MORE TO MUNCH ON Snack options span dayparts and forms

SEAFOOD DIET

Consumers consider sustainability, health and convenience

HERE’S TO SUMMER Beer and wine help usher in a successful season for grocers

IN COLORADO, KROGER SHOWCASES RESILIENCY

May 2023 Volume 102, Number 5 www.progressivegrocer.com 90th ANNUAL REPORT PLUS THE PG 100 12 imperatives for grocers looking to thrive in an era of change BROUGHT TO YOU BY

�ETRADE.COM

e q u i s i t e SaratogaWater.com | | Weekdays Reach u y u Bluetriton B ands Rep esen a ive au h ized supplie day! ©

Contact your GOYA® representative or email salesinfo@goya.com | trade.goya.com ©2023 Goya Foods, Inc. Learn More! A Unique Caribbean Drink. Your shoppers will love the bold, authentic flavor of GOYA® Jamaican Style Ginger Beer. Its spicy kick and refreshing fizz will awaken your shoppers’ taste buds - introducing them to a new favorite beverage. Bold. Spicy. Authentic.

Contents 05.23 Volume 102 Issue 5 12 NIELSEN’S SHELF STOPPERS Fresh Seafood 13 MINTEL GLOBAL NEW PRODUCTS Nonchocolate Confectionery 14 ALL’S WELLNESS Leading Customers to Functional Foods Departments 67 EDITORS’ PICKS FOR INNOVATIVE PRODUCTS 68 AHEAD OF WHAT’S NEXT Making the Most of Multicultural Marketing 6 EDITOR’S NOTE How to Make Your Stores Safer 8 IN-STORE EVENTS CALENDAR July 2023 4 progressivegrocer.com COVER STORY Crossroads In its 90th Annual Report, PG offers 12 imperatives for grocers looking to thrive in an era of change. 16 37

Table Mesa King Soopers, in Boulder, Colo., has triumphantly reopened after a tragic in-store shooting in 2021, thanks to parent company Kroger's focus on uplifting the communities it serves.

37 RETAILER DEEP DIVE Resiliency in Action

In Colorado, Kroger drives growth by uplifting a community.

48 SOLUTIONS

Current Considerations

Consumers weigh sustainability, health and convenience when purchasing seafood, while plantbased products make a play for their piece of the fish pie.

53 FRESH FOOD

Building the Perfect Produce Department

UNFI’s Dorn Wenninger offers advice on making this key store department an irresistible lure for customers.

57 BEVERAGES

Summer Beer and Wine Review

Learn how best to market and merchandise new drink offerings for retail success.

8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR

Paula Lashinsky 917-446-4117 plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS

Mike Duff and Jenny McTaggart

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI)

Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALE MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

REGIONAL SALES MANAGER (EAST COAST)

Dave Cappelli 312-505-3385 dcappelli@ensembleiq.com

BUSINESS DEVELOPMENT MANAGER

Lou Meszoros 203-610-2807 lmeszoros@ensembleiq.com

ACCOUNT EXECUTIVE/CLASSIFIED ADVERTISING Terry Kanganis 201-855-7615 • Fax: 201-855-7373 tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com

PROJECT MANAGEMENT/PRODUCTION/ART

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Rebecca Welsby rwelsby@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

60 EQUIPMENT & DESIGN

Leading the Charge

Food retailers are in the forefront of companies expanding the network of charging stations for electric vehicles.

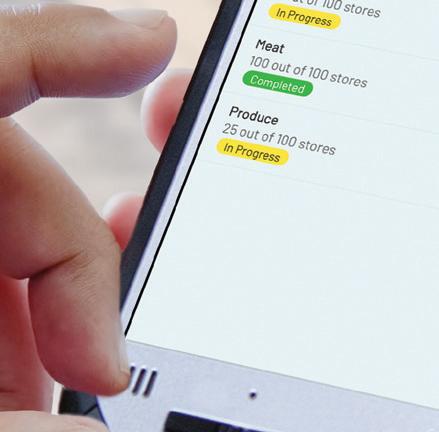

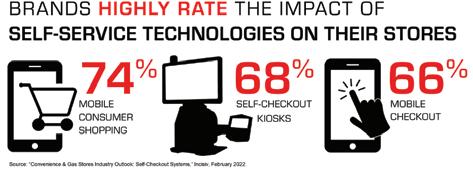

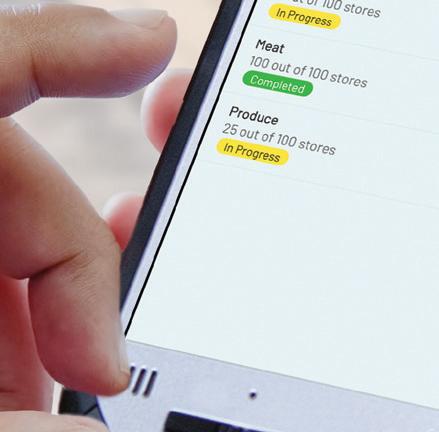

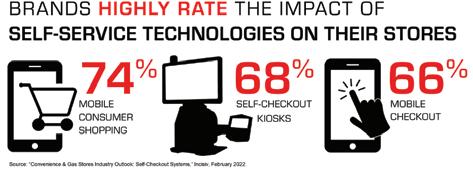

63 TECHNOLOGY

Greater Expectations

Self-checkout is evolving to make the process as seamless as possible for customers and retailers alike.

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Single copy price $14, except selected special issues. Foreign single copy price $16, except selected special issues. Subscription: $125 a year; $230 for a two year supscription; Canada/Mexico $150 for a one year supscription; $270 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $170 a one year supscrption; $325 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA.

POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Copyright ©2023 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

48 PROGRESSIVE GROCER May 2023 5

By Gina Acosta

How to Make Your Stores Safer

HERE’S FIVE IMPORTANT TIPS FOR ASSET PROTECTION IN GROCERY.

s you will read in Progressive Grocer’s 90th Annual Report, food retailers operating in North America today face a slew of hard challenges, from labor shortages to skyrocketing costs to dwindling profit margins. But there’s another challenge lurking in the shadows, and it isn’t being talked about enough in the industry: asset protection.

At the 2023 Retail Industry Leaders Association (RILA) Asset Protection Conference this month in Denver, retailers such as Kroger, Walmart, Target, Dollar Tree and many others detailed incidents of e-commerce fraud, violence against store workers, self-checkout fraud, habitual criminal offenders taking advantage of an overtaxed and under-resourced criminal justice system, rising organized retail crime losses, shrink numbers trending up, civil unrest, active-shooter events, persistent unlawful activity on store property, and more events disrupting operations in profound ways. Session after session, grocery retailers said that the No. 1 threat to their business is asset protection.

A law enforcement official from New York City reported that retail theft has jumped 77% over the past five years. The CEO of Ulta Beauty said that his stores have seen a 50% increase in violent incidents in the past six months. On the grocery front, Kroger’s director of asset protection, Chris Harris, discussed how the expiration of expanded SNAP benefits is going to lead to possibly even more incidents or threats.

“In March, the extra government push for SNAP benefits ran out,” Harris noted, “and that means the average individual has roughly $85 less in grocery spend every month. For a family of four, that’s more than $300 less that they’re going to have to spend on groceries. Now, they’re still going to buy groceries, but not as much. So, if sales go down, that’s going to put more pressure on shrink. … Plus there’s the uptick in organized retail crime, in theft activity, there’s the decriminalization of minor shoplifting cases. All of that adds complexity, and these are the things that we’re concerned about.”

Ahead of the Pack

Harris gave three reasons that Kroger has been at the forefront of experimenting with asset protection technology, deploying a number of artificial-intelligence, machine-learning and biometric solutions to help identify and prevent losses via what it now calls its “asset protection ecosystem platform.”

“First, we’re a total-loss organization, so if it’s a loss, we’re involved,” Harris said. “It could be ordering, buying practices, whatever – we’re involved. It has been VP of Asset Protection Mike Lamb’s personal mission to improve the technology for reducing shrink at Kroger. Second, Kroger is large. If you think of how much human capital we would need to accomplish what we can do with technology, there would be no ROI. And third, our CEO, the highest levels of leadership, embrace it. Sometimes you have

to convince them, you have to educate them, you have to show them the benefits of the technology. But without that, you’re going to run into roadblocks. So, really, those three things at Kroger I think continue to drive us forward from a technological standpoint.”

In addition to leveraging emerging technologies, other leaders at the RILA conference had the following advice for retailers facing increased threats, theft and other loss incidents:

Call in everything. Even if the police don’t show up, encourage your store employees to report every incident to law enforcement so there’s a paper trail.

Consider taking a stand or speaking out on regulatory and legal issues related to decriminalization of petty theft and other crimes.

Build relationships with law enforcement and the local community via meet-and-greet events. Keep a dialog flowing to build respect and empathy.

Create technology bridges with law enforcement to track and identify habitual offenders who hit the same stores over and over.

Consider participating in diversion and restorative-justice programs with minor offenders.

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

6 progressivegrocer.com EDITOR’S NOTE

By Joe Toscano, Vice President, Trade & Industry Development at Purina

S uppor ti ng U S troops has alw ay s been p art of Purina Dog Chow’s hi s tory since it s fo unding nearly a century a go. B u t in 2018, when Dog Chow saw a cri ti c al, life-changing need that w as not being f ully a ddress ed for veter ans, it s newes t mi ssion bec ame clear.

Approximately 3. 5 million milit ary veter ans su ffer from Pos t-Tr aumati c Stress Di s order (PTSD), and it c an have dev as t ati ng effect s on their f amilies, wor k , and interper s onal lives. Thank f ully, s ervice dog s c an redu ce the s everity of PTSD s ymptoms and suicidal behavior s for thes e veter ans. Yet, even with evidence-b as ed result s, du e to the co s t and ti me it t akes to tr ain a s ervice dog, only 1% of tho s e in need who s eek a s ervice dog receive one ea ch year.

Dog Chow s et o u t on a mi ssion to help change that, and Service Dog

S alu te w as born .

Since 2018, Dog Chow has donated more than $1 million to s ervice dog org aniz ati ons, suppor ti ng the c are and tr aining of more s ervice dog s for veter ans with PTSD and other po s t-comb at challenges. B u t the mi ssion has only jus t begun

It i s import ant to note that thes e s ervice dog s are not the same as emo ti onal support, ther apy or comp anion dog s. R ather, they are especially tr ained for veter ans, helping their handler perform t asks they c annot otherwi s e perform on their own Thes e specialized sk ill s are, in p art, what make thes e dog s remar kable, b u t al s o r are. It t akes abo u t two year s and approximately

$25,000 to f ully tr ain a s ervice dog and ensure the perfect pla cement for ea ch dog and veter an .

The inve s tment i s l a rge, b u t the imp a ct i s pricele ss. Some of the demon s tr a ted benefit s of PTSD s ervice dog s for veter a n s incl u de red u ced a nxiety a nd s tre ss , improved s leep, improved confidence to ret u rn to wor k or s chool – or even to be in p u blic, a re s tored s en s e of p u rpo s e, a nd more.

Many of thes e changes aren’t s een with the naked eye, which i s why, las t year, Dog Chow launched it s fir s t-ever Vi sible Imp a ct Aw ard, in p artner ship with the A ss ociati on of Service Dog Provider s for Milit ary Veter ans (ASDPMV). The aw ard celebr ated the remar kable imp a ct s ervice dog s have on the daily live s of veter ans experiencing PTSD

and recognize thes e o u t s t anding s ervice dog s and the org aniz ati ons that tr ained them.

Want to join Purina Dog Chow and Purina ass ociates in bringing more aw areness and support to veter an s ervice dog s? A s a ret ailer, yo u c an play a cri ti c al role in a dv ancing aw areness for o ur mi ssion, which i s now highlighted on every b a g of Dog Chow Complete that arrives to ret ail s tores. Yo u c an al s o cont a ct yo ur Purina sales rep to learn more abo u t special Service Dog S alu te in- s tore signa ge, s ocial and digit al ass et s, a ddi ti onal merchandi s e and more to drive a ttenti on for the progr am.

O u r mi ss ion i s n’t over. Will yo u join us?

SUPPLIER PERSPECTIVES PET SPECIALTY SPONSORED CONTENT

When it comes to PTSD service dogs for veterans, the mission is far from over for Dog Chow

Purina tr ademar ks are owned by Société des Produit s Nes tlé S A

Independent Retailer Month

National Blueberry Month

National Hot Dog Month

National Ice Cream Month

National Horseradish Month

National Baked Beans Month

National Watermelon Month

National Grilling Month

1

Blink-182 Day. We didn’t know it was a thing, either, but they’ve got various hits to blast in your stores.

2

I Forgot Day. Use this occasion to advise shoppers to create a list of what they want to buy before they visit the store, either online or with good old pencil and paper.

9 National Don’t Put All Your Eggs in One Omelet Day. Present an in-person or virtual demo on some fast and flavorful omelet ideas that will elevate any meal occasion.

16

It’s Fresh Spinach Day, so feel free to showcase this star of the produce section.

23

Peanut Butter and Chocolate Day. As far as we’re concerned, it’s the perfect combination.

30

Paperback Book Day. Ask your associates and customers to share on your website what they’re currently reading, and gauge interest in forming an ongoing book club.

3 Air Conditioning Appreciation Day. Now’s the time — in this part of the world, anyway — when we really need it.

4 Independence Day. Have your beer, soft-drink, snack, deli/ prepared food and meat offerings ready.

5

National Bikini Day. Perhaps not optimal shopping attire, but on this one day, why not?

6

National Fried Chicken Day. Remind customers to pick up your in-store version for an easy lunch or dinner.

7

Global Forgiveness Day. Your card aisle offers myriad ways to say sorry, and flowers play a key part in many apologies.

8

National Blueberry Day. Provide a comprehensive recipe collection covering all of the ways that home cooks can use this delectable fruit.

10 Teddy Bear Picnic Day. Although this occasion specifically mentions one highly popular stuffed animal, other beloved inanimate childhood companions are more than welcome.

17 Global Hug Your Kids Day. This should be a daily occurrence, of course, but parents should offer an extra squeeze today.

24 National Cousins Day. These built-in besties are always up for anything –including trips to the grocery store.

11 International Essential Oils Day Educate shoppers on what these are and how they can best use them in health-and-wellness applications.

18 Islamic New Year. Help our Moslem friends and neighbors mark the start of Muharram, the month of remembrance, by providing the ingredients for traditional dishes.

25 International Red Shoe Day

12 National Simplicity Day. Highlight nofuss hacks to make mealtime a snack any time of day.

13

Gruntled Workers Day. Leverage this humorous observance to check in with your associates and find out what they enjoy most about their jobs.

14

National Be Nice to Bugs Day. Make shoppers aware of these creepycrawly critters’ paramount place in the ecosystem, which includes the growing of our food.

15

National Give Something Away Day. Direct altruistic customers to store donation bins for canned goods, gently used household items and more.

19 National Barbara Day. Everyone knows at least one. Shout out all who work for or shop with you by offering them a free piece of fruit to snack on.

26 National Aunt and Uncle Day

20 National Pennsylvania Day. Shine the spotlight on the best that the Keystone State has to offer in terms of food and drink.

27 Bagpipe Appreciation Day

21

Take a Monkey to Lunch Day.

If customers can find ones that are available — but not in the store, of course. BTW, photos or it didn’t happen.

28 National Soccer Day. With the popularity of “Ted Lasso” creating even greater buzz around this global sport in the States, lean in on promos featuring MLS stars.

22 Casual Pi Day. Here’s a commemoration of the approximate value of the mathematical constant — and another excuse for pi/ pie puns and promos.

29 National Lipstick Day. Direct those wishing to mark the occasion to the cosmetics aisle.

31 International Lifeguard Appreciation Day. Offer all those who keep swimmers safe a special discount.

S M T W T F S IN-STORE EVENTS Calendar 07.23 8 progressivegrocer.com

July might be national horseradish month, but horseradish is a great way to spice things up all year round! It's a flavorful, piquant condiment for grilling season, but it offers much more!

Passover & Easter

Horseradish root is a staple at both Passover and Easter meals. Horseradish root commonly serves as the maror or bitter herb on the traditional Passover Seder plate.

Pickling Season

We typically see a jump in demand when pickling season comes around. This is because horseradish root can add a touch of spice in addition to the natural tannins helping to keep pickles crispier for longer periods of time.

Fire Cider

Once cold and flu season comes around horseradish becomes a hot commodity because of its immune boosting and sinus clearing abilities. It's a key ingredient in ire Cider and many other health remedies!

Holiday Meals

Horseradish is a unique condiment that is often a big part of holiday celebrations. It pairs great with main course proteins but is also a popular add to sides like deviled eggs and mashed potatoes!

Ask your wholesalers about fresh and spicy horseradish root! www.jrkelly.com 618-344-2910 jrkelly@jrkelly.com

n Increased facings from 70 to 90, a 29% increase*. n Automatically billboards and faces product. n Reduces losses from bag hook tearout. n Cuts over 1 hour/day labor for restocking. n Allows rear restocking and proper date rotation. n Dramatically increases sales in the same space. n Adjusts to accommodate various package widths. * Based upon average 8’ run by 5’ high peg candy gondola installations. Your results may vary. ©2020 Trion Industries, Inc.

Candy Trion Industries, Inc. TrionOnline.com info@triononline.com 800-444-4665 Gain Facings and Cut Labor with WONDERBAR® Tray Merchandising MODERNIZE YOUR MERCHANDISING SELL MORE IN THE SAME SPACETM Ga S S VS AFTER WONDERBAR® 90 FACINGS BEFORE WONDERBAR® 70 FACINGS WonderBar® Tray Merchandising

Sell More Peg

Trion Industries, Inc. TrionOnline.com info@triononline.com 800-444-4665 ■ I e e f f m 99 121, 22% e e*. ■ A m lly ll f e p . ■ Re e l e f m k e . ■ ve 1 / y l f e k . ■ All e e k p pe e . ■ D m lly e e le e me p e. ■ A j mm e v p k e . * B e p ve e 8’ y 5’ l y k l ll . Y e l m y v y. ©2020 T I e , I . Sell More Salty Snacks WonderBar® T y Me VS BEFORE WONDERBAR® 99 FACINGS AFTER WONDERBAR® 121 FACINGS G WONDERBAR® T y Me D NIZ Y U H NDI ING LL IN THE TM G L L

12 progressivegrocer.com FRONT END Shelf Stoppers Fresh Seafood Latest 52 WksW/E 04/01/23 Latest 52 WksW/E 04/01/23 Latest 52 Wks YAW/E 04/02/22 Latest 52 Wks YAW/E 04/02/22 Latest 52 Wks YAW/E 04/03/21 Latest 52 Wks YAW/E 04/03/21 Basket Facts How much is the average American household spending per trip on various fresh seafood items versus the year-ago period? Source: Nielsen, Total U.S. (All outlets combined) — includes grocery stores, drug stores, mass merchandisers, select dollar stores, select warehouse clubs and military commissaries (DeCA) for the 52 weeks ending April 1, 2023 Source: Nielsen Homescan, Total U.S., 52 weeks ending Feb. 25, 2023 Salmon Crab Shrimp Lobster Cod and Scrod Total Department Performance Top Fresh Seafood Categories by Dollar Sales $7,329,521,053 $7,436,056,821 $7,584,883,332 Fresh Seafood Generational Snapshot Which cohort is spending, on average, the most per trip on crab? Millennials $8.59 Gen Xers $8.32 Boomers $8.32 The Greatest Generation $6.73 Source: Nielsen Homescan, Total U.S., 52 weeks ending Feb. 25, 2023 $9.92 on all fresh seafood items, up 1.4% compared with a year ago $8.17 on crab, up 3.1% compared with a year ago $13.82 on cod and scrod, up 21.6% compared with a year ago $11.88 on salmon, up 6.8% compared with a year ago Cross-Merch Candidates Wine Spirits Nuts and Seeds Processed Meat Food Storage Supplies Fully Cooked Meat Coating Mixes and Crumbs Frozen Health and Beauty Care Lighting $3,000,000,000 2,500,000,000 2,000,000,000 1,500,000,000 1,000,000,000 500,000,000 0

Nonchocolate Confectionery

Market Overview

Inflation will inevitably have impacts, but nonchocolate confectionery’s relatively low price point will keep it from significant harm, and even position it for success as consumers look to trade down from more expensive indulgences.

Nonchocolate confection is further insulated from conversations about health and sugar, with snacking and indulging top reasons for purchase. Subsequently, low-sugar offerings remain niche.

Key Issues

Consumers are embracing the versatility that this market has to offer, and they aren’t significantly tied to one type of nonchocolate confectionery, so keeping things interesting with innovation is a natural opportunity to grab attention in a competitive market.

The chewy segment is currently in the lead, highlighting the importance that consumers place on the eating experience.

As potential economic uncertainties challenge innovation, engaging with consumers may be a relatively lowcost solution to create excitement about current offerings on platforms like social media.

Consumers sharpened their sweet tooth in the past two years, pushing sales past $10 billion. The market isn’t expected to slow anytime soon, with sales expected to reach $14.3 billion by 2027.

What Consumers Want, and Why

PROGRESSIVE GROCER May 2023 13 MINTEL CATEGORY INSIGHTS Global New Products Database

FOR MORE INFORMATION, VISIT WWW.MINTEL.COM OR CALL 800-932-0400

will turn to nonchocolate confectionery

it’s

easy

nonchocolate

Nonchocolate’s

Consumers

because

fun, delicious and an

treat, especially when times are stressful. Nostalgia will continue to win in the

confectionery market, with its ability to appeal to consumers in different ways, providing positive reminders of the past.

versatility will continue to shine, with familiarity still a winner. Innovation remains most appealing to younger, more exploratory generations as they gain purchasing power.

ALL’S WELLNESS

By Molly Hembree, MS, RD, LD

Leading Customers to Functional Foods

tretching your grocery dollar can mean taking advantage of every sale, coupon, promo or bulk item, or it can mean making sure your pennies are put to work for you, which includes food that helps your health. Functional foods, which may be referred to as “superfoods,” are loosely understood to mean foods that offer health benefits beyond basic nutrition through physiologically active components. These benefits can include an improved state of health and well-being and/or reduced or minimized risk of certain diseases or health conditions.

Although eating more functional foods may sound like a fancy upgrade to an eating pattern, functional foods are found across your retailer’s in-store or online marketplace. Often, functional foods are easily found and best consumed in their “whole food” minimally processed form. However, functional foods also expand into the fortified, enriched or enhanced food category, as these additives to food can improve the benefit of the product.

Following are four key grocery departments where you can direct your customers to find functional foods.

Produce

If there are any obvious products with health-related functions at the grocery store, they’re lurking in the produce department. Fruits and vegetables have a natural built-in ability to protect our health now and in the future, namely through phytonutrients (plant compounds that strengthen our own defenses and help our bodies perform at their best), vitamins and minerals. Keep your shoppers engaged with this department by stocking bright and cheerful produce from wall to wall, offering steamer bags of various curated vegetable and seasoning mixes, and cross-merchandising kitchen gadgets like vegetable spiralizers and strawberry hullers. Be sure to have markdown bins with “just about to expire” produce so your store can still make profit and customers can still make banana bread.

Plant-Based Proteins

The current default when we hear plant-based proteins is to picture meat substitutes or “analogs.” Consider “beefing” up these sales, however, by advocating for classic plant proteins: tofu; beans; peas (like split peas, chickpeas or black-eyed peas); lentils; tempeh; and even soy-based dairy items. Lean on your in-store culinary staff to find ways to use these ingredients alongside animal-based main courses, or even to create vegetarian dishes for your hot bar that target plant-based patrons. Some customers could be hesitant to throw affordable lentils or tofu in their carts, but accompanying these items with recipe cards that take the guesswork out of

how to prepare and enjoy them at mealtime should dispel any confusion.

Beverages

Whether drinks are fruity, bubbly, creamy, fermented or flat, how we sip can have a big impact on our health. Thanks to drinks like orange juice with added calcium, kombucha made with fermented tea, shakes with added protein, or seltzer waters with probiotics, the beverage area has no shortage of functional items. Try to offer many popular beverages in both single-serve and jug-size options so customers can try them first and then commit to a bigger size on the next shopping trip. Or you can offer discounts on stacking different products: A medley of various functional beverages can come with a better price tag than one purchased separately. Consider having an additional refrigerated beverage case near fresh readyto-eat meals so that grabbing these drinks is a no-brainer for on-the-go shoppers.

Snacks

We shouldn’t get ahead of ourselves with the idea that the entire snack aisle now boasts a health halo. However, terrific go-to snacks with functional effects include air-popped popcorn or popcorn kernels, nuts, seeds, or dried fruit. Keeping with the theme of turning to “whole foods” first, find ways to promote the VIPs of this section. Set up a trail mix station with clear glass jars to display tasty combos like almonds + dried cranberries + sunflower seeds, or cashews + popcorn + pistachios. Make digital or print infographics to guide customers on what to do with various seeds: For instance, did you know chia seeds make a great pudding, sunflower seeds can be made into seed butter, or pumpkin seeds can be crushed for a perfect protein coating? Be your customers’ trusted source of food inspiration.

Functional foods are already tucked among many of the common offerings on store shelves. Encourage your shoppers to explore functional foods, particularly in the produce, plant-based protein, beverage and snack aisles, to increase basket size.

14 progressivegrocer.com

THESE HIGHLY NUTRITIOUS PRODUCTS AREN’T FOUND ONLY IN THE STORE PERIMETER.

Functional foods are already tucked among many of the common offerings on store shelves.

Molly Hembree, MS, RD, LD, is a registered dietitian for Kroger Health.

Consistent flame height Resistance to elevated temperature Drop-resistant from a height of 5 feet Flame extinguishes within 2 seconds Safe volumetric displacement * ARE YOU PLAYING WITH FIRE? SELLING GENERIC LIGHTERS COULD PUT YOU AT RISK. Not a BIC® Lighter Longest-Lasting Lighter merica’s Safest and © 2023 BIC USA Inc., Shelton, CT 06484 *vs. fixed-flame, non-refillable lighters of comparable size BIC.® SAFETY YOU CAN COUNT ON. TO ORDER, VISIT NEWREQUEST.BIC.COM Did you know when it comes to lighters, most safety standards are voluntary? At BIC, we never compromise on quality. In fact, every lighter we sell undergoes more than 50 quality checks. That’s why BIC® Maxi Classic® is known as America’s safest and longest-lasting lighter.*

BY PG STAFF

ould it shock you to learn that this annual report was written by ChatGPT? Of course it wasn’t, but the significance of the artificial intelligence (AI) chatbot can’t be overstated, especially when it comes to its influence in the grocery industry. Intelligent chat is about to revolutionize an industry that’s already in the throes of epic transformation.

In March, Instacart said that it would add OpenAI’s ChatGPT chatbot technology to its grocery delivery app, joining a growing list of companies that are turning to the human-like AI language tool. Instacart will use the chatbot to power a new search engine designed to respond to users’ food-related questions, such as asking for recipe ideas and ingredients, or healthy meal options. By tapping ChatGPT’s language software, the search engine’s responses will come in the form of a dialog, rather than a list of search engine results. Instacart expects to roll out the new feature, called “Ask Instacart,” later this year. Meanwhile on Twitter and TikTok, U.S. consumers are putting ChatGPT to work as a personal assistant that’s able to find the best deals, discounts and fulfillment options for groceries. ChatGPT-generated recipes, meal plans and grocery lists are going viral.

One TikTok user, Mellyssa Viele, posted a video about how she used ChatGPT to create a diet-specific seven-day meal plan that’s endometriosis-friendly and good for hormone imbalances in women, as well as helping reduce inflammation. ChatGPT was quick to fulfill Viele’s request, whittling down the meal plan each time she asked for something new, such as keeping each day under 1,700 calories or incorporating snacks.

Technology such as ChatGPT, or its competitors, which include Google’s Bard or Microsoft’s Bing, holds much promise for the grocery industry, which is under tremendous pressure to keep shoppers loyal, cut costs and generate alternative revenue.

Progressive Grocer’s 90th Annual Report and The PG 100 ranking of the top food retailers in North America show that the nearly $3 trillion highly competitive grocery industry is at a crossroads, facing extraordinary challenges on various fronts, including expenses, labor, supply chain and profits. Optimism about the grocery retail climate has fallen among executives over the past year in the face of continuously rising costs. In addition to expense pressures, retailers are worried about labor issues (wages, recruitment and retention); supply chain disruptions; and ever-increasing competitive threats from discounters and online players.

At the same time, how consumers work, shop and eat has completely changed since COVID. Shifts toward online grocery shopping and remote work are having far-reaching societal implications, and the consequences are disrupting nearly every aisle of the grocery store.

To thrive over the next year, grocers will need to focus on cutting costs, maximizing efficiencies and improving customer loyalty with technology. Specifically, emerging technology such as intelligent chat and other personalization tools will be key to customer loyalty in the future. If the retailers listed in The PG 100 want to emerge in a better position a year from now, they’ll need to focus on the 12 imperatives for thriving in an era of change, as detailed in the following pages.

EXCLUSIVE

PG offers 12 imperatives for grocers looking to thrive in an era of change.

BROUGHT TO YOU BY

PROGRESSIVE GROCER May 2023 17

Nearly a fourth of grocers responding to PG’s Annual Report survey chose “asset protection/security/crisis management” as one of the top five issues keeping them up at night. With the potential of supermarket shootings joining the threats that they’re already used to — chief among them theft and shrink — it’s no wonder that they feel concerned.

Theft from both employees and customers is a perennial problem in retailing, but organized retail crime in particular is growing in both scope and complexity, according to a recent report from the National Retail Federation. Criminal groups have become more brazen and are using new channels to resell stolen goods, which are often everyday consumer products that are easier to resell, as opposed to more expensive luxury items. Late last year, Target reported that organized retail crime accounted for more than $400 million in profit losses for the company. In response, the retailer has been increasing anti-theft measures in its stores while encouraging lawmakers to act on the issue.

Many grocers remain focused on how

to get a better handle on overall shrink, and with the overarching goal of making their operations more sustainable, they seem to be making good progress in this

area. Technology is helping, including computer vision systems, and robots roaming the aisles to give a bird’s-eye view of what’s going on in stores.

This year’s Annual Report finds that a large chunk of grocers, especially smaller, independent operators, are still in the early or developing stages of omnichannel capability. Survey respondents chose online ordering, third-party delivery and mobile apps as their top focus areas for future omni strategies.

Of course, large national retailers such as Walmart and Kroger — and Amazon, which operates Whole Foods

Grocery retailing has always been known as a low-profit business, but in recent years, more companies have been seeking alternative revenue in the form of fulfillment services, advertising, financial services and more.

Leading on this front is Walmart, whose global advertising business grew more than 30% to reach $2.7 billion in fiscal year 2023. The growth was led by Walmart Connect, the company’s retail media business that offers advertisers an opportunity to reach Walmart shoppers online, in the app and in its U.S. stores.

Additionally, in January, Walmart entered the last-mile fulfillment business for other retailers through a partnership with Salesforce. The retailer also runs a business e-commerce site for small- and medium-sized businesses and nonprofits. These initiatives are all part of Walmart’s future business model that has expanded from the three main pillars of e-commerce, financial services, and health and wellness to now include media, advertising and fulfillment services.

Kroger, another grocer that was an early adopter of retail media networks, is now partnering with Disney Advertising to share first-party shopper data that will target streaming audiences, starting on Hulu. The grocer’s retail media arm, Kroger Precision Marketing, will use its data science capabilities to help advertisers reach audiences and measure the sales impact of the initiative across Kroger’s stores, including sales and conversions by household. Look to see more retailers making use of customer data to grow their business in the coming years.

Market stores — are miles ahead in terms of omnichannel strategies, and pure-play online grocers like Misfits Market and Weee! continue to capture niche markets, but that doesn’t mean smaller players should exit the race.

In fact, some of the biggest retailers have chosen to change course in recent months as they react to learnings from pilots and newer initiatives. Walmart, for instance, said in February that it will close its e-commerce-only stores, since the company has added pickup and delivery operations to thousands of its full-service locations and has found

that strategy to be sufficient.

In the meantime, Walmart and others will rely more on data and automation in the months ahead in an effort to create more efficient and predictable operations.

For now, as cost concerns remain top of mind for inflation-wary consumers, it seems that physical stores will continue to benefit regardless of retailers’ plans for online ordering. The most recent Brick Meets Click/Mercatus Grocery Shopping Survey, released in mid-April, reveals that online grocery sales were down 8% from the same period in 2022, with decreases in delivery, pickup

18 progressivegrocer.com

and ship-to-home. At the same time, the average number of online grocery orders from monthly active users continued to dwindle from pandemic-era highs. Lower-income households were 34% more likely to use pickup over delivery in an effort to save money.

Sylvain Perrier, president and CEO of Mercatus, suggests that traditional grocers should focus on ways to maintain engagement with their existing shoppers. “Proven ways of growing your online revenue hinge on providing a great customer experience, encouraging your more loyal customers to use frequently, and benefiting from positive

word-of-mouth advocacy that will attract others to use your online services,” notes Perrier.

Meanwhile, retailers are advised to align their buy-online-pickup-in-store and curbside pickup strategies to ensure that they’re encouraging shoppers to take advantage of these services according to need.

GROCERIES

In short, dedicating resources to omnichannel development should be seen as an investment for traditional

grocers — not as an expense — so that they can keep up with competitors in this increasingly digital landscape.

Even if online grocery has slowed down a bit for now, the future for this service still looks bright.

The 2023 Brick Meets

Click/Mercatus 5-Year

Grocery Sales Forecast, released at the beginning of the year, predicts that overall e-grocery sales will increase to a 13.6% share of the market by 2027.

Health continues to be a major priority for American consumers, with GlobalData analysts even predicting in February that shoppers would remain more influenced by their personal health than lower prices when buying food in 2023. Food retailers are uniquely positioned to help consumers manage their health through diet, medication and more. A key development of late is grocers’ ramped-up adoption of online SNAP/EBT initiatives that enable lower-income consumers to conveniently purchase healthy foods and have the orders delivered to their homes or made available for pickup at nearby stores. Also proliferating are food incentive programs such as Double Up Food Bucks, which allows SNAP recipients to earn free produce when they buy fresh fruits and vegetables with their benefit at participating retailers, and produce prescription programs that offer shoppers with diet-related health risks or conditions access to fresh fruits and vegetables “prescribed” by health care providers. Such endeavors

are part of a wider “Food as Medicine” approach at retail that also encompasses individual consultations and customized store tours with retail dietitians, as well as products and recipes targeting those with certain health issues like heart disease or diabetes via informational signage, shelf tags and QR codes.

Other ways that grocers are tailoring health offerings for customers is through internet platforms such as Sifter, which facilitates quick, easy product discovery and shopping, especially for those with special diet needs, including food allergies and food interactions with prescription medications, as well as eating preferences such as Mediterranean-style and vegan.

Retailers like Kroger and Walmart are also encouraging time-strapped shoppers to visit their in-store clinics for basic health care services and their pharmacies for vaccinations, saving potentially time-consuming visits to doctors or hospital emergency rooms. In another important development, specialty pharmacies operated by Hy-Vee, Publix and others are offering services for those with chronic and complex health conditions; these services include infusion clinics that Hy-Vee is opening in various locations across its Midwestern footprint.

Higher costs experienced by both retailers and their customers have been a major concern in the past year, and it looks like this hindrance will continue for the immediate future, even as inflation starts to soften. Grocers responding to PG’s Annual Report survey said that they expect operational costs (including energy, fuel and supplies) and overall inflation to see the largest increases for the remainder of 2023. Unfortunately, these thorny issues are also cutting into both their gross margin and net profit.

In addition to these rising costs, retailers are staying up at night worrying about labor issues such as recruitment and retention, and supply chain disruption. While they have only so much control over these challenges, some are responding by raising wages to attract and retain higher-caliber workers, and a growing number of retailers are looking to diversify their supplier network and keep a closer eye on inventory. All the while, they’re trying their best to keep prices competitive.

Different studies have offered slightly conflicting views on how inflation

20 progressivegrocer.com

F e at ce.c grocery/ ow: G w xt O f ? W v f groc et ’ oc t.

has affected shopping behavior so far.

According to the “2023 Consumer Research Report” by software company Salsify, three-fourths of consumers say they’re looking for discounts or free delivery and are buying less or putting off large purchases (the survey included shoppers in the United States, the United Kingdom, Germany, France and Australia). Meanwhile, the latest “U.S. Grocery Shopper Trends” report from FMI — The Food Industry Association, conducted by The Hartman Group, affirms that shoppers are aware of and often concerned about inflation but aren’t scaling back their orders dramatically. Instead, those affected by high prices are looking for deals where and when they can across the omnichannel realm.

A report from Coresight Research finds that grocery discount chains such as ALDI and Grocery Outlet have outperformed the broader grocery market in foot traffic over the past few months, and, of course, the

private label sector has been another beneficiary, with store brands accounting for 18.2% of total U.S. food and beverage sales as of Feb. 19, up from 17.4% for the entirety of 2022.

According to the report’s authors, Research Associate Sujeet Naik and Sector Lead Anand Kumar, a key takeaway is that the inflationary pressures are persistent. “Although U.S. grocery inflation is forecast to ease gradually over the course of 2023, the fallout of high prices and consumers’ associated behaviors will linger for some time,” they write, “This implies we will see significant stickiness in grocery shopping priorities into 2023, with many shoppers favoring low-cost options over quality and convenience. We anticipate that dollar stores and discounters will be more sought-out channels again this year.”

Yet as grocers look to offer more discounts and promotions as a competitive response, they would be wise

to balance this strategy by highlighting premium in-store offerings, such as special events, full-service departments and fresh and/or local selections. After all, these are the niches that help them stand out from more mainstream discounters.

One retailer responding to PG’s Annual Report survey says that he sees loyalty programs as the best investment in the next one to three years because, “with inflation driving price increases, this is a great incentive for customers to drive stickiness.”

FMI’s VP of tax, trade, sustainability and policy development, Andy Harig, recently noted that while he expects high food prices to remain the norm for most of 2023, the food industry is working on advancing technologies that will save time, money and resources to help get more affordable food onto consumers’ tables. This includes the use of driverless trucks, robotics, vertical farming, artificial intelligence, blockchain and more.

In just one example of artificial intelligence (AI) implementation, BJ’s Wholesale Club is partnering with Simbe to roll out the latter’s business intelligence solution, Tally, to all BJ’s club locations. The AI-powered robot will provide greater visibility into club conditions and deeper business insights, with the goal of ultimately improving operational efficiencies and enhancing the member experience.

Expect to see more retailers following suit with AI and other tools as they focus on better serving customers while cutting costs and improving efficiencies.

Contactless forms of payment are being accepted at an increasing number of grocery stores, while a few retailers continue to experiment with completely checkout-free technology. Further, in a more emerging field of payment, Giant Eagle made

headlines in March by revealing that it’s installing Bitcoin ATMs (called BTMs) at 125 of its GetGo convenience stores in various Midwestern and Mid-Atlantic metropolitan areas.

In PG’s 2023 Annual Report survey, 31% of respondents chose “mobile wallet app” as one of the smartphone features that their customers value most when grocery shopping.

A recent PYMENTS.com study finds that while just 6.1% of grocery shoppers say they prefer to pay for their

groceries with digital wallets, groceries now account for 62% of all purchases made using a digital wallet. Also, 4% of all in-store checkouts made by members of Gen Z are done using a digital wallet.

Perhaps the most aggressive retailer on the checkout innovation front is Amazon, which is expanding its Amazon One and Dash Cart contactless payment solutions to more Whole Foods Market stores across the country, the latest being

22 progressivegrocer.com

“Although U.S. grocery inflation is forecast to ease gradually over the course of 2023, the fallout of high prices and consumers’ associated behaviors will linger for some time.”

—Sujeet Naik and Anand Kumar, Coresight Research

11 stores in the Denver market. Amazon is also making its Just Walk Out technology available to other retailers on a third-party basis.

East Coast retailer cooperative Wakefern Food Corp., meanwhile, has expanded its pilot with Israel-based checkout technology provider Trigo to include an autonomous convenience store at Wakefern’s corporate campus in Edison, N.J.

Whole Foods CEO Jason Buechel re-

With the Plant Based Foods Association (PBFA) reporting earlier this year that plant-based food dollar sales grew 6.6% in 2022 to $8 billion, it looks like plant-forward eating is here for the foreseeable future as consumer eating patterns evolve in response to health, animal welfare and sustainability imperatives.

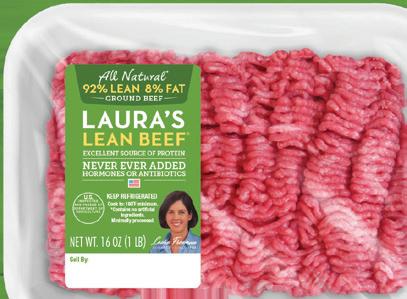

Suppliers and retailers are continuing to respond to this demand, with the result that shoppers now have more choice than ever when it comes to plant-based offerings. In the protein case, for instance, not only are there more chicken, pork and seafood analogues to join those already long-established meatless beefstyle burgers and crumbles, but items are also available in a variety of formats across the store: fresh, frozen and even

shelf stable. Meal kit companies Green Chef and Sunbasket offer options free of animal proteins, while plant-based charcuterie is starting to spark interest.

Product innovations in this space include items from the very busy Impossible Foods: Impossible Beef Lite, boasting no trans fat or cholesterol, and 75% less saturated fat, as well as 45% less total fat, than 90/10 lean beef from cows, and three plant-based chicken SKUs, Impos-

cently shared with news website Axios that he foresees a future in which grocery technologies like frictionless Just Walk Out checkout and Amazon Dash Carts co-exist with service provided by people, including store team members and “foragers” who scour local farmers’ markets and other community sites for new products. “I see a hybrid that takes place,” he noted. “I want to be sure we provide all the options that customers are looking for.”

sible Spicy Chicken Nuggets and Patties and Impossible Chicken Tenders, thereby doubling the company’s plant-based chicken portfolio to six products. Meanwhile, equally busy rival plant-based brand Beyond Meat has come out with Beyond Pepperoni and Beyond Chicken Fillet for foodservice, following its successful rollout of Beyond Steak.

There’s a whole plethora of products out there beside meat alternatives, however. According to the PBFA’s report, plantbased categories saw considerable unit growth in the following five categories: creamers, eggs, protein powders, ready-todrink beverages, and dips and spreads.

So, while recent stats suggest that plant-based meat consumption may have peaked — dollar sales for combined refrigerated and frozen alt meats were down 8.9% year over year, according to March 2023 data from Circana — there’s no reason to believe that plant-based eating will end up a flash in the pan.

There’s no “i” in team, as the saying goes, but in today’s economy, having a full and engaged roster of team members requires a certain amount of personally important compensation and benefits. Following the era of the essential worker in 2020 and 2021 and The Great Resignation in 2022, grocery employers certainly recognize the im-

portance of recruitment and retention.

According to The Food Retailing Industry Speaks survey published by FMI — The Food Industry Association, retailers continue to invest in their associates. An overwhelming 86% of retailers are offering higher compensation, and 72% are offering improved benefits.

In such a tight labor market, benefits go well beyond previously standard health coverage and time off. As workers demand flexibility, grocers are meeting that need with more shift

PROGRESSIVE GROCER May 2023 23

There’s a right way to do pork.

We call it the Prairie Fresh® Way.

At Prairie Fresh, we control the entire production process – from farms to processing plants to store distribution. That’s our connected food system.

And that’s the Prairie Fresh Way. It’s our way of delivering outstanding pork to your shelves that will keep your shoppers coming back for more. Isn’t it time to imagine all the possibilities when you partner with us?

prairiefreshway.com

© Seaboard Foods 2023

© Seaboard Foods 2023

Maximize Quality in Your Meat Case The Prairie Fresh Way

Speaking with…Pat Watkins, Vice President of Retail Sales, Seaboard Foods, producers of Prairie Fresh

U.S. raised, all natural and premium quality are among the top claims consumers look for when making meat purchases1 and 71 percent of consumers are willing to pay more for quality meat products.2

Progressive Grocer asked Pat Watkins, Vice President of Retail Sales for Seaboard Foods, how The Prairie Fresh Way — the company’s unique approach to producing pork in a way that achieves unmatched, consistent quality — can help grocery retailers attract and retain loyal meat customers.

Progressive Grocer: Exactly what is The Prairie Fresh Way, and what does it mean for grocery retailers looking for ways to improve their offerings in the pork category?

Pat Watkins: It is our approach to how pork should be raised that is founded on a connected food system. We collaborate with our American-owned farms in the Midwest and Great Plains, processing plants and networked supply chain colleagues, which means we control the production process from farm to delivery. Because we control the entire process, we can maintain the highest production standards in everything from the exceptional attributes achieved from superior genetics to operating the newest plants in the industry to tailoring animal feed for ideal characteristics.

PG: There are three distinct product lines within the Prairie Fresh brand. Can you describe what each offers?

PW: We recently introduced Prairie Fresh USA Prime,®our premium pork brand that is setting a new standard in the meat case and meeting consumer demand for restaurantquality meals at home. Quality is proven with a three-step evaluation process that includes proprietary technology that checks cuts for tenderness, color, and marbling and ensures a higher level of consistency and quality. A hand-selection

step from the top tier of our nest, all-natural pork means cuts will deliver superior tenderness and rich, juicy avor. Plus, distinctive labeling and merchandising and marketing support are driving consumer interest.

Our Prairie Fresh Signature products are meeting increased consumer demand for value-added, and convenient meat products, with the 2023 Power of Meat study nding 67 percent of meat shoppers purchased value-added meat and poultry last year, especially among online purchases. Pre-seasoned, pre-portioned cuts are available in a variety of avors that have been consumer tested. Products come in net-weight, case-ready packaging that describes features consumers consider most important — things like product avor and protein content, plus a picture of dishes made with the product. Online recipes equip consumers with ideas to elevate their Prairie Fresh Signature dishes such as Honey Sriracha Pork Noodle Bowl or Make-and-BakeLater Garlic Herb Pork Tenderloin Sandwich.

Prairie Fresh Natural is our line of minimally processed pork made with no arti cial ingredients, which lets our quality shine through. It’s a perfect complement to our other lines to provide retailers the right mix of products for self-service and meat counter displays. No matter which product grocers choose, members of our plant production team are invested in making pork the right to speci cation for our customers. You see the difference in better yield and consistency in the meat case.

PG: What else would you like retailers to know about partnering with Prairie Fresh?

PW: The Prairie Fresh Way extends to the way we service our customers. Our deep meat knowledge, marketing support and data-driven consumer insights are the foundation to our partnership. We know that keeping your shelves stocked with quality pork is how you keep your shoppers happy. And that’s what we’re here to help you do.

ADVERTORIAL

›› TO JOIN US ON THE PRAIRIE FRESH WAY, VISIT www.prairiefreshway.com

1 2022 Power of Meat study, 2 Prairie Fresh data

options and tech-driven scheduling tools. Schnuck Markets, for example, has broadened its flex force employment options that allow associates to select shifts and store locations that best align with their schedules.

In a high-stress decade, employers are also ramping up their mental

health-and-wellness benefits. Walmart, for its part, recently introduced a new workplace course that guides managers in helping workers who are struggling with mental health issues.

Even as jobless claims are starting to tick up again, grocery industry employers continue to invest in engagement to main-

tain their workforces and build their businesses for the future. Whether it’s offering more perks for e-commerce gig workers, expanding paid parental leave to full-time store associates or continuing hybrid work models at corporate offices, efforts to maintain individual workers’ satisfaction are pivotal in staying competitive.

With today’s consumers being constantly inundated with new products, advertisements and promotional offers, next-generation personalization has been adopted by many grocers in an effort to stand out among a crowded field. Where retailers once used generic segmentation to offer personalization, more are now moving toward an individualized approach.

Personalization has taken on many different forms in the grocery industry, but providing targeted communications, product recommendations and more is the name of the game in this technology-forward day and age. Sujeet Naik, research associate at Coresight

Research, asserts that proper personalization, especially in terms of promotions and recommendations, can help food retailers increase both sales and basket size. Data, consumer analytics and machine-learning technologies can give grocers the ability to tailor these things at an individual level to create true customer satisfaction.

While privacy concerns have cropped up for shoppers in recent years, 90% of consumers still appreciate personalized offers, according to customer experience

management company Merkle. As Shekar Raman, CEO and co-founder of Birdzi, notes in an online Progressive Grocer column, true personalization has a greater effect on long-term customer relationships, since the shopper is consistently shown effective messaging and deals.

Nothing against macaroni and cheese, hot soup, and rotisserie chicken — which remain stalwarts of grocery perimeters — but the prepared food offerings at many food retailers are becoming more eclectic.

Reflecting a diverse shopping base, prepared food offerings are increasingly created to be culturally relevant and ethnically inspired. Shoppers at Whole Foods Market, for example, can pick up a 12-ounce portion of chicken tikka masala or chicken tinga enchiladas in the grab-and-go case, or linger over the many options at the grocer’s famous hot food bar. Customers at Wegmans Food

Markets can bring home a power bowl featuring Peruvian chicken with green sauce, or Greek Santorini salad, among dozens of other offerings. Regionality is another play, evident in popular barbecue fare at H-E-B stores, in Texas and lobster salad rolls at Shaw’s, in New England. Sushi, meanwhile, is nearly ubiquitous in grocery stores throughout the United States.

In addition to offering more flavor, retail delis are providing different formats. Prepared food areas have

become veritable food halls, with grab-and-go packaged products, hot bars, cold bars, meal kit displays and more.

In today’s economy, grocers can also deliver value and better compete with restaurants by offering meal deals.

The Fresh Market, for instance, promotes its line of Bistro Meals by offering an entrée and two sides that start at $9.99.

On that note, nearly 90% of shoppers who purchase deli prepared foods, sandwiches or meal kits consider them an alternative to restaurant fare or last-minute dinner plans, according to research from Advantage Solutions.

26 progressivegrocer.com

2023 +38% 2019 +23% Deli SalesfromGrab & Go

As inflation surged over the past year, driving up CPG prices, customers stepped up their purchases of the affordable options offered by store brands. Using data from Circana, PLMA reported in April that store-brand sales were maintaining double-digit growth rates and gaining market share in both dollars and units. During the first three months of 2023, store-brand dollar volume rose 10.3% on a year-overyear basis, compared with 5.6% for branded products.

As a result of this heightened consumer interest, retailers are introducing even more new store-brand offerings. Among those that have recently done so are Albertsons Cos., which has expanded and redesigned its health-conscious Open Nature line, now featuring an updated logo and 12 new dairy-free products; Dollar General, which has launched the OhGood! collection of gummy vitamins and supplements, as well as reformulating and rebranding its super-premium Nature’s Menu pet food brand and beefing up its store-brand skin and hair care assortment; and Weis Markets, which has debuted the Weis by Nature ice cream brand with 11 crowd-pleasing flavors.

As evidenced by these examples, store brands have moved far beyond their humble generic origins to become items able to compete on quality with premium national brands — but not at premium prices.

“We believe every customer should have access to affordable organic options that support healthy lifestyles and diverse shopping preferences,” said Jennifer Saenz, EVP and chief merchandising officer at Albertsons, when the grocer unveiled a new visual identity for its O Organics brand in March. “Over the years, we have made organic foods more accessible by

Along with this year’s Earth Day came a slew of reports from grocers large and small detailing their efforts to help protect the planet — and they mean business. Sprouts Farmers Market, for example, is literally laying the groundwork for a more sustainable future by contributing food waste diverted from its stores to create compost and feed for regenerative farms in Tennessee and Missouri. Kroger, meanwhile, is helping to reduce food waste by partnering with Upcycled Foods Inc. to create private label packaged breads that contain 10% upcycled grain.

expanding O Organics to every aisle across our stores, making it possible for health- and budget-conscious families to incorporate organic food into every meal.”

Offering shoppers value-priced premium products is a winning proposition for customers and grocers alike. In 2018, O Organics became a $1 billion brand and one of the nation’s largest brands of USDA Certified Organic products. Today, it’s the leading organic brand sold at Albertsons banners, boasting more than 1,500 products in its assortment.

More grocers than ever are signing on to curb food waste through the Flashfood app, and others, including Walmart, Amazon and The Giant Co., are rolling out electric delivery vehicles that avoid standard gasoline usage and prevent harmful greenhouse-gas emissions. Conserving natural resources is on the agenda for Fareway Stores, which is building a 1-megawatt solar facility near its headquarters, and also introducing electric vehicle-charging stations at several of its stores throughout Iowa (for more on retailers’ EV charging stations, see the article starting on page 60).

These examples of supermarket sustainability efforts just scratch the surface of an issue that has become table stakes for the industry. Consumers are becoming hyper-vigilant about identifying sustainable practices, with Shopkick recently finding that 55% of shoppers consider those practices when making a purchase.

Additionally, Kroger’s retail data science, insights and media arm, 84.51°, reports that 51% of shoppers are especially concerned about sustainability related to items at the deli, meat and fish counters, further proving that now is the time to walk the walk when it comes to doing right by Mother Nature.

28 progressivegrocer.com

PROGRESSIVE GROCER May 2023 29 Rank Company Fiscal YearEnd Sales (In Millions of Dollars U.S.) Prior Year Percent Change Store Count Top Executives 1 Walmart U.S. $420,600 $393,247 6.96% 5,317 John Furner, President and CEO 2 Amazon (online store and physical store segments only) $238,967 $239,150 -0.08% 600 Andrew R. Jassy, CEO 3 Costco (U.S.) $165,294 $141,398 16.90% 578 W. Craig Jelinek, President and CEO 4 The Kroger Co. $148,258 $137,888 7.52% 2,719 Rodney McMullen, Chairman and CEO 5 Walgreens Boots Alliance (U.S retail) $132,703 $132,509 0.15% 8,756 Rosalind Brewer, CEO 6 Target $109,120 $106,005 2.94% 1,948 Brian Cornell, Chairman and CEO 7 CVS Health (retail segment) $106,594 $100,105 6.48% 7,795 Karen Lynch, President and CEO 8 Sam’s Club (U.S.) $84,345 $73,556 14.67% 600 Kathryn McLay, President and CEO 9 Albertsons Cos. $77,600 $71,887 7.95% 2,271 Vivek Sankaran, President and CEO 10 Ahold Delhaize USA $57,959 $53,699 7.93% 2,051 J.J. Fleeman, CEO 11 Loblaw Cos. Ltd. $56,504 $52,269 8.10% 2,742 Galen G. Weston, Chairman and President 12 Publix Super Markets $54,500 $47,997 13.55% 1,334 Randall T. Jones Sr., CEO 13 Alimentation Couche-Tard (U.S. stores) $41,754 $31,128 34.14% 5,714 Brian Hannasch, President and CEO 14 Walmart de Mexico y Centroamerica $40,496 $35,964 12.60% 3,744 Guilherme Loureiro, President and CEO 15 H-E-B $38,900 $34,000 14.41% 420 Charles Butt, Chairman and CEO 16 Dollar General $37,844 $34,220 10.59% 19,104 Todd Vasos, Chairman and CEO 17 C&S Wholesale Grocers $34,700 $33,022 5.08% 637 Bob Palmer, CEO 18 Costco (Canada) $31,675 $27,298 16.03% 107 Pierre Riel, EVP/COO, Costco International 19 Empire Company Ltd. (Sobeys) $30,162 $28,268 6.70% 1,600 Michael Medline, President and CEO 20 United Natural Foods Inc. $28,928 $26,950 7.34% 73 Steven Spinner, Chairman and CEO 21 Dollar Tree (includes Family Dollar) $28,318 $26,309 7.64% 16,340 Richard W. Dreiling, President and CEO 22 Rite Aid $24,568 $24,043 2.18% 2,450 Elizabeth "Busy" Burr, Acting President and CEO 23 Meijer Inc. $24,257 $22,151 9.51% 262 Rick Keyes, President and CEO 24 Walmart Canada $22,300 $21,773 2.42% 402 Gonzalo Gebara, President and CEO 25 7-Eleven Inc. (U.S. only) $21,254 $23,841 -10.85% 12,702 Joe DePinto, CEO 26 ALDI USA $20,565 $18,200 12.99% 2285 Jason Hart, CEO 27 BJ’s Wholesale Club $18,918 $16,306 16.02% 237 Bob Eddy, President and CEO 28 Metro (Canada) $18,888 $18,283 3.31% 1,620 Eric R. La Fleche, President and CEO 29 Wakefern Food Corp. $18,300 $17,800 2.81% 362 Joe Colalillo, Chairman and CEO 30 Trader Joe’s Co. $16,543 $14,900 11.03% 544 Dan Bane, Chairman and CEO 31 QuikTrip Corp. $16,400 $11,300 45.13% 980 Chet Cadieux, CEO 32 RaceTrac $16,200 $9,600 68.75% 552 Max McBrayer, CEO 33 Casey’s $15,225 $12,950 17.57% 2,452 Darren Rebelez, CEO 34 Wawa $15,102 $11,900 26.91% 965 Chris Gheysens, President and CEO 35 EG America (U.S.) $13,541 $12,254 10.50% 1,702 George Fournier, President 36 Hy-Vee Food Stores Inc. $12,785 $12,100 5.66% 285 Jeremy Gosch, Chairman and CEO 37 Wegmans Food Markets Inc. $12,300 $11,200 9.82% 110 Colleen Wegman, President and CEO 38 Sheetz Inc. $11,700 $5,600 108.93% 630 Joseph Sheetz, CEO 39 Associated Wholesale Grocers $11,500 $10,812 6.36% 70 Dave Smith, President and CEO

Company reports, Progressive Grocer research, industry and analyst

Source:

estimates

30 progressivegrocer.com Rank Company Fiscal YearEnd Sales (In Millions of Dollars U.S.) Prior Year Percent Change Store Count Top Executives 40 Giant Eagle Inc. $11,200 $10,600 5.66% 474 Bill Artman, CEO 41 SpartanNash Co. $9,640 $8,900 8.31% 147 Tony Sarsam, President and CEO 42 WinCo Foods Inc. $9,500 $8,400 13.10% 139 Grant Haag, CEO 43 Soriana $9,189 $8,206 11.98% 824 Ricardo Martin Bringas, CEO 44 Southeastern Grocers LLC $9,000 $9,600 -6.25% 423 Anthony Hucker, President and CEO 45 Northeast Grocery Inc. $8,400 $8,120 3.45% 293 Frank Curci, Chairman and CEO 46 HelloFresh $8,335 $6,527 27.70% N/A Dominik Richter, CEO 47 Alimentation Couche-Tard (Canada, Couche-Tard) $7,948 $6,085 30.62% 2111 Brian Hannasch, President and CEO 48 Chedraui USA $7,500 $6,300 19.05% 379 Jose Antonio Chedraui Eguia, CEO 49 Raley’s Supermarkets $6,750 $6,100 10.66% 253 Keith Knopf, President and CEO 50 Demoulas Super Markets Inc. (Market Basket) $6,600 $6,200 6.45% 87 Arthur Demoulas, President and CEO 51 Sprouts Farmers Market $6,404 $6,099 5.00% 386 Jack Sinclair, CEO 52 The Save Mart Cos. $5,700 $5,600 1.79% 204 Nicole Pesco, CEO 53 ARKO Corp. $5,602 $4,728 18.49% 1,404 Arie Kotler, President and CEO 54 Stater Bros. Markets $5,600 $4,700 19.15% 170 Pete Van Helden, CEO 55 Big Lots $5,468 $6,150 -11.09% 1,425 Bruce Thorn, President and CEO 56 Ingles Markets Inc. $5,300 $4,988 6.26% 198 James Lanning, President and CEO 57 Save A Lot $4,900 $4,700 4.26% 800 Leon Bergmann, CEO 58 Save-On-Foods $4,812 $4,289 12.19% 181 Darrell Jones, President 59 H-E-B (Mexico) $4,800 $4,300 11.63% 71 Fernando Martinez, Director General 60 Weis Markets $4,695 $4,224 11.15% 196 Jonathan Weis, Chairman, President and CEO 61 Dollarama $4,330 $3,430 26.24% 1,421 Neil Rossy, President and CEO 62 Defense Commissary Agency (DeCA) $4,200 $4,000 5.00% 236 Grier Martin, CEO 63 Brookshire Grocery Co. $4,100 $3,800 7.89% 180 Brad Brookshire, Chairman and CEO 64 Schnuck Markets Inc. $3,700 $3,600 2.78% 112 Todd Schnuck, Chairman and CEO 65 Alex Lee Inc. (Lowes Foods) $3,600 $3,500 2.86% 100 Brian George, President and CEO 66 Grocery Outlet Inc. $3,578 $3,079 16.21% 441 Eric Lindberg, CEO 67 Key Food Stores Cooperative $3,500 $3,100 12.90% 265 Dean Janeway, CEO 68 Brookshire Brothers $3,400 $3,400 0.00% 180 John Alston, President and CEO 69 Houchens Industries Inc. $3,190 $2,890 10.38% 300 Dion Houchins, Chairman and CEO 70 K-VA-T Food Stores Inc. (Food City) $3,100 $2,800 10.71% 138 Steven C. Smith, CEO 71 Associated Food Stores $2,800 $2,600 7.69% 450 Robert Obray, President and CEO 72 Big Y Foods Inc. $2,700 $2,500 8.00% 84 Charles D’Amour, President and CEO 73 Giant Tiger (Canada) $2,663 $2,515 5.88% 260 Gino DiGioacchino, Interim CEO 74 99 Cents Only $2,634 $2,359 11.66% 391 Barry Feld, CEO 75 Bozzuto’s Inc. (Wholesale) $2,500 $2,400 4.17% N/A Michael Bozzuto, President and CEO

32 progressivegrocer.com Rank Company Fiscal YearEnd Sales (In Millions of Dollars U.S.) Prior Year Percent Change Store Count Top Executives 76 The Fresh Market $2,100 $1,980 6.06% 160 Jason Potter, CEO 77 Woodman’s Markets $1,900 $1,800 5.56% 19 Phil Woodman, President 78 Village Super Market $1,820 $1,512 20.37% 34 Robert Sumas, CEO 79 Rouse Enterprises LLC $1,800 $1,600 12.50% 63 Donny Rouse, CEO 80 Marc Glassman Inc. (Marc’s stores) $1,730 $1,530 13.07% 61 Marc Glassman, Chairman 81 Vallarta Supermarkets $1,730 $1,498 15.49% 53 Enrique Gonzalez Jr., President and CEO 82 H Mart $1,700 $1,400 21.43% 97 Il Yeon Kwon, Founder and CEO 83 Lowe’s Pay-N-Save Inc. $1,700 $1,590 6.92% 146 Roger Lowe Jr., CEO 84 Coborn’s Inc. $1,623 $1,400 15.93% 120 Chris Coborn, President and CEO 85 Save-On Foods $1,500 $1,200 25.00% 186 Darrell Jones, President 86 99 Ranch Market $1,500 $1,387 8.15% 58 Alice Chen, CEO 87 Fresh Thyme Market $1,400 $1,204 16.28% 70 Gerald Melville, President 88 La Michoacana Meat Market $1,400 $1,200 16.67% 135 Rafael Ortega, President Source: Company reports, Progressive Grocer research, industry and analyst estimates n Illuminate spaces with innovative, high quality technology n Minimize energy consumption and cost n Collaborate with a lighting leader that has over 100 years experience Lighting solutions from your trusted partner Explore our broad portfolio of lighting and controls solutions at Acuitybrands.com/grocery AB_1065502_NTLACCTS_Progressive Grocer Half Page Ad_0222.indd 1 2/16/22 4:01 PM

PROGRESSIVE GROCER May 2023 33 Rank Company Fiscal YearEnd Sales (In Millions of Dollars U.S.) Prior Year Percent Change Store Count Top Executives 89 Northgate Gonzalez Market $1,345 $1,105 21.72% 42 Miguel Gonzalez Reynoso, President and CEO 90 Fareway Stores Inc. $1,300 $1,135 14.54% 108 Reynolds Cramer, President and CEO 91 Lidl U.S. $1,275 $1,100 15.91% 177 Michal Lagunionek, President and CEO 92 Superior Grocers $1,275 $1,075 18.60% 47 Mimi Song, President and CEO 93 Sedano’s Supermarkets $1,200 $1,150 4.35% 35 Agustin Herran, President and CEO 94 Festival Foods $1,100 $1,050 4.76% 40 Mark Skogen, CEO 95 Natural Grocers by Vitamin Cottage $1,089 $1,055 3.22% 164 Kemper Isley, Chairman, Director and Co-President 96 M&M Food Market $1,035 $982 5.40% 2315 Andy O'Brien, CEO 97 Gopuff $1,000 $1,800 -44.44% N/A Yakir Gola and Rafael Ilishayev, Co-CEOs 98 Patel Brothers $700 $576 21.53% 56 Talashi Patel, Co-Founder 99 Blue Apron $458 $470 -2.55% N/A Linda Kozlowski, CEO 100 Thrive Market $510 $450 13.33% N/A Nick Green, CEO TOTAL $2,490,508 11.94%

Sound Bites

AS CONSUMERS KEEP ON SNACKING, CPGS AND RETAILERS FIND NEW WAYS TO MEET TASTES ACROSS DAYPARTS AND FORMS.

By Lynn Petrak

aybe it’s stress eating caused by the economy. It could be part of the shifting work culture. It might be attributed to diets that are less centered on defined meals and more driven by personal circumstances and cravings.

At any rate, the trend toward all-day snacking has yet to slow down. What may have started with pre-pandemic on-the-go lifestyles has continued in the wake of an unconventional decade, with data bearing out Americans’ penchant for snacking.

According to information from Circana (the new name for the recently merged IRI and NPD firms), 49% of consumers eat three or more snacks per day. That’s up four percentage points from just two years ago.

Circana’s 2023 Snacking Survey also found that the noshing way of life spans demographics. The 25-34 age bracket leads the charge, with 68% eating threeplus snacks a day, followed by those age 35-44 (60%) and Gen Z consumers between 18 and 24 (58%).

“All generations are snacking three-plus snacks a day, just at varying levels,” noted Sally Lyons Wyatt, EVP of client insights at Chicago-based Circana, during a recent webinar with SNAC International.

As snacking covers a wide population ground, it also extends to occasions throughout the day. Circana’s data reveals that morning and late evening are the largest growth occasions, likely because of changed or changing work/life behaviors. According to Wyatt, younger generations are “really rocketing” morning and late-evening eating.

Other research supports the ongoing snackification of diets. Research from 210 Analytics finds that while volume is down in some categories, snack sales are defying many inflation-era trends.

“Sales of cookies, crackers and snacks are boosted by inflation, much like many areas of the store,” Anne Marie Roerink, principal of San Antonio-based 210 Analytics, tells Progressive Grocer. “However, where most areas have fallen to single-digit dollar increases, cookies, crackers and snacks are still growing by double digits in the mid-teens.”

Deirdre McFarland, SVP, marketing and communications at New York-based ad analytics firm NCSolutions, agrees that certain snack categories are holding their own. “People like their cookies. Although the unit price for cookies was up 16.34% in February 2023 compared to February

Key Takeaways

The trend toward all-day snacking has yet to slow down.

Macro trends within the salty snack sector include plant-based and better-for-you products, as well as intense flavors and the combination of sweet and savory.

Meanwhile, the overall sweet snack space is defined by parallel demand for indulgent and permissibly indulgent offerings.

34 progressivegrocer.com SOLUTIONS Snack Report

2022, the units per trip were down less than half a percentage point,” observes McFarland, adding, “This indicates that consumers might not be as concerned about the price hikes if it means keeping their pantries stocked with cookies.”

Meanwhile, to Roerink’s point, some types of snacks are performing especially well, both in terms of innovation and sales.

Feeling Salty

Perennially popular salty snacks continue to land in shoppers’ baskets. “Salty snacks are a giant seller, with $29 billion in the past year,” notes Roerink. “This was up 15.5%, as the average price per pound increased by nearly 17% over the past year.”

Reflecting the entrenchment of salty snacks, high pricing hasn’t made a big dent in consumption habits. “Potato wholesale prices are prompting very high inflation in the fresh produce department, frozen potato products, and potato chips as well,” says Roerink. “Nevertheless, pound sales are only trailing prior-year levels by 1.1%.”

Within the salty snack sector, some macro trends are evident. Plantbased and better-for-you products, for example, continue to be a hotbed of R&D activity. Recent introductions include tomato chips from Just Pure Foods and plant-based popped crisps from Pure Protein. Flavor, including intense flavors and palate-piquing combinations, is another area of differentiation in salty snacks. Intensity is an attribute of new products like Takis Intense Nacho snacks from Grupo Bimbo-owned Barcel USA, and Sweet and Tangy BBQ Doritos from PepsiCo-owned Frito-Lay.

During the SNAC International webinar, Wyatt pointed to the blurring of flavors evident in this stalwart category, which now features items like Skinny Pop’s Sweet Vanilla Kettle popcorn, Trix Popcorn and Bugles’ Cinnamon Toast Crunch corn chips. “We’ve seen it happen, even in salty snacks that are predominantly salty, crunchy and crispy, to now, with sweet [flavors],” she said. “It’s happening because we’ve added more to those categories, and it’s showing up in what consumers tell us they love about their favorite snacks.”

Carnivorous Cravings

What accelerated with Paleo, keto and other high-protein diets a few years ago seemingly hasn’t peaked, as meat snacks are another popular snack form.

Roerink observes: “With an average assortment of 50 different items between the front end and aisle, the average number of items

per store has increased 5.9% over the past few years.”

Many of those items include meat snacks that are innovative in form and ingredients. “There are quite a few developments, from different types of protein, such as bison and elk, to the same types of claims seen in the meat department, including organic, grass-fed and regenerative agriculture,” says Roerink.

On that last point, the Chomps brand of meat snacks recently revealed that it’s working with the outcomes-based verified regenerative sourcing solution Land to Market, based in Durango, Colo., to measure its environmental impact.

“At our scale, when thinking about domestic and international sources, we want to uphold the highest standards, challenge our own supply base, and better our own understanding so we can ask the right questions,” explains Peter Maldonado, co-founder and CEO of Naples, Fla.-based Chomps.

PROGRESSIVE GROCER May 2023 35

masonways.com | 800-837-2881

The blurring of categories includes fusions of salty snacks and meat snacks. Earlier this year, Jack Link’s and Doritos teamed up to launch beef jerky and meat sticks featuring popular Doritos flavors, including its signature spicy coating and Flamin’ Hot profile.

The Sweet Indulgence Spectrum