EDITORS’ PICKS: PRODUCTS WORTHY OF RETAILER, CONSUMER ATTENTION AHOLD DELHAIZE ON THE RISE What’s behind the retail growingconglomerate’smomentum SUSTAINABILITY STARS Spotlighting eco-friendliestgrocers’moves POULTRY FOR THE WIN Chicken and turkey offer value for shoppers September 2022 Volume 101, Number www.progressivegrocer.com9 GroceryofFutureThe 2022 GenNext Awards honor those reimagining the industry 2022 GiantEmilyAwardGenNextwinner:MassiFood

® fi 0 Y S 40,000 K 40,000 PEOPLE CARBONAVOTED®#1 ® fi fi fi fi x ™ fi fi fi fi fi fi fi LIFEUNSTAINED™www.carbona.com © 2021 Delta Carbona, L.P.

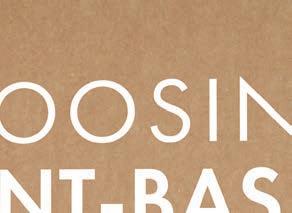

ContentsFeatures09.22 VolumeIssue1019 13 MINTEL GLOBAL NEW PRODUCTS Potato and Tortilla Chips Departments 14 ALL’S WELLNESS Healthy Holiday Eating on a Budget 16 UPWARD Lessons in Leadership 122 AHEAD OF WHAT’S NEXT Taste Maker 8 EDITOR’S NOTE Remember Isom 10 IN-STORE EVENTS CALENDAR November 2022 12 NIELSEN’S SHELF STOPPERS General Merchandise 4 progressivegrocer.com COVER STORY 78 Bright Futures Progressive Grocer’s 2022 GenNext Awards go to those younger members of the grocery industry who will determine its direction for years to come. 78 14 18 FEATURE The Ascendancy of Ahold Delhaize The mega-chain is gaining momemtum through omnichannel, private brands and sustainability. 30 SPECIAL REPORT A Journey Worth Taking With a number of retailers making significant progress on the path toward a net-zero future, PG takes a look at their top sustainability initiatives. 2022 TheBillyAwardGenNextwinner:MiltonKrogerCo.

Contact your GOYA representative or email salesinfo@goya.com | GoyaTrade.com * Source: Mintel (2020). Plant-Based Proteins US – May 2020 ©2022 Goya Foods, Inc. Plant based foods are hotter than ever*. That’s why now is the perfect time to stock NEW GOYA® Latin Roots plant-based chips! They’re made from delicious root vegetables to deliver an unforgettable taste experience that will keep your shoppers coming back for more. Crafted with the same authenticity that only comes from the Latin food brand, GOYA® Latin Roots are perfect for shoppers looking for a unique snacking experience. TO OUR DELICIOUS LATIN ROOT CHIPS

The Design Categories Grocery a

8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com

GROCERY GROUP PUBLISHER John Schrei 248-613-8672 jschrei@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Gina Acosta 813-417-4149 gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt 347-962-9395 bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj 773-992-4405 mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak 708-945-0415 lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe 502-550-5082 ecrowe@ensembleiq.com

CONTRIBUTING EDITORS Steven Duffy and Jenny McTaggart

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI) Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com

SENIOR SALES MANAGER Bob Baker (NEW ENGLAND, MID-ATLANTIC SOUTHEAST US, EASTERN CANADA) 732-429-2080 rbaker@ensembleiq.com

SENIOR SALES MANAGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

BUSINESS DEVELOPMENT MANAGER-GROCERY GROUP Lou Meszoros 203-610-2807 lmeszoros@ensembleiq.com

ACCOUNT EXECUTIVE/CLASSIFIED ADVERTISING Terry Kanganis 201-855-7615 • Fax: tkanganis@ensembleiq.com201-855-7373

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com

EVENTS VICE PRESIDENT, EVENTS Michael Cronin mcronin@ensembleiq.com

VICE PRESIDENT, EVENTS & CONFERENCES Megan Judkins 773-837-7595 mjudkins@ensembleiq.com

MARKETING BRAND MARKETING MANAGER Rebecca Welsby 773-992-4407 rwelsby@ensembleiq.com

AUDIENCE LIST RENTAL MeritDirect Marie Briganti 914-309-3378

SUBSCRIBER SERVICES/SINGLE-COPY PURCHASES Toll Free: 1-877-687-7321 Fax: contact@progressivegrocer.com1-888-520-3608

PROJECT MANAGEMENT/PRODUCTION/ART CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

REPRINTS, PERMISSIONS AND LICENSING Wright’s Media ensembleiq@wrightsmedia.com 877-652-5295

CORPORATE OFFICERS

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Single copy price $14, except selected special issues. Foreign single copy price $16, except selected special issues. Subscription: $125 a year; $230 for a two year supscription; Canada/Mexico $150 for a one year supscription; $270 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $170 a one year supscrption; $325 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Copyright ©2022 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations. Bets and Ethical to In Up EQUIPMENT & DESIGN

CHIEF EXECUTIVE OFFICER Jennifer Litterick CHIEF FINANCIAL OFFICER Jane Volland CHIEF HUMAN RESOURCES OFFICER Ann Jadown EXECUTIVE VICE PRESIDENT, CONTENT Joe Territo EXECUTIVE VICE PRESIDENT, OPERATIONS Derek Estey

publication may

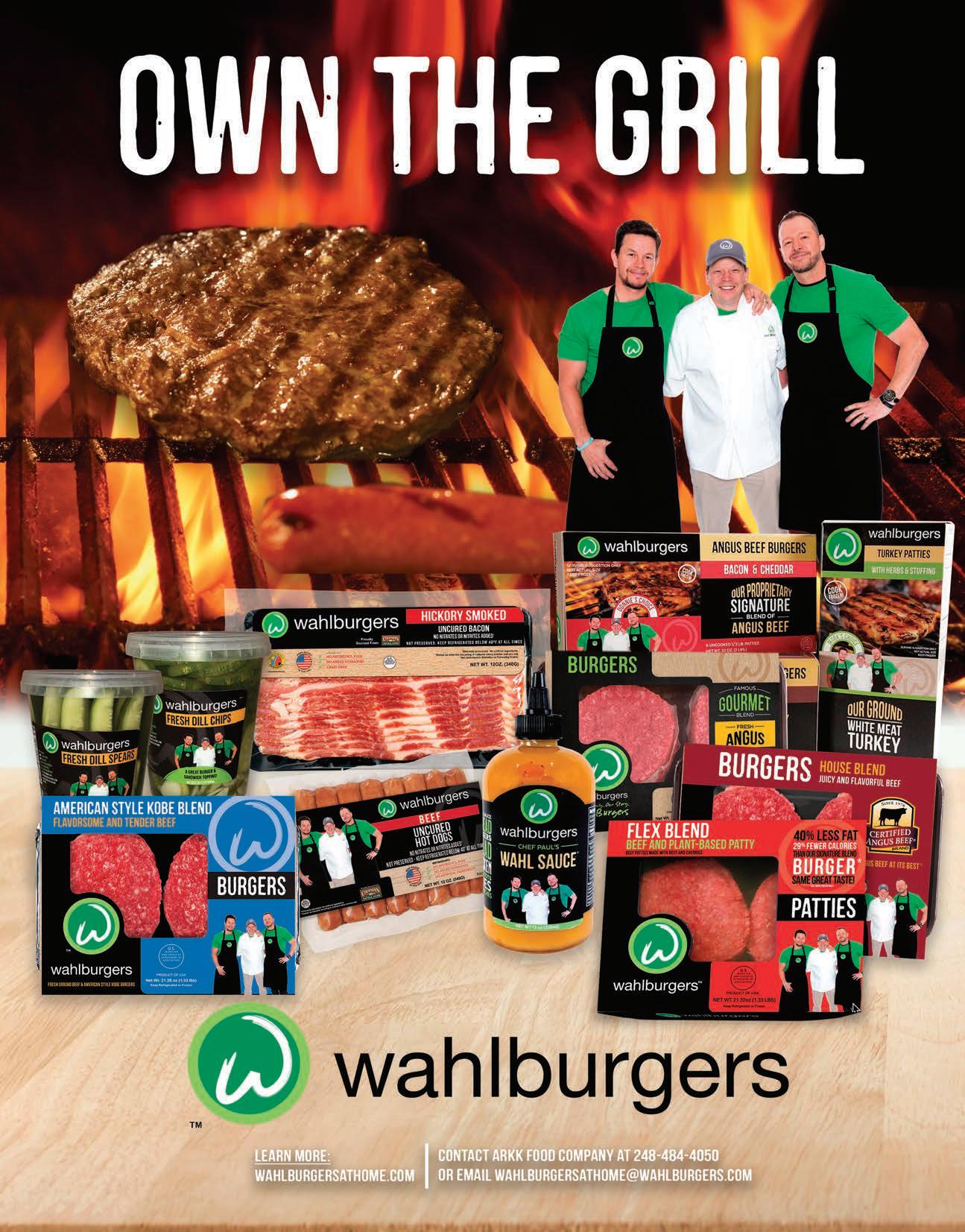

Contents09.22 VolumeIssue1019 6 progressivegrocer.com 1005252 PROGRESSIVE GROCER’S 2022 EDITORS’ PICKS Best

The annual program unearthed many products worthy of retailer and consumer attention. 100 SOLUTIONS Shoppers Flocking to ChickenPoultryandturkey offer different forms of value for today’s mindful consumers. 105 CPG PROFILE Flavorful

Vanilla supplier Lafaza Foods’ three-pronged approach to sustainability is focused on forests, farmers and flavor. 108 CENTER STORE Cheers

Drinking

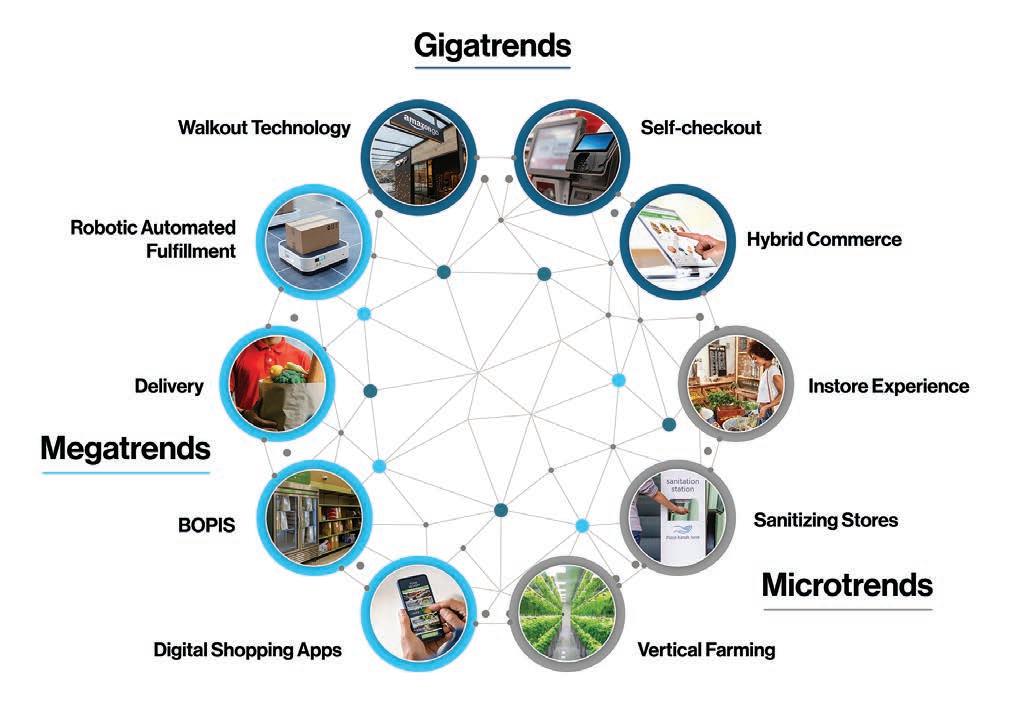

Better-for-you and high-ABV options in beer, hard cider and seltzers are gaining traction among consumers. 113 TECHNOLOGY Leveling

Today’s shelf-edge technology solutions address experience, data, retail media and more. 118

Shaping

These key trend types offer

path forward for grocers and consumers. 108

By Gina Acosta

By Gina Acosta

Remember Isom

IN EASTERN KENTUCKY, AN INDEPENDENT GROCER TRIES TO REBUILD A COMMUNITY

wen Christon is a rarity in the grocery industry.TheAfrican American owner of the Isom IGA grocery store, in Isom, Ky., Christon started working at the store as a cashier shortly after it opened in 1973. Twenty-five years later, she bought the store, which is the only full-service gro cer in the area for 20 miles.

Over the years, Christon shaped the store into a gathering place for the community. She made investments in the store, such as replacing refrigerated cases, installing self-checkout lanes and adding e-commerce solutions. In 2007, she was even named IGA International Retailer of the Year.

“What makes her unique is not only that she is a female-led busi ness in grocery, but she’s African American also,” says John Ross, CEO of Chicago-based IGA. “She’s become a fixture and a leader in her community in a way that no one would’ve expected, probably least of which her. And she’s had spectacular success.”

But this past July 28, everything changed for Christon and the entire Isom community.

A once-in-a-thousand-years flooding event ravaged the community of 1,500 people in coal mining country, about 20 miles west of the Virginia state line. There’s been a lot of flooding news this summer, with historic floods in Arizona, Tex as and other states. But in eastern Kentucky, floods swept away entire communities, including Christon’s store. More than 6 feet of water and mud destroyed everything. Now, a critical part of keeping that commu nity alive is gone, Ross notes.

When disaster struck Christon’s store, however, IGA was in immedi ate contact with her licensed distrib utor, MDI, on marshaling resources to help her, according to Ross.

“There were daily calls about what we could do to support her,” he says. “The interesting thing about her is that it’s a relatively small store serving an economically challenged re gion, and yet she’s one of our most innovative retailers. She’s not afraid to invest in new technology. There’s a lot of people that could have sat back during COVID and not reinvested in their stores because business was booming. She did exactly the opposite. She’s been continuously re investing in her store. She’s the only store in town, but it’s a great store and a great shopping experience. The loyalty happening in the commu nity right now is coming because her customers recognize that.”

The community has indeed come together to raise money for rebuilding efforts, which Ross estimates will cost at least $2 million. People from all over Letcher County, the state and the coun try have been donating money to a Go FundMe page. The IGA Foundation is also raising money for Isom IGA.

The rallying around Gwen Chris ton and her grocery store, which has a sign out front that says “Hometown Proud,” is a reminder that independent grocers really are the heart of commu nities across this great country. With out Christon’s store, Isom, Ky., is not just a food desert — it’s also a commu nity without community. Independent grocers offer better connections to lo cally grown food, to locally supplied food and fresh products, and to more specialized customer service. They also foster community connections among residents that are irreplaceable.

Now more than ever — amid pan demics, extreme weather events, and economic hardship due to inflation — indie grocers need the industry’s sup port. If you would like to donate to the Isom IGA rebuilding efforts, please go to flooding.help-isom-iga-rebuild-after-historic-https://www.gofundme.com/f/

Gina Acosta gacosta@ensemleiq.comEditor-In-Chief

8 progressivegrocer.com EDITOR’S NOTE

Now more than ever — support.need—dueeconomicweatherpandemics,amidextremeevents,andhardshiptoinflationindiegrocerstheindustry’s

Banana Pudding Lovers Month

Gluten-Free Diet Awareness Month

National Diabetes Month

National Fun With Fondue Month

National Native American Heritage Month

National Peanut Butter Lovers Month

National Pepper Month

Daylight6 Saving Time ends. Now we fall back once more to Standard Time.

Marie7 (1867).BirthdayCurie’s Honor this adoptedbirthplaceandfromspotlightingheritagescientist’strailblazingdualbydishesPolandFrance,herandhomeland.

National13 Pupusa Day. Provide a recipe for this national dish of El Salvador — tortillas stuffed with meat, cheese or refried beans.

World14 Diabetes Day. Make shoppers aware all of the resources — condition.livingstore(s)availableconsultationsitems,health-and-wellnessfoods,pharmacy—atyourforpeoplewiththis

Extra1 Mile Day. Salute all of your associates who go above and beyond every day for customers and co-workers alike. Day2 of the Dead. Observe this Mexican belovedAmericansintroducedholidaytomanyinthefilm“Coco.”

StoutInternational3Day.

Sláinte! Roast4 Dinner Day. Tell customers to think of it as practice for the big feast later this month.

National5 Chinese Takeout Day. Direct shoppers to the delicious Asianinspired selections among preparedyourfoods.

Cook8 Something Bold and Pungent Day. May we suggest kimchi?

LouisianaNational9 Day. Promote ofdistinctivethecuisinesthePelicanState.

Sesame10 Street Day. In honor of this children’s television stalwart, showcase all boastingproductsits familiar characters.

Veterans11 Day. Pay tribute to all of those who have served our country in the armed forces, especially in times of war.

National12 Happy Hour Day. Offer online instructions for cocktails to mark the occasion in style.

National20 Peanut Butter Fudge Day. Ask customers for their sure-fire recipes to make this indulgent treat.

Advent27

Begins. Make sure that you’re well stocked with calendars.

National15 Clean Out Your Fridge Day. Depending on how big a job it is, productscleaningmaybe in order – and remind shoppers to replace the baking soda.

National16 Indiana Day. Put foods and beverages from the Hoosier State front and center.

National17 Hiking Day. Call out trail mixes, jerky and other handy snacks for a day enjoying nature.

Mickey18 BirthdayMouse’s(1928).

It’s also powerultimatehomagebirthday,Minnie’ssopaytotheDisneycouple.

National19 Adoption Day. Profile your associates and customers who have embarked on this rewarding journey, both as parents and children.

CookieGingerbreadNational21Day.

Now’s the time to start baking these seasonal staples. Love22 FrecklesYourDay.

protectshoppersEncouragetotheir skin, regardless of these usually harmless spots from sun exposure.

National23 Cashew Day. These tasty nuts are low in sugar and high in fiber, heartheathy fats and plant protein, so a handful serves as a nutritious anytime snack.

Thanksgiving.24

Remember to have all of the shoppingforessentialsholidayonhandlast-minuteruns.

Flossing25 Day. Point shoppers to the oral care aisle for an teethnecessitydisplayinformativefeaturingthisforstrongandgums.

National26 Cake Day. Your in-store bakery is goods.popularforappropriatethesettingtheseperenniallybaked

Red28 Planet Day. Perhaps the perfect time to highlight Mars products?

Throw29 Out Your Leftovers Day. Anything that’s rotting needs to go.

National30 Mason Jar Day. Find out from shoppers their preferred uses for these containers.time-honored

S M T W T F S IN-STORE EVENTS Calendar 11.22 10 progressivegrocer.com

SUPERCHARGEYOURPROFITS #1 Alkaline Water* #1 Still Water, Total US in Natural* #1 Premium Water 1L Multipack in Total Universe* #1 Premium Water Velocity Brand, Total US in Food, Natural, Convenience and MULO* sales@essentiawater.com | 877.293.2239 | essentiawater.com *Source: IRI/SPINS/WFM L52 WKS Period Ending 3/20/22 with the #1 alkaline water*

12 progressivegrocer.com FRONT END Shelf Stoppers General Merchandise Latest 52 WksW/E 07/30/22 Latest 52 WksW/E 07/30/22 Latest 52 Wks YAW/E 07/31/21 Latest 52 Wks YAW/E 07/31/21 Latest 52 Wks YAW/E Latest08/01/2052WksYAW/E 08/01/20 BasketFacts How much is the average productsonspendinghouseholdAmericanpertripvariousgeneralmerchandiseversustheyear-agoperiod? Source: Nielsen, Total U.S. (All outlets combined) — includes grocery stores, drug stores, mass merchandisers, select dollar stores, select warehouse clubs and military commissaries (DeCA) for the 52 weeks ending July 30, 2022 Source: Nielsen Homescan, Total U.S., 52 weeks ending July 2, 2022 Kitchen Appliances Home Appliances Household Storage Batteries Utensils and Accessories Total Department Performance Top General Merchandise Categories by Dollar Sales $49,116,685,372 $49,660,625,909 $47,815,657,254MerchandiseGeneral Generational Snapshot Which cohort is spending, on average, the most per trip on pens? $9.96Millennials Gen $9.84Xers $7.93Boomers The Greatest$7.20Generation Source: Nielsen Homescan, Total U.S., 52 weeks ending July 2, 2022 $16.85 on all general merchandise items, up 3.5% compared with a year ago $12.06 on batteries, up 8.9% compared with a year ago $21.46 on cellular phone accessories, up 31.4% compared with a year ago $11.61 on light bulbs, down 0.3% compared with a year ago Cross-Merch Candidates DiaperingNeeds CombosMeal Snack and Variety PacksFruit Snacks PastriesToaster Wraps and Tortilla Shells Writing Tools and SuppliesCookedFullyMeat Feminine Care Deodorant $5,000,000,0004,000,000,0003,000,000,0002,000,000,0001,000,000,0000

Potato and Tortilla Chips

Market Overview

Consumption of potato and tortilla chips is nearly universal, and the category saw an 8% increase in 2020. The next year saw sales correct, and by 2023, consumers are expected to resume their pre-pandemic pace of slow but steady growth, fueled by interest in on-the-go snacking options and chips that can offer flavors that attune to consumers’ sense of the familiar.

Nearly six in 10 American consumers reported eating regular plain potato chips in the past few months.

Half of U.S. consumers are interested in trying potato chips cooked in healthier oils.

Despite the 8% sales growth for potato and tortilla chips noted above, consumer usage occasions for the category’s offerings remained consistent: potato chips primarily at lunch, and tortilla chips mostly with dinner.

Key Issues

as an indulgence with little nutritional benefit. Yet, as consumers emerge from a pandemic with greater interest in their health, the chip category faces a distinct challenge, one that it’s already begun to meet with baked and popped options, but to which consumers would like to add healthier oils and ingredients, and functional attributes.

A return to dining out may negatively affect chips, but not to the same degree as other CPG foods, simply because potato chips are so associated with the lunch occasion as opposed to dinner.

With finances tight, consumers’ definition of “affordable” is altered, and they’ll seek to stretch their food dollar and want to make sure that the products they purchase remain “fresh” for as long as possible before going to waste.

What Want,ConsumersandWhy

Despite the 8% sales growth for potato and tortilla chips noted above, consumer usage occasions for the category’s offerings remained consistent: potato mostlyandprimarilychipsatlunch,tortillachipswithdinner.

regionallyavailablecouldtheflavorstoflavors.aconsumerstermspushhasofconsumerssinglehealthiercanartificialclaims,useyoungerparticularlyhealthieringredientsthatgenerallyConsumersbelievenaturalmakeforachip,asentimentstrongamongconsumers.Theofnatural-adjacentsuchas“freefromingredients,”conveyasenseofaoption.Smallerpackagesizesforon-the-goeating,aswellasservings,wouldhelpmeettheirgoallimitingsnacks.Muchofthecategory’sfocusinrecentyearsbeenonflavorsthattheboundariesinofspiciness,yetstronglyindicatepreferenceforfamiliarThisdoesn’thavemeanstandardchipareathingofpast,however,andincludebroadeningoptionswithmorespecificflavors.

PROGRESSIVE GROCER September 2022 13 MINTEL CATEGORY INSIGHTS Global New Products Database

FOR MORE INFORMATION, VISIT WWW.MINTEL.COM OR CALL 800-932-0400

By Karen Buch, RDN, LDN

Healthy Holiday Eating on a Budget

RETAIL DIETITIANS CAN HELP DIFFERENTIATE AND CONTRIBUTE TO CUSTOMER RETENTION THIS HOLIDAY SEASON.

n 2022, grocery inflation reached its highest point since 1979. Nearly one-quarter (23.6%) of U.S. households say that they don’t have spare cash. Americans are feeling the pinch of rising food prices, soaring fuel costs and the looming threat of recession. Inevitably, budget-conscious shoppers will need help balancing the cost of holiday gift-giving with the cost of holiday eating and entertaining this holiday season.

Less Impulse Buying

When budgets tighten, impulse buying is one of the first con sumer behaviors to change. More than 70% of consumers re port being less likely to grab an unplanned treat while grocery shopping. Increasingly, cash-strapped consumers will choose online shopping with delivery to reduce the temptation to buy impulse items, while eliminating the related fuel costs of in-store shopping. In fact, 63% of consumers plan to do some or all meal planning digitally. Retailers can use e-blasts featuring discounts and links to digital coupons, along with social media posts, to entice consum ers to add deserving items to their holiday shopping lists. They don’t have to be complex: Consumers often search online for basic holiday recipe favorites, including green bean casserole, mashed potatoes, cookies and appetizers.

Trading Down

“Trading down” means different things to different shoppers. For example, some may swap traditional holiday fresh fruits and vegetables for smaller quantities of produce varieties that are on sale. Others may trade down altogether from fresh produce to less expensive frozen or canned pri vate-brand options. Some may also trade down when it comes to meats and seafood, closely comparing frozen and fresh departments in search of bargain pricing. July purchasing data reflects an inflation rate jump of 28% in the frozen meat category. Therefore, the fresh case may still be the best place to bargain shop. Suggest holiday recipes featuring budget-friendly pork tenderloin and roasts, beef strip loin and sirloin, and case-ready selec tions in place of more costly cuts like prime rib and filet mignon.

Diluting Share of Wallet

As financial optimism and the purchasing power of the dollar drop, so can customer loyalty. Memberships to warehouse/club stores become more attractive to value shoppers, prompting traditional grocery retailers to lose some share of wallet to discount and big-box retailers. Consumers will also turn to online shopping and digital price checking to get the best deals. Re tailers need to stay connected with their shopper base and offer affordable holiday meal solutions, both in-store and online.

Differentiate During the Holidays

Retail dietitians can help differentiate and contribute to customer retention by offering budget-friendly holiday menu ideas, and tips on how to stretch food dollars, reduce food waste and gain the best nutrition out of their spend.

Demonstrate ways to save on holiday menu favorites. Create holiday recipes using food brands featured on discount promotions, in combination with private-brand ingredients that help decrease price per portion. Align in-store displays and cross-merchandising with holiday meal deals to position your stores as affordable, one-stop destinations for healthy holiday shopping.

Help ReinventConsumersPartyFoods

Show customers how to make the most of leftover holiday entertaining menu items by first storing them at proper temperatures, and then using them as creative secondary meals. Save raw veggie tray leftovers to use as soup starters or steamed veggie side dishes. Offer recipes to use today’s fruit tray as tomorrow’s breakfast smoothies. Serving a holiday shrimp tray on ice? Rein vent the remainder as a hearty shrimp-andfrozen-corn chowder. Have leftover beef steak? Get creative by making steak-andpepper fajitas or steak-and-egg omelets.

One of the best ways that consumers can save holiday food dollars is to ensure that healthy foods purchased are eaten, rather than landing in the waste bin.

Karen Buch, RDN, LDN, is a registered dietitian/nutritionist who specializes in retail dietetics and food and culinary nutrition communications. One of the first supermarket dietitians, she is now founder and principal consultant at Nutrition Connections LLC, providing consulting services nationwide. You can connect with her on Twitter @karenbuch and at NutritionConnectionsLLC.com.

Align in-store displays and crossmerchandising with holiday meal deals to position your stores as affordable one-stop destinations for healthy holiday shopping.

14 progressivegrocer.com ALL’S WELLNESS

UP GRABS! L NT- OWE ED & L NT- ED THE ONLY To schedule a cutting, contact Tim White at (513) 227-0730, or at timw@gwfg.com. You won’t believe how much it tastes like actual chicken! Visit SkinnyButcher.com/TradePartners for more info.

By Angelina Bice

Ida Liu, global head of Citi Private Bank, also spoke at the event, introducing attend ees to the concept of the “DQ,” or “Decen cy Quotient.” Liu characterized this as how we show up for each other with kindness and respect, and how we collaborate. “By being kind, we are able to collaborate bet FORUM PROVIDED OF AND TAKEAWAYS FOR WOMEN IN THE WORKPLACE.

extUp recently held its annual Executive Forum conference, where the organiza tion brings together c-suite executives and cutting-edge thinkers for three days of connection, learning and develop ment toward its goal of Advancing All Women in Business. The incredible speakers brought some serious knowl edge to the table, from diversity at work to the value of taking risks. The 2022 fo rum took place Aug. 2-4 at the Terranea Resort, in Rancho Palos Verdes, Calif.

During the conference, Priscilla Tuan, chief marketing officer and executive leadership team member at Sovos Brands, made the salient point that “main taining transparency and tapping into our humanity is the only path forward” for business leaders. In the same session, Michael Del Pozzo, president and general manager, Gatorade performance portfolio at PepsiCo Beverages

North America, noted that being inten tional and modeling how a modern leader leads is key to building strong teams in 2022. Taking walk-and-talks to check in, no matter your level of seniority, and visibly leaving the office to spend time with family normalizes this behavior for staff and encourages authentic leadership.

“By being kind, we are able to collaborate better, and this builds our resilience and our grit.”

—Ida Liu, Citi Private Bank

Researcher, writer and entrepreneur Anna Gifty OpokuAgyeman (left) appreared onstage at NextUp’s Executive Forum 2022.

16 progressivegrocer.com UPWARD

Lessons Leadershipin NEXTUP’S 2022 EXECUTIVE

PLENTY

LEARNINGS

ter, and this builds our resilience and our grit,” she observed.

Author, speaker and researcher Tamara Myles taught attendees that driving retention through meaningful work is the path forward. “Work is not ornamental to our well-being — it’s fundamental,” said Myles, who also pointed out that executives must “keep the 90/10 rule in mind: High-potential employees are 10% of your

team, and 90% are an opportunity for development.” The closing keynote came from Mike Walsh, CEO of Tomorrow and a noted futurist. To Walsh, “Culture is your organization’s true operating system.” He ad vised leaders to design a distributed decision-making environment, because highly centralized organizations “will not survive crisis. Autonomy is essential.”

All in all, it was a jam-packed three days of learning, and we couldn’t be more thrilled to have been joined by so many leaders in California this year. If you’re interested in hearing from amazing speakers like this firsthand, NextUp’s next conference, the Leadership Summit, will take place Oct. 19-21. Visit nextupisnow. org/events/summit to learn more.

Angelina Bice is copywriter and content strategist at NextUp, a 501c3 nonprofit dedicated to Advancing All Women. NextUp has more than 15,000 members, 21 regions, and 300-plus national corporate partners and regional sponsors committed to transforming workplaces for gender equity.

Ida Liu, global head of private banking at Citibank (right), spoke with NextUp’s Sarah Alter at the annual event.

Ida Liu, global head of private banking at Citibank (right), spoke with NextUp’s Sarah Alter at the annual event.

•Retail Pricing •Shelf •Store•Payments•Retail•Store•Consumer•RetailManagementMarketingServicesOperationsTechnologyDesign&Equipment UNFI offers a comprehensive suite of retail services, including: Professional Services Contact us: PSsales@UNFI.com | Services.UNFI.com

Retailer Deep Dive

The grocery industry was abuzz with excitement last month as rumors swirled that Ahold Delhaize was in talks with the Albertsons Cos. on a merger. Whether the rumors are true, Ahold Delhaize CEO Frans Muller has repeatedly hinted that the company thinks that there’s an opportunity for growth in the grocery industry, due to the accelerating pace of consolidation, especially in the United States.

“The whole market will continue to consolidate,” Muller said at IEX Investors Day in Amsterdam in July.

At a Giant Co. store in Philadelphia, Ahold Delhaize showcases its customer value proposition by offering customers healthy, quality and delicious choices in all departments, but especially in the perimeter with fresh. The company has also been adding more plantbased choices, and some of its stores even have nutritionists on hand to guide consumers who are new to the vegan lifetsyle.

Key Takeaways

Ahold Delhaize’s Food Lion banner continues to lead brand performance.

The retail conglomerate has reached 30% private-brand penetration at a time when consumers are increasingly seeking out bargains.

It has also converted its first facility into a self-managed network, part of a three-year journey to a selfdistribution model. Gina

18 progressivegrocer.com FEATURE

DelhaizeofAscendancyTheAhold The mega-chain is gaining momentum through omnichannel, private brands and sustainability. By

Acosta

Turn Sustainability Into

With City US, you can make sustainability mandates work for you to gain a new edge — with up to 10%+ Energy Reduction and 50%+ Energy Cost Savings. From refrigeration systems to lighting and HVAC, your facilities will be inviting to customers while staying as low energy and low cost as possible. And it’s all thanks to our 360-degree suite of self-performed, Energy-led FM and Building and Engineering Solutions, from a team that’s dedicated solely to your brand.

Nationwide Leader in Grocery Facilities Management Holistic, Proactive FM, Building and Engineering, and Energy Management Solutions Global Sustainability Council Provides Best Practices from Around the World

Opportunity Learn more at www.CityFM.us

Retailer Deep Dive

“The complexity of this industry is increasing rapidly, and the smaller players are finding it difficult to make the in vestments that are needed now in sustainability, in innova tion, in digitization. Moreover, the tailwind of COVID has fallen away, making it clear who are less well positioned, so only now that consolidation is really getting underway. We have a strong balance sheet, and we are ready to seize our opportunities in the consolidation battle, both on the American East Coast and in Europe.”

In the United States, where the international retail conglomerate operates 2,048 stores, the timing of a merger announced this year would make sense.

Ahold Delhaize USA has been strengthening its position as it looks to take its hyper-local value proposition national. After blockbuster revenue years in 2020 and 2021, Ahold Delhaize has demonstrated that it can keep growing by focusing on omnichannel innovation, prioritizing value and expanding its assortment of high-quality, low-cost private-brand products.

A combined Ahold Delhaize USA and Albertsons Cos. would create the largest supermarket chain in the United States.

“Our brands are laser-focused on helping consumers manage spending by proactively highlighting savings opportunities along the customer journey,” Muller said

during the company’s sec ond-quarter earnings call in August. “Powered by data and insights, we do this by providing great value offers via omnichannel loyalty programs, by prioritiz ing healthy food options through Guiding Stars and Nutri-Score linked promo tions, and by expanding the assortment and availability of high-quality, low-cost Own Brand products and bulk offerings.”

A Family of Local Brands

The Zaandam, Netherlands-based operator of 7,452 stores with more than 400,000 employees came into existence in July 2016 when Dutch company Royal Ahold and Belgian firm Delhaize Group merged.

Ahold Delhaize’s U.S. business, Ahold Delhaize USA, today has a presence across the East Coast of the United States, where it operates what it likes to call “a family of great local brands,” comprising Food Lion, FreshDirect, The Giant Co., Giant Food, Hannaford, Stop & Shop Supermarket Co., Peapod Digital Labs, and Retail Business Services.

When it reported second-quarter earnings in August, the company noted group revenue of $22 billion, a 6.4% increase. According to Ahold Delhaize, revenue was driven by positive contri butions from same-store sales growth of 4.7%, foreign currency translation benefits, and, to a lesser extent, by the acquisition of DEEN super markets in the Netherlands and higher gasoline sales. Group online sales grew 4.8%.

However, the beating heart of Ahold Delhaize seems to be its U.S. business: In 2021, Ahold Del haize USA reported annual sales of $53.7 billion, up 3.6% from 2020.

When it reported Q2 earnings in August, U.S. net sales were $14.03 billion, an increase of 7.7%. U.S.

“The whole market will continue to consolidate. The complexity of this industry is increasing rapidly, and the smaller players are finding it difficult to make the investments that are needed now in sustainability, in innovation, in digitization. Moreover, the tailwind of COVID has fallen away, making it clear who are less well positioned, so only now that consolidation is really getting underway. We have a strong balance sheet, and we are ready to seize our opportunities in the consolidation battle, both on the American East Coast and in Europe.”

—Frans Muller, CEO, Ahold Delhaize

CEO Frans Muller says that Ahold's local brands provide distinct, competitive and societal advantages. On the one hand, "they allow us to successfully navigate short-term market volatility, and on the other, they provide operational bandwidth and financial stability so we can remain focused on our exciting long-term growth agenda."

20 progressivegrocer.com

FEATURE

www.enstrom.com

Retailer Deep Dive

comps rose 6.4%. Based on the strength of this per formance, Ahold Delhaize raised its EPS to increase by mid-single digits compared with 2021, and free cash flow to be approximately $2 billion compared with the guidance the company gave in May.

In Q2, Ahold Delhaize USA’s Food Lion banner continued to lead brand performance. In fact, Muller said that Food Lion has been the “clear outperformer” in the company and right now is one of the fastest-growing brands in the United States, with close to double-digit comps.

“Food Lion has had very strong growth and market share gains. In fact, we think that we gained market share on the East Coast as an overall U.S. business,” Muller observed. “At the top end, we see Food Lion, and at the low end, we see Stop & Shop, but overall market share gains there.” Muller added that the company hasn’t seen consumers on the East Coast trading down on their favorite items to save cash.

According to Natalie Knight, CFO at Ahold Delhaize, the Stop & Shop brand’s financial performance has been affected by delays in store remodels.

“At Stop & Shop, the challenge has been that we really just

Technology is leveraged throughout The Giant Co.'s Riverwalk store in Philadelphia. Features include digital displays that show ads for products and touchscreen stations where customers can search for information or place orders.

Technology is leveraged throughout The Giant Co.'s Riverwalk store in Philadelphia. Features include digital displays that show ads for products and touchscreen stations where customers can search for information or place orders.

22 progressivegrocer.com

FEATURE

haven’t had the opportunity to complete the really aggressive remodeling program that we have envisioned,” Knight said during the Q2 results call. “If we look at Food Lion several years ago, that was really the key to success, in addition to pricing and culture. You got a different look and feel when you went into the store. And when we look at Stop & Shop, that’s something where we definitely have big plans. They have been slower than we would have liked during COVID-19, because it was just hard to meet the technical requirements to do it. We are moving at full speed at the moment. There’s a real focus in terms of what we want to do in the New York area, because that’s the place where ... we believe we can be really impactful and show people what we want to do with the brand.”

In June, Stop & Shop revealed a $140 million remodeling investment across its New York City stores over the next two years. The initiative aims to improve the shopping experience for local customers by adding thousands of new products to the assortment that reflect the diversity of the neighborhoods and communities that Stop & Shop serves, Ahold Delhaize says.

Omnichannel Ecosystem

Last year, when Ahold Delhaize held its investor day in November, the company said that it expected its online sales across its grocery banners in the United States and Europe

to double by 2025. The grocery chain also noted that e-commerce would be the foundation of an “omnichannel ecosystem” that would generate an additional $10 billion between 2023 and 2025.

So, how’s that going?

Well, in the second quarter, U.S. online sales at Ahold were up 16.4%. Not as strong as the 61% increase in the prior-year quarter, but impressive nonetheless, considering an economic envi ronment in which shoppers are counting every penny due to historic inflation, and e-commerce sales overall have been slowing.

In the United States, Ahold Delhaize now has more than 1,400 online grocery pickup points, and it has also added new instant-delivery options with partners such as Instacart.

“We are looking at how do we work much more collaboratively between Stop & Shop and FreshDirect to really capitalize on the benefits of both of those brands and what they can do to help each other in that area,” Knight said.

In July, FreshDirect, the Northeast’s leading pure-play online grocer, celebrated its 20th year in business (Ahold Delhaize acquired the company in

24 progressivegrocer.com

FEATURE Retailer Deep Dive CUSTOMERS NOT STORE? THINKINGABOUT YOURWHEN FRESH CUSTOMERS . . . “GIVE UP AND LEAVE” IT’S HARD TO FILL THEIR SHOES.

early 2021). The e-grocer said a week later that it would launch its first shop per loyalty program in 2023.

In late August, however, FreshDi rect revealed that it would exit the Philadelphia and Washington, D.C., markets. The company said that the move would “allow it to better serve customers in the tri-state market sur rounding New York City.” FreshDirect competes with Ahold’s digital-forward Giant Co. and Giant Food banners in those areas, so the move makes sense in terms of increasing efficiencies.

In fact, The Giant Co., which has a new interim CEO, John Ruane, starting this month, has been working this year to make e-commerce more attractive to cost-conscious consumers, including the elimination of order minimums and grocery pickup fees.

“With today’s customers having more choices than ever before, it’s critical that we continue taking steps to differentiate our online shopping experience,” said Matt Simon, VP of brand experience at The Giant Co., when news of these e-commerce changes broke. “Not only do these enhancements accelerate our

Earlier this year, The Giant Co. made it easier for inflation-battered shoppers to get groceries delivered. The grocery store chain eliminated order minimums and fees for online shoppers who use Giant Direct and Martin’s Direct services for pickup.

omnichannel strategy, but they also provide our Giant Direct and Martin’s Direct customers with greater convenience and value, uniquely positioning Giant Co. as an online grocer of choice.”

PROGRESSIVE GROCER September 2022 25

GIVE THEM A REASON 845-331-2111 | professionalseriesequipment.com © 2022 M&E Mfg. Co., Inc. Trademarks property of M&E Mfg. Co., Inc. Beyond Smart DELI ª The In-Store “Relationship Management” Specialists Professional Series ® SOLD THROUGH DEALERS ONLYSOLD THROUGH M&E MFG. CO., INC.

Last November, The Giant Co. opened a new state-of-theart direct e-commerce fulfillment center in Philadelphia to serve more customers in that city and — for the first time in its 98-year history — southern New Jersey.

Transforming the Supply Chain

Ahold Delhaize USA has been busy putting into place a supply chain transformation plan since 2021, a three-year journey to establish an integrated self-distribution network to support the division’s omnichannel growth. In March, the company shared that it had converted a facility into a self-managed network in Bethlehem, Pa., bringing the total number of network facilities to 21.

“The conversion of the Bethlehem facility is an import ant milestone,” said Bob L’Heureux, VP, supply chain services for ADUSA Supply Chain Services and self-dis tribution implementation lead, last March. “It’s not only the first facility to convert in 2022, but with the addition of this distribution center, we now have the first facility in the network that serves more than one Ahold Delhaize USA brand. This is an important capability to add as we continue to transform the supply chain network into an integrated, flexible model that supports omnichannel growth for the brands we serve.”

Sitting at 1.2 million square feet, the Bethlehem distribution center receives, selects and transports 200 million cases of nonperishable grocery annu ally for more than 210 Stop & Shop and Giant Co. stores and e-commerce centers. The facility is equipped with the supply chain network’s end-toend forecasting and replenishment technology from Atlanta-based Relex Solutions, which enables great er precision in order accuracy, resulting in better in-stocks, fresher products and reduced food waste.

Bethlehem is one of seven new and acquired warehouses revealed in December 2019 as part of Ahold Delhaize USA companies’ supply chain transformation. Following that announcement, ADUSA Distribution also acquired another distri bution center, in Mauldin, S.C.

In August, Ahold Delhaize USA poached San ja Krajnovic from Goodlettsville, Tenn.-based Dollar General and named her EVP, distribu tion and transportation for the ADUSA Supply Chain network. Krajnovic joins the supply chain leadership team as Ahold Delhaize USA companies continue to transition to an integrat ed self-distribution model.

26 progressivegrocer.com

FEATURE Retailer Deep Dive masonways.com 800-837-2881 Over 80 Base Sizes | Retail Display SolutionsBOOTH #2069

Private-Brand Peak

Buried deep in the Ahold Delhaize Q2 earnings report was a not-so-sur prising nugget: The com pany has achieved 30% private-brand penetration. After all, the company has been working hard to elevate its own brands.

Earlier this year, the conglomerate installed a new leader in charge of private brands, Ian Prisuta, who has hit the ground running trying to meet the company’s stated goal of having more than half of its sales of own brands come from healthy products by 2022.

“In terms of the U.S., we see opportunity for the rest of the year in private label, where in some cases, we have better margins than the rest of our portfolio,” Knight said.

In July, Prisuta tapped into two retail trends — private label and diversity — when he launched an incubator program for certified diverse-owned suppliers to develop new, exceptional-quality private-brand products.

“Through this program, we’re hoping to identify a select number of innovative food and beverage manufac turing companies with products made from high-qual ity, distinctive ingredients, or healthy options that will appeal to the widely diverse customers of the brands of Ahold Delhaize USA,” Prisuta said at the time. “I’m confident there are suppliers that we haven’t engaged with yet that would be a valuable addition to our pri vate-brand portfolio, and the entire private-brands team is excited for the opportunity to develop new relation ships with those businesses.”

During the two-and-a-half-month Incubator Program, the chosen participants will learn from the company’s private-brands team about its private-brand structure and goals, and will grow their knowledge of the brands of Ahold Delhaize USA. The program will include educational sessions and discussions on best practices with various functional sub ject-matter experts. Participants will also be paired with their own personal pri vate-brand mentors, who will help them prepare for their final product pitch.

The incubator program is part of Ahold Delhaize’s strong focus on its environmental, social and governmental (ESG) efforts, including Giant Food’s recent partnership with circular-reuse platform Loop, from Tren ton, N.J.-based Terracy cle, and Dutch retailer

Albert Heijn’s rollout of a 100% electric delivery fleet in 2022 for The Hague city center, with Rotterdam, Utrecht and Amsterdam to follow next year. Ahold’s U.S. brand Hannaford also disclosed plans to be fully powered by renewable energy by 2024. Additionally, just last month, the company bolstered its ESG strategy further by appointing Jan Ernst de Groot, already its chief legal officer since 2016, to the additional role of chief sustainability officer. De Groot is well known in the Dutch and international sustainability community, with a track record of leading transformative sustainability programs at companies, and supervisory roles at NGOs and civil society organizations.

“For a long time, sustainability has had a central position in our organization,” Muller said at the time of de Groot’s appointment to the chief sustainability officer position. “It is one of our four key strategic focus areas, and a critical driver of our purpose: Eat well. Save time. Live better. Our activity and performance in this area are attracting increasing interest from customers, (future) associates, inves tors and other stakeholders. With the appointment of Jan Ernst, we ensure that the full scope and dimen sion of sustainability and ESG are holistically represented at the exec utive committee level.”

Jan Ernst de Groot is chief legal officer and chief sustainability officer at

The perimeter at the Riverwalk Giant Co. store in Philly boasts a food hall, a kombucha tap, in-house smoked meats, a dairy department dedicated to plant-based dairy, a smoothie bar (pictured above), a brewpub, organic wines and two separate areas for outdoor seating.

PROGRESSIVE GROCER September 2022 27

SAY PLASTICTONO SWITCH TO NON WOVEN REUSABLE BAGS TO HELP THE ENVIRONMENT Fabric from 40-80GSM Carries up to 25 lbs Non Woven Fabric Available in All Colors Very Low Cost Replace Plastic and Paper Bags Reuse 125 Times Custom Sizes, Print 1-4 Colors Meets State, County, City Laws 500 Newfield Avenue, Ste 10, Stamford, CT 06905 t. 203.614.8005 f. 203.614.8006 www.spackbg.com e. sales@sustainablepackagingco.com SAYPLASTIC

“Sustainable

LET’S KEEP IT GREEN. SWITCH TO NON ENVIRONMENTTOREUSABLEWOVENBAGSHELPTHE 500 Newfield Avenue, Ste 10, Stamford, CT 06905 t. 203.614.8005 f. 203.614.8006 www.spackbg.com e. sales@sustainablepackagingco.com Fabric from 40-80GSM Carries up to 25 lbs Non Woven Fabric Available in All Colors Very Low Cost Replace Plastic and Paper Bags Reuse 125 Times Custom Sizes, Print 1-4 Colors Meets State, County, City Laws

Packaging helped me eliminate paper bags as we switched to their non woven t-shirt reusable bag program. With the very low cost we were able to offer 4 bags for a dollar. Their bags meet the New York state guidelines for reusable non woven. We also sell woven bags but their non woven out sell these by 25 to 1. We don't even carry brown bags any more... not an option at the front end.” —President of a Food Chain in NY.

Sustainability Scorecard

AWorthJourneyTaking

By Jenny McTaggart

ifteen years ago, Progressive Grocer published its first-ever “green” issue, with the cover headline “Green is the New Black.” At that time (early 2007), sustainability was just becoming a mainstream trend in U.S. business as companies were beginning to recognize that it behooved them to invest in more earth-friend ly practices and products to ensure a healthier environment, keep their shareholders happy and, especially, to reach consumers who were supporting these noble ideas with their wallets.

Fast-forward to 2022, and the grocery industry has started to rack up some rather impressive achievements while setting some

Key Takeaways

A number of grocers have taken some major steps in areas such as energy efficiency, waste from packaging and surplus food, sourcing, and transportation and Someshipping.grocers see such actions as a competitive advantage.

As food retailers embrace a circular economy, they’re also encouraging consumers to recycle and reuse packaging.

major commitments related to sustain ability. Of course, the industry has been gradually pulled along by government regulations that place more emphasis on climate change, but a growing number of retailers have recognized that what’s good for the environment is often good for business, too.

Led by large mass-market retailers like Walmart and Target, which often have to answer to their concerned shareholders — as well as smaller chains with more environmentally progressive European connections, like Aldi and the regional

With a number of retailers making significant progress on the path toward a net-zero future, PG takes a look at their top sustainability initiatives planned for the next several years.

Target's first net-zero-energy store, in Vista, Calif., will inform the retailer's investments in new store and remodel programs as it strives to achieve net-zero greenhouse-gas emissions enterprise-wide by 2040.

30 progressivegrocer.com SPECIAL REPORT

F

Sustainability? We’re Living It. Alaska Seafood aligns with the highest global sustainability standards, and Nature-of course. AlaskaSeafood.org - RFMcertification.org

everyallAvocadosday,day.It'sourfocus&ourhistory. Get year-round freshness with Westfalia, the market leader in avocado growing, shipping, ripening, handling, and distribution. WESTFALIAFRUIT.COM

SUSTAINABILITY AT WESTFALIA THE FIRST FAIR TRADE CERTIFIED TM AVOCADO SUPPLIER IN THE WORLD

SPEAKING WITH…Raina Nelson, President and CEO, Westfalia Fruit Marketing USA LLC

Westfalia is committed to producing safe, exceptional quality fruit, all while ensuring sustainable, ethical and responsible management of its bio-resources and the communities and environments across the globe. Nowhere is that commitment more evident than in the company’s prime-quality, ready-to-eat avocados, which Westaflia grows, sources, ripens, packs, processes and markets year-round, all in a sustainable manner.

Progressive Grocer asked Raina Nelson, President and CEO of Westfalia Fruit Marketing USA LLC, to explain how and why the company is committed to sustainability in everything it does.

Progressive Grocer: First, let’s talk about your focus on sustainability as a whole.

Raina Nelson: At Westfalia, sustainability isn’t just a catchphrase. It is engrained in everything we do. Our founder, Dr. Hans Merensky, is regarded as the father of modern avocado production. He was ahead of his time in adopting techniques that conserve water, protect and rejuvenate soils, and offer sustainable livelihoods to the people who farmed his land and beyond. Today, we honor and extend his legacy by taking proactive steps to achieve zero waste to landfill and carbon neutrality, and to reduce pesticide usage on farms. Our sustainability strategy prioritizes the environment, local economies, and most importantly, our people. We believe in growth: the growth of people, the economies we touch, communities that surround us, our customers, our partners, and our products.

PG: That commitment to sustainability is terrific — but does it really matter to retailers who are dealing with so many other challenges these days?

RN: Does it matter?Absolutely! Shoppers care about sustainability, which means retailers should, too. Statistics show that nearly 80% of U.S. consumers consider sustainability (of a product, the retailer, or the brand) when making at least some purchases1; younger generations are increasingly willing to pay more for products with the least negative impact on the environment2; and 43% of avocado purchasers are concerned that avocados are not sustainably grown and processed.3 That means vague avocado sustainability claims could be preventing grocery retailers from reaping business from loyal avocado shoppers.

PG: Westfalia has the distinction of being the global leader in avocados. How do you bring your commitment to sustainability to bear in the avocado market? What is the Westfalia Difference?

RN: Westfalia has developed new ways of growing avocados that protect water resources and produce strong, healthy avocado trees that will bear fruit and nourish the land for decades to come. We’ve pioneered low-flow drip technology that uses small pipes to emit less than one litre of water an hour per nozzle — just enough to replace what’s been lost through evaporation and transpiration. The technique saves water, improves air in the soil, and produces higher yields and healthier soils, allowing our growers to use up to 43% less water while increasing the output and economic value of the fruit. Another example: Westfalia’s developing orchards in Colombia feature 15% to 20% organic carbon in the soils.

While Westfalia is committed to the UN’s Sustainable Development Goals, we also have set our own targets. In 2020, the company improved water-use efficiency by 14%, generated 50% more of its own electricity, reduced waste to landfill by 9%, and lowered its carbon footprint per kilo of fruit by 5%. Our goal is to achieve zero waste to landfill by 2025, carbon neutrality by 2030, and to reduce pesticide usage on farms by 50% by 2035.

PG: We haven’t talked about the quality and availability of your avocados. What would you like to share with grocery retailers?

RN: At Westfalia, sustainability and quality go hand-in-hand. Being market leaders in the ripening process means we can provide fruit at exactly the correct level of ripeness, depending on when the fruit must be ready to eat. Our vertical integration from multiple countries of origin allows us to provide fruit when and where retailers need it, every single day. We have quality avocados all year long. We grow, source and ripen. We research and develop. We pack and process. We sell and ship. And just as important, if not more so, than all of those things, we care and conserve.

The bottom line is that we’re all a part of the future and must all work together to build a bright one.

For more information, email info@westfaliafruit.com westfaliafruit.com 1Sensormatic Solutions, April 2022 study 22019 McKinsey study 3Cooper Roberts Research, “Avocados Tracking 2021”

ADVERTORIAL

The momentum of plant-based foods is undeniable. To us, it seems only natural to put a plant-based product in a plant-based package. Trees are perennial plants. With a harvest to planting ratio of 1 to 3 trees and a recovery rate of 91 percent, corrugated boxes are made to be remade using both new and recycled plant fibers. Natural. Authentic. Remade. Extraordinary.

Learn more about the renewability, recyclability and responsibility of boxes at boxesareextraordinary.com.

CORRUGATED BOXES: Plant-based Packaging from Renewable Forests

SPEAKING WITH...RACHEL KENYON, Senior Vice President, Fibre Box Association (FBA)

Corrugated boxes are staple packaging products that all grocery retailers rely on. Progressive Grocer reached out to Rachel Kenyon , Senior Vice President of the Fibre Box Association (FBA), to find out the role tree farming plays in creating that packaging and why the process is important to grocers and the customers they serve.

Progressive Grocer: Most people know trees are used to make paper products, including corrugated cardboard boxes. Many worry that the process is damaging our forests and harming our environment. Should they be concerned?

Rachel Kenyon: Actually, nothing could be further from the truth. In fact, the forest products industry is wholly vested in growing and sustaining abundant, healthy forests as an endless natural resource. Private landowners grow almost all of the trees used to make corrugated boxes; they are deeply invested in maintaining a sustainable crop to stay in business. These landowners grow, harvest and regrow trees using sustainable forest management practices that perpetuate infinitely renewable forestlands; for every tree harvested, two more are planted, helping make sure that U.S. forests are not only preserved — but nourished and cultivated. So, the forest products industry is actually helping and growing — not hurting — U.S. forests.

PG: There is a relationship between farm families and the land. Can you explain what that is?

RK: The families that own these tree farms want to sustain their forest for generations to come. That means they’re very intentionally trying to manage it so they can harvest trees every year and don’t have to wait for 25 years for newly planted trees to mature. In fact, the paper and wood

products industry has quantifiable sustainability goals, which are spelled out in the American Forest and Paper Association’s Better Practices, Better Planet 2030 report (https://www.afandpa.org/2030), which showcases a commitment to manufacture sustainable products for a sustainable future.

PG: How does the process work? And how does it tie in with regenerative agriculture?

RK: Regenerative agriculture is a farming practice that can rebuild soil organic matter and restore soil biodiversity — and it is what privately owned tree farms practice. For example, say there are three trees in a row and the middle tree isn’t as strong as the others. The farmers will leave that smaller tree and wait until it is ready to be harvested. That means there are always trees in different stages of growth on the farms. It is similar to farmers rotating their crops. Because the whole forest isn’t harvested, it maintains biodiversity, protects animals, and protects watershed. And even after trees are cut, what’s left nourishes the soil for growing new ones.

PG: What does all of this mean for grocery retailers?

RK: We all know how fast the term ‘plant-based’ has grown — everywhere you look you see it, especially in the context of the food we eat. But it doesn’t have to stop there. Trees are perennial plants grown specifically to make recyclable packaging materials like corrugated boxes. And that means boxes are plant-based packaging. When grocery retailers put their plant-based products in plant-based containers, then encourage customers to recycle the boxes delivered to their doorsteps, they’re helping to build a circular, sustainable supply chain. Not only is that great for the environment — it can help build business, too.

➤ To learn more about boxes and how they can help your store become a more sustainable enterprise, visit www.corrugated.org.

ADVERTORIAL

Sustainability Scorecard

U.S. banners belonging to Ahold Delhaize — a number of grocers have taken some major steps in areas such as energy efficiency, waste from packaging and surplus food, sourcing, and transportation and shipping. They are essential ly in the process of creating more sustainable, less wasteful supply chains from farm to fork, even getting their suppliers on board.

Some even see it as a competitive ad vantage: Amanda Nusz, SVP of corporate responsibility at Minneapolis-based Target, alludes to this idea when talking about the company’s new Target Forward program: “We want our guests to turn to Target first when they think about sustainability.”

Looking ahead to the remainder of 2022 and beyond, Progressive Grocer’s Sustainability Scorecard doesn’t set out to rank individual companies, but rather highlights some of the key initiatives being planned by the country’s most forward-thinking retailers, as stated in their annual reports; ESG (environmental, social and governance) or sustainability reports; or elsewhere.

Every company seems to be on a slightly different part of its sustainability journey, although most have similar objec tives. Regardless of where they are on this journey, each step taken seems most definitely worth it in terms of working toward a healthier environment, more content consumers, and, quite often, cost savings in the process.

A Universal Mission That Requires Action

Before we begin looking at retailers’ major sustainability plans, it’s fair to ask the question, how much responsibility do grocers really have when it comes to the environment? New York-based global consulting firm McKinsey & Co.

estimates that the food system cur rently accounts for more than 30% of global greenhouse-gas (GHG) emissions, although grocers’ direct contributions to these emissions is relatively low, accounting for about 7% of the total food value chain.

Still, McKinsey advises that retail ers would be wise to take a leading role in moving the entire industry toward a more sustainable future. In an article recently highlighted on the firm’s website, called “Decarboniz ing Grocery,” the authors note that “the grocery sector has a unique opportunity to become the driving force for decarbonization of the entire food system.”

Simply put, according to McKinsey, “In the fight against climate change, the time is ripe for grocers to move from ‘playing defense’ (risk mitigation) to ‘playing offense’ (targeted value creation) — not only to help protect the planet, but also to strengthen their businesses.”

Counting carbs (no, not those carbs, but car bon dioxide, or CO 2 , being the primary green house gas emitted through human activities) seems to be a good place to start as retailers plot out their sustainability journeys. This re

This graphic produced by Ahold Delhaize illustrates the company's health and sustainability journey planned through 2040. Several of the country's leading grocery companies have similar goals.

“We want our guests to turn to Target first when they think sustainability.”about

—Amanda Nusz, Target

36 progressivegrocer.com

SPECIAL REPORT

*330mL and 500mL sizes, bottle only **Projected total bottle volume per 2022 sales forecast © 2022 FIJI Water Company LLC. All Rights Reserved. FIJI, EARTH’S FINEST, EARTH’S FINEST WATER, the Trade Dress, and accompanying logos are trademarks of FIJI Water Company LLC or its affiliates. FW220628-24 Earth’s Finest Water Is Also Earth-Friendly RECYCLED100%PLASTIC* FIJI Water is committed to sustainability and is proud to launch its 330mL and 500mL bottles made from 100% recycled plastic* in 2022. This change will replace more than 50% of FIJI Water’s plastic bottles in the U.S.** FIJI Water is available direct. Contact your FIJI Water representative at 888.426.3454 or at FIJIWater.com .

SPECIAL REPORT

Sustainability Scorecard

quires not only taking a close internal look at what kind of GHG emissions a company is responsible for, but also seeking outside help to consult and give oversight.

According to the McKinsey article, two terms are most commonly used by companies when measuring carbon emissions: “carbon neutrality,” which is commonly used to refer only to CO2 and is often associated with the practice of offsetting emissions rather than reducing them, and “net zero,” which essentially refers to all GHG emissions and entails a focus on rapid, real emission cuts. The latter requires companies to set quantified targets, including for indirect emissions across their entire value chains.

Perhaps not surprisingly, Albertsons and other large publicly owned grocery chains like Ahold Delhaize, Target and Walmart have set goals to reach net-zero emissions, most of them by 2040.

Other chains are looking at reducing CO2 as a more realistic starting point.

Energy Conservation in Stores, and Renewable Energy

One of the main areas that falls into scopes 1 and 2 is energy consumption in stores, which can be reduced significantly by modernizing lighting, refrigeration, heating, ventilation, air conditioning and cooling. This will most certainly continue to be a major focus area for grocers in the next few years.

Ahold Delhaize, with global headquarters in Zaandam, Netherlands, shared in its “2021 Annual Report” that more than 40% of its carbon emissions come from leaks in refrig eration systems. While it seems possible to reduce emissions by approximately 60% at a neutral cost, initiatives like replacing refrigeration systems are more expensive and “will require significant capital expenditure at an earlier stage than [we] initially planned,” the company noted.

The retailer is prioritizing energy efficiency as it builds and remodels stores, and is installing energy-efficient equipment such as LED lights; doors on cabinets, heat recuperation; heat pumps; CO2 refrigeration systems (which not only reduce emissions, but are also more energy efficient than conventional refrigerators); and improved insulation. It’s also retrofitting ex isting refrigeration systems with more eco-friendly alternatives, while working to further control and reduce refrigerant leaks.

Meanwhile, the company is accelerating the switch to renewable power, with a number of its brands planning to use 100% renew able electricity by 2023. (To procure renewable energy, retailers can turn to renewable energy credits, look into solar power or other green energy, or look at power purchase agreements.)

Issaquah, Wash.-based warehouse club oper ator Costco has had success using display case shields to reduce energy use in its U.S. operations. The shields are employed during hours that the warehouses are closed to reduce power use while maintaining product temperature. As a result, there’s less load on the refrigeration system, with improved product temperature maintenance.

Batavia, Ill.-based Aldi US, which has sustain ability aspirations built into its business model, now has nearly 500 stores using refrigerants that have near-zero global-warming potential, and the discount grocer estimates that 51% of potential carbon emis sions have been saved due to its continued transition to natural refrigerants and phase-out of harmful refrigerants. Meanwhile, the growing chain is testing a smart-building automation system to minimize wasted energy with the lowest possible emissions.

In 2021, Aldi continued to purchase green elec tricity to cover 100% of its energy consumption and introduced its first company wind turbine, in Dwight, Ill. The company installed solar rooftop panels on additional buildings, bringing its total to more than 120 stores and 12 distribution centers. For 2022, it plans to install solar panels on an additional 60 stores and one new distribution center.

Seattle-based Amazon claims to be the world’s larg est corporate purchaser of renewable energy, and is on a path to powering operations with 100% renewable energy by 2025, five years ahead of its original target. The online retailing giant now has 134 utility-scale wind and solar projects and 176 on-site solar projects that supply renewable energy to its corporate offices, fulfillment centers, data centers and physical stores, including some Whole Foods units.

Target, which just released its first ESG report, is committing to source 60% of its electricity from renewable sources for its operations by 2025 — and that number jumps to 100% by 2030. Meanwhile, the company recently retrofitted its first net-ze ro-energy store, which is expected to generate up to 10% more renewable energy per year than needed to support its operations (the energy surplus can be transmitted back into a local power grid). The Vista, Calif., store will generate renewable energy through 3,420 solar panels across its roof and carport cano pies. Even its HVAC system will be powered through solar energy. The store and its new features will in form Target’s investments in new stores and remodel programs, according to the company.

Lakeland, Fla.-based Publix Super Markets, a founding partner of the U.S. Environmental Protection Agency’s GreenChill program, now has 77 stores that have earned Silver GreenChill certifications, 28 stores with Gold GreenChill certifications and one Platinum Certified store.

Sunbury, Pa.-based Weis Markets, another

70% say that they take into when shopping, and and reduction are among the most important for them.

Source: Aldi/Morning Consult survey commissioned by Aldi

38 progressivegrocer.com

of Aldi shoppers

sustainability

account

grocery

and food waste

plastic

packaging

sustainability issues

in 2021

regional player with a strong focus on sustainability, has turned to nuclear-generated electricity to reduce GHG emis sions from its electricity use compared with prior years. The retailer has now expanded its use of zero-emissions nucle ar-generated electricity to 67% of its electricity usage.

Like Publix, Weis has had numerous stores achieve the annual GreenChill certification. Notably, its store in Hanover, Pa., has earned its 13th consecutive GreenChill certification — an EPA record.

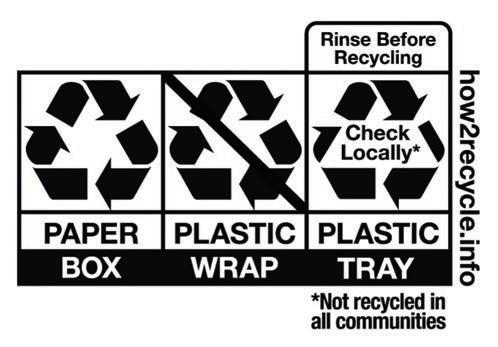

Reducing Plastics and Other Packaging Waste

Waste, whether from plastic bags, excess or unrecyclable packaging, or even unused food, falls under the scope 3 emissions that grocers track, and has also been gaining more attention in recent years.

Perhaps one of the most publicized “green” trends over the past decade or so is the switch to reusable shopping bags, largely brought on by local legislation. A number of retailers reacted by discouraging, or even outright banning, single-use plastic bags in their stores. That trend was followed by bans on plastic straws and other in-store packaging. While this may

Consumers Want Transparency in Sourcing and Values

Recent data from Chicago-based NielsenIQ shows that sales volume for products with sustainability-related claims and certifications on their packaging have increased significantly over the past three years. The data compares the past 52 weeks ended Aug. 6, 2022, versus three years ago. Here’s how the claims compare:

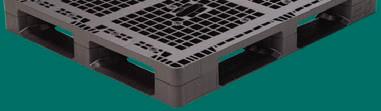

So, why aren’t you using a solution that can complete up to 400 trips without failure1? Meet the reusable plastic pallet that outperforms wood with improved hygiene, durability, sustainability and strength. Don’t let wood pallets hold you back. Make the switch to reusable pallets today.

Manufacturing,

Company

Animal Welfare (Includes Cruelty-Free, Cage-Free, Free-Range and Humane) +37.1% Environmental Sustainability (Includes Sustainably Certified, Carbon Footprint, Renewable Energy, Less Emissions and Zero Waste) +24.5% Social Responsibility (Includes B Corporation and Fair Trade) +22.1% Sustainable Farming (Includes EU Organic Farming, Family Farmed and Farm-Raised) +19.1% Sustainable Packaging (Includes Recycled Packaging, Eco-Friendly Packaging, Plastic-Free and Tetra Pak) +17.5%

A Better Way with ORBIS. LEARN MORE WWW.ORBISCORPORATION.COMAT®2022ORBISCorporation1InFasTracktestingcompletedatVirginiaTech,usingthe40x48Odyssey®pallet.

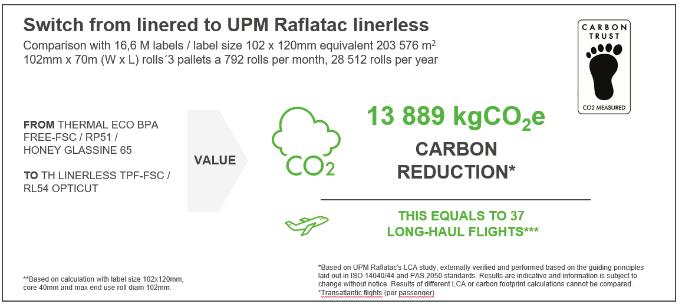

Labeling Innovation Helps Grocery Retailers Improve Performance and Reduce Environmental Impact

UPM Raflatac OptiCut™ Direct Thermal (DT) Linerless label materials enable grocery retailers to create business efficiencies and transition to more sustainable packaging.

Consumers, governments, and the industry have increased their expectations of companies’ environmental impact. This means retailers must take tangible sustainability actions such as switching to sustainable packaging and reducing waste.

Grocery retailers can respond to these trends by using OptiCut DT Linerless labels from UPM Raflatac, a leading global supplier of pressure-sensitive labeling solutions. UPM Raflatac’s whole Linerless product range carries the CarbonNeutral® certification by Climate Impact Partners. They have compensated for the Linerless range’s unavoidable greenhouse gas emissions based on cradle-to-customer scope. This means that when you choose UPM Raflatac’s Linerless, you take immediate action to help mitigate climate change.

Credible sustainability impact

For companies switching to DT linerless from linered labels, the sustainability impact is significant. Illustration 1 shows the carbon reduction in a case example of a retailer moving from standard DT linered labels to Opticut Linerless. As you can see, the retailer attained nearly 14,000 kgCO2e carbon reduction, which equals 37 long-haul flights, on a volume of 28.5 thousand label rolls.

To ensure the credibility of these calculations, UPM Raflatac works with the Carbon Trust so companies using OptiCut labels can obtain reliable and verified calculations of their carbon reduction.

Efficiency and performance

OptiCut products are designed to improve process efficiency and performance. Illustration 2 shows a case example of efficiencies created when switching to OptiCut Linerless from standard linered DT labels. As you can see, the change resulted in significant waste and reel change reductions, as well as 56 percent increase in the quantity of labels per roll.

As well, OptiCut products offer print clarity and low adhesive build-up in your linerless printer. This means that your liner-free printer is less likely to jam and reduces the frequency of printer maintenance. Finally, OptiCut labels perform in various conditions, including, cold, humid, moist and hot.

“We developed OptiCut to meet needs of grocery retailers that use a variety of food packaging types and retail weigh scales in a fast-paced retail environment,” stated Brinder Gill, Sales Director, UPM Raflatac Americas. “We recognized the need for a linerless solution where the adhesive will not jam up the liner-free printer and the label will perform in diverse environments.”

Linerless solution for retailers of all sizes

Regardless of the size of your business, UPM Raflatac can support your transition to linerless. “There is no comparison in our linerless capacity, which exceeds 100 million meters2,” said Gill. “We support our customers through a global distribution network, enabling them to transition to DT linerless solutions smoothly and at their

about UPM Raflatac OptiCut DT Linerless at go.upmraflatac.com/opticutlinerless.

Readpace.”more

M K S R

B S

B S V

SPECIAL REPORT

Sustainability Scorecard

not be the biggest trend — or the one to make the most differ ence in regard to the environment — going forward, retailers are expanding their actions to other parts of the store.

Austin, Texas-based Whole Foods, which claims to have been the first U.S. grocer to ban plastic grocery bags at check out in 2008, is now offering smaller produce pull bags, and has eliminated all Styrofoam (polystyrene) meat packaging trays in its stores in the United States and Canada, as well as removing all Styrofoam from its foodservice packaging.

Aldi, which has never offered the single-use plastic checkout bags commonly used by other retailers, has traditionally given its customers the option to purchase multiuse plastic bags (the thick er plastic bags with handles), or paper bags if needed. Now the retailer is focused on eliminating the multiuse plastic bags sold in its checkout lanes by the end of 2023. It will continue to sell paper bags (unless restricted locally) or reusable shopping totes, and will encourage customers to bring their own bags.

Joan Kavanaugh, VP of national buying at Aldi, tells Pro gressive Grocer that the retailer is also exploring alternative options for plastic produce and meat bags in its stores. “We’re proud to be the first major grocery retailer with nearly 2,200 stores nationwide to make a commitment of this magnitude and will continue trailblazing the grocery retail industry when it comes to limiting plastic waste,” she says.

Ahold Delhaize USA also has various initiatives in place to help reduce its in-store plastic use. In 2021, its Giant Co., Han naford, and Stop & Shop stores transitioned their own-brand commodity fresh chicken program from EPS (expanded poly styrene) foam trays to more easily recyclable PET rigid trays. Food Lion and Giant Food are scheduled to transition their commodity chicken programs away from foam trays through out this year. The Giant Co., Giant Food, Hannaford, and Stop & Shop also transitioned their Nature’s Promise organic fresh chicken programs from EPS foam trays to PET rigid trays.

Publix, for its part, wants to let its shoppers choose what bags they use, but it still continues to encourage reusable bags and has recycling stations for plastic/paper bags in its stores. In fact, the retailer turns its recycled bags into plastic pel lets that are sold to manufacturers for use in new plastic bags, fencing, benches and more.

Further down the supply chain, Publix (as well as other retailers) is paying closer attention to packaging during shipping. For example, when Publix began to use a steadier pallet to stack product in its Lakeland dairy plant, the company found that it no longer needed the cardboard slip sheets it used to protect the ice cream. That change saves nearly 1 million square feet of cardboard each year, according to Publix.

In another innovative shipping move, Publix’s neighbor up north, Rochester, N.Y.-based Wegmans, has started using newly designed RPCs (returnable plastic containers) to get fresh seafood from suppli ers to its stores, eliminating the need for Styrofoam coolers. Wegmans claims to be the first retailer to launch such a program for seafood. It worked with Atlanta-based Tosca to get the smaller crates that would be suitable for the seafood team’s needs.

Another way that more grocers are cutting down on plastic and other in-store waste is through their store-brand packaging.

UPM Raflatac, a global supplier of label materi als, is seeing an uptick in interest from retailers in regard to recycling. Brinder Gill, sales director at the Asheville, N.C.-based company, notes, “We work with numerous retailers and packaging suppliers on initiatives for packaging redesign for their in-house brands to enable recyclability, where labels play an important role.”

Aldi built sustainability into its original store model by operating smaller units, displaying products in shipping boxes (as shown here), and encouraging customers to use reusable bags. Now the company is planning to eliminate multiuse plastic bags by the end of 2023.

Kroger is partnering with TerraCycle to allow shoppers to recycle the grocer's own-brand flexible packaging.