WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

AS THE FDA SHOWS SIGNS OF GREATER SUPPORT FOR NOVEL NICOTINE PRODUCTS, THE CONVENIENCE STORE INDUSTRY HOLDS GUARDED HOPE

Boost your business with a responsible digital platform that enhances customer engagement and loyalty. The AGDC Digital Trade Program helps retailers connect with Adult Tobacco Consumers 21+ while driving business growth through incentives.

Receive a Scan Data Base Incentive payment for each eligible Scan Data transaction timely submitted to AGDC.

Earn incremental per-transaction incentive funds for each identified Consistent LID appearing 5 or more weeks in Scan Data.

Submit weekly Scan Data files for 13 out of 13 weeks to receive additional incentive payments.

Mentorship is so important for women’s advancement, especially in the current climate

ACCORDING TO THE latest “Women in the Workplace” report from McKinsey and LeanIn.Org, only half of companies are prioritizing women’s career advancement — a continuation of a several-year trend in declining commitment to gender diversity. This means women today are facing less career support and fewer opportunities to advance.

An even more alarming stat from the report is that for the first time, women are less interested in being promoted than men: 69% of entry-level women want a promotion vs. 80% of entry-level men, while 84% of senior-level women desire to be promoted vs. 92% of senior-level men.

The stats, however, don’t tell the full story because women display just as much commitment to their careers as men, and when women and men receive similar levels of support from managers and more senior colleagues, they are equally enthusiastic about getting promoted. The problem is, as the data shows, that women do not receive the same level of career support as men.

It is against this backdrop that Convenience Store News announces the exciting launch of the Top Women in Convenience (TWIC) Mentorship Program. Offering both traditional mentorship and peer mentorship, this program is designed to connect and create bonds between colleagues across the industry and across seniority levels for professional and personal development.

Convenience Store News launched Top Women in Convenience in 2014 to spotlight the integral role women

EDITORIAL EXCELLENCE AWARDS (2016-2026)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

play in convenience retailing and celebrate individuals across retailer, distributor and supplier businesses for outstanding contributions to their companies and the industry at large. To date, 799 women have been recognized as part of the awards program and annual gala.

In a recent survey of past TWIC winners, mentorship scored high when respondents were asked what type of new programming they would be most interested in. We listened and mobilized, and are thrilled to bring the Top Women in Convenience Mentorship Program to the industry.

Especially in the current climate, mentorship is so important for women’s advancement.

One of my favorite moments from the most recent TWIC Awards Gala was when Woman of the Year Tanisha Sanders of ITG Brands spoke about the influence mentors had on her career, and she called on all the leaders in the room — women and men alike — to help others rise.

“I stand here before you tonight because someone was very intentional about reaching back and creating space for me. … Thriving doesn’t happen in isolation. It happens when someone makes it to the top and they send that elevator back down. We must use our voice and make space for the next generation of women coming behind us,” Sanders told the crowd.

We at Convenience Store News are proud to be doing our part to send the elevator down.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2025 Eddie Award Honorable Mention, Folio: Business to Business, Retail, Full Issue, September 2024

Business to Business, Magazine Section

2024 Eddie Award, Folio:

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section

2023 Eddie Award Honorable Mention, Folio:

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio:

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio:

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio:

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio:

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Majors Management

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

S S S C

He cared about his team, his community and the industry that had given him so much

Steve built a company that treats its employees as its most valuable asset.

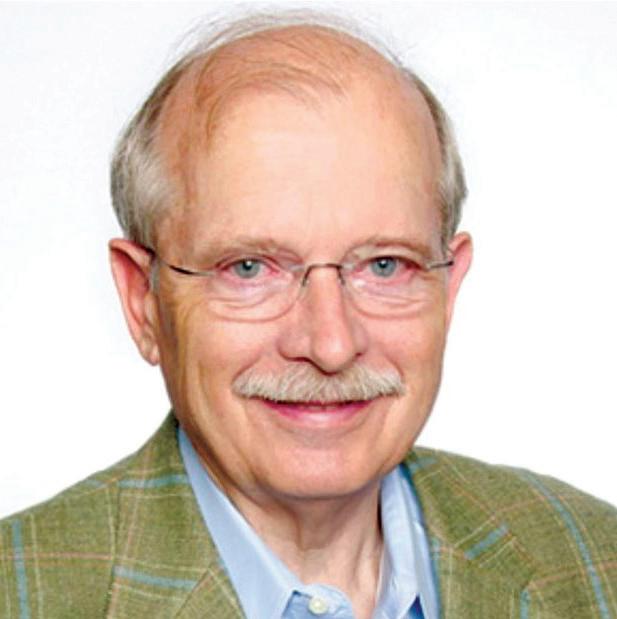

THE PASSING OF STEVE SHEETZ, former CEO and board chair of Sheetz Inc., on Jan. 4 at the age of 77 marks the loss of one of the true giants of the convenience store industry. For those of us who have covered this business for decades, Steve wasn’t just a successful operator or visionary executive. He was a reminder of what this industry can be when leaders put people first.

Steve’s accomplishments are well documented in our pages. In 1995, Convenience Store News inducted him into the Hall of Fame, recognizing a career that had already reshaped expectations for what a regional convenience retailer could become. Nearly a quarter century later, in our February 2019 50th anniversary issue, Steve appeared on the cover in a Mount Rushmore-style illustration honoring the 50 most influential people in convenience store history. He was shoulder to shoulder with Chester Cadieux of QuikTrip, Alain Bouchard of Alimentation Couche-Tard and Jere Thompson of 7-Eleven — company he unquestionably belonged in.

But accolades, as meaningful as they are, only tell part of the story.

What always impressed me most about Steve was his clarity about what truly drives success in convenience retail. He understood that great stores, strong food programs, bold marketing and smart technology are essential, but none of them matter without great people executing them. Long before “culture” became a buzzword, Steve built a company that treats its employees as its most valuable asset.

That philosophy is reflected in Sheetz’s extraordinary track record as an employer. Year after year, the retailer has been recognized among the best companies to work for in the United States — an achievement few retailers in any sector, let alone convenience, can claim. These honors didn’t come from slogans or press releases. They came from consistent investments in training, benefits, advancement opportunities, and respect for frontline employees who carry the brand every day.

Steve’s leadership helped transform Sheetz from a small, family-run operation in Altoona, Pa., into one of the most innovative and admired convenience store chains in the country. Under his watch, Sheetz embraced made-to-order food, pushed operational boundaries and stayed relentlessly focused on the customer experience. Yet even as the company scaled, it never lost its sense of humanity — a reflection of Steve’s own values.

He also believed deeply in developing future leaders, both within Sheetz and beyond. His involvement in education, entrepreneurship programs and mentoring spoke to a long-term view of the industry, one that recognized our responsibility to leave things better than we found them.

Steve Sheetz helped define modern convenience retail. More importantly, he showed that treating people right isn’t just good ethics, it’s good business.

That is a legacy worthy of the lasting respect of an entire industry.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

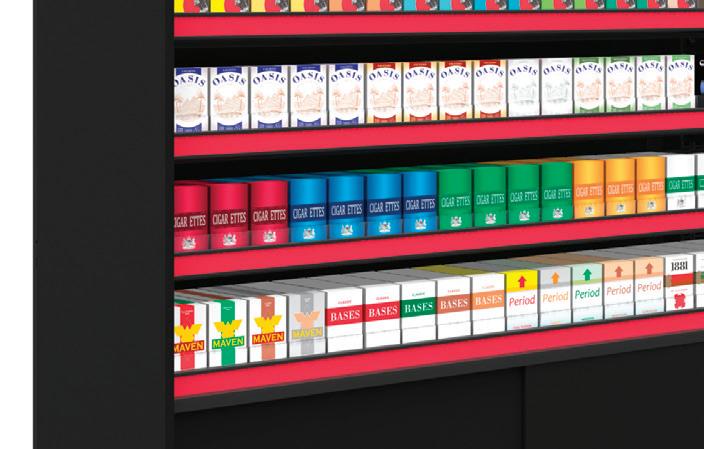

multi-use Zip Track ® system handles different size and shape packages with ease.

ZIP Track® is a modern merchandising system that forwards and faces its product offerings at all times. Quickly add new facings with this cost-effective easy to install and adjust system.

Use actual product to set lane width. Slide product front-to-back to ‘ZIP’ tracks together in final position.

COVER STORY

26 Cause For Optimism

As the FDA shows signs of greater support for novel nicotine products, the convenience store industry holds guarded hope.

46 A Thriving Workplace

There are several key components that can set a company apart from others.

DEPARTMENTS

EDITOR’S NOTE

4 Send the Elevator Down Mentorship is so important for women’s advancement, especially in the current climate.

VIEWPOINT

6 Steve Sheetz Never Forgot

That Retail Is a People Business He cared about his team, his community and the industry that had given him so much.

SMALL OPERATOR

22 A Vision of the Future

The building blocks for the future of retail are already here.

LEARNING LAB

56 How to Beat Burnout & Build Long-Term Success

Convenience Store News’ Future Leaders Learning Lab provides techniques to recognize the signs early and establish healthy work habits.

STORE SPOTLIGHT

74 Blending Cultural Heritage With Modern Convenience

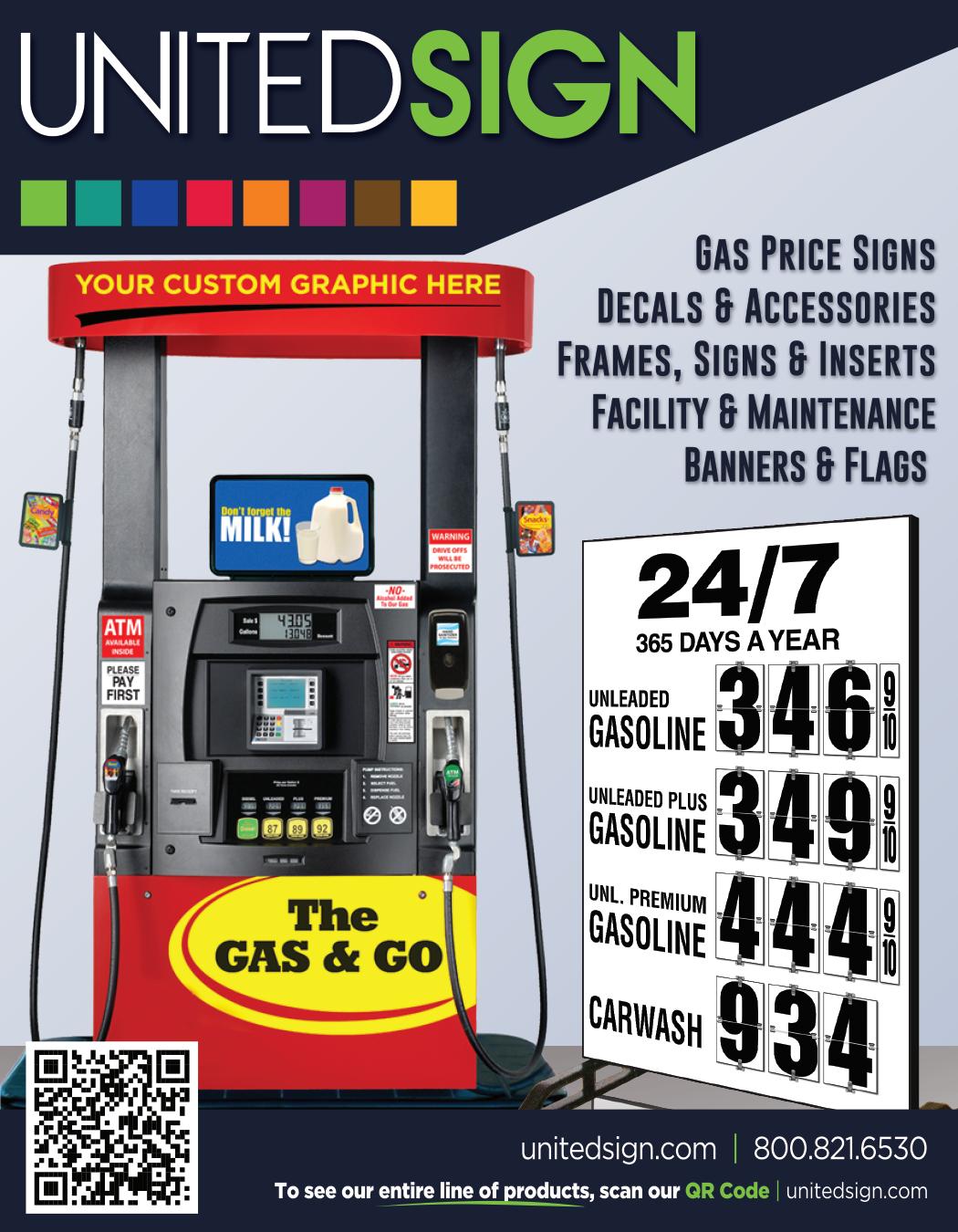

OWL™ Services is the nation’s premier provider of construction, program management, compliance, technology and fueling equipment solutions.

We serve convenience stores, fueling centers, EV charging hubs, fleet operations and more.

We ensure America’s mobility.

36 Leveraging Limited-Time Offers

Convenience retailers can use temporary menu additions to build a permanent customer base. PACKAGED BEVERAGES

42 BFY Reshapes the Cold Vault Shoppers are increasingly reaching for better-for-you beverages.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

7-Eleven CEO Joe DePinto Retires

Parent company Seven & i Holdings Co. Ltd. announced DePinto’s retirement after more than 20 years at 7-Eleven Inc. Stanley Reynolds, 7-Eleven president, and Douglas Rousencrans, executive vice president and chief operating officer, are serving as interim co-CEOs.

The sites were previously part of its acquisition of Bradley Oil. Post-divestment, Stinker plans to sharpen its focus on core assets and capitalize its upcoming development projects.

The Pennsylvania-based retailers’ rivalry intensifies as Sheetz sets up shop in the Philadelphia-area market for the first time. Its first store in Royersford, Pa., is located directly across the street from a Wawa store.

The retailer is teaming up with Quorso following a previous deployment across Circle K’s European network in 2025. The partnership, focused on streamlining in-store management tasks, will now include more than 7,800 stores in the United States and Canada.

Buc-ee’s topped the convenience category of the Forbes’ 2026 Best Customer Service ranking. Companies were evaluated on four factors: personal interaction, speed, services and resolution.

The convenience industry continues to evolve at record pace — driven by innovation, shifting shopper expectations and mounting operational challenges. In this webinar, now available for on-demand viewing, senior leaders from across the U.S. convenience store landscape reflected on the biggest trends, wins and lessons of 2025, and shared what they expect will define success in 2026. The program also delivered a first look at the results of Convenience Store News’ exclusive 2026 Forecast Study.

For more webinars, visit the CSNews Webinars section of CSNews.com.

Retailers are operating in an extremely competitive landscape, so they’re making significant investments in their business and technologies, from forecourt equipment to in-store systems. Margins are tight, and customers expect speed, convenience and a seamless experience at the pump and in-store, writes John Morris, senior director of Anthem Product Management at Dover Fueling Solutions. In this environment, measuring and understanding what’s working to ensure a return on every investment has never been more critical. While gallons sold is a great starting point, today’s retailers can go even further with other valuable indicators, such as transaction counts, customer conversion or engagement at the pump, that show whether the business is becoming more efficient and delivering stronger results.

Cheez-It Crunch is a new, bold snack line that combines 100% real cheese with a more satisfying crunch and a 3D shape designed to deliver edge-to-edge bold flavor in every bite, according to its maker. Cheez-It Crunch comes in three flavors: Kick’n Nacho Cheese, where classic cheddar cheese is layered with a kick of nacho spice; Zesty Jalapeño Cheddar, combining the iconic Cheez-It cheddar taste with a bold kick of spicy jalapeno; and Sharp White Cheddar, a complex cheddar taste with buttery notes. All three varieties are available in full-size, 6.5-ounce bags for a suggested retail price of $4.49.

Alternative pouches are fueling a surge in convenience-store sales as an emerging category, delivering a fast, convenient energy boost on the go while resonating with shoppers seeking non-nicotine options.

At the forefront of the emerging alternative pouch segment is Grinds—a category pioneer that has established credibility and leadership while delivering innovation.

Convenience Store News spoke with Matt Canepa, co-founder of Grinds, about how his brand’s expertise can help c-stores unlock the category’s potential.

Convenience Store News: How did Grinds become a trailblazer in non-nicotine pouches?

Matt Canepa: We’ve been doing this for 16+ years. Long before nicotine pouches took o in convenience, we were building non-nicotine alternatives for people who wanted focus, energy and functionality without tobacco or nicotine.

is the next step: consumers who want that same discreet, convenient format—but without nicotine. We didn’t follow the category—we helped build it.

CSN: What distinguishes Grinds from competitors?

MC: We’ve always seen Grinds as a pouch company independent of tobacco or nicotine. From day one, our focus has been delivering functional benefits— starting with energy—through a pouch format that consumers already understand and trust.

We started as a direct-to-consumer brand, which gives us a competitive edge because we have years of rich consumer data and insight. We know who uses these products, why they use them, where they fit into daily routines and how they perform at retail.

Bringing manufacturing in-house was a major unlock for us. It allows us to iterate faster, control quality and respond directly to consumer feedback.

Speed and control matter—especially in a category that’s still evolving.

Our story began when my co-founder Pat [Pezet] and I were college baseball teammates, working late on a marketing project. It was hot and we didn’t want to brew hot co ee, so we tried putting co ee grounds in our mouths for a quick energy boost—and that moment sparked the idea for our first co ee pouch products. We began by sampling with one of our core consumer groups—baseball players, who are already familiar with chew-style products. After winning a campus-wide business plan competition, we knew we had something real and decided to pursue the idea full-time—we even appeared on Shark Tank, where we gained tremendous exposure and built sales.

Nicotine pouches created mass pouch awareness. Consumers now understand how pouches work, how they’re used and where they fit into a day. What we’re seeing now

CSN: How has Grinds evolved along with the category?

MC: Today, Grinds is about function. Energy will always be a core pillar, but we’ve expanded into flavorful and functional white pouches. We are developing additional functional solutions—such as a Hydration formula—within the same pouch format.

CSN: What is the best way to merchandise Grinds?

MC: Register placement is a powerful way to drive impulse trial and build in-store awareness. But when clean counters are mandated, many retail partners place Grinds in the HBC or Energy sets—near energy shots, supplements, and other functional products. That positioning aligns with how consumers actually use Grinds, and helps drive incremental dollars in what can otherwise be a stagnant or declining category across most convenience stores.

Casey’s is one of Grinds’ longest and most successful partnerships. The retailer started with three SKUS and has steadily expanded the assortment over the past several years to more than 10 SKUs.

Matt Canepa and Pat Pezet develop the idea for Grinds

With their [Grinds] help, we were able to take a category mainly driven by need state in HBC, to a category that can drive sales and tra c. We truly value this partnership and look forward to continued collaboration.”

—Dana Begley, Category Manager, Casey’s

Expansion into

Support from trial customers accelerates

2025

Walmart expanded Grinds from a limited test of 500 stores to 2,700 doors.

THE CONVENIENCE CHANNEL recently lost two giants of the industry: Carl Bolch Jr., chairman emeritus and former CEO of RaceTrac Inc., and Stephen (Steve) G. Sheetz, former president, CEO and chairman of the board of Sheetz Inc.

Bolch passed away on Dec. 26 at the age of 82. As the leader of RaceTrac for more than 50 years, he was a visionary who laid the long-term foundation for RaceTrac, as well as a mentor, friend and source of inspiration to many, the company said.

Under Bolch’s leadership, Atlanta-based RaceTrac grew from 100 stores in two states to 500-plus locations in 10 states. More than 90 years after the company was founded by Carl Bolch Sr., RaceTrac is now the 22nd largest privately owned company in the United States, according to Forbes, and the third-largest company in its home state of Georgia.

“While our sadness is beyond measure in sharing this news, I believe we ultimately find inspiration and contentment in the legacy our father and mentor has created,” the Bolch family said in a statement. “For over half a century, our father not only helped to build one of the largest private companies in the U.S., but he provided a livelihood for thousands while forging a culture of innovation, lifelong learning and humility.”

Bolch also previously served as president of the Society of Independent Gasoline Marketers of America (SIGMA) and board chair of NACS. His accolades included the Distinguished Marketer award from SIGMA in 2003, Convenience Store Petroleum’s Retail Leader of the Year

award, and induction into the Convenience Store News Hall of Fame in 2009.

Steve Sheetz, who was also inducted into the Hall of Fame in 1995, passed away on Jan. 4 at the age of 77. At just 12 years old, he began working part-time for Sheetz Kwik Shopper, the company his brother Bob Sheetz founded in 1952.

After earning his degree from Penn State University in 1969, Steve became supervisor and director of operations for all four Sheetz locations in operation at that time. He later worked alongside Bob to grow the company to 100 stores by 1983.

Following Bob’s retirement, Steve served as president and CEO of Sheetz Inc. from 1984 to 1995, guiding the company through a period of significant growth. He also served as chairman of the Sheetz Board of Directors from 1995 to 2013, before transitioning to chairman of CLI Transport in 2013. In 2020, he retired as an official Sheetz executive, while continuing to serve as chairman of the Family Committee.

“Above all, Uncle Steve was the center of our family,” said current Sheetz Inc. President and CEO Travis Sheetz. “We are so deeply grateful for his leadership, vision and steadfast commitment to our employees, customers and communities.”

ON JAN. 15, U.S. Senate Democratic Whip Dick Durbin (D-Ill.) and U.S. Sen. Roger Marshall (R-Kan.) reintroduced the Credit Card Competition Act (CCCA), which will increase competition in the credit card market, putting an end to the Visa-Mastercard duopoly that is pressuring businesses and ultimately consumers.

Visa and Mastercard currently control about 85% of the credit card market and, according to the legislators, will not negotiate fair terms with Main Street merchants. Today, the average American family pays nearly $1,200 per year in swipe fees, while banks profit $111.2 billion annually from these fees, the legislators noted.

“Americans are struggling with everyday purchases like groceries and gas, and credit card swipe fees inflate those already exorbitant prices,” Durbin said. “By bringing real competition to credit card networks, which is currently dominated by the Visa-Mastercard duopoly, we can reduce swipe fees and hold down costs for Main Street merchants and their customers. Let’s pass the Credit Card Competition Act as soon as possible.”

Reintroduction of the bipartisan bill came two days after the measure was endorsed by President Donald Trump. In a social media post, Trump said the legislation is needed “in order to stop the out of control swipe fee ripoff.”

The same day that Durbin and Marshall, along with U.S. Sen. Peter Welch (D-Vt.), formally reintroduced the CCCA bill in the U.S. Senate, U.S. Reps. Lance Gooden (R-Texas) and Zoe Lofgren (D-Calif.) did the same in the U.S. House of Representatives.

The Merchants Payments Coalition (MPC) welcomed movement on the legislation.

“From President Trump endorsing the bill to Sen. Durbin making a push for passage on the Senate floor, momentum to finally bring competition to credit card swipe fees is at the highest level we’ve ever seen and is building quickly,” said MPC Executive Committee member and NACS General Counsel Doug Kantor. “When Donald Trump, Roger Marshall, Dick Durbin, Lance Gooden and Zoe Lofgren all agree on something, that’s a clear sign that this is a nonpartisan issue that impacts American families across the political spectrum.”

The CCCA has the support of nearly 300 trade associations and nearly 2,000 companies, as well as a broad coalition of consumer, labor and pro-competition organizations.

U.S. sales of store brands in 2025 increased roughly $9 billion year over year to a record $282.8 billion. — Private Label Manufacturers Association $9B

The new year began with the lowest national fuel average in years at $2.81.

7 in 10

Seven in 10 shoppers say they’ve used artificial intelligence tools and features to assist with their shopping journey.

— Acosta Group

Sunoco LP purchased 36 convenience stores from Pops Mart Fuels LLC. The sites are located in North Carolina, South Carolina and Wisconsin. Financial details of the transaction were not disclosed.

ExtraMile Convenience Stores LLC, a joint venture between Chevron U.S.A. Inc. and Jacksons Food Stores, reached an agreement with Moore Oil Co. to bring the brand to the Birmingham, Ala., area. Moore Oil will convert more than 20 of its current Chevron Food Mart locations to the ExtraMile brand.

Love’s Travel Stops is growing Love’s Financial, the company’s financial services arm, through the acquisition of three freight factoring providers: TBS Factoring Service, Saint John Capital and Financial Carrier Services. The companies operate out of Oklahoma City, Chicago and Charlotte, N.C., respectively.

Petroleum Marketing Group acquired nine c-stores from Blythewood Oil Co., located between Charlotte, N.C., and Columbia, S.C. The transaction marked Blythewood Oil’s exit from the convenience channel.

Reliance Oil LLC picked up six Shell-branded sites from SAC Inc., which operates convenience stores in the Bedford and Harrisburg, Pa., markets. The deal was only for the Shellbranded stores and Shell wholesale portion of the businesses owned by SAC.

Pilot ushered in the new year with a redesigned mobile app. The new app includes more personal features to fit the user journey, and improved reliability and security.

Weigel’s Stores Inc. also unveiled a redesigned mobile app. Designed to support everyday visits, the new MyWeigel’s Rewards app reduces visual clutter while elevating the most-used tools within the rewards program.

Alltown Fresh introduced its first merchandise and apparel line, Alltown Fresh Collection. The line features 23 custom-designed and printed pieces.

GATE Petroleum Co. is adding a taste of Bono’s Pit Bar-B-Q to its menu. Through a partnership with Bono’s, Gate will offer selections from the restaurant chain at 30 Gate Made-to-Order Fresh Kitchen locations.

Swisher is embarking on a $135-million expansion of its manufacturing operation in Jacksonville, Fla. The project supports rising demand for nicotine and caffeine oral pouch products.

Mars Inc. closed on its $35.9-billion acquisition of Kellanova at the end of 2025. Mars expects the combined snacking business to generate around $36 billion in annual revenue with a portfolio that includes nine billion-dollar brands.

The U.S. Food and Drug Administration authorized the marketing of six nicotine pouch products through the premarket tobacco product application pathway. The products are sold under the on! PLUS brand and made by Helix Innovations LLC, a subsidiary of Altria Group Inc.

Sunoco stations across the United States joined the WEX mobile payment platform. WEX’s DriverDash allows commercial fleet drivers to pay for fuel directly from their smartphone instead of using a physical card.

The Army & Air Force Exchange Service will increase access to on-installation mental health services, starting with the planned opening of mental health clinics in Japan, Okinawa and Korea. The initial Cohen Veterans Network clinics are slated to open in fall 2026.

Loop Neighborhood Markets launched a retail media network, LoopMedia Connect. The integrated platform includes Loop’s website, loyalty app, video screens at fuel pumps, in-store digital screens, in-store radio and social media channels.

The platform allows brands and vendors to activate campaigns seamlessly across multiple touchpoints.

The Coca-Cola Co. tapped its current executive vice president and chief operating officer Henrique Braun to be CEO, effective March 31. Braun will succeed James Quincey, who will transition to executive chairman following his tenure of nine years as chief executive.

Core-Mark International, a Performance Food Group company, will serve as the national supplier for RaceTrac Inc.’s growing footprint of more than 600 convenience stores. The expansion brings every RaceTrac location into its distribution system.

National Retail Solutions is partnering with NationsBenefits, allowing merchants to seamlessly accept NationsBenefits Overthe-Counter (OTC) Flex Card. The move drives health plan members into local independent stores to purchase health and wellness products.

Philip Morris International’s U.S. businesses invested $37 million into its manufacturing facility in Wilson, N.C. The factory produces HEETS for IQOS 3.0, the only heated tobacco product authorized by the Food and Drug Administration.

M&M’S Honey Roasted Peanut

M&M’S Honey Roasted Peanut offers a familiar, yet indulgent snacking experience. According to the brand, roasted peanut delivers a satisfying crunch, while the candy’s nutty flavor pairs perfectly with M&M’S signature milk chocolate and a golden honey glaze. M&M’S Honey Roasted Peanut is available in a 1.63-ounce single size, 2.83-ounce share size, and 8.6-ounce sharing size standup pouch. A permanent addition to the lineup, M&M’S Honey Roasted Peanut joins the latest innovations from M&M’S, including M&M’S PB&J, M&M’S Peanut Butter Minis and M&M’S Peanut Butter Mega. MARS INC. • NEWARK, N.J. • MARS.COM

The latest release from the Mountain Dew brand is the first indulgent flavor in its portfolio. Created to meet emerging consumer demand in the growing “dirty soda” category, Dirty Mountain Dew Cream Soda Dew mixes the iconic citrus kick of Mountain Dew with a smooth cream flavor twist to provide a distinctive, indulgent taste. Following in the footsteps of cult classics like Mountain Dew Baja Blast and Mountain Dew Code Red, Dirty Mountain Dew reinforces the brand’s legacy of pushing flavor boundaries while staying ahead of the curve, its maker said. The new flavor rolls out nationally in early 2026.

PEPSICO BEVERAGES NORTH AMERICA • PURCHASE, N.Y. • MOUNTAINDEW.COM

SweeTARTS Freeze Dried

Turning Point Brands introduces FRE Watermelon, the latest addition to its rapidly growing FRE nicotine pouch portfolio. With this release, FRE becomes the first white pouch brand to offer a full assortment of strengths, ranging from 3 to 15 milligrams, according to the company. FRE also stands apart through its premoistened pouches, ensuring flavor across all five strengths. Packaging upgrades, including soft-touch cans and enlarged flavor bars, enhance shelf appeal while simplifying inventory for retailers and maximizing revenue per facing.

TURNING POINT BRANDS • SANTA MONICA, CALIF. • TURNINGPOINTBRANDS.COM

New from Ferrara, SweeTARTS Freeze Dried showcases the brand’s vibrant and mouthwatering combination of sweet and tart in an exciting new form, according to the company. The candy takes the classic mini, chewy SweeTARTS experience to new heights with an unexpected, distinct crunchy texture. SweeTARTS Freeze Dried is available in a 4-ounce pack, making it perfect for consumers who are looking for an afternoon treat, a go-to movie theater bite, a road trip companion or simply a fun addition to the desk drawer.

FERRARA • CHICAGO • SWEETARTSCANDY.COM

Chester’s 2.0

Chester’s Chicken is raising the bar with Chester’s 2.0, anchored by a new Crispy Station merchandiser alongside a two-basket fryer and refreshed packaging. Developed with Marshall Air, the Crispy Station merchandiser leverages proprietary ThermoGlo technology to hold chicken hot, crispy and fresh for up to three times longer than most convenience store merchandisers, the company said. The two-basket frying system allows operators to fill the hot case in half the time by frying two products at once. Chester’s revamped packaging suite also features heat-resistant cups and lids, allowing for prepackaged sides.

CHESTER’S CHICKEN • BIRMINGHAM, ALA. • CHESTERSCHICKEN.COM

The building blocks for the future of retail are already here

By Roy Strasburger, CEO, StrasGlobal

I HAVE SEEN THE FUTURE, and it is a toilet. (I mean literally, not metaphorically.)

Over Christmas and New Year, I had the opportunity to spend time with my family in Vietnam and Cambodia. I’m writing this column in a café in Hanoi. We have had a wonderful time — warm weather, beautiful tropical scenery, ancient ruins, great food, and warm and welcoming people.

Southeast Asia is one of my favorite places to visit and spend time. This part of the world also contains what we would think of as a dichotomy between the past and the present.

Farmers till their fields with water buffalos pulling the plows, and plant rice by hand while high-speed trains go by in the distance. A rickshaw driver pedals his passengers on a three-wheeled bicycle through the shadows of 30-story buildings while following the GPS directions on his phone. A street vendor pushes his cart down the road and takes payment with a tap-to-pay device. A street-side restaurant that takes up about 20 square feet containing two tables, eight 18-inch high stools and a giant gas-powered wok being stirred by a man in a T-shirt hands over a plastic bag to a motor scooter driver delivering a meal that was ordered on a smartphone.

Old/new. Past/present. But also, a window into what is to come?

Predicting the future is hard work and the odds of getting something right are relatively slim. In most cases, it’s no better than a 50-50 chance of whether you guessed right or not. The problem is that the future isn’t a straight line from the past. But the past can be an indicator of how things might develop in the future.

In case you missed it, the first Vision Group Network (VGN) Global Virtual Summit was held in November. Members from all seven 2025 Vision Groups presented the issues they discussed during their meetings, with an emphasis on what the future holds for the convenience and mobility industry.

To kick things off, futurist Gerd Leonhard, CEO of The Futures Agency, gave the keynote presentation about where he thought we would be in 2030. He pointed out that one shouldn’t really try to predict the future, but rather, you should focus on preparing for the future instead. This means looking at all the different opportunities and possibilities that might take place instead of betting on a specific outcome or development.

Gerd said there’s going to be 10 gamechangers (artificial intelligence, robotics, supercomputing, nuclear fusion, free abundant energy, biotechnology, synthetic biology, biofuels,

genetic engineering, and geoengineering) and four revolutions (geopolitical, digital, sustainability and purpose) in the next five years. His argument for each is compelling.

After Gerd, we heard presentations from each of the Vision Groups. To “summit up” (see what I did there), the members saw the future developing in several different areas:

• The evolution of AI and its enhancement of productivity, reduction of expenses, optimization of profitability, and hyper-personalization of experiences

• The impact of GLP-1 weight loss drugs on foodservice programs

• The importance of the customer experience

• The inevitability, but unknown timing, of the transition to electric vehicles (EVs)

• The integration of payment systems

That’s just to name a few. You can read the free Virtual Global Summit Vision Report and see copies of the presentations on the VGN website (vgnsharing.com).

So, what does this mean for retailers?

First and foremost, you need to watch and understand the changes in your customers’ buying habits and profiles. Gen Z customers are going to want different products, services and experiences than millennials. As customer demographics change, you need to adapt your offering

As customer demographics change, you need to adapt your offering and marketing to meet those changes.

and marketing to meet those changes.

The rise of GLP-1 drugs could have a big impact on your candy, alcohol, snacks and foodservice sales as these drugs are designed specifically to decrease appetite and reduce impulse cravings for sweets, alcohol and tobacco — the core categories of a convenience store. What can you stock to appeal to your customers who are using GLP-1 drugs, and what products and services can you introduce to replace sales lost as buying habits change?

As EVs become more numerous and gasoline consumption continues to fall, what can you do to make your store a destination shop? If it is gasoline sales that are pulling your customers in, what’s your strategy for when they don’t need gasoline anymore? You must become a destination rather than a transit site, and that means carrying products that will make customers come to you.

As I’ve mentioned over the last couple of years, I believe having an outstanding foodservice offer is the way forward. You will not replace gasoline customers by just putting in EV chargers at your location. You need to have something that will attract them when they don’t need to buy energy. Outstanding customer service, a superclean location, curated product selection and frictionless customer interaction will be table stakes to stay competitive.

How does this play out in real-life? Let’s look at what I’ve seen on this trip:

Right product, right place. Although we would consider hand-planting rice a labor-intensive way of farming, it is the most economical and efficient method for farmers with small plots. However, what makes this case study interesting is that the farmers are using rice that has been modified for the change in climate — less rain and more dry spells — so that they can maximize their harvest and revenues.

It is an example of changing the product to meet changing demands.

Enhanced productivity. By using GPS, the rickshaw driver can find the quickest way to his destination, allowing him to do more trips per day. Knowing where the traffic snarls are is important when you are pedaling in heavy traffic in 85 degrees with 90% humidity.

Removing payment friction. By accepting digital payments, it makes it easy for the customer who doesn’t have to fumble with paper currency in a land where the exchange rate is 25,000 to the dollar. For the vendor, he doesn’t have wait for the customer to count out the notes or make change, and the money is immediately in his bank account which reduces his chances of being robbed.

Becoming a destination. The food stall is in competition with hundreds, if not thousands, of other food vendors within walking distance. This chef has created a dish that makes him stand out from the others (usually these stalls are one-item menus). Bonus innovation: although he

only sells one dish, he is listed on the local online food delivery app so that customers can access his wok at their convenience.

Hyper-personalization. I didn’t mention this earlier, but one of our hotels had a super automated toilet in the bathroom. I know that multifunction bidet/toilets have been around since the 1980s, but now you can adjust the functions (water temperature, seat temperature, air drying temperature, water pressure, noise suppression, music type and volume, lighting levels, etc.) to your personal preferences — and the toilet will recognize you and automatically revert to your settings. Talk about hyper-personalization in a very personal way!

The bottom line is that the building blocks for the future of retail are already here. We just need to recognize the potential and be open to the possibilities. CSN

Roy Strasburger is CEO of StrasGlobal, a privately held retail consulting, operations and management provider serving the small-format retail industry nationwide. StrasGlobal operates retail locations for companies that don’t have the desire, expertise or infrastructure to operate them. Learn more at strasglobal.com. Strasburger is also cofounder of Vision Group Network, whose members discuss future trends, challenges and opportunities, and then share with all retailers and suppliers, regardless of the size of their business.

Editor’s note: The opinions expressed in this article are the author’s and do not necessarily reflect the views of Convenience Store News.

Dial up your product mix with the latest launches and must-watch trends in candy and snacks. This is where standout items get discovered — and sales strategies get sharper.

AS THE FDA SHOWS SIGNS OF GREATER SUPPORT FOR NOVEL NICOTINE PRODUCTS, THE CONVENIENCE STORE INDUSTRY HOLDS GUARDED HOPE

By Renée M. Covino

WHEN CONVENIENCE STORE retailers were asked as part of Convenience Store News’ 2026 Forecast Study what will have the biggest impact on their sales and profitability in the year ahead, tobacco regulation was at the top of the list, trailing only inflation and national economic issues, and increasing operational costs.

In particular, the U.S. Food and Drug Administration (FDA) and its Center for Tobacco Products (CTP) significantly impact the tobacco/nicotine business at convenience stores. But recent encouraging signs from the agency have c-store players hopeful.

According to David Spross, executive director of the National Association of Tobacco Outlets (NATO), last year could be classified as “a year of change,” bringing new initiatives to the FDA and CTP — and some much needed industry optimism.

He noted that after the Trump Administration took office in January 2025 and new leadership came in, including Department of Health and Human Services Secretary Robert F. Kennedy Jr., FDA Commissioner Dr. Marty Makary and Temporary CTP Director Bret Koplow, the opportunity to “reset and streamline” FDA/CTP operations was in play. And indeed, some positive news was recorded during the fourth quarter of last year, particularly around novel nicotine products:

• In September, the FDA launched a pilot program aimed at increasing efficiency and streamlining the review process of premarket tobacco product applications (PMTAs) for nicotine pouch products. The agency said it would use tobacco harm reduction and the continuum of risk in reviewing applications since there is evidence that nicotine pouches help some adults switch from more harmful tobacco products.

• In October, Koplow spoke at a food and drug law industry conference about regulation that recognizes tobacco harm reduction. He recognized “e-cigarettes, nicotine pouches, heated tobacco products and snus for their potential beneficial use for current tobacco users, predicated on recognition of a continuum of risk among different tobacco products, with combustible tobacco products generally posing the highest risk.”

• In early December, the FDA launched a new and improved web portal for submitting tobacco product applications

“With the tobacco and nicotine landscape evolving to less harmful products such as nicotine pouches and vapor products, retailers need to be thinking about providing product options for the adult nicotine consumer of the future.”

— David Spross, National Association of Tobacco Outlets

electronically, “further enhancing the application submission process by making it a more integrated and efficient experience,” the agency said.

• In late December, because of the changes made to the review process including real-time communication with the applicant, the FDA said it was able to “complete scientific review in record time,” authorizing the marketing of six on! PLUS nicotine pouch products made by Helix Innovations LLC.

Considering what has already taken place, Spross is optimistic for the year ahead.

“With the recent PMTA authorizations and more decisions expected to come in 2026, there will be more clarity into vapor and nicotine pouch products that are authorized for sale and those that are denied,” he told Convenience Store News. “Further, increased authorizations will result in more products for retailers to sell to adult nicotine consumers.”

From the legal perspective, two partners specializing in tobacco at the national law firm of Troutman Pepper concur there is cause for optimism, albeit cautious.

Agustin Rodriguez told CSNews that he was impressed with the FDA director acknowledging a continuum of risk and noting there are products deemed safer than combustible cigarettes. “The speech that he gave was helpful and in contrast to the previous administration that avoided discussing that,” he said. Rodriguez also praised the FDA’s pilot program for nicotine pouch PMTAs, which results in more frequent interaction between the agency and manufacturers undergoing the PMTA process.

Bryan Haynes agrees with his partner that the FDA’s pilot program has shown to be a

“The proof is in the pudding and the pudding is on the table, but the [FDA] needs to serve it up.”

— Agustin Rodriguez, Troutman Pepper

more efficient process with more frequent and less formal communications with applicants. He specifically cited the on! PLUS authorizations — which occurred “at lighting speed,” as he put it — as a very encouraging sign.

Still, this is just a start. “The proof is in the pudding and the pudding is on the table, but the agency needs to serve it up,” quipped Rodriguez. “There needs to be more PMTA marketing orders in the pouch sector moving forward.”

Haynes agrees. “The proof is in the pudding. The pilot program is working as intended for this authorization (on! PLUS). And for a lot of our clients, they saw applications actually getting processed, ones that had languished for a number of years. We want to see a lot more of this,” he said. “My hope and expectation is that it will occur this year.”

Another reason for continued optimism under the Trump Administration is the positive change in regard to tobacco/nicotine regulations that have not happened.

“The absence of category-killing regulations — like the menthol ban in cigarettes, a flavor ban in cigars, nicotine caps, and more — those are positive things not happening that seemed likely to happen under the Biden Administration,” Haynes explained. “So, the absence of things that are bad are a positive right now as well.”

He also reported that there’s buzz that some flavored ENDS (electronic nicotine delivery systems) may begin to get PMTA market authorizations. “It’s another area where the proof will be in the pudding,” Haynes told CSNews

Maximizing Momentum

Most experts agree that the time is ripe for c-stores to maintain compliance in order to make the most of the latest support and industry optimism. But what constitutes compliance?

“There’s a very real situation where retailers are wanting to sell what consumers are wanting to purchase, but there’s also a cloudy situation with wanting to stay compliant,” explained Rodriguez of Troutman Pepper.

“It matters for c-store retailers that authorizations are presumably coming, but I don’t think clarity exists right now for a fully regulated marketplace,” Haynes added.

As the nicotine category continues to expand, it is of the utmost importance that the c-store operator remains diligent in offering only products that

“The absence of categorykilling regulations — like the menthol ban in cigarettes, a flavor ban in cigars, nicotine caps, and more — those are positive things not happening that seemed likely to happen under the Biden Administration.”

— Bryan Haynes, Troutman Pepper

While positive developments are being seen at the federal level, what’s happening at the state and local regulatory levels is cause for concern, according to industry insiders.

Some states and localities are pushing to tax smokefree products the same as cigarettes or worse. For example, Washington State enacted a bill that increased the tax on nicotine pouches by 95% — putting them at a higher tax rate than cigarettes.

“I worry [about] what’s happening in the states. There’s still a huge misunderstanding in some about the relative risk of products,” said Agustin Rodriguez, a partner specializing in tobacco at the national law firm of Troutman Pepper. “There was so much confusion in Washington State; the law that passed was such an overage on the part of the agency.”

He encourages both retailers and trade associations to get the word out that overreaching legislation like this doesn’t make public health sense and is bad for business.

Dan Mulvaney, director of industry engagement for Philip Morris International Inc. (PMI), agrees. He believes local legislation like what Washington State passed offers smokers no financial incentive to move to a less harmful product and sometimes can price out consumers enough that they turn to illicit markets.

“Instead, policymakers should be prioritizing commonsense policy that taxes smokefree products according to their relative risks to encourage switching from more harmful products,” Mulvaney stated.

have undergone the regulatory process, said Ralph Brown, vice president of government affairs for Cheyenne International, a tobacco product manufacturer. “This entails the operator maintaining active engagement with its wholesale and manufacturer representatives to ensure that the products they are offering comply with the requirements,” he said.

NATO’s Spross, while noting that more vapor and nicotine pouch PMTA decisions are expected this year, said in the meantime, he would encourage retailers to sell products that: have PMTA authorization, have an application that is under FDA review, or have a PMTA denial that is being challenged in court. He emphasized that retailers need to continue to train their staffs on preventing tobacco and nicotine sales to minors.

It would also behoove c-store operators to plan for change beyond this year, he said. “With the tobacco and nicotine landscape evolving to less harmful products such as nicotine pouches and vapor products, retailers need to be thinking about providing product options for the adult nicotine consumer of the future,” Spross stated. “This transformation is expected to expand with tobacco heating products on the horizon.” CSN

To stay compliant with the U.S. Food and Drug Administration, convenience store operators should follow these steps and share them with their store managers:

1. Maintain an internal authorized tobacco/ nicotine products list that managers can easily reference. Work only with distributors that provide written confirmation of FDA authorization and/or only sell products that have PMTA authorization, have an application that is under FDA review, or have a PMTA denial that is being challenged in court.

2. Create a compliance binder or digital folder with FDA authorization proof, tobacco permits/licenses, inspection logs and corrective actions. During inspections, documentation can make the difference between a warning or a fine. Courts also have shown growing recognition of retailer good-faith compliance.

3. Conduct annual or biannual refresher training for store personnel on identification verification, compliant nicotine products, and how to respond to inspectors.

4. Monitor state and local regulations apart from the FDA. Assign one person (a manager or compliance lead) to track flavor bans, local licensing rules, excise tax changes and local tobacco directories. Industry experts report that many c-store violations stem from state or local laws, not federal rules.

5. Engage with trade associations and read FDA compliance bulletins regularly. It’s been shown that retailers who stay informed adapt faster and avoid costly surprises. Here, too, it would be beneficial to appoint one person to be responsible for this task.

6. Rebalance the backbar toward growth categories. Gradually shift space toward FDA-authorized nicotine pouches and compliant smokeless products, avoiding overreliance on disposable vapes with uncertain regulatory futures.

We know how your customers roll. With our endless fl avor lineup, every customer can find their favorite. So load up your roller grill with the #1 sausage brand in America* and keep your customers coming back again and again. Which last time we checked, is pretty good for sales. Get the sausage for every customer’s style at JohnsonvilleFoodservice.com.

Convenience retailers can use temporary menu additions to build a permanent customer base

By Angela Hanson

MENU PLANNING IS A KEY COMPONENT of success in convenience foodservice, but all prepared food and dispensed beverage offerings don’t have to be permanent to be advantageous.

Food-forward retailers, including multiple winners of Convenience Store News’ 2025 Foodservice Innovators Awards, are increasingly garnering positive results from limited-time offers (LTOs) that are strategically planned and scheduled.

“LTOs play a critical role in driving trial, creating excitement and expanding the reach of our core menu,” said Philip Santini, senior director of foodservice and bar strategy at York, Pa.-based Rutter’s, last year’s gold-medal winner for Foodservice Innovator of the Year. “They allow us to introduce new flavor profiles, test emerging formats and strategically reposition categories that aim to avoid long-term operational complexity.”

Temporary menu items can cater to different customers in different ways. For newer

“LTOs are a core part of our strategy.”

— Julie Ryan, EG America

customers, they can be an effective way to introduce a c-store or foodservice program. For existing customers, they can provide a new reason to enjoy a familiar brand.

At Westborough, Mass.-based EG America, whose banners include Cumberland Farms, Certified Oil, Fastrac and Tom Thumb, “LTOs are a core part of our strategy,” said Julie Ryan, vice president of food and beverage. Cumberland Farms was last year’s silver-medal winner for Dispensed Beverages Innovator of the Year.

In addition to helping the company test new concepts while gaining deeper insights into consumer preferences, LTOs help cultivate “a distinct food culture,” Ryan said.

“Maintaining a strong innovation pipeline is a priority for us, whether an item ultimately remains an LTO or earns a permanent spot on the menu,” she explained. “Beyond introducing new flavors, LTOs also allow us to respond to shifting macroeconomic conditions.”

As an example, she pointed to the increased focus on health and value-conscious spending seen after the holiday season, which the retailer responds to with protein-forward LTOs.

While Rutter’s has found that prepared food LTOs typically deliver the greatest overall impact because they influence both basket size and meal-part selection, beverage LTOs perform extremely well in key seasons and often drive incremental visits, Santini said.

“Each category serves a distinct strategic purpose and together they help balance our promotional calendar and sustain guest engagement throughout the year,” he added.

EG America also has seen significant results from LTO collaborations within its Hyperfreeze frozen dispensed beverage program. “Our Sour Patch Watermelon Hyperfreeze was one of our top performers [in 2025], resonating with guests across age groups,” Ryan said. “Beverage LTOs give us a powerful way to drive trial, generate excitement and reinforce EG America’s leadership in beverage innovation.”

To develop a high-demand LTO, operators balance multiple priorities. Rising trends may provide inspiration, but c-stores must also weigh practical considerations such as operational feasibility and how well quality and authenticity can be maintained across their footprint.

“We let the customer lead our LTO development strategy,” Ryan explained. “Our focus starts with understanding what our guests want more of, informed by a combination of broader market trends, top-performing items within our own assortment, insights from our supplier partners, and ongoing feedback from our store operators.”

While LTOs provide an opportunity to generate buzz by trying something unique and differentiated from existing menus, operators may want to avoid “polarizing” flavors, according to Dee Cleveland, director of marketing at Nashville-based Hunt Brothers Pizza, which partners with convenience stores across the country.

“We want the c-store to be successful and sell out of their product, not have a hard time with sell-through. While the flavor might be flashy, it may only appeal to certain consumers,” she said.

“While the flavor might be flashy, it may only appeal to certain consumers.”

— Dee Cleveland, Hunt Brothers Pizza

At Hunt Brothers, one of the mottos is keep it simple. “We employ this even in our LTO programs,” Cleveland said. “We do not want them to be a ton of extra work for our store owners, and we don’t want them to have to worry about shifting ingredients from one product to another. Therefore, our LTO pizzas are delivered to the store completely finished and topped.”

Santini has found at Rutter’s that the best results can come from creativity that does something new with ingredients already on hand. Cross-utilization is a major priority for the chain.

“We intentionally look for ways to use the ingredients already in our pantry across multiple menu applications, which keeps costs down, simplifies execution and reduces inventory complexity,” he said.

Rutter’s doesn’t forbid the use of new ingredients, but they must meet clear criteria: operationally simple, scalable across multiple stores, and viable for use in future LTOs or permanent items. “If an ingredient cannot serve more than one purpose, we evaluate it very carefully before moving forward,” Santini noted.

C-stores with more resources can benefit from shifting LTO complexity outside of the store, as EG America does. The company has an onsite culinary center that enables it to produce products efficiently and in varying quantities.

“That flexibility enables us to experiment and innovate without committing to high order minimums, while central assembly helps reduce complexity and labor demands at the store level,” Ryan said.

While execution of LTOs is dependent on in-store labor or external suppliers, she pointed out that EG America frequently seeks to maximize value and operational efficiency using a hybrid approach that mixes existing and new ingredients, such as taking a core pizza or sandwich and

MAY 6-8, 2026

EMBASSY SUITES

SAN ANTONIO RIVERWALK

SAN ANTONIO, TX

CFX BOARD OF ADVISORS

YOU’RE INVITED TO BE OUR GUEST

Come together with the brightest minds in convenience foodservice for two powerful days of insight, collaboration, and connection.

Immerse yourself in San Antonio and experience a highly curated agenda delivering:

• Insight-driven sessions focused on foodservice innovation, execution and profitability

• Power Hour Plus networking, a structured, high-impact session designed to maximize meaningful, peer-to-peer conversations

• On-the-move excursions, including food and store tours that bring learning beyond the conference room

Jeannie Amerson, Executive Consultant, W. Capra (Chairperson)

Jim Bressi, Vice President of Foodservice, Spinx Co.

Ashley Evans, Fresh Food & Dispensed Beverage Manager- ampm, Thorntons & TravelCenters of America, bp US Convenience

Dave Grimes, Vice President of Foodservice, Martin & Bayley/Huck’s

Beth Hoffer, Vice President, Foodservice, Weigel’s

Ryan Krebs, Senior Director of Food & Beverage, Sprint Mart

Ben Lucky, Convenience Retail Foodservice Strategist

Grant Morris, Head of Global Foodservice, Circle K

Philip Santini, Senior Director, Foodservice & Bar Strategy, Rutter’s

Paul Servais, Vice President of Foodservice, Kwik Trip

introducing new toppings or other components. This “allows us to deliver something fresh and compelling without adding complexity to our operations,” she said.

Operators vary on the ideal promotional window for LTO promotions, with most settling on two- to four-month periods. Rutter’s generally plans for a 12-week window.

“It provides enough time for awareness, adoption and meaningful reporting while still maintaining urgency,” Santini said. “We typically aim for a balanced cadence throughout the year that aligns with major category focuses and promotional moments, rather than a fixed number of LTOs.”

Cleveland believes the duration should be based on the brand’s consumer visit cycle. “We have found that typically for our convenience store partners, the visit cycle tends to be a bit higher and move faster, so reducing the duration to six to 10 weeks is the most effective for both consumers and our c-store partners,” she said.

While it’s not uncommon for a successful LTO to eventually become a permanent menu item, retailers should have a clear idea of what value it brings to the menu and why before making such a shift. Rutter’s considers several key indicators: sustained guest demand, strong margin performance, a clear category fit, and operational consistency across stores.

“An LTO must demonstrate stable, repeatable performance beyond the novelty bump and must complement our existing menu. Only when an item proves it can succeed as part of our long-term platform do we evaluate it for permanent placement,” Santini said.

Meanwhile, EG America reviews a combination of customer

“We intentionally look for ways to use the ingredients already in our pantry across multiple menu applications.”

— Philip Santini, Rutter’s

feedback and performance metrics, including close tracking of units per store per day as compared to the benchmark performance of existing permanent items in the same category.

“Equally important is feedback from our store operators,” Ryan said. “They’re on the front lines, talking with guests every day and hearing firsthand what’s resonating and what isn’t. We factor that insight heavily into our decision-making.”

Regional tastes also come into play, especially for a geographically diverse company.

“Certain products can be standout successes in specific markets and given the breadth of our footprint, there isn’t a one-size-fits-all permanent menu across the system,” Ryan said. CSN

Elevate your shelves with this aromatic blend featuring hints of rich vanilla. Swisher Sweets BLK Cream is only available for a limited time, so stock up now!

By Kathleen Furore

increasingly reaching for better-for-you beverages

WHAT ARE YOUR PLANS for the cold vault in 2026? It’s a question that convenience store operators industrywide are weighing as they try to predict the packaged beverages that shoppers will be reaching for in the months ahead.

Recent data from Acosta Group shines a light on what's trending in the category. Sixty-three percent of c-store beverage shoppers are looking for better-for-you (BFY) options at least occasionally, with categories such as protein drinks, hydration beverages and sparkling prebiotic sodas getting attention, according to Acosta Group’s “What C-Store Beverage Shoppers Really Reach For” report, a compilation of insights from proprietary shopper studies.

The boom in beverages boasting healthier flavor and ingredient profiles is a common thread being heard from industry consultants and c-store operators alike.

“The packaged beverage space continues to evolve and is being driven by health trends and functionality. We are seeing this in emerging brands that are providing

cleaner labels in energy products, lower or no sugar offerings, and protein enhanced beverages,” said Scott Johnson, executive vice president of strategy at beverage consulting firm Enliven, headquartered in Franklin, Tenn. “These are long-term trends that have spiked recently with general awareness of younger consumers and the adoption of GLP-1s into the lives of many.”

Chris Stewart, vice president of merchandising at Ankeny, Iowa-based Casey's General Stores Inc., echoes Johnson, noting that the trend is not limited to just one or two types of products.

“Energy drinks continue to be a strong performer in the cold vault, with sugarfree and zero options leading in the category. We’re also seeing functional beverages gain traction across all segments, offering benefits like fiber, protein and electrolytes in formats such as soda, coffee and water,” said Stewart.

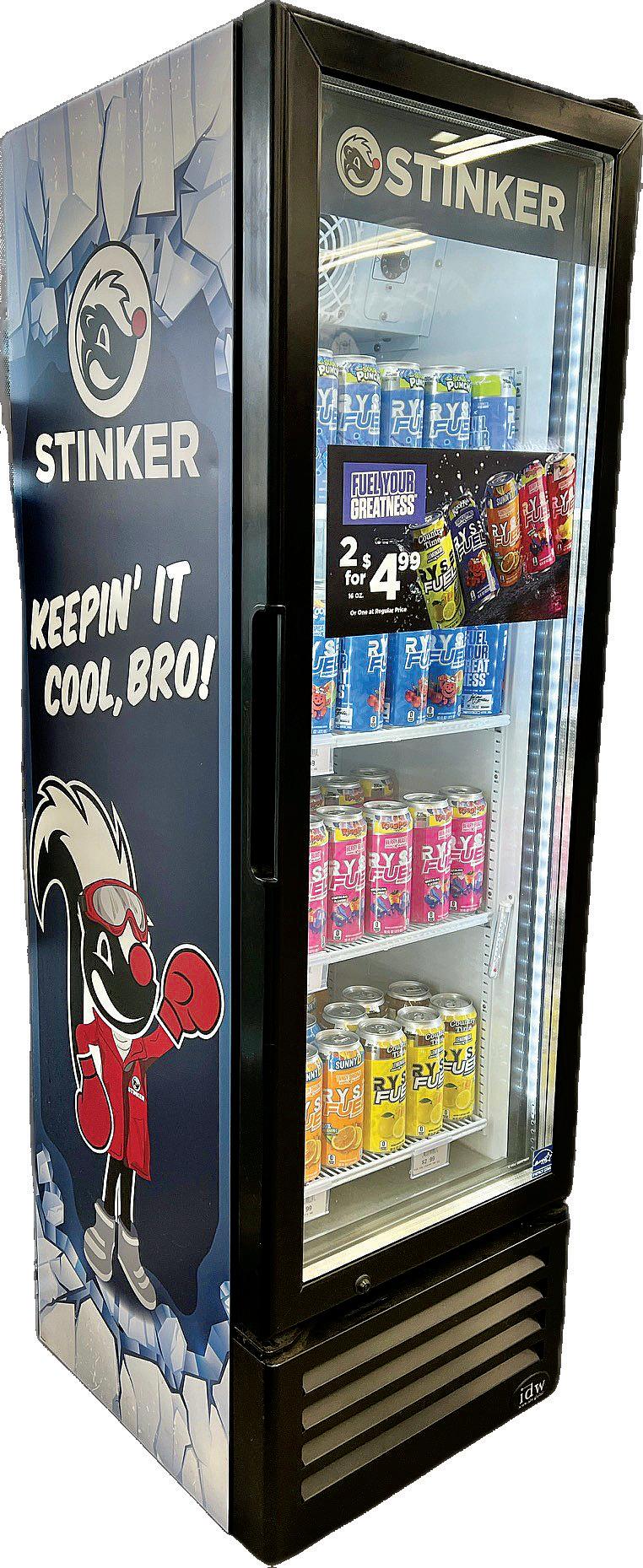

At Stinker Stores in Boise, Idaho, Director of Category Management and Merchandising Ken Rash also sees the trend toward better-for-you and unique flavors in beverages continuing. He suggests his fellow c-store retailers look beyond better-known brands to discover new products to add to their packaged beverage portfolios.

“While the larger beverage brands still have LTOs [limited-time offers] planned in 2026 with some of these

“The packaged beverage space continues to evolve and is being driven by health trends and functionality.”

— Scott Johnson, Enliven

benefits, many smaller companies are developing in other channels and countries outside of the United States,” Rash said. “We have found some of these by looking at the restaurant industry, as well as at chains such as Whole Foods, Natural Grocers and Sprouts.”

How to make the most of limited shelf space is an obstacle that c-store operators continually strive to overcome — one that can make planning cold vault inventory a challenging task considering the myriad options available in the category.

“Limited space in convenience stores is a universal challenge across the entire store and all categories due to their relatively smaller footprint. Making the right inventory decisions is critical for the store operator regardless of the source, whether warehouse-delivered or DSD,” noted Hobie Walker, senior vice president of Jacksonville, Fla.-based Acosta Group’s small format division.

His advice: “Rely on the most current, relevant convenience store shopper data when making inventory decisions.” He went on to cite the company’s 2025 “Convenience Store Shopper Study,” which found that over half of all c-store shoppers who come into the store are seeking products with healthy benefits at least some of the time. “Their list includes vitamin- and protein-infused products and items with less sugar and artificial sweeteners. Making product and inventory decisions with these attributes just makes sense."

Still, that doesn’t mean stocking your cold vault with only BFY beverages is wise. While 63% of c-store beverage shoppers are looking for BFY options, interest is situational, not constant —

21% of shoppers always or often choose BFY beverages while 42% sometimes do.

Also of note: Of the 14 health-oriented beverage types studied, only protein drinks and sparkling prebiotic sodas are consumed by a majority for health benefits, Acosta’s research revealed.

Consequently, it is important for c-store operators to keep in mind that the sweeping health trends driving grocery headlines don’t always translate to the convenience channel.

“Limited shelf space and a shopper mindset rooted in immediacy mean innovation has to prove incremental sales and staying power. In this channel, taste, portability and instant appeal often outweigh ingredient purity or health claims,” Acosta’s report noted.

However convenience retailers decide to stock their cold vaults, creatively merchandising and promoting the category are both keys to unlocking strong sales. For Casey’s, this means looking beyond the cold vault for opportunities to highlight product.

“We know that some of the best opportunities to drive cold vault sales happen outside the vault itself,” Stewart said. “By strategically featuring products on the Front Feature End Cap and leveraging premium placements throughout the store, we can maximize visibility and provide additional holding capacity for high-performing promotions.”

Casey’s promotions prioritize delivering

“We know that some of the best opportunities to drive cold vault sales happen outside the vault itself.”

— Chris Stewart, Casey’s General Stores Inc.

value to its guests, with strategies that make it easy to discover great deals through the Casey’s Rewards program, Stewart explained.

“Guests can save on bundled offers or unlock member-only discounts, which allows us to create exclusive pairings between cold vault items and prepared foods like our handmade pizza,” he said.

Based on its shopper studies, Acosta Group suggests making BFY options easy to spot and recommends three ways that c-store retailers can accomplish this goal:

1. Use signage to highlight on-the-go performance and create impulse zones for wellness-oriented beverages. Functional drinks that are easy to find, clearly messaged and paired with offers convert far better than niche wellness SKUs buried in the cooler.

2. Balance indulgence with BFY alternatives to serve both core and emerging shopper segments.

3. Partner with distributors to finetune planograms and ensure flawless shelf execution.

Ultimately, the secret to success in the packaged beverages category doesn’t lie in what Walker calls “endless innovation.” Instead, he said “it’s about executing with nuance and precision: delivering products that meet shoppers’ immediate needs, merchandising with intention, and aligning innovation with what actually sells.” CSN

In 2023, convenience store chain Stinker Stores decided to try a new approach to packaged beverage sales. The retailer introduced an “innovation cooler” to showcase products not typically found in the regular cold vault.

“We rolled out a four-shelf beverage cooler that focused on bringing in small beverage brands that our consumers might not normally see in our stores or our competitors,” Ken Rash, director of category management and merchandising, told Convenience Store News

That test run has since become standard practice. Innovation coolers are an important component of Stinker’s packaged beverage program today in 75 of the chain’s 93 stores.

“We usually try to get a mix of energy, hydration, sparkling water or soda and maybe a coffee or tea option,” Rash explained. “We have found success with the program and have had several of these brands earn fulltime placement in our regular cooler set.”

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

By Tammy Mastroberte

IN TODAY’S COMPETITIVE ENVIRONMENT, finding and retaining high-quality employees is top of mind for most retailers, especially in the convenience store industry with its historically high turnover rates at the store level. Fostering a positive relationship with employees at all levels and creating a workplace where they know what is required of them, feel supported, and are rewarded and offered growth opportunities can set a company apart from others.

“We want our team members to feel really connected to the overall company culture and a larger purpose where they are part of a family beyond just the store they work in,” said Alison Lapointe, director of talent development and learning at La Plata, Md.-based Dash In Food Stores, which operates 60-plus locations. “For new team members in-store and at new store opening orientations, we let them know they have career opportunities and can grow beyond just the one store, and that we care about them and have a leadership team that will go to bat for them.”

Dash In, which has landed on Fortune’s 100 Best Companies to Work For list multiple times, prioritizes its employees in a number of ways, including profit sharing, flexible time off, daily pay and growth programs. From day one, new store employees are told they could grow from a team member to a supervisor, assistant general manager and general manager.

“It’s important for people to feel like they are not just a number filling a shift and checking people in and out of the store,” said Lapointe. “It’s about connecting them to a larger culture.”

While incentives like a competitive wage, health benefits and the opportunity to work as many as hours as they like are important to employees, it’s also key to make sure they know what is expected of them and to reward them when they perform well, according to Jeff Keune, principal consultant at 4910 Consulting, a Boston-based brain trust that works with c-store retailers.

“It’s important for people to feel like they are not just a number, filling a shift and checking people in and out of the store. It’s about connecting them to a larger culture.”

— Alison Lapointe, Dash

In Food Stores

“There are a lot of great people who leave because they feel like they don’t know what they are supposed to do,” Keune said, noting that training and defining expectations are essential. “Make sure the culture, expectations and standards are clear. Knowing it’s a hard job, the more you can celebrate them and make sure they feel pride and importance in the brand, the better they will do every day.”

Rewards, Benefits & Growth

Offering upfront training along with training that allows for growth within a company is something top-performing employees value and look for in an employer. Whether they’re working the register, handling foodservice, greeting customers or stocking shelves, c-stores need to “set employees up for success,” which means clear directions and expectations from day one, coaching when needed, and rewarding a job well-done, Keune explained.

“Know your brand standards and create an operating playbook laying out systems, processes and expectations,” he said. “There should be coaching if an employee is not meeting standards, but also a culture of rewards when people do a good job.”

At Dash In, each employee receives onboarding training and, recently added, top-performing employees designated as certified trainers go into stores and train others.

“We are being more intentional about coaching and providing feedback — both negative and positive — because people in

general want to do a good job,” Lapointe said.

Highlighting a job done well helps create a positive work environment and gives employees the desire to strive for more. For example, Wendy’s holds national conventions where they recognize team members, store managers and franchisees in a public way, Keune noted. This inspires those who are doing well to work harder, so they can be on that stage in the future.

“Thorntons has had general manager conferences and based on scorecards, the top 10 were brought on stage and recognized with video, and then the general manager of the year drove away with a new car,” he added.

Strong benefits are also something employees look for in a company, whether it’s health benefits, competitive pay, flexible scheduling or the option for daily pay. Dash In provides all of this and more to its team members.

“The baseline is competitive pay,” Lapointe shared. “We are very serious about making sure employees are well compensated and won’t leave to go to a competitor for 50 cents more an hour. We make sure we are competitive, and the benefits we give reflect that as well.”

Each year, the company surveys employees to make sure they understand the benefits package during open enrollment, and then another survey goes out six months later to see what additional benefits employees may be interested in. Both pet insurance and legal services have been added based on this survey, according to Lapointe.

“We added access to a legal plan, so team members can contact an attorney if they need something around child support, divorce, a car accident and more, and people have taken advantage of it,” she reported.

Additionally, the chain offers 100% tuition reimbursement for college and GED, as well as “a really generous 401K program” with all full-time employees automatically enrolled, Lapointe said, noting that this benefit is also extended to part-time employees who work 30 hours a week.

“We automatically start putting 2% of their pay in and we match up to 7%. We do profit sharing as well each year.”