faces, we have the solutions to help – and beyond. In addition to driving commitment to innovation helps you stay your consumers. Natural* Meats | Star Ranch Angus® Beef | Reuben® Corned Beef

Tyson Foods is constantly evolving and growing to stay relevant and defend our title of the Beef & Pork Experts™.

Visit theBeefAndPorkExperts.com to learn more about our innovative solutions.

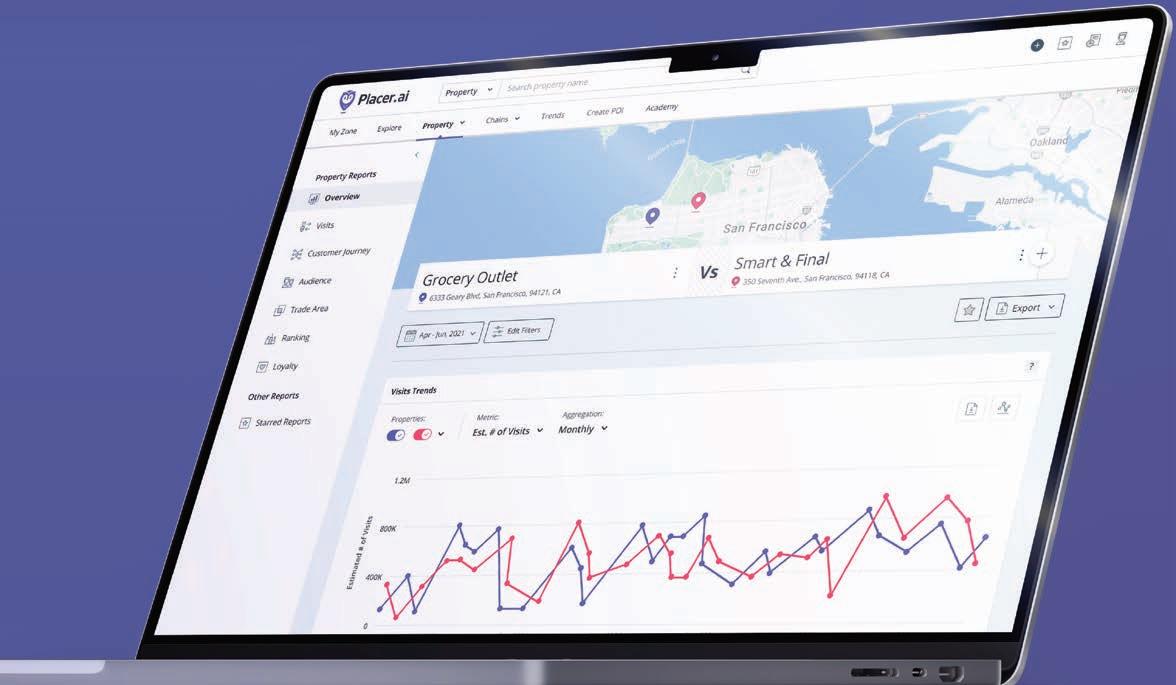

Unleash the power of real-time intelligence with City US’ SOUNDTech+ powered by DST machine learning and AI. This cutting-edge technology uncovers valuable data to help detect and prevent equipment failure with predictive maintenance that’s not possible otherwise. City’s Energy Bureau and expert facilities teams also use big data to take fast action to increase efficiency, cut costs and fine-tune asset as well as energy management. And our advanced Internet of Things framework provides a backbone for legacy and new systems alike to stay connected — and deliver insights that help sharpen your edge in real time.

Contact us at sales@cfm-us.com Learn more at CityFM.us

According to Bloomreach’s chief strategy officer, grocery needs to be customized to each shopper.

Albertsons’ Rosita Szatkowska received a $5,000 grant at the recent Top Women in Grocery event.

Breaking Through

PG presents the top 10 innovations expected to transform grocery in 2023.

Grocers should set their sights on net-zero targets by taking a holistic view of decarbonization efforts.

The food retail industry is transitioning toward a sustainable future through innovation.

Food retailers can do various things to keep their stores and offices staffed.

A visit to Bowery Farming’s largest facility to date reveals how the company is in the forefront of changing how produce is grown and shipped.

8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com

BRAND MANAGEMENT

BRAND DIRECTOR John Schrei 248-613-8672 jschrei@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS Jenny McTaggart, André Patenaude and Barbara Sax

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI) Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALE MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

BUSINESS DEVELOPMENT MANAGER Lou Meszoros 203-610-2807 lmeszoros@ensembleiq.com

ACCOUNT EXECUTIVE/CLASSIFIED ADVERTISING Terry Kanganis 201-855-7615 • Fax: 201-855-7373 tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com

AUDIENCE LIST RENTAL MeritDirect Marie Briganti 914-309-3378

SUBSCRIBER SERVICES/SINGLE-COPY PURCHASES Toll Free: 1-877-687-7321 Fax: 1-888-520-3608 contact@progressivegrocer.com

PROJECT MANAGEMENT/PRODUCTION/ART

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Rebecca Welsby rwelsby@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Single copy price $14, except selected special issues. Foreign single copy price $16, except selected special issues. Subscription: $125 a year; $230 for a two year supscription; Canada/Mexico $150 for a one year supscription; $270 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $170 a one year supscrption; $325 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA.

POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Copyright ©2022 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

A LOOK BACK AT A PIVOTAL TIME FOR BOTH PROGRESSIVE GROCER AND THE ESSENTIAL INDUSTRY IT COVERS.

n early November, top leaders from every corner of the grocery industry gathered in Orlando, Fla., to attend Progressive Grocer’s inaugural Grocery Industry Week. It was a pivotal event during a pivotal year in which PG celebrated its 100th birthday, I became editor-in-chief of this wonderful brand, and the grocery industry recalibrated many aspects of its operations, including returning to in-person events after nearly three years of a catastrophic pandemic.

More than 600 attendees traveled to the Hyatt Grand Cypress Resort near Walt Disney World to attend the sold-out summit, which consisted of GenNext: The Future Leaders Forum (a celebration of the most promising emerging talent in grocery); the Grocery Leaders Executive Forum (thought leadership from senior executives on the major issues post-COVID that have affected grocery); our first-ever Retailer of the Century Awards (a celebration of the food retailers that have had the greatest influence on the industry over the past 100 years); and PG’s renowned Top Women in Grocery extravaganza (the most prestigious honor for female leaders in the grocery industry).

Executives such as Kroger CEO Rodney McMullen, Meijer CEO Rick Keyes, Hershey CEO Michele Buck, Albertsons COO Susan Morris, Shipt CEO Kamau Witherspoon and Publix SVP John Goff participated in the events, among hundreds of others.

Lowes Foods President Tim Lowe kicked off the Grocery Leaders Executive Forum with an inspiring presentation on why grocers need to get into the entertainment business, especially post-pandemic.

In another forum session, McMullen explained the reasoning for his company’s planned merger with Albertsons. He said that he prefers the term “merger” to the idea of an “acquisition,” because both companies have something to offer the other.

I’m so thankful to work with such talented and wonderful people. I’m so grateful to have been given the opportunity to spend my days thinking about the evolution of grocery e-commerce, the resilience of supply chains and the future of in-store experience.

“You’ll never hear me use the word ‘acquire,’ McMullen said. “To me, it’s about merging and bringing out the best of both companies. As long as we’re humble enough, I guarantee you there are a lot of things that Albertsons does better than us. Hopefully, we’ll find some things that we’re better at as well. Together, we can create something that neither party can do individually.”

A couple of weeks after appearing at PG’s forum, McMullen and Albertsons CEO Vivek Sankaran headed to Washington, D.C., to answer

congressional questions over the merger.

PG’s multi-day conference featuring thought-provoking content and incredible networking opportunities culminated with the Top Women in Grocery Gala, where program honorees Mary Ellen Adcock, SVP of Kroger, and Michele Buck, CEO of Hershey, were honored with Trailblazer awards. Additionally, Meijer VP of Fresh Lynette Ackley was inducted into the Top Women in Grocery Hall of Fame, and the inaugural Salesforce Continuing Education Award went to Rosita Szatkowska, a grocery operations specialist from Albertsons and 2022 Rising Star. (You can read more about Rosita’s award on page 67 and more about Top Women in Grocery in this issue’s Ahead of What’s Next column by PG Managing Editor Bridget Goldschmidt on page 98.)

As I look back on my first year as editor-in-chief of PG, our triumphant Grocery Industry Week, and everything that my incredible team of editors — Bridget, Senior Editor Lynn Petrak, Digital Editor Marian Zboraj and Multimedia Editor Emily Crowe — have accomplished, I’m so thankful to work with such talented and wonderful people. I’m so grateful to have been given the opportunity to spend my days thinking about the evolution of grocery e-commerce, the resilience of supply chains and the future of in-store experience. And I’m exhilarated for what’s to come.

Gina Acosta Editor-In-Chief gacosta@ensemleiq.com

1

Black History Month

Canned Food Month

Celebration of Chocolate Month

Great American Pie Month

National Cherry Month

National Grapefruit Month

2

3

4

Change Your Password Day. Good advice, applicable both at home and at work, to start off the month.

Groundhog Day. Take friendly bets on whether Punxsutawney Phil will see his shadow.

Bubblegum Day. Make sure that the front end is stocked with an enticing selection for impulse shoppers.

National Homemade Soup Day. Point customers in the right directions with signage pointing out the proper ingredients across the store to prepare a comforting creation from scratch. 5

6

7

8

9

10

11

National Pork Rind Day. Go ahead and dig in.

National Valentine Shopping Reminder Day. Post friendly hints in the card, candy and floral departments.

National Fettuccine Alfredo Day. This classic rich pasta dish is deserving of reappraisal – and perhaps a low-carb makeover.

13

14

National Boy Scout Day. Give a salute – and a free piece of fruit – to any uniformed scouts who enter your store(s).

National Pizza Day. Why should shoppers call a takeout place when they can just pick one up from your prepared food or frozen sections?

National Cream Cheese Brownie Day. Showcase this swirly baked treat in the in-store bakery.

National Latte Day. Steer customers to your on-site coffee shop for a little espresso and steamed milk while they shop. 12

15

16

17

18

National Homegating Day. Encourage shoppers to keep the party at home when they settle down to watch the Big Game.

National Cheddar Day. Proudly display your finest wheels, wedges, chunks and slices of America’s favorite cheese.

It’s Valentine’s Day, of course, but also make sure to mark National Call in Single Day for those unattached souls who want some “me” time.

National Black Girl Magic Day. Celebrate all of the amazing African American women in your world.

Fat Thursday. This Polish observance takes place right before the 40-day period of Lenten fasting, so get the paczki (Polish doughnuts) ready.

Since Girl Scout Cookie Weekend starts today and runs through the 19 th, invite troops to set up tables in front of your stores to sell this highly popular fare.

National Battery Day. This is a good time to check that smoke detectors, flashlights and other important equipment haven’t run out of juice. 19

National Lash Day. Customers in search of the perfect smoky eye need look no further than the cosmetics aisle.

26

National Pistachio Day. Whether eaten on their own, in a range of dishes or in ice cream (yum!), these nuts pack powerhouse nutrition.

20

National Comfy Day. Now is the time to promote herbal teas, bath beads, aromatherapy and other relaxing items.

21

International Mother Language Day. Have all of your associates who learned English later in life share a (clean) phrase in their original tongue.

22

Ash Wednesday

Cook a Sweet Potato Day

23

National Toast Day. Pay homage to this simple but beloved dish by polling shoppers to see what their preferred type of bread is to toast and what their favorite topping is.

27

National Protein Day. Plant- and animal-based items get equal star billing today.

28

Floral Design Day. Let your talented floral associates show just what they’re capable of.

24

I Hate Coriander Day. Here’s a chance to change the minds of those who think this herb tastes soapy –crushing or cooking it is said to reduce any unpleasant flavor.

25

Let’s All Eat Right Day. Provide some nutritious but tasty recipes for families to try.

Total retail sales of packaged still and sparkling water reached an estimated $23.7 billion in 2021. Increased consumer interest in health and wellness drives the market’s growth as consumers swap sugary drinks for still and sparkling waters.

Consumers’ return to social activities in 2021 greatly benefited the bottled water market, and bottled water brands across the board, from basic private label to premium aspirational brands, experienced increased growth.

Sparkling and mineral water remain two of the fastest-growing nonalcoholic beverage categories, and 2021 sales may have been even higher if not for supply chain constraints.

Functionality is the most prevalent trend within the water category as brands launch new water products that go beyond just hydration. From probiotic waters that support the microbiome, to relaxation waters that help mitigate stress, all functional benefits are on the table when it comes to water product innovation.

Flavor innovation represents a key opportunity for brands to attract younger consumers, and unique flavors can allow water to compete with flavorful beverages such as carbonated soft drinks and sports drinks. Floral- and herbalflavored waters are trending, indicating opportunities for waters that blend familiar and trending flavors, such as blueberry lavender or watermelon mint.

Basic private label bottled water is a growing segment of the water market, and while consumers view refillable water bottles as the most environmentally friendly water option, bottled water’s taste and convenience outweigh environmental concerns in the minds of most consumers. However, increased discourse regarding climate change may result in decreased water bottle purchases.

Packaged water is a growing market, thanks to high consumer interest in betterfor-you beverages and the strong association between health and hydration.

Water’s inherent health benefits should be enhanced with functional ingredients that transform water into the ultimate functional drink. Functional claims bring water into new consumption occasions and appeal to Gen Z and Millennial consumers.

Sales have increased 40% since 2016, making packaged water one of the strongest-performing markets in the beverage industry.

Flavored still and flavored sparkling are two of the fastest-growing segments of the water market, as flavor innovation makes water a more exciting and enjoyable beverage. Flavor innovation appeals to younger water consumers and is necessary for products to stand out on shelf.

mid the hustle and bustle of the holiday season, shoppers are also setting their sights on the ways that they can make positive changes for their health in the new year. Too often, customers rely on weight man agement as a barometer by which to measure their health successes or failures. Weight loss and dieting are fleeting, however, and not reliable measures of health status, despite making regular appearances on New Year’s resolution lists. Healthy eating doesn’t necessarily mean striving for the latest low-calorie food, but should instead be focused on seeking out foods with more health benefits, like helping to control or prevent chronic disease, and foods that are rich in vitamins, minerals and other nutrients.

Retailers can be allies to patrons by ushering them into the better-for-you sections of the store to highlight nutrient-dense foods that match their life styles and preferences. Throughout the aisles, plenty of products exist that combine easy preparation, affordability and impressive nutrition facts. Encourage consumers to browse healthy foods for their upcoming 2023 eating resolutions in four major grocery store sections: produce, frozen, delicatessen and canned foods.

Nutrition abounds in the produce section. Whether it’s kum quats, dragon fruits and pomegranates, or mushrooms, lettuce and tomatoes, fruits and vegetables offer power beyond the plate. These foods may increase energy, improve digestion, protect organ function, and prevent major health conditions like cancer, diabetes and heart disease. Partner with your merchan dising and category management teams to set up informative displays in the produce area that highlight major benefits of in-season win ter produce like sweet potatoes, pears, Brussels sprouts and kiwi. Invite your retail dietitians to coordinate cooking demos that draw attention to these fruits and vegetables through attractive main dishes or welcome side dishes to improve sales lift and foster customers’ health.

Frozen foods have seen much more widespread acceptance over the past several years, as evidenced by the growing share of shoppers’ carts. Meals, snacks and even novelties in the frozen section have expanded in variety and seen improvements in ingredient decks. Create window clings and add more meal suggestions within your retailer’s app to inspire customers to make meals and snacks using frozen foods. Examples include smoothies

(frozen fruit + frozen vegetables + protein powder + low-fat dairy/nondairy milk); stir-fries (frozen vegetable and noodle kit + frozen poultry/plant-based poultry + low-sodium sauce); or waffles (frozen wholegrain waffles + frozen berries + maple syrup).

The deli doesn’t just mean cold cuts and cheese slices, but also salads, prepared pastas, soups, relishes, salsas, spreads and more. Lure shoppers to this area by showcasing products that are both convenient and healthy additions to mealtime. Provide digital coupons for stacking the savings on larger quantities of foods to support New Year’s goals, such as bean-based soup, hummus, mixed green salads, roasted vegetable mixes, light coleslaws and lentil salads. Shoppers may also respond well to good deals on building a “to-go” meal from three or more deli items, or coupons toward better-for-you meal kits that take the guesswork out of eating well in the new year.

Foods preserved via canning have long shelf lives and are simple to add to healthy recipes for the home cook. Show how versatile canned goods can be with cross-merchandising efforts. Canned fruit like no-sugar-added cherries with reduced-sugar ice cream, or canned no-salt-added corn and black beans with whole wheat tortillas, make it practical for shoppers to build their carts well for 2023. Take the opportunity to clear up any confusion that customers may have about the healthfulness of canned goods by inviting your social media teams and retail dietitians to create blogs, livestreams and other digital content to emphasize the benefits associated with many canned foods.

The new year often brings a renewed interest in personal health and can provide the perfect opportunity for retailers to be true wellness destinations for their shoppers and communities.

HELP SHOPPERS MAKE POSITIVE CHANGES FOR THEIR HEALTH THIS COMING YEAR.

Retailers can be allies to patrons by ushering them into the better-for-you sections of the store to highlight nutrientdense foods that match their lifestyles and preferences.

e at NextUp held our annual Leadership Summit at the Hyatt Regency Dallas, Oct. 19-21 – our first in person since 2019. Over three jam-packed days of learning, we connected with one another and took in the inspiration and strategies that will change the working world for the better for women.

On our first day, keynote speaker Katie Goodman encouraged us to use our creativity to get our ideas out there without letting perfectionism or our inner fears hold us back, while Christine Ruggiero showed us all the value of giving ourselves permission to have our emotions as we process hard things – but then getting ourselves together and being the leaders we need to be.

The amazing Anna Gifty Opoku-Agyeman, an award-winning researcher,

preventive care for an organization. We can each be a sponsor instead of a gatekeeper, intentionally becoming someone who ushers in and equips the next generation.

Lorraine Stomski, SVP, associate learning and leadership at Walmart, gave us great advice about using our influence and our voices to support women. Development and opportunities to upskill can improve a diverse talent pipeline. As leaders, we also need to be vulnerable, owning our mistakes and lessons learned, and having truth-tellers in our lives. That makes us better leaders.

The Women in Tech panel was highly informative. The main takeaway was that female leaders in the tech industry must be intentional about creating spaces under them to bring in a diverse group of women, and we have to measure where

we are and where we want to go in improving female representation in the tech industry. Inclusion must be approached systemically, and leaders need to sponsor, not just mentor, those that they’re bringing in.

Derek Lewis, president, multicultural business and equity development at PepsiCo Beverages North America, told us that when we gain positions of power, we need to use them. We should immediately take responsibility to hire diversity in thought, skills and looks. Further, we need to make the changes that are translated into day-to-day practices. These are the minute-by-minute actions of everyday business that are necessary to create real change and enable people to be both go-getters and go-givers.

There was so much more learning than we could possibly sum up in a single article — and for all of you who weren’t there, we want you with us next year. Check out nextupisnow.org to learn more about NextUp, our mission to Advance All Women and our two annual national conferences.

NextUp is a 501c3 nonprofit dedicated to Advancing All Women. NextUp has more than 15,000 members, 21 regions, and 300-plus national corporate partners and regional sponsors committed to transforming workplaces for gender equity.

The pandemic may be finally behind us (fingers crossed), but the grocery retail landscape is still proving difficult to navigate as operators grapple with such problems as lingering supply chain snarls and surging prices due to record inflation. In such a climate, those brands that have stepped up to provide trusted guidance on how to keep sales growing not just in their particular categories — even relatively mature ones — but also throughout the store, have emerged as retailers’ staunchest allies in generating hard-won profits.

Whether by creating attractive in-store displays, rolling out smart cross-merchandising initiatives, launching effective traditional and digital marketing campaigns, developing on-target new products to meet evolving customer needs, or sharing impactful advice based on carefully gathered consumer insights, the 19 brands profiled in the following pages refused to let category and total-store sales slide, choosing to work with their retailer partners to make a real difference in the aisles.

By PG StaffBased on their submissions detailing the various ways that they helped retailers succeed despite the many real challenges encountered by food manufacturers and sellers over the past year, Progressive Grocer chose those brands whose efforts in this space our editors deemed the most impressive. Read on to find out just how each of the 19 companies profiled in the following pages earned its wellearned spot as a 2022 Category Captain.

PG pays tribute to those companies who excelled in category management during another challenging year for the grocery retail industry.

AbbottWhen a national retailer was experiencing a market share gap in the oral electrolytes category, Abbott shifted strategy to capitalize on the latest shopper trends, providing recommendations to drive category growth and market share.

Abbott conducted consumer research to understand purchase intent and incrementality to the category. What it found was that the oral electrolytes category is a growth segment, with a 14.6% five-year growth projection, and that the pandemic accelerated the importance of hydration, immunity and health. With a substantial 80% of consumers worried about protecting their immunity, shoppers expect to find oral electrolytes in three to four locations in the store, based on need state. Abbott further discovered that immunity-focused brands saw a 190% increase in sales during COVID, that one in five shoppers have tried a new product due to health messaging, and that 32% of oral electrolytes users want benefits beyond rehydration.

Based on this research, Abbott proposed the following strategy to the national retailer: Add incremental/relevant innovation to the oral electrolytes

segment and de-seasonalize immunity. The product being researched was differentiated with added zinc and magnesium for immune support, but with the trusted power of Pedialyte to hydrate. Shopper activation consisted of a digital approach to reaching parents and adults seeking cough, cold and flu solutions during the key Q1 and Q4 time periods. The plan included on- and off-site digital media and banners communicating the key benefit of immune support to shoppers. Placement was in the healthand-wellness section, reaching shoppers focused on proactively boosting hydration/immunity or on using immune support products while sick.

In July 2021, two Pedialyte Immune Support products launched at the national retailer, along with the strategy. As a result, the national retailer gained 4.1 points of market share in the pediatric digestive health category, expanded oral electrolytes usage occasions and brought new users to the category.

Further, the targeted media activation garnered a $2.11 incremental return on investment for the brand, a 16% sales lift and 49% new buyers to the brand. Perhaps most interestingly, unaided social media impact from influencers on Instagram and Twitter drove an 18% lift in brand sales.

Over the past several years, the alcohol industry has seen significant shifts in consumer and shopper preferences blurring the traditional categories of beer, wine and spirits. This shift started with flavored malt beverages and then progressed to malt-based seltzers, and now to wine and spirit-based seltzers. These significant changes in consumer demand have created complexity for shoppers and retailers alike with the emergence of a fourth category.

Anheuser-Busch has led the conversation in defining this new category, creating a framework to analyze it and introducing recommended merchandising guidelines for retailers to effectively grow these products. A-B spent hours talking to people to define the new category, which has been dubbed “hard beverages.” People define the term as fully formed alcoholic drinks generally not exceeding 20% ABV in a convenient option. Flavor is the primary attri-

bute, with a range from light to flavorful across various dimensions of carbonation, alcohol taste and drink profiles.

After A-B polled consumers to define hard beverages, the company created a category expansion framework to analyze and provide insight into growth trends, innovation white space and merchandising recommendations.

Starting with the understanding that this area is huge — $9.4 billion over last year — and that the growth is 24% incremental to alcohol, the hard-beverage space creates the opportunity to manage this complexity as a new category.

A-B also researched how shoppers interact with hard beverages to create a set of merchandising guidelines for retailers. Key principles include providing a unified location for hard beverages of any malt, wine or spirit base; merchandising

adjacent warm and cold beverages together; and focusing cold placements on top brands with the highest rates of sale.

Using this research, A-B has worked with several retailers to bring these recommended strategies to life. A major national grocer that reallocated cold wine space to hard beverages has seen 130% growth in spirit-based hard beverages. A regional grocer that reflowed its sets to put hard beverages first in the flow has seen dollar sales grow 8% in the latest year. Also, a major national mass retailer implemented a new buying structure to reduce the complexity across traditional beer, wine and spirits responsibilities.

A-B continues to integrate these insights and recommendations into Ignite, its retail category strategy, to continue advising retailers on how to effectively grow the alcohol category. In fact, the company has leveraged both established industry research partners and cutting-edge providers to inform how the alcohol and beer category will grow.

As COVID waned and inflationary pressures grew, A-B led the conversation with the industry in terms of consumer insights, evolving occasions and shopper behaviors. Off-premise category growth has largely held from COVID, but consumer demand and shopping behavior have begun to shift. A-B brought new insights and recommendations to retail to help capture growth. The waves of

A-B recommended to a large regional grocer a proactive shelf space allocation that has contributed to 0.9 points of market share growth. Retailers continue to drive traffic through remodels in their alcohol departments and are adding more space to meet the elevated demand. A-B continues to enhance alcohol macro-space insights and recommendations to find macro-space opportunities and understand alcohol’s role within the context of the total store. A major national grocery retailer has leveraged these recommendations to add about 10 feet of additional alcohol space to its remodels, beginning in late 2022.

Additionally, the online alcohol category continues to see growth. A-B has continued its work with retailers and to make recommendations to drive online growth leveraging Ignite omni-fundamentals and growth drivers on the shifting online shopper. This year, A-B evolved its proprietary eRetail scorecard system to encompass 46 benchmarks, launching with national grocers to identify opportunities that spur online loyalty and sales.

Additionally, A-B launched The Vault in 2021, a one-of-a-kind collaboration center where it’s designing the future of total alcohol. In The Vault’s first full year, A-B hosted 15 retailers across grocery, mass, drug and convenience, each visit highlighting trends in regard to consumers, occasions and the alcohol industry,

opportunities

programming, hard beverages

capabilities.

Innovation has been a focus for A-B over the past year, with new products shaped by the macro-trends of premiumization, health and wellness, flavor, and the value equation. The company’s innovation has helped increase category growth in the grocery channel. One example is the launch of Bud Light Next, the first national zero-carb light lager.

with specific

for growth via macro-space planning, meals

and category

Challenge is laser-focused on moving the overall butter category forward for retailers and end consumers. As the largest butter manufacturer in the United States, it delivers upwards of 50%-70% of the total butter category for retailers between its Challenge and private brands, with an emphasis on driving incrementality.

While the butter/margarine category grew 19% during the pandemic as people rediscovered the joy of baking, the team at Challenge Butter was behind the scenes working to reimagine the future of butter in a post-pandemic world to ensure continued growth. Through extensive primary shopper research that took the Challenge team into the homes of butter consumers, the company discovered a huge opportunity to expand usage occasions beyond breakfast and dinner. Another key learning was the need for the category to appeal to younger demographics.

With the pandemic uppermost in consumers’ minds, and new habits engraining themselves into daily life, consumers’ willingness to adopt a healthier lifestyle only grew stronger. Chiquita took this opportunity to own the breakfast occasion by promoting cross-category consumption and reinforcing the position of its bananas as a breakfast staple.

Although breakfast is recognized by many as the most important meal of the day, various expensive options make a balanced, nutritional breakfast seem out of reach for families. Leveraging the position of cereals, yogurts and bananas as healthy breakfast classics, Chiquita teamed with General Mills on the Go Bananas for Breakfast campaign to highlight that good nutrition can be affordable.

On average, a bowl of any General Mills Big G cereal with a Chiquita ba-

Challenge’s research also uncovered that consumers shop the category through the lens of six subsegments. By understanding the distinct role of each segment, the company identified opportunities to drive new usage while simultaneously appealing to new consumers.

This research influenced retailers to re-evaluate the category for the first time in decades. The most underdeveloped segment was flavor, previously an afterthought in innovation and assortment decisions. Challenge seized the opportunity by introducing six Butter Snack Spreads in dessert and seasoned

varieties. By delivering a 45% increase to basket size, Challenge Butter Snack Spreads enable retailers to capture incremental value among butter shoppers.

Within the category’s finite space, a distinct merchandising strategy was essential to deliver on consumer needs and to capture growth. Challenge Butter Snack Spreads were the first spreadable butter varieties to be available in shelf-ready packaging, adding efficiency for retail workers at a time when labor challenges were escalating. Another first for the category was a fun augmented-reality experience for consumers through a QR code on the product lid to drive deeper consumer engagement, in addition to online shopper marketing efforts.

These unique snack spreads and creative initiatives have propelled Challenge into the position of a leading innovator in the butter category, bringing excitement, flavor and quality offerings that push the boundaries of the dairy case.

aimed to address the finding that most Americans don’t consumer the recommended daily amounts of whole grain, calcium, vitamin D and potassium, according to the 2020-25 Dietary Guidelines for Americans. By incorporating all three foods into one breakfast, Chiquita and General Mills help fuel consumers with three of the five recommended food groups — grain, fruit and dairy — delivering 12-plus grams of whole grain, 30% of the daily value of calcium, 25% of the daily value of vitamin D and 15% of the daily value of potassium.

$1, making it one of the most affordable and nutritious breakfasts around. Thus, from Jan. 1 to mid-April 2022, Go Bananas for Breakfast offered an easyto-prepare, nutritious and affordable breakfast bowl with all three brands in a limited-time offer to save up to $6 via on-pack coupons and a digital rebate.

The breakfast bowl combination

To reach its audience, the campaign used linear and online TV ads, programmatic and YouTube ads, and a robust social media campaign. To raise awareness of the campaign in-store, Chiquita built its presence outside of the produce section with point-of-sale materials in the cereal and yogurt aisles of key retailers.

In stores where both Chiquita and General Mills were present, IRI logged a 2% dollar sales increase versus 2021.

As an iconic 136-year-old brand, The Coca-Cola Co. is consistently looking for ways to deliver exciting innovation to consumers who are familiar with the brand, while investing in the refreshment of future drinkers. Developed under the successful Real Magic brand platform, Coca-Cola Creations launched in February 2022, seeking to drive engagement and relevance with Gen Z by quenching their thirst for discovery through unexpected beverages and packaging designs, culturally relevant expressions, and creative collaborations.

Coca-Cola Starlight and Coca-Cola Starlight Zero Sugar hit shelves in the United States in February 2022 as the first limited-edition flavor offering from the global innovation platform Coca-Cola Creations. Appearing on the market for about six months, the Starlight beverage was inspired by the infinite possibilities of space, fusing signature Coca-Cola taste with unexpected touches like a new reddish hue. Coca-Cola Starlight also boasted a novel packaging design featuring a multidimensional light-filled star field.

With the private space exploration sector seeing $366 billion in revenue in 2019, as reported by the Harvard Business Review, Starlight created a category solution by leveraging the outer-space curiosity of Gen Z. Throughout its limited release, Starlight generated $225 million in incremental dollars to the sparking soft-drink (SSD) category, based on data from Numerator and Nielsen. This was largely achieved by expanding existing drinkers’ consumption while also recruiting Gen Z into the category with the aim of haloing across core Coca-Cola brands.

Positive results for Starlight were realized early on: Walmart pre-order product completely sold out in one day, resulting in the highest one-day unit sell for The Coca-Cola Co. on Walmart.com.

“Walmart is leaning in,” notes Todd Wetmore, merchandising director of carbonated soft drinks at the retailer. “We deem [Starlight] as the [SSD] category’s No. 1 innovation item for Q1.”

To connect further with trendy Gen Z consumers, Starlight also became the first Coca-Cola product to debut on the popular livestreaming platform Twitch. Starlight also harnessed the power of Gen Z influencer culture by creating bespoke boxes that articulated the full magic of the Starlight experience. The campaign was anchored by a partnership with global pop star Ava Max that featured an augmented-reality “Concert on a Coca-Cola” experience available exclusively by scanning a Starlight can.

The launch of Starlight has no doubt proved successful for Coca-Cola Creations, with the products generating $57 million in total year-to-date sales, and 50 million bottles and cans sold, according to Nielsen. Starlight created a strong, positive halo around the Coca-Cola brand, with 78% of previous non-Coca-Cola purchasers having purchased another Coca-Cola product since buying Starlight.

With additional limited-edition beverages already in the works, Coca-Cola Creations is poised to introduce more innovative products and experiences across the physical and digital realms.

It was a challenging year for produce, thanks to such headwinds as supply chain disruptions, inflation, and consumer trends toward indulgent foods. Dole’s category leadership rose to meet the challenges, providing strategic direction to retail to re-engage lost buyers, optimize promotions, and implement winning pricing, merchandising and marketing strategies.

Inflation has affected shopper be-

havior, causing trade-down within the value-added salad category and switching out to commodity vegetables. One example of this includes Dole partnering with a national retailer to regain kit buyers, leveraging a $1-off-a-Dole-kit promotion.

The promotion drove a 25% increase in households buying a Dole kit and a 5% increase for any kit, along with 22% dollar sales growth for Dole kits and 4% growth for any kit among households that hadn’t purchased a kit

in the previous 12 weeks during the promotion period. Results remained similar after the promotion.

Also, higher average retails on shelf in 2022 wreaked havoc on retailers’ promotional strategies. Dole partnered with a large Midwest retailer, using its historical elasticity coefficients through Nielsen’s Revenue Management and Optimization (RMO) portal to project the impact of adjusting everyday chopped kit pricing from $3.99 to $4.19 and promoted pricing from

$2.99 to $3.14. The projected results showed a 5% increase in dollars, with little impact on unit sales, and a 5.3% increase in net revenue. Actual results proved better than projected promotional outcomes for the retailer, with an increase of 25.1% in dollars, 6.3% in units and 30.9% in net revenue.

Finally, organic continues to be the fastest-growing banana segment and the best means to drive organic volume in the produce department. Dole worked with a retailer to increase conventional pricing, narrowing the price gap to organic and fueling trade-up. In addition, Dole identified stores in which to deploy secondary display racks and marketing tactics to boost banana awareness and consumption. These actions led to organic dollar growth of 17.6%, versus

run-of-market growth of 0.7%, without cannibalizing conventional — 4.3%, versus 2.0% run of market — and increased total banana revenue of 5.3%, versus 1.5 % run of market.

Activating these pillars, Dole stepped

up collaboration to reach new heights in retail partnerships, enabling those retail partners that heavily depended on the company’s category development team to add between three and four points of growth ahead of their competitors.

You might say that E&J Gallo Winery thought outside the box when it came to making a play for sales. To capitalize on growth in the 3-liter (3L) box wine segment — which has been propelling overall wine category growth sales and outpacing the leading 750-milliliter and 1.5-liter sizes — the wine company teamed up with the National Cattlemen’s Beef Association on a Game Day Ready joint promotion in early fall 2021.

The MVP of the program was Gallo’s Black Box brand of 3L boxed wine. The No. 2 brand in its package class, that variety was up 9.9% in sales on a year-over-year basis and came in as the sixth overall wine brand in sales in the United States, according to Gallo. The Black Box portfolio encompasses Cabernet Sauvignon, Chardonnay, Pinot Noir and Pinot Grigio, sold in shatterproof and resealable boxes.

The wines were positioned as an adult-beverage choice for watching the game either at home or at a tailgate party or other celebration. Through the promotion, shoppers could score dual-purchase coupons for the product and for $5-off beef items.

As intuitive as the pairing of wine and beef seems, Gallo confirmed the potential of the program by targeting consumers who overindexed in watching professional football, baseball and basketball games while enjoying their favorite beef recipes and wine.

To kick off the promotion in eye-catching style, the company developed point-of-sale display materials that included a 3D pricer frame, an end cap kit, and a saddlebag kit featuring both Gallo and beef logos. A modified flex kit was also available, containing enough materials for three displays: a 36-foot roll, three oversize pillow signs and up to 15 price shelf talkers. Digital was part of the mix, too, through digital coupons and a QR code that enabled shoppers to enter a sweepstakes to win game-day essentials.

Many participating retailers cruised to a win with this joint promotion. One retail customer reported a 59% lift in total basket sales when Black Box was included, while that store’s meat category experienced its highest repeat purchase rate of the year. Black Box display sales at the location rose 34% and, significantly, drove a 63% increase in new shoppers entering the 3L box wine category.

The cross-category promotion aligned with Gallo’s recent investments in sporting events. In 2022, the winery became the new official wine sponsor of the National Football League, which attracts up to 180 million viewers.

On a parallel track, Gallo is beefing up its Black Box line. Earlier this year, the company introduced its Savvy Man spokesman, portrayed by actor Adam Scott, in a new campaign. The brand has also rolled out new varieties, including Buttery Chardonnay, Tart & Tangy Sauvignon Blanc, Vibrant & Velvety Red Blend, and Deep & Dark Cabernet Sauvignon.

What happens when one of the most basic grocery staples meets advanced grocery tech? In a reflection of the growing power of data in the retail and CPG industries, Flowers Foods recently saw an uplift in sales of traditional sandwich bread after deploying data tools to determine the best price points and events at one of its retail customers.

Flowers, a major player in the commercial bread category, tapped cloudbased artificial intelligence (AI)-powered solutions provider SymphonyAI Retail to gauge the effectiveness of its promotions at a time when consumers have been feeling pinched by inflation and other circumstances. The baked goods manufacturer used SymphonyAI Retail’s Shopper Card data systems tool to assess shopper behavior during special promotional events at a major retailer’s stores in the Southern California region. Traditional sandwich bread was chosen as the assessment target, because that item is a crucial part of the sector, accounting for more than one-third of the category’s volume.

The results were, indeed, a slice of

shoppers’ lives: The data helped Flowers better understand how consumers react to a specific event. Among other findings, the information revealed whether shoppers were new to the brand or switching from another brand. Flowers was also able to determine whether its most valuable customers were engaged in the promotional effort and whether people were increasing their consumption.

Having such data in hand confirmed a meaningful return on promotional activity investment and verified that Flowers was on track in the commercial bread category. As the company points out in its Category Captains submission, “In the current inflationary environment, it is imperative to maximize promotional effectiveness which helps retailers, vendors and consumers offset inflationary pressures.”

From a numbers standpoint, follow-up data showed that dollar sales of traditional loaf bread at the participating stores grew 8.7% and increased market share of

As inflation has taken a bite out of many food categories, shoppers are responding by switching up what they’re buying and eating. That’s true in packaged salads, too, where there has been a bit of shifting going on.

Fresh Express switched gears along with, and, in some cases, ahead of, price-conscious consumers looking for healthy, convenient plant-based nutrition. Following an extended period of strong sales as consumers mostly ate at home, growth in the company’s value-added salads finally slowed a bit in 2021, due to price increases related to fuel costs, supply chain issues and labor challenges, among other market factors.

the SoCal market area by 24 basis points. The number of baskets and household counts increased by 2.7% and 2.9%, respectively, for the overall segment. As for ROI, the percentage of profitable promotions rose from 26% in the prior year to 44% after implementation.

Further, learning more about how people shop for traditional bread can go beyond one brand’s lift. According to the data gleaned by Flowers at the major retailer’s stores, the improved ratings metrics benefited all brands in the commercial loaf bread space.

Flowers remains a formidable player in the commercial bread category. The company recently reported that it has outperformed the total bread category for the total United States on a yearover-year basis, with an 8% lift in dollar sales versus the overall market. Flowers produces private label breads, as well as branded products under the names Nature’s Own, Dave’s Killer Bread, Wonder, Canyon Bakehouse and Tastykake, among others.

Heeding the trend and recognizing consumers’ new mindsets, Fresh Express focused its category management efforts on the impact of inflation. For example, the company suggested a promotion update from a three-for-$12 offer to a two-for-$8 offer to stay relevant. In addition, Fresh Express shared information with its retail customers on the slowing growth of premium salads and pointed out the uptick in sales of classic salad varieties.

As shopper interest in private label products intensified during inflationary times, the company also supported sales of its Fresh Express brand. The recognition of that trend and the support led to an increase in repeat buyers of Fresh Express salads, an indicator of loyalty.

The quick pivots during yet another time of volatility

worked: Several Fresh Express retail partners outpaced the rest of the market to grow their share by as much as millions of dollars, according to the company. That’s notable, since results cycled growth numbers from the growth-heavy pandemic.

Even as it focused on delivering value to inflation-wary shoppers, Fresh Express has looked ahead and kept R&D efforts rolling. The company recently launched three new chopped kit flavors and one new salad blend, adding variety and shelf interest to the category. The category management team supported planogram builds to include these new items while eliminating slower-moving and high-shrink products.

Likewise, the company has continued to invest in national promotional campaigns throughout the year, using Google PPC and display ads to drive awareness sales. Social media is a priority for Fresh Express, which has a following of 360,000 users. For the first nine months of 2022, the company’s digital ads on social media delivered 1.8 million post engagements and a 2.1 million reach, while its YouTube videos have racked up more than 810,000 views.

A campaign during Salad Month in May was particularly effective. The omnichannel program included social media, digital coupons, influencer and recipe videos, digital ads, an e-newsletter, and a recipe book.

With 125 years of experience behind it, The Hershey Co. doesn’t wait until opportunity knocks. The venerable CPG heard that one important purchase trend was coming and acted swiftly to capitalize on the move.

Hershey puts it this way: “As consumer needs change and shopper behavior evolves, it’s our job to meet them where they are.”

In an era of BOPIS and curbside pickup, Hershey has met many shoppers when they’re in the physical-store space. This opportunity is the “second basket,” occurring when shoppers pick up their click-and-collect groceries and then buy more items in-store on the same day.

There are many reasons that consumers take this additional trip, like going back for forgotten items, wanting to look at certain items in person, swapping out substitutions or purchasing items that aren’t available online. Hershey cites data showing that 10%-20% of click-and-collect trips include a second basket with a $38 average size. The current value of measured second-basket retailers is $3.4

billion across all categories, the company notes.

Given that candies and snacks have long been associated with impulse buys, the opportunity to attract consumers on their way to a second basket is strong. Candy is actually the most impulsive of the categories that land in the second basket, along with snacks, dairy and produce. According to Hershey, there’s an incremental opportunity of $102 million for the candy, mint and gum categories in this type of purchase.

To encourage unplanned purchases and help retailers capture a sizeable second basket, Hershey’s category management and shopper insights teams are targeting shoppers through both in-store and curbside transactions. If timing is everything in promotions, it’s especially crucial here, as Hershey has determined that the most effective points of messaging happen during the “Order is ready” and “On my way” phases of the digital journey. Among other tactics, Hershey offers craving and snack solutions at curbside points, and coupons or reminders of micro-occasions and seasons to

drive shoppers back in-store.

In addition to nabbing extra sales in the second basket, Hershey is also finding new opportunities for category success through its Mobile Customer Insights Center, an expandable 53-foot tractor-trailer that looks like a rolling Hershey’s bar and delivers insights, innovation and strategy for the company’s grocery retail partners. Inside the vehicle, grocers and Hershey’s team members meet in a collaborative environment to drive strategies across different facets of the business, from transaction zones to merchandising solutions to alternative fulfillment, among other topics. Hershey notes that at the time of its Category Captains submission, the Insights Center had hosted more than 155 grocery partner attendees at 50-plus meetings around the country in 2022.

While a continually disruptive environment and evolving consumer preferences have driven changes in categories, effective category management is also changing. Hormel Foods Corp. recently redesigned its approach to strategic business planning, engaging its sales team to work cross-functionally with retailers to assess the business, identify new opportunities, and work together to co-create solutions that ultimately benefit shoppers, retailers and Hormel.

The company’s infrastructure has been redesigned

to best follow this model. Hormel is in the process of merging five independently run business units into one $8 billion retail sales unit. That unit will be supported by a new center of excellence, Brand Fuel.

Brand Fuel will pinpoint emerging insights to develop products and boost shopper engagement with optimized assortment, shelving and pricing strategies. The Brand Fuel group will also include Hormel’s digital experience team.

As part of this change, the company’s marketing team has moved from a brand-focused team to one structured on need states and solutions. On a more macro level, Hormel had transitioned into three operating segments — retail, foodservice and international — as of Oct. 31 of this year.

It’s no small task to take on so many changes at once, but Hormel has made big strides by zeroing in on shopper insights that drive decisions within categories, and then sharing those insights with retailer partners in the spirit of collaboration. One example is its relationship with an independent Midwest grocery chain; through a cross-functional, cross-category program, Hormel and the retailer teamed up to turn around a typical lull period to grow sales by 29% on a year-over-year basis and net $1.3 million in additional retail sales.

Hormel’s re-envisioned partner approach works

across many business areas, including supply chain, category vision and multibrand promotions. Another example is a campaign called The Bowl Bowl, in which many store departments — and categories — came together on an insight-based shopper solution for game day.

Sustainability, increasingly important across categories, is another area in which Hormel and its retail partners align. For instance, the new, more sustainable bottle for Planters peanuts, which uses 8% less plastic and saves 220 tons of plastic annually, has done well for many retailers since its launch in 2022. Hormel supported the refreshed packaging rollout in the nuts category with in-store displays, online advertising and social media.

New product development also reflects the company’s insights-based, shopper-centric and collaborative approach to category growth. In the dynamic plant-based space, Hormel’s recently introduced products include a line of Happy Little Plants meatballs, while its Applegate Naturals Do Good Dogs are made with 100% natural grass-fed beef raised with practices that regenerate the land.

The Idaho Potato Commission (IPC) continues to raise its data game using industry-leading insights to drive category growth for its partners. Uniquely, the commission deploys category experts throughout the country to help retailers maximize their sales in the fresh potato category. These

industry veterans canvass the country, meeting with category managers to help them stay ahead of evolving shopping patterns.

Within the potato category, one of the most interesting segments over the past five years has been 24-ounce baby or creamer potatoes, which have captured the attention of consumers, causing a wave of new items to enter the segment. As a result, some retailers have run out of space to put them and have really struggled with optimizing category space allocation. The IPC was able to step in, however, with analytics to help advise retailers on how to best merchandise and price the segment to maximize dollars.

One retailer this year experimented with a newly designed set

in 2021. The focus for the category was the 24-ounce potato segment in every color and variety imaginable. The retailer ran with the new category layout for six months and relied on the IPC’s capabilities to help it analyze the results, which were were disappointing: The category lost 20% in dollars, contributing to a precipitous loss of market share. Leveraging the IPC’s insights, however, the retailer was able to reverse course and implement mandatory 5-pound bagged russet end caps, which proved much more successful.

In addition to individualized category reviews, the IPC releasedquarterly deep dives in January 2022. Each deep dive looks at the United States on a regional basis to evaluate the changes occurring within the cate -

gory. The reviews focus on driving attention to Idaho crop supply updates, potato variety analyses and regional reports for all nine Nielsen reported regions. According to the IPC, these reports have led to multiple customer meetings with its promotion directors and have contributed to 127 in-depth category reviews across the country.

The IPC is helping retailers understand the importance of using russets to win with shoppers. One of the ways it did so was through the creation of an online tool enabling retailers to edit and add price points and recipes to build their own personalized ads. The commission also worked to increase understanding of what makes Idaho potatoes special via product quality, traceability, certified inspections and brand recognition.

A post-pandemic return to mobility and an increasing desire for convenience have led to an uptick in snacking throughout the day, with savory snacks, including pantry crackers, leading the charge. With the knowledge that consumers are averaging more than five snacks per day, that pantry crackers are a growing segment, and that 50% of all food occasions are snacks, Kellogg Co. set out to better understand current cracker shopper and consumer behaviors to find opportunities for innovation.

Kellogg used its proprietary Landmark occasion study to learn more about the loyalty and dollars of younger

households and families, with consumer and shopper research informing the fact that afternoon snacking is the No. 1 occasion for crackers. In an effort to take advantage of this key occasion, reinterest lapsed cohorts and further build baskets, the manufacturer introduced Puff’d — a munchable, grazable, airy snack that builds on a strong equity connection with Cheez-Its.

Thus far, the introduction of Puff’d has not only created a win for Kellogg, but has also helped grow incremental sales for the overall cracker category. Some 44% of cracker innovation dollar sales have been driven by Puff’d this year, making the brand the No. 1 innovation introduction in the segment. A total of 71% of Puff’d dollars were incremental to the cracker category, with 67% from category expansion and 4% from new buyers in the aisle. Puff’d is also registering a shorter purchase cycle and seeing a higher household penetration rate compared with total cracker penetration rates in households with children.

As a purveyor of fresh, dried and marinated mushrooms; mushroom powders; and mushroom sauces, Monterey Mushrooms has bet its entire livelihood on the popularity of that particular product. The company, which was established with a single farm in 1971, now has several farms across the United States and offers products for both foodservice and retail.

This past year, company was forced to weather a rough patch when demand for its products decreased. Instead of resting on its laurels, though, Monterey gathered insights from more than 2,000 consumers

As a global leader in the avocado business since 1983, Mission Produce sources, produces and distributes fresh Hass avocados to retail, wholesale and foodservice customers in more than 25 countries. The company added mangoes to the mix in 2021 and, with an eye toward further innovation, has developed several value-added services to help its customers experience the best returns in their avocado categories.

Through the use of its proprietary Avocado Intel market intelligence tool, Mission can gather data-driven insights to support category management. The tool allows the company to highlight industry trends, perform peer comparisons, analyze store performance, and provide timely category and shopper data, all of which enable it to help customers meet anticipated demand for its products, realize higher profits, attract more shoppers and reduce shrink. Avocado Intel can also inform customers of how the market is responding to Mission’s products and uncover new growth and sales opportunities in real time.

This year, the tool was used to substantially improve organic avocado sales for one of Mission’s largest retailer partners. The company found that 90% of this retailer’s organic avocado shoppers were purchasing organic avocados elsewhere, and that in the Southeast region, this retailer had only a 32% market share of organics, compared with a 51% market share of total avocados. Mission then profiled the shoppers who were purchasing organic avocados elsewhere and found that they earned high incomes, skewed toward families with children and were highly committed to organic products.

Using the information it had gleaned, Mission recommended that the retailer use a bag better designed for the shopper demographic it was missing, and also supported the retailer in the transition. The results were impactful, with the retailer’s avocado category sales increasing by 62% in dollars and 36% in volume year over year. Additionally, dollar and volume shares of the market increased by 8.4 points year over year, and volume share increased from 29.40 to 37.80.

At a retail site in one particular region, Monterey chose to place a special emphasis on its growing segments, reviewing everyday retails and aligning promotions with category goals. Over this period of intense scrutiny, sales were up 5.0 points, units were up 4.4 points and pounds were up 3.3 points over the rest of the market. In another region, the same focus was placed on reviewing retails and promotion alignment, and sales went up 2.2 points, units rose 3.9 points and pounds increased 3.5 points over the market.

and revisited its category management approach to develop a plan that focused on growing segments and increasing the size of purchases with frequent users.

The company’s new approach, along with a special understanding of its partners’ goals for the category, helped create strong results during a very challenging time.

In a year plagued by inflation, supply issues and shifting consumer preferences, many brands in the olive oil aisle have been forced to pass along a price increase to consumers, causing them to consider switching to less healthy fats and oils. Pompeian, meanwhile, was able to increase sales and build the value perception of olive oil through new promotions, innovations and marketing efforts.

The manufacturer, which offers consumer-friendly packaging with extra-virgin olive oil descriptions such as “Fresh & Fruity” and “Robust,” also spurred category consumption with the launch of seven new e-commerce items. Each olive oil is also labeled with the best uses for its specific variety, including those for roasting, sautéing, stir-frying and mixing into marinades.

The company further found success by reaching out to consumers in unique ways. Its new strategic communications

Produce provider NatureSweet expanded its fair-trade partnership to two strategic divisions within a large national retailer in early 2022. The program provided the retailer a point of differentiation in the market when media outlets brought attention to the unethical treatment of agricultural workers in North America. Fair trade ensures that workers receive fair wages, work in safe conditions, protect the environment and obtain community development funds to improve their lives.

Fair trade has given NatureSweet the opportunity to add value to the entire supply chain, as well as allowing the company to continue to pursue its mission of transforming the lives of agricultural workers in North America by keeping people its top priority. In tandem with what it does for its associates and their families and communities, NatureSweet’s commitment

platform helped drive olive oil loyalty via distinct narratives spotlighting product education, usage-heavy recipes, and the benefits of shopping farmer-owned, planet-friendly brands. On social media, Pompeian expanded its target and prioritized video, a bolder tone/aesthetic and relatable recipe content.

These pivots generated a 746% increase in paid Facebook and Instagram

engagements between the first and second quarters, as well as a 31% increase in Instagram impressions. Retail-driving influencer programs resulted in more than 42,000 cart additions of the company’s products via Instacart, and an Amazon Live with the same objective drove approximately 500 sales in one hour.

Additionally, Pompeian prioritized stock availability and speed, as well as price reductions tied to on-shelf communication during key selling periods, with one such effort generating a 26% incremental sales lift over Easter. The company also worked with complementary store departments to encourage at-home cooking, and in the Midwest, Pompeian put a display in the produce section where shoppers could receive a free bag of potatoes with the purchase of Pompeian olive oil.

All of this led to double-digit sales increases for Pompeian that offset category volume declines and bolstered category dollar sales compared with last year.

to Fair Trade Certification augments its already long-standing relationship and certification with EFI, also known as the Equitable Food Initiative. This initiative was executed at the national retailer’s fair-trade divisions through on-shelf mini billboards, secondary displays with messaging, and online banner ads that

received 328,359 impressions, or more than 20,000 impressions per day, in May 2022.

In the first eight weeks through June 18, the two fair-trade divisions realized a 200-basis-point advantage in dollar percentage growth and a 50-basis-point advantage in trips over the remaining national retailer’s non-fair-trade divisions. These improvements led to the fair-trade divisions realizing a 30-basis-point greater improvement in market share within the snacking tomato segment than the non-fair-trade divisions. The fair-trade divisions sold nearly 273,000 pounds across three items, resulting in a $13,000 premium paid to support fair-trade initiatives transforming communities.

Additionally, fair-trade initiatives are voted on by NatureSweet associates. Each of NatureSweet’s agricultural plants have fair-trade committees to represent associates. Members are elected by peers, and a supervisory board serves as the voice of about 5,000 associates.

Initiatives include education, child care, food, health services, housing, infrastructure, training and community services. For example, an education program teaches associates to read and write. In 2021, about 150 associates earned their high school degrees.

Each of NatureSweet’s facilities has a health and safety manager who leads developmental training, addresses issues and takes precautionary measures to prevent any injury. The company provides preventive health care for associates that includes access to a variety of medical services, with mental and emotional health top priorities. This is why NatureSweet created programs like Sweet Life, which gives associates access to psychologists and one-on-one therapy. Additionally, the Sweet Family program is a 16-week course that educates associates on human development, with topics such as parenting and emotional intelligence, to name just a few. Initiatives like these help complement the company’s purpose, which comes back to improving the lives of agricultural workers in North America.

Although inflation surpassed COVID as the chief concern for U.S. consumers this year, Pharmavite’s new product initiatives were able to help sustain vitamin, mineral and Supplement (VMS) category growth. Post-pandemic, selfcare has risen to the top of the category entry points. Consumers are no longer thinking of the category for a specific health concern, but as a ritual to proactively take care of themselves. This has resulted in the VMS category evolving into two distinct needs for purchase conversion: general wellness and specialized needs.

To ensure that the company is serving both types of consumers, Pharmavite’s Nature Made brand expanded earlier this year with the launch of Nature Made Wellblends, a line of 13 scientifically developed supplements to keep the wellness cycle of sleep, stress and immune health in balance. Stress leads to sleep problems, and both issues can compromise the immune system.

To support its curated line of products, the company kicked off a partnership in June with home organization experts and stars of the popular Netflix series “Get Organized with The Home Edit,” Clea Shearer and Joanna Teplin, to inspire people to optimize their wellness routines and keep stress, sleep and immune health in balance. Through the partnership, The Home

Edit founders shared their own experiences as well as how Nature Made Wellblends’ targeted solutions helped them proactively support their overall well-being as they navigate running their business, motherhood, busy schedules, travel and life’s stressors. Retail media campaigns ran across traditional TV as well as streaming platforms, and digital and social channels engaged influencer support. Additionally, relevant lifestyle- and health-focused podcasts reached consumers throughout their day in key markets.

Meanwhile, Pharmavite has also committed to advancing its operations. In fact, the company was working to alleviate pandemic-induced supply chain challenges long before COVID ever reached North America. Specifically, in the past year, the company consolidated bottle sizes, added airfreight methods of bulk deliveries and stretched its organizations teams to the max to get product on retail shelves.

Pharmavite also revamped its recruitment process to attract top talent as its needs have grown.

To help retailer partners be as successful as possible, Pharmavite’s Aisle of the Future project has identified top-level insights for retailers and brought them to life online and in-store. Pharmavite category managers have introduced new options to help retailer partners fit their strategies against a menu of proprietary opportunities to best match joint business needs. The category management team has a deep toolbox of resources at its fingertips, including an assortment optimization tool for retail line reviews. This model has helped simulate demand transfer of volume when items are removed from or added to the assortment, enabling retailers to seamlessly make category assortment and new-item decisions.

The expectations for a more engaging and frictionless shopping experience have never been higher. Pet care company Nestlé Purina knows that brands and retailers that drive these elevated experiences will stand out above the rest. As a result, the company is dedicated to delivering omnichannel solutions in this space and demonstrating the importance of the pet category with its strategic partners.

Dedicated pet end caps have been a foundational merchandising solution that Purina’s Shopper Innovation & Experience team has recommended to retail partners for years. But as the world becomes more digitally connected and focused on the omnichannel experience, the company has partnered with strategic retailers to drive more pet category traffic, brand conversion and customer loyalty through purposeful digital solutions, all rooted in Purina’s emerging category insights and strategies.

These solutions are brought to life at Purina’s Retail Innovation Center, in St. Louis — an experiential learning lab highlighting omnichannel solutions that inspire new business prospects — and are then used to engage top retailers in a proprietary co-creation process to build out opportunities that deliver mutual value for the retailer, Purina and ultimately, the pet shopper.

Using the Retail Innovation Center’s co-creation process, the team inspired a Meijer-specific solution with the SVP of merchandising, marketing team and buyers. This drove immediate buy-in on an idea to launch an interactive end cap at scale, anchored in a category-first approach. For example, instead of leading with a Purina One brand story, the project started with a narrative on the power of “outcome-based nutrition,” and then supported it with why the Purina One portfolio could deliver on that need. These category “stories” change throughout the year and feature anything from litter education to the benefit of variety in wet cat food, and even cause-based programming.

Pet parents have certainly taken notice of these interactive end caps powered by “lift-andlearn” technology during their shopping trips to Meijer stores. This is evident in the impressive results for both the Midwest grocer and Purina since the launch of the engagement tool. For instance, Perch-enabled stores are consistently outperforming non-Perch-enabled stores by double digits, and Purina is seeing brand growth in nearly all strategic segments. Even more exciting are the analytics that the team has captured regarding engagement rate, which continues to climb, showing that this solution is establishing a new shopper behavior while driving conversion. That’s a win-win for both the retailer and the CPG company.

Meijer Inc. is one of Purina’s most progressive partners, and during its annual business-planning visit to the Retail Innovation Center the retailer was introduced to an interactive pet end cap powered by Perch technology — a digital in-store solution that seamlessly incorporates a digital screen to automatically sense which products shoppers touch, and then responds with videos and information about the product.

By Lynn Petrak

By Lynn Petrak

or products that have been considered commodities for decades, it’s all about the specifics for beef and pork right now. From down-to-the-farm origin details to the best price points to tailored instructions, consumers want the goods on red meats offered by brands and grocers.

The nature of the current retail environment is driving these and other demands for beef and pork, which are also invariably affected by livestock supplies. A 2022 IBM report concludes that “consumers want it all,” and notes that purpose-driven consumers who choose products and brands based on how well they align with their values represent the largest segment of consumers. Other recent research from FMI — The Food Industry Association and NielsenIQ shows that 80% of shoppers want at least one other indicator beyond ingredients and nutrition information, like certification and claims, allergen information, and values-based details like animal welfare, fair trade and labor practices. Also, in today’s economy, shoppers want to arm themselves with price information to get the best deal possible.

The market for beef and pork, at least in the near term, reflects shoppers’ appetite for specifics.

As 2023 approaches, one can expect the trend of storytelling to continue with beef and pork products. That trend began a few years ago, when protein companies added more details about farmers and ranchers on their websites, social media platforms and even on packaging.

Kent Harrison, VP, marketing and premium programs at Springdale, Ark.-based Tyson Foods, confirms that such information resonates with shoppers, especially when it comes to sustainability.

“We know that our independent ranchers and farmers view the land and their cattle/hogs as so much more than just a business — it’s their livelihood, their heritage and their legacy for future generations,” notes Harrison. “It’s our role as a brand to champion American agriculture, and to do so we must increase transparency in our animal welfare practices and sustainability efforts

In 2023, one can expect the trend of storytelling to continue with beef and pork products.

Meat processors and their retail partners are also expanding their portfolios to include products from additional or different sources.

The issue of price versus value in the meat case will likely continue next year.

Today’s consumers are seeking extraordinary eating experiences they can enjoy without guilt — like the world-class sophistication of Trusted Veal from Europe. The trusted taste of traditional Dutch veal is the finest in the world — with lofty standards of quality, sustainability, animal welfare and food safety that live up to the legend. Give today’s confident cooks an irresistible reason to keep coming back to your meat case — the continental allure of European Veal.

Discover More at TrustedVeal.com

with shoppers. These are topics that consumers care about and influence their purchasing decisions.”

Other beef processors and brands are emphasizing sustainability as they share information with consumers. “Beef producers and brands must consider consumers’ perceptions of sustainability,” asserts Jim Rogers, SVP of sales at Arkansas City, Kan.-based Creekstone Farms Premium Beef. “On an aided basis, almost half of meat eaters assume sustainably raised meat addresses antibiotic/hormone and animal welfare topics. At Creekstone Farms, all cattle can be traced to their ranch of origin, and our team has invested in telling the stories of our cattle producers to help consumers understand where their food comes from.”

In addition to connecting shoppers with producers, meat processors and their retail partners are expanding their portfolios to