culties.

2

Crepe Day. These fancy French pancakes can be enjoyed any time of day.

African American Heritage Month

Barley Month

Canned Food Month

Celebration of Chocolate Month

Great American Pie Month

National Cherry Month

National Heart Healthy Month

National Hot Breakfast Month

15

National Flag of Canada Day. Salute our neighbors to the north, as well as one of their most iconic symbols.

3

For those who weren’t around in 1959 or never heard Don McLean’s “American Pie,” this is The Day the Music Died.

9

Oatmeal Monday. This warm, lling breakfast is a great way to start the morning.

16

National Almond Day. This storied nut is everything it’s cracked up to be.

10

World Pulses Day. Help shoppers understand the importance of dried edible seeds of legumes for sustainable agriculture, food security and human health.

4

Medjool Date Day. Encourage shoppers to reach for this sweet fruit as an alternative to candy.

11

For Be Electri c Day, tout the charging stations in your parking lot(s) for electric vehicles.

5

International Clash Day celebrates the legendary British punk band who, lest we forget, once got “Lost in the Supermarket.”

6

National Chopsticks Day. This is a great opportunity to recommend an easy stir-fry recipe for dinner.

12

17

National Cabbage Day. This often overlooked vegetable is packed with vitamin C, ber and vitamin K.

18

This is the rst day of fasting of the Moslem observance Ramadan, which runs through March 19.

Fat Thursday. On this Thursday before Lent, Polish people typically celebrate with paczki (deepfried doughnuts lled with cream or fruit preserves).

19

U.S. Coast Guard Reserve Birthday. Let’s hear it for this military branch, which was established back in 1941.

22

National Cook a Sweet Potato Day. Customers will be glad they did.

7

Rose Day. Tell shoppers to stop by the oral department for a single perfect specimen to present to someone special.

13

National Cheddar Day. Mark this observance with a range of recipes incorporating America’s favorite cheese.

14

Valentine’s Day. Remind shoppers that this occasion isn’t just for signi cant others, since love comes in many forms.

23

National Play Tennis Day. Make sure those on their way to partake in the sport of kings are amply hydrated and fed.

24 National Steakburger Day. For when a hamburger isn’t enough.

25

Inconvenience Yourself Day. This is a chance to shift the focus from your own concerns to those of others.

26

Thermos Bottle Day. This vacuum ask has been keeping hot things hot and cold things cold since 1892.

20

National Love Your Pet Day. We know how we feel about ours.

21

National Grain Free Day. For carb counters and others, highlight all of your offerings that t this description.

27

For Retro Day, try rolling back prices for some of the oldest brands you carry.

28

National Tooth Fairy Day is an appropriate occasion to highlight kids’ oral health.

By Diane Quagliani, MBA, RDN, LDN

Americans are encouraged to eat seafood for better health, but few of us are eating enough to bene t.

The 2020 – 2025 Dietary Guidelines for Americans recommend that adults consume about 8 ounces — or two servings — of seafood weekly, but almost 90% of us don’t meet this recommendation.

Eating seafood, including sh and shell sh, is linked to many health bene ts, in large part due to EPA and DHA — types of omega-3 fatty acids that are especially plentiful in “oily” seafood like salmon, sardines and mackerel. Potential bene ts from eating seafood include lower risk of heart disease and certain cancers, as well as better pregnancy outcomes, brain health and eye health. Because seafood is generally high in unsaturated fat, it promotes heart health when replacing cuts of meat high in saturated fat.

Seafood also offers a nutrient package of high-quality protein, and a variety of vitamins and minerals. Canned sh that contains bones (e.g., sardines and salmon) provides calcium.

Potential benefits from eating seafood include lower risk of heart disease and certain cancers, as well as better pregnancy outcomes, brain health and eye health.

Some pregnant women might avoid seafood because of worries about mercury content. It’s true that high exposure to mercury over time can harm the brain and nervous system — a particular concern in the case of a developing baby.

However, the Dietary Guidelines recommend that pregnant or breastfeeding women consume 8 to 12 ounces (two to three servings) per week of lower-mercury seafood, because the omega-3 fatty acids plentiful in many varieties help promote cognitive development in young children.

A few examples of lower-mercury seafood are salmon, sardines, cod, freshwater trout, tilapia, shrimp and crab. Pregnant women should avoid seafood with high mercury content, such as shark, sword sh, king mackerel and orange roughy.

Pregnant women, as well as older people, young children and people with weakened immune systems, should avoid raw sh and shell sh such as sushi, oysters, clams, scallops and mussels; partially cooked seafood such as shrimp and crab; and refrigerated smoked seafood.

Your retail dietitians can advise shoppers on the types and amounts of seafood that are best for them.

Some shoppers lack the con dence to prepare seafood at home — especially the pricier fresh varieties. Retailers can net more sales by offering how-to resources to help them get great results at home. Provide easy and appealing recipes at the fresh seafood case, on your website and during cooking demos. Include tips about the avor pro le of different types of seafood, and recommend cooking methods and complementary side dishes to round out meals.

For budget-conscious shoppers, feature promotions that encourage stocking up on economical frozen and canned seafood, along with accompanying recipes. At the fresh seafood case, point out less-expensive options and provide safe storage tips to help avoid spoilage and waste.

Advise seafood shoppers on safe cooking as well. Cook sh to 145°F or until it is opaque and akes easily with a fork. When cooking live mussels, clams or oysters, discard any shells that don’t open during cooking.

Diane Quagliani, MBA, RDN, LDN, specializes in nutrition communications for consumer and health professional audiences. She has assisted national retailers and CPGs with nutrition strategy, web content development, trade show exhibiting, and the creation and implementation of shelf tag programs.

Consumers are increasingly seeking personalized VMS solutions, with 52% interested in AI-driven personalized vitamins. This demand for tailored products re ects a broader shift toward health span optimization over lifespan extension.

Transparency in ingredients and bene ts is a critical factor for consumers. Brands that clearly communicate the composition and expected outcomes of their products are more likely to build trust and loyalty, with 31% of consumers wanting more transparency.

Despite a projected 26% growth in retail sales by 2030, the VMS market faces challenges due to product saturation and differentiation. Brands must innovate and effectively communicate unique bene ts to maintain a competitive advantage.

In the current landscape, ingredient transparency stands out as a key driver of trust and purchase decisions. Consumers are demanding disclosure on sourcing, ingredients and clinical evidence supporting product bene ts.

As class actions and public scrutiny increase, regulatory authorities are expected to implement more rigorous oversight of VMS marketing claims, labeling and ingredient safety. The industry will see tighter enforcement in regard to evidence-based claims, allergen disclosures and substantiation of health outcomes.

Looking ahead, the VMS market is poised for a shift toward hyper-speci c products designed to optimize health span rather than simply extend lifespan. Advances in supplements tailored to biohacking goals such as supporting cognitive function, cellular repair and longevity at an individualized level will see growth.

Brands can leverage emerging AI to create highly personalized VMS solutions. Consumers are actively looking for products that align with their individual profiles, lifestyles and health objectives. AI VMS is a luxury accessible primarily to those with disposable income. Consequently, such technology could risk alienating lower-income consumers.

The VMS market is evolving, expanding beyond its traditional boundaries and gaining broader appeal. With this growth comes a clear need for products that go beyond the experience of simply swallowing pills. Consumers often stick to using no more than three products at a time, as juggling too many can lead to “pill fatigue.” To address this, consider formats that break away from routine and feel more engaging – such as functional foods and beverages that can seamlessly fit into daily habits.

Transparency and clean labeling aren’t just trends – they’re essential for consumer trust and market di erentiation. Companies that prioritize responsible sourcing and openly share their manufacturing processes demonstrate to consumers their commitment to safety and quality, which directly influences purchasing decisions.

With around 40% of consumers turning to social media for VMS information – and misinformation spreading rapidly through wellness influencers – it’s more important than ever for brands to provide reliable, unbiased information. Brands have a responsibility to counter fearmongering and serve as trusted sources of clarity and education. By strategically using social media, brands can combat misinformation, building trust with their consumers. This involves educating audiences, particularly those experimenting with new wellness routines, on what their products do, the purpose of each ingredient, and the realistic results they can expect.

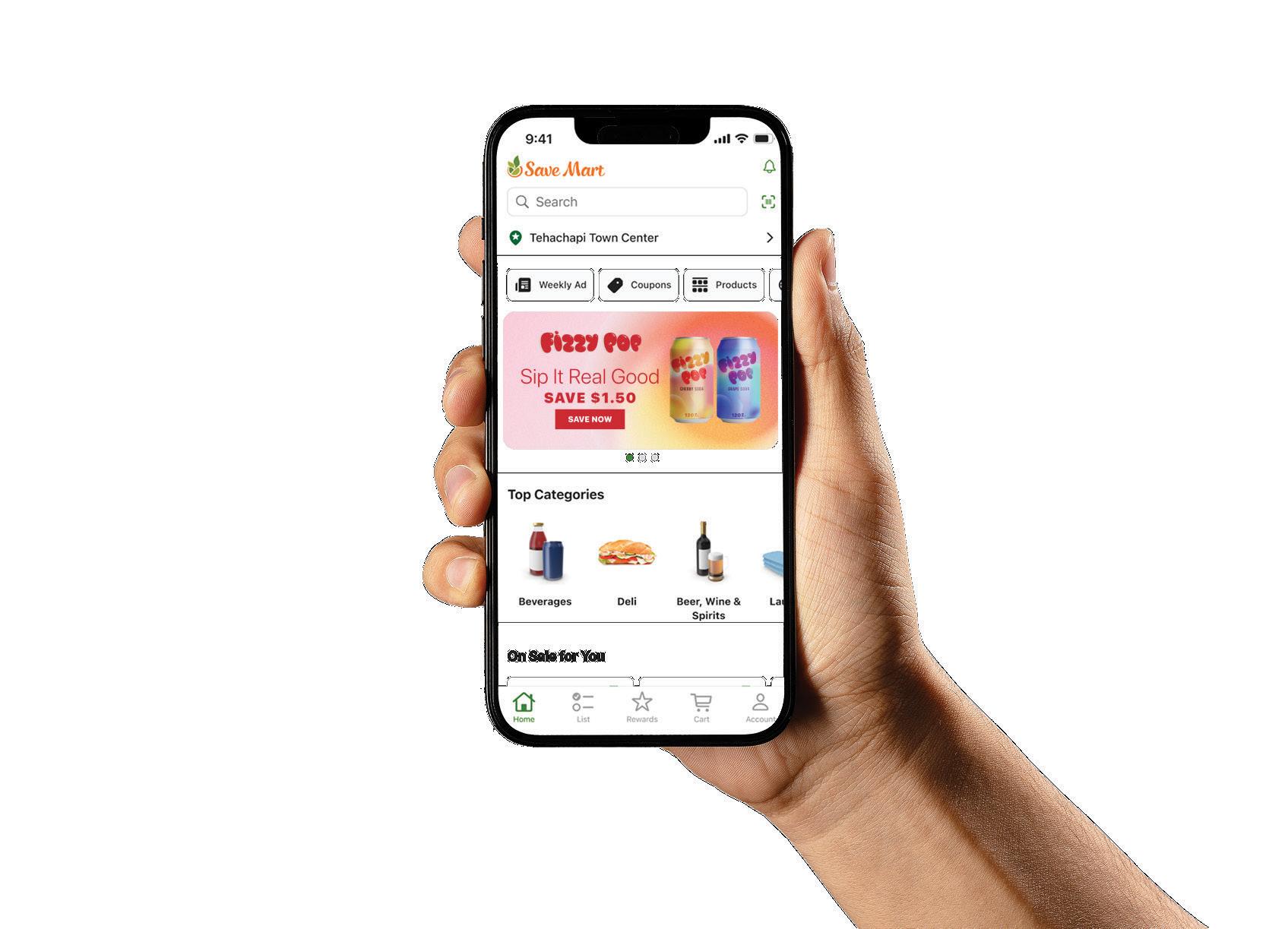

Omnichannel Engagement Delivers Measurable Growth

Results from TSMC’s unified app, loyalty, retail media and cashback programs

...We're not trying to compete with national chains on their terms—we're using digital tools to deepen the authentic connections that define us as a regional grocer.”

– Andy Comer, Vice President, Marketing at TSMC

Ready to embrace omnichannel? Contact Swi ly today.

WITH BOLD TRANSFORMATION, FIERCE COMMUNITY LOYALTY AND A PEOPLE-FIRST CULTURE, THE FOOD RETAILER REDEFINES WHAT A REGIONAL GROCER CAN BE.

By Gina Acosta

Awoman in the bakery at Lucky supermarket No. 759, in San Jose, Calif., has been working there for 47 years.

She smiles when she says this, as if the decades have passed in seasons rather than shifts. “I was 21 when I started here,” she says, brushing powdered sugar from her apron. “The day our dairy clerk was born? That was my fi rst day here. Every year, when he has a birthday, I have an anniversary.”

Nearby, a meat cutter with 40 years of service jokes that he “still has all 10 fi ngers, after all these years.”

At the front end, a cashier explains that she joined the company when she was “practically a kid,” and now works beside associates younger than her own children.

What stands out even more than the long tenure of the sta is how they speak.

They mention customers by name with the ease of recalling relatives.

They talk about neighborhoods the way others talk about family –birthdays remembered, graduations celebrated, grandparents’ routines observed over decades.

And when they talk about the company’s transformation – new leadership, new formats, new tools, new energy – something unmistakable fl ickers across their faces. Their pride is constant, but now it carries momentum.

During Progressive Grocer’s visit in August, the pace of evolution across The Save Mart Companies was undeniable. Associates shared stories of a company not simply changing, but also accelerating. What once took years now happens in months. Change there is not conceptual; it is visible in remodeled aisles, sharper assortments, improved execution and a companywide sense of forward motion.

President Jim Perkins captures it unequivocally: “We aren’t tweaking things,” he says. “We’re transforming everything. Price. Merchandising. Digital. Formats. Loyalty. Supply chain. Culture. Everything. And we’re doing it fast.”

This is not a comeback story. It is a rebirth.

“We aren’t tweaking things. We’re transforming everything. Price. Merchandising. Digital. Formats. Loyalty. Supply chain. Culture. Everything. And we’re doing it fast.”

—Jim Perkins, President, The Save Mart Companies

Based in Modesto, Calif., The Save Mart Companies (TSMC) has served Western communities for more than 70 years. Today, the company operates 200-plus stores on the West Coast, employs more than 11,000 associates and generates roughly $4 billion in annual revenue. In addition to Save Mart, Lucky and FoodMaxx, the company operates the Roth’s and Chuck’s banners in Oregon and Washington state.

In 2024, TSMC entered a new era under The Jim Pattison Group (JPG) – and under the leadership vision set by Shane Sampson, who joined the company as executive chairman in 2022 and became CEO when JPG acquired the business. Sampson laid the strategic foundation for modernization, growth and cultural transformation, and in 2024 he hired industry veteran Perkins as president to execute on that roadmap. Backed by JPG’s patient capital and long-term commitment, TSMC is now positioned for accelerated expansion and renewed operational excellence. Perkins leads this e ort with the clarity of a leader who understands both the intensity of competition and the strength of Save Mart’s roots. “We’re a regional

2024.

grocer surrounded by giants,” he says. “If we want to win, we have to be faster, more local, more innovative and more connected to our people than anyone else.”

California, Nevada, Oregon and Washington state are among the most competitive grocery markets in the country. Yet Perkins sees the landscape as an advantage. “We’re small enough to be nimble and big enough to matter,” he says. “That’s when transformation can actually take hold.”

Associates echo this view. “We used to make changes once or twice a year,” one Lucky department manager says. “Now it feels like every month something new is rolling out, and the pace is energizing.”

The impacts are visible store by store. Price investments have reshaped customer perception. Category resets in beverages, multicultural foods, natural snacks and fresh have modernized stores. Lighting, refrigeration and in-stock conditions have been upgraded. As one associate notes, “When the store feels crisp, customers trust you more.”

Leadership practices have also shifted. Perkins, Donovan Ford – the company’s COO – and the store operations team made more than 600 store visits last year. “We run the company from the floor of the stores,” Ford says. “That’s where reality is.”

Perkins’ motto – “test, measure, test again” – has become cultural infrastructure. Ideas move quickly from pilot to refi nement to scale. “We’re not afraid to try things,” Perkins says. “We’re not afraid to adjust. We’re not afraid to move.”

And with JPG behind it, TSMC now has the capital structure to support bolder moves in technology, formats, loyalty and supply chain – strengths that position the company for sustainable expansion.

Nowhere is the company’s transformation more visible than inside FoodMaxx, its high-velocity value banner.

A walk through a FoodMaxx in San Jose feels like stepping into a bustling international marketplace. Pallets tower overhead. Produce is vibrant and abundant. Forklifts hum in the background. Families push overflowing carts through extra-wide aisles built for stock-up trips. The energy is equal parts warehouse e ciency and neighborhood familiarity.

“We won’t be beat,” Store Director Alicia Hernandez asserts. “Customers know it. And they tell us.”

FoodMaxx succeeds not only through price, but also through cultural accuracy. Stores feature marinated carne asada prepared the way local families expect, Asian yogurts and ready-to-drink boba, and bulk rice, spices and sweet breads tailored to multigenerational households.

FoodMaxx VP of Operations Nick Chan explains, “We buy di erently, we price di erently, and most importantly, we listen di erently.”

Continued on page 18

A walk through a FoodMaxx in San Jose, Calif., is like stepping into a bustling international marketplace.

If FoodMaxx is velocity, Lucky is reinvention.

The Lucky + Ace Hardware co-location in San Jose is one of the region’s most innovative pairings. Customers can buy avocados and paint in one trip. “People pick up dinner ingredients and remember they need a propane tank,” Perkins says. “Now they can get both without making a second trip.”

Lucky also serves as TSMC’s digital launchpad. Flashfood, digital coupons, Amazon Returns, loyalty pilots, curbside pickup and digital signage all mostly begin at Save Mart before rolling out systemwide.

Chief Digital O cer Tamara Pattison frames the mission clearly: “Every innovation begins with a customer need. Our job is to build solutions that genuinely improve their shopping experience.”

Then there is Save Mart – the company’s most hospitality-forward banner.

Save Mart store No. 1, in Modesto, feels part grocery store, part café and part community hub. Customers drop o tri-tip to be grilled while they shop. The Tipping Point bar buzzes with regulars. A fresh-cut fruit station resembles a

chef’s prep table. Signature cakes draw customers across county lines.

“If it doesn’t serve the customer, we don’t keep it,” says Store Director Jerald Smith.

That spirit extends to Frankie’s Bottle Shop & Bar, a curated spirits retail and bar experience opening in South Lake Tahoe in 2026. “Frankie’s refl ects the next chapter of Save Mart’s evolution,” says VP of Marketing Andy Comer.

on page 20

To our associates who make it real, our customers who inspire us daily, our supplier partners who help us deliver, and our communities who've supported us for over 70 years—this honor belongs to you.

While format innovation shows where the company is headed, operations reveal how it’s getting there.

According to Ford, he leads with an unshakeable principle: “There are no registers in the o ce. Reality is in the aisles.” Ford and his team emphasize several additional operational priorities:

Operational Insight 1: Scheduling With Precision

Store teams have refi ned scheduling practices to match tra c patterns, ensuring better coverage during peak hours. Ford stresses that strong operations depend on “having the right people, in the right place, at the right time.”

Operational Insight 2: Front End Focus

Front end experience has become a top focus. Ford notes that the company has sharpened expectations regarding speed, courtesy and service consistency, ensuring that “every checkout feels intentional, not rushed.”

Operational Insight 3: Shrink Reduction Through Behavior, Not Just Tools TSMC is also attacking shrink through improved training and awareness. Rather than relying solely on technology, the company is emphasizing associate ownership. Ford points to improvements driven by “better habits, better eyes and better accountability.”

Operational Insight 4: Store Audits With a Coaching Mindset

During store walks, leaders focus on coaching, not correcting. Ford describes it as “teaching the ‘why,’ not just pointing out the ‘what.’” Associates say that this shift has made expectations clearer and feedback more constructive.

Operational Insight 5: Cross-Functional Speed

Ford and store operations leaders Daniel Moore, group VP of operations (Save Mart and Lucky), and Chan highlight the importance of cross-team coordination – merchandising, supply chain, digital and operations working in lockstep.

This has allowed changes to roll out faster and more consistently than in previous years.

The cumulative impact: cleaner stores, faster front ends, tighter operations, and team members who feel supported – not micromanaged –through change.

Transformation extends deep behind the scenes.

For instance, the new Symbotic automated warehouse system will reshape TSMC’s cost structure and replenishment speed. “It’s a massive leap forward,” Perkins says, “the kind that strengthens every banner.”

Category management has evolved dramatically. Teams are making sharper, data-driven decisions. Local suppliers have more access. Assortments are cleaner and more relevant. Departments that once shifted in predictable yearly cycles now move with modern agility.

Digital transformation continues to accelerate. Pattison’s team is rebuilding the Save Mart app, increasing personalization, strengthening Amazon and DoorDash integrations, and preparing for a major loyalty relaunch.

And through all of it, culture remains the company’s defi ning force.

“Every innovation begins with a customer need. Our job is to build solutions that genuinely improve their shopping experience.”

—Tamara Pattison, Chief Digital Of cer, The Save Mart Companies

Chief Human Resources O cer Joan DobiasDavis cites the statistic that communicates it best: More than 30% of associates have been with TSMC for 20 years or more. “You cannot replicate that,” she says. “You cannot train that. It is an emotional bond – to each other, to our customers, to our communities.”

And yet, some of the most powerful evidence of Save Mart’s transformation comes not from technology or formats, but from what happens outside the aisles – in the communities its stores call home.

Across banners, TSMC’s community presence extends far beyond the walls of the store – a reality that associates describe not as a program, but as a lived identity.

In San Francisco, Store Director Thomas Wilson embodies that commitment with a deep sense of service and connection to his neighborhood. As Wilson puts it plainly: “We want to be everyone’s neighbor. A real neighbor like the one that you have at home.”

For Wilson and his team, community connection is not a corporate initiative – it’s part of daily store leadership. “Store leadership isn’t just about operations,” he explains. “It’s about being an active neighbor. Our teams identify community needs fi rsthand and drive contribution decisions, because they live and work in the neighborhoods.”

That authenticity shows up in dozens of ways. For instance, every year on 9/11, Wilson’s store honors local fi rst responders with in-store celebrations and standing ovations. Customers join in spontaneously, buying gift cards for fi refighters and thanking them for their service. His team partners with schools on healthy-living programs like Bike & Roll to School Week, reads to students, supports veterans through Wreaths Across America, and even quietly helps elderly neighbors with yard cleanup. “That’s what it’s all about,” Wilson says. “We’re more than a grocery store at The Save Mart Companies.”

Associates say that these e orts thrive for one reason: Leadership empowers them to act. “When associates feel genuinely supported and empowered to serve their communities, customers feel the di erence,” Wilson notes, crediting leaders like Sampson, Perkins, Pattison and Comer for creating an environment where care becomes action.

One of the most powerful examples of that empowerment is Wilson’s annual partnership with the San Francisco

FROM STORE DIRECTOR EMPOWERMENT TO MULTI-GENERATIONAL COMMITMENT, A QUIET FORCE ACCELERATES SAVE MART’S EVOLUTION.

By Gina Acosta

Walk into any Save Mart, Lucky or FoodMaxx location, and the strongest throughline isn’t a department or display — it’s the people.

The way that associates talk about their work is personal, rooted in camaraderie, shared history and a sense of purpose that transcends the job description. Chief Human Resources Of cer Joan Dobias-Davis puts it simply: “Our associates are the heart of this company. Transformation doesn’t happen at headquarters. It happens in the aisles.”

One de ning characteristic of the Save Mart culture is its multi-generational workforce. At many stores, Gen Z cashiers work side by side with associates who have been with the company for decades — a blend that Dobias-Davis sees as an advantage rather than a challenge.

“It’s the multi-generational aspect of our workforce,” she says. “You see younger folks teaching more tenured associates about digital tools, and older associates teaching them service. It works both ways.”

That sense of shared purpose is reinforced by Save Mart’s emphasis on growth and internal promotion. Many store leaders began their careers in entry-level roles before nding long-term pathways within the organization.

“Whenever we can, we promote from within,” Dobias-Davis notes, pointing to skilled departments — from meat to foodservice — where mentorship and hands-on coaching help associates build lasting careers.

Store Director Jerald Smith, of Save Mart Store No. 1, in Modesto, Calif., echoes that sentiment, describing how his team members respond to leadership that invests in their development.

Leadership accessibility plays an important role in this cultural fabric. Store Director Thomas Wilson, of Lucky California Store No. 755, in San Francisco, frames his approach around what he calls the “three Es”: empathy, energy and empowerment.

“You lead by example,” he says, “and when associates feel genuinely supported, customers feel the difference.”

COO Donovan Ford reinforces that philosophy at scale. His operational approach favors transparency and coaching over criticism. “We teach the ‘why,’ not just the ‘what,’” Ford explains — a subtle shift that associates say has made expectations clearer, strengthened accountability and increased con dence across teams.

Longevity remains one of Save Mart’s greatest cultural markers. More than 30% of associates have been with the company for 20 years or more, a level of retention Dobias-Davis calls extraordinary. In stores, that tenure translates into deep relationships, continuity and a sense of belonging. “You can’t teach authenticity,” she says. “You can train someone on a register, but you can’t replicate genuine pride.”

As younger generations enter the workforce, Save Mart leaders see opportunity rather than friction. Gen Z associates, Dobias-Davis observes, are already helping customers navigate apps, loyalty programs and digital coupons. “They’re ahead of the rest of us,” she says with a laugh. “They’re adaptable and mission-driven — and that aligns perfectly with who we are.”

Across its banners, Save Mart is demonstrating that cultural strength doesn’t come from programs or slogans. It comes from people who show up every day with pride, curiosity, generosity and a commitment to taking care of one another — the quiet force propelling Save Mart’s transformation forward.

“Community engagement is core to our identity. … That’s not brand positioning. That’s who we are.”

—Andy Comer, VP of Marketing, The Save Mart Companies

Sheri s and You Foundation.

Each November, his store hosts a massive shopping spree for 275 families, including veterans, fi rst responders, teachers, and local residents in need. The event draws the mayor, the sheri and community leaders, but the emotional heart comes from the shoppers themselves, who often stop mid-trip to watch and

QUAD HELPS RETAILERS SUCH AS THE SAVE MART COMPANIES TURN EVERY SHOPPER JOURNEY INTO A MOMENT OF MEANING.

When Kevin Bridgewater, SVP of strategic retail solutions at Sussex, Wis.-based Quad, talks about loyalty, he doesn’t begin with apps, points or digital IDs. He begins with people – the way they move through a store, the way they pause at a display, the way they glance at their phones and then back at a shelf. For him, loyalty is not a program. It’s a language.

“The days of loyalty being a card swipe and a coupon are over,” Bridgewater asserts. “Today, loyalty is about connection, understanding when a shopper is ‘heads up’ and when they’re ‘heads down,’ and meeting them in both places.”

Bridgewater oversees teams that help major retailers translate data into design, two disciplines many enterprises treat separately but that he believes must function as one. When he describes Quad’s philosophy, his voice carries both the precision of a strategist and the conviction of a creative. “Data tells us who a shopper is,” he says. “Design tells them we understand them.”

That idea – that data and creativity can coexist in service of the customer – is at the center of Quad’s work with grocers across the country, including Progressive Grocer Retailer of the Year The Save Mart Companies (TSMC). With customers shopping in shorter bursts, visiting

cheer. “It is such a beautiful thing during the holidays,” Wilson observes. “The customers shopping that day are just blown away.”

Comer sums it up: “Community engagement is core to our identity. That’s who we are. That’s not brand positioning. That’s who we are.”

In a region crowded with large-scale competitors, Save Mart’s most powerful di erentiator may be the one that no one else can replicate: a culture of genuine service, lived every day by associates who know their communities – and are trusted to care for them.

stores more often and expecting relevance from the moment they walk in, Bridgewater sees a massive opportunity for retailers willing to rethink how they communicate.

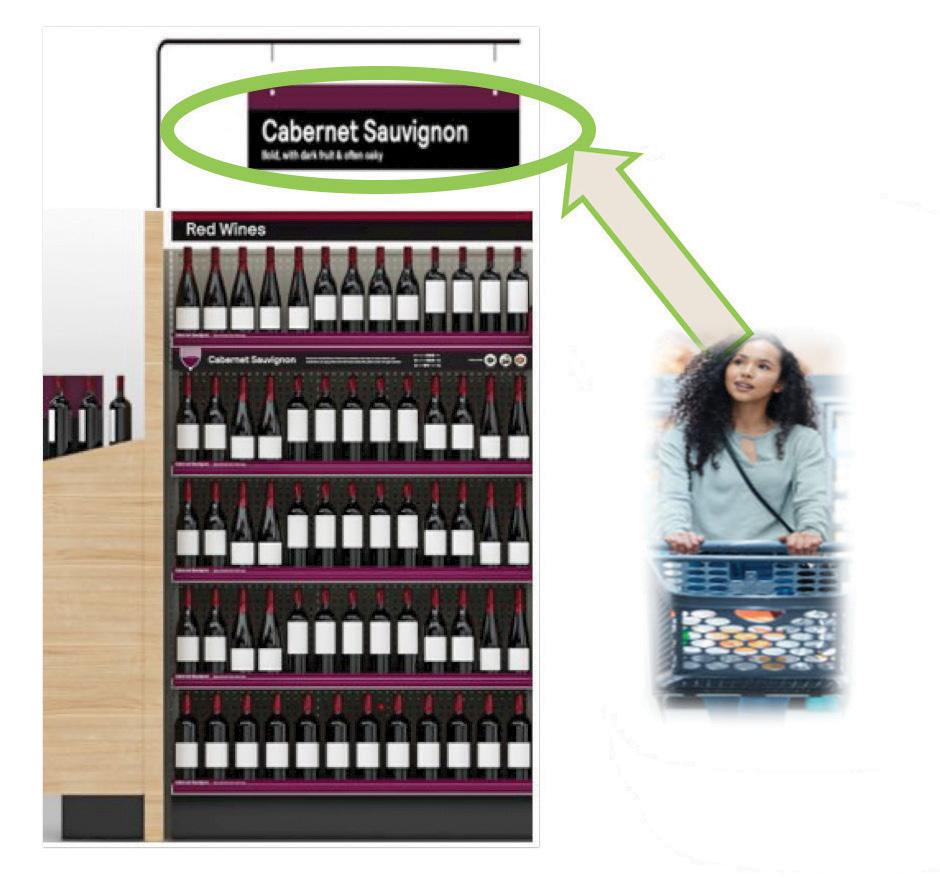

One of the biggest shifts, he says, is the rise of in-store retail media: digital screens, dynamic creative and targeted messaging that in uence shoppers at the exact moment of decision.

“It’s the most precise form of media there is,” Bridgewater explains. “A brand can put a message in front of a shopper right as they’re holding a product. That moment affects not just the purchase today, but the habits that shape their future trips.”

For regional grocers in particular, Bridgewater sees in-store media as a powerful equalizer. Large national chains may dominate off-site media with enormous audience pools, but regionals own something even more valuable: foot traf c.

“A retailer with 20 or 50 stores might not have a massive digital audience,” he says, “but they have real people walking their aisles every day. That’s in uence. That’s scale. And when you unify that through strong creative, you become incredibly compelling to brands.”

Bridgewater believes that creative is just as important as placement. Quad uses a number of testing tactics, such as eye tracking, to understand what captures consumer attention. Even the height of a QR code can affect engagement. “Good design isn’t about being clever,” Bridgewa-

ter notes. “It’s about being clear. It’s about guiding a shopper’s eye to the thing that matters.”

This design-led clarity becomes even more critical in high-velocity environments such as grocery, where shoppers are often juggling lists, budgets and time constraints. Bridgewater describes modern grocery shopping as “a rhythm” that retailers must respect. “People don’t shop the same way they did 10 years ago,” he observes. “The pandemic changed the cadence. There’s more frequent shopping, more demand for inspiration throughout the day. Retailers have to inspire without slowing people down.”

That balance, between inspiration and ef ciency, is where Quad sees retailers such as TSMC excelling. Save Mart’s willingness to activate new retail media strategies, personalize digital communications, and treat design as both art and utility has made it an ideal partner in Quad’s eyes. “Save Mart understands that a great customer experience isn’t one thing,” Bridgewater says. “It’s the store, the signage, the app, the offer, the tone – all of it working together.”

Looking ahead, Bridgewater believes that loyalty will continue to shift toward emotional trust, not transactional patterns. “You can have the lowest price and the most personalized offer,” he says, “but if the store experience isn’t strong, if the shopper doesn’t feel seen, everything else loses impact.”

For Bridgewater, the future belongs to retailers that see loyalty not as a program to manage but as a relationship to nurture. “When data and design move in sync,” he says, “you don’t just communicate with customers, you connect with them. That’s what builds loyalty that lasts.”

“Today, loyalty is about connection, understanding when a shopper is ‘heads up’ and when they’re ‘heads down,’ and meeting them in both places.”

—Kevin Bridgewater, SVP of Strategic Retail Solutions, Quad

This year’s Impact Awards honorees are being the change they wish to see in the world.

By PG Editorial Sta

Mahatma Gandhi, to whom the phrase in the deck is often attributed, had it right: The best way to effect change is to start with yourself, or, in the case of a business, your company. That’s just what our 49 2025 Impact Awards honorees have done, across the categories of community service/local impact, educational support/learning achievement, ethical sourcing/supply chain transparency, food security/nutritional leadership, philanthropic innovation/corporate giving, sustainability/resource conservation, and workforce development/employee support, with stellar results.

For example, as part of its aptly named Recipe for Change energy and emissions program, Albertsons Cos. is converting refrigeration systems to reduce climate impact while working to improve refrigerant leak rates, while Hy-Vee has introduced a series of new and enhanced nancial, lifestyle and health care employee bene ts, with the goal of promoting a culture of autonomy and ownership at every level and encouraging each employee to feel empowered to thrive. Other worthy environmental, social and governance (ESG) initiatives include ALDI’s Impact Grant Program to address children’s health and wellness and reduce food insecurity, Publix’s work to advance eco-friendly seafood practices, Dollar General’s expansion of fresh produce access, and Raley’s redirection of 17.5 million pounds of food from land lls through its food rescue programs. All of these endeavors, and the others detailed in the following pages, helped move the needle on some of the biggest ESG issues facing the retail industry, winning the spotlighted companies accolades for their conscientiousness from the business community and shoppers alike.

Then there’s the nancial case for being a change maker. As Sandy Douglas, CEO of Providence, R.I.-based United Natural Foods Inc. (UNFI) – which received two Impact Awards this year – recently told PG Editorial Director and Associate Publisher Gina Acosta during the publication’s Grocery Impact event in November: “We have a simple rule that sustainability of any kind, whether it involves our people or planet or really any agenda, is about two things. First, it’s good for the planet, our people, our communities, and second, it’s good for our business, so that we don’t do anything that is not good for our business. The fact that it’s the right thing to do has a one-plus-one-equals-three effect.”

Albertsons Cos., in partnership with the Albertsons Cos. Foundation, launched the Million Hour Volunteer Rally in September 2024 to help neighbors in need nationally. The retailer donated more than $600,000 worth of volunteer hours in support of food banks and pantries. Volunteers sorted and packed food, delivered meals, and assisted with administrative tasks to make a difference in the lives of people facing hunger. In addition, Albertsons Cos. invited customers, employees and partners to volunteer in the ght against hunger through its Nourishing Neighbors volunteer charitable efforts.

ALDI has advanced two major community initiatives: delivering care packages across the United States and launching the Impact Grant Program. In 2024, during a surge in natural disasters, ALDI worked with employees across its 26 operating regions to support Feeding America relief efforts. Hundreds of employees packed more than 29,000 shelf-stable and canned food care packages for Feeding America distribution. In addition, the ALDI Impact Grant Program launched to help nonpro ts encourage community change focused on improving children’s health and wellness and reducing food insecurity.

Equifruit, a 100% Fairtrade company, supports banana-growing communities by establishing digni ed supplier relationships, fairer pay and safer working conditions. Then, for each 40-pound case of bananas sold, Equifruit contributes a $1 Fairtrade premium. In a Fairtrade Premium impact example, at Hacienda Celia Maria, in Ecuador, the money funded covered seating at a local school, providing shade and protection for 211 students. To further the effects of its work, Equifruit helps retailers communicate Fairtrade’s positive community impacts through marketing, in-store support, digital campaigns and sustainability reporting.

Roots Market strives to be “a hub of humanity” in its Clarksville and Olney, Md., markets through such initiatives as a biannual Vegan Fest; food, toy and blood drives; a reusable-bag refund donation program; Teacher Tuesdays; and Senior Discount Days. The company regularly hosts food drives for healthful foods that are often not available in pantries. Further, the independent grocer recently launched a Little Free Library in both of its store locations to expand access to books in the communities that it serves.

To honor the Jasper Volunteer Fire Brigade, which worked under extreme conditions to protect the community when wild res broke out near Jasper, Alberta, Freson Bros. launched a high-visibility in-store fundraising campaign with signage and donation cards in every location and matched customer donations for a total of CAD $149,275 donated to the brigade. The campaign adhered to Freson Bros.’ proven playbook for activating store-level fundraising quickly and effectively and strengthened ties with local communities and emergency services, opening the door for future collaboration.

Since 2018, Kent’s Market has been making a difference for military families through Meals for Military events that the company hosts each year. Over the years the Utah-based independent grocery store chain has raised millions of dollars to supply groceries for military families. In 2025, Kent’s Market held its largest Meals for Military event to date, offering $800-plus in groceries and a home-cooked meal for each family, as well as providing meet-and-greet opportunities with local of cials and celebrities who thanked attendees for their service and sacri ce.

Having a “hospitality heart” is a core principle for Sendik’s, with family health and hunger relief being its two main pillars of support. The independent grocer supports these causes through its annual Charity Invitational Golf Tournament, which is centered on a different cause each year, including curing childhood cancer, as well as food bank and Feeding America support. Through a roundup campaign, the sale of children’s novelty items, a holiday food donation and tournament proceeds, Sendik’s raised nearly $200,000 in 2024 to help its neighbors in the greater Milwaukee area.

In 2024, Southeastern Grocers donated more than $4 million to local communities, focusing on disaster relief, food insecurity, health and well-being, and support for military families. SEG donated nearly $600,000 and essential supplies to the American Red Cross, as well as offering localized support following Hurricanes Helene and Milton. After Hurricane Helene, SEG launched a mobile pantry in Madeira Beach, Fla. SEG also partners with Feeding America, and it’s a proud supporter of military families through donations to Folds of Honor that provide educational scholarships to children and spouses of fallen and disabled service members.

Organic Hive’s Fair Trade IBD program ensures that a portion of all proceeds funds ecological and social projects for communities in northeast Brazil, where the Rice’s Honey brand’s beekeeper partners are located. Among the program’s initiatives are the renovation of a school garden and a plant nursery, which will provide hands-on agricultural education to students and supply them with fresh fruits and vegetables, and the renovation of the headquarters of the Association of Beekeepers of Moreilândia e Mata Grande. Future plans include the construction of mobile honey extraction units for the beekeepers.

Community support is important to Cub. The company rebuilt its North Minneapolis store in 2021, following the protests over George Floyd’s murder. That Minneapolis community, formerly a food desert, was able to maintain its access to healthy food. Then Cub designated 1,200 square feet of store space as the Northside Community Center @ CUB, hiring Lisa Clemons, founder of the Mother’s Love nonpro t, as space manager and creating a safe space for kids after school, a food packing and distribution location, a cultural event hub, and a training center.

To drive continuous learning and advancement, Giant Food implemented a suite of training programs designed to equip employees at all levels with the skills to succeed. New and revamped exempt manager training programs aim to increase retention rates, and new on-demand microlearning workshops expand engagement opportunities across store locations. These initiatives reinforce the Ahold Delhaize USA brand’s commitment to learning, growth and career progression through structured training and leadership development. Hundreds of associates and managers have already been successfully trained under the programs.

Fairtrade America has enhanced its programming to meet evolving coffee farmer needs worldwide. In 2021, the European Union revealed its new Deforestation Regulation, widely regarded not only as the strictest environmental supply chain standard around, but also as a step toward a climate-resilient future. Coffee farmers, many living in poverty, must develop new technical skills and resources to meet the standard. In response, Fairtrade has provided all 592 certi ed coffee-farming organizations access to deforestation risk monitoring, giving Fairtrade-certi ed coffee farmers the necessary tools to meet these deforestation standards.

SpartanNash’s Our Family Scholarship aims to uplift individuals who exemplify leadership, compassion and service, and provides meaningful support for educational advancement. The company considers the scholarship an investment in the long-term well-being of its customers, associates and communities. This year, 15 deserving students have each received a $5,000 scholarship – a grant open to both SpartanNash associates and shoppers who live in states served by SpartanNash through company-operated stores or independent grocer partners. To date, Our Family has awarded $230,000 under its scholarship program.

Over the past 14 years, Publix has donated more than $920,000 to the Sustainable Fisheries Partnership (SFP) in support of eco-friendly seafood practices. SFP’s initiatives reduce the environmental impacts of shing and sh farming, protect ocean biodiversity, and advance economic opportunities for shers and their communities worldwide. Publix also supports the CanFISH Gear Lending Program, which provides gear to help minimize impacts on ocean wildlife. Additionally, last year, the retailer funded a digital hub that helps educate commercial shers on best practices to reduce marine wildlife bycatch.

The Western Michigan University (WMU) Food Marketing program is designed to foster the next generation of food industry leadership while also providing the tools for experienced industry professionals and organizations to upskill for current industry needs. The curriculum is based upon the fundamentals of category management, with the addition of retail core knowledge, professional selling, supply chain management and a focus on analytics. WMU’s Food Marketing program was named one of the top CPG programs in the country by Progressive Grocer sister publication Consumer Goods Technology.

Last year, SunOpta launched a new initiative to digitally engage Tier 1 suppliers through a supply chain data platform, enhancing visibility and enabling SunOpta to identify and mitigate supply chain risks before they escalate, promoting accountability and continuous improvement. The company continues to pair third-party certi cations and audits — such as Organic, the Rainforest Alliance, the Gluten-Free Certi cation Organization and Non-GMO Project veri cation — with in-person supplier visits. This hands-on engagement enables a deeper understanding of supplier operations and helps build more ethical, transparent relationships across the value chain.

Family-owned U.S-based turkey producer Diestel Family Ranch is committed to ethical sourcing and supply chain transparency. To that end, Diestel last year became the rst turkey producer to achieve Regeni ed certi cation from a global leader in regenerative-agriculture veri cation. Regeni ed offers the rst third-party regenerative program recognized by USDA’s Food Safety and Inspection Services for both single and multi-ingredient products, with veri cation throughout the Diestel supply chain. To achieve certi cation, Diestel met Regeni ed’s rigorous 6-3-4 Standards covering soil health, adaptive stewardship and ecosystem processes.

All of Tonnino’s tuna is wild-caught using pole-and-line methods – in fact, it’s a member of the International Pole and Line Foundation. The company avoids sh-aggregating devices and follows Dolphin Safe practices to protect marine ecosystems and reduce bycatch. Its tuna undergoes mercury testing to ensure product purity and consumer safety. To give shoppers full visibility into what they’re buying, Tonnino introduced the Trace Your Tuna feature: With just a few clicks, customers can trace the origin of their tuna, including where it was caught and how it was sourced.

Through UNFI’s Climate Action Partnership initiative, the company fosters strong, transparent, mutually bene cial relationships with suppliers that align with its climate action strategy by providing resources and support to help suppliers measure, manage and minimize their climate impact. During Natural Products Expo West this past year, UNFI convened a collaborative, invite-only Climate Summit for 80-plus attendees from 50 key supplier and retailer partners. The company heard from many attendees that the energy of the conversations and the commitment to climate action were highlights of the event.

As food insecurity reaches high levels in Central Oregon, Rudy’s Markets is stepping up to help its neighbors. Two of its stores united shoppers and employees to raise more than $70,824 for the Food for February fundraiser this year alone. The fully employee-owned markets match these donations dollar for dollar. Newport Avenue Market and Oliver Lemon’s also have a partnership with local wholesalers to procure thousands of pounds of food at wholesale prices, including fresh produce and meat, that are tailored to the shopping lists of local food banks.

In June 2024, the Albertsons Cos. Foundation launched an effort to address childhood hunger during the summer, with the aim of helping schoolkids who rely on free or reduced-priced meals. The organization worked to support the U.S. Department of Agriculture’s Summer Electronic Bene t Transfer for Children Program, which provides grocery bene ts to low-income families with school-age children, reaching out to parents and caregivers online and in their communities. The Albertsons Cos. Foundation works with feeding programs to get the word out locally and boost participation in the program overall.

Giant Food’s corporate giving strategy unites nancial contributions, associate involvement and customer engagement to accomplish its goals. In 2024, Giant Food prioritized investing in causes that align deeply with the Ahold Delhaize USA brand’s values and purpose and allow it to make the greatest difference in its region and beyond. Giant’s contributions to the USO National Capital District and The Children’s Pediatric Cancer Foundation totaled nearly $2.5 million in 2024. Each year, the company participates in numerous volunteer events. In 2024 these events came to 1,490 total hours volunteered by its associates.

In 2021, Dollar General unveiled plans to provide its customers with better access to fresh produce. The planned initiative had, by January 2024, surpassed the milestone of offering fresh produce in 5,000 stores, more than any other U.S. mass retailer or grocer. By the fourth quarter of 2024, DG had expanded produce availability to more than 6,700 of its stores. In furthering produce and food-focused efforts, DG also became a myPlate partner, promoting USDA’s key healthy-eating initiative, as well as a Feeding America partner.

Mars Food & Nutrition brand Ben’s Original is dedicated to ghting food insecurity. In 2024, Ben’s donated $25,000 and the equivalent of 350,000 meals to longtime partner Feeding America to help provide resources and support food banks during the California wild res. Through a partnership with Share Our Strength and the No Kid Hungry campaign, the Ben’s Original After School Hero promotion contributed $1.25 million to help provide more than 10 million meals to children facing hunger across the United States. Ben’s also donated $150,000 to Walmart’s End Hunger. Spark Change. campaign.

Since being a member of 1% for the Planet, vitamin and supplement maker MegaFood has contributed more than $2 million to environmental partners through nancial contributions, product donations and paid employee volunteerism. MegaFood partnered with Vitamin Angels to donate $150,000 to provide more than 600,000 women and children worldwide with life-changing vitamins and nutrients. The company also works with the National Young Farmers Coalition to advocate for critical changes in agriculture, including advancing the Farm Bill, equitable USDA land access for all farmers, and farmer mental health.

Established in 2006, the Niman Ranch Next Generation Foundation empowers young farmers and has distributed more than $1.75 million through 500-plus scholarships and grants, nurturing aspiring farmers, rural leaders and sustainable-agriculture advocates. Niman Ranch works with partners to create such activations as Marczyk Fine Foods’ Round Up At the Register campaign. From Regenerative Agriculture Grants that fuel on-farm sustainability initiatives, to Women in Food Grants that support young women pursuing a farm-to-table career, the foundation’s work is critical to sustainable family farming.

Launched in 2024, Publix’s Good Together initiative gives customers and associates the opportunity to donate to help protect, conserve and restore local ecosystems. Funds raised in the retailer’s home state of Florida support ocean conservation and marine debris removal efforts in collaboration with FORCE BLUE and the National Park Foundation, while funds raised in other states support tree plantings with the Arbor Day Foundation in forests of greatest need within those states. With more than $4.9 million raised across the company’s eight-state footprint over the past two years, the campaign has been a huge success for recipient organizations.

Albertsons Cos. partners with the Washington State Department of Ecology’s Use Food Well campaign, which supports the goal of reducing food waste by 50% by decade’s end. The retailer holds events to educate consumers on food waste reduction through meal planning, shopping for only what will be used and properly storing food. Its Washington Safeway supermarkets use in-store displays and promotional materials to engage and inform customers. Also as part of the initiative, Safeway works with chef Joel Gamoran on smart ideas about how to use leftover food.

Botticelli Foods roots its mission in delivering authentic Italian avors while meeting its responsibility to operate sustainably and purposefully. A transformative initiative centers on the production of the company’s pasta sauces, demonstrating how sustainability and tradition can thrive together. The company has implemented a circular production model, turning waste into a resource. In preparing its tomato sauce, Botticelli repurposes peels, seeds and other organic materials into a renewable biofuel source powering critical operations at the company’s facility in Sicily, reducing fossil fuel reliance and emissions. PHILANTHROPIC

Through its mission-driven culture, SimplyProtein is a brand that’s both “mindfully making waves” and one of North America’s fastest-growing companies. Its transparency, sustainability and ethical business practices have earned SimplyProtein B Corp certi cation, as well as praise for its leadership in continuous development, communities’ mental and physical health, the planet, stakeholder governance, and more. Additionally, last year, SimplyProtein formed the Wellness Collective, an employee-led team advancing projects that directly bene t the communities where its employees and partners live and work.

Since its 2021 launch, the Canadian Food Innovation Network has accelerated the development, commercialization and adoption of new technologies across the food value chain to bene t processors, retailers and consumers. CFIN has invested more than CAD $20.2 million in 96 collaborative projects, including those aimed at improving food retail sustainability and ef ciency. Grocers are pivotal to furthering food system sustainability, so CFIN supports early-stage companies building technologies that improve grocery sustainability by reducing spoilage, increasing supply chain transparency or cutting packaging waste. SUSTAINABILITY/RESOURCE

RJW is cultivating business practices that yield long-term sustainability bene ts. The company’s aerodynamic trailers and idle reduction technologies are boosting fuel ef ciency, allowing RJW to cover longer distances on a single tank of fuel. By centralizing inventory in one location and offering a full suite of retail logistics services in-house, the company signi cantly reduces the number of trucks needed to travel between regional warehouses to ful ll customer needs. This translates to fewer carbon emissions and less diesel fuel consumption throughout the supply chain.

As the most popular seafood in the United States, shrimp is in high demand, but shrimp farming can contribute to greenhouse-gas emissions. In response, the Chicken of the Sea Frozen Foods subsidiary of Thai Union Group has launched a Shrimp Decarbonization Project, in collaboration with The Nature Conservancy, to help companies achieve their public greenhouse-gas emission reduction goals. The program supports farms as they adopt practical, science-based solutions, among them transitioning to renewable energy, boosting energy ef ciency and deploying innovative technologies.

Last year, Straus deepened its impact on circular packaging, carbon-neutral farming, zero-waste innovation and climate advocacy. It collaborated with supplying farms by providing nancial incentives for innovative carbon-sequestrating methods and soundly managed grazing, which builds healthy soil. Straus also launched the 100% electric heat pump refrigeration project. This rst-of-its-kind system at industrial and commercial scale will reduce greenhouse-gas emissions, increase energy ef ciency and serve as a model for sustainable cold storage. Additionally, the Farmto-School Bag-in-Box Milk Program diverted 345,920 single-use 8-ounce milk cartons from land lls.

Equifruit, a certi ed B Corp. and a 100% Fairtrade company, has committed to reshaping the banana industry by advocating for ethical practices supporting fairer wages, safer working conditions and environmental sustainability. For more than 18 years, Equifruit has secured long-term banana contracts with Fairtrade pricing, which re ects the true cost of sustainable production. It has also advanced sustainability and resource conservation initiatives nanced through Fairtrade premiums. These initiatives include reducing plastic waste in northern Peru and promoting regenerative agriculture in Ecuador, where Equifruit helped launch natural fertilizer production.

The woman-and-minority-owned bakery transitioned to 100% sustainable packaging for its retail cookies, reducing plastic waste and helping mitigate the environmental damage caused by traditional packaging materials. The company also partnered with Plastic Bank to ensure that for every bag of cookies sold, the equivalent of ve bags of ocean plastic is removed from the ocean. This partnership not only combats plastic waste, but also empowers local communities by providing incentives for plastic collection, bene ting those in regions most affected by plastic pollution.

Sustainability is integrated across Raley’s operations, from stores to supply chain. Through operational procedures, the company maximizes food donations to local food banks: Raley’s redirected 17.5 million pounds of food from land lls through its food rescue programs. Additionally, the company, which recycled 78.4 million pounds of material from 2022 to 2023, eliminates 145,000 pounds of plastic produce bags and trash bags annually and uses store displays to encourage customers to reduce their use of individual-use plastic water bottles.

The solution provider expanded its eco-friendly BioGreenChoice product line, measurably reducing single-use plastic disposables. TrueChoicePack also added/increased post-consumer recycled (PCR) content in existing products and helped customers transition from polystyrene to more recyclable polypropylene for disposable products, complying with local regulations and improving lifecycle impact. Clear labeling on compostable and recyclable options lets consumers actively participate in waste reduction. TrueChoicePack helped communities bene t from reduced land ll burden and plastic pollution, and helped reduce grocery packaging’s environmental footprint.

SUSTAINABILITY/RESOURCE CONSERVATION

Upshop’s Total Store Operations platform includes AI-powered ordering that prevents overstock and shrink, digital production planning that helps fresh departments prep just the right amount, expiration tracking that prompts early action on short-dated items, smart markdowns that save food and margin, and built-in donation tools that give edible foods a second life. At one retailer, bakery and deli waste dropped by 36% after adopting Upshop’s production-planning solution, while stores using its expiration date management are diverting between 56% and 71% of short-dated products from land lls.

Bakery product and plant-based food maker Vandemoortele’s Corporate Sustainability Strategy 2030 places sustainability at the core of the company’s operations, encompassing production processes, company culture and product design change. Deployed across its operations and value chain, the sustainability strategy is built on three key goals –conscious nutrition, protecting nature and enhancing lives – all supported by a solid governance foundation. Vandemoortele’s commitment to sustainability led to an EcoVadis Platinum rating, placing it in the top 1% of companies assessed globally for environmental, social and governance performance.

SUSTAINABILITY/RESOURCE CONSERVATION

HarvestHold Fresh, a Verdant Technologies solution, offers a sheet that releases 1-methylcyclopropene (1-MCP) to slow ripening and extend the shelf life of fresh produce by up to 50%. This results in lower shrink, fewer rejections, less spoilage and improved consumer satisfaction, all without requiring changes to existing packing work ows. The solution also reduces shipping costs and environmental impact by eliminating the need for ice and plastic liners. This past year, Verdant has expanded HarvestHold to such high-priority categories as broccoli, mini cucumbers and peaches.

World Centric’s molded ber products are made from rapidly renewable agricultural byproducts like sugarcane and bamboo, which are used to create packaging designed to break down in two to four months in a commercial composting environment. For paper products, it uses only FSC Certi ed paper from responsibly managed forests, and rather than use petroleum (a nite resource) to produce clear cups and containers, it uses PLA, a compostable bioplastic made from plant sugars. World Centric also focuses on increasing the percentage of its products made with renewable energy.

If you accepted or processed

credit cards between 2007–2023, you could be eligible to get a payment from a class action settlement.

**YOU MAY BE ENTITLED TO A SETTLEMENT PAYMENT**

To receive a payment, file a claim by May 18, 2026. WHAT IS THIS ABOUT?

A proposed class action settlement has been reached in three related lawsuits. The lawsuits allege that, beginning in 2007, Discover misclassified certain Discover-issued consumer credit cards as commercial credit cards, which in turn caused merchants and others to incur excessive interchange fees. The misclassification did not impact cardholders. Discover denies the claims in the lawsuits, and the Court has not decided who is right or wrong. Instead, the proposed settlement, if approved, will resolve the lawsuits and provide benefits to Settlement Class Members.

The Settlement Class includes all End Merchants, Merchant Acquirers, and Payment Intermediaries involved in processing or accepting a Misclassified Card Transaction during the period from January 1, 2007 through December 31, 2023. To view the full Settlement Class definition, including defined terms and excluded entities, go to www.DiscoverMerchantSettlement.com.

To receive a settlement payment, with very limited exceptions, you will need to file a claim by May 18, 2026 and/or provide additional information to the Settlement Administrator. Under the proposed settlement, Discover will make payments to eligible Settlement Class Members who submit valid claims. Discover has agreed to pay between $540 million and $1.225 billion plus interest in connection with this settlement. Your settlement payment amount will be calculated based on a variety of factors.

You can file a claim for a payment by May 18, 2026 and/or provide additional information. Alternatively, you can exclude yourself from the settlement by opting out, in which case you will receive no payment under this settlement and retain any right you may have to sue Discover about the claims in these lawsuits or related to the Misclassified Card Transactions. If you do not exclude yourself, and the Court approves the settlement, you will be bound by the Court’s orders and judgments and will release any claims against Discover in these lawsuits or related to the Misclassified Card Transactions. If you do not exclude yourself, you can object to or comment on any part of the settlement. The deadline to either exclude yourself or object to the settlement is March 25, 2026. Visit the website for information on how to exercise these options.

As part of its Recipe for Change energy and emissions program, Albertsons Cos. is converting refrigeration systems to reduce climate impact while working to improve refrigerant leak rates. In a related move, it’s establishing an in-house refrigeration technician workforce to support its goals. However, the commercial refrigeration industry faces a technician shortage. So Albertsons Cos. joined the North American Sustainable Refrigeration Council’s Refrigeration Technician Recruitment, Advancement, Development and Education program as a founding partner to provide funding and unique retail insights to ensure that it meets industry needs.

Dedicated to creating a workplace environment where everyone can thrive, Raley’s employs more than 300 individuals with disabilities and partners with 200-plus organizations that support workforce development. Raley’s partners with PRIDE Industries, an organization that helps people with disabilities transition into the workforce, and with Meristem, an Autism Program for Young Adults, to provide store leadership training for neurodiverse team members. The company also works with the California School of the Deaf and Norcal Services for the Deaf and Hard of Hearing to engage potential candidates.

To recruit and support employees, meat snack maker Chomps has implemented a suite of programs and bene ts that support workers both on and off the clock. The company is embracing exibility, well-being and work-life balance, starting with a hybrid work schedule tailored for maximum productivity and exibility. Employees can take a day off each quarter for proactive self-care and also absent themselves for World Mental Health Day. In addition, Chomps provides comprehensive employee training and fosters a continuous-learning culture by providing company-reimbursed personal and professional development opportunities.

In 2024 alone, the Schnucks Proud Assistance Fund, which is supported by Schnucks teammates, invested more than $92,000 in 38 teammate families to help increase family stability. Their dollars went to rent assistance, mortgage assistance, funeral assistance, emergency home repairs, electric-bill assistance, and more. Schnucks uses the back-ofce ef ciencies of the United Way organization to help administer the fund so that 100% of the money raised goes directly to teammates in need, with the grocer covering all administrative fees.

To promote a culture of autonomy and ownership at every level and encourage each employee to feel empowered to thrive, Hy-Vee recently introduced a series of new and enhanced nancial, lifestyle and health care employee bene ts. Among the recent initiatives are free weekend meals for retail employees who work Fridays, Saturdays or Sundays, and a new expanded maternity and parental leave policy. The company also piloted a program that allows unlimited access to primary and walk-in care at Hy-Vee Health Exemplar Care clinics, at no cost.

To ensure that employees understand the importance of saving for retirement, The Fresh Market expanded its nancial education offerings to include webinars, Lunch & Learns with certi ed nancial advisors, and one-on-one counseling. It also launched two pilot emergency savings programs to help employees build their cash reserves, and, to make sure that employees don’t deplete their personal savings when crisis strikes, the grocer established the TFM Cares fund, which has provided $179,462 in grants since its inception. Further, the company’s generous 30% discount empowers employees to save on everyday expenses.